Regulatory Frameworks Shaping the Future of Ammonia Fuel

SEP 19, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Regulatory Background and Objectives

Ammonia fuel has emerged as a promising alternative energy carrier in the global transition towards decarbonization. The historical development of ammonia as an industrial chemical dates back to the early 20th century with the Haber-Bosch process, but its consideration as a fuel is relatively recent, gaining significant momentum in the past decade. This evolution has been driven by increasing recognition of ammonia's potential as a hydrogen carrier and carbon-free fuel, particularly in hard-to-abate sectors such as maritime shipping, power generation, and heavy industry.

The regulatory landscape for ammonia fuel has been shaped by three primary forces: environmental protection imperatives, energy security concerns, and industrial safety requirements. International climate agreements, particularly the Paris Agreement and subsequent COP decisions, have established decarbonization targets that indirectly support the development of alternative fuels like ammonia. The International Maritime Organization's (IMO) strategy to reduce greenhouse gas emissions from shipping by at least 50% by 2050 has specifically accelerated interest in ammonia as a marine fuel.

Current regulatory frameworks governing ammonia primarily focus on its traditional use as a fertilizer and industrial chemical. These regulations address production safety, transportation, storage, and handling but are generally insufficient for its widespread adoption as a fuel. The gap between existing regulations and those needed for ammonia fuel applications represents a critical challenge that must be addressed to enable market growth.

The technical objectives for ammonia fuel regulation development include establishing comprehensive safety standards for ammonia combustion systems, defining emissions monitoring protocols, creating fuel quality specifications, and developing risk assessment methodologies specific to ammonia fuel applications. These objectives must balance safety considerations with the need to enable innovation and commercial deployment.

Regional differences in regulatory approaches are becoming increasingly apparent. The European Union has taken a proactive stance through its Fit for 55 package and hydrogen strategy, which indirectly supports ammonia as a hydrogen carrier. Japan has explicitly included ammonia in its national energy strategy, while Australia has focused on export potential through hydrogen and ammonia production initiatives. The United States has adopted a more market-driven approach with targeted research funding and selective regulatory interventions.

The evolution of ammonia fuel regulations is expected to follow a trajectory from initial guidance documents and voluntary industry standards to more formalized international codes and mandatory regulations. This progression will likely be influenced by early demonstration projects, incident learning, and international harmonization efforts through bodies such as the International Organization for Standardization (ISO) and the International Maritime Organization.

The regulatory landscape for ammonia fuel has been shaped by three primary forces: environmental protection imperatives, energy security concerns, and industrial safety requirements. International climate agreements, particularly the Paris Agreement and subsequent COP decisions, have established decarbonization targets that indirectly support the development of alternative fuels like ammonia. The International Maritime Organization's (IMO) strategy to reduce greenhouse gas emissions from shipping by at least 50% by 2050 has specifically accelerated interest in ammonia as a marine fuel.

Current regulatory frameworks governing ammonia primarily focus on its traditional use as a fertilizer and industrial chemical. These regulations address production safety, transportation, storage, and handling but are generally insufficient for its widespread adoption as a fuel. The gap between existing regulations and those needed for ammonia fuel applications represents a critical challenge that must be addressed to enable market growth.

The technical objectives for ammonia fuel regulation development include establishing comprehensive safety standards for ammonia combustion systems, defining emissions monitoring protocols, creating fuel quality specifications, and developing risk assessment methodologies specific to ammonia fuel applications. These objectives must balance safety considerations with the need to enable innovation and commercial deployment.

Regional differences in regulatory approaches are becoming increasingly apparent. The European Union has taken a proactive stance through its Fit for 55 package and hydrogen strategy, which indirectly supports ammonia as a hydrogen carrier. Japan has explicitly included ammonia in its national energy strategy, while Australia has focused on export potential through hydrogen and ammonia production initiatives. The United States has adopted a more market-driven approach with targeted research funding and selective regulatory interventions.

The evolution of ammonia fuel regulations is expected to follow a trajectory from initial guidance documents and voluntary industry standards to more formalized international codes and mandatory regulations. This progression will likely be influenced by early demonstration projects, incident learning, and international harmonization efforts through bodies such as the International Organization for Standardization (ISO) and the International Maritime Organization.

Global Market Demand Analysis for Ammonia as Alternative Fuel

The global market for ammonia as an alternative fuel is experiencing significant growth driven by the urgent need for decarbonization across various sectors. Maritime shipping represents one of the most promising markets, as the International Maritime Organization's ambitious targets to reduce greenhouse gas emissions by at least 50% by 2050 have spurred interest in zero-carbon fuels. Ammonia's high energy density and existing global production and distribution infrastructure position it as a leading candidate for long-distance shipping applications.

The power generation sector presents another substantial market opportunity, particularly in regions transitioning away from coal. Japan has emerged as a frontrunner, with major utilities conducting large-scale demonstrations of ammonia co-firing in conventional power plants. These initiatives aim to reduce carbon emissions while utilizing existing infrastructure, creating a potential market demand of several million tons annually just for this application.

Industrial applications constitute a third major market segment, with ammonia showing promise for high-temperature processes that are difficult to electrify. Steel manufacturing, cement production, and other energy-intensive industries are actively exploring ammonia as both a hydrogen carrier and direct fuel to meet increasingly stringent emissions regulations.

Regional analysis reveals varying levels of market readiness and demand. Asia-Pacific, led by Japan, South Korea, and Singapore, demonstrates the most aggressive adoption strategies, supported by government-backed initiatives and industrial consortia. Europe follows closely, with particular interest from Nordic countries and major shipping nations. North America shows growing interest, though regulatory frameworks are still evolving.

Market forecasts project the global ammonia fuel market to grow at a compound annual growth rate exceeding 15% between 2023 and 2030. This growth trajectory is supported by increasing carbon pricing mechanisms, tightening emissions regulations, and expanding clean energy mandates across multiple jurisdictions.

Cost considerations remain a critical factor influencing market adoption. Currently, green ammonia production costs range between $600-1,000 per ton, significantly higher than conventional ammonia. However, analysts project these costs to decrease substantially as renewable electricity prices fall and electrolyzer technologies mature, potentially reaching cost parity with conventional fuels in carbon-regulated markets by 2030.

Consumer and regulatory pressures for sustainable supply chains are creating additional market pull, particularly from companies with net-zero commitments seeking to decarbonize their logistics operations. This trend is especially pronounced in consumer-facing industries where environmental credentials increasingly influence purchasing decisions.

The power generation sector presents another substantial market opportunity, particularly in regions transitioning away from coal. Japan has emerged as a frontrunner, with major utilities conducting large-scale demonstrations of ammonia co-firing in conventional power plants. These initiatives aim to reduce carbon emissions while utilizing existing infrastructure, creating a potential market demand of several million tons annually just for this application.

Industrial applications constitute a third major market segment, with ammonia showing promise for high-temperature processes that are difficult to electrify. Steel manufacturing, cement production, and other energy-intensive industries are actively exploring ammonia as both a hydrogen carrier and direct fuel to meet increasingly stringent emissions regulations.

Regional analysis reveals varying levels of market readiness and demand. Asia-Pacific, led by Japan, South Korea, and Singapore, demonstrates the most aggressive adoption strategies, supported by government-backed initiatives and industrial consortia. Europe follows closely, with particular interest from Nordic countries and major shipping nations. North America shows growing interest, though regulatory frameworks are still evolving.

Market forecasts project the global ammonia fuel market to grow at a compound annual growth rate exceeding 15% between 2023 and 2030. This growth trajectory is supported by increasing carbon pricing mechanisms, tightening emissions regulations, and expanding clean energy mandates across multiple jurisdictions.

Cost considerations remain a critical factor influencing market adoption. Currently, green ammonia production costs range between $600-1,000 per ton, significantly higher than conventional ammonia. However, analysts project these costs to decrease substantially as renewable electricity prices fall and electrolyzer technologies mature, potentially reaching cost parity with conventional fuels in carbon-regulated markets by 2030.

Consumer and regulatory pressures for sustainable supply chains are creating additional market pull, particularly from companies with net-zero commitments seeking to decarbonize their logistics operations. This trend is especially pronounced in consumer-facing industries where environmental credentials increasingly influence purchasing decisions.

Current Regulatory Landscape and Implementation Challenges

The global regulatory landscape for ammonia as a fuel is currently in a nascent stage, characterized by fragmented approaches across different jurisdictions. The International Maritime Organization (IMO) has emerged as a key player, developing the Initial IMO Strategy on Reduction of GHG Emissions from Ships, which indirectly promotes alternative fuels like ammonia. However, specific regulations addressing ammonia's unique properties and risks remain underdeveloped in most regions.

In the European Union, the FuelEU Maritime initiative and the European Green Deal provide frameworks that could accelerate ammonia fuel adoption, though explicit ammonia-specific regulations are still evolving. The EU's Renewable Energy Directive (RED II) recognizes ammonia as a potential renewable fuel carrier, but implementation guidelines remain incomplete.

The United States has taken steps through the Environmental Protection Agency (EPA) and Department of Energy (DOE) to explore ammonia as an alternative fuel, yet comprehensive regulatory frameworks are lacking. The Jones Act presents additional complexities for maritime applications of ammonia fuel in US waters, potentially limiting deployment flexibility.

In Asia, Japan has positioned itself as a leader with its Strategic Roadmap for Hydrogen and Ammonia, providing clear regulatory pathways for ammonia fuel implementation. South Korea and Singapore have similarly developed preliminary frameworks, while China's approach remains primarily focused on industrial applications rather than fuel use.

A significant implementation challenge lies in the absence of internationally harmonized safety standards for ammonia fuel handling, storage, and bunkering. The toxic and corrosive properties of ammonia necessitate specialized protocols that current maritime and land transport regulations do not adequately address.

Infrastructure certification presents another regulatory hurdle, as existing frameworks for fuel infrastructure were not designed with ammonia's specific requirements in mind. This creates uncertainty for potential investors and slows deployment of necessary supply chain components.

Emissions accounting methodologies for ammonia fuel remain inconsistent across jurisdictions, complicating compliance verification and carbon credit mechanisms. The "well-to-wake" emissions profile of ammonia varies significantly depending on production methods, yet many regulatory frameworks lack the sophistication to differentiate between green, blue, and gray ammonia production pathways.

Cross-border transport regulations for ammonia fuel remain particularly problematic, with inconsistent approaches to classification, permitting, and safety requirements creating potential bottlenecks in developing global supply chains. These regulatory gaps must be addressed to enable the seamless international movement necessary for ammonia to function effectively as a global fuel option.

In the European Union, the FuelEU Maritime initiative and the European Green Deal provide frameworks that could accelerate ammonia fuel adoption, though explicit ammonia-specific regulations are still evolving. The EU's Renewable Energy Directive (RED II) recognizes ammonia as a potential renewable fuel carrier, but implementation guidelines remain incomplete.

The United States has taken steps through the Environmental Protection Agency (EPA) and Department of Energy (DOE) to explore ammonia as an alternative fuel, yet comprehensive regulatory frameworks are lacking. The Jones Act presents additional complexities for maritime applications of ammonia fuel in US waters, potentially limiting deployment flexibility.

In Asia, Japan has positioned itself as a leader with its Strategic Roadmap for Hydrogen and Ammonia, providing clear regulatory pathways for ammonia fuel implementation. South Korea and Singapore have similarly developed preliminary frameworks, while China's approach remains primarily focused on industrial applications rather than fuel use.

A significant implementation challenge lies in the absence of internationally harmonized safety standards for ammonia fuel handling, storage, and bunkering. The toxic and corrosive properties of ammonia necessitate specialized protocols that current maritime and land transport regulations do not adequately address.

Infrastructure certification presents another regulatory hurdle, as existing frameworks for fuel infrastructure were not designed with ammonia's specific requirements in mind. This creates uncertainty for potential investors and slows deployment of necessary supply chain components.

Emissions accounting methodologies for ammonia fuel remain inconsistent across jurisdictions, complicating compliance verification and carbon credit mechanisms. The "well-to-wake" emissions profile of ammonia varies significantly depending on production methods, yet many regulatory frameworks lack the sophistication to differentiate between green, blue, and gray ammonia production pathways.

Cross-border transport regulations for ammonia fuel remain particularly problematic, with inconsistent approaches to classification, permitting, and safety requirements creating potential bottlenecks in developing global supply chains. These regulatory gaps must be addressed to enable the seamless international movement necessary for ammonia to function effectively as a global fuel option.

Existing Regulatory Frameworks and Compliance Requirements

01 Regulatory frameworks for ammonia fuel safety standards

Regulatory frameworks establish safety standards for the handling, storage, and use of ammonia as a fuel. These regulations address the toxic and corrosive properties of ammonia to ensure safe implementation in various applications. The frameworks include specifications for equipment design, operational procedures, and emergency response protocols to minimize risks associated with ammonia fuel systems.- Safety regulations and standards for ammonia fuel handling: Regulatory frameworks addressing the safe handling, storage, and transportation of ammonia as a fuel. These regulations focus on minimizing risks associated with ammonia's toxicity and flammability characteristics. Standards include specifications for containment systems, safety protocols during transfer operations, and emergency response procedures to prevent and mitigate potential hazards in ammonia fuel infrastructure.

- Environmental compliance for ammonia fuel systems: Regulatory frameworks governing emissions and environmental impact of ammonia fuel systems. These include standards for monitoring and controlling nitrogen oxide emissions, ammonia slip, and other potential environmental contaminants. Regulations address lifecycle assessment requirements, carbon footprint calculations, and environmental permitting processes specific to ammonia fuel production, distribution, and utilization facilities.

- Certification frameworks for ammonia fuel infrastructure: Regulatory systems establishing certification requirements for ammonia fuel infrastructure components and systems. These frameworks include technical standards for equipment certification, inspection protocols, and compliance verification procedures. Regulations cover certification of storage tanks, piping systems, dispensing equipment, and safety systems specific to ammonia fuel applications, ensuring compatibility with existing energy infrastructure regulations.

- International maritime regulations for ammonia as marine fuel: Regulatory frameworks specifically addressing the use of ammonia as a marine fuel in international shipping. These include International Maritime Organization (IMO) guidelines, classification society rules, and port authority requirements for ammonia-fueled vessels. Regulations cover bunkering operations, crew training requirements, risk assessment methodologies, and emission control standards for vessels using ammonia propulsion systems.

- Market-based regulatory mechanisms for ammonia fuel adoption: Regulatory frameworks implementing market-based mechanisms to incentivize ammonia fuel adoption. These include carbon pricing schemes, tax incentives, subsidies, and renewable fuel standards that recognize ammonia as a low-carbon fuel option. Regulations establish criteria for green ammonia certification, carbon intensity scoring methodologies, and compliance pathways for fuel suppliers and end-users transitioning to ammonia-based energy systems.

02 Environmental compliance for ammonia fuel production and usage

Environmental regulations govern the production and usage of ammonia fuel to minimize ecological impact. These frameworks include emissions standards, carbon footprint assessments, and sustainability requirements for ammonia production facilities. Compliance measures address concerns related to nitrogen oxide emissions, potential ammonia leakage, and overall lifecycle environmental impact of ammonia as an alternative fuel.Expand Specific Solutions03 Certification and standardization systems for ammonia fuel infrastructure

Certification frameworks establish standardized requirements for ammonia fuel infrastructure, including storage facilities, transportation systems, and fueling stations. These standards ensure compatibility across different systems and regions while maintaining consistent safety and performance levels. The frameworks include technical specifications for materials, equipment ratings, and operational parameters specific to ammonia's unique properties as a fuel.Expand Specific Solutions04 International maritime regulations for ammonia as marine fuel

Maritime regulatory frameworks address the use of ammonia as a shipping fuel, establishing guidelines for vessel design, crew training, and operational procedures. These regulations align with International Maritime Organization (IMO) requirements for alternative fuels and include provisions for bunkering operations, emissions monitoring, and risk assessment. The frameworks facilitate the transition to ammonia fuel while ensuring maritime safety and environmental protection.Expand Specific Solutions05 Carbon credit and incentive frameworks for ammonia fuel adoption

Regulatory frameworks establish incentive mechanisms and carbon credit systems to promote ammonia fuel adoption. These include tax benefits, subsidies, and emissions trading schemes that recognize ammonia's potential as a low-carbon or carbon-neutral fuel option. The frameworks define methodologies for calculating emissions reductions, verification procedures, and market mechanisms to monetize environmental benefits associated with switching to ammonia fuel.Expand Specific Solutions

Key Regulatory Bodies and Industry Stakeholders

The regulatory landscape for ammonia fuel is evolving rapidly as this technology transitions from early development to commercial implementation. Currently, the market is in an early growth phase with increasing investment but remains relatively small compared to established fuel sectors. Technical maturity varies significantly across applications, with companies like AMOGY, Kawasaki Heavy Industries, and Linde GmbH leading innovation in ammonia power solutions. Academic institutions including Tianjin University and Huazhong University of Science & Technology are advancing fundamental research, while industrial players such as IHI Corp, Samsung Heavy Industries, and Weichai Power focus on practical applications particularly in maritime and heavy transport sectors. The regulatory frameworks are developing unevenly across regions, creating both challenges and opportunities as stakeholders work to establish safety standards, emissions protocols, and infrastructure requirements.

Weichai Power

Technical Solution: Weichai Power has developed innovative ammonia-fueled internal combustion engine technology specifically designed for heavy-duty transportation and power generation applications. Their approach centers on direct ammonia combustion rather than cracking to hydrogen, utilizing proprietary injection systems and combustion chamber designs that overcome ammonia's challenging ignition properties[2]. Weichai's technology incorporates advanced catalytic systems that significantly reduce NOx emissions, a critical regulatory concern for ammonia combustion. The company has successfully demonstrated ammonia-diesel dual-fuel engines that can operate with up to 75% ammonia substitution while maintaining performance comparable to conventional diesel engines. On the regulatory front, Weichai has worked extensively with Chinese authorities to develop safety standards for ammonia fuel handling in transportation applications, contributing to national standards for ammonia fuel quality, storage requirements, and emissions limits. Their regulatory strategy emphasizes the adaptation of existing diesel engine frameworks to accommodate ammonia's unique properties, creating a pathway for faster regulatory approval and market adoption[4].

Strengths: Direct ammonia combustion eliminates need for cracking infrastructure; leverages existing engine manufacturing capabilities; established regulatory pathways in Chinese market. Weaknesses: NOx emissions management remains challenging at high ammonia percentages; current regulatory frameworks limited primarily to Chinese market.

Cummins Intellectual Property, Inc.

Technical Solution: Cummins has developed a comprehensive ammonia fuel technology platform focused on both hydrogen-carrier applications and direct ammonia utilization. Their approach includes advanced ammonia-compatible fuel systems for internal combustion engines and fuel cells, with specialized materials and components designed to withstand ammonia's corrosive properties[3]. Cummins' technology incorporates proprietary catalysts that enable efficient ammonia decomposition at lower temperatures, improving overall system efficiency for hydrogen-carrier applications. For direct combustion, they've engineered specialized injection systems and combustion control algorithms that optimize ammonia combustion while minimizing NOx formation. On the regulatory front, Cummins has been actively engaged with international standards organizations to develop safety protocols and performance standards for ammonia fuel systems in transportation applications. Their regulatory strategy emphasizes a harmonized global approach, working with authorities in multiple markets to establish consistent standards for ammonia fuel quality, storage requirements, and emissions limits[5]. Cummins has also developed comprehensive risk assessment methodologies specifically for ammonia fuel applications that are being incorporated into emerging regulatory frameworks.

Strengths: Dual-path approach addressing both direct ammonia use and hydrogen-carrier applications; global regulatory engagement creating harmonized standards; extensive experience with emissions compliance systems. Weaknesses: Technology still in development phase with limited full-scale demonstrations; regulatory frameworks for mobile applications remain fragmented across different markets.

Critical Standards and Safety Protocols for Ammonia Fuel

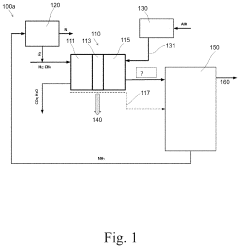

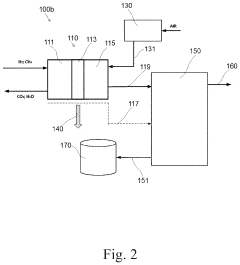

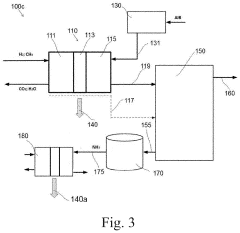

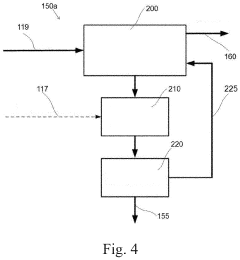

Solid oxide fuel cell arrangement generating ammonia as byproduct and utilizing ammonia as secondary fuel

PatentInactiveUS20220093950A1

Innovation

- A solid oxide fuel cell system that includes a gas separator to extract ammonia from the tail-gas stream, which can be used to fuel a secondary energy conversion device, stored, or reformed into hydrogen, utilizing heat transfer means to optimize the separation process.

Environmental Impact Assessment and Sustainability Metrics

The environmental impact assessment of ammonia as a fuel represents a critical dimension in evaluating its viability within future energy frameworks. Ammonia combustion produces nitrogen and water as primary byproducts, offering a significant advantage over conventional fossil fuels that release carbon dioxide. However, incomplete combustion can lead to nitrogen oxide (NOx) emissions, which contribute to air pollution and acid rain, necessitating advanced combustion technologies and catalytic systems for mitigation.

Life cycle assessment (LCA) methodologies are increasingly being standardized for ammonia fuel applications, with regulatory bodies developing specific protocols to measure carbon intensity across production, transportation, storage, and end-use phases. The European Union's Renewable Energy Directive II and the International Maritime Organization's carbon intensity indicators provide frameworks for these assessments, requiring comprehensive data collection and transparent reporting mechanisms.

Water consumption metrics represent another crucial sustainability parameter, particularly for green ammonia production which relies on electrolysis processes. Regulatory frameworks are beginning to incorporate water stress indicators and efficiency requirements, with Australia and the Middle East establishing pioneering standards due to their water scarcity challenges coupled with renewable energy abundance.

Land use considerations are similarly gaining regulatory attention, especially regarding the placement of renewable energy infrastructure supporting ammonia production. Environmental impact statements increasingly require assessments of habitat disruption, biodiversity impacts, and land competition with agriculture, with Japan's hydrogen strategy explicitly addressing these concerns through designated industrial zoning for ammonia infrastructure.

Circular economy principles are being integrated into ammonia fuel regulations, with emphasis on catalyst recovery, water recycling, and waste heat utilization. The EU's Circular Economy Action Plan now includes specific provisions for ammonia production facilities, mandating recovery rates for precious metals used in catalysts and establishing thermal efficiency standards.

Sustainability certification schemes are emerging as market-based regulatory mechanisms, with initiatives like the Ammonia Energy Association's developing certification standards to verify environmental credentials. These schemes incorporate criteria for renewable energy sourcing, water stewardship, and social impact considerations, providing a comprehensive framework for sustainability assessment beyond mere carbon accounting.

Harmonization of these environmental metrics across jurisdictions remains a significant challenge, with international bodies like the International Partnership for Hydrogen and Fuel Cells in the Economy working to develop globally recognized sustainability standards for ammonia fuel. This standardization effort aims to prevent regulatory fragmentation while ensuring that environmental safeguards remain robust across diverse implementation contexts.

Life cycle assessment (LCA) methodologies are increasingly being standardized for ammonia fuel applications, with regulatory bodies developing specific protocols to measure carbon intensity across production, transportation, storage, and end-use phases. The European Union's Renewable Energy Directive II and the International Maritime Organization's carbon intensity indicators provide frameworks for these assessments, requiring comprehensive data collection and transparent reporting mechanisms.

Water consumption metrics represent another crucial sustainability parameter, particularly for green ammonia production which relies on electrolysis processes. Regulatory frameworks are beginning to incorporate water stress indicators and efficiency requirements, with Australia and the Middle East establishing pioneering standards due to their water scarcity challenges coupled with renewable energy abundance.

Land use considerations are similarly gaining regulatory attention, especially regarding the placement of renewable energy infrastructure supporting ammonia production. Environmental impact statements increasingly require assessments of habitat disruption, biodiversity impacts, and land competition with agriculture, with Japan's hydrogen strategy explicitly addressing these concerns through designated industrial zoning for ammonia infrastructure.

Circular economy principles are being integrated into ammonia fuel regulations, with emphasis on catalyst recovery, water recycling, and waste heat utilization. The EU's Circular Economy Action Plan now includes specific provisions for ammonia production facilities, mandating recovery rates for precious metals used in catalysts and establishing thermal efficiency standards.

Sustainability certification schemes are emerging as market-based regulatory mechanisms, with initiatives like the Ammonia Energy Association's developing certification standards to verify environmental credentials. These schemes incorporate criteria for renewable energy sourcing, water stewardship, and social impact considerations, providing a comprehensive framework for sustainability assessment beyond mere carbon accounting.

Harmonization of these environmental metrics across jurisdictions remains a significant challenge, with international bodies like the International Partnership for Hydrogen and Fuel Cells in the Economy working to develop globally recognized sustainability standards for ammonia fuel. This standardization effort aims to prevent regulatory fragmentation while ensuring that environmental safeguards remain robust across diverse implementation contexts.

Cross-Border Harmonization of Ammonia Fuel Regulations

The harmonization of ammonia fuel regulations across international borders represents a critical challenge in the global transition towards sustainable energy systems. Currently, regulatory frameworks for ammonia as a fuel vary significantly between countries and regions, creating barriers to widespread adoption and international trade. Major maritime nations such as Japan, Norway, and Singapore have begun developing specific regulations for ammonia bunkering and fuel handling, while others lag behind with limited or non-existent frameworks.

International organizations including the International Maritime Organization (IMO) and International Organization for Standardization (ISO) are working to establish unified standards for ammonia fuel specifications, safety protocols, and emissions monitoring. The IMO's initial strategy aims to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels, creating momentum for ammonia fuel adoption but requiring coordinated regulatory approaches.

Key challenges in cross-border harmonization include divergent safety standards, varying environmental requirements, and inconsistent certification processes. For instance, ammonia's toxicity necessitates stringent safety measures, but countries differ in their risk assessment methodologies and acceptable exposure limits. Similarly, emissions monitoring requirements and carbon accounting frameworks show significant variation across jurisdictions.

Bilateral and multilateral agreements are emerging as effective mechanisms for regulatory alignment. The Green Shipping Corridors initiative, involving major ports in Asia, Europe, and North America, aims to establish consistent regulations for ammonia-fueled vessels along specific trade routes. These corridors serve as testing grounds for regulatory harmonization before broader implementation.

Regional harmonization efforts are also gaining traction, particularly in the European Union through its FuelEU Maritime initiative and in the Asia-Pacific Economic Cooperation (APEC) region. These regional frameworks provide templates for broader international alignment while accommodating local conditions and priorities.

Industry stakeholders are advocating for a phased approach to regulatory harmonization, beginning with agreement on fundamental safety standards and gradually expanding to encompass performance specifications, emissions monitoring, and carbon accounting methodologies. Classification societies like DNV GL and Lloyd's Register are playing crucial roles by developing technical guidelines that often inform subsequent regulatory frameworks.

The economic implications of regulatory fragmentation are substantial, with studies suggesting that harmonized regulations could reduce compliance costs by 15-30% and accelerate ammonia fuel adoption by 3-5 years. Achieving this harmonization will require unprecedented cooperation between national regulatory bodies, international organizations, and industry stakeholders to balance safety, environmental protection, and commercial viability.

International organizations including the International Maritime Organization (IMO) and International Organization for Standardization (ISO) are working to establish unified standards for ammonia fuel specifications, safety protocols, and emissions monitoring. The IMO's initial strategy aims to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels, creating momentum for ammonia fuel adoption but requiring coordinated regulatory approaches.

Key challenges in cross-border harmonization include divergent safety standards, varying environmental requirements, and inconsistent certification processes. For instance, ammonia's toxicity necessitates stringent safety measures, but countries differ in their risk assessment methodologies and acceptable exposure limits. Similarly, emissions monitoring requirements and carbon accounting frameworks show significant variation across jurisdictions.

Bilateral and multilateral agreements are emerging as effective mechanisms for regulatory alignment. The Green Shipping Corridors initiative, involving major ports in Asia, Europe, and North America, aims to establish consistent regulations for ammonia-fueled vessels along specific trade routes. These corridors serve as testing grounds for regulatory harmonization before broader implementation.

Regional harmonization efforts are also gaining traction, particularly in the European Union through its FuelEU Maritime initiative and in the Asia-Pacific Economic Cooperation (APEC) region. These regional frameworks provide templates for broader international alignment while accommodating local conditions and priorities.

Industry stakeholders are advocating for a phased approach to regulatory harmonization, beginning with agreement on fundamental safety standards and gradually expanding to encompass performance specifications, emissions monitoring, and carbon accounting methodologies. Classification societies like DNV GL and Lloyd's Register are playing crucial roles by developing technical guidelines that often inform subsequent regulatory frameworks.

The economic implications of regulatory fragmentation are substantial, with studies suggesting that harmonized regulations could reduce compliance costs by 15-30% and accelerate ammonia fuel adoption by 3-5 years. Achieving this harmonization will require unprecedented cooperation between national regulatory bodies, international organizations, and industry stakeholders to balance safety, environmental protection, and commercial viability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!