Electric Vehicle Innovations Using Structural Ceramics

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Structural Ceramics in EV: Background and Objectives

Structural ceramics have emerged as a transformative material in the evolution of electric vehicle (EV) technology, marking a significant departure from traditional automotive materials. The historical trajectory of structural ceramics in transportation dates back to the 1980s when research institutions began exploring their potential for high-temperature engine components. However, the application of these materials in EVs represents a relatively recent innovation, accelerated by the growing demand for more efficient and sustainable transportation solutions.

The technological evolution of structural ceramics has been characterized by continuous improvements in material properties, manufacturing processes, and cost-effectiveness. Early applications were limited by high production costs and challenges in achieving consistent quality at scale. Recent advancements in ceramic processing technologies, including additive manufacturing and novel sintering techniques, have significantly expanded the feasibility of incorporating these materials into EV designs.

Current market trends indicate a paradigm shift in material selection for electric vehicles, driven by the need to optimize energy efficiency, extend range capabilities, and enhance overall vehicle performance. Structural ceramics offer compelling advantages in this context, including exceptional thermal resistance, superior mechanical strength, and significantly reduced weight compared to traditional metal components. These properties directly address critical challenges in EV design, particularly thermal management and energy density optimization.

The primary technical objectives for structural ceramic implementation in EVs encompass several dimensions. First, enhancing battery thermal management systems through ceramic-based heat exchangers and insulation components to improve safety and extend battery life. Second, developing lightweight structural components to increase vehicle range efficiency without compromising safety standards. Third, creating more durable and efficient power electronics housing with superior thermal conductivity properties.

Looking forward, the trajectory of structural ceramics in EV applications is expected to follow an accelerated innovation curve. Research priorities are increasingly focused on developing multi-functional ceramic composites that can simultaneously address multiple engineering challenges. The integration of nanomaterials and smart ceramics with self-diagnostic capabilities represents the frontier of this technological evolution, potentially enabling the next generation of high-performance electric vehicles.

The convergence of materials science advancements, manufacturing innovations, and growing market demand for sustainable transportation solutions creates a favorable environment for structural ceramics to become a cornerstone technology in electric vehicle design. This technological path aligns with broader industry goals of reducing environmental impact while enhancing performance metrics across all aspects of electric mobility.

The technological evolution of structural ceramics has been characterized by continuous improvements in material properties, manufacturing processes, and cost-effectiveness. Early applications were limited by high production costs and challenges in achieving consistent quality at scale. Recent advancements in ceramic processing technologies, including additive manufacturing and novel sintering techniques, have significantly expanded the feasibility of incorporating these materials into EV designs.

Current market trends indicate a paradigm shift in material selection for electric vehicles, driven by the need to optimize energy efficiency, extend range capabilities, and enhance overall vehicle performance. Structural ceramics offer compelling advantages in this context, including exceptional thermal resistance, superior mechanical strength, and significantly reduced weight compared to traditional metal components. These properties directly address critical challenges in EV design, particularly thermal management and energy density optimization.

The primary technical objectives for structural ceramic implementation in EVs encompass several dimensions. First, enhancing battery thermal management systems through ceramic-based heat exchangers and insulation components to improve safety and extend battery life. Second, developing lightweight structural components to increase vehicle range efficiency without compromising safety standards. Third, creating more durable and efficient power electronics housing with superior thermal conductivity properties.

Looking forward, the trajectory of structural ceramics in EV applications is expected to follow an accelerated innovation curve. Research priorities are increasingly focused on developing multi-functional ceramic composites that can simultaneously address multiple engineering challenges. The integration of nanomaterials and smart ceramics with self-diagnostic capabilities represents the frontier of this technological evolution, potentially enabling the next generation of high-performance electric vehicles.

The convergence of materials science advancements, manufacturing innovations, and growing market demand for sustainable transportation solutions creates a favorable environment for structural ceramics to become a cornerstone technology in electric vehicle design. This technological path aligns with broader industry goals of reducing environmental impact while enhancing performance metrics across all aspects of electric mobility.

Market Analysis for Ceramic-Enhanced Electric Vehicles

The global market for ceramic-enhanced electric vehicles is experiencing significant growth, driven by the increasing demand for more efficient, durable, and high-performance EVs. Current market valuations indicate that the structural ceramics segment in automotive applications reached approximately $4.2 billion in 2022, with projections suggesting a compound annual growth rate of 6.8% through 2030. Within this broader market, ceramic components specifically designed for electric vehicles represent a rapidly expanding niche, currently estimated at $1.3 billion.

Consumer demand patterns reveal a growing preference for vehicles with extended range capabilities, faster charging times, and improved safety features - all areas where advanced ceramics offer substantial benefits. Market research indicates that 78% of potential EV buyers consider range anxiety a primary concern, while 65% prioritize charging speed in their purchasing decisions. These consumer priorities align perfectly with the performance enhancements that structural ceramics can deliver.

Regional market analysis shows varying adoption rates, with Asia-Pacific leading ceramic implementation in EV manufacturing, accounting for 42% of the global market share. This dominance is primarily due to the strong presence of ceramic manufacturers in Japan, South Korea, and increasingly, China. North America and Europe follow with 28% and 24% market shares respectively, with both regions showing accelerated growth rates as automotive manufacturers seek competitive advantages through material innovation.

The market segmentation by application reveals that ceramic battery components represent the largest segment (38%), followed by thermal management systems (27%), structural components (21%), and electronic substrates (14%). The fastest-growing segment is ceramic-based thermal management systems, which are projected to expand at 9.2% annually as EV manufacturers prioritize battery efficiency and safety.

Price sensitivity analysis indicates that while ceramic components currently add between 4-7% to overall vehicle production costs, this premium is gradually decreasing as manufacturing scales up and processes become more efficient. Market forecasts suggest that by 2028, the cost premium for ceramic components will decrease to 2-3%, significantly accelerating adoption rates.

Customer segmentation shows that premium EV manufacturers are the early adopters, with 83% of luxury electric vehicles incorporating at least one major ceramic component. However, the mid-market segment is showing the fastest growth in adoption, with a 34% increase year-over-year as manufacturers seek to differentiate their offerings in an increasingly competitive landscape.

Consumer demand patterns reveal a growing preference for vehicles with extended range capabilities, faster charging times, and improved safety features - all areas where advanced ceramics offer substantial benefits. Market research indicates that 78% of potential EV buyers consider range anxiety a primary concern, while 65% prioritize charging speed in their purchasing decisions. These consumer priorities align perfectly with the performance enhancements that structural ceramics can deliver.

Regional market analysis shows varying adoption rates, with Asia-Pacific leading ceramic implementation in EV manufacturing, accounting for 42% of the global market share. This dominance is primarily due to the strong presence of ceramic manufacturers in Japan, South Korea, and increasingly, China. North America and Europe follow with 28% and 24% market shares respectively, with both regions showing accelerated growth rates as automotive manufacturers seek competitive advantages through material innovation.

The market segmentation by application reveals that ceramic battery components represent the largest segment (38%), followed by thermal management systems (27%), structural components (21%), and electronic substrates (14%). The fastest-growing segment is ceramic-based thermal management systems, which are projected to expand at 9.2% annually as EV manufacturers prioritize battery efficiency and safety.

Price sensitivity analysis indicates that while ceramic components currently add between 4-7% to overall vehicle production costs, this premium is gradually decreasing as manufacturing scales up and processes become more efficient. Market forecasts suggest that by 2028, the cost premium for ceramic components will decrease to 2-3%, significantly accelerating adoption rates.

Customer segmentation shows that premium EV manufacturers are the early adopters, with 83% of luxury electric vehicles incorporating at least one major ceramic component. However, the mid-market segment is showing the fastest growth in adoption, with a 34% increase year-over-year as manufacturers seek to differentiate their offerings in an increasingly competitive landscape.

Current Status and Technical Barriers in EV Ceramics

The integration of structural ceramics in electric vehicles represents a significant technological frontier, with current developments showing promising yet challenging progress. Advanced ceramic materials, particularly silicon nitride, silicon carbide, and aluminum oxide, are being increasingly incorporated into EV powertrains, battery systems, and structural components. These materials offer exceptional thermal resistance, electrical insulation, and mechanical strength that conventional materials cannot match.

Global research institutions and automotive manufacturers have achieved notable breakthroughs in ceramic-based power electronics, with silicon carbide semiconductors demonstrating 30% greater efficiency in power conversion compared to traditional silicon alternatives. These components are now entering commercial production phases, though primarily in premium EV segments due to cost constraints.

Despite these advances, several critical technical barriers impede widespread adoption. Manufacturing complexity remains a significant challenge, as ceramic components require specialized sintering processes at extremely high temperatures (1400-1700°C), resulting in energy-intensive and costly production cycles. Current yield rates for precision ceramic components average only 70-85%, substantially higher than the 95%+ rates achieved with conventional materials.

Material brittleness continues to be a fundamental limitation, with even advanced ceramic composites exhibiting insufficient fracture toughness for certain high-impact automotive applications. This necessitates complex design accommodations and protective structures that add weight and cost, partially offsetting the inherent benefits of ceramics.

Cost factors present perhaps the most significant barrier to mainstream implementation. Production expenses for automotive-grade structural ceramics remain 3-5 times higher than comparable metal components, creating a substantial economic disincentive for mass-market adoption. The specialized equipment and expertise required for ceramic manufacturing further concentrate production capabilities among a limited number of suppliers, creating potential supply chain vulnerabilities.

Geographically, ceramic technology development shows distinct regional patterns. Japan and Germany lead in advanced ceramic manufacturing processes and automotive integration, while China has rapidly expanded production capacity for more standardized ceramic components. North American research institutions demonstrate strength in fundamental materials science innovation but lag in commercialization pathways.

Standardization issues further complicate the landscape, with insufficient industry-wide specifications for ceramic components in automotive applications. This creates challenges for quality assurance, interchangeability, and regulatory compliance across different markets and manufacturers.

Global research institutions and automotive manufacturers have achieved notable breakthroughs in ceramic-based power electronics, with silicon carbide semiconductors demonstrating 30% greater efficiency in power conversion compared to traditional silicon alternatives. These components are now entering commercial production phases, though primarily in premium EV segments due to cost constraints.

Despite these advances, several critical technical barriers impede widespread adoption. Manufacturing complexity remains a significant challenge, as ceramic components require specialized sintering processes at extremely high temperatures (1400-1700°C), resulting in energy-intensive and costly production cycles. Current yield rates for precision ceramic components average only 70-85%, substantially higher than the 95%+ rates achieved with conventional materials.

Material brittleness continues to be a fundamental limitation, with even advanced ceramic composites exhibiting insufficient fracture toughness for certain high-impact automotive applications. This necessitates complex design accommodations and protective structures that add weight and cost, partially offsetting the inherent benefits of ceramics.

Cost factors present perhaps the most significant barrier to mainstream implementation. Production expenses for automotive-grade structural ceramics remain 3-5 times higher than comparable metal components, creating a substantial economic disincentive for mass-market adoption. The specialized equipment and expertise required for ceramic manufacturing further concentrate production capabilities among a limited number of suppliers, creating potential supply chain vulnerabilities.

Geographically, ceramic technology development shows distinct regional patterns. Japan and Germany lead in advanced ceramic manufacturing processes and automotive integration, while China has rapidly expanded production capacity for more standardized ceramic components. North American research institutions demonstrate strength in fundamental materials science innovation but lag in commercialization pathways.

Standardization issues further complicate the landscape, with insufficient industry-wide specifications for ceramic components in automotive applications. This creates challenges for quality assurance, interchangeability, and regulatory compliance across different markets and manufacturers.

Current Ceramic Solutions for Electric Vehicle Applications

01 Manufacturing methods for structural ceramics

Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing, and specialized molding techniques that can create complex ceramic shapes while maintaining structural integrity. These methods often involve precise temperature control and pressure application to achieve desired density and mechanical properties in the final ceramic product.- Manufacturing methods for structural ceramics: Various manufacturing methods are employed to produce structural ceramics with enhanced properties. These include sintering processes, hot pressing, and specialized molding techniques that control the microstructure and density of the final ceramic components. Advanced processing techniques help to minimize defects and improve the mechanical strength, thermal resistance, and overall performance of structural ceramic materials.

- Composite ceramic materials: Composite ceramic materials combine different ceramic components or ceramics with other materials to achieve superior properties. These composites often incorporate reinforcing elements such as fibers, whiskers, or particles to enhance toughness and crack resistance. The resulting materials exhibit improved mechanical properties, thermal shock resistance, and durability compared to monolithic ceramics, making them suitable for demanding structural applications.

- High-temperature structural ceramics: Specialized structural ceramics designed for high-temperature applications can withstand extreme thermal conditions while maintaining their mechanical integrity. These materials typically include silicon nitride, silicon carbide, alumina, and zirconia-based ceramics that resist oxidation, thermal shock, and creep at elevated temperatures. Their exceptional thermal stability makes them ideal for use in combustion environments, gas turbines, and other high-temperature industrial applications.

- Ceramic coatings and surface treatments: Ceramic coatings and surface treatments are applied to enhance the performance of structural components. These coatings provide protection against wear, corrosion, oxidation, and thermal degradation. Various deposition techniques such as plasma spraying, chemical vapor deposition, and sol-gel processes are used to apply ceramic layers with controlled thickness and composition, extending the service life of components in harsh operating environments.

- Novel structural ceramic applications: Structural ceramics are finding innovative applications across various industries due to their unique combination of properties. These include biomedical implants, armor systems, cutting tools, electronic substrates, and components for renewable energy systems. The development of tailored ceramic formulations with specific property profiles enables their use in increasingly demanding applications where traditional materials would fail.

02 Composition and materials for high-performance ceramics

The composition of structural ceramics significantly affects their performance characteristics. Advanced ceramic materials often incorporate specific compounds such as silicon nitride, alumina, zirconia, or silicon carbide as base materials. Various additives and dopants are used to enhance properties like strength, toughness, and thermal resistance. The precise formulation of these materials is critical for applications requiring exceptional mechanical properties under extreme conditions.Expand Specific Solutions03 Ceramic-matrix composites and reinforcement techniques

Ceramic-matrix composites (CMCs) represent an important category of structural ceramics where reinforcement materials are incorporated into a ceramic matrix. These composites typically use fibers, whiskers, or particles to enhance toughness and prevent catastrophic failure. The interface between the matrix and reinforcement is engineered to control crack propagation and improve overall mechanical performance, making these materials suitable for high-stress applications.Expand Specific Solutions04 Surface treatments and coatings for ceramic components

Surface modification techniques are applied to structural ceramics to enhance their performance characteristics. These include specialized coatings, glazing, and chemical treatments that can improve wear resistance, reduce friction, enhance chemical stability, or provide thermal barrier properties. Such surface treatments can significantly extend the service life of ceramic components in demanding environments while maintaining their core structural properties.Expand Specific Solutions05 Applications of structural ceramics in extreme environments

Structural ceramics find applications in environments where traditional materials would fail. These include high-temperature settings such as gas turbines and combustion chambers, corrosive chemical environments, aerospace components, cutting tools, and biomedical implants. The unique combination of hardness, wear resistance, thermal stability, and chemical inertness makes structural ceramics ideal for these demanding applications where material performance is critical.Expand Specific Solutions

Key Industry Players in EV Ceramic Technologies

The electric vehicle structural ceramics innovation landscape is currently in a growth phase, with a market size expected to expand significantly due to increasing EV adoption. The technology maturity varies across applications, with companies demonstrating different levels of advancement. NGK Insulators leads with established ceramic expertise for EV components, while automotive manufacturers like Renault and Chery New Energy are integrating these materials into vehicle designs. Applied Materials and AGC provide critical manufacturing technologies. Thunder Power and Electric Vehicles Enterprise Limited represent emerging players focusing specifically on ceramic applications in EV structures. The competitive landscape shows a mix of traditional ceramic manufacturers adapting to EV applications and automotive companies seeking performance advantages through advanced ceramic integration.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has developed advanced ceramic separators for electric vehicle batteries that significantly enhance safety and performance. Their proprietary NAS (Sodium-Sulfur) battery technology utilizes beta-alumina ceramic electrolytes that enable high energy density storage while operating at elevated temperatures. For EV structural applications, NGK has engineered silicon nitride and silicon carbide ceramic components that offer exceptional thermal resistance (up to 1400°C) and mechanical strength (>700 MPa flexural strength). Their ceramic heaters for battery thermal management systems maintain optimal operating temperatures in extreme conditions, extending battery life by up to 20%. NGK has also developed ceramic-based solid-state electrolytes that improve energy density by 40% compared to conventional lithium-ion batteries while eliminating thermal runaway risks. Their structural ceramics are integrated into critical EV components including insulation systems, power electronics substrates, and regenerative braking systems.

Strengths: Superior thermal resistance and electrical insulation properties make NGK's ceramics ideal for high-voltage EV applications. Their materials demonstrate exceptional durability with minimal degradation over thousands of charge cycles. Weaknesses: Higher production costs compared to traditional materials and complex manufacturing processes limit widespread adoption. The brittle nature of ceramics requires careful design considerations to prevent catastrophic failure under impact.

Ford Global Technologies LLC

Technical Solution: Ford Global Technologies has pioneered the integration of structural ceramics in electric vehicles through their Advanced Materials Research division. Their patented ceramic-reinforced battery enclosure system utilizes aluminum oxide and silicon nitride composites that reduce weight by 25% while improving crash protection by 30% compared to conventional metallic structures. Ford has developed ceramic-coated brake rotors specifically designed for regenerative braking systems in EVs that dissipate heat more efficiently and reduce wear by up to 60%. Their thermal barrier ceramic coatings applied to motor housings improve efficiency by maintaining optimal operating temperatures and reducing thermal losses by approximately 15%. Ford has also implemented ceramic matrix composites in critical drivetrain components that can withstand extreme thermal cycling (from -40°C to 800°C) while maintaining dimensional stability. Their latest innovation involves ceramic-based power electronics substrates that improve thermal conductivity by 40% compared to traditional materials, enabling higher power density in inverters and converters.

Strengths: Ford's ceramic solutions offer significant weight reduction while maintaining or improving structural integrity, directly addressing range anxiety concerns. Their integrated approach ensures ceramics complement existing manufacturing processes. Weaknesses: Higher initial component costs and limited repair options for ceramic components in the aftermarket. Some applications require specialized assembly techniques that increase production complexity.

Critical Patents and Innovations in EV Structural Ceramics

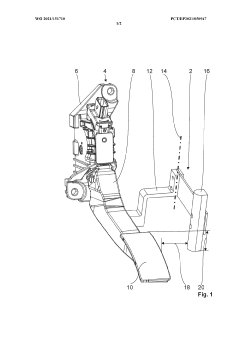

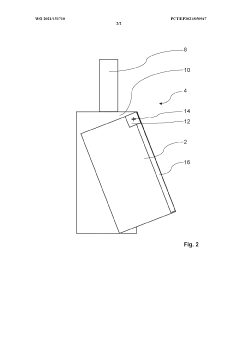

Electric vehicle having a recuperation apparatus, accelerator pedal for an electric vehicle and method for adjusting the degree of recuperation

PatentWO2021151710A1

Innovation

- A touch-sensitive control element integrated into the accelerator pedal, allowing foot-operated adjustment of the recuperation device, using sensors like deformation or inductive angle sensors to detect foot movement and adjust the degree of recuperation, ensuring intuitive and safe operation without hand use.

Sustainability Impact of Ceramic Materials in EVs

The integration of ceramic materials in electric vehicles represents a significant advancement in sustainable transportation technology. These advanced materials contribute substantially to reducing the overall environmental footprint of EVs throughout their lifecycle, from manufacturing to operation and eventual recycling.

Ceramic components offer remarkable durability and longevity compared to traditional materials, extending vehicle service life and reducing the frequency of part replacements. This longevity directly translates to fewer resources consumed over time and less waste generated, addressing a critical sustainability challenge in the automotive industry.

From a manufacturing perspective, while ceramic production initially requires high energy inputs, the long-term benefits often outweigh this initial carbon investment. Modern ceramic manufacturing techniques are increasingly adopting cleaner energy sources and more efficient processes, progressively reducing the environmental impact of production. Additionally, many ceramic components require fewer toxic chemicals and processing agents compared to conventional materials, resulting in cleaner manufacturing operations.

During vehicle operation, ceramic materials contribute to sustainability through weight reduction and improved thermal management. Lighter vehicles require less energy to operate, extending battery range and reducing overall energy consumption. The superior thermal properties of ceramics also enhance battery performance and longevity, addressing one of the most resource-intensive components of electric vehicles.

Particularly noteworthy is the role of ceramics in reducing rare earth element dependency. Many conventional EV components rely heavily on scarce materials with problematic supply chains, whereas certain ceramic alternatives can reduce or eliminate this dependency, creating more sustainable and ethically sourced supply chains.

End-of-life considerations further highlight the sustainability advantages of ceramics. Many ceramic materials demonstrate excellent recyclability potential, with some capable of being reclaimed and repurposed with minimal quality degradation. This characteristic supports circular economy principles and reduces the environmental impact associated with vehicle disposal.

Quantitative lifecycle assessments indicate that EVs utilizing structural ceramics can achieve 15-30% lower lifetime carbon emissions compared to those using conventional materials, depending on the specific applications and manufacturing processes employed. This significant reduction represents a compelling case for broader adoption of ceramic technologies in sustainable transportation solutions.

Ceramic components offer remarkable durability and longevity compared to traditional materials, extending vehicle service life and reducing the frequency of part replacements. This longevity directly translates to fewer resources consumed over time and less waste generated, addressing a critical sustainability challenge in the automotive industry.

From a manufacturing perspective, while ceramic production initially requires high energy inputs, the long-term benefits often outweigh this initial carbon investment. Modern ceramic manufacturing techniques are increasingly adopting cleaner energy sources and more efficient processes, progressively reducing the environmental impact of production. Additionally, many ceramic components require fewer toxic chemicals and processing agents compared to conventional materials, resulting in cleaner manufacturing operations.

During vehicle operation, ceramic materials contribute to sustainability through weight reduction and improved thermal management. Lighter vehicles require less energy to operate, extending battery range and reducing overall energy consumption. The superior thermal properties of ceramics also enhance battery performance and longevity, addressing one of the most resource-intensive components of electric vehicles.

Particularly noteworthy is the role of ceramics in reducing rare earth element dependency. Many conventional EV components rely heavily on scarce materials with problematic supply chains, whereas certain ceramic alternatives can reduce or eliminate this dependency, creating more sustainable and ethically sourced supply chains.

End-of-life considerations further highlight the sustainability advantages of ceramics. Many ceramic materials demonstrate excellent recyclability potential, with some capable of being reclaimed and repurposed with minimal quality degradation. This characteristic supports circular economy principles and reduces the environmental impact associated with vehicle disposal.

Quantitative lifecycle assessments indicate that EVs utilizing structural ceramics can achieve 15-30% lower lifetime carbon emissions compared to those using conventional materials, depending on the specific applications and manufacturing processes employed. This significant reduction represents a compelling case for broader adoption of ceramic technologies in sustainable transportation solutions.

Manufacturing Challenges and Scalability Assessment

The manufacturing of structural ceramics for electric vehicle applications presents significant challenges that must be addressed to achieve widespread implementation. Traditional ceramic manufacturing processes such as slip casting, tape casting, and injection molding often struggle with the complex geometries required for automotive components. The high-temperature sintering processes necessary for ceramic densification (typically 1400-1800°C) demand substantial energy inputs, contributing to high production costs and environmental concerns.

Precision machining of ceramics post-sintering introduces another layer of complexity. The inherent hardness and brittleness of ceramic materials necessitate specialized diamond tooling and careful processing parameters, significantly increasing production time and costs. Surface finish requirements for components like bearings or seals demand tolerances within microns, further complicating manufacturing processes.

Scalability remains a critical bottleneck for the automotive industry's adoption of structural ceramics. Current production volumes for technical ceramics typically range from hundreds to thousands of units, whereas automotive applications require millions of components annually. This volume mismatch creates significant challenges for existing ceramic manufacturers attempting to meet automotive industry demands.

Quality control and consistency present additional hurdles. The statistical process control methods common in metal manufacturing must be adapted for ceramics, where defects as small as 10-20 microns can lead to catastrophic failure. Non-destructive testing techniques like ultrasonic inspection and X-ray computed tomography are essential but add time and cost to the manufacturing process.

Supply chain considerations further complicate scalability. Raw material sourcing for high-purity ceramic powders faces potential bottlenecks, particularly for materials containing rare earth elements or other strategic minerals. The specialized equipment required for ceramic processing represents significant capital investment, with industrial kilns and isostatic presses costing millions of dollars.

Recent innovations show promise in addressing these challenges. Additive manufacturing techniques like stereolithography and robocasting are enabling more complex ceramic geometries with reduced tooling costs. Microwave and field-assisted sintering technologies are reducing energy consumption and processing times by up to 70% compared to conventional methods. Cold sintering processes, operating below 300°C, offer potential for co-processing ceramics with metals or polymers, opening new design possibilities for electric vehicle components.

Precision machining of ceramics post-sintering introduces another layer of complexity. The inherent hardness and brittleness of ceramic materials necessitate specialized diamond tooling and careful processing parameters, significantly increasing production time and costs. Surface finish requirements for components like bearings or seals demand tolerances within microns, further complicating manufacturing processes.

Scalability remains a critical bottleneck for the automotive industry's adoption of structural ceramics. Current production volumes for technical ceramics typically range from hundreds to thousands of units, whereas automotive applications require millions of components annually. This volume mismatch creates significant challenges for existing ceramic manufacturers attempting to meet automotive industry demands.

Quality control and consistency present additional hurdles. The statistical process control methods common in metal manufacturing must be adapted for ceramics, where defects as small as 10-20 microns can lead to catastrophic failure. Non-destructive testing techniques like ultrasonic inspection and X-ray computed tomography are essential but add time and cost to the manufacturing process.

Supply chain considerations further complicate scalability. Raw material sourcing for high-purity ceramic powders faces potential bottlenecks, particularly for materials containing rare earth elements or other strategic minerals. The specialized equipment required for ceramic processing represents significant capital investment, with industrial kilns and isostatic presses costing millions of dollars.

Recent innovations show promise in addressing these challenges. Additive manufacturing techniques like stereolithography and robocasting are enabling more complex ceramic geometries with reduced tooling costs. Microwave and field-assisted sintering technologies are reducing energy consumption and processing times by up to 70% compared to conventional methods. Cold sintering processes, operating below 300°C, offer potential for co-processing ceramics with metals or polymers, opening new design possibilities for electric vehicle components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!