Ammonia Fuel's Influence on Energy Sector Regulatory Developments

SEP 19, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Evolution and Objectives

Ammonia fuel has emerged as a promising alternative energy carrier in the global transition toward sustainable and carbon-neutral energy systems. The evolution of ammonia as a fuel source can be traced back to the early 20th century, with its first applications in internal combustion engines during World War II due to petroleum shortages. However, it wasn't until the early 2000s that ammonia regained significant attention as researchers and industry leaders began exploring its potential as a zero-carbon fuel in response to growing climate change concerns.

The technical development of ammonia fuel has accelerated dramatically over the past decade, driven by advancements in production methods, storage technologies, and combustion efficiency. Traditional ammonia production via the Haber-Bosch process, which relies heavily on natural gas and produces substantial carbon emissions, is gradually being supplemented by green ammonia production pathways utilizing renewable electricity, water electrolysis, and nitrogen separation from air.

Regulatory frameworks governing ammonia fuel have evolved in parallel with technological developments. Initially focused primarily on safety considerations due to ammonia's toxicity, regulations have expanded to encompass environmental impact assessments, carbon intensity standards, and incentive structures for low-carbon ammonia production. Countries including Japan, Australia, and several European nations have established specific regulatory pathways for ammonia fuel integration into their energy systems.

The primary technical objectives for ammonia fuel development center around addressing several key challenges. First, improving the efficiency and reducing the cost of green ammonia production to achieve price parity with conventional fuels. Second, enhancing combustion technologies to minimize NOx emissions while maximizing energy output. Third, developing comprehensive safety protocols and infrastructure for ammonia transportation, storage, and handling at scale.

From a regulatory perspective, objectives include establishing internationally harmonized standards for ammonia fuel quality, safety requirements, and emissions thresholds. Additionally, creating clear certification systems for differentiating between various production pathways (gray, blue, and green ammonia) based on carbon intensity is crucial for enabling appropriate market incentives and carbon accounting.

The trajectory of ammonia fuel development points toward its increasing integration into multiple sectors, including maritime shipping, power generation, and potentially heavy transport. Technical roadmaps generally project commercial-scale deployment beginning in the maritime sector by 2025-2030, followed by power generation applications, with broader adoption across additional sectors anticipated by 2040 as production scales and costs decline.

The technical development of ammonia fuel has accelerated dramatically over the past decade, driven by advancements in production methods, storage technologies, and combustion efficiency. Traditional ammonia production via the Haber-Bosch process, which relies heavily on natural gas and produces substantial carbon emissions, is gradually being supplemented by green ammonia production pathways utilizing renewable electricity, water electrolysis, and nitrogen separation from air.

Regulatory frameworks governing ammonia fuel have evolved in parallel with technological developments. Initially focused primarily on safety considerations due to ammonia's toxicity, regulations have expanded to encompass environmental impact assessments, carbon intensity standards, and incentive structures for low-carbon ammonia production. Countries including Japan, Australia, and several European nations have established specific regulatory pathways for ammonia fuel integration into their energy systems.

The primary technical objectives for ammonia fuel development center around addressing several key challenges. First, improving the efficiency and reducing the cost of green ammonia production to achieve price parity with conventional fuels. Second, enhancing combustion technologies to minimize NOx emissions while maximizing energy output. Third, developing comprehensive safety protocols and infrastructure for ammonia transportation, storage, and handling at scale.

From a regulatory perspective, objectives include establishing internationally harmonized standards for ammonia fuel quality, safety requirements, and emissions thresholds. Additionally, creating clear certification systems for differentiating between various production pathways (gray, blue, and green ammonia) based on carbon intensity is crucial for enabling appropriate market incentives and carbon accounting.

The trajectory of ammonia fuel development points toward its increasing integration into multiple sectors, including maritime shipping, power generation, and potentially heavy transport. Technical roadmaps generally project commercial-scale deployment beginning in the maritime sector by 2025-2030, followed by power generation applications, with broader adoption across additional sectors anticipated by 2040 as production scales and costs decline.

Market Demand Analysis for Ammonia as Alternative Fuel

The global market for ammonia as an alternative fuel is experiencing significant growth driven by the urgent need for decarbonization across various sectors. Current projections indicate the ammonia fuel market could reach $10 billion by 2030, with a compound annual growth rate exceeding 15% between 2023-2030. This growth is primarily fueled by ammonia's potential as a carbon-free hydrogen carrier and direct fuel, offering substantial advantages in energy density compared to compressed hydrogen.

Maritime shipping represents the most immediate and substantial market opportunity, with major industry players including Maersk, NYK Line, and MAN Energy Solutions actively developing ammonia-powered vessels. The International Maritime Organization's increasingly stringent emissions regulations, particularly the target of reducing greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels, have created strong regulatory drivers for ammonia adoption in this sector.

Power generation constitutes another significant market segment, with ammonia co-firing in existing coal plants gaining traction as a transitional decarbonization strategy. Japan leads this development, with JERA conducting successful demonstrations of 20% ammonia co-firing at commercial scale. Several countries including Australia, Saudi Arabia, and Norway are positioning themselves as future ammonia export hubs, recognizing the emerging market opportunity.

Industrial applications represent a third major market segment, with ammonia potentially serving as both a feedstock and fuel in hard-to-abate sectors such as steel manufacturing and cement production. The fertilizer industry, already the largest consumer of ammonia globally, is exploring green ammonia production to reduce its carbon footprint.

Regional market analysis reveals Asia-Pacific as the fastest-growing region for ammonia fuel demand, driven by Japan's strategic hydrogen roadmap and South Korea's hydrogen economy initiatives. Europe follows closely, with the European Union's Hydrogen Strategy explicitly recognizing ammonia's role in hydrogen transport and storage.

Market barriers include the current high production costs of green ammonia, with prices ranging from $600-1,200 per ton compared to $200-400 for conventional ammonia. Infrastructure limitations present another significant challenge, as specialized storage, handling, and transportation facilities require substantial investment.

Consumer acceptance factors include safety concerns regarding ammonia's toxicity and the need for specialized training for handling. However, the maritime sector's familiarity with similar hazardous materials provides a foundation for addressing these challenges through established safety protocols and standards.

The market trajectory suggests a phased adoption approach, beginning with maritime applications and power generation co-firing, followed by broader industrial applications as production scales and costs decrease. This progression aligns with regulatory timelines in key markets, creating a predictable demand growth pattern that supports investment in production capacity and infrastructure development.

Maritime shipping represents the most immediate and substantial market opportunity, with major industry players including Maersk, NYK Line, and MAN Energy Solutions actively developing ammonia-powered vessels. The International Maritime Organization's increasingly stringent emissions regulations, particularly the target of reducing greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels, have created strong regulatory drivers for ammonia adoption in this sector.

Power generation constitutes another significant market segment, with ammonia co-firing in existing coal plants gaining traction as a transitional decarbonization strategy. Japan leads this development, with JERA conducting successful demonstrations of 20% ammonia co-firing at commercial scale. Several countries including Australia, Saudi Arabia, and Norway are positioning themselves as future ammonia export hubs, recognizing the emerging market opportunity.

Industrial applications represent a third major market segment, with ammonia potentially serving as both a feedstock and fuel in hard-to-abate sectors such as steel manufacturing and cement production. The fertilizer industry, already the largest consumer of ammonia globally, is exploring green ammonia production to reduce its carbon footprint.

Regional market analysis reveals Asia-Pacific as the fastest-growing region for ammonia fuel demand, driven by Japan's strategic hydrogen roadmap and South Korea's hydrogen economy initiatives. Europe follows closely, with the European Union's Hydrogen Strategy explicitly recognizing ammonia's role in hydrogen transport and storage.

Market barriers include the current high production costs of green ammonia, with prices ranging from $600-1,200 per ton compared to $200-400 for conventional ammonia. Infrastructure limitations present another significant challenge, as specialized storage, handling, and transportation facilities require substantial investment.

Consumer acceptance factors include safety concerns regarding ammonia's toxicity and the need for specialized training for handling. However, the maritime sector's familiarity with similar hazardous materials provides a foundation for addressing these challenges through established safety protocols and standards.

The market trajectory suggests a phased adoption approach, beginning with maritime applications and power generation co-firing, followed by broader industrial applications as production scales and costs decrease. This progression aligns with regulatory timelines in key markets, creating a predictable demand growth pattern that supports investment in production capacity and infrastructure development.

Technical Barriers and Global Development Status

Ammonia fuel technology faces significant technical barriers despite its promising potential as a carbon-free energy carrier. The primary challenge remains the high energy requirement for ammonia synthesis through the traditional Haber-Bosch process, which consumes approximately 1-2% of global energy production. This energy-intensive nature undermines ammonia's viability as a sustainable fuel alternative unless the production process itself is decarbonized using renewable energy sources.

Storage and transportation present another substantial hurdle. While ammonia's liquefaction properties are favorable compared to hydrogen (liquefying at -33°C at atmospheric pressure versus hydrogen's -253°C), its corrosive nature necessitates specialized materials for containment systems. This increases infrastructure costs and complicates widespread adoption in existing energy distribution networks.

Safety concerns constitute a critical barrier, as ammonia is both toxic and caustic. Its pungent odor, while serving as a natural leak detector, creates public acceptance challenges. Regulatory frameworks worldwide are still evolving to address these safety considerations, with significant variations across regions creating an uneven global development landscape.

Combustion efficiency represents another technical limitation. Direct ammonia combustion produces lower flame speeds and higher ignition energy requirements compared to conventional fuels, resulting in reduced energy conversion efficiency. Current combustion technologies require further refinement to optimize ammonia's performance in various applications, particularly in transportation sectors.

Globally, ammonia fuel development shows distinct regional patterns. Japan leads in ammonia fuel technology advancement, having incorporated it into its Strategic Energy Plan with ambitious targets for power generation. The country has established several demonstration projects for ammonia co-firing in coal power plants, achieving up to 20% ammonia blending ratios.

European development focuses primarily on ammonia's role in the hydrogen economy, with countries like Germany, the Netherlands, and Denmark investing in green ammonia production facilities powered by offshore wind. The European Union's Renewable Energy Directive II provides regulatory support for these initiatives, though harmonized safety standards remain under development.

In North America, development has been more fragmented, with research institutions and private companies driving innovation rather than coordinated government initiatives. The United States Department of Energy has recently increased funding for ammonia fuel research, but regulatory frameworks lag behind technological advancements.

Emerging economies, particularly China and India, are showing growing interest in ammonia fuel technology, primarily motivated by energy security concerns and decarbonization goals. However, their regulatory approaches remain in nascent stages, creating uncertainty for large-scale implementation.

Storage and transportation present another substantial hurdle. While ammonia's liquefaction properties are favorable compared to hydrogen (liquefying at -33°C at atmospheric pressure versus hydrogen's -253°C), its corrosive nature necessitates specialized materials for containment systems. This increases infrastructure costs and complicates widespread adoption in existing energy distribution networks.

Safety concerns constitute a critical barrier, as ammonia is both toxic and caustic. Its pungent odor, while serving as a natural leak detector, creates public acceptance challenges. Regulatory frameworks worldwide are still evolving to address these safety considerations, with significant variations across regions creating an uneven global development landscape.

Combustion efficiency represents another technical limitation. Direct ammonia combustion produces lower flame speeds and higher ignition energy requirements compared to conventional fuels, resulting in reduced energy conversion efficiency. Current combustion technologies require further refinement to optimize ammonia's performance in various applications, particularly in transportation sectors.

Globally, ammonia fuel development shows distinct regional patterns. Japan leads in ammonia fuel technology advancement, having incorporated it into its Strategic Energy Plan with ambitious targets for power generation. The country has established several demonstration projects for ammonia co-firing in coal power plants, achieving up to 20% ammonia blending ratios.

European development focuses primarily on ammonia's role in the hydrogen economy, with countries like Germany, the Netherlands, and Denmark investing in green ammonia production facilities powered by offshore wind. The European Union's Renewable Energy Directive II provides regulatory support for these initiatives, though harmonized safety standards remain under development.

In North America, development has been more fragmented, with research institutions and private companies driving innovation rather than coordinated government initiatives. The United States Department of Energy has recently increased funding for ammonia fuel research, but regulatory frameworks lag behind technological advancements.

Emerging economies, particularly China and India, are showing growing interest in ammonia fuel technology, primarily motivated by energy security concerns and decarbonization goals. However, their regulatory approaches remain in nascent stages, creating uncertainty for large-scale implementation.

Current Ammonia Fuel Production and Utilization Solutions

01 Emission standards and environmental regulations for ammonia fuel

Regulatory frameworks are being developed to address the environmental impact of ammonia as a fuel, particularly focusing on emission standards. These regulations aim to control nitrogen oxide (NOx) emissions and other pollutants associated with ammonia combustion. Environmental protection agencies worldwide are establishing guidelines for the safe use of ammonia fuel in various applications, including power generation and transportation, to ensure compliance with air quality standards while promoting cleaner energy alternatives.- Emission standards and environmental regulations for ammonia fuel: Regulatory frameworks are being developed to address the environmental impact of ammonia as a fuel, particularly focusing on emission standards. These regulations aim to control nitrogen oxide (NOx) emissions and other potential pollutants associated with ammonia combustion. Environmental protection agencies worldwide are establishing guidelines for ammonia fuel usage in various applications, ensuring that its adoption as an alternative fuel aligns with climate goals while minimizing harmful emissions.

- Safety protocols and handling requirements for ammonia fuel: Regulatory bodies are implementing comprehensive safety protocols for the handling, storage, and transportation of ammonia fuel due to its toxicity and corrosive properties. These regulations include specific requirements for equipment design, material compatibility, leak detection systems, and emergency response procedures. Safety standards also address training requirements for personnel involved in ammonia fuel operations to minimize risks associated with its use as an energy carrier.

- Infrastructure and distribution regulations for ammonia fuel: Regulatory frameworks are being established to govern the development of ammonia fuel infrastructure, including production facilities, storage terminals, and distribution networks. These regulations address technical specifications for ammonia-compatible equipment, pipeline standards, and refueling station requirements. Authorities are also developing certification processes for infrastructure components to ensure compliance with safety and performance standards as the ammonia fuel ecosystem expands.

- International maritime regulations for ammonia as marine fuel: The International Maritime Organization (IMO) and national maritime authorities are developing specific regulations for the use of ammonia as a marine fuel. These include amendments to the International Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC Code) and new guidelines for ammonia-fueled vessels. Regulations address bunkering procedures, crew training requirements, and emission control areas, supporting the maritime industry's transition to ammonia as a zero-carbon fuel option.

- Certification and standardization of ammonia fuel quality: Regulatory bodies and standards organizations are developing specifications for ammonia fuel quality, purity requirements, and testing methodologies. These standards ensure consistency in fuel properties across different production methods and applications. Certification processes are being established to verify compliance with these standards, including requirements for contaminant limits, water content, and other parameters that affect performance and safety. These standardization efforts facilitate the commercial adoption of ammonia as an alternative fuel.

02 Safety protocols and handling requirements for ammonia fuel

Regulatory bodies are implementing comprehensive safety protocols for the handling, storage, and transportation of ammonia fuel due to its toxicity and corrosive properties. These regulations include requirements for specialized equipment, training for personnel, and emergency response procedures. Safety standards address the risks associated with ammonia's flammability limits, pressure requirements, and potential for accidental release, establishing containment specifications and monitoring systems to prevent hazards in industrial and commercial applications.Expand Specific Solutions03 Infrastructure and distribution regulations for ammonia fuel

Regulatory frameworks are being established to govern the development of ammonia fuel infrastructure, including production facilities, storage terminals, and distribution networks. These regulations address technical specifications for pipelines, fueling stations, and port facilities designed for ammonia handling. Standards for material compatibility, pressure ratings, and leak detection systems are being implemented to ensure the safe and efficient transport of ammonia fuel from production sites to end-users, supporting the transition to this alternative energy carrier.Expand Specific Solutions04 Certification and quality standards for ammonia fuel

Regulatory authorities are developing certification processes and quality standards specific to ammonia fuel to ensure consistency and reliability across the supply chain. These standards define acceptable purity levels, contaminant limits, and performance characteristics required for different applications. Testing protocols and verification methods are being established to certify ammonia fuel products, enabling market acceptance and facilitating international trade while ensuring that fuel quality meets the requirements of various combustion technologies and fuel cell systems.Expand Specific Solutions05 International harmonization of ammonia fuel regulations

Efforts are underway to harmonize ammonia fuel regulations across different countries and regions to facilitate global adoption and trade. International organizations are working to develop consistent standards for ammonia fuel specifications, safety requirements, and emissions controls. These collaborative initiatives aim to reduce regulatory barriers, establish common certification procedures, and create unified codes that address the unique properties of ammonia as an energy carrier, supporting its role in decarbonization strategies while ensuring regulatory consistency across jurisdictions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Ammonia fuel's regulatory landscape is evolving rapidly as the energy sector transitions toward decarbonization. The market is in early development stages but growing significantly, with projections indicating substantial expansion by 2030. Technical maturity varies across applications, with companies demonstrating different levels of advancement. Academic institutions like Tianjin University and Huazhong University of Science & Technology are driving fundamental research, while commercial players show varying degrees of specialization: AMOGY is pioneering ammonia-powered transportation solutions, TotalEnergies and Linde are developing infrastructure capabilities, and maritime applications are being advanced by HD Hyundai Heavy Industries and CSSC Huangpu Wenchong Shipbuilding. Boeing and RTX are exploring aviation applications, indicating the technology's cross-sector potential despite remaining technical and regulatory challenges.

Toyota Motor Corp.

Technical Solution: Toyota has developed a multi-faceted approach to ammonia fuel technology, focusing on both direct ammonia combustion engines and ammonia-powered fuel cell systems. Their direct combustion technology involves modified internal combustion engines that can efficiently burn ammonia-hydrogen blends, addressing ammonia's inherently low flame speed and high ignition temperature. Toyota's research has demonstrated successful operation with up to 90% ammonia content while maintaining acceptable NOx emission levels through advanced exhaust treatment systems. For maritime applications, Toyota has partnered with shipbuilders to develop large-scale ammonia-fueled engines for cargo vessels, directly influencing IMO (International Maritime Organization) regulatory discussions on alternative fuels. Their fuel cell approach uses an onboard cracker to convert ammonia to hydrogen, which then powers Toyota's established fuel cell technology. The company has been actively engaged with regulatory bodies in Japan and internationally to establish safety standards for ammonia vehicles, contributing technical data on emission profiles, safety systems, and fuel handling protocols.

Strengths: Dual-track approach addressing both combustion and fuel cell applications provides flexibility as regulations evolve; extensive experience with alternative fuel vehicles provides credibility in regulatory discussions; strong partnerships across the value chain. Weaknesses: Ammonia's toxicity presents significant safety challenges for consumer vehicle applications; infrastructure requirements for widespread adoption remain substantial; competing internal priorities between hydrogen and ammonia technologies may dilute focus.

AMOGY, Inc.

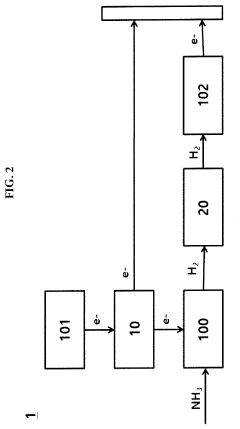

Technical Solution: AMOGY has developed a proprietary ammonia-to-power technology that efficiently cracks ammonia into hydrogen, which is then used in fuel cells to generate electricity. Their system integrates a compact ammonia cracking technology with PEM fuel cells, enabling high energy density power generation with zero carbon emissions. The company has demonstrated this technology in various applications including a drone, tractor, and most recently a semi-truck, proving the scalability of their solution. AMOGY's approach addresses the key challenge of ammonia as a fuel - its efficient conversion to usable energy - through their catalyst technology that enables cracking at lower temperatures (around 650°C compared to traditional 850°C+), significantly improving overall system efficiency. Their regulatory strategy includes active engagement with maritime regulatory bodies as they target shipping applications where ammonia fuel presents particular advantages.

Strengths: Proprietary cracking technology enables efficient ammonia-to-power conversion at lower temperatures than conventional methods; demonstrated scalability across multiple vehicle platforms; strong focus on maritime applications where regulatory frameworks are actively evolving. Weaknesses: Still requires significant infrastructure development for widespread adoption; safety concerns around ammonia handling need to be addressed through regulatory frameworks that are still developing.

Critical Patents and Innovations in Ammonia Fuel Technology

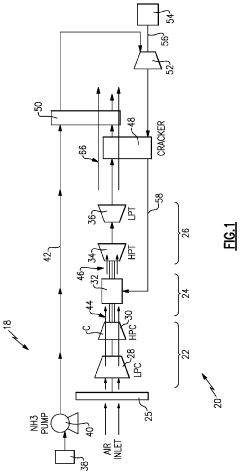

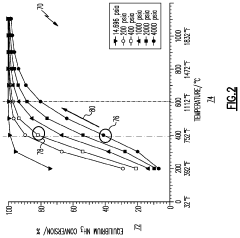

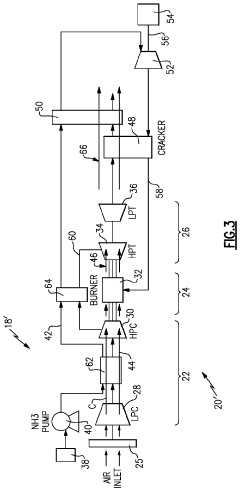

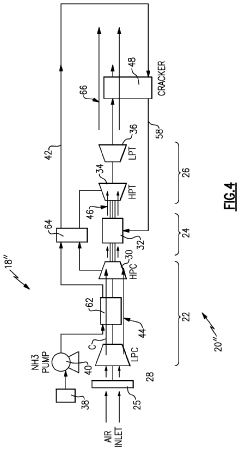

Efficient turbine engine using integrated ammonia fuel processing

PatentActiveUS11802508B2

Innovation

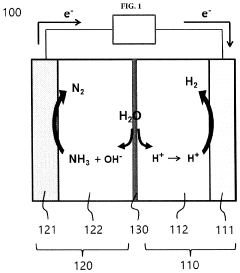

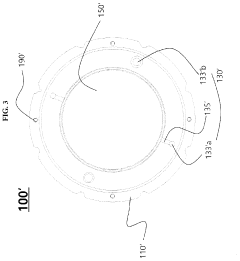

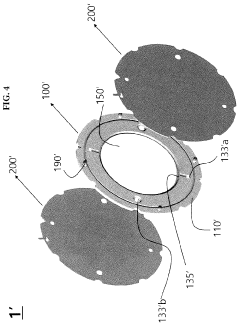

- The integration of an ammonia-fueled flow path with a cracking device and heat exchangers in a gas turbine engine, where ammonia is decomposed into hydrogen and nitrogen, allowing for thermal energy transfer and waste heat recovery through a turboexpander, enhancing mechanical drive output and cooling capabilities.

Hydrogen production system using ammonia and fuel cell using ammonia

PatentPendingUS20240247380A1

Innovation

- A hydrogen production system integrating a cathode and anode with a bipolar membrane, using a neutral and alkaline electrolyte respectively, and an oxygen adjustment mechanism to optimize hydrogen production and power generation, reducing energy consumption and improving storage efficiency.

Regulatory Framework and Policy Implications

The regulatory landscape surrounding ammonia fuel is rapidly evolving as governments worldwide recognize its potential as a carbon-neutral energy carrier. Current regulatory frameworks primarily focus on ammonia's traditional uses in agriculture and industrial applications, with limited provisions specifically addressing its role as an energy vector. This regulatory gap presents both challenges and opportunities for industry stakeholders and policymakers.

International maritime regulations are among the first to adapt, with the International Maritime Organization (IMO) developing specific guidelines for ammonia as a marine fuel. These include safety protocols, crew training requirements, and emissions standards that acknowledge ammonia's zero-carbon combustion profile while addressing concerns about potential nitrogen oxide (NOx) emissions.

National governments are implementing varied approaches to ammonia fuel regulation. Japan has incorporated ammonia into its Strategic Energy Plan with specific regulatory pathways for power generation and transportation applications. The European Union is integrating ammonia fuel considerations into its Renewable Energy Directive and Emissions Trading System, creating market mechanisms that recognize ammonia's potential contribution to decarbonization goals.

Policy implications extend beyond direct regulation to include financial incentives and market structures. Carbon pricing mechanisms increasingly recognize ammonia's role in emissions reduction, while green hydrogen certification schemes are being expanded to include derivative products like green ammonia. These economic instruments are proving as influential as direct regulation in shaping market development.

Safety regulations represent a critical area requiring harmonization. Existing frameworks for ammonia handling in industrial settings provide a foundation, but require significant adaptation for widespread energy applications. Regulatory bodies are developing risk-based approaches that balance safety concerns with the need for commercial deployment.

Cross-border regulatory cooperation is emerging as essential for ammonia fuel's global adoption. International standards organizations are working to establish consistent specifications for fuel-grade ammonia, while trade agreements increasingly address regulatory barriers to the movement of low-carbon fuels including ammonia.

The policy landscape remains dynamic, with regulatory sandboxes and pilot programs allowing for controlled testing of ammonia fuel applications while informing permanent regulatory frameworks. This adaptive approach recognizes that regulations must evolve alongside technological developments to effectively balance innovation, safety, and environmental protection in this emerging energy sector.

International maritime regulations are among the first to adapt, with the International Maritime Organization (IMO) developing specific guidelines for ammonia as a marine fuel. These include safety protocols, crew training requirements, and emissions standards that acknowledge ammonia's zero-carbon combustion profile while addressing concerns about potential nitrogen oxide (NOx) emissions.

National governments are implementing varied approaches to ammonia fuel regulation. Japan has incorporated ammonia into its Strategic Energy Plan with specific regulatory pathways for power generation and transportation applications. The European Union is integrating ammonia fuel considerations into its Renewable Energy Directive and Emissions Trading System, creating market mechanisms that recognize ammonia's potential contribution to decarbonization goals.

Policy implications extend beyond direct regulation to include financial incentives and market structures. Carbon pricing mechanisms increasingly recognize ammonia's role in emissions reduction, while green hydrogen certification schemes are being expanded to include derivative products like green ammonia. These economic instruments are proving as influential as direct regulation in shaping market development.

Safety regulations represent a critical area requiring harmonization. Existing frameworks for ammonia handling in industrial settings provide a foundation, but require significant adaptation for widespread energy applications. Regulatory bodies are developing risk-based approaches that balance safety concerns with the need for commercial deployment.

Cross-border regulatory cooperation is emerging as essential for ammonia fuel's global adoption. International standards organizations are working to establish consistent specifications for fuel-grade ammonia, while trade agreements increasingly address regulatory barriers to the movement of low-carbon fuels including ammonia.

The policy landscape remains dynamic, with regulatory sandboxes and pilot programs allowing for controlled testing of ammonia fuel applications while informing permanent regulatory frameworks. This adaptive approach recognizes that regulations must evolve alongside technological developments to effectively balance innovation, safety, and environmental protection in this emerging energy sector.

Environmental Impact Assessment

Ammonia fuel's environmental impact assessment reveals a complex profile of benefits and challenges that are shaping regulatory frameworks in the energy sector. When combusted, ammonia produces nitrogen and water vapor as primary byproducts, offering a significant advantage over fossil fuels by eliminating carbon dioxide emissions at the point of use. This characteristic positions ammonia as a potentially valuable tool in meeting increasingly stringent carbon reduction targets established by regulatory bodies worldwide.

However, the environmental assessment must account for the entire lifecycle of ammonia as a fuel. Current industrial ammonia production predominantly relies on the Haber-Bosch process, which is energy-intensive and typically powered by fossil fuels. This production pathway generates substantial greenhouse gas emissions, estimated at 1.8% of global CO2 emissions. Regulatory frameworks are increasingly adopting lifecycle assessment approaches that consider these upstream emissions when evaluating alternative fuels.

Nitrogen oxide (NOx) emissions present another significant environmental concern with ammonia combustion. These compounds contribute to air pollution, acid rain, and photochemical smog formation. Regulatory bodies, particularly in densely populated regions, are implementing stricter NOx emission standards that will influence ammonia fuel adoption pathways and required control technologies.

Ammonia's toxicity and potential for accidental release introduce additional environmental risks that regulators must address. Exposure to high concentrations can harm aquatic ecosystems and terrestrial vegetation. Consequently, environmental protection agencies are developing specialized risk assessment protocols and safety standards for ammonia fuel infrastructure, including storage facilities, transportation networks, and fueling stations.

The emergence of green ammonia production methods, utilizing renewable electricity for hydrogen production, represents a transformative opportunity to improve the environmental profile. Regulatory incentives are increasingly differentiating between conventional and green ammonia, with preferential treatment for production pathways with lower environmental footprints. This regulatory distinction is driving investment in renewable-powered ammonia synthesis technologies.

Water usage in ammonia production and potential impacts on water resources are becoming important considerations in water-stressed regions. Environmental impact assessments now routinely include water footprint analyses, influencing facility siting decisions and technology selection. Regulatory authorities in regions experiencing water scarcity are implementing more stringent water use efficiency requirements for industrial processes, including ammonia production.

Land use changes associated with renewable energy infrastructure for green ammonia production are also subject to environmental assessment. The expansion of solar and wind facilities to power electrolysis requires substantial land area, potentially affecting biodiversity and ecosystem services. Regulatory frameworks are evolving to balance these competing environmental priorities through comprehensive impact assessment methodologies.

However, the environmental assessment must account for the entire lifecycle of ammonia as a fuel. Current industrial ammonia production predominantly relies on the Haber-Bosch process, which is energy-intensive and typically powered by fossil fuels. This production pathway generates substantial greenhouse gas emissions, estimated at 1.8% of global CO2 emissions. Regulatory frameworks are increasingly adopting lifecycle assessment approaches that consider these upstream emissions when evaluating alternative fuels.

Nitrogen oxide (NOx) emissions present another significant environmental concern with ammonia combustion. These compounds contribute to air pollution, acid rain, and photochemical smog formation. Regulatory bodies, particularly in densely populated regions, are implementing stricter NOx emission standards that will influence ammonia fuel adoption pathways and required control technologies.

Ammonia's toxicity and potential for accidental release introduce additional environmental risks that regulators must address. Exposure to high concentrations can harm aquatic ecosystems and terrestrial vegetation. Consequently, environmental protection agencies are developing specialized risk assessment protocols and safety standards for ammonia fuel infrastructure, including storage facilities, transportation networks, and fueling stations.

The emergence of green ammonia production methods, utilizing renewable electricity for hydrogen production, represents a transformative opportunity to improve the environmental profile. Regulatory incentives are increasingly differentiating between conventional and green ammonia, with preferential treatment for production pathways with lower environmental footprints. This regulatory distinction is driving investment in renewable-powered ammonia synthesis technologies.

Water usage in ammonia production and potential impacts on water resources are becoming important considerations in water-stressed regions. Environmental impact assessments now routinely include water footprint analyses, influencing facility siting decisions and technology selection. Regulatory authorities in regions experiencing water scarcity are implementing more stringent water use efficiency requirements for industrial processes, including ammonia production.

Land use changes associated with renewable energy infrastructure for green ammonia production are also subject to environmental assessment. The expansion of solar and wind facilities to power electrolysis requires substantial land area, potentially affecting biodiversity and ecosystem services. Regulatory frameworks are evolving to balance these competing environmental priorities through comprehensive impact assessment methodologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!