Environmental Challenges Posed by Ammonia Fuel and Mitigation Strategies

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Development Background and Objectives

Ammonia has emerged as a promising carbon-free energy carrier in the global pursuit of sustainable energy solutions. The history of ammonia as a fuel dates back to the early 20th century, with intermittent interest during fuel shortages. However, it has gained significant attention in recent decades due to its potential role in decarbonizing hard-to-abate sectors. Unlike hydrogen, ammonia offers higher energy density and easier storage and transportation capabilities, making it particularly attractive for long-distance shipping and heavy industry applications.

The technical evolution of ammonia fuel has progressed through several distinct phases. Initially viewed primarily as a chemical feedstock for fertilizer production via the Haber-Bosch process developed in the early 1900s, ammonia's potential as an energy carrier remained largely unexplored until the energy crises of the 1970s. Recent technological advancements in renewable energy production have revitalized interest in "green ammonia," produced using renewable electricity, water, and nitrogen from the air.

Current technological development focuses on addressing ammonia's environmental challenges while maximizing its potential as a carbon-free fuel. The primary objectives include reducing nitrogen oxide (NOx) emissions during combustion, minimizing ammonia slip (unburned ammonia release), and developing efficient catalytic systems for ammonia cracking to produce hydrogen. These objectives align with broader climate goals of reducing greenhouse gas emissions while ensuring minimal environmental impact from alternative fuels.

The global research landscape shows accelerating investment in ammonia fuel technologies, with significant initiatives in Japan, Australia, Europe, and increasingly in North America. Japan's Strategic Roadmap for Hydrogen and Ammonia has positioned ammonia as a key element in their energy transition, while the European Union has incorporated ammonia in its hydrogen strategy as a hydrogen carrier. Australia has positioned itself as a potential major exporter of green ammonia, leveraging its abundant renewable energy resources.

Looking forward, the technical objectives for ammonia fuel development include improving combustion efficiency in various applications (maritime engines, gas turbines, and fuel cells), reducing production costs of green ammonia to achieve price parity with fossil fuels, and establishing comprehensive safety standards and protocols for widespread ammonia fuel adoption. The integration of ammonia into existing energy infrastructure represents both a significant challenge and opportunity in the transition to a low-carbon economy.

The technical evolution of ammonia fuel has progressed through several distinct phases. Initially viewed primarily as a chemical feedstock for fertilizer production via the Haber-Bosch process developed in the early 1900s, ammonia's potential as an energy carrier remained largely unexplored until the energy crises of the 1970s. Recent technological advancements in renewable energy production have revitalized interest in "green ammonia," produced using renewable electricity, water, and nitrogen from the air.

Current technological development focuses on addressing ammonia's environmental challenges while maximizing its potential as a carbon-free fuel. The primary objectives include reducing nitrogen oxide (NOx) emissions during combustion, minimizing ammonia slip (unburned ammonia release), and developing efficient catalytic systems for ammonia cracking to produce hydrogen. These objectives align with broader climate goals of reducing greenhouse gas emissions while ensuring minimal environmental impact from alternative fuels.

The global research landscape shows accelerating investment in ammonia fuel technologies, with significant initiatives in Japan, Australia, Europe, and increasingly in North America. Japan's Strategic Roadmap for Hydrogen and Ammonia has positioned ammonia as a key element in their energy transition, while the European Union has incorporated ammonia in its hydrogen strategy as a hydrogen carrier. Australia has positioned itself as a potential major exporter of green ammonia, leveraging its abundant renewable energy resources.

Looking forward, the technical objectives for ammonia fuel development include improving combustion efficiency in various applications (maritime engines, gas turbines, and fuel cells), reducing production costs of green ammonia to achieve price parity with fossil fuels, and establishing comprehensive safety standards and protocols for widespread ammonia fuel adoption. The integration of ammonia into existing energy infrastructure represents both a significant challenge and opportunity in the transition to a low-carbon economy.

Market Analysis for Ammonia as Alternative Fuel

The global market for ammonia as an alternative fuel is experiencing significant growth driven by the urgent need for decarbonization across various sectors. Currently valued at approximately $72.5 billion, the ammonia fuel market is projected to expand at a compound annual growth rate of 5.3% through 2030, potentially reaching $93.6 billion by that time. This growth trajectory is primarily supported by increasing governmental commitments to reduce carbon emissions and achieve net-zero targets.

The transportation sector represents the most promising market segment for ammonia fuel adoption, particularly in maritime shipping where decarbonization options are limited. Major shipping companies including Maersk, NYK Line, and MAN Energy Solutions have initiated pilot projects to test ammonia-powered vessels, with commercial deployment expected by 2025. The International Maritime Organization's target to reduce shipping emissions by 50% by 2050 serves as a significant market driver.

Power generation constitutes another substantial market opportunity, with ammonia co-firing in existing coal plants gaining traction as a transitional solution. Japan leads this segment with JERA implementing a 20% ammonia co-firing demonstration at the Hekinan thermal power plant. The power generation segment is expected to grow at 7.2% annually through 2028.

Geographically, Asia-Pacific dominates the ammonia fuel market landscape, accounting for 42% of global demand, followed by Europe at 31%. Japan, South Korea, and Australia have established the most advanced ammonia fuel ecosystems, while European adoption is accelerating through initiatives like the EU Hydrogen Strategy, which explicitly includes ammonia as a hydrogen carrier.

Market barriers remain significant, with production costs being the primary challenge. Green ammonia currently costs $600-900 per ton compared to $200-350 for conventional ammonia. Infrastructure limitations also constrain market growth, as specialized storage, transportation, and bunkering facilities require substantial investment estimated at $30-50 billion globally by 2030.

Competitive dynamics are evolving rapidly with traditional ammonia producers like CF Industries and Yara International expanding into green ammonia production. Energy majors including Shell, BP, and Total have announced strategic investments in ammonia fuel technology. Additionally, specialized technology providers such as Haldor Topsoe and ThyssenKrupp are developing innovative ammonia synthesis and cracking technologies to improve efficiency and reduce costs.

Consumer acceptance represents another critical market factor, with safety concerns and operational familiarity serving as potential adoption barriers that require comprehensive training programs and safety protocols to address.

The transportation sector represents the most promising market segment for ammonia fuel adoption, particularly in maritime shipping where decarbonization options are limited. Major shipping companies including Maersk, NYK Line, and MAN Energy Solutions have initiated pilot projects to test ammonia-powered vessels, with commercial deployment expected by 2025. The International Maritime Organization's target to reduce shipping emissions by 50% by 2050 serves as a significant market driver.

Power generation constitutes another substantial market opportunity, with ammonia co-firing in existing coal plants gaining traction as a transitional solution. Japan leads this segment with JERA implementing a 20% ammonia co-firing demonstration at the Hekinan thermal power plant. The power generation segment is expected to grow at 7.2% annually through 2028.

Geographically, Asia-Pacific dominates the ammonia fuel market landscape, accounting for 42% of global demand, followed by Europe at 31%. Japan, South Korea, and Australia have established the most advanced ammonia fuel ecosystems, while European adoption is accelerating through initiatives like the EU Hydrogen Strategy, which explicitly includes ammonia as a hydrogen carrier.

Market barriers remain significant, with production costs being the primary challenge. Green ammonia currently costs $600-900 per ton compared to $200-350 for conventional ammonia. Infrastructure limitations also constrain market growth, as specialized storage, transportation, and bunkering facilities require substantial investment estimated at $30-50 billion globally by 2030.

Competitive dynamics are evolving rapidly with traditional ammonia producers like CF Industries and Yara International expanding into green ammonia production. Energy majors including Shell, BP, and Total have announced strategic investments in ammonia fuel technology. Additionally, specialized technology providers such as Haldor Topsoe and ThyssenKrupp are developing innovative ammonia synthesis and cracking technologies to improve efficiency and reduce costs.

Consumer acceptance represents another critical market factor, with safety concerns and operational familiarity serving as potential adoption barriers that require comprehensive training programs and safety protocols to address.

Technical Barriers and Environmental Challenges

Despite ammonia's potential as a carbon-free fuel, significant technical barriers and environmental challenges must be addressed before widespread adoption. The most pressing environmental concern is ammonia's toxicity. With an exposure limit of 25-50 ppm, ammonia poses serious health risks including respiratory irritation, pulmonary edema, and even death at high concentrations. This necessitates robust safety protocols and containment systems throughout the fuel lifecycle, from production to storage and utilization.

Ammonia combustion presents another major challenge: the formation of nitrogen oxides (NOx). When ammonia burns, it can produce significant NOx emissions, which contribute to smog formation, acid rain, and respiratory health issues. Current combustion technologies struggle to balance complete ammonia conversion with minimal NOx production, creating a technical paradox that requires innovative combustion strategies and post-combustion treatment systems.

Ammonia slip—unburned ammonia in exhaust gases—represents both an efficiency loss and environmental hazard. Even small concentrations of ammonia released to the atmosphere can harm aquatic ecosystems through deposition and contribute to particulate matter formation. Developing catalytic systems that can effectively handle ammonia slip remains a significant technical challenge.

The energy density limitations of ammonia (18.6 MJ/kg compared to diesel's 45.5 MJ/kg) necessitate larger fuel storage systems, creating additional safety concerns and increasing the potential environmental impact of leaks or accidents. This challenge is particularly acute in transportation applications where space and weight constraints are critical.

Water contamination risks present another environmental concern. Ammonia is highly soluble in water and can rapidly form ammonium hydroxide, which is toxic to aquatic life even at low concentrations. Spills during transport or storage could have devastating effects on local ecosystems, requiring sophisticated containment systems and emergency response protocols.

Material compatibility issues further complicate ammonia's implementation. Ammonia's corrosive nature necessitates specialized materials for storage and handling infrastructure, many of which have their own environmental footprints. The environmental impact of producing these specialized materials must be factored into lifecycle assessments of ammonia as a fuel.

Addressing these challenges requires a multifaceted approach combining advanced combustion technologies, catalytic systems for NOx reduction, sophisticated monitoring systems, and enhanced safety protocols. Promising mitigation strategies include selective catalytic reduction (SCR) systems, advanced combustion chamber designs, and the development of ammonia-tolerant materials with reduced environmental footprints.

Ammonia combustion presents another major challenge: the formation of nitrogen oxides (NOx). When ammonia burns, it can produce significant NOx emissions, which contribute to smog formation, acid rain, and respiratory health issues. Current combustion technologies struggle to balance complete ammonia conversion with minimal NOx production, creating a technical paradox that requires innovative combustion strategies and post-combustion treatment systems.

Ammonia slip—unburned ammonia in exhaust gases—represents both an efficiency loss and environmental hazard. Even small concentrations of ammonia released to the atmosphere can harm aquatic ecosystems through deposition and contribute to particulate matter formation. Developing catalytic systems that can effectively handle ammonia slip remains a significant technical challenge.

The energy density limitations of ammonia (18.6 MJ/kg compared to diesel's 45.5 MJ/kg) necessitate larger fuel storage systems, creating additional safety concerns and increasing the potential environmental impact of leaks or accidents. This challenge is particularly acute in transportation applications where space and weight constraints are critical.

Water contamination risks present another environmental concern. Ammonia is highly soluble in water and can rapidly form ammonium hydroxide, which is toxic to aquatic life even at low concentrations. Spills during transport or storage could have devastating effects on local ecosystems, requiring sophisticated containment systems and emergency response protocols.

Material compatibility issues further complicate ammonia's implementation. Ammonia's corrosive nature necessitates specialized materials for storage and handling infrastructure, many of which have their own environmental footprints. The environmental impact of producing these specialized materials must be factored into lifecycle assessments of ammonia as a fuel.

Addressing these challenges requires a multifaceted approach combining advanced combustion technologies, catalytic systems for NOx reduction, sophisticated monitoring systems, and enhanced safety protocols. Promising mitigation strategies include selective catalytic reduction (SCR) systems, advanced combustion chamber designs, and the development of ammonia-tolerant materials with reduced environmental footprints.

Current Ammonia Emission Control Solutions

01 Ammonia production and storage challenges

The production and storage of ammonia as a fuel presents significant environmental challenges. These include energy-intensive production processes that often rely on fossil fuels, contributing to greenhouse gas emissions. Storage challenges involve safety concerns due to ammonia's toxicity and corrosiveness, requiring specialized containment systems to prevent leaks and environmental contamination. Innovations in production methods and storage technologies aim to address these environmental impacts while maintaining feasibility for fuel applications.- Ammonia production and storage challenges: Ammonia fuel faces significant production and storage challenges that impact its environmental viability. These include energy-intensive production processes that can lead to high carbon emissions if not powered by renewable sources. Storage issues relate to ammonia's toxicity, requiring specialized containment systems to prevent leaks and environmental contamination. Advanced production methods and safer storage solutions are being developed to address these environmental concerns.

- Emissions reduction technologies: Various technologies are being developed to reduce harmful emissions associated with ammonia fuel use. These include catalytic systems that minimize nitrogen oxide (NOx) formation during combustion, advanced scrubbing technologies to capture and neutralize ammonia slip, and hybrid systems that optimize combustion parameters to reduce overall emissions. These technologies aim to make ammonia a more environmentally friendly alternative to conventional fuels.

- Green ammonia production methods: Green ammonia production methods utilize renewable energy sources to synthesize ammonia with minimal environmental impact. These approaches include electrolysis-based hydrogen production coupled with nitrogen separation from air, followed by the Haber-Bosch process powered by renewable electricity. Solar, wind, and hydroelectric power are being integrated into ammonia production facilities to create truly carbon-neutral fuel. These methods address the significant carbon footprint associated with conventional ammonia production.

- Ammonia fuel cell technologies: Ammonia fuel cell technologies offer a cleaner way to extract energy from ammonia compared to combustion methods. These systems directly convert ammonia to electricity through electrochemical reactions, avoiding many of the emissions issues associated with combustion. Developments include direct ammonia fuel cells and systems that first crack ammonia into hydrogen before use in conventional fuel cells. These technologies significantly reduce environmental impacts while maintaining energy efficiency.

- Safety and environmental monitoring systems: Advanced safety and environmental monitoring systems are essential for addressing ammonia fuel environmental challenges. These include sophisticated leak detection technologies, environmental impact assessment tools, and emergency response systems designed specifically for ammonia fuel infrastructure. Continuous monitoring of air and water quality around ammonia facilities helps prevent environmental contamination and ensures rapid response to potential incidents, minimizing ecological damage.

02 Emissions reduction and control systems

Environmental challenges associated with ammonia fuel combustion include potential emissions of nitrogen oxides (NOx) and unreacted ammonia slip. Advanced control systems and catalytic technologies are being developed to minimize these emissions. These systems monitor combustion parameters and adjust operating conditions to optimize efficiency while reducing harmful byproducts. Selective catalytic reduction and other post-combustion treatment technologies help convert nitrogen compounds into harmless nitrogen gas, addressing a major environmental concern with ammonia fuel adoption.Expand Specific Solutions03 Green ammonia production technologies

Environmentally sustainable ammonia production methods are being developed to address the carbon footprint of conventional production. These include electrolysis-based systems powered by renewable energy sources like wind and solar, which split water to produce hydrogen that is then combined with nitrogen from air separation units. Biological and photocatalytic ammonia synthesis approaches are also being explored as alternatives to the traditional Haber-Bosch process. These green production pathways significantly reduce or eliminate carbon emissions associated with ammonia fuel production.Expand Specific Solutions04 Safety and handling infrastructure

Ammonia's toxicity and corrosive properties present environmental risks during transportation, distribution, and handling. Specialized infrastructure is required to prevent leaks and spills that could harm ecosystems and water resources. Advanced monitoring systems, leak detection technologies, and emergency response protocols are being developed to mitigate these risks. Material compatibility issues must also be addressed to prevent degradation of containment systems that could lead to environmental contamination.Expand Specific Solutions05 Ammonia fuel cell technologies

Fuel cell technologies that directly utilize ammonia offer potential environmental benefits compared to combustion approaches. These systems can convert ammonia to electricity with higher efficiency and lower emissions than traditional combustion methods. Direct ammonia fuel cells and systems that first crack ammonia into hydrogen for use in conventional fuel cells are being developed. These technologies address challenges related to catalyst poisoning, operating temperatures, and system integration while providing pathways to reduce the environmental impact of ammonia as an energy carrier.Expand Specific Solutions

Key Industry Players and Research Institutions

The ammonia fuel market is currently in an early development stage, characterized by growing interest due to its potential as a carbon-free energy carrier. The global market size remains relatively small but is projected to expand significantly as decarbonization efforts intensify. Technologically, ammonia fuel systems are advancing through various maturity levels, with companies like Kawasaki Heavy Industries, IHI Corp, and Toyota Motor Corp leading industrial development of combustion technologies. Academic institutions including Tianjin University, University of Strathclyde, and Harbin Institute of Technology are conducting foundational research on emission control systems. Meanwhile, GenCell and TotalEnergies OneTech are developing innovative fuel cell applications, while shipping companies like HD Hyundai Heavy Industries and CSSC Huangpu Wenchong are exploring maritime implementations. The competitive landscape reflects a collaborative ecosystem of academic-industrial partnerships working to overcome technical challenges in ammonia's safe utilization as a sustainable fuel.

Alfa Laval Corporate AB

Technical Solution: Alfa Laval has developed specialized technologies addressing the environmental challenges of ammonia as a marine fuel. Their Multi-Fuel Combustion (MFC) system enables vessels to operate on ammonia while minimizing harmful emissions through precise fuel delivery and combustion control. A key innovation is their PureBallast ammonia-compatible ballast water treatment system that prevents ammonia contamination of marine ecosystems during ballast operations. Alfa Laval's PureNOx water treatment technology specifically targets the removal of ammonia and nitrogen compounds from scrubber water, preventing ocean acidification and eutrophication[5]. Their heat exchanger technology has been adapted with specialized materials resistant to ammonia corrosion while maintaining high thermal efficiency. For safety and environmental protection, Alfa Laval has developed a comprehensive ammonia vapor processing system that captures and neutralizes ammonia emissions during bunkering and operation, reducing the risk of atmospheric release by over 99%[6]. Their integrated approach includes continuous monitoring systems that detect minute ammonia leaks before they pose environmental or safety hazards.

Strengths: Specialized expertise in marine applications where ammonia fuel adoption is advancing rapidly; comprehensive approach addressing multiple environmental pathways (water, air); proven technology for treating ammonia-contaminated water streams. Weaknesses: Solutions primarily focused on maritime applications with limited transferability to other sectors; higher initial investment costs compared to conventional systems; requires specialized maintenance and operator training.

Kawasaki Heavy Industries Ltd.

Technical Solution: Kawasaki Heavy Industries has developed comprehensive ammonia fuel technologies focusing on both marine and land-based applications. Their approach includes specialized ammonia-ready gas carriers and ammonia-fueled engines with advanced NOx reduction systems. The company has pioneered a dual-fuel ammonia/LNG engine for maritime applications that achieves over 80% ammonia combustion ratio while maintaining thermal efficiency comparable to conventional engines[1]. Their mitigation strategy centers on a proprietary selective catalytic reduction (SCR) system that can reduce NOx emissions by up to 95% when using ammonia as fuel. Additionally, Kawasaki has developed specialized fuel handling systems with multi-layered leak detection and neutralization technologies to address ammonia's toxicity concerns. Their ammonia supply chain concept integrates production, transportation, and utilization infrastructure to minimize environmental impacts across the entire lifecycle[2].

Strengths: Comprehensive approach covering the entire ammonia value chain from production to utilization; advanced NOx reduction technology with proven high efficiency; significant experience in handling ammonia through their gas carrier business. Weaknesses: Their systems require substantial capital investment; the SCR technology adds complexity and maintenance requirements; current solutions still produce some N2O emissions which is a potent greenhouse gas.

Critical Patents and Innovations in Ammonia Fuel

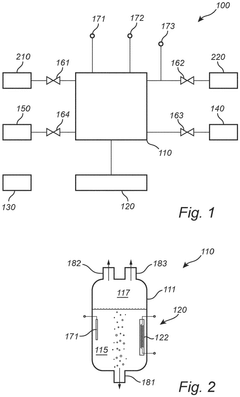

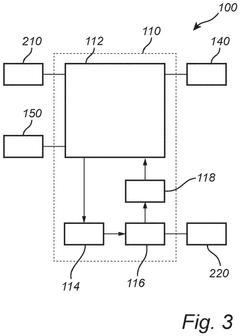

Ammonia handling system and method

PatentPendingEP4599921A1

Innovation

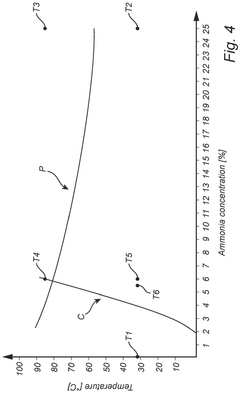

- A system and method for ammonia removal using a water-based absorption liquid with temperature-controlled operation in absorption and regeneration modes, allowing ammonia absorption and subsequent evaporation of ammonia-water vapour for reuse as fuel, reducing the need for fresh water and chemical waste.

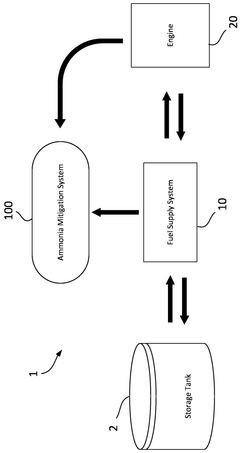

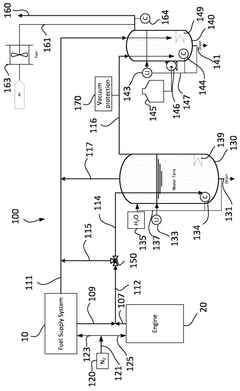

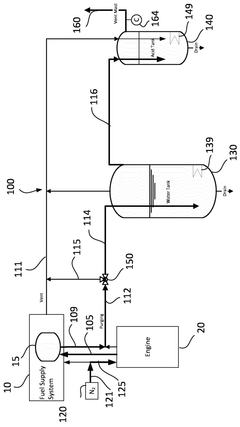

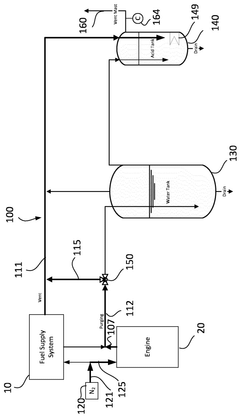

Ammonia mitigation system for ammonia fuel supply system and ammonia engine and a method for operating the mitigation system

PatentWO2025087954A1

Innovation

- A compact, modular ammonia mitigation system comprising two ammonia mitigating devices – a water tank for absorption and an acid tank for neutralization – designed to treat ammonia-containing vent streams before discharge, ensuring safe ammonia levels are maintained even in constrained maritime environments.

Regulatory Framework and Compliance Requirements

The regulatory landscape for ammonia as a fuel is rapidly evolving as governments worldwide recognize both its potential as a carbon-free energy carrier and the environmental challenges it presents. Current regulations primarily focus on ammonia's traditional use as a fertilizer and industrial chemical, with established frameworks for handling, storage, and transportation under hazardous materials classifications.

In the United States, the Environmental Protection Agency (EPA) regulates ammonia under the Clean Air Act and the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), with reportable release thresholds set at 100 pounds. The Occupational Safety and Health Administration (OSHA) has established a permissible exposure limit (PEL) of 50 ppm for workplace safety. These regulations will need significant adaptation to address ammonia's emerging role as a fuel.

The International Maritime Organization (IMO) is developing specific guidelines for ammonia as a marine fuel through its International Code of Safety for Ships Using Gases or Other Low-flashpoint Fuels (IGF Code). The IMO's initial strategy aims to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels, positioning ammonia as a potential compliance pathway.

The European Union's Renewable Energy Directive (RED II) and the proposed FuelEU Maritime initiative create frameworks that could accelerate ammonia fuel adoption while ensuring environmental safeguards. Japan has included ammonia in its Strategic Energy Plan, with specific regulations being developed to enable its 2050 carbon neutrality goal.

Compliance requirements for ammonia fuel systems typically include rigorous risk assessments, leak detection systems, emergency shutdown procedures, and personnel training. Facilities must implement comprehensive environmental monitoring programs to detect potential ammonia releases to air and water. Regular emissions testing and reporting are mandatory in most jurisdictions.

Emerging regulatory trends include life-cycle assessment requirements to verify the carbon intensity of ammonia production pathways, particularly for "green ammonia" certification. Several countries are developing specific standards for ammonia bunkering operations and fuel quality specifications. Regulatory sandboxes are being established in countries like Singapore and Norway to test ammonia fuel technologies under controlled conditions while developing appropriate safety protocols.

Companies investing in ammonia fuel technologies must engage proactively with regulatory bodies, as compliance frameworks remain in flux. Industry consortia are working with governments to develop practical standards that balance safety concerns with the need to accelerate decarbonization through ammonia fuel adoption.

In the United States, the Environmental Protection Agency (EPA) regulates ammonia under the Clean Air Act and the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), with reportable release thresholds set at 100 pounds. The Occupational Safety and Health Administration (OSHA) has established a permissible exposure limit (PEL) of 50 ppm for workplace safety. These regulations will need significant adaptation to address ammonia's emerging role as a fuel.

The International Maritime Organization (IMO) is developing specific guidelines for ammonia as a marine fuel through its International Code of Safety for Ships Using Gases or Other Low-flashpoint Fuels (IGF Code). The IMO's initial strategy aims to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels, positioning ammonia as a potential compliance pathway.

The European Union's Renewable Energy Directive (RED II) and the proposed FuelEU Maritime initiative create frameworks that could accelerate ammonia fuel adoption while ensuring environmental safeguards. Japan has included ammonia in its Strategic Energy Plan, with specific regulations being developed to enable its 2050 carbon neutrality goal.

Compliance requirements for ammonia fuel systems typically include rigorous risk assessments, leak detection systems, emergency shutdown procedures, and personnel training. Facilities must implement comprehensive environmental monitoring programs to detect potential ammonia releases to air and water. Regular emissions testing and reporting are mandatory in most jurisdictions.

Emerging regulatory trends include life-cycle assessment requirements to verify the carbon intensity of ammonia production pathways, particularly for "green ammonia" certification. Several countries are developing specific standards for ammonia bunkering operations and fuel quality specifications. Regulatory sandboxes are being established in countries like Singapore and Norway to test ammonia fuel technologies under controlled conditions while developing appropriate safety protocols.

Companies investing in ammonia fuel technologies must engage proactively with regulatory bodies, as compliance frameworks remain in flux. Industry consortia are working with governments to develop practical standards that balance safety concerns with the need to accelerate decarbonization through ammonia fuel adoption.

Safety Protocols and Risk Management Strategies

The implementation of ammonia as a fuel source necessitates comprehensive safety protocols and risk management strategies due to its toxic and corrosive properties. Establishing multi-layered safety systems is paramount, beginning with robust engineering controls such as leak detection systems, automated shutdown mechanisms, and proper ventilation systems. These technical safeguards must be complemented by administrative controls including detailed standard operating procedures (SOPs), regular safety audits, and emergency response plans specifically tailored for ammonia-related incidents.

Personnel training represents a critical component of ammonia safety management. All staff involved in handling ammonia fuel systems must undergo specialized training covering proper handling procedures, personal protective equipment usage, recognition of exposure symptoms, and emergency response protocols. Refresher courses should be conducted periodically to ensure knowledge retention and awareness of updated safety practices.

Risk assessment methodologies specific to ammonia fuel applications need systematic implementation across the fuel lifecycle. This includes Hazard and Operability Studies (HAZOP), Failure Mode and Effects Analysis (FMEA), and quantitative risk assessments to identify potential failure points and establish appropriate mitigation measures. The unique properties of ammonia require specialized risk matrices that account for both acute toxicity risks and long-term environmental impacts.

Storage and transportation safety demands particular attention, with requirements for specialized containment systems resistant to ammonia's corrosive properties. Double-walled tanks, appropriate pressure relief systems, and strategic placement of storage facilities away from densely populated areas constitute essential safety measures. Transportation protocols must include route planning that minimizes exposure to vulnerable populations and ecosystems.

Emergency response planning must address the specific challenges posed by ammonia releases. This includes establishing evacuation procedures, coordination with local emergency services, and maintaining appropriate neutralizing agents and remediation equipment. Simulation exercises should be conducted regularly to test response effectiveness and identify improvement opportunities.

Regulatory compliance frameworks vary globally but typically include standards from organizations such as OSHA, EPA, and international maritime authorities. Staying current with evolving regulations requires dedicated compliance management systems and regular engagement with regulatory bodies to anticipate future requirements. Industry collaboration through sharing of best practices and incident learnings can accelerate safety improvements across the ammonia fuel sector.

Continuous improvement processes should incorporate incident investigation methodologies, near-miss reporting systems, and regular review of safety performance indicators. These feedback mechanisms enable organizations to adapt their safety protocols as operational experience with ammonia fuel systems grows, ensuring that risk management strategies evolve alongside technological advancements.

Personnel training represents a critical component of ammonia safety management. All staff involved in handling ammonia fuel systems must undergo specialized training covering proper handling procedures, personal protective equipment usage, recognition of exposure symptoms, and emergency response protocols. Refresher courses should be conducted periodically to ensure knowledge retention and awareness of updated safety practices.

Risk assessment methodologies specific to ammonia fuel applications need systematic implementation across the fuel lifecycle. This includes Hazard and Operability Studies (HAZOP), Failure Mode and Effects Analysis (FMEA), and quantitative risk assessments to identify potential failure points and establish appropriate mitigation measures. The unique properties of ammonia require specialized risk matrices that account for both acute toxicity risks and long-term environmental impacts.

Storage and transportation safety demands particular attention, with requirements for specialized containment systems resistant to ammonia's corrosive properties. Double-walled tanks, appropriate pressure relief systems, and strategic placement of storage facilities away from densely populated areas constitute essential safety measures. Transportation protocols must include route planning that minimizes exposure to vulnerable populations and ecosystems.

Emergency response planning must address the specific challenges posed by ammonia releases. This includes establishing evacuation procedures, coordination with local emergency services, and maintaining appropriate neutralizing agents and remediation equipment. Simulation exercises should be conducted regularly to test response effectiveness and identify improvement opportunities.

Regulatory compliance frameworks vary globally but typically include standards from organizations such as OSHA, EPA, and international maritime authorities. Staying current with evolving regulations requires dedicated compliance management systems and regular engagement with regulatory bodies to anticipate future requirements. Industry collaboration through sharing of best practices and incident learnings can accelerate safety improvements across the ammonia fuel sector.

Continuous improvement processes should incorporate incident investigation methodologies, near-miss reporting systems, and regular review of safety performance indicators. These feedback mechanisms enable organizations to adapt their safety protocols as operational experience with ammonia fuel systems grows, ensuring that risk management strategies evolve alongside technological advancements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!