Ammonia Fuel's Role in Achieving Global Renewable Energy Standards

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Development History and Objectives

Ammonia as a potential energy carrier has a rich historical development dating back to the early 20th century. The Haber-Bosch process, developed in 1909, revolutionized ammonia production by enabling its synthesis from atmospheric nitrogen and hydrogen under high pressure and temperature. This breakthrough primarily served agricultural needs through fertilizer production, transforming global food production capabilities. However, ammonia's potential as an energy carrier remained largely unexplored until recent decades.

The 1970s energy crisis sparked initial interest in alternative fuels, with some preliminary research into ammonia's combustion properties. Despite this early attention, significant research momentum only began building in the early 2000s as climate change concerns intensified. By 2010, several research institutions had established dedicated programs exploring ammonia's potential in energy systems, particularly for power generation and as a hydrogen carrier.

The technical evolution of ammonia fuel systems has progressed through several distinct phases. Initial efforts focused on direct combustion in modified internal combustion engines, facing challenges with ignition stability and NOx emissions. The second wave of development explored ammonia fuel cells, particularly solid oxide and proton exchange membrane technologies. Most recently, research has expanded to include ammonia as a hydrogen carrier for fuel cells and as a marine fuel alternative.

Current technical objectives for ammonia fuel development center around several key areas. First, improving production efficiency through advanced electrolysis and renewable energy integration aims to reduce the carbon footprint of ammonia synthesis. Second, enhancing combustion stability and efficiency in various engine types remains crucial for practical applications. Third, developing cost-effective catalysts for ammonia cracking to release hydrogen addresses its potential as a hydrogen carrier.

The long-term vision for ammonia fuel technology encompasses its integration into a renewable energy ecosystem. As intermittent renewable sources like wind and solar expand globally, ammonia offers a promising medium for energy storage and transport. The ultimate objective is positioning ammonia as a carbon-free energy vector that can be synthesized using renewable electricity, stored efficiently, and utilized across multiple sectors including transportation, power generation, and industrial processes.

Achieving these objectives requires overcoming significant technical hurdles while aligning with evolving global renewable energy standards. The trajectory suggests ammonia could play a pivotal role in energy transition strategies, particularly in hard-to-decarbonize sectors like long-distance shipping and seasonal energy storage.

The 1970s energy crisis sparked initial interest in alternative fuels, with some preliminary research into ammonia's combustion properties. Despite this early attention, significant research momentum only began building in the early 2000s as climate change concerns intensified. By 2010, several research institutions had established dedicated programs exploring ammonia's potential in energy systems, particularly for power generation and as a hydrogen carrier.

The technical evolution of ammonia fuel systems has progressed through several distinct phases. Initial efforts focused on direct combustion in modified internal combustion engines, facing challenges with ignition stability and NOx emissions. The second wave of development explored ammonia fuel cells, particularly solid oxide and proton exchange membrane technologies. Most recently, research has expanded to include ammonia as a hydrogen carrier for fuel cells and as a marine fuel alternative.

Current technical objectives for ammonia fuel development center around several key areas. First, improving production efficiency through advanced electrolysis and renewable energy integration aims to reduce the carbon footprint of ammonia synthesis. Second, enhancing combustion stability and efficiency in various engine types remains crucial for practical applications. Third, developing cost-effective catalysts for ammonia cracking to release hydrogen addresses its potential as a hydrogen carrier.

The long-term vision for ammonia fuel technology encompasses its integration into a renewable energy ecosystem. As intermittent renewable sources like wind and solar expand globally, ammonia offers a promising medium for energy storage and transport. The ultimate objective is positioning ammonia as a carbon-free energy vector that can be synthesized using renewable electricity, stored efficiently, and utilized across multiple sectors including transportation, power generation, and industrial processes.

Achieving these objectives requires overcoming significant technical hurdles while aligning with evolving global renewable energy standards. The trajectory suggests ammonia could play a pivotal role in energy transition strategies, particularly in hard-to-decarbonize sectors like long-distance shipping and seasonal energy storage.

Global Market Demand for Carbon-Neutral Fuel Alternatives

The global market for carbon-neutral fuel alternatives has witnessed unprecedented growth in recent years, driven by increasing environmental concerns and stringent regulatory frameworks aimed at reducing greenhouse gas emissions. As nations worldwide commit to ambitious climate targets, including net-zero emissions by mid-century, the demand for sustainable fuel solutions has escalated dramatically across various sectors, particularly in transportation, power generation, and industrial applications.

The International Energy Agency (IEA) reports that renewable energy capacity additions reached 280 GW in 2020, representing a 45% increase from 2019, despite the global pandemic. This trend underscores the accelerating transition toward cleaner energy sources and highlights the growing market potential for carbon-neutral alternatives like ammonia fuel.

Maritime shipping, which accounts for approximately 3% of global CO2 emissions, has emerged as a key market for ammonia fuel. The International Maritime Organization's target to reduce greenhouse gas emissions by at least 50% by 2050 has created substantial demand for zero-carbon fuels in this sector. Industry analysts project that ammonia could capture up to 25% of the maritime fuel market by 2050, representing a significant commercial opportunity.

The power generation sector presents another substantial market for ammonia as a carbon-neutral fuel. Countries with limited renewable resources or inadequate energy storage capabilities are increasingly exploring ammonia as a means to import and store renewable energy. Japan, for instance, has incorporated ammonia co-firing in coal power plants into its strategic energy plan, aiming to reduce carbon emissions while maintaining grid stability.

Industrial applications, particularly in hard-to-abate sectors like steel and cement production, are driving additional demand for carbon-neutral fuels. These industries require high-temperature heat that is challenging to electrify, making carbon-neutral combustible fuels like ammonia particularly valuable. The steel industry alone accounts for 7-9% of global CO2 emissions, presenting a substantial market opportunity for alternative fuels.

Regional market analysis reveals varying levels of demand across different geographies. Asia-Pacific, led by Japan, South Korea, and Singapore, demonstrates the strongest market potential due to limited domestic renewable resources and strong policy support. Europe follows closely, driven by ambitious climate targets and carbon pricing mechanisms that incentivize the adoption of carbon-neutral fuels.

Economic factors also influence market demand, with the cost gap between conventional and carbon-neutral fuels gradually narrowing due to technological improvements, economies of scale, and increasingly stringent carbon pricing. The European Union's carbon price has reached record levels, exceeding €50 per tonne in 2021, enhancing the economic competitiveness of carbon-neutral alternatives like ammonia.

The International Energy Agency (IEA) reports that renewable energy capacity additions reached 280 GW in 2020, representing a 45% increase from 2019, despite the global pandemic. This trend underscores the accelerating transition toward cleaner energy sources and highlights the growing market potential for carbon-neutral alternatives like ammonia fuel.

Maritime shipping, which accounts for approximately 3% of global CO2 emissions, has emerged as a key market for ammonia fuel. The International Maritime Organization's target to reduce greenhouse gas emissions by at least 50% by 2050 has created substantial demand for zero-carbon fuels in this sector. Industry analysts project that ammonia could capture up to 25% of the maritime fuel market by 2050, representing a significant commercial opportunity.

The power generation sector presents another substantial market for ammonia as a carbon-neutral fuel. Countries with limited renewable resources or inadequate energy storage capabilities are increasingly exploring ammonia as a means to import and store renewable energy. Japan, for instance, has incorporated ammonia co-firing in coal power plants into its strategic energy plan, aiming to reduce carbon emissions while maintaining grid stability.

Industrial applications, particularly in hard-to-abate sectors like steel and cement production, are driving additional demand for carbon-neutral fuels. These industries require high-temperature heat that is challenging to electrify, making carbon-neutral combustible fuels like ammonia particularly valuable. The steel industry alone accounts for 7-9% of global CO2 emissions, presenting a substantial market opportunity for alternative fuels.

Regional market analysis reveals varying levels of demand across different geographies. Asia-Pacific, led by Japan, South Korea, and Singapore, demonstrates the strongest market potential due to limited domestic renewable resources and strong policy support. Europe follows closely, driven by ambitious climate targets and carbon pricing mechanisms that incentivize the adoption of carbon-neutral fuels.

Economic factors also influence market demand, with the cost gap between conventional and carbon-neutral fuels gradually narrowing due to technological improvements, economies of scale, and increasingly stringent carbon pricing. The European Union's carbon price has reached record levels, exceeding €50 per tonne in 2021, enhancing the economic competitiveness of carbon-neutral alternatives like ammonia.

Current Ammonia Synthesis Technologies and Barriers

Ammonia synthesis has been dominated by the Haber-Bosch process for over a century, which combines nitrogen from the air with hydrogen at high temperatures (400-500°C) and pressures (150-300 bar) over an iron-based catalyst. This energy-intensive process consumes approximately 1-2% of global energy production and generates significant CO2 emissions—about 1.8 tons of CO2 per ton of ammonia produced when using natural gas as the hydrogen source. While highly optimized over decades, the fundamental thermodynamic limitations of this process present a significant barrier to sustainability goals.

Alternative synthesis technologies are emerging but face considerable challenges. Electrochemical ammonia synthesis, which directly converts nitrogen and water to ammonia using electricity, offers a potentially carbon-free pathway but currently suffers from low conversion rates (typically <10%) and poor selectivity. Catalyst degradation and nitrogen activation at ambient conditions remain persistent technical hurdles that limit commercial viability.

Photocatalytic ammonia synthesis, utilizing solar energy to drive the reaction, represents another promising approach. However, current photocatalysts demonstrate insufficient quantum efficiency (<1%) and struggle with stability issues under prolonged operation. The technology remains largely confined to laboratory settings with significant scaling challenges ahead.

Biological nitrogen fixation mimics natural processes using engineered microorganisms or enzymes. While environmentally benign, these biological routes face limitations in production rates and scale-up difficulties. Current bioreactor designs achieve only milligram-scale production, orders of magnitude below industrial requirements.

Plasma-assisted ammonia synthesis has gained attention for its ability to activate nitrogen under milder conditions. Nevertheless, energy efficiency remains problematic, with most systems requiring 10-15 times more energy per unit of ammonia than conventional processes. Material durability under plasma conditions presents additional challenges.

Infrastructure constraints further complicate the transition to sustainable ammonia production. Existing global ammonia infrastructure is built around centralized, large-scale Haber-Bosch plants. Integrating intermittent renewable energy sources with these facilities presents significant technical challenges related to process flexibility and hydrogen storage.

Economic barriers are equally formidable. Green ammonia production costs currently range from $600-1,200 per ton, compared to $200-400 per ton for conventional methods. This cost differential, primarily driven by renewable electricity and capital expenses for new technologies, represents a major obstacle to widespread adoption in price-sensitive agricultural markets where most ammonia is consumed.

Alternative synthesis technologies are emerging but face considerable challenges. Electrochemical ammonia synthesis, which directly converts nitrogen and water to ammonia using electricity, offers a potentially carbon-free pathway but currently suffers from low conversion rates (typically <10%) and poor selectivity. Catalyst degradation and nitrogen activation at ambient conditions remain persistent technical hurdles that limit commercial viability.

Photocatalytic ammonia synthesis, utilizing solar energy to drive the reaction, represents another promising approach. However, current photocatalysts demonstrate insufficient quantum efficiency (<1%) and struggle with stability issues under prolonged operation. The technology remains largely confined to laboratory settings with significant scaling challenges ahead.

Biological nitrogen fixation mimics natural processes using engineered microorganisms or enzymes. While environmentally benign, these biological routes face limitations in production rates and scale-up difficulties. Current bioreactor designs achieve only milligram-scale production, orders of magnitude below industrial requirements.

Plasma-assisted ammonia synthesis has gained attention for its ability to activate nitrogen under milder conditions. Nevertheless, energy efficiency remains problematic, with most systems requiring 10-15 times more energy per unit of ammonia than conventional processes. Material durability under plasma conditions presents additional challenges.

Infrastructure constraints further complicate the transition to sustainable ammonia production. Existing global ammonia infrastructure is built around centralized, large-scale Haber-Bosch plants. Integrating intermittent renewable energy sources with these facilities presents significant technical challenges related to process flexibility and hydrogen storage.

Economic barriers are equally formidable. Green ammonia production costs currently range from $600-1,200 per ton, compared to $200-400 per ton for conventional methods. This cost differential, primarily driven by renewable electricity and capital expenses for new technologies, represents a major obstacle to widespread adoption in price-sensitive agricultural markets where most ammonia is consumed.

Current Ammonia Fuel Implementation Approaches

01 Ammonia fuel production methods

Various methods for producing ammonia fuel are disclosed, including processes that utilize renewable energy sources. These methods aim to create sustainable ammonia production pathways that reduce carbon emissions compared to traditional production methods. The technologies include electrolysis-based systems, catalytic processes, and integrated production facilities that can operate with intermittent renewable energy inputs.- Ammonia fuel production methods: Various methods for producing ammonia fuel are disclosed, including processes that utilize renewable energy sources. These methods aim to create sustainable ammonia production pathways that reduce carbon emissions compared to traditional production methods. The technologies include electrolysis-based systems, catalytic processes, and integrated production facilities that can operate with intermittent renewable energy inputs.

- Ammonia fuel storage and transportation systems: Specialized systems for the safe storage and transportation of ammonia fuel are described. These include pressurized containers, cryogenic storage solutions, and specialized handling equipment designed to address the challenges associated with ammonia's toxicity and corrosive properties. The innovations focus on improving safety, reducing leakage risks, and optimizing the logistics chain for ammonia as an energy carrier.

- Ammonia combustion engines and power generation: Engines and power generation systems specifically designed or modified to use ammonia as a fuel are presented. These include internal combustion engines with specialized injection systems, gas turbines adapted for ammonia combustion, and hybrid systems that may use ammonia alongside other fuels. The technologies address challenges such as ammonia's lower flame speed and higher ignition energy requirements compared to conventional fuels.

- Ammonia fuel cells and hydrogen generation: Systems that utilize ammonia in fuel cells or as a hydrogen carrier are described. These include direct ammonia fuel cells, ammonia cracking technologies for hydrogen production, and integrated systems that combine these processes. The technologies aim to leverage ammonia's high hydrogen content and relatively easy storage properties to enable efficient energy conversion while addressing challenges related to catalyst poisoning and system efficiency.

- Ammonia fuel infrastructure and safety systems: Infrastructure and safety systems necessary for the widespread adoption of ammonia as a fuel are presented. These include refueling stations, monitoring systems, emergency response equipment, and regulatory frameworks. The technologies focus on mitigating risks associated with ammonia's toxicity and addressing public safety concerns while enabling practical deployment of ammonia fuel across various applications from transportation to stationary power generation.

02 Ammonia fuel storage and transportation systems

Specialized systems for the safe storage and transportation of ammonia fuel are described. These include advanced containment vessels, pressure management systems, and safety mechanisms designed specifically for ammonia's unique properties. The technologies address challenges related to ammonia's toxicity and corrosiveness while enabling practical distribution networks for ammonia as an energy carrier.Expand Specific Solutions03 Ammonia combustion engines and power generation

Innovations in engine design and combustion systems that enable the efficient use of ammonia as a fuel for power generation. These include modified internal combustion engines, gas turbines, and specialized burners that can handle ammonia's combustion characteristics. The technologies address challenges such as ammonia's high ignition temperature and relatively slow flame speed to achieve efficient power output with reduced emissions.Expand Specific Solutions04 Ammonia fuel cells and hydrogen generation

Systems that utilize ammonia in fuel cells or as a hydrogen carrier for energy applications. These technologies include direct ammonia fuel cells, ammonia cracking systems that extract hydrogen for use in conventional hydrogen fuel cells, and integrated power systems. The approaches leverage ammonia's high hydrogen content and easier storage properties compared to pure hydrogen.Expand Specific Solutions05 Ammonia fuel blending and emission control

Methods for blending ammonia with other fuels and controlling emissions from ammonia combustion. These include dual-fuel systems that combine ammonia with conventional fuels like diesel or natural gas, as well as specialized catalytic converters and exhaust treatment systems designed to minimize NOx and other emissions. The technologies enable cleaner combustion while addressing ammonia's challenging combustion properties.Expand Specific Solutions

Leading Organizations in Ammonia Fuel Research and Production

Ammonia fuel is emerging as a critical component in the global renewable energy transition, currently in an early commercial development phase. The market is projected to grow significantly as nations seek carbon-neutral alternatives, though widespread adoption faces technical and infrastructure challenges. Leading academic institutions (Tianjin University, Northwestern University, Delft University of Technology) are advancing fundamental research, while commercial players demonstrate varying levels of technological maturity. AMOGY is pioneering ammonia-powered transportation solutions, Siemens is developing large-scale systems, and traditional energy companies like China Petroleum & Chemical Corp. are exploring ammonia's potential in their decarbonization strategies. The ecosystem includes specialized players focusing on specific applications, from marine environments (Sunrui Marine) to power generation (SAFCell), indicating a diversifying but still developing competitive landscape.

Ammonia Casale SpA

Technical Solution: Ammonia Casale has developed advanced ammonia synthesis technologies specifically designed for renewable energy applications. Their proprietary "Casale Ammonia Process" integrates renewable hydrogen production with highly efficient ammonia synthesis, achieving energy efficiency improvements of up to 30% compared to conventional processes[1]. The company has pioneered pressure-swing adsorption technology that removes impurities from synthesis gas streams, increasing catalyst longevity and process reliability. Their modular ammonia production units are scalable from 10 to 3000 tons per day, making them adaptable for various renewable energy integration scenarios[3]. Casale has also developed specialized catalysts that operate effectively at lower temperatures and pressures than traditional Haber-Bosch processes, reducing the energy intensity of ammonia production while maintaining high conversion rates when using fluctuating renewable energy inputs[5].

Strengths: Industry-leading expertise in ammonia synthesis technology with over 100 years of experience; proprietary catalysts specifically designed for renewable energy integration; modular and scalable solutions adaptable to different market needs. Weaknesses: Higher initial capital costs compared to conventional systems; technology still requires significant renewable energy infrastructure to achieve full carbon neutrality; limited deployment in large-scale renewable ammonia projects to date.

Kellogg, Brown & Root, Inc.

Technical Solution: KBR has developed the Purifier™ ammonia technology, which they've adapted specifically for renewable energy applications. Their system integrates electrolysis-derived hydrogen with their proprietary ammonia synthesis process, achieving production efficiencies up to 25% higher than conventional methods when using renewable energy sources[1]. KBR's technology employs advanced catalysts and optimized process conditions that allow for operation under variable load conditions, making it compatible with fluctuating renewable energy inputs. Their ammonia synthesis loop incorporates a magnetocaloric refrigeration system that reduces energy consumption in the cooling phase by approximately 30% compared to traditional mechanical refrigeration[3]. KBR has also pioneered a modular design approach that enables scalable implementation from small distributed renewable energy hubs to large centralized production facilities, with capacities ranging from 50 to 3000 metric tons per day[6].

Strengths: Extensive experience in ammonia production technology with over 50 plants worldwide; proven technology adaptable to renewable energy sources; modular design approach enabling flexible implementation. Weaknesses: Higher capital costs for renewable integration compared to conventional fossil-based systems; technology still requires significant renewable energy infrastructure; limited number of fully renewable ammonia plants currently in operation.

Key Patents and Breakthroughs in Green Ammonia Production

Carbon dioxide sequestering fuel synthesis system and use thereof

PatentInactiveGB2452169A

Innovation

- A carbon dioxide sequestering fuel synthesis system that electrolyzes saltwater or brine to produce hydrogen and metal hydroxide, using an osmotic exchanger to capture atmospheric CO2, which is then converted into carbonate/bicarbonate, and further processed to produce ammonia, urea, and guanidine, utilizing a solid oxide fuel cell for energy conversion.

Systems and methods for forming nitrogen-based compounds

PatentActiveUS11885029B2

Innovation

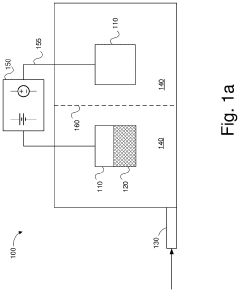

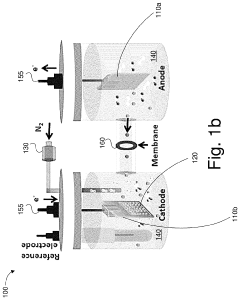

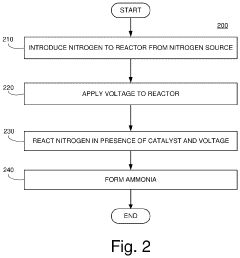

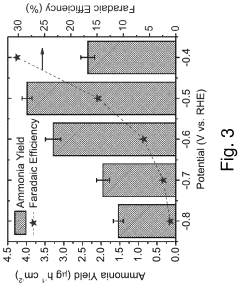

- A system comprising an anode, cathode, and catalyst material with nanoparticles having interior cavities, configured to use nitrogen and water to generate ammonia, utilizing electrocatalytic fixation of nitrogen under ambient conditions with a voltage supply and electrolyte to enhance yield and Faradaic efficiency.

Environmental Impact Assessment of Ammonia Fuel Adoption

The environmental implications of ammonia fuel adoption represent a critical dimension in evaluating its viability as a renewable energy carrier. When comparing ammonia to conventional fossil fuels, significant reductions in greenhouse gas emissions can be achieved throughout the fuel lifecycle. Studies indicate that green ammonia production pathways can reduce carbon emissions by up to 90% compared to natural gas or coal-based alternatives, particularly when renewable electricity sources power the Haber-Bosch process.

However, ammonia presents unique environmental challenges that require careful consideration. Its toxicity to aquatic ecosystems poses risks in case of spills or leaks during transportation and storage. Even at low concentrations, ammonia can cause severe damage to fish populations and aquatic biodiversity. This necessitates robust containment systems and stringent safety protocols across the supply chain.

Air quality impacts constitute another important consideration. While ammonia combustion produces zero carbon emissions, it can generate nitrogen oxides (NOx) without proper combustion management technologies. These emissions contribute to smog formation and respiratory health issues in urban environments. Advanced catalytic converters and selective catalytic reduction systems have demonstrated the ability to mitigate these emissions by up to 95% in controlled testing environments.

Water usage represents a significant environmental factor in ammonia production. The conventional Haber-Bosch process requires substantial water inputs, potentially straining resources in water-scarce regions. Emerging electrochemical synthesis methods show promise in reducing water requirements by approximately 30-40% compared to traditional approaches, though these technologies remain in developmental stages.

Land use considerations vary significantly based on production pathways. Green ammonia facilities powered by renewable energy may require substantial land area for solar or wind installations. Analysis indicates that integrated renewable energy-ammonia production systems require approximately 2-5 hectares per megawatt of production capacity, depending on geographic location and renewable resource quality.

Life cycle assessment (LCA) studies comparing ammonia with other alternative fuels reveal competitive environmental performance. When produced using renewable electricity, ammonia's carbon footprint (15-20 gCO2eq/MJ) compares favorably to hydrogen (20-25 gCO2eq/MJ) when accounting for transportation and storage emissions, though both significantly outperform conventional diesel (approximately 95 gCO2eq/MJ).

However, ammonia presents unique environmental challenges that require careful consideration. Its toxicity to aquatic ecosystems poses risks in case of spills or leaks during transportation and storage. Even at low concentrations, ammonia can cause severe damage to fish populations and aquatic biodiversity. This necessitates robust containment systems and stringent safety protocols across the supply chain.

Air quality impacts constitute another important consideration. While ammonia combustion produces zero carbon emissions, it can generate nitrogen oxides (NOx) without proper combustion management technologies. These emissions contribute to smog formation and respiratory health issues in urban environments. Advanced catalytic converters and selective catalytic reduction systems have demonstrated the ability to mitigate these emissions by up to 95% in controlled testing environments.

Water usage represents a significant environmental factor in ammonia production. The conventional Haber-Bosch process requires substantial water inputs, potentially straining resources in water-scarce regions. Emerging electrochemical synthesis methods show promise in reducing water requirements by approximately 30-40% compared to traditional approaches, though these technologies remain in developmental stages.

Land use considerations vary significantly based on production pathways. Green ammonia facilities powered by renewable energy may require substantial land area for solar or wind installations. Analysis indicates that integrated renewable energy-ammonia production systems require approximately 2-5 hectares per megawatt of production capacity, depending on geographic location and renewable resource quality.

Life cycle assessment (LCA) studies comparing ammonia with other alternative fuels reveal competitive environmental performance. When produced using renewable electricity, ammonia's carbon footprint (15-20 gCO2eq/MJ) compares favorably to hydrogen (20-25 gCO2eq/MJ) when accounting for transportation and storage emissions, though both significantly outperform conventional diesel (approximately 95 gCO2eq/MJ).

Policy Frameworks Supporting Ammonia as Renewable Energy Carrier

The global transition to renewable energy has catalyzed significant policy developments supporting ammonia as a renewable energy carrier. The European Union's Green Deal and Renewable Energy Directive establish ambitious frameworks that explicitly recognize ammonia's potential in decarbonizing hard-to-abate sectors. These policies mandate increasing percentages of renewable fuels in transport and industry, creating market pull for ammonia-based solutions.

Japan has emerged as a policy leader with its Strategic Roadmap for Hydrogen and Ammonia, which targets 3 million tons of ammonia use in power generation by 2030. This commitment is reinforced by substantial government subsidies and tax incentives for ammonia infrastructure development, positioning Japan as a first-mover in ammonia energy markets.

In the United States, the Inflation Reduction Act provides production tax credits of up to $3 per kilogram for clean hydrogen, which directly benefits green ammonia production. These incentives, coupled with the Department of Energy's Hydrogen Shot initiative, create favorable economics for ammonia energy projects across the supply chain.

Australia has implemented the Hydrogen Energy Supply Chain program specifically supporting ammonia export infrastructure, recognizing its strategic position as a potential renewable energy exporter. Similarly, South Korea's Hydrogen Economy Roadmap includes provisions for ammonia co-firing in existing coal plants, demonstrating policy alignment with practical implementation pathways.

International maritime regulations are also driving ammonia adoption. The International Maritime Organization's carbon intensity reduction targets of 40% by 2030 have prompted classification societies to develop ammonia-specific safety standards and regulatory frameworks for shipping applications.

Carbon pricing mechanisms across multiple jurisdictions further enhance ammonia's competitiveness against fossil fuels. The EU Emissions Trading System, for instance, creates economic incentives for ammonia adoption by increasing costs for carbon-intensive alternatives.

Developing nations are incorporating ammonia into their Nationally Determined Contributions under the Paris Agreement, with countries like Morocco and Chile establishing green ammonia production zones with streamlined permitting and dedicated renewable energy allocations.

Cross-border cooperation frameworks, such as the Japan-Australia Hydrogen Energy Supply Chain and the EU-North Africa Green Hydrogen Alliance, demonstrate how international policy coordination is essential for establishing global ammonia supply chains and harmonizing technical standards.

Japan has emerged as a policy leader with its Strategic Roadmap for Hydrogen and Ammonia, which targets 3 million tons of ammonia use in power generation by 2030. This commitment is reinforced by substantial government subsidies and tax incentives for ammonia infrastructure development, positioning Japan as a first-mover in ammonia energy markets.

In the United States, the Inflation Reduction Act provides production tax credits of up to $3 per kilogram for clean hydrogen, which directly benefits green ammonia production. These incentives, coupled with the Department of Energy's Hydrogen Shot initiative, create favorable economics for ammonia energy projects across the supply chain.

Australia has implemented the Hydrogen Energy Supply Chain program specifically supporting ammonia export infrastructure, recognizing its strategic position as a potential renewable energy exporter. Similarly, South Korea's Hydrogen Economy Roadmap includes provisions for ammonia co-firing in existing coal plants, demonstrating policy alignment with practical implementation pathways.

International maritime regulations are also driving ammonia adoption. The International Maritime Organization's carbon intensity reduction targets of 40% by 2030 have prompted classification societies to develop ammonia-specific safety standards and regulatory frameworks for shipping applications.

Carbon pricing mechanisms across multiple jurisdictions further enhance ammonia's competitiveness against fossil fuels. The EU Emissions Trading System, for instance, creates economic incentives for ammonia adoption by increasing costs for carbon-intensive alternatives.

Developing nations are incorporating ammonia into their Nationally Determined Contributions under the Paris Agreement, with countries like Morocco and Chile establishing green ammonia production zones with streamlined permitting and dedicated renewable energy allocations.

Cross-border cooperation frameworks, such as the Japan-Australia Hydrogen Energy Supply Chain and the EU-North Africa Green Hydrogen Alliance, demonstrate how international policy coordination is essential for establishing global ammonia supply chains and harmonizing technical standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!