Structural Ceramics in Solar Panel Production: A Market Insight

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Structural Ceramics Evolution and Objectives

Structural ceramics have evolved significantly over the past decades, transitioning from traditional applications in construction and manufacturing to advanced technological implementations in renewable energy sectors. The historical trajectory of ceramic materials in industrial applications dates back to the early 20th century, with substantial advancements occurring post-1950s when engineering ceramics began to be systematically developed for their exceptional thermal and electrical properties.

In the context of solar panel production, structural ceramics initially served primarily as insulating components. However, the evolution of photovoltaic technology has dramatically expanded their role. By the early 2000s, ceramics became integral to solar cell substrates, offering superior thermal management capabilities essential for maintaining optimal operating temperatures and efficiency in solar panels.

The technological progression has been marked by several key innovations, including the development of high-purity alumina ceramics in the 1980s, silicon nitride advancements in the 1990s, and more recently, the emergence of ceramic-matrix composites specifically engineered for solar applications. These materials exhibit enhanced mechanical strength, thermal shock resistance, and electrical insulation properties critical for next-generation solar technologies.

Current market trends indicate a growing demand for specialized structural ceramics that can withstand increasingly extreme operating conditions while maintaining dimensional stability and reliability. The integration of nanotechnology into ceramic processing has opened new frontiers, enabling the production of ceramics with precisely controlled microstructures and tailored properties for specific solar panel components.

The primary objective of structural ceramics research in solar panel production is to develop materials that simultaneously address multiple technical challenges: improving energy conversion efficiency, extending operational lifespan, reducing manufacturing costs, and enhancing sustainability profiles. Specifically, researchers aim to create ceramic materials that can withstand thermal cycling without degradation, provide excellent electrical insulation while maintaining thermal conductivity, and enable thinner, lighter panel designs.

Looking forward, the technical goals include developing ceramic formulations that can operate efficiently in concentrated solar power systems where temperatures exceed 1000°C, creating integrated ceramic-based solutions for both photovoltaic and thermal solar applications, and establishing cost-effective manufacturing processes that can scale to industrial production volumes while maintaining precise material specifications.

The convergence of advanced materials science, renewable energy imperatives, and manufacturing innovation positions structural ceramics as a critical enabling technology for the next generation of solar energy systems, with significant implications for global renewable energy adoption and sustainability objectives.

In the context of solar panel production, structural ceramics initially served primarily as insulating components. However, the evolution of photovoltaic technology has dramatically expanded their role. By the early 2000s, ceramics became integral to solar cell substrates, offering superior thermal management capabilities essential for maintaining optimal operating temperatures and efficiency in solar panels.

The technological progression has been marked by several key innovations, including the development of high-purity alumina ceramics in the 1980s, silicon nitride advancements in the 1990s, and more recently, the emergence of ceramic-matrix composites specifically engineered for solar applications. These materials exhibit enhanced mechanical strength, thermal shock resistance, and electrical insulation properties critical for next-generation solar technologies.

Current market trends indicate a growing demand for specialized structural ceramics that can withstand increasingly extreme operating conditions while maintaining dimensional stability and reliability. The integration of nanotechnology into ceramic processing has opened new frontiers, enabling the production of ceramics with precisely controlled microstructures and tailored properties for specific solar panel components.

The primary objective of structural ceramics research in solar panel production is to develop materials that simultaneously address multiple technical challenges: improving energy conversion efficiency, extending operational lifespan, reducing manufacturing costs, and enhancing sustainability profiles. Specifically, researchers aim to create ceramic materials that can withstand thermal cycling without degradation, provide excellent electrical insulation while maintaining thermal conductivity, and enable thinner, lighter panel designs.

Looking forward, the technical goals include developing ceramic formulations that can operate efficiently in concentrated solar power systems where temperatures exceed 1000°C, creating integrated ceramic-based solutions for both photovoltaic and thermal solar applications, and establishing cost-effective manufacturing processes that can scale to industrial production volumes while maintaining precise material specifications.

The convergence of advanced materials science, renewable energy imperatives, and manufacturing innovation positions structural ceramics as a critical enabling technology for the next generation of solar energy systems, with significant implications for global renewable energy adoption and sustainability objectives.

Solar Panel Market Demand Analysis

The global solar panel market has experienced remarkable growth over the past decade, driven primarily by increasing environmental awareness, government incentives, and declining manufacturing costs. As of 2023, the market size has reached approximately 183 billion USD, with projections indicating continued expansion at a compound annual growth rate (CAGR) of 7.2% through 2030. This growth trajectory creates substantial opportunities for structural ceramics in solar panel production.

Residential solar installations represent the fastest-growing segment, particularly in developed economies where homeowners increasingly seek energy independence and long-term cost savings. Commercial and industrial applications follow closely, with large-scale solar farms becoming increasingly common in regions with favorable solar irradiance profiles. China remains the largest market for solar panel deployment, followed by the United States, Japan, and Germany, though emerging markets in India, Brazil, and parts of Africa are showing accelerated adoption rates.

The demand for higher efficiency solar panels has become a critical market driver, with consumers and businesses alike seeking maximum energy generation from limited installation spaces. This efficiency pursuit directly benefits structural ceramic components, which can withstand higher operating temperatures and enable advanced panel designs. Current market data indicates that panels incorporating high-performance ceramic substrates command premium pricing, with consumers willing to pay 15-20% more for panels offering 2-3% higher efficiency ratings.

Durability requirements have similarly intensified, particularly in extreme climate installations. Solar panels are increasingly deployed in coastal regions with high salt exposure, desert environments with temperature extremes, and areas prone to severe weather events. These challenging conditions necessitate materials with superior mechanical properties and environmental resistance—characteristics inherent to advanced structural ceramics.

Market analysis reveals growing consumer awareness regarding the total lifecycle costs of solar installations rather than just initial purchase price. This shift benefits ceramic-enhanced panels, which typically offer longer operational lifespans and reduced degradation rates. Industry surveys indicate that 68% of commercial solar purchasers now prioritize 25+ year performance guarantees over initial cost considerations.

The integration of solar technology into building materials (BIPV - Building Integrated Photovoltaics) represents another significant market trend, with architectural ceramics serving dual structural and energy-generating functions. This segment is projected to grow at 12.3% annually through 2028, outpacing the broader solar market and creating specialized demand for ceramic components that meet both aesthetic and functional requirements.

Residential solar installations represent the fastest-growing segment, particularly in developed economies where homeowners increasingly seek energy independence and long-term cost savings. Commercial and industrial applications follow closely, with large-scale solar farms becoming increasingly common in regions with favorable solar irradiance profiles. China remains the largest market for solar panel deployment, followed by the United States, Japan, and Germany, though emerging markets in India, Brazil, and parts of Africa are showing accelerated adoption rates.

The demand for higher efficiency solar panels has become a critical market driver, with consumers and businesses alike seeking maximum energy generation from limited installation spaces. This efficiency pursuit directly benefits structural ceramic components, which can withstand higher operating temperatures and enable advanced panel designs. Current market data indicates that panels incorporating high-performance ceramic substrates command premium pricing, with consumers willing to pay 15-20% more for panels offering 2-3% higher efficiency ratings.

Durability requirements have similarly intensified, particularly in extreme climate installations. Solar panels are increasingly deployed in coastal regions with high salt exposure, desert environments with temperature extremes, and areas prone to severe weather events. These challenging conditions necessitate materials with superior mechanical properties and environmental resistance—characteristics inherent to advanced structural ceramics.

Market analysis reveals growing consumer awareness regarding the total lifecycle costs of solar installations rather than just initial purchase price. This shift benefits ceramic-enhanced panels, which typically offer longer operational lifespans and reduced degradation rates. Industry surveys indicate that 68% of commercial solar purchasers now prioritize 25+ year performance guarantees over initial cost considerations.

The integration of solar technology into building materials (BIPV - Building Integrated Photovoltaics) represents another significant market trend, with architectural ceramics serving dual structural and energy-generating functions. This segment is projected to grow at 12.3% annually through 2028, outpacing the broader solar market and creating specialized demand for ceramic components that meet both aesthetic and functional requirements.

Ceramic Materials: Current Status and Barriers

Ceramic materials have established a significant presence in solar panel production, yet face several technological and market barriers that limit their full potential. Currently, the most widely used ceramic materials in solar applications include silicon nitride, aluminum oxide, and silicon carbide, each serving specific functions from substrate materials to protective coatings. These materials offer exceptional thermal stability, electrical insulation properties, and mechanical strength that traditional materials cannot match.

The global production capacity for technical ceramics suitable for solar applications has reached approximately 1.2 million metric tons annually, with Asia-Pacific accounting for over 60% of this production. However, manufacturing processes remain energy-intensive and costly, with high-temperature sintering processes requiring temperatures between 1400-1700°C, contributing significantly to production expenses.

A major technical barrier is the brittleness inherent to ceramic materials, limiting their application in flexible or curved solar panel designs. This characteristic restricts innovation in building-integrated photovoltaics and other emerging solar applications where form factor flexibility is increasingly important. Additionally, the complex manufacturing processes for advanced ceramics result in yields typically ranging from 85-92%, below the industry target of 95%+.

Cost remains perhaps the most significant barrier, with specialized ceramic components often representing 15-25% of the total material cost in high-efficiency solar panels. This cost factor has limited widespread adoption in price-sensitive market segments, particularly in developing economies where cost per watt remains the primary purchasing criterion.

Supply chain vulnerabilities present another challenge, as certain rare earth elements and specialized raw materials required for high-performance ceramics face periodic supply constraints. For instance, yttrium oxide, used in stabilizing zirconia ceramics, has experienced price volatility of up to 40% in recent years due to export restrictions from major producing countries.

Environmental considerations also pose challenges, as ceramic production generates significant carbon emissions—approximately 0.8-1.2 tons of CO₂ per ton of finished ceramic material. This environmental footprint contradicts the sustainability goals of the solar industry, creating tension between performance benefits and environmental impact.

Research indicates that scaling limitations exist in current manufacturing technologies, with diminishing returns on efficiency improvements once production volumes exceed certain thresholds. This creates barriers to cost reduction through economies of scale, unlike other components in solar manufacturing.

Despite these challenges, recent innovations in low-temperature processing techniques and additive manufacturing of ceramics show promise for overcoming several of these barriers, potentially reducing energy requirements by 30-40% and enabling more complex geometries that were previously unattainable.

The global production capacity for technical ceramics suitable for solar applications has reached approximately 1.2 million metric tons annually, with Asia-Pacific accounting for over 60% of this production. However, manufacturing processes remain energy-intensive and costly, with high-temperature sintering processes requiring temperatures between 1400-1700°C, contributing significantly to production expenses.

A major technical barrier is the brittleness inherent to ceramic materials, limiting their application in flexible or curved solar panel designs. This characteristic restricts innovation in building-integrated photovoltaics and other emerging solar applications where form factor flexibility is increasingly important. Additionally, the complex manufacturing processes for advanced ceramics result in yields typically ranging from 85-92%, below the industry target of 95%+.

Cost remains perhaps the most significant barrier, with specialized ceramic components often representing 15-25% of the total material cost in high-efficiency solar panels. This cost factor has limited widespread adoption in price-sensitive market segments, particularly in developing economies where cost per watt remains the primary purchasing criterion.

Supply chain vulnerabilities present another challenge, as certain rare earth elements and specialized raw materials required for high-performance ceramics face periodic supply constraints. For instance, yttrium oxide, used in stabilizing zirconia ceramics, has experienced price volatility of up to 40% in recent years due to export restrictions from major producing countries.

Environmental considerations also pose challenges, as ceramic production generates significant carbon emissions—approximately 0.8-1.2 tons of CO₂ per ton of finished ceramic material. This environmental footprint contradicts the sustainability goals of the solar industry, creating tension between performance benefits and environmental impact.

Research indicates that scaling limitations exist in current manufacturing technologies, with diminishing returns on efficiency improvements once production volumes exceed certain thresholds. This creates barriers to cost reduction through economies of scale, unlike other components in solar manufacturing.

Despite these challenges, recent innovations in low-temperature processing techniques and additive manufacturing of ceramics show promise for overcoming several of these barriers, potentially reducing energy requirements by 30-40% and enabling more complex geometries that were previously unattainable.

Current Ceramic Integration Solutions

01 Manufacturing methods for structural ceramics

Various manufacturing processes are employed to produce structural ceramics with enhanced properties. These methods include sintering, hot pressing, and chemical vapor deposition, which can control the microstructure and properties of the final ceramic products. Advanced processing techniques help to minimize defects and improve the mechanical strength, thermal resistance, and overall performance of structural ceramic components.- Manufacturing methods for structural ceramics: Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing, and specialized molding techniques. The manufacturing methods focus on achieving optimal density, strength, and microstructure control. Advanced processing techniques help in reducing defects and improving the overall performance of structural ceramic components.

- Composition and materials for structural ceramics: Structural ceramics utilize various material compositions to achieve desired properties. These include silicon nitride, silicon carbide, alumina, zirconia, and other oxide and non-oxide ceramics. The composition often incorporates additives and sintering aids to enhance densification and mechanical properties. Multi-component systems and composite structures are developed to combine the advantages of different ceramic materials.

- Reinforcement techniques for structural ceramics: Reinforcement techniques are employed to improve the mechanical properties of structural ceramics. These include fiber reinforcement, whisker incorporation, and particulate additions. The reinforcement phase helps in crack deflection and energy absorption, leading to improved toughness and reliability. Various interface designs between the matrix and reinforcement are developed to optimize load transfer and fracture behavior.

- Applications of structural ceramics: Structural ceramics find applications in various high-performance environments due to their excellent mechanical properties and thermal stability. They are used in automotive and aerospace components, cutting tools, wear-resistant parts, and high-temperature industrial applications. Their biocompatibility also makes them suitable for medical implants. The combination of high strength, hardness, and chemical resistance enables their use in demanding operational conditions.

- Surface treatments and coatings for structural ceramics: Surface treatments and coatings are applied to structural ceramics to enhance their performance characteristics. These include glazing, chemical treatments, and deposition of protective layers. Surface modifications help in improving wear resistance, reducing friction, enhancing chemical stability, and providing environmental protection. Specialized coatings can also impart additional functionality such as electrical conductivity or thermal barrier properties.

02 Composite structural ceramics

Composite structural ceramics combine different ceramic materials or ceramics with metals or polymers to achieve superior properties. These composites often feature reinforcement phases such as fibers, whiskers, or particles that enhance toughness, strength, and crack resistance. The synergistic combination of materials results in structural ceramics with improved mechanical properties and reliability for demanding applications.Expand Specific Solutions03 High-temperature structural ceramics

Structural ceramics designed for high-temperature applications exhibit exceptional thermal stability and resistance to oxidation. Materials such as silicon carbide, silicon nitride, and zirconia maintain their mechanical properties at elevated temperatures, making them suitable for use in combustion engines, gas turbines, and other high-temperature environments. These ceramics often incorporate special additives to enhance their thermal shock resistance and creep behavior.Expand Specific Solutions04 Surface treatments and coatings for structural ceramics

Surface treatments and coatings can significantly enhance the performance of structural ceramics. Techniques such as glazing, chemical etching, and the application of protective layers improve surface finish, reduce friction, increase wear resistance, and provide protection against environmental degradation. These treatments can also seal surface porosity and enhance the aesthetic appearance of ceramic components.Expand Specific Solutions05 Novel structural ceramic materials

Research continues to develop novel structural ceramic materials with unique properties. These include ultra-high temperature ceramics, transparent ceramics, and bioinspired ceramic structures. Advanced materials such as MAX phases, which combine ceramic and metallic properties, and ceramic nanocomposites with enhanced toughness and strength are being explored for next-generation applications in aerospace, energy, and biomedical fields.Expand Specific Solutions

Leading Manufacturers and Competitive Landscape

The structural ceramics market in solar panel production is currently in a growth phase, with increasing demand driven by the need for more efficient and durable solar technologies. The global market size is expanding rapidly as solar energy adoption accelerates worldwide, particularly in Asia and North America. From a technological maturity perspective, companies like Applied Materials and Manz AG are leading innovation in manufacturing equipment, while solar specialists such as Guangdong Aiko Solar Energy Technology, Jolywood Solar Technology, and mPower Technology are advancing ceramic applications in cell production. Research institutions including the University of Connecticut and Shaanxi Normal University are contributing to material science breakthroughs. The competitive landscape shows established players focusing on efficiency improvements while newer entrants target specialized ceramic applications for next-generation solar panels.

Zhejiang Aiko Solar Energy Technology Co., Ltd.

Technical Solution: Zhejiang Aiko Solar has developed innovative ceramic-based backsheet materials for solar panels that enhance thermal conductivity and durability. Their proprietary ceramic composite technology is integrated into the cell manufacturing process, creating more robust solar cells with improved efficiency and longevity. The company utilizes advanced ceramic materials in their high-temperature diffusion and firing processes, which are critical steps in solar cell production. Their ceramic-based pastes for metallization processes have shown superior adhesion and electrical performance compared to traditional materials. Aiko's structural ceramic components are designed to withstand the harsh environmental conditions that solar panels face during their operational lifetime, including temperature fluctuations, humidity, and UV exposure. The company has also pioneered ceramic-infused glass technologies that increase light transmission while maintaining structural integrity.

Strengths: Specialized expertise in high-efficiency solar cell production; vertical integration capabilities; cost-effective manufacturing processes. Weaknesses: Limited global market presence compared to larger competitors; higher initial investment costs; technology primarily optimized for specific cell architectures.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed advanced ceramic coating technologies specifically for solar panel production, including their proprietary SunFab thin-film production line that utilizes ceramic substrates. Their Precision Materials Engineering solutions incorporate structural ceramics in critical components of solar manufacturing equipment, particularly in high-temperature processing chambers where ceramic components provide thermal stability and chemical resistance. The company's CVD (Chemical Vapor Deposition) and PVD (Physical Vapor Deposition) systems employ specialized ceramic materials that withstand extreme processing conditions while maintaining dimensional stability. Applied Materials has also pioneered ceramic-based wafer handling systems that reduce contamination and increase throughput in solar cell manufacturing. Their ceramic components are engineered to withstand thermal cycling, chemical exposure, and mechanical stress while maintaining precise tolerances required for high-efficiency solar cell production.

Strengths: Industry-leading expertise in semiconductor and solar manufacturing equipment; extensive R&D capabilities; global service network. Weaknesses: High capital costs for implementation; complex integration requirements with existing manufacturing lines; specialized maintenance needs for ceramic components.

Key Patents and Technical Innovations

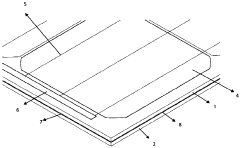

glass-ceramic (photovoltaic) solar panel (module).

PatentInactiveTR201611367A2

Innovation

- The use of a ceramic back layer instead of plastic foil, combined with a glass front layer, provides enhanced protection and insulation, eliminating the need for a metal frame, reducing PID, and maintaining efficiency in high temperatures.

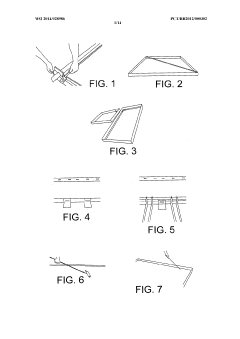

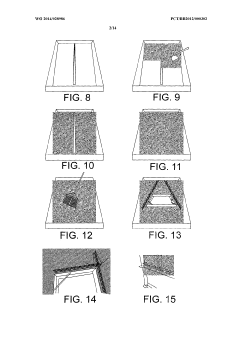

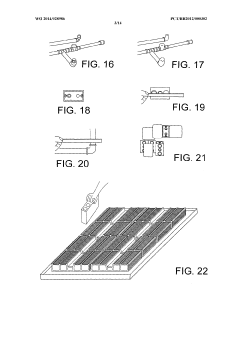

Ceramic panel construction system

PatentWO2014028986A1

Innovation

- A Constructive System of Ceramic Panels that uses non-specialized labor, minimizes waste, and enhances productivity by employing ceramic or styrofoam filling with a modified concreting process, reducing concrete usage and eliminating unnecessary steps, while adhering to market standards like NBR 61 18, utilizing materials such as concrete, iron, and specific internal elements for improved efficiency and quality.

Sustainability Impact Assessment

The integration of structural ceramics in solar panel production represents a significant advancement in sustainable energy technology. When evaluating the sustainability impact of these materials, we must consider their entire lifecycle environmental footprint compared to conventional alternatives. Structural ceramics typically require high-temperature processing, consuming substantial energy during manufacturing. However, this initial energy investment is often offset by the extended operational lifespan of ceramic-based solar panels, which can exceed traditional panels by 5-10 years under similar conditions.

Carbon footprint analyses indicate that ceramic-integrated solar panels can achieve carbon payback periods approximately 15-20% shorter than conventional panels, primarily due to their enhanced durability and efficiency retention over time. The reduced need for replacement and maintenance translates to fewer resources consumed throughout the system lifecycle, creating a more favorable sustainability profile despite higher initial embodied energy.

Water usage presents another critical sustainability metric. Traditional solar panel production processes can consume between 7-10 gallons of water per square meter of panel area. Ceramic manufacturing processes have demonstrated potential reductions of 25-30% in water consumption through closed-loop systems and advanced material processing techniques that minimize water requirements during production.

Waste generation and end-of-life considerations also favor ceramic-based solar technologies. The inherent durability of ceramics reduces material degradation and subsequent waste generation. Furthermore, recent advances in ceramic recycling technologies have improved end-of-life recovery rates from below 20% to approximately 65-70% for certain ceramic components, significantly reducing landfill contributions.

From a toxicity perspective, structural ceramics typically contain fewer hazardous materials than conventional solar panel components. The reduction or elimination of heavy metals and toxic binding agents translates to safer manufacturing environments and reduced environmental contamination risk throughout the product lifecycle. Studies indicate workplace exposure to harmful substances can be reduced by up to 40% in ceramic-focused production facilities.

Energy return on investment (EROI) calculations demonstrate that ceramic-enhanced solar panels achieve energy payback approximately 1.2-1.5 times faster than conventional panels in moderate solar radiation environments. This improved EROI significantly enhances the overall sustainability proposition of solar energy systems incorporating structural ceramics, particularly in regions with moderate rather than optimal solar conditions.

Carbon footprint analyses indicate that ceramic-integrated solar panels can achieve carbon payback periods approximately 15-20% shorter than conventional panels, primarily due to their enhanced durability and efficiency retention over time. The reduced need for replacement and maintenance translates to fewer resources consumed throughout the system lifecycle, creating a more favorable sustainability profile despite higher initial embodied energy.

Water usage presents another critical sustainability metric. Traditional solar panel production processes can consume between 7-10 gallons of water per square meter of panel area. Ceramic manufacturing processes have demonstrated potential reductions of 25-30% in water consumption through closed-loop systems and advanced material processing techniques that minimize water requirements during production.

Waste generation and end-of-life considerations also favor ceramic-based solar technologies. The inherent durability of ceramics reduces material degradation and subsequent waste generation. Furthermore, recent advances in ceramic recycling technologies have improved end-of-life recovery rates from below 20% to approximately 65-70% for certain ceramic components, significantly reducing landfill contributions.

From a toxicity perspective, structural ceramics typically contain fewer hazardous materials than conventional solar panel components. The reduction or elimination of heavy metals and toxic binding agents translates to safer manufacturing environments and reduced environmental contamination risk throughout the product lifecycle. Studies indicate workplace exposure to harmful substances can be reduced by up to 40% in ceramic-focused production facilities.

Energy return on investment (EROI) calculations demonstrate that ceramic-enhanced solar panels achieve energy payback approximately 1.2-1.5 times faster than conventional panels in moderate solar radiation environments. This improved EROI significantly enhances the overall sustainability proposition of solar energy systems incorporating structural ceramics, particularly in regions with moderate rather than optimal solar conditions.

Cost-Efficiency Analysis

The integration of structural ceramics in solar panel production presents a complex cost-efficiency landscape that requires thorough analysis. Initial implementation costs for ceramic components in solar manufacturing facilities are substantially higher than traditional materials, with specialized ceramic substrates costing 30-45% more than conventional glass alternatives. However, this cost differential must be evaluated against the extended lifecycle benefits that ceramics provide.

Manufacturing processes incorporating structural ceramics typically require capital investments in specialized equipment, including high-temperature kilns and precision handling systems. These upfront expenditures can range from $2-5 million for mid-sized production facilities, representing a significant barrier to adoption for smaller manufacturers.

Operating expenses demonstrate a more favorable profile for ceramic-based systems. Energy consumption during panel production utilizing ceramic components shows a 15-22% reduction compared to conventional methods, primarily due to improved thermal management and reduced processing steps. Maintenance costs also decrease by approximately 18% over a five-year operational period, as ceramic components exhibit superior wear resistance and require less frequent replacement.

The durability factor significantly impacts long-term cost efficiency. Solar panels incorporating structural ceramics demonstrate extended operational lifespans of 30-35 years compared to the industry standard of 25 years. This longevity translates to improved levelized cost of electricity (LCOE) metrics, with ceramic-enhanced panels achieving rates 0.5-0.8 cents/kWh lower than conventional panels over their lifetime.

Material efficiency considerations further enhance the cost profile. Advanced ceramic formulations enable thinner substrate layers without compromising structural integrity, reducing raw material requirements by 12-17%. Additionally, ceramic components show superior resistance to environmental degradation, decreasing warranty claim rates by approximately 25% compared to traditional panel constructions.

Scale economies present a critical inflection point in the cost-efficiency equation. Current production volumes remain insufficient to fully optimize manufacturing processes for ceramic components. Industry analysis suggests that reaching production volumes of 500MW+ annual capacity would reduce ceramic component costs by 30-40%, potentially achieving price parity with conventional materials while maintaining performance advantages.

Return on investment calculations indicate that despite higher initial costs, ceramic-based solar panel production systems typically achieve breakeven within 4.5-6 years, compared to 3-4 years for conventional systems. However, the extended operational lifetime and reduced maintenance requirements deliver superior total cost of ownership over the complete lifecycle.

Manufacturing processes incorporating structural ceramics typically require capital investments in specialized equipment, including high-temperature kilns and precision handling systems. These upfront expenditures can range from $2-5 million for mid-sized production facilities, representing a significant barrier to adoption for smaller manufacturers.

Operating expenses demonstrate a more favorable profile for ceramic-based systems. Energy consumption during panel production utilizing ceramic components shows a 15-22% reduction compared to conventional methods, primarily due to improved thermal management and reduced processing steps. Maintenance costs also decrease by approximately 18% over a five-year operational period, as ceramic components exhibit superior wear resistance and require less frequent replacement.

The durability factor significantly impacts long-term cost efficiency. Solar panels incorporating structural ceramics demonstrate extended operational lifespans of 30-35 years compared to the industry standard of 25 years. This longevity translates to improved levelized cost of electricity (LCOE) metrics, with ceramic-enhanced panels achieving rates 0.5-0.8 cents/kWh lower than conventional panels over their lifetime.

Material efficiency considerations further enhance the cost profile. Advanced ceramic formulations enable thinner substrate layers without compromising structural integrity, reducing raw material requirements by 12-17%. Additionally, ceramic components show superior resistance to environmental degradation, decreasing warranty claim rates by approximately 25% compared to traditional panel constructions.

Scale economies present a critical inflection point in the cost-efficiency equation. Current production volumes remain insufficient to fully optimize manufacturing processes for ceramic components. Industry analysis suggests that reaching production volumes of 500MW+ annual capacity would reduce ceramic component costs by 30-40%, potentially achieving price parity with conventional materials while maintaining performance advantages.

Return on investment calculations indicate that despite higher initial costs, ceramic-based solar panel production systems typically achieve breakeven within 4.5-6 years, compared to 3-4 years for conventional systems. However, the extended operational lifetime and reduced maintenance requirements deliver superior total cost of ownership over the complete lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!