Material Selection for Optimal Ammonia Fuel Storage and Transport

SEP 19, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Storage Background and Objectives

Ammonia has emerged as a promising carbon-free energy carrier in the global transition toward sustainable energy systems. With a hydrogen content of 17.8% by weight and an energy density of 18.6 MJ/kg, ammonia represents a viable solution for hydrogen storage and transport challenges. The historical development of ammonia technology dates back to the early 20th century with the Haber-Bosch process, which revolutionized fertilizer production. However, its potential as an energy carrier has only gained significant attention in the past decade due to increasing pressure for decarbonization.

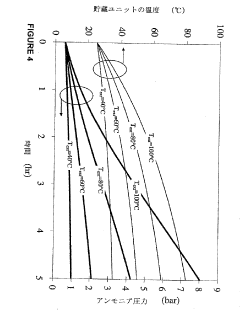

The current technological landscape for ammonia fuel storage encompasses various approaches, including pressurized storage (typically at 10-20 bar), refrigerated storage (at -33°C at atmospheric pressure), and hybrid systems combining moderate pressure and cooling. Each method presents distinct advantages and challenges regarding energy efficiency, safety, and economic viability. The evolution of materials science has continuously improved containment solutions, moving from traditional carbon steel to advanced composites and specialized alloys.

Recent technological breakthroughs in catalyst development have also enhanced the potential for ammonia as a hydrogen carrier, with improved efficiency in both synthesis and cracking processes. These advancements are critical as they address the energy intensity of ammonia production and utilization, which has historically been a significant barrier to widespread adoption.

The primary objective of material selection research for ammonia storage is to identify and develop materials that can safely contain ammonia while minimizing weight, cost, and environmental impact. This includes addressing challenges such as hydrogen embrittlement, stress corrosion cracking, and material degradation under varying temperature and pressure conditions. Additionally, materials must comply with increasingly stringent safety regulations and environmental standards across different jurisdictions.

Another key goal is to enhance the energy efficiency of the entire ammonia value chain, from production through storage to end-use applications. This requires materials that can withstand the specific conditions of each stage while minimizing energy losses during transitions between states or during long-term storage.

The technological trajectory indicates a growing convergence between ammonia storage solutions and renewable energy systems, particularly in the context of grid balancing and seasonal energy storage. This integration necessitates materials that can operate reliably under dynamic loading conditions and frequent cycling, representing a significant departure from traditional static storage applications in the fertilizer industry.

Future research directions will likely focus on novel composite materials, advanced coatings, and innovative storage architectures that can significantly reduce the energy penalties associated with ammonia storage while enhancing safety profiles and reducing overall system costs.

The current technological landscape for ammonia fuel storage encompasses various approaches, including pressurized storage (typically at 10-20 bar), refrigerated storage (at -33°C at atmospheric pressure), and hybrid systems combining moderate pressure and cooling. Each method presents distinct advantages and challenges regarding energy efficiency, safety, and economic viability. The evolution of materials science has continuously improved containment solutions, moving from traditional carbon steel to advanced composites and specialized alloys.

Recent technological breakthroughs in catalyst development have also enhanced the potential for ammonia as a hydrogen carrier, with improved efficiency in both synthesis and cracking processes. These advancements are critical as they address the energy intensity of ammonia production and utilization, which has historically been a significant barrier to widespread adoption.

The primary objective of material selection research for ammonia storage is to identify and develop materials that can safely contain ammonia while minimizing weight, cost, and environmental impact. This includes addressing challenges such as hydrogen embrittlement, stress corrosion cracking, and material degradation under varying temperature and pressure conditions. Additionally, materials must comply with increasingly stringent safety regulations and environmental standards across different jurisdictions.

Another key goal is to enhance the energy efficiency of the entire ammonia value chain, from production through storage to end-use applications. This requires materials that can withstand the specific conditions of each stage while minimizing energy losses during transitions between states or during long-term storage.

The technological trajectory indicates a growing convergence between ammonia storage solutions and renewable energy systems, particularly in the context of grid balancing and seasonal energy storage. This integration necessitates materials that can operate reliably under dynamic loading conditions and frequent cycling, representing a significant departure from traditional static storage applications in the fertilizer industry.

Future research directions will likely focus on novel composite materials, advanced coatings, and innovative storage architectures that can significantly reduce the energy penalties associated with ammonia storage while enhancing safety profiles and reducing overall system costs.

Market Analysis for Ammonia as Alternative Fuel

The global market for ammonia as an alternative fuel is experiencing significant growth driven by the urgent need for decarbonization across various industries. Currently valued at approximately $72.5 billion, the ammonia fuel market is projected to expand at a compound annual growth rate of 5.3% through 2030, with particularly strong momentum in maritime shipping, power generation, and heavy industry sectors.

Maritime shipping represents one of the most promising markets for ammonia fuel adoption. With the International Maritime Organization's stringent emissions reduction targets, shipping companies are actively seeking zero-carbon alternatives to conventional bunker fuels. Major shipping lines including Maersk, NYK Line, and MOL have announced pilot projects for ammonia-powered vessels, signaling strong industry commitment.

The power generation sector presents another substantial market opportunity. Countries with limited renewable energy resources but ambitious carbon reduction goals, such as Japan and South Korea, have incorporated ammonia co-firing in coal plants into their national energy strategies. Japan aims to increase ammonia use in power generation to 3 million tons annually by 2030, creating significant market demand.

Heavy industry applications, particularly in steel manufacturing and cement production, represent emerging markets where ammonia could serve as both a fuel and hydrogen carrier. Several steel manufacturers in Europe have initiated pilot projects using ammonia in blast furnaces to reduce carbon emissions from traditional coking coal processes.

Regional market analysis reveals Asia-Pacific as the dominant market for ammonia fuel adoption, accounting for approximately 42% of global demand. This is primarily driven by Japan's aggressive ammonia fuel strategy and China's growing interest in green ammonia production. Europe follows closely at 35% market share, supported by stringent emissions regulations and substantial government funding for alternative fuel infrastructure.

Market barriers include the current high production costs of green ammonia compared to conventional fuels, with green ammonia production costs ranging from $650-1,200 per ton versus $200-450 for conventional ammonia. Infrastructure limitations present another significant challenge, as specialized storage and handling facilities require substantial capital investment.

Consumer adoption is heavily influenced by regulatory frameworks, with regions implementing carbon pricing mechanisms showing accelerated interest in ammonia fuel solutions. The EU's carbon border adjustment mechanism and expanding emissions trading systems are creating economic incentives that improve ammonia fuel's competitiveness against conventional alternatives.

Maritime shipping represents one of the most promising markets for ammonia fuel adoption. With the International Maritime Organization's stringent emissions reduction targets, shipping companies are actively seeking zero-carbon alternatives to conventional bunker fuels. Major shipping lines including Maersk, NYK Line, and MOL have announced pilot projects for ammonia-powered vessels, signaling strong industry commitment.

The power generation sector presents another substantial market opportunity. Countries with limited renewable energy resources but ambitious carbon reduction goals, such as Japan and South Korea, have incorporated ammonia co-firing in coal plants into their national energy strategies. Japan aims to increase ammonia use in power generation to 3 million tons annually by 2030, creating significant market demand.

Heavy industry applications, particularly in steel manufacturing and cement production, represent emerging markets where ammonia could serve as both a fuel and hydrogen carrier. Several steel manufacturers in Europe have initiated pilot projects using ammonia in blast furnaces to reduce carbon emissions from traditional coking coal processes.

Regional market analysis reveals Asia-Pacific as the dominant market for ammonia fuel adoption, accounting for approximately 42% of global demand. This is primarily driven by Japan's aggressive ammonia fuel strategy and China's growing interest in green ammonia production. Europe follows closely at 35% market share, supported by stringent emissions regulations and substantial government funding for alternative fuel infrastructure.

Market barriers include the current high production costs of green ammonia compared to conventional fuels, with green ammonia production costs ranging from $650-1,200 per ton versus $200-450 for conventional ammonia. Infrastructure limitations present another significant challenge, as specialized storage and handling facilities require substantial capital investment.

Consumer adoption is heavily influenced by regulatory frameworks, with regions implementing carbon pricing mechanisms showing accelerated interest in ammonia fuel solutions. The EU's carbon border adjustment mechanism and expanding emissions trading systems are creating economic incentives that improve ammonia fuel's competitiveness against conventional alternatives.

Current Materials Challenges in Ammonia Storage

The storage of ammonia as a fuel presents significant materials challenges due to its corrosive nature and specific physical properties. Current materials used for ammonia storage primarily include carbon steel, stainless steel, and specialized alloys, each with distinct limitations. Carbon steel, while economical, suffers from stress corrosion cracking when exposed to ammonia, particularly in the presence of oxygen and moisture. This necessitates careful monitoring and maintenance protocols that increase operational costs.

Stainless steel offers improved corrosion resistance but at substantially higher costs, creating economic barriers for large-scale implementation. The 300-series austenitic stainless steels (particularly types 304 and 316) demonstrate good compatibility with ammonia but require specific nickel content to maintain structural integrity over extended periods. Even these materials show vulnerability at weld points and under certain temperature and pressure conditions.

Specialized aluminum alloys present an alternative with lower weight and reasonable corrosion resistance, but they typically exhibit lower strength characteristics, limiting their application in high-pressure storage systems. The mechanical properties of these alloys can degrade over time through hydrogen embrittlement mechanisms when in contact with ammonia.

Composite materials represent an emerging solution, with carbon fiber reinforced polymers (CFRPs) offering excellent strength-to-weight ratios. However, current polymer liners used in these composites often demonstrate inadequate permeation resistance to ammonia, leading to gradual degradation and potential safety concerns. The interface between composite layers also presents potential failure points under thermal cycling conditions.

Sealing materials and gaskets constitute another critical challenge area. Traditional elastomers like natural rubber and many synthetic varieties degrade rapidly when exposed to ammonia. Fluoroelastomers and perfluoroelastomers demonstrate better resistance but add significant cost and may still experience performance degradation under extreme temperature conditions or during rapid decompression events.

The development of novel coating technologies has shown promise in enhancing conventional materials' performance. However, current coating solutions often suffer from adhesion issues, non-uniform application, and degradation over time, particularly at points of mechanical stress. The long-term stability of these coatings under real-world operating conditions remains inadequately characterized.

Material compatibility issues extend beyond the storage vessels themselves to valves, fittings, and monitoring equipment. The diversity of materials in these components creates potential weak points in the storage system, with each material-ammonia interaction requiring specific consideration and engineering solutions.

Stainless steel offers improved corrosion resistance but at substantially higher costs, creating economic barriers for large-scale implementation. The 300-series austenitic stainless steels (particularly types 304 and 316) demonstrate good compatibility with ammonia but require specific nickel content to maintain structural integrity over extended periods. Even these materials show vulnerability at weld points and under certain temperature and pressure conditions.

Specialized aluminum alloys present an alternative with lower weight and reasonable corrosion resistance, but they typically exhibit lower strength characteristics, limiting their application in high-pressure storage systems. The mechanical properties of these alloys can degrade over time through hydrogen embrittlement mechanisms when in contact with ammonia.

Composite materials represent an emerging solution, with carbon fiber reinforced polymers (CFRPs) offering excellent strength-to-weight ratios. However, current polymer liners used in these composites often demonstrate inadequate permeation resistance to ammonia, leading to gradual degradation and potential safety concerns. The interface between composite layers also presents potential failure points under thermal cycling conditions.

Sealing materials and gaskets constitute another critical challenge area. Traditional elastomers like natural rubber and many synthetic varieties degrade rapidly when exposed to ammonia. Fluoroelastomers and perfluoroelastomers demonstrate better resistance but add significant cost and may still experience performance degradation under extreme temperature conditions or during rapid decompression events.

The development of novel coating technologies has shown promise in enhancing conventional materials' performance. However, current coating solutions often suffer from adhesion issues, non-uniform application, and degradation over time, particularly at points of mechanical stress. The long-term stability of these coatings under real-world operating conditions remains inadequately characterized.

Material compatibility issues extend beyond the storage vessels themselves to valves, fittings, and monitoring equipment. The diversity of materials in these components creates potential weak points in the storage system, with each material-ammonia interaction requiring specific consideration and engineering solutions.

Current Material Solutions for Ammonia Containment

01 Metal-organic frameworks for ammonia storage

Metal-organic frameworks (MOFs) are advanced porous materials that can effectively store ammonia through adsorption mechanisms. These materials offer high surface area and tunable pore sizes that can be optimized for ammonia molecules. MOFs provide significant advantages in terms of storage capacity and safety compared to conventional methods, allowing for efficient ammonia storage at lower pressures and temperatures, which improves transport efficiency and reduces energy requirements.- Metal-organic frameworks for ammonia storage: Metal-organic frameworks (MOFs) are porous materials that can effectively store ammonia through adsorption mechanisms. These materials offer high surface area and tunable pore structures that can be optimized for ammonia uptake. MOFs provide advantages in terms of storage capacity, safety, and release control, making them suitable for efficient ammonia storage and transport applications.

- Metal hydride and salt-based storage systems: Metal hydrides and salt-based compounds can store ammonia through chemical bonding, offering high volumetric storage efficiency. These materials form stable complexes with ammonia that can be released under controlled conditions of temperature and pressure. The reversible binding of ammonia to these materials provides a safe and efficient method for ammonia storage and transport, with reduced risks associated with pressurized systems.

- Specialized container designs for ammonia transport: Specialized containers with advanced insulation, pressure management systems, and safety features are developed for efficient ammonia transport. These containers include innovations in material selection, structural design, and monitoring systems to prevent leakage and maintain optimal storage conditions. The designs focus on maximizing storage capacity while ensuring safety during handling, transportation, and distribution of ammonia.

- Liquid ammonia carriers and absorption materials: Liquid carriers and absorption materials can store ammonia in a safer form than compressed gas. These include ionic liquids, certain solvents, and porous materials that can absorb and release ammonia under controlled conditions. This approach reduces pressure requirements and improves safety profiles for ammonia storage and transport, while maintaining high volumetric efficiency and facilitating easier handling.

- Ammonia storage efficiency monitoring and optimization systems: Advanced monitoring and control systems are developed to optimize ammonia storage and transport efficiency. These systems incorporate sensors, data analytics, and automation to monitor parameters such as temperature, pressure, and concentration. The technology enables real-time adjustments to maintain optimal conditions, predict maintenance needs, and maximize storage efficiency while ensuring safety throughout the ammonia supply chain.

02 Liquid ammonia transport systems

Specialized systems for transporting ammonia in liquid form involve pressure vessels, cryogenic tanks, and safety mechanisms. These systems maintain ammonia in liquid state through pressurization or cooling to increase storage density. The technology includes specialized valves, monitoring systems, and insulation techniques to prevent leakage and maintain temperature control during transport. Liquid ammonia transport offers higher density storage compared to gaseous forms, improving overall transport efficiency.Expand Specific Solutions03 Chemical carriers for ammonia storage

Chemical carriers bind ammonia in stable compounds for safer storage and transport. These include metal ammine complexes, metal hydrides, and other materials that form chemical bonds with ammonia molecules. The ammonia can be released when needed through controlled heating or other triggering mechanisms. This approach allows for higher volumetric storage capacity and improved safety during transport as the ammonia is chemically bound rather than stored in free form.Expand Specific Solutions04 Ammonia storage in solid absorbents

Solid absorbent materials can store ammonia through physical adsorption or absorption processes. These materials include activated carbon, zeolites, and specialized polymers that can capture and hold ammonia molecules within their structure. The technology offers advantages in safety and storage density, with the ability to release ammonia under controlled conditions. Solid absorbents can be designed with specific surface properties to optimize ammonia uptake and release kinetics.Expand Specific Solutions05 Innovative container designs for ammonia transport

Advanced container designs specifically engineered for ammonia transport incorporate safety features, monitoring systems, and efficient loading/unloading mechanisms. These containers include specialized pressure relief systems, double-walled construction, and integrated cooling systems to maintain optimal storage conditions. Some designs feature modular components that can be adapted to different transport modes (ship, rail, truck) to improve logistics efficiency and reduce handling risks during transfers between transport modes.Expand Specific Solutions

Leading Companies in Ammonia Fuel Infrastructure

The ammonia fuel storage and transport market is in an early growth phase, characterized by increasing interest due to ammonia's potential as a carbon-free energy carrier. The global market is projected to expand significantly as decarbonization efforts intensify, though current commercial applications remain limited. From a technological maturity perspective, established industrial gas companies like Air Liquide, Linde GmbH, and Ammonia Casale lead with extensive experience in conventional ammonia handling. Research institutions such as Shanghai Jiao Tong University and Dalian Institute of Chemical Physics are advancing novel storage materials, while companies including Samsung Heavy Industries and Equinor Energy are developing specialized transport solutions. Emerging players like Amminex Emissions Technology are innovating in solid-state storage technologies, indicating a diversifying competitive landscape as the sector transitions from research to commercialization.

Ammonia Casale SpA

Technical Solution: Ammonia Casale has developed advanced metal-organic frameworks (MOFs) specifically engineered for ammonia storage and transport. Their proprietary MOF materials feature tailored pore sizes and chemical functionalities that maximize ammonia adsorption capacity while minimizing energy requirements for loading and unloading. The company's technology incorporates copper-based MOFs with high surface area (>3000 m²/g) and optimized binding sites that can store ammonia at moderate pressures (10-15 bar) and near-ambient temperatures, significantly reducing the energy costs associated with conventional high-pressure or cryogenic storage methods. Their integrated storage systems include specialized coatings to protect metal components from ammonia-induced corrosion, utilizing aluminum alloys with specific oxide layer treatments that maintain structural integrity over thousands of loading cycles. Ammonia Casale has also pioneered composite tank designs that combine these advanced materials with structural reinforcements to meet maritime and land transport safety regulations.

Strengths: Superior adsorption capacity compared to conventional materials, reducing storage volume requirements by up to 40%. Lower operating pressures enhance safety and reduce infrastructure costs. Weaknesses: Higher initial manufacturing costs compared to conventional steel tanks, and the specialized materials may have limited production scaling capabilities in the short term.

Linde GmbH

Technical Solution: Linde has developed a comprehensive material solution for ammonia storage and transport called "AmmoniaMax" that addresses both safety and efficiency concerns. Their system utilizes specialized stainless steel alloys (316L modified with nitrogen enrichment) that demonstrate superior resistance to ammonia stress corrosion cracking while maintaining structural integrity at operating pressures up to 45 bar. The inner surfaces of their storage vessels feature proprietary nickel-based coatings that create a passive layer, reducing the risk of hydrogen embrittlement and extending service life by up to 30%. For transport applications, Linde has engineered composite materials that combine lightweight carbon fiber reinforcement with specialized polymer liners resistant to ammonia permeation. Their material selection strategy also incorporates advanced gasket and sealing materials based on modified PTFE compounds that maintain flexibility and sealing properties even after prolonged exposure to ammonia. The company's integrated approach includes specialized heat exchange materials that optimize the energy efficiency during liquefaction and regasification processes, reducing energy consumption by approximately 15% compared to conventional systems.

Strengths: Comprehensive material solution addressing multiple aspects of ammonia handling with proven industrial-scale implementation and global supply chain integration. Weaknesses: Higher initial capital costs compared to conventional materials, and the specialized alloys require careful quality control during manufacturing to ensure consistent performance.

Key Innovations in Corrosion-Resistant Materials

Method and apparatus for safe storage and safe transportation of ammonia, and use of ammonia storage material

PatentInactiveJP2010513812A

Innovation

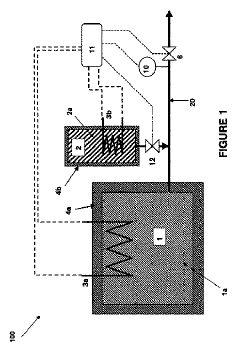

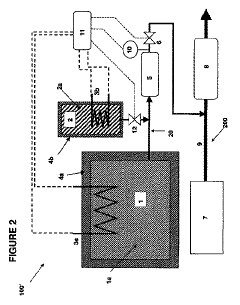

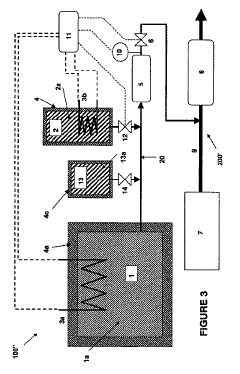

- A dual ammonia storage system with materials having different vapor pressures is used, where a first material with higher vapor pressure is connected to a second material with lower vapor pressure to manage pressure fluctuations by reversible adsorption and absorption, controlled by a fluid connection and heating mechanisms.

Steel for the transport and storage of liquid ammonia

PatentWO2024052805A1

Innovation

- Austenitic stainless steel with specific weight percentage compositions, including chromium, manganese, nickel, nitrogen, carbon, and iron, is used to create containers capable of storing and transporting both LNG and liquid ammonia, offering mechanical and corrosion resistance suitable for both fuels.

Safety Standards and Regulatory Framework

The regulatory landscape for ammonia fuel storage and transport is governed by a complex framework of international, national, and industry-specific standards. The International Maritime Organization (IMO) has established the International Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC Code), which includes specific provisions for ammonia transport vessels. Additionally, the International Organization for Standardization (ISO) provides standards such as ISO 5771 for ammonia storage tanks and ISO 7103 for handling procedures.

In the United States, the Occupational Safety and Health Administration (OSHA) regulates ammonia under 29 CFR 1910.111, which mandates specific requirements for storage containers, including material specifications, pressure ratings, and safety relief devices. The Environmental Protection Agency (EPA) classifies ammonia as a hazardous substance under the Clean Air Act and requires facilities storing more than 10,000 pounds to develop risk management plans.

European regulations are primarily governed by the Seveso III Directive (2012/18/EU), which establishes tiered requirements based on ammonia quantities stored. The directive mandates comprehensive safety management systems, emergency planning, and regular inspections for facilities handling significant ammonia volumes. Material selection must comply with the Pressure Equipment Directive (2014/68/EU), which specifies requirements for pressure vessels containing hazardous substances.

Material compatibility certification is a critical regulatory requirement across jurisdictions. Materials used for ammonia storage must undergo rigorous testing to verify resistance to stress corrosion cracking, particularly for steel alloys. The American Society of Mechanical Engineers (ASME) Boiler and Pressure Vessel Code Section VIII provides detailed specifications for materials suitable for ammonia service, including requirements for post-weld heat treatment and non-destructive examination.

Emerging regulations are increasingly focusing on the dual-use nature of ammonia as both an industrial chemical and potential energy carrier. The International Energy Agency (IEA) has published guidelines for hydrogen and ammonia as future fuels, which are being incorporated into national regulatory frameworks. Japan's Strategic Energy Plan explicitly addresses ammonia fuel infrastructure requirements, establishing pioneering standards for material selection in ammonia fuel applications.

Compliance with these regulations necessitates careful material selection that balances mechanical properties, corrosion resistance, and economic considerations. Materials must not only meet current standards but also anticipate regulatory evolution as ammonia transitions from primarily industrial use to a significant role in the clean energy ecosystem. This regulatory complexity creates both challenges and opportunities for material innovation in ammonia fuel systems.

In the United States, the Occupational Safety and Health Administration (OSHA) regulates ammonia under 29 CFR 1910.111, which mandates specific requirements for storage containers, including material specifications, pressure ratings, and safety relief devices. The Environmental Protection Agency (EPA) classifies ammonia as a hazardous substance under the Clean Air Act and requires facilities storing more than 10,000 pounds to develop risk management plans.

European regulations are primarily governed by the Seveso III Directive (2012/18/EU), which establishes tiered requirements based on ammonia quantities stored. The directive mandates comprehensive safety management systems, emergency planning, and regular inspections for facilities handling significant ammonia volumes. Material selection must comply with the Pressure Equipment Directive (2014/68/EU), which specifies requirements for pressure vessels containing hazardous substances.

Material compatibility certification is a critical regulatory requirement across jurisdictions. Materials used for ammonia storage must undergo rigorous testing to verify resistance to stress corrosion cracking, particularly for steel alloys. The American Society of Mechanical Engineers (ASME) Boiler and Pressure Vessel Code Section VIII provides detailed specifications for materials suitable for ammonia service, including requirements for post-weld heat treatment and non-destructive examination.

Emerging regulations are increasingly focusing on the dual-use nature of ammonia as both an industrial chemical and potential energy carrier. The International Energy Agency (IEA) has published guidelines for hydrogen and ammonia as future fuels, which are being incorporated into national regulatory frameworks. Japan's Strategic Energy Plan explicitly addresses ammonia fuel infrastructure requirements, establishing pioneering standards for material selection in ammonia fuel applications.

Compliance with these regulations necessitates careful material selection that balances mechanical properties, corrosion resistance, and economic considerations. Materials must not only meet current standards but also anticipate regulatory evolution as ammonia transitions from primarily industrial use to a significant role in the clean energy ecosystem. This regulatory complexity creates both challenges and opportunities for material innovation in ammonia fuel systems.

Environmental Impact Assessment

The environmental impact of ammonia as a fuel extends across its entire lifecycle, from production to storage, transport, and eventual use. When evaluating materials for ammonia storage and transport systems, environmental considerations must be integrated into the selection process to ensure sustainability and regulatory compliance. Traditional materials used in ammonia handling, such as carbon steel and stainless steel, present varying environmental footprints related to their production, maintenance, and end-of-life disposal.

Material production processes for high-grade stainless steels and specialized alloys typically involve energy-intensive manufacturing, resulting in significant carbon emissions. For instance, the production of one ton of stainless steel generates approximately 2.8 tons of CO2 equivalent, considerably higher than carbon steel at 1.8 tons. Advanced composite materials, while offering superior performance characteristics, often incorporate petroleum-based polymers with substantial environmental implications during both manufacturing and disposal phases.

Leakage prevention represents a critical environmental consideration in material selection. Ammonia releases can cause severe environmental damage, including water eutrophication, soil acidification, and air quality degradation. Materials that demonstrate superior resistance to stress corrosion cracking and fatigue under cyclic loading conditions significantly reduce the probability of containment failures and subsequent environmental contamination.

The recyclability and reusability of materials constitute another important environmental dimension. Metals like aluminum and certain grades of steel offer excellent recycling potential with minimal quality degradation, whereas composite materials present more complex recycling challenges. The environmental assessment must account for the entire lifecycle, including the potential for material recovery and reprocessing at end-of-life.

Climate resilience of materials has emerged as an increasingly important factor as extreme weather events become more frequent. Materials must withstand varying temperature conditions without compromising structural integrity or increasing emissions through thermal expansion or contraction. This is particularly relevant for large-scale storage facilities in diverse geographical locations.

Regulatory frameworks worldwide are evolving to impose stricter environmental standards on industrial materials and processes. The European Union's REACH regulations, the United States EPA guidelines, and similar frameworks in Asia-Pacific regions establish compliance requirements that directly influence material selection decisions. Materials that proactively meet or exceed these standards offer strategic advantages in global deployment scenarios.

Quantitative life cycle assessment (LCA) methodologies provide valuable frameworks for comparing environmental impacts across different material options. These assessments typically evaluate indicators such as global warming potential, acidification potential, eutrophication potential, and resource depletion. Recent LCA studies indicate that advanced high-nickel alloys, despite their higher initial environmental footprint, may offer superior lifetime environmental performance due to their exceptional durability and reduced maintenance requirements.

Material production processes for high-grade stainless steels and specialized alloys typically involve energy-intensive manufacturing, resulting in significant carbon emissions. For instance, the production of one ton of stainless steel generates approximately 2.8 tons of CO2 equivalent, considerably higher than carbon steel at 1.8 tons. Advanced composite materials, while offering superior performance characteristics, often incorporate petroleum-based polymers with substantial environmental implications during both manufacturing and disposal phases.

Leakage prevention represents a critical environmental consideration in material selection. Ammonia releases can cause severe environmental damage, including water eutrophication, soil acidification, and air quality degradation. Materials that demonstrate superior resistance to stress corrosion cracking and fatigue under cyclic loading conditions significantly reduce the probability of containment failures and subsequent environmental contamination.

The recyclability and reusability of materials constitute another important environmental dimension. Metals like aluminum and certain grades of steel offer excellent recycling potential with minimal quality degradation, whereas composite materials present more complex recycling challenges. The environmental assessment must account for the entire lifecycle, including the potential for material recovery and reprocessing at end-of-life.

Climate resilience of materials has emerged as an increasingly important factor as extreme weather events become more frequent. Materials must withstand varying temperature conditions without compromising structural integrity or increasing emissions through thermal expansion or contraction. This is particularly relevant for large-scale storage facilities in diverse geographical locations.

Regulatory frameworks worldwide are evolving to impose stricter environmental standards on industrial materials and processes. The European Union's REACH regulations, the United States EPA guidelines, and similar frameworks in Asia-Pacific regions establish compliance requirements that directly influence material selection decisions. Materials that proactively meet or exceed these standards offer strategic advantages in global deployment scenarios.

Quantitative life cycle assessment (LCA) methodologies provide valuable frameworks for comparing environmental impacts across different material options. These assessments typically evaluate indicators such as global warming potential, acidification potential, eutrophication potential, and resource depletion. Recent LCA studies indicate that advanced high-nickel alloys, despite their higher initial environmental footprint, may offer superior lifetime environmental performance due to their exceptional durability and reduced maintenance requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!