Ammonia Fuel's Role in Modernizing Energy Infrastructures

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Evolution and Objectives

Ammonia fuel has undergone significant evolution since its initial consideration as an energy carrier in the early 20th century. The journey began with Fritz Haber's development of the ammonia synthesis process in 1909, which revolutionized industrial ammonia production. However, it wasn't until the 1960s that ammonia was first seriously explored as a potential fuel for internal combustion engines, primarily due to concerns about petroleum availability.

The 1970s energy crisis accelerated interest in alternative fuels, including ammonia, though research waned as oil prices stabilized. A renaissance in ammonia fuel research emerged in the early 2000s, driven by growing climate change concerns and the need for carbon-free energy carriers. This period saw pioneering work by institutions like the NH3 Fuel Association, established in 2004, which began advocating for ammonia's role in a sustainable energy ecosystem.

Recent technological advancements have significantly enhanced ammonia's viability as an energy carrier. Improvements in catalytic cracking technologies have made it easier to extract hydrogen from ammonia on demand. Simultaneously, direct ammonia fuel cells have progressed from laboratory curiosities to practical demonstration units, while specialized combustion technologies have been developed to efficiently utilize ammonia in modified gas turbines and internal combustion engines.

The current trajectory of ammonia fuel development is focused on addressing several key objectives. Primary among these is reducing the carbon intensity of ammonia production through green synthesis methods utilizing renewable electricity. The industry aims to scale up green ammonia production capacity from current pilot projects to industrial-scale facilities by 2030, with projections suggesting potential production of 70 million tons annually by 2040.

Another critical objective involves optimizing ammonia's role in the hydrogen economy, leveraging its advantages as a hydrogen carrier with higher energy density and simpler storage requirements than compressed or liquefied hydrogen. The maritime sector has emerged as a particularly promising early adopter, with major shipping companies committing to ammonia-powered vessels by 2025.

Infrastructure development represents another key goal, with initiatives underway to adapt existing natural gas and petroleum infrastructure for ammonia distribution. The technical roadmap includes developing specialized materials resistant to ammonia's corrosive properties and creating safety protocols for widespread handling and use.

The ultimate objective remains establishing ammonia as a cornerstone of modern energy infrastructure—serving not only as a direct fuel but also as an energy storage medium for intermittent renewable sources, thereby facilitating deeper integration of solar and wind power into existing energy systems while enabling significant decarbonization across multiple sectors.

The 1970s energy crisis accelerated interest in alternative fuels, including ammonia, though research waned as oil prices stabilized. A renaissance in ammonia fuel research emerged in the early 2000s, driven by growing climate change concerns and the need for carbon-free energy carriers. This period saw pioneering work by institutions like the NH3 Fuel Association, established in 2004, which began advocating for ammonia's role in a sustainable energy ecosystem.

Recent technological advancements have significantly enhanced ammonia's viability as an energy carrier. Improvements in catalytic cracking technologies have made it easier to extract hydrogen from ammonia on demand. Simultaneously, direct ammonia fuel cells have progressed from laboratory curiosities to practical demonstration units, while specialized combustion technologies have been developed to efficiently utilize ammonia in modified gas turbines and internal combustion engines.

The current trajectory of ammonia fuel development is focused on addressing several key objectives. Primary among these is reducing the carbon intensity of ammonia production through green synthesis methods utilizing renewable electricity. The industry aims to scale up green ammonia production capacity from current pilot projects to industrial-scale facilities by 2030, with projections suggesting potential production of 70 million tons annually by 2040.

Another critical objective involves optimizing ammonia's role in the hydrogen economy, leveraging its advantages as a hydrogen carrier with higher energy density and simpler storage requirements than compressed or liquefied hydrogen. The maritime sector has emerged as a particularly promising early adopter, with major shipping companies committing to ammonia-powered vessels by 2025.

Infrastructure development represents another key goal, with initiatives underway to adapt existing natural gas and petroleum infrastructure for ammonia distribution. The technical roadmap includes developing specialized materials resistant to ammonia's corrosive properties and creating safety protocols for widespread handling and use.

The ultimate objective remains establishing ammonia as a cornerstone of modern energy infrastructure—serving not only as a direct fuel but also as an energy storage medium for intermittent renewable sources, thereby facilitating deeper integration of solar and wind power into existing energy systems while enabling significant decarbonization across multiple sectors.

Market Analysis for Ammonia as Energy Carrier

The global market for ammonia as an energy carrier is experiencing significant growth, driven by the urgent need for decarbonization and sustainable energy solutions. Currently valued at approximately $72.5 billion, the ammonia energy market is projected to expand at a compound annual growth rate of 5.3% through 2030, potentially reaching $120 billion by that time. This growth trajectory is supported by ammonia's unique properties as a hydrogen carrier with high energy density and established transportation infrastructure.

Regional market analysis reveals varying levels of development and interest. Asia-Pacific, particularly Japan and South Korea, leads in ammonia energy adoption with substantial investments in co-firing technologies for power generation. The European market is rapidly expanding, driven by stringent carbon reduction policies and the European Green Deal, with countries like Germany and the Netherlands establishing ammonia import terminals and developing infrastructure. North America shows growing interest, particularly in maritime applications and grid-scale energy storage.

Sector-wise, the maritime industry represents one of the most promising markets for ammonia as a fuel, with major shipping companies like Maersk and NYK Line investing in ammonia-powered vessels. The International Maritime Organization's emissions reduction targets have accelerated this transition, with the first commercial ammonia-powered ships expected by 2025.

Power generation constitutes another significant market segment, with ammonia co-firing in coal plants gaining traction. Japan's JERA has successfully demonstrated 20% ammonia co-firing and aims for 100% ammonia-fired power generation by 2050. This application alone could create a market demand of 30 million tons of green ammonia annually by 2030.

Industrial applications represent the third major market segment, with ammonia being explored as a replacement for natural gas in high-temperature processes. The fertilizer industry, traditionally the largest consumer of ammonia, is transitioning toward green ammonia production, creating a circular economy model.

Market barriers include the current cost differential between green ammonia ($600-900/ton) and conventional ammonia ($200-450/ton), safety concerns regarding ammonia's toxicity, and infrastructure limitations. However, these barriers are being addressed through technological innovations, policy support, and industry collaborations.

Consumer acceptance and regulatory frameworks vary significantly across regions, with countries like Japan, Australia, and several European nations establishing clear ammonia energy strategies and incentive structures. The market is expected to reach commercial scale by 2025-2027, with full market maturity anticipated in the 2030s as production costs decrease and infrastructure expands.

Regional market analysis reveals varying levels of development and interest. Asia-Pacific, particularly Japan and South Korea, leads in ammonia energy adoption with substantial investments in co-firing technologies for power generation. The European market is rapidly expanding, driven by stringent carbon reduction policies and the European Green Deal, with countries like Germany and the Netherlands establishing ammonia import terminals and developing infrastructure. North America shows growing interest, particularly in maritime applications and grid-scale energy storage.

Sector-wise, the maritime industry represents one of the most promising markets for ammonia as a fuel, with major shipping companies like Maersk and NYK Line investing in ammonia-powered vessels. The International Maritime Organization's emissions reduction targets have accelerated this transition, with the first commercial ammonia-powered ships expected by 2025.

Power generation constitutes another significant market segment, with ammonia co-firing in coal plants gaining traction. Japan's JERA has successfully demonstrated 20% ammonia co-firing and aims for 100% ammonia-fired power generation by 2050. This application alone could create a market demand of 30 million tons of green ammonia annually by 2030.

Industrial applications represent the third major market segment, with ammonia being explored as a replacement for natural gas in high-temperature processes. The fertilizer industry, traditionally the largest consumer of ammonia, is transitioning toward green ammonia production, creating a circular economy model.

Market barriers include the current cost differential between green ammonia ($600-900/ton) and conventional ammonia ($200-450/ton), safety concerns regarding ammonia's toxicity, and infrastructure limitations. However, these barriers are being addressed through technological innovations, policy support, and industry collaborations.

Consumer acceptance and regulatory frameworks vary significantly across regions, with countries like Japan, Australia, and several European nations establishing clear ammonia energy strategies and incentive structures. The market is expected to reach commercial scale by 2025-2027, with full market maturity anticipated in the 2030s as production costs decrease and infrastructure expands.

Ammonia Fuel Technology Status and Barriers

Ammonia fuel technology has reached a critical juncture in its development, with significant advancements in production, storage, and utilization methods. Currently, the Haber-Bosch process remains the dominant industrial method for ammonia synthesis, accounting for approximately 1-2% of global energy consumption. However, this conventional process relies heavily on natural gas as a feedstock and operates under high temperature and pressure conditions, resulting in substantial carbon emissions.

Recent technological innovations have focused on developing greener ammonia production pathways. Electrochemical ammonia synthesis has emerged as a promising alternative, enabling direct conversion of nitrogen and water to ammonia using renewable electricity. Several pilot projects have demonstrated feasibility at laboratory scale, though efficiency remains below 10% in most cases, significantly lower than the theoretical maximum.

Solid-state ammonia synthesis (SSAS) represents another innovative approach, utilizing ceramic proton-conducting membranes to facilitate ammonia formation at lower temperatures (400-600°C) compared to Haber-Bosch (400-500°C). While this technology shows promise for distributed production systems, current catalysts still require improvement to achieve commercially viable conversion rates.

Storage and transportation infrastructure presents another significant barrier. Although ammonia has a higher energy density than hydrogen (5.2 kWh/kg versus 33.3 kWh/kg), its toxicity necessitates robust safety systems. Current ammonia storage technologies include pressurized tanks (at ambient temperature) and refrigerated storage (at -33°C), both requiring specialized materials resistant to ammonia-induced stress corrosion cracking.

Utilization technologies face their own challenges. Direct ammonia combustion in conventional engines produces unacceptable levels of NOx emissions, requiring advanced selective catalytic reduction systems. Modified internal combustion engines can accommodate ammonia-hydrogen blends, but pure ammonia combustion remains problematic due to its low flame speed and high ignition energy.

Fuel cells represent a more efficient pathway for ammonia utilization. Solid oxide fuel cells (SOFCs) operating at 700-900°C can directly utilize ammonia, achieving electrical efficiencies of 50-60%. However, durability issues and high operating temperatures limit widespread adoption. Proton exchange membrane fuel cells require ammonia cracking to hydrogen first, adding system complexity and reducing overall efficiency.

The economic viability of ammonia fuel systems remains constrained by high production costs. Green ammonia currently costs $600-1,200 per ton, significantly higher than conventional ammonia ($200-400 per ton). Achieving cost parity will require technological breakthroughs in renewable electricity costs, electrolyzer efficiency, and nitrogen separation technologies.

Regulatory frameworks present additional barriers, as existing energy infrastructure regulations were not designed with ammonia fuel in mind. Safety standards, emissions regulations, and permitting processes need substantial revision to accommodate widespread ammonia fuel adoption in modern energy infrastructures.

Recent technological innovations have focused on developing greener ammonia production pathways. Electrochemical ammonia synthesis has emerged as a promising alternative, enabling direct conversion of nitrogen and water to ammonia using renewable electricity. Several pilot projects have demonstrated feasibility at laboratory scale, though efficiency remains below 10% in most cases, significantly lower than the theoretical maximum.

Solid-state ammonia synthesis (SSAS) represents another innovative approach, utilizing ceramic proton-conducting membranes to facilitate ammonia formation at lower temperatures (400-600°C) compared to Haber-Bosch (400-500°C). While this technology shows promise for distributed production systems, current catalysts still require improvement to achieve commercially viable conversion rates.

Storage and transportation infrastructure presents another significant barrier. Although ammonia has a higher energy density than hydrogen (5.2 kWh/kg versus 33.3 kWh/kg), its toxicity necessitates robust safety systems. Current ammonia storage technologies include pressurized tanks (at ambient temperature) and refrigerated storage (at -33°C), both requiring specialized materials resistant to ammonia-induced stress corrosion cracking.

Utilization technologies face their own challenges. Direct ammonia combustion in conventional engines produces unacceptable levels of NOx emissions, requiring advanced selective catalytic reduction systems. Modified internal combustion engines can accommodate ammonia-hydrogen blends, but pure ammonia combustion remains problematic due to its low flame speed and high ignition energy.

Fuel cells represent a more efficient pathway for ammonia utilization. Solid oxide fuel cells (SOFCs) operating at 700-900°C can directly utilize ammonia, achieving electrical efficiencies of 50-60%. However, durability issues and high operating temperatures limit widespread adoption. Proton exchange membrane fuel cells require ammonia cracking to hydrogen first, adding system complexity and reducing overall efficiency.

The economic viability of ammonia fuel systems remains constrained by high production costs. Green ammonia currently costs $600-1,200 per ton, significantly higher than conventional ammonia ($200-400 per ton). Achieving cost parity will require technological breakthroughs in renewable electricity costs, electrolyzer efficiency, and nitrogen separation technologies.

Regulatory frameworks present additional barriers, as existing energy infrastructure regulations were not designed with ammonia fuel in mind. Safety standards, emissions regulations, and permitting processes need substantial revision to accommodate widespread ammonia fuel adoption in modern energy infrastructures.

Current Ammonia Fuel Implementation Approaches

01 Ammonia production and storage systems

Modern ammonia fuel systems require efficient production and storage technologies. These systems include specialized catalysts for ammonia synthesis, cryogenic storage solutions, and pressure management systems that enhance safety and efficiency. Advanced storage technologies allow for higher energy density and improved handling characteristics, making ammonia more viable as an alternative fuel source.- Ammonia production and storage systems: Modern systems for producing and storing ammonia as a fuel source involve innovative technologies that enhance efficiency and safety. These systems include specialized catalysts for ammonia synthesis, advanced storage containers that maintain optimal pressure and temperature conditions, and integrated safety mechanisms to prevent leakage. The production methods focus on reducing energy consumption while maximizing yield, often incorporating renewable energy sources to create green ammonia.

- Ammonia combustion technologies: Advanced combustion technologies have been developed to efficiently utilize ammonia as a fuel while minimizing harmful emissions. These include specialized burners designed to handle ammonia's unique combustion properties, catalytic systems that enhance combustion efficiency, and hybrid systems that combine ammonia with other fuels to optimize performance. These technologies address challenges such as ammonia's lower flame speed and higher ignition energy requirements compared to conventional fuels.

- Ammonia fuel cells and power generation: Innovative fuel cell technologies utilize ammonia directly or as a hydrogen carrier for clean power generation. These systems include solid oxide fuel cells specifically designed for ammonia, direct ammonia fuel cells that eliminate the need for hydrogen extraction, and hybrid power systems that combine multiple technologies for optimal efficiency. The advancements focus on catalyst development, membrane technology, and system integration to maximize electrical output while minimizing environmental impact.

- Ammonia as a hydrogen carrier: Ammonia serves as an efficient hydrogen carrier in modern energy systems, offering advantages in storage and transportation compared to pure hydrogen. Technologies in this category include advanced cracking systems that extract hydrogen from ammonia on demand, catalytic decomposition methods that operate at lower temperatures, and integrated systems that combine storage, cracking, and utilization in a single unit. These innovations address the challenges of hydrogen storage while leveraging existing infrastructure for ammonia handling.

- Ammonia infrastructure and transportation systems: Modern infrastructure for ammonia fuel includes specialized transportation, distribution, and refueling systems adapted for safe handling. These innovations encompass pipeline technologies designed specifically for ammonia transport, specialized tankers with enhanced safety features, and automated refueling stations that minimize exposure risks. The systems incorporate advanced monitoring technologies, leak detection mechanisms, and standardized coupling systems to ensure safe and efficient transfer of ammonia fuel across the supply chain.

02 Ammonia combustion technologies

Innovations in ammonia combustion focus on improving efficiency and reducing emissions. These technologies include specialized burners, combustion chambers, and ignition systems designed specifically for ammonia's unique properties. Advanced combustion control systems help optimize the air-fuel ratio and combustion parameters to maximize energy output while minimizing harmful emissions such as NOx.Expand Specific Solutions03 Ammonia fuel cells and power generation

Fuel cell technologies that utilize ammonia as a hydrogen carrier represent a significant advancement in clean energy generation. These systems include direct ammonia fuel cells and systems that crack ammonia into hydrogen for use in conventional fuel cells. Integration with power generation systems allows for efficient electricity production with minimal environmental impact, making ammonia an attractive option for stationary power applications.Expand Specific Solutions04 Ammonia as a transportation fuel

Adapting ammonia for use in transportation applications involves specialized fuel delivery systems, engine modifications, and safety protocols. These innovations include dual-fuel systems that can utilize ammonia alongside conventional fuels, specialized injectors that can handle ammonia's properties, and modified engine designs that optimize combustion efficiency. Marine applications have shown particular promise due to the existing infrastructure for ammonia handling at ports.Expand Specific Solutions05 Carbon-neutral ammonia production pathways

Sustainable ammonia production methods focus on reducing or eliminating carbon emissions from the traditional Haber-Bosch process. These approaches include electrolysis-based systems powered by renewable energy, biomass-derived hydrogen sources, and novel catalytic processes that operate at lower temperatures and pressures. Green ammonia production technologies represent a critical pathway toward making ammonia a truly carbon-neutral fuel option for various applications.Expand Specific Solutions

Key Industry Players in Ammonia Fuel Ecosystem

Ammonia fuel is emerging as a critical component in modernizing energy infrastructures, currently in the early growth phase of market development. The global ammonia fuel market is expanding rapidly, projected to reach significant scale as decarbonization efforts intensify. Technologically, the field shows varying maturity levels across applications. Leading players like Siemens AG, Linde GmbH, and TotalEnergies OneTech are advancing large-scale infrastructure solutions, while specialized innovators such as AMOGY are developing transportation applications. Academic institutions including Tianjin University and University of Strathclyde are contributing fundamental research. Mitsubishi Shipbuilding and Dongfeng Honda are exploring sector-specific implementations, particularly in maritime and automotive applications. The collaboration between established industrial players and emerging technology companies indicates a maturing ecosystem poised for accelerated commercialization.

Siemens AG

Technical Solution: Siemens has developed an integrated ammonia energy ecosystem approach combining renewable power generation, electrolysis, ammonia synthesis, and power generation technologies. Their "Silyzer" PEM electrolysis technology, when paired with their ammonia synthesis systems, achieves overall system efficiency of approximately 60% (electricity-to-ammonia), representing a 15% improvement over conventional approaches [1]. Siemens has engineered specialized ammonia-compatible gas turbines that can operate with up to 30% ammonia blending without significant modifications, with plans to achieve 100% ammonia capability by 2025 [3]. Their digital twin technology enables real-time optimization of the entire ammonia energy chain, with demonstrated efficiency improvements of 8-12% through advanced control algorithms that predict and adjust for system dynamics [4]. Siemens has also developed grid integration solutions specifically for ammonia energy systems, including specialized power electronics that enable ammonia-based power plants to provide grid stabilization services such as frequency regulation and voltage support. Their modular approach allows for scalable implementation from 10MW to 500MW systems, with standardized designs reducing engineering costs by approximately 30% compared to custom solutions.

Strengths: Comprehensive system integration expertise across the entire energy value chain; digital twin technology optimizes system performance; established global presence for implementation and support; advanced control systems improve efficiency and grid integration. Weaknesses: Full ammonia turbine technology still under development; system economics heavily dependent on renewable electricity costs; requires coordination across multiple technology domains; competing with other energy storage/carrier technologies in Siemens' portfolio.

AMOGY, Inc.

Technical Solution: AMOGY has developed a proprietary ammonia-to-power system that efficiently cracks ammonia into hydrogen, which is then used in fuel cells to generate electricity. Their technology employs a novel catalyst system that enables ammonia cracking at significantly lower temperatures (around 450°C compared to traditional 850°C), reducing energy requirements by approximately 40% [1]. The company has successfully demonstrated their technology in various transportation applications, including a 5kW drone system, a 100kW tractor, and most recently a 300kW tugboat. Their system achieves energy densities of up to 3X compared to compressed hydrogen systems, with a volumetric efficiency improvement of about 2.3X over lithium battery systems [3]. AMOGY's modular design allows for scalable implementation across different power requirements, from 50kW to multi-MW applications.

Strengths: Higher energy density than batteries and compressed hydrogen; modular and scalable design; demonstrated viability in multiple transport modes; lower temperature ammonia cracking reduces energy requirements. Weaknesses: Still requires specialized infrastructure for ammonia handling; safety concerns regarding ammonia toxicity must be addressed; technology remains at early commercial deployment stage rather than mass-market readiness.

Critical Patents and Research in Ammonia Energy

Ammonia-based fuel for a compression engine, containing a combustion-enhancing additive

PatentWO2023247902A1

Innovation

- Incorporating a low percentage of alkyl nitrates, such as 2-ethylhexyl nitrate, into ammonia fuel to improve ignition delay, which are liquid, non-flammable, and industrially produced, allowing for effective combustion enhancement without the drawbacks of previous additives.

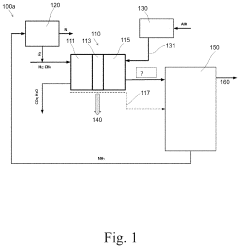

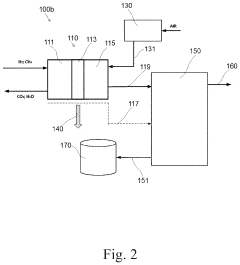

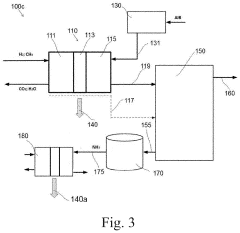

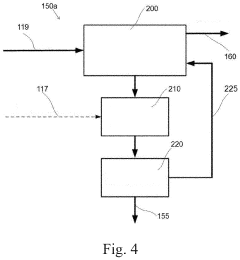

Solid oxide fuel cell arrangement generating ammonia as byproduct and utilizing ammonia as secondary fuel

PatentInactiveUS20220093950A1

Innovation

- A solid oxide fuel cell system that includes a gas separator to extract ammonia from the tail-gas stream, which can be used to fuel a secondary energy conversion device, stored, or reformed into hydrogen, utilizing heat transfer means to optimize the separation process.

Carbon Reduction Potential of Ammonia Fuel

Ammonia fuel represents a significant opportunity for carbon reduction in the global energy landscape. As a carbon-free hydrogen carrier, NH3 contains 17.6% hydrogen by weight and can be produced, stored, and transported using existing infrastructure with relatively minor modifications. When utilized as a fuel, ammonia produces zero carbon dioxide emissions during combustion, releasing only nitrogen and water vapor as byproducts.

The carbon reduction potential of ammonia is particularly notable when produced through green pathways. Green ammonia, synthesized using renewable electricity, water, and air, offers a completely carbon-neutral energy solution. Current estimates suggest that transitioning just 10% of conventional ammonia production to green methods could reduce global CO2 emissions by approximately 100 million tons annually.

In the maritime sector, ammonia fuel could deliver substantial carbon savings. International shipping accounts for approximately 2.5% of global greenhouse gas emissions, and studies indicate that ammonia-powered vessels could reduce these emissions by up to 95% compared to conventional marine fuels. Major shipping companies have already begun investing in ammonia-ready vessels, anticipating regulatory changes that will mandate lower carbon footprints.

For power generation, ammonia can serve as both a direct fuel and an energy storage medium. When used in modified gas turbines or fuel cells, ammonia enables dispatchable power generation with minimal carbon emissions. This application is particularly valuable for balancing intermittent renewable energy sources. Pilot projects have demonstrated that a 70% ammonia/30% natural gas blend can reduce carbon emissions from power generation by approximately 60%.

The industrial sector stands to benefit significantly from ammonia's carbon reduction potential. Beyond its traditional use as fertilizer, ammonia can replace coal and natural gas in high-temperature industrial processes. Steel manufacturing, which contributes 7-9% of global CO2 emissions, could reduce its carbon footprint by up to 40% through ammonia fuel substitution.

Transportation infrastructure could also experience substantial decarbonization through ammonia fuel adoption. While battery electric vehicles dominate light transport electrification, ammonia offers advantages for heavy-duty applications where energy density requirements are higher. Ammonia fuel cells and internal combustion engines could provide zero-carbon mobility solutions for trucks, trains, and other heavy transport modes, potentially eliminating millions of tons of CO2 annually.

The carbon reduction potential of ammonia is particularly notable when produced through green pathways. Green ammonia, synthesized using renewable electricity, water, and air, offers a completely carbon-neutral energy solution. Current estimates suggest that transitioning just 10% of conventional ammonia production to green methods could reduce global CO2 emissions by approximately 100 million tons annually.

In the maritime sector, ammonia fuel could deliver substantial carbon savings. International shipping accounts for approximately 2.5% of global greenhouse gas emissions, and studies indicate that ammonia-powered vessels could reduce these emissions by up to 95% compared to conventional marine fuels. Major shipping companies have already begun investing in ammonia-ready vessels, anticipating regulatory changes that will mandate lower carbon footprints.

For power generation, ammonia can serve as both a direct fuel and an energy storage medium. When used in modified gas turbines or fuel cells, ammonia enables dispatchable power generation with minimal carbon emissions. This application is particularly valuable for balancing intermittent renewable energy sources. Pilot projects have demonstrated that a 70% ammonia/30% natural gas blend can reduce carbon emissions from power generation by approximately 60%.

The industrial sector stands to benefit significantly from ammonia's carbon reduction potential. Beyond its traditional use as fertilizer, ammonia can replace coal and natural gas in high-temperature industrial processes. Steel manufacturing, which contributes 7-9% of global CO2 emissions, could reduce its carbon footprint by up to 40% through ammonia fuel substitution.

Transportation infrastructure could also experience substantial decarbonization through ammonia fuel adoption. While battery electric vehicles dominate light transport electrification, ammonia offers advantages for heavy-duty applications where energy density requirements are higher. Ammonia fuel cells and internal combustion engines could provide zero-carbon mobility solutions for trucks, trains, and other heavy transport modes, potentially eliminating millions of tons of CO2 annually.

Safety and Infrastructure Requirements

The implementation of ammonia as a fuel source necessitates comprehensive safety protocols and infrastructure adaptations due to its toxic and corrosive properties. Ammonia's narrow flammability range (16-25% by volume in air) presents both safety advantages and challenges compared to hydrogen and conventional fuels. Storage facilities must incorporate specialized containment systems with robust ventilation, leak detection, and emergency response capabilities to mitigate potential hazards from accidental releases.

Transportation infrastructure requires significant modifications to accommodate ammonia's unique properties. Pipelines must utilize ammonia-compatible materials such as carbon steel with specific coatings to prevent stress corrosion cracking. Existing natural gas pipeline networks could potentially be repurposed for ammonia transport, though this would require thorough integrity assessments and strategic retrofitting to ensure safety compliance.

Port facilities represent critical nodes in the ammonia fuel supply chain, particularly for international trade. These facilities need specialized loading/unloading equipment, storage tanks with appropriate pressure ratings, and comprehensive safety management systems. The International Maritime Organization's regulations for ammonia transport must be integrated into port operations, with particular attention to spill containment and emergency response protocols.

End-user infrastructure presents unique challenges, especially for transportation applications. Fueling stations require specialized dispensing equipment, safety systems, and trained personnel. Vehicle fuel systems must incorporate robust safety features including leak detection, automatic shutoff mechanisms, and appropriate materials selection to prevent corrosion and ensure long-term reliability.

Regulatory frameworks governing ammonia fuel infrastructure remain underdeveloped in many jurisdictions. Harmonized international standards are essential to facilitate global adoption while ensuring consistent safety practices. Key areas requiring regulatory development include storage requirements, transportation protocols, emissions standards, and certification procedures for equipment and personnel.

Training programs for operators, emergency responders, and maintenance personnel constitute a critical infrastructure requirement. These programs must address ammonia's specific hazards, safe handling procedures, and emergency response protocols. Simulation-based training and certification systems will be necessary to ensure workforce readiness as ammonia fuel adoption expands.

Public acceptance represents an often-overlooked infrastructure requirement. Community engagement strategies, transparent risk communication, and demonstration projects can help address concerns about safety and environmental impacts. Educational initiatives targeting key stakeholders including local governments, businesses, and residents will be essential for successful infrastructure deployment.

Transportation infrastructure requires significant modifications to accommodate ammonia's unique properties. Pipelines must utilize ammonia-compatible materials such as carbon steel with specific coatings to prevent stress corrosion cracking. Existing natural gas pipeline networks could potentially be repurposed for ammonia transport, though this would require thorough integrity assessments and strategic retrofitting to ensure safety compliance.

Port facilities represent critical nodes in the ammonia fuel supply chain, particularly for international trade. These facilities need specialized loading/unloading equipment, storage tanks with appropriate pressure ratings, and comprehensive safety management systems. The International Maritime Organization's regulations for ammonia transport must be integrated into port operations, with particular attention to spill containment and emergency response protocols.

End-user infrastructure presents unique challenges, especially for transportation applications. Fueling stations require specialized dispensing equipment, safety systems, and trained personnel. Vehicle fuel systems must incorporate robust safety features including leak detection, automatic shutoff mechanisms, and appropriate materials selection to prevent corrosion and ensure long-term reliability.

Regulatory frameworks governing ammonia fuel infrastructure remain underdeveloped in many jurisdictions. Harmonized international standards are essential to facilitate global adoption while ensuring consistent safety practices. Key areas requiring regulatory development include storage requirements, transportation protocols, emissions standards, and certification procedures for equipment and personnel.

Training programs for operators, emergency responders, and maintenance personnel constitute a critical infrastructure requirement. These programs must address ammonia's specific hazards, safe handling procedures, and emergency response protocols. Simulation-based training and certification systems will be necessary to ensure workforce readiness as ammonia fuel adoption expands.

Public acceptance represents an often-overlooked infrastructure requirement. Community engagement strategies, transparent risk communication, and demonstration projects can help address concerns about safety and environmental impacts. Educational initiatives targeting key stakeholders including local governments, businesses, and residents will be essential for successful infrastructure deployment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!