Comparison of Structural Ceramics and Metal Alloys in Construction

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Structural Materials Evolution and Objectives

The evolution of structural materials in construction has undergone significant transformations throughout history, from primitive wooden structures to sophisticated composite systems. The comparison between structural ceramics and metal alloys represents a critical juncture in this evolution, as both material categories offer distinct advantages and limitations that fundamentally influence modern construction practices.

Structural ceramics, including materials such as silicon carbide, alumina, and zirconia, emerged as engineered construction materials in the mid-20th century, though their precursors in the form of fired clay bricks date back thousands of years. These advanced ceramics have progressively developed to address inherent brittleness while capitalizing on their exceptional compressive strength, thermal stability, and corrosion resistance properties.

Metal alloys, conversely, have evolved from simple bronze and iron applications to sophisticated steel formulations and lightweight aluminum and titanium alloys. The development of controlled alloying processes in the late 19th and early 20th centuries revolutionized construction capabilities, enabling unprecedented structural spans and heights through materials with superior tensile strength and ductility.

The technological trajectory of both material classes has been driven by increasing demands for performance optimization in extreme environments, energy efficiency, and sustainability. Recent advancements in ceramic matrix composites (CMCs) and high-entropy alloys (HEAs) represent the cutting edge of this ongoing evolution, with research focusing on overcoming traditional limitations of each material category.

The primary objective of comparing structural ceramics and metal alloys is to establish a comprehensive framework for material selection that optimizes performance across multiple parameters including strength-to-weight ratio, thermal behavior, corrosion resistance, fabrication complexity, lifecycle costs, and environmental impact. This comparison aims to identify specific application domains where each material class excels and to explore hybrid solutions that leverage complementary properties.

Secondary objectives include mapping the technological readiness levels of emerging ceramic and metallic materials for construction applications, identifying critical research gaps that limit broader adoption, and forecasting future innovation pathways that could disrupt current material selection paradigms. The ultimate goal is to develop decision-making tools that enable architects and engineers to make evidence-based material selections optimized for specific construction challenges.

This comparative analysis must also consider the evolving regulatory landscape, particularly regarding embodied carbon and end-of-life recyclability, as these factors increasingly influence material selection decisions alongside traditional performance metrics.

Structural ceramics, including materials such as silicon carbide, alumina, and zirconia, emerged as engineered construction materials in the mid-20th century, though their precursors in the form of fired clay bricks date back thousands of years. These advanced ceramics have progressively developed to address inherent brittleness while capitalizing on their exceptional compressive strength, thermal stability, and corrosion resistance properties.

Metal alloys, conversely, have evolved from simple bronze and iron applications to sophisticated steel formulations and lightweight aluminum and titanium alloys. The development of controlled alloying processes in the late 19th and early 20th centuries revolutionized construction capabilities, enabling unprecedented structural spans and heights through materials with superior tensile strength and ductility.

The technological trajectory of both material classes has been driven by increasing demands for performance optimization in extreme environments, energy efficiency, and sustainability. Recent advancements in ceramic matrix composites (CMCs) and high-entropy alloys (HEAs) represent the cutting edge of this ongoing evolution, with research focusing on overcoming traditional limitations of each material category.

The primary objective of comparing structural ceramics and metal alloys is to establish a comprehensive framework for material selection that optimizes performance across multiple parameters including strength-to-weight ratio, thermal behavior, corrosion resistance, fabrication complexity, lifecycle costs, and environmental impact. This comparison aims to identify specific application domains where each material class excels and to explore hybrid solutions that leverage complementary properties.

Secondary objectives include mapping the technological readiness levels of emerging ceramic and metallic materials for construction applications, identifying critical research gaps that limit broader adoption, and forecasting future innovation pathways that could disrupt current material selection paradigms. The ultimate goal is to develop decision-making tools that enable architects and engineers to make evidence-based material selections optimized for specific construction challenges.

This comparative analysis must also consider the evolving regulatory landscape, particularly regarding embodied carbon and end-of-life recyclability, as these factors increasingly influence material selection decisions alongside traditional performance metrics.

Market Analysis for Advanced Construction Materials

The global market for advanced construction materials is experiencing significant growth, driven by increasing urbanization, infrastructure development, and the demand for sustainable building solutions. The market for structural ceramics and metal alloys specifically is projected to reach $175 billion by 2028, with a compound annual growth rate of 6.8% from 2023 to 2028. This growth trajectory is supported by expanding construction activities in emerging economies and renovation projects in developed regions.

Structural ceramics, including materials like silicon carbide, alumina, and zirconia, are gaining traction in the construction sector due to their exceptional thermal stability, corrosion resistance, and durability. The market segment for advanced ceramics in construction applications was valued at approximately $42 billion in 2022, with particular demand growth in high-performance flooring, cladding, and specialized structural components.

Metal alloys, particularly high-performance steel variants, aluminum alloys, and titanium composites, continue to dominate the advanced construction materials market with a share of 58%. Their versatility, established supply chains, and favorable strength-to-weight ratios maintain their position as the preferred choice for structural frameworks in both residential and commercial construction projects.

Regional analysis reveals that Asia-Pacific leads the market consumption of both material categories, accounting for 41% of global demand, followed by North America (24%) and Europe (22%). China and India are the primary growth engines in the Asia-Pacific region, with infrastructure development initiatives creating substantial demand for advanced construction materials.

End-user segmentation shows that commercial construction represents the largest application sector (37%), followed by industrial (28%), residential (21%), and infrastructure projects (14%). The commercial sector's dominance is attributed to the increasing adoption of high-performance materials in signature architectural projects and high-rise buildings where material performance specifications are more stringent.

Price sensitivity analysis indicates that while structural ceramics typically command a premium of 30-45% over conventional materials, their total lifecycle cost advantage is becoming increasingly recognized by developers and architects. Metal alloys, despite facing price volatility due to raw material fluctuations, maintain competitive positioning through established fabrication processes and widespread industry familiarity.

Market barriers include high initial costs, limited awareness of advanced material benefits among smaller contractors, and regulatory hurdles in certain regions. However, these barriers are gradually diminishing as building codes evolve to accommodate innovative materials and as sustainability certifications increasingly reward the use of durable, low-maintenance construction solutions.

Structural ceramics, including materials like silicon carbide, alumina, and zirconia, are gaining traction in the construction sector due to their exceptional thermal stability, corrosion resistance, and durability. The market segment for advanced ceramics in construction applications was valued at approximately $42 billion in 2022, with particular demand growth in high-performance flooring, cladding, and specialized structural components.

Metal alloys, particularly high-performance steel variants, aluminum alloys, and titanium composites, continue to dominate the advanced construction materials market with a share of 58%. Their versatility, established supply chains, and favorable strength-to-weight ratios maintain their position as the preferred choice for structural frameworks in both residential and commercial construction projects.

Regional analysis reveals that Asia-Pacific leads the market consumption of both material categories, accounting for 41% of global demand, followed by North America (24%) and Europe (22%). China and India are the primary growth engines in the Asia-Pacific region, with infrastructure development initiatives creating substantial demand for advanced construction materials.

End-user segmentation shows that commercial construction represents the largest application sector (37%), followed by industrial (28%), residential (21%), and infrastructure projects (14%). The commercial sector's dominance is attributed to the increasing adoption of high-performance materials in signature architectural projects and high-rise buildings where material performance specifications are more stringent.

Price sensitivity analysis indicates that while structural ceramics typically command a premium of 30-45% over conventional materials, their total lifecycle cost advantage is becoming increasingly recognized by developers and architects. Metal alloys, despite facing price volatility due to raw material fluctuations, maintain competitive positioning through established fabrication processes and widespread industry familiarity.

Market barriers include high initial costs, limited awareness of advanced material benefits among smaller contractors, and regulatory hurdles in certain regions. However, these barriers are gradually diminishing as building codes evolve to accommodate innovative materials and as sustainability certifications increasingly reward the use of durable, low-maintenance construction solutions.

Current Capabilities and Limitations of Ceramics vs Alloys

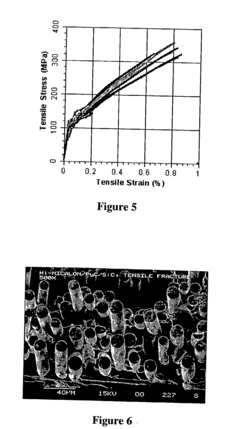

Structural ceramics and metal alloys represent two distinct material categories with unique properties that significantly impact their application in construction. Advanced ceramics, including silicon carbide, alumina, and zirconia, offer exceptional compressive strength that can exceed 3,000 MPa, substantially outperforming most metal alloys. Their thermal stability allows them to maintain structural integrity at temperatures above 1,000°C, where many alloys would soften or melt. Additionally, ceramics demonstrate superior chemical inertness, making them resistant to corrosion in aggressive environments where metals would deteriorate rapidly.

However, ceramics suffer from inherent brittleness with fracture toughness typically below 10 MPa·m^1/2, compared to high-performance alloys that can exceed 100 MPa·m^1/2. This brittleness results in catastrophic failure under tensile loading without the plastic deformation warning signs exhibited by metals. Manufacturing limitations further constrain ceramic applications, as complex geometries remain challenging to produce consistently at scale, and production costs can be 3-5 times higher than comparable metal components.

Metal alloys, particularly steel and aluminum systems, maintain dominance in construction due to their balanced mechanical properties. High-strength steels can achieve tensile strengths of 1,500 MPa while maintaining ductility, allowing for plastic deformation before failure—a critical safety feature in structural applications. Their excellent machinability and formability enable complex structural designs with predictable performance characteristics across varying load conditions.

The joining capabilities of metals represent another significant advantage, with welding, bolting, and riveting offering reliable connection methods that have been refined over centuries. Conversely, joining ceramics remains problematic, often requiring specialized techniques like brazing with active metal fillers or mechanical fastening systems that introduce stress concentrations at connection points.

Recent advancements in ceramic matrix composites (CMCs) are beginning to address traditional ceramic limitations by incorporating fiber reinforcements that improve toughness while maintaining thermal resistance. Similarly, metal matrix composites (MMCs) enhance conventional alloy performance by incorporating ceramic particles or fibers to achieve property combinations previously unattainable in monolithic materials.

Cost considerations remain a decisive factor in material selection, with structural ceramics typically costing $50-200 per kilogram compared to $2-20 for specialized alloys. This economic reality, combined with the established supply chains and fabrication infrastructure for metals, continues to limit widespread ceramic adoption in mainstream construction applications despite their superior performance in specific metrics.

The environmental impact profiles of these materials differ significantly, with ceramics generally requiring higher processing temperatures (1,400-1,700°C) than metals (typically below 1,200°C), resulting in greater energy consumption during manufacturing. However, ceramics often demonstrate superior service lifespans in harsh environments, potentially offsetting initial environmental costs through reduced replacement frequency.

However, ceramics suffer from inherent brittleness with fracture toughness typically below 10 MPa·m^1/2, compared to high-performance alloys that can exceed 100 MPa·m^1/2. This brittleness results in catastrophic failure under tensile loading without the plastic deformation warning signs exhibited by metals. Manufacturing limitations further constrain ceramic applications, as complex geometries remain challenging to produce consistently at scale, and production costs can be 3-5 times higher than comparable metal components.

Metal alloys, particularly steel and aluminum systems, maintain dominance in construction due to their balanced mechanical properties. High-strength steels can achieve tensile strengths of 1,500 MPa while maintaining ductility, allowing for plastic deformation before failure—a critical safety feature in structural applications. Their excellent machinability and formability enable complex structural designs with predictable performance characteristics across varying load conditions.

The joining capabilities of metals represent another significant advantage, with welding, bolting, and riveting offering reliable connection methods that have been refined over centuries. Conversely, joining ceramics remains problematic, often requiring specialized techniques like brazing with active metal fillers or mechanical fastening systems that introduce stress concentrations at connection points.

Recent advancements in ceramic matrix composites (CMCs) are beginning to address traditional ceramic limitations by incorporating fiber reinforcements that improve toughness while maintaining thermal resistance. Similarly, metal matrix composites (MMCs) enhance conventional alloy performance by incorporating ceramic particles or fibers to achieve property combinations previously unattainable in monolithic materials.

Cost considerations remain a decisive factor in material selection, with structural ceramics typically costing $50-200 per kilogram compared to $2-20 for specialized alloys. This economic reality, combined with the established supply chains and fabrication infrastructure for metals, continues to limit widespread ceramic adoption in mainstream construction applications despite their superior performance in specific metrics.

The environmental impact profiles of these materials differ significantly, with ceramics generally requiring higher processing temperatures (1,400-1,700°C) than metals (typically below 1,200°C), resulting in greater energy consumption during manufacturing. However, ceramics often demonstrate superior service lifespans in harsh environments, potentially offsetting initial environmental costs through reduced replacement frequency.

Contemporary Applications and Implementation Methods

01 Ceramic-Metal Composite Materials

Composite materials combining ceramics and metals offer enhanced structural properties. These composites leverage the high temperature resistance and hardness of ceramics with the ductility and toughness of metals. The integration creates materials with superior mechanical properties, thermal stability, and wear resistance for applications in aerospace, automotive, and industrial sectors.- Ceramic-Metal Composite Materials: Composite materials combining ceramics and metals offer enhanced mechanical properties and thermal stability. These composites typically consist of ceramic particles or fibers embedded in a metal matrix, or metal particles dispersed in a ceramic matrix. The integration of these dissimilar materials creates synergistic effects, resulting in improved strength, toughness, and resistance to extreme environments compared to either material alone.

- Joining and Bonding Techniques for Ceramics and Metals: Various methods have been developed to join ceramics to metals, addressing the challenges of different thermal expansion coefficients and chemical compatibility. These techniques include brazing, diffusion bonding, active metal brazing, and the use of interlayers. Successful joining methods create strong interfaces that maintain structural integrity under thermal and mechanical stresses, enabling the production of complex components for high-performance applications.

- High-Temperature Applications and Thermal Barrier Coatings: Structural ceramics and metal alloys are extensively used in high-temperature applications such as gas turbines, aerospace components, and industrial furnaces. Thermal barrier coatings consisting of ceramic layers on metal substrates provide thermal insulation and oxidation resistance. These materials and coating systems enable components to withstand extreme temperatures while maintaining structural integrity and performance under severe operating conditions.

- Advanced Manufacturing Processes for Ceramic-Metal Systems: Innovative manufacturing techniques have been developed for producing ceramic-metal components, including additive manufacturing, powder metallurgy, spark plasma sintering, and directed energy deposition. These processes allow for precise control of microstructure and properties, enabling the fabrication of complex geometries with tailored material distributions. Advanced manufacturing approaches overcome traditional limitations in processing dissimilar materials and enable new design possibilities.

- Wear and Corrosion Resistant Materials: Specialized ceramic-metal materials have been developed for applications requiring exceptional wear and corrosion resistance. These include ceramic-reinforced metal matrix composites, cermet cutting tools, and protective coatings. By combining the hardness and chemical stability of ceramics with the toughness and conductivity of metals, these materials provide extended service life in aggressive environments such as cutting tools, mining equipment, chemical processing, and marine applications.

02 Bonding Techniques for Ceramic-Metal Interfaces

Various methods have been developed to create strong bonds between ceramics and metals, addressing the challenge of joining dissimilar materials. These techniques include diffusion bonding, brazing, active metal brazing, and the use of interlayers to accommodate thermal expansion differences. Proper bonding is crucial for structural integrity in high-stress and high-temperature applications.Expand Specific Solutions03 High-Temperature Resistant Alloys

Specialized metal alloys have been formulated to withstand extreme temperatures while maintaining structural integrity. These alloys often contain elements such as nickel, cobalt, chromium, and refractory metals to enhance creep resistance, oxidation resistance, and thermal stability. Such materials are critical for applications in turbine engines, furnace components, and other high-temperature environments.Expand Specific Solutions04 Advanced Structural Ceramics

Advanced structural ceramics, including silicon nitride, silicon carbide, alumina, and zirconia, offer exceptional hardness, wear resistance, and thermal stability. These materials are engineered to overcome traditional ceramic brittleness through microstructural design, grain boundary engineering, and incorporation of reinforcing phases. They serve critical roles in cutting tools, engine components, and armor applications.Expand Specific Solutions05 Surface Treatments and Coatings

Surface modification techniques enhance the performance of both ceramics and metal alloys. These include thermal spray coatings, physical vapor deposition, chemical vapor deposition, and surface nitriding or carburizing. Such treatments can improve wear resistance, corrosion protection, thermal barrier properties, and friction characteristics while maintaining the bulk material's structural integrity.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The structural ceramics and metal alloys construction market is currently in a growth phase, with increasing adoption across high-performance applications. The global market is expanding at approximately 5-7% annually, driven by demand for materials with superior mechanical properties and durability. From a technological maturity perspective, metal alloys represent a more established technology, with companies like Kobe Steel, Hyundai Steel, and Sanyo Special Steel leading traditional applications. Meanwhile, structural ceramics are gaining momentum in specialized applications, with CeramTec GmbH, Kyocera, and 3M Innovative Properties advancing ceramic material science. Academic institutions like Harbin Institute of Technology and Xi'an Jiaotong University are bridging fundamental research with industrial applications, particularly in ceramic-metal composites that leverage advantages of both material classes.

CeramTec GmbH

Technical Solution: CeramTec GmbH has developed advanced structural ceramic solutions specifically designed for construction applications. Their flagship technology involves silicon nitride (Si3N4) and aluminum oxide (Al2O3) ceramic composites that demonstrate exceptional mechanical properties. These materials undergo a proprietary high-pressure sintering process that achieves near-theoretical density (>99.5%), significantly enhancing structural integrity. CeramTec's construction ceramics feature nano-scale grain structures (typically 200-500nm) that contribute to fracture toughness values exceeding 7 MPa·m1/2, substantially higher than conventional ceramics. Their ceramic components can withstand compressive strengths of up to 3500 MPa, making them suitable for load-bearing applications in modern architecture. Additionally, CeramTec has pioneered ceramic-polymer hybrid materials that combine the hardness of ceramics with improved impact resistance, addressing the traditional brittleness limitation of ceramic materials in construction settings.

Strengths: Superior wear resistance and hardness (Mohs 9+) compared to metal alloys; exceptional chemical inertness allowing application in corrosive environments; thermal stability up to 1600°C far exceeding most construction metals; significantly lower weight (40-60% lighter than steel) for equivalent structural performance. Weaknesses: Higher initial manufacturing costs compared to metal alternatives; more complex joining and integration requirements; lower tensile strength and impact resistance requiring careful design considerations.

Kobe Steel, Ltd.

Technical Solution: Kobe Steel has developed proprietary high-performance metal alloys specifically engineered for construction applications. Their KOBELCO series features advanced steel alloys with microalloying elements (Nb, V, Ti) in precisely controlled amounts (typically 0.05-0.15%) that create nanoscale precipitates, significantly enhancing strength without compromising ductility. Their flagship construction alloys achieve yield strengths exceeding 960 MPa while maintaining elongation values of 15-20%. Kobe's technology includes thermo-mechanical controlled processing (TMCP) that creates optimized microstructures through carefully controlled rolling and cooling parameters. This results in fine-grained structures (typically 5-10μm) with excellent toughness even at low temperatures (-40°C). Additionally, Kobe has pioneered corrosion-resistant alloys containing precisely balanced Cr (2-5%) and Cu (0.3-0.5%) additions that form protective surface layers, extending service life in aggressive environments without requiring additional protective coatings. Their weathering steel variants demonstrate corrosion rates approximately 1/8 that of conventional structural steels in atmospheric exposure.

Strengths: Superior ductility and toughness compared to ceramics, allowing for plastic deformation before failure; excellent weldability and formability enabling complex structural designs; lower manufacturing costs and more established fabrication infrastructure; better vibration damping properties critical for seismic design. Weaknesses: Lower temperature resistance than ceramics (typically limited to 600-800°C); susceptibility to corrosion requiring protective treatments; higher density resulting in greater structural weight; thermal expansion issues requiring more extensive accommodation in design.

Key Patents and Innovations in Material Science

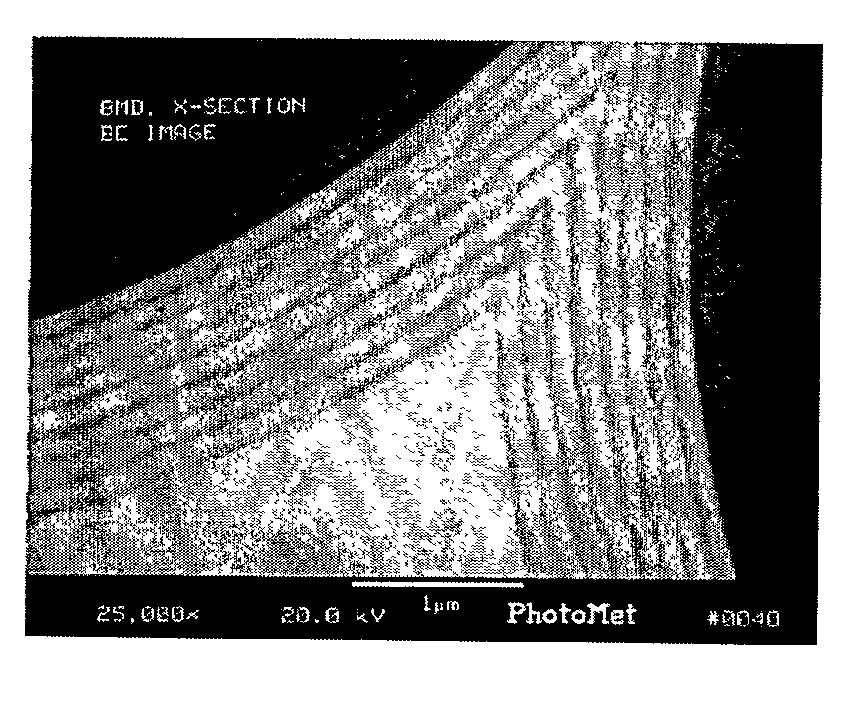

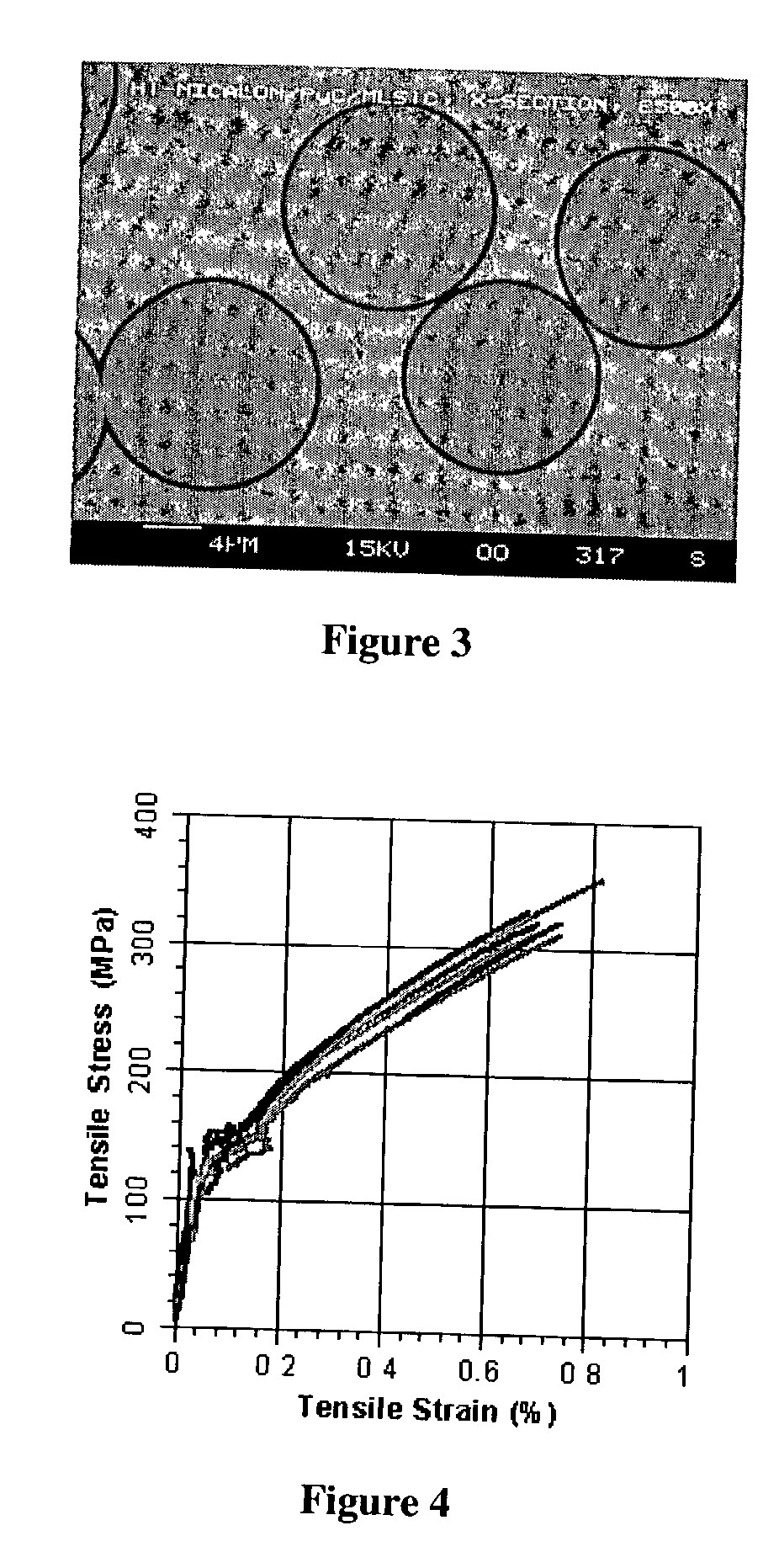

Fiber-reinforced ceramic composite material comprising a matrix with a nanolayered microstructure

PatentInactiveUS20050181192A1

Innovation

- A fiber-reinforced ceramic matrix composite material with a nanolayered ceramic matrix microstructure is developed, where a plurality of thin layers of a primary ceramic phase are interposed by very thin layers of a secondary phase, increasing the matrix cracking strength and toughness by interrupting grain growth and limiting grain size to enhance mechanical properties.

Process for combined production of metal alloys and zirconium corundum

PatentInactiveUS4363658A

Innovation

- A process involving the melting of zirconium concentrate, iron ore, and aluminum at 1,950°C to 2,000°C, with the introduction of fluxes and additives like ferrosilicon and ferromanganese, followed by separate pouring of zirconium corundum and metal alloys, which includes manganese and optionally titanium, to create a metal alloy suitable for alloying cast irons and preventing chilling.

Environmental Impact and Sustainability Factors

The environmental impact of construction materials has become increasingly significant in the face of global climate challenges. When comparing structural ceramics and metal alloys, their environmental footprints differ substantially across their entire life cycles. Structural ceramics generally require high-temperature firing processes that consume considerable energy during manufacturing, resulting in significant carbon emissions. However, once produced, ceramic materials demonstrate exceptional durability and chemical stability, requiring minimal maintenance over their extended service life.

Metal alloys, particularly steel and aluminum, present a different environmental profile. Their production involves energy-intensive mining and refining processes that generate substantial greenhouse gas emissions. Steel manufacturing alone accounts for approximately 7-9% of global carbon emissions. However, metals offer significant environmental advantages through their recyclability, with steel being one of the most recycled materials globally, achieving recycling rates exceeding 85% in some developed economies.

The embodied energy comparison reveals that advanced ceramics typically require 10-30 MJ/kg during production, while steel averages 20-25 MJ/kg and aluminum approximately 155-220 MJ/kg. This energy investment must be evaluated against material longevity and performance characteristics to determine true environmental efficiency.

Water consumption presents another critical sustainability factor. Metal production processes, particularly aluminum, consume substantial water resources, with estimates suggesting 10-20 cubic meters per ton of finished product. Ceramic manufacturing generally requires less water but may involve toxic chemicals that necessitate careful wastewater management.

Resource depletion concerns differ between these material categories. Metal alloys rely on finite mineral resources, with some critical alloying elements facing potential supply constraints. Structural ceramics primarily utilize abundant materials like silicon, aluminum, and oxygen, though some specialized ceramics incorporate rare earth elements that present extraction challenges and geopolitical supply risks.

End-of-life considerations strongly favor metal alloys due to their established recycling infrastructure. While ceramics offer exceptional durability, their recycling processes remain limited and energy-intensive. The circular economy potential for ceramics typically involves downcycling into aggregate materials rather than closed-loop recycling.

Recent innovations are addressing these sustainability challenges through development of low-temperature ceramic processing techniques, increased use of recycled content in metal alloys, and design approaches that facilitate eventual material separation and recovery. The construction industry's growing adoption of life cycle assessment methodologies is providing more comprehensive understanding of these materials' true environmental impacts beyond simple carbon footprint calculations.

Metal alloys, particularly steel and aluminum, present a different environmental profile. Their production involves energy-intensive mining and refining processes that generate substantial greenhouse gas emissions. Steel manufacturing alone accounts for approximately 7-9% of global carbon emissions. However, metals offer significant environmental advantages through their recyclability, with steel being one of the most recycled materials globally, achieving recycling rates exceeding 85% in some developed economies.

The embodied energy comparison reveals that advanced ceramics typically require 10-30 MJ/kg during production, while steel averages 20-25 MJ/kg and aluminum approximately 155-220 MJ/kg. This energy investment must be evaluated against material longevity and performance characteristics to determine true environmental efficiency.

Water consumption presents another critical sustainability factor. Metal production processes, particularly aluminum, consume substantial water resources, with estimates suggesting 10-20 cubic meters per ton of finished product. Ceramic manufacturing generally requires less water but may involve toxic chemicals that necessitate careful wastewater management.

Resource depletion concerns differ between these material categories. Metal alloys rely on finite mineral resources, with some critical alloying elements facing potential supply constraints. Structural ceramics primarily utilize abundant materials like silicon, aluminum, and oxygen, though some specialized ceramics incorporate rare earth elements that present extraction challenges and geopolitical supply risks.

End-of-life considerations strongly favor metal alloys due to their established recycling infrastructure. While ceramics offer exceptional durability, their recycling processes remain limited and energy-intensive. The circular economy potential for ceramics typically involves downcycling into aggregate materials rather than closed-loop recycling.

Recent innovations are addressing these sustainability challenges through development of low-temperature ceramic processing techniques, increased use of recycled content in metal alloys, and design approaches that facilitate eventual material separation and recovery. The construction industry's growing adoption of life cycle assessment methodologies is providing more comprehensive understanding of these materials' true environmental impacts beyond simple carbon footprint calculations.

Cost-Benefit Analysis of Material Selection

When evaluating structural materials for construction projects, a comprehensive cost-benefit analysis is essential to make informed decisions between structural ceramics and metal alloys. The initial acquisition cost represents only one dimension of the economic equation. Structural ceramics typically command a higher upfront investment compared to traditional metal alloys, with advanced ceramic materials often costing 2-5 times more per unit volume than high-performance steel alloys.

However, the lifecycle cost analysis reveals a more nuanced picture. Structural ceramics demonstrate superior durability with minimal degradation over time, potentially extending service life by 30-50% compared to metal alternatives in harsh environments. This longevity translates to reduced replacement frequency and associated labor costs, creating significant long-term economic advantages despite higher initial expenditure.

Maintenance requirements constitute another critical cost factor. Metal alloys generally demand regular inspection, corrosion protection, and periodic treatments, with maintenance costs typically accounting for 15-25% of lifecycle expenses. In contrast, ceramics require minimal maintenance intervention due to their inherent corrosion resistance, potentially reducing these ongoing expenses by up to 70%.

Energy efficiency considerations further impact the cost-benefit equation. Buildings utilizing advanced ceramic components can achieve enhanced thermal insulation properties, potentially reducing heating and cooling energy consumption by 10-20% compared to metal-based structures. This energy saving compounds annually, representing substantial operational cost reduction over a building's lifespan.

Installation complexity and associated labor costs must also be factored into the analysis. Metal alloys benefit from established fabrication techniques and workforce familiarity, while ceramic implementation often requires specialized handling and installation procedures. This disparity can increase initial installation costs for ceramic solutions by 15-30%, though this gap continues to narrow as ceramic construction techniques evolve.

Risk assessment represents a final critical dimension in the cost-benefit framework. Metal structures in corrosive or high-temperature environments face accelerated deterioration risks, potentially leading to catastrophic failures and associated liability costs. Ceramics offer superior performance under these extreme conditions, mitigating failure risks and potentially reducing insurance premiums by 5-15% for certain applications.

The optimal material selection ultimately depends on project-specific parameters including expected service life, environmental exposure conditions, performance requirements, and available budget constraints. A comprehensive cost-benefit analysis incorporating these multidimensional factors provides the foundation for strategic material selection decisions that balance immediate financial constraints with long-term performance and economic advantages.

However, the lifecycle cost analysis reveals a more nuanced picture. Structural ceramics demonstrate superior durability with minimal degradation over time, potentially extending service life by 30-50% compared to metal alternatives in harsh environments. This longevity translates to reduced replacement frequency and associated labor costs, creating significant long-term economic advantages despite higher initial expenditure.

Maintenance requirements constitute another critical cost factor. Metal alloys generally demand regular inspection, corrosion protection, and periodic treatments, with maintenance costs typically accounting for 15-25% of lifecycle expenses. In contrast, ceramics require minimal maintenance intervention due to their inherent corrosion resistance, potentially reducing these ongoing expenses by up to 70%.

Energy efficiency considerations further impact the cost-benefit equation. Buildings utilizing advanced ceramic components can achieve enhanced thermal insulation properties, potentially reducing heating and cooling energy consumption by 10-20% compared to metal-based structures. This energy saving compounds annually, representing substantial operational cost reduction over a building's lifespan.

Installation complexity and associated labor costs must also be factored into the analysis. Metal alloys benefit from established fabrication techniques and workforce familiarity, while ceramic implementation often requires specialized handling and installation procedures. This disparity can increase initial installation costs for ceramic solutions by 15-30%, though this gap continues to narrow as ceramic construction techniques evolve.

Risk assessment represents a final critical dimension in the cost-benefit framework. Metal structures in corrosive or high-temperature environments face accelerated deterioration risks, potentially leading to catastrophic failures and associated liability costs. Ceramics offer superior performance under these extreme conditions, mitigating failure risks and potentially reducing insurance premiums by 5-15% for certain applications.

The optimal material selection ultimately depends on project-specific parameters including expected service life, environmental exposure conditions, performance requirements, and available budget constraints. A comprehensive cost-benefit analysis incorporating these multidimensional factors provides the foundation for strategic material selection decisions that balance immediate financial constraints with long-term performance and economic advantages.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!