Ammonia Fuel and the Circular Economy: Opportunities and Challenges

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Evolution and Objectives

Ammonia has emerged as a promising alternative fuel in the global pursuit of sustainable energy solutions. The evolution of ammonia as a fuel dates back to the early 20th century, with its first notable application during World War II when it was used in Belgium for bus transportation due to diesel shortages. However, it wasn't until the early 2000s that serious research into ammonia's potential as a carbon-free energy carrier began to accelerate, driven by growing concerns about climate change and the need for decarbonization.

The technical evolution of ammonia fuel has progressed through several distinct phases. Initially, research focused on ammonia's combustion properties and its potential as a direct replacement for fossil fuels in internal combustion engines. This phase revealed significant challenges related to ammonia's low flame speed and high ignition temperature. The second phase, beginning around 2010, saw increased interest in ammonia as a hydrogen carrier, leveraging its high hydrogen content (17.6% by weight) and established global production and distribution infrastructure.

Recent technological advancements have catalyzed the third phase of ammonia fuel development, characterized by innovative approaches to ammonia synthesis and utilization. Green ammonia production, using renewable electricity for hydrogen generation via water electrolysis and subsequent nitrogen fixation through the Haber-Bosch process, has emerged as a cornerstone of sustainable ammonia fuel systems. Simultaneously, novel combustion technologies, including ammonia-hydrogen dual-fuel systems and direct ammonia fuel cells, have addressed many of the earlier technical limitations.

The primary objective of current ammonia fuel research is to establish a circular economy framework where ammonia serves as both an energy carrier and a means of energy storage. This involves developing carbon-neutral or carbon-negative ammonia production pathways, enhancing the efficiency of ammonia utilization technologies, and creating integrated systems that minimize resource consumption and waste generation.

Specific technical goals include reducing the energy intensity of green ammonia production, which currently requires approximately 10-12 MWh of electricity per ton of ammonia, improving the performance of ammonia combustion systems to achieve emissions profiles comparable to conventional fuels, and advancing ammonia cracking technologies for on-demand hydrogen generation. Additionally, there is significant focus on developing ammonia fuel cells with improved power density and durability.

The ultimate aim is to position ammonia as a versatile energy vector within a circular economy, capable of addressing multiple sectors including maritime shipping, long-haul transportation, grid-scale energy storage, and industrial heat applications, while simultaneously reducing greenhouse gas emissions and fostering energy independence.

The technical evolution of ammonia fuel has progressed through several distinct phases. Initially, research focused on ammonia's combustion properties and its potential as a direct replacement for fossil fuels in internal combustion engines. This phase revealed significant challenges related to ammonia's low flame speed and high ignition temperature. The second phase, beginning around 2010, saw increased interest in ammonia as a hydrogen carrier, leveraging its high hydrogen content (17.6% by weight) and established global production and distribution infrastructure.

Recent technological advancements have catalyzed the third phase of ammonia fuel development, characterized by innovative approaches to ammonia synthesis and utilization. Green ammonia production, using renewable electricity for hydrogen generation via water electrolysis and subsequent nitrogen fixation through the Haber-Bosch process, has emerged as a cornerstone of sustainable ammonia fuel systems. Simultaneously, novel combustion technologies, including ammonia-hydrogen dual-fuel systems and direct ammonia fuel cells, have addressed many of the earlier technical limitations.

The primary objective of current ammonia fuel research is to establish a circular economy framework where ammonia serves as both an energy carrier and a means of energy storage. This involves developing carbon-neutral or carbon-negative ammonia production pathways, enhancing the efficiency of ammonia utilization technologies, and creating integrated systems that minimize resource consumption and waste generation.

Specific technical goals include reducing the energy intensity of green ammonia production, which currently requires approximately 10-12 MWh of electricity per ton of ammonia, improving the performance of ammonia combustion systems to achieve emissions profiles comparable to conventional fuels, and advancing ammonia cracking technologies for on-demand hydrogen generation. Additionally, there is significant focus on developing ammonia fuel cells with improved power density and durability.

The ultimate aim is to position ammonia as a versatile energy vector within a circular economy, capable of addressing multiple sectors including maritime shipping, long-haul transportation, grid-scale energy storage, and industrial heat applications, while simultaneously reducing greenhouse gas emissions and fostering energy independence.

Market Analysis for Green Ammonia Applications

The global green ammonia market is experiencing significant growth, driven by increasing demand for sustainable energy carriers and carbon-neutral fertilizers. Current market valuations place green ammonia at approximately $72 million in 2022, with projections indicating potential growth to reach $17 billion by 2030, representing a compound annual growth rate exceeding 70%. This remarkable growth trajectory is underpinned by ammonia's versatility as both an energy carrier and industrial feedstock.

The maritime sector presents one of the most promising near-term markets for green ammonia. With the International Maritime Organization's increasingly stringent emissions regulations, shipping companies are actively seeking alternative fuels. Green ammonia offers a viable solution with zero carbon emissions during combustion and energy density superior to batteries, making it suitable for long-distance maritime transport. Major shipping companies including Maersk and NYK Line have already announced pilot projects incorporating ammonia-powered vessels.

Power generation represents another substantial market opportunity, particularly for grid balancing and energy storage applications. Green ammonia can be used in modified gas turbines or dedicated ammonia-fired power plants, providing dispatchable power to complement intermittent renewable energy sources. Countries with limited renewable resources but strong ammonia infrastructure, such as Japan and South Korea, are positioning themselves as early adopters in this segment.

The fertilizer industry, traditionally the largest consumer of conventional ammonia, presents a natural transition market for green ammonia. With growing consumer demand for sustainably produced food, agricultural companies are facing pressure to reduce the carbon footprint of their supply chains. Premium markets for "green" agricultural products could support the price premium of green ammonia fertilizers, particularly in Europe and North America.

Regional market dynamics vary significantly. The Middle East and North Africa region is emerging as a potential green ammonia production hub due to abundant renewable energy resources and existing export infrastructure. Australia has positioned itself as a leader in green hydrogen and ammonia production with multiple large-scale projects under development targeting export markets. European countries are focusing on developing import facilities and end-use applications, driven by strong decarbonization policies.

Market barriers include the significant cost differential between conventional and green ammonia, with current production costs for green ammonia approximately 2-4 times higher than fossil-based alternatives. Infrastructure limitations present another challenge, as specialized storage, handling, and transportation facilities are required. Regulatory frameworks remain underdeveloped in many regions, creating uncertainty for potential investors and project developers.

The maritime sector presents one of the most promising near-term markets for green ammonia. With the International Maritime Organization's increasingly stringent emissions regulations, shipping companies are actively seeking alternative fuels. Green ammonia offers a viable solution with zero carbon emissions during combustion and energy density superior to batteries, making it suitable for long-distance maritime transport. Major shipping companies including Maersk and NYK Line have already announced pilot projects incorporating ammonia-powered vessels.

Power generation represents another substantial market opportunity, particularly for grid balancing and energy storage applications. Green ammonia can be used in modified gas turbines or dedicated ammonia-fired power plants, providing dispatchable power to complement intermittent renewable energy sources. Countries with limited renewable resources but strong ammonia infrastructure, such as Japan and South Korea, are positioning themselves as early adopters in this segment.

The fertilizer industry, traditionally the largest consumer of conventional ammonia, presents a natural transition market for green ammonia. With growing consumer demand for sustainably produced food, agricultural companies are facing pressure to reduce the carbon footprint of their supply chains. Premium markets for "green" agricultural products could support the price premium of green ammonia fertilizers, particularly in Europe and North America.

Regional market dynamics vary significantly. The Middle East and North Africa region is emerging as a potential green ammonia production hub due to abundant renewable energy resources and existing export infrastructure. Australia has positioned itself as a leader in green hydrogen and ammonia production with multiple large-scale projects under development targeting export markets. European countries are focusing on developing import facilities and end-use applications, driven by strong decarbonization policies.

Market barriers include the significant cost differential between conventional and green ammonia, with current production costs for green ammonia approximately 2-4 times higher than fossil-based alternatives. Infrastructure limitations present another challenge, as specialized storage, handling, and transportation facilities are required. Regulatory frameworks remain underdeveloped in many regions, creating uncertainty for potential investors and project developers.

Ammonia Fuel Technology Status and Barriers

Ammonia fuel technology has seen significant advancements in recent years, yet faces substantial barriers to widespread adoption. Currently, the predominant production method remains the century-old Haber-Bosch process, which consumes approximately 1-2% of global energy and contributes significantly to carbon emissions. While this process is mature and economically viable at scale, its carbon intensity presents a major obstacle to ammonia's role in a circular economy.

Green ammonia production technologies utilizing renewable electricity for electrolysis are emerging as promising alternatives. Several demonstration plants have been established globally, including projects by Yara in Norway, NEOM in Saudi Arabia, and CF Industries in the United States. However, these technologies currently operate at limited scale and with higher production costs compared to conventional methods, typically 2-4 times more expensive per ton.

Storage and transportation infrastructure for ammonia is relatively well-established due to its long history as a fertilizer, with approximately 20 million tons transported annually. Existing infrastructure includes specialized tankers, pipelines, and storage facilities. Nevertheless, significant expansion would be required to support ammonia's potential role as a major energy carrier.

The most critical technical barrier remains ammonia utilization as a fuel. Direct ammonia combustion in engines and turbines faces challenges including low flame speed, high ignition energy requirements, and NOx emissions. Current combustion efficiency in modified gas turbines reaches only 70-80% of natural gas equivalents. Cracking technologies to convert ammonia back to hydrogen before use add complexity and energy penalties of 15-30%.

Safety considerations present additional challenges, as ammonia is toxic and corrosive. While industrial handling protocols exist, broader deployment would require enhanced safety systems and public acceptance. Material compatibility issues also persist, as ammonia can cause stress corrosion cracking in certain alloys commonly used in energy infrastructure.

Regulatory frameworks remain underdeveloped for ammonia as an energy carrier. Current regulations primarily address its use as a fertilizer or refrigerant, creating uncertainty for energy applications. Standards for fuel-grade ammonia, emissions controls, and safety protocols specific to energy applications are still evolving.

Economic viability represents perhaps the most significant barrier. The cost gap between conventional and green ammonia production remains substantial, with green ammonia currently priced at $600-1,200 per ton versus $200-400 for conventional production. Without carbon pricing or other policy support mechanisms, this price differential significantly impedes market development.

Technical innovation is progressing in catalyst development, with researchers exploring ruthenium and iron-based catalysts that could operate at lower temperatures and pressures than conventional systems, potentially reducing energy requirements by 20-30%.

Green ammonia production technologies utilizing renewable electricity for electrolysis are emerging as promising alternatives. Several demonstration plants have been established globally, including projects by Yara in Norway, NEOM in Saudi Arabia, and CF Industries in the United States. However, these technologies currently operate at limited scale and with higher production costs compared to conventional methods, typically 2-4 times more expensive per ton.

Storage and transportation infrastructure for ammonia is relatively well-established due to its long history as a fertilizer, with approximately 20 million tons transported annually. Existing infrastructure includes specialized tankers, pipelines, and storage facilities. Nevertheless, significant expansion would be required to support ammonia's potential role as a major energy carrier.

The most critical technical barrier remains ammonia utilization as a fuel. Direct ammonia combustion in engines and turbines faces challenges including low flame speed, high ignition energy requirements, and NOx emissions. Current combustion efficiency in modified gas turbines reaches only 70-80% of natural gas equivalents. Cracking technologies to convert ammonia back to hydrogen before use add complexity and energy penalties of 15-30%.

Safety considerations present additional challenges, as ammonia is toxic and corrosive. While industrial handling protocols exist, broader deployment would require enhanced safety systems and public acceptance. Material compatibility issues also persist, as ammonia can cause stress corrosion cracking in certain alloys commonly used in energy infrastructure.

Regulatory frameworks remain underdeveloped for ammonia as an energy carrier. Current regulations primarily address its use as a fertilizer or refrigerant, creating uncertainty for energy applications. Standards for fuel-grade ammonia, emissions controls, and safety protocols specific to energy applications are still evolving.

Economic viability represents perhaps the most significant barrier. The cost gap between conventional and green ammonia production remains substantial, with green ammonia currently priced at $600-1,200 per ton versus $200-400 for conventional production. Without carbon pricing or other policy support mechanisms, this price differential significantly impedes market development.

Technical innovation is progressing in catalyst development, with researchers exploring ruthenium and iron-based catalysts that could operate at lower temperatures and pressures than conventional systems, potentially reducing energy requirements by 20-30%.

Current Ammonia Synthesis and Utilization Methods

01 Ammonia production and synthesis for fuel applications

Various methods and systems for producing ammonia as a renewable fuel source in a circular economy. These technologies focus on sustainable ammonia synthesis processes that can utilize renewable energy sources, reducing carbon emissions compared to traditional production methods. The systems often integrate catalytic processes and energy-efficient reactions to convert nitrogen and hydrogen into ammonia for use as a clean fuel alternative.- Ammonia production and synthesis for fuel applications: Methods and systems for producing ammonia as a renewable fuel source, focusing on sustainable synthesis processes that can be integrated into circular economy frameworks. These innovations include catalytic processes, energy-efficient production methods, and technologies that enable ammonia to be produced using renewable energy sources, reducing carbon footprint and enabling closed-loop fuel systems.

- Ammonia storage, transportation and distribution systems: Technologies for safely storing, transporting, and distributing ammonia fuel within a circular economy framework. These innovations address the challenges of ammonia's physical properties, including specialized containment systems, monitoring technologies, and infrastructure solutions that enable efficient handling throughout the supply chain while minimizing losses and environmental impact.

- Ammonia combustion and energy conversion technologies: Systems and methods for efficiently converting ammonia into usable energy through combustion or other conversion processes. These technologies include specialized engines, turbines, and fuel cells designed to work with ammonia fuel, addressing challenges such as NOx emissions, combustion efficiency, and integration with existing power generation infrastructure to enable circular economy applications.

- Ammonia fuel monitoring and control systems: Advanced monitoring and control technologies specifically designed for ammonia fuel systems in circular economy applications. These innovations include sensors, diagnostic tools, and automated control systems that optimize ammonia utilization, ensure safety, and provide real-time data on system performance, enabling more efficient operation and integration into sustainable energy ecosystems.

- Ammonia recycling and circular economy integration: Methods and systems specifically focused on recycling ammonia and integrating it into circular economy frameworks. These technologies enable the recovery of ammonia from waste streams, conversion of ammonia by-products back into fuel, and closed-loop systems that minimize resource inputs and waste outputs, creating sustainable cycles for ammonia as an energy carrier.

02 Ammonia fuel storage and distribution systems

Technologies related to the safe storage, handling, and distribution of ammonia as a fuel within a circular economy framework. These innovations address the challenges of ammonia's toxicity and corrosive properties through specialized containment systems, monitoring technologies, and distribution infrastructure. The systems enable efficient transportation and storage of ammonia fuel while maintaining safety standards and minimizing environmental impact.Expand Specific Solutions03 Ammonia combustion and power generation technologies

Systems and methods for utilizing ammonia as a combustion fuel for power generation in engines, turbines, and other energy conversion devices. These technologies focus on optimizing combustion parameters, reducing NOx emissions, and improving energy efficiency when using ammonia as a primary or supplementary fuel. The innovations enable ammonia to serve as a carbon-free energy carrier in a circular economy by converting its chemical energy into mechanical or electrical power.Expand Specific Solutions04 Ammonia fuel monitoring and control systems

Advanced monitoring and control technologies for ammonia fuel systems that ensure optimal performance, safety, and efficiency. These innovations include sensors, diagnostic tools, and automated control mechanisms that monitor ammonia quality, combustion parameters, emissions, and system integrity. The technologies enable real-time adjustments and predictive maintenance to maximize the benefits of ammonia as a sustainable fuel within a circular economy framework.Expand Specific Solutions05 Ammonia recycling and circular economy integration

Methods and systems for recycling ammonia and integrating it into broader circular economy frameworks. These technologies focus on capturing, purifying, and reusing ammonia from various waste streams, as well as integrating ammonia fuel systems with other renewable energy technologies. The innovations enable closed-loop ammonia cycles that minimize resource consumption and environmental impact while maximizing the economic and environmental benefits of ammonia as a sustainable energy carrier.Expand Specific Solutions

Leading Organizations in Ammonia Fuel Ecosystem

The ammonia fuel market is currently in an early growth phase, characterized by increasing interest in its potential as a carbon-neutral energy carrier within the circular economy framework. The global market size is expanding, with projections suggesting significant growth as decarbonization efforts intensify across transportation and energy sectors. Technologically, the field shows varying maturity levels, with companies like AMOGY making notable advances in ammonia-powered transportation applications, while Battolyser Holding develops dual-function battery-electrolyzer systems. Academic institutions including Northwestern University and Tianjin University are driving fundamental research, while industrial players such as Linde GmbH and Sinopec are scaling commercial applications. The ecosystem features collaboration between startups, research institutions, and established energy companies, indicating a maturing but still developing technological landscape requiring further innovation to overcome efficiency and infrastructure challenges.

AMOGY, Inc.

Technical Solution: AMOGY has developed an innovative ammonia-to-power technology that efficiently converts ammonia into hydrogen for fuel cell applications. Their system employs a proprietary catalyst that enables ammonia cracking at lower temperatures (around 450°C compared to traditional 850°C), significantly improving energy efficiency. The technology integrates a compact ammonia cracking reactor with PEM fuel cells to generate clean electricity. AMOGY's solution addresses the critical challenge of hydrogen storage and transport by utilizing ammonia as a hydrogen carrier, which contains 17.6% hydrogen by weight and can be liquefied at -33°C under ambient pressure. Their system has been successfully demonstrated in various mobility applications, including a drone with 3x the flight time of batteries, a tractor with 8-hour operation capability, and a semi-truck with over 300-mile range.

Strengths: Higher energy density than batteries (3x energy density of Li-ion); faster refueling compared to batteries; zero-carbon operation when using green ammonia; compact system design enabling mobile applications. Weaknesses: Still requires high temperatures for cracking; catalyst degradation over time; safety concerns with ammonia handling; higher system complexity compared to direct battery solutions.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed comprehensive ammonia-based energy systems supporting circular economy principles. Their technology portfolio includes green ammonia production facilities that integrate renewable energy with advanced electrolyzers achieving 70% efficiency, significantly higher than conventional systems. Sinopec has engineered specialized catalysts for the Haber-Bosch process that operate at lower temperatures (380°C vs traditional 450°C) and pressures, reducing energy requirements by approximately 20%. Their ammonia utilization technologies include direct ammonia fuel cells with power densities reaching 50mW/cm² and ammonia cracking systems with hydrogen recovery rates exceeding 95%. Sinopec has also developed ammonia co-firing technologies for existing coal power plants, enabling up to 20% ammonia substitution without significant modifications. Their circular approach includes carbon capture technologies integrated with ammonia production, using the captured CO2 for enhanced oil recovery or conversion to value-added chemicals, creating a closed-loop system that significantly reduces overall carbon emissions.

Strengths: Vertical integration capabilities from production to utilization; extensive existing infrastructure that can be adapted; significant R&D resources; ability to implement at industrial scale. Weaknesses: Still heavily invested in fossil fuel infrastructure creating potential conflicts; green ammonia production remains more costly than conventional methods; technology transition requires significant capital investment; safety and regulatory challenges in implementation.

Key Patents in Ammonia Fuel Technologies

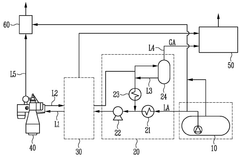

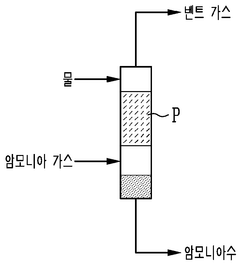

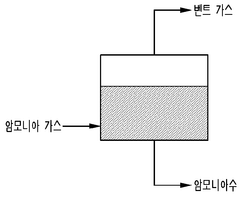

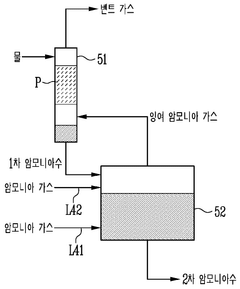

Ammonia processing system and ship including same

PatentWO2025084466A2

Innovation

- An ammonia processing system that includes a fuel storage unit, a fuel supply unit, a processing apparatus with a scrubber and absorption tank, and a recovery tank to recover and reuse ammonia discharged during ship stoppages.

Systems and methods for forming nitrogen-based compounds

PatentActiveUS11885029B2

Innovation

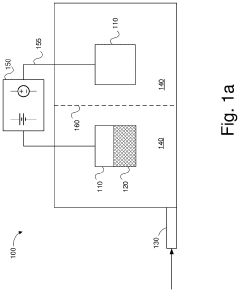

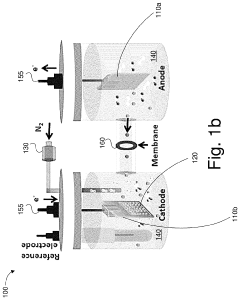

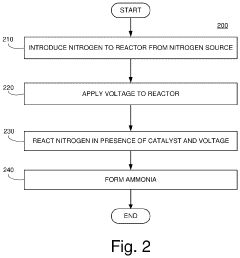

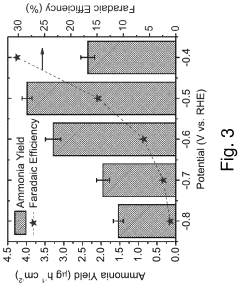

- A system comprising an anode, cathode, and catalyst material with nanoparticles having interior cavities, configured to use nitrogen and water to generate ammonia, utilizing electrocatalytic fixation of nitrogen under ambient conditions with a voltage supply and electrolyte to enhance yield and Faradaic efficiency.

Carbon Neutrality and Policy Frameworks

The global commitment to carbon neutrality has created a fertile ground for ammonia fuel to emerge as a significant player in the energy transition landscape. The Paris Agreement's ambitious target of limiting global warming to well below 2°C has prompted nations worldwide to establish carbon neutrality goals, typically targeting 2050-2060. Within this framework, ammonia presents a compelling case as a carbon-free hydrogen carrier that can facilitate deep decarbonization across multiple sectors, particularly in hard-to-abate industries like shipping and heavy industry.

Policy frameworks supporting ammonia as a clean fuel are evolving rapidly across different regions. The European Union's Green Deal and Hydrogen Strategy explicitly recognize ammonia's potential in the energy transition, allocating substantial funding for research and demonstration projects. Similarly, Japan's Strategic Roadmap for Hydrogen and Ammonia positions ammonia as a key element in achieving its 2050 carbon neutrality target, with specific focus on co-firing ammonia in existing coal power plants.

In the United States, the Inflation Reduction Act of 2022 provides significant tax incentives for clean hydrogen production, indirectly benefiting ammonia production pathways. Meanwhile, Australia has positioned itself as a potential ammonia export powerhouse through its National Hydrogen Strategy, leveraging its abundant renewable resources to produce green ammonia for domestic use and international markets, particularly in Asia.

The regulatory landscape is increasingly incorporating carbon pricing mechanisms that enhance the economic viability of ammonia fuel systems. Carbon taxes, emissions trading schemes, and carbon border adjustment mechanisms are creating economic incentives that gradually shift the cost advantage from fossil fuels to carbon-neutral alternatives like green ammonia. These policy instruments are critical in addressing the current cost gap between conventional and green ammonia production methods.

International maritime regulations are also evolving to favor ammonia adoption. The International Maritime Organization's initial strategy to reduce greenhouse gas emissions from ships by at least 50% by 2050 compared to 2008 levels has catalyzed interest in ammonia as a marine fuel. Classification societies and regulatory bodies are developing safety standards and operational guidelines for ammonia-fueled vessels, addressing the unique handling requirements of this fuel.

Despite these positive developments, policy harmonization remains a challenge. Inconsistent standards, varying incentive structures, and differing regulatory approaches across jurisdictions create market fragmentation that could impede the scaling of ammonia fuel technologies. A coordinated international approach to ammonia fuel regulation, certification, and trade would significantly accelerate its adoption within the circular economy framework.

Policy frameworks supporting ammonia as a clean fuel are evolving rapidly across different regions. The European Union's Green Deal and Hydrogen Strategy explicitly recognize ammonia's potential in the energy transition, allocating substantial funding for research and demonstration projects. Similarly, Japan's Strategic Roadmap for Hydrogen and Ammonia positions ammonia as a key element in achieving its 2050 carbon neutrality target, with specific focus on co-firing ammonia in existing coal power plants.

In the United States, the Inflation Reduction Act of 2022 provides significant tax incentives for clean hydrogen production, indirectly benefiting ammonia production pathways. Meanwhile, Australia has positioned itself as a potential ammonia export powerhouse through its National Hydrogen Strategy, leveraging its abundant renewable resources to produce green ammonia for domestic use and international markets, particularly in Asia.

The regulatory landscape is increasingly incorporating carbon pricing mechanisms that enhance the economic viability of ammonia fuel systems. Carbon taxes, emissions trading schemes, and carbon border adjustment mechanisms are creating economic incentives that gradually shift the cost advantage from fossil fuels to carbon-neutral alternatives like green ammonia. These policy instruments are critical in addressing the current cost gap between conventional and green ammonia production methods.

International maritime regulations are also evolving to favor ammonia adoption. The International Maritime Organization's initial strategy to reduce greenhouse gas emissions from ships by at least 50% by 2050 compared to 2008 levels has catalyzed interest in ammonia as a marine fuel. Classification societies and regulatory bodies are developing safety standards and operational guidelines for ammonia-fueled vessels, addressing the unique handling requirements of this fuel.

Despite these positive developments, policy harmonization remains a challenge. Inconsistent standards, varying incentive structures, and differing regulatory approaches across jurisdictions create market fragmentation that could impede the scaling of ammonia fuel technologies. A coordinated international approach to ammonia fuel regulation, certification, and trade would significantly accelerate its adoption within the circular economy framework.

Circular Economy Integration Strategies

Integrating ammonia fuel systems into the circular economy framework requires strategic approaches that maximize resource efficiency while minimizing environmental impacts. The transition toward ammonia as a sustainable energy carrier necessitates comprehensive integration strategies that address the entire lifecycle from production to end-use and recovery.

A key integration strategy involves establishing closed-loop ammonia production systems where renewable energy powers electrolysis for green hydrogen generation, which then combines with nitrogen through the Haber-Bosch process. These systems can be designed to operate at various scales, from industrial complexes to distributed energy networks, enabling localized production that reduces transportation emissions and enhances energy security.

Infrastructure adaptation represents another critical integration pathway. Existing natural gas infrastructure can be partially repurposed for ammonia distribution, though this requires careful materials selection to prevent nitrogen embrittlement. Dual-purpose infrastructure that accommodates both conventional fuels and ammonia during transition periods offers a pragmatic approach to gradual system transformation while maintaining energy reliability.

Waste heat recovery systems present significant circular economy opportunities. The exothermic nature of ammonia synthesis and its potential reconversion to hydrogen release substantial thermal energy that can be captured for district heating, industrial processes, or conversion to electrical power through organic Rankine cycles. This cascading energy use maximizes the utility derived from each unit of primary energy input.

Cross-sector integration strategies connect ammonia fuel systems with agricultural and industrial sectors. Ammonia's dual role as both energy carrier and fertilizer precursor creates unique synergies where production facilities can flexibly respond to energy and agricultural market demands. During periods of energy surplus, excess production can be directed toward fertilizer markets, while energy scarcity can trigger prioritization of fuel applications.

Digital technologies enable sophisticated integration through smart grid connections, predictive maintenance systems, and blockchain-based tracking of ammonia's carbon intensity throughout its lifecycle. These technologies facilitate real-time optimization of production and distribution based on renewable energy availability, market demands, and carbon reduction targets.

Regulatory frameworks and market mechanisms must evolve to support circular ammonia economies. Carbon pricing, renewable content standards, and lifecycle assessment requirements can create economic incentives that favor closed-loop systems over linear production models. Policy coordination across energy, agricultural, and industrial sectors is essential to prevent regulatory conflicts and maximize system efficiency.

A key integration strategy involves establishing closed-loop ammonia production systems where renewable energy powers electrolysis for green hydrogen generation, which then combines with nitrogen through the Haber-Bosch process. These systems can be designed to operate at various scales, from industrial complexes to distributed energy networks, enabling localized production that reduces transportation emissions and enhances energy security.

Infrastructure adaptation represents another critical integration pathway. Existing natural gas infrastructure can be partially repurposed for ammonia distribution, though this requires careful materials selection to prevent nitrogen embrittlement. Dual-purpose infrastructure that accommodates both conventional fuels and ammonia during transition periods offers a pragmatic approach to gradual system transformation while maintaining energy reliability.

Waste heat recovery systems present significant circular economy opportunities. The exothermic nature of ammonia synthesis and its potential reconversion to hydrogen release substantial thermal energy that can be captured for district heating, industrial processes, or conversion to electrical power through organic Rankine cycles. This cascading energy use maximizes the utility derived from each unit of primary energy input.

Cross-sector integration strategies connect ammonia fuel systems with agricultural and industrial sectors. Ammonia's dual role as both energy carrier and fertilizer precursor creates unique synergies where production facilities can flexibly respond to energy and agricultural market demands. During periods of energy surplus, excess production can be directed toward fertilizer markets, while energy scarcity can trigger prioritization of fuel applications.

Digital technologies enable sophisticated integration through smart grid connections, predictive maintenance systems, and blockchain-based tracking of ammonia's carbon intensity throughout its lifecycle. These technologies facilitate real-time optimization of production and distribution based on renewable energy availability, market demands, and carbon reduction targets.

Regulatory frameworks and market mechanisms must evolve to support circular ammonia economies. Carbon pricing, renewable content standards, and lifecycle assessment requirements can create economic incentives that favor closed-loop systems over linear production models. Policy coordination across energy, agricultural, and industrial sectors is essential to prevent regulatory conflicts and maximize system efficiency.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!