The Strategic Role of Ammonia Fuel in Decarbonizing Heavy Industries

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Background and Decarbonization Goals

Ammonia has emerged as a promising carbon-free energy carrier in the global pursuit of decarbonization. Historically, ammonia has been primarily utilized as a fertilizer since the development of the Haber-Bosch process in the early 20th century, which enabled industrial-scale production by combining nitrogen from the air with hydrogen. This established process now produces over 180 million tonnes of ammonia annually worldwide, supporting global food production for billions of people.

In recent years, ammonia has gained significant attention as a potential fuel due to its unique properties. It contains no carbon atoms, releasing only nitrogen and water when combusted properly, making it an attractive option for reducing greenhouse gas emissions. With an energy density of 18.6 MJ/kg, ammonia can store more energy by volume than hydrogen, while being easier to liquefy and transport under moderate conditions (at -33°C at atmospheric pressure or 10 bar at ambient temperature).

The technical evolution of ammonia as an energy carrier has accelerated dramatically since 2015, with research institutions and industry players developing new methods for both production and utilization. Green ammonia production, which uses renewable electricity to power electrolysis for hydrogen generation before nitrogen fixation, represents a significant advancement from traditional carbon-intensive methods that rely on natural gas or coal.

Heavy industries face particularly challenging decarbonization pathways due to their reliance on high-temperature processes and energy-dense fuels. Sectors such as shipping, steel manufacturing, cement production, and long-haul transportation collectively account for approximately 30% of global carbon emissions, with limited viable alternatives to fossil fuels until recently.

The primary decarbonization goal for ammonia fuel technology is to provide a practical, scalable solution for these hard-to-abate sectors. Industry roadmaps typically target 2030 for commercial deployment of ammonia-powered ships and industrial furnaces, with broader adoption anticipated by 2040. The International Maritime Organization has set ambitious targets to reduce shipping emissions by at least 50% by 2050 compared to 2008 levels, with ammonia positioned as a key enabler of this transition.

Technical objectives include improving ammonia combustion efficiency, reducing NOx emissions through advanced catalytic systems, developing purpose-built engines and turbines for ammonia fuel, and dramatically scaling green ammonia production capacity. The ammonia energy ecosystem aims to achieve cost parity with conventional fuels by 2035, requiring significant advances in renewable electricity generation, electrolyzer technology, and ammonia synthesis processes.

In recent years, ammonia has gained significant attention as a potential fuel due to its unique properties. It contains no carbon atoms, releasing only nitrogen and water when combusted properly, making it an attractive option for reducing greenhouse gas emissions. With an energy density of 18.6 MJ/kg, ammonia can store more energy by volume than hydrogen, while being easier to liquefy and transport under moderate conditions (at -33°C at atmospheric pressure or 10 bar at ambient temperature).

The technical evolution of ammonia as an energy carrier has accelerated dramatically since 2015, with research institutions and industry players developing new methods for both production and utilization. Green ammonia production, which uses renewable electricity to power electrolysis for hydrogen generation before nitrogen fixation, represents a significant advancement from traditional carbon-intensive methods that rely on natural gas or coal.

Heavy industries face particularly challenging decarbonization pathways due to their reliance on high-temperature processes and energy-dense fuels. Sectors such as shipping, steel manufacturing, cement production, and long-haul transportation collectively account for approximately 30% of global carbon emissions, with limited viable alternatives to fossil fuels until recently.

The primary decarbonization goal for ammonia fuel technology is to provide a practical, scalable solution for these hard-to-abate sectors. Industry roadmaps typically target 2030 for commercial deployment of ammonia-powered ships and industrial furnaces, with broader adoption anticipated by 2040. The International Maritime Organization has set ambitious targets to reduce shipping emissions by at least 50% by 2050 compared to 2008 levels, with ammonia positioned as a key enabler of this transition.

Technical objectives include improving ammonia combustion efficiency, reducing NOx emissions through advanced catalytic systems, developing purpose-built engines and turbines for ammonia fuel, and dramatically scaling green ammonia production capacity. The ammonia energy ecosystem aims to achieve cost parity with conventional fuels by 2035, requiring significant advances in renewable electricity generation, electrolyzer technology, and ammonia synthesis processes.

Market Demand Analysis for Green Ammonia in Heavy Industries

The global market for green ammonia in heavy industries is experiencing significant growth driven by the urgent need for decarbonization solutions. Current estimates indicate the global green ammonia market could reach $5.4 billion by 2025, with a compound annual growth rate exceeding 54% through 2030. This remarkable growth trajectory is primarily fueled by increasing regulatory pressures on carbon-intensive industries to reduce emissions and achieve climate targets.

Heavy industries, particularly steel manufacturing, cement production, and maritime shipping, represent the most promising market segments for green ammonia adoption. These sectors collectively account for approximately 20% of global carbon emissions and face substantial challenges in transitioning to low-carbon alternatives. The maritime shipping industry alone could potentially consume up to 130 million tons of green ammonia annually by 2040 as vessels transition from conventional bunker fuels.

Regional market analysis reveals varying adoption patterns, with Europe leading in policy support and investment commitments for green ammonia infrastructure. The European Union's ambitious carbon neutrality goals have established a favorable environment for green ammonia projects, with over €8 billion allocated to hydrogen and ammonia initiatives under various funding mechanisms. Asia-Pacific follows closely, driven by Japan's and South Korea's strategic investments in ammonia co-firing for power generation and industrial applications.

Customer demand analysis indicates three primary market drivers: regulatory compliance, corporate sustainability commitments, and long-term economic considerations. Major industrial players are increasingly viewing green ammonia not merely as a compliance cost but as a strategic investment to secure future market position and avoid carbon pricing penalties. Survey data from industrial stakeholders shows that 67% of heavy industry executives now consider decarbonization technologies as "highly important" to their competitive strategy.

Price sensitivity remains a significant market barrier, with green ammonia currently costing 2-3 times more than conventional ammonia. However, cost projection models suggest price parity could be achieved by 2030-2035 through economies of scale, technological improvements, and carbon pricing mechanisms. Early adopters are primarily motivated by strategic positioning and regulatory compliance rather than immediate economic returns.

Supply chain readiness presents another critical market factor. Current global production capacity for green ammonia remains limited at approximately 0.5 million tons annually, significantly below projected demand. Industry analysts forecast that meeting the potential demand from heavy industries would require more than 200 new large-scale production facilities globally by 2040, representing an investment opportunity exceeding $300 billion.

Heavy industries, particularly steel manufacturing, cement production, and maritime shipping, represent the most promising market segments for green ammonia adoption. These sectors collectively account for approximately 20% of global carbon emissions and face substantial challenges in transitioning to low-carbon alternatives. The maritime shipping industry alone could potentially consume up to 130 million tons of green ammonia annually by 2040 as vessels transition from conventional bunker fuels.

Regional market analysis reveals varying adoption patterns, with Europe leading in policy support and investment commitments for green ammonia infrastructure. The European Union's ambitious carbon neutrality goals have established a favorable environment for green ammonia projects, with over €8 billion allocated to hydrogen and ammonia initiatives under various funding mechanisms. Asia-Pacific follows closely, driven by Japan's and South Korea's strategic investments in ammonia co-firing for power generation and industrial applications.

Customer demand analysis indicates three primary market drivers: regulatory compliance, corporate sustainability commitments, and long-term economic considerations. Major industrial players are increasingly viewing green ammonia not merely as a compliance cost but as a strategic investment to secure future market position and avoid carbon pricing penalties. Survey data from industrial stakeholders shows that 67% of heavy industry executives now consider decarbonization technologies as "highly important" to their competitive strategy.

Price sensitivity remains a significant market barrier, with green ammonia currently costing 2-3 times more than conventional ammonia. However, cost projection models suggest price parity could be achieved by 2030-2035 through economies of scale, technological improvements, and carbon pricing mechanisms. Early adopters are primarily motivated by strategic positioning and regulatory compliance rather than immediate economic returns.

Supply chain readiness presents another critical market factor. Current global production capacity for green ammonia remains limited at approximately 0.5 million tons annually, significantly below projected demand. Industry analysts forecast that meeting the potential demand from heavy industries would require more than 200 new large-scale production facilities globally by 2040, representing an investment opportunity exceeding $300 billion.

Current State and Challenges of Ammonia as Carbon-Free Fuel

Ammonia has emerged as a promising carbon-free fuel candidate in the global effort to decarbonize heavy industries. Currently, global ammonia production stands at approximately 180 million tonnes annually, primarily used for fertilizer production. However, its potential as an energy carrier is gaining significant attention due to its high energy density (18.6 MJ/kg) and zero-carbon combustion properties.

The existing infrastructure for ammonia production, storage, and transportation represents a significant advantage. Over 120 ports worldwide have ammonia terminals, and international shipping routes for ammonia are well-established. This existing network could be leveraged for scaling up ammonia as a fuel, reducing the initial investment required for infrastructure development.

Despite these advantages, ammonia faces several critical technical challenges. The most significant is its low combustion efficiency and high ignition temperature (651°C), making it difficult to use in conventional engines without modifications. Current combustion technologies struggle with ammonia's narrow flammability range and slow flame propagation speed, resulting in incomplete combustion and potential NOx emissions.

Storage and safety concerns present another major challenge. While ammonia has a higher energy density than hydrogen, it requires storage at -33°C or under pressure of 10 bar, necessitating specialized containment systems. Its toxicity and corrosive properties demand robust safety protocols and materials resistant to ammonia-induced degradation.

The carbon footprint of ammonia production remains problematic. Conventional production via the Haber-Bosch process is energy-intensive and currently relies heavily on natural gas, generating significant CO2 emissions (1.8-3.0 tonnes of CO2 per tonne of ammonia). The transition to green ammonia production using renewable electricity for hydrogen generation is technically feasible but remains economically challenging at scale.

Regulatory frameworks for ammonia as a fuel are still underdeveloped in most regions. The lack of standardized safety protocols, emissions standards, and certification processes creates uncertainty for potential investors and slows commercial adoption.

Cost competitiveness represents perhaps the most immediate barrier. Current production costs for conventional ammonia range from $400-700 per tonne, while green ammonia production costs are estimated at $900-1,800 per tonne. This significant price premium makes the economic case for ammonia fuel difficult without supportive policies or carbon pricing mechanisms.

Research efforts are intensifying globally to address these challenges, with particular focus on catalyst development for more efficient ammonia synthesis, combustion optimization technologies, and innovative storage solutions. The pace of innovation will largely determine how quickly ammonia can transition from a promising concept to a commercially viable carbon-free fuel for heavy industries.

The existing infrastructure for ammonia production, storage, and transportation represents a significant advantage. Over 120 ports worldwide have ammonia terminals, and international shipping routes for ammonia are well-established. This existing network could be leveraged for scaling up ammonia as a fuel, reducing the initial investment required for infrastructure development.

Despite these advantages, ammonia faces several critical technical challenges. The most significant is its low combustion efficiency and high ignition temperature (651°C), making it difficult to use in conventional engines without modifications. Current combustion technologies struggle with ammonia's narrow flammability range and slow flame propagation speed, resulting in incomplete combustion and potential NOx emissions.

Storage and safety concerns present another major challenge. While ammonia has a higher energy density than hydrogen, it requires storage at -33°C or under pressure of 10 bar, necessitating specialized containment systems. Its toxicity and corrosive properties demand robust safety protocols and materials resistant to ammonia-induced degradation.

The carbon footprint of ammonia production remains problematic. Conventional production via the Haber-Bosch process is energy-intensive and currently relies heavily on natural gas, generating significant CO2 emissions (1.8-3.0 tonnes of CO2 per tonne of ammonia). The transition to green ammonia production using renewable electricity for hydrogen generation is technically feasible but remains economically challenging at scale.

Regulatory frameworks for ammonia as a fuel are still underdeveloped in most regions. The lack of standardized safety protocols, emissions standards, and certification processes creates uncertainty for potential investors and slows commercial adoption.

Cost competitiveness represents perhaps the most immediate barrier. Current production costs for conventional ammonia range from $400-700 per tonne, while green ammonia production costs are estimated at $900-1,800 per tonne. This significant price premium makes the economic case for ammonia fuel difficult without supportive policies or carbon pricing mechanisms.

Research efforts are intensifying globally to address these challenges, with particular focus on catalyst development for more efficient ammonia synthesis, combustion optimization technologies, and innovative storage solutions. The pace of innovation will largely determine how quickly ammonia can transition from a promising concept to a commercially viable carbon-free fuel for heavy industries.

Current Ammonia Fuel Implementation Solutions

01 Ammonia production and synthesis for carbon-free fuel

Methods for producing ammonia as a carbon-free fuel source through improved synthesis processes. These technologies focus on creating ammonia through environmentally friendly methods that reduce or eliminate carbon emissions. The processes typically involve catalytic synthesis under controlled conditions to maximize efficiency while minimizing environmental impact. These innovations enable ammonia to serve as a viable alternative fuel that can significantly contribute to decarbonization efforts.- Ammonia production and synthesis for carbon-free fuel: Methods for producing ammonia as a carbon-free fuel source through various synthesis processes. These technologies focus on creating ammonia through environmentally friendly methods that avoid carbon emissions. The processes typically involve nitrogen fixation combined with hydrogen production from renewable sources, enabling the creation of ammonia fuel without generating carbon dioxide as a byproduct.

- Ammonia combustion and utilization systems: Systems designed specifically for the efficient combustion and utilization of ammonia as a fuel. These innovations include specialized burners, engines, and power generation systems adapted to handle ammonia's unique combustion properties. The technologies address challenges such as ammonia's lower flame speed and higher ignition temperature compared to conventional fuels, enabling cleaner energy production with reduced carbon emissions.

- Ammonia cracking and hydrogen extraction technologies: Methods for extracting hydrogen from ammonia through cracking processes, enabling the use of ammonia as a hydrogen carrier. These technologies focus on catalytic decomposition of ammonia into nitrogen and hydrogen, which can then be used in fuel cells or other applications. The processes typically involve specialized catalysts and reactor designs that operate at specific temperatures and pressures to optimize hydrogen yield while minimizing energy consumption.

- Carbon capture and utilization in ammonia production: Technologies that integrate carbon capture, utilization, and storage (CCUS) with ammonia production processes. These innovations focus on capturing CO2 emissions from conventional ammonia production methods and either sequestering them or converting them into useful products. The approaches include advanced absorption materials, membrane separation technologies, and chemical conversion processes that prevent carbon from entering the atmosphere while producing ammonia fuel.

- Renewable energy integration with ammonia fuel systems: Systems that integrate renewable energy sources with ammonia production and utilization for complete decarbonization. These technologies couple wind, solar, or hydroelectric power with electrolyzers for hydrogen production, which is then combined with nitrogen to produce ammonia. The innovations include energy storage solutions, grid integration systems, and flexible production methods that can operate intermittently with variable renewable energy inputs.

02 Ammonia combustion systems and engines

Specialized combustion systems and engines designed specifically for ammonia fuel utilization. These technologies include modified internal combustion engines, turbines, and burners that can efficiently use ammonia as a primary fuel source. The designs address ammonia's unique combustion properties, including its lower flame speed and higher ignition temperature compared to conventional fuels. These systems enable effective energy extraction from ammonia while maintaining low carbon emissions.Expand Specific Solutions03 Ammonia storage and transportation solutions

Technologies for safely storing and transporting ammonia fuel. These innovations include specialized tanks, containers, and handling systems designed to address ammonia's specific properties, such as its toxicity and corrosiveness. The solutions incorporate advanced materials, safety mechanisms, and monitoring systems to ensure secure containment during storage and transportation. These technologies are crucial for establishing a viable ammonia fuel infrastructure that can support widespread adoption of this carbon-free energy carrier.Expand Specific Solutions04 Ammonia fuel cells and power generation

Systems that convert ammonia directly into electricity through fuel cell technology or other power generation methods. These technologies include direct ammonia fuel cells, ammonia-fed solid oxide fuel cells, and hybrid systems that can efficiently extract energy from ammonia without combustion. The innovations focus on catalyst development, membrane technology, and system integration to maximize electrical conversion efficiency while minimizing emissions. These power generation methods represent a key pathway for utilizing ammonia in clean energy applications.Expand Specific Solutions05 Carbon capture and utilization in ammonia systems

Technologies that integrate carbon capture, utilization, and storage (CCUS) with ammonia production or usage systems. These innovations focus on capturing CO2 emissions from conventional ammonia production processes or from systems where ammonia is used as an energy carrier. The captured carbon can be utilized in various applications or sequestered, further enhancing the decarbonization potential of ammonia-based energy systems. These integrated approaches maximize the climate benefits of ammonia fuel by addressing emissions across the entire value chain.Expand Specific Solutions

Key Industry Players in Ammonia Fuel Development

The ammonia fuel market for decarbonizing heavy industries is in an early growth phase, with increasing momentum as industries seek sustainable alternatives. The market is projected to expand significantly as ammonia's potential as a carbon-free energy carrier gains recognition. Technologically, the sector shows varying maturity levels across the value chain. Leading players like AMOGY, Saudi Aramco, and Sinopec are advancing commercial applications, while academic institutions including MIT, KAUST, and Tianjin University are driving fundamental research. Established industrial gas companies such as Linde are developing infrastructure solutions, while energy majors like LG Electronics and Weichai Power are exploring ammonia's integration into existing systems. This competitive landscape reflects a strategic positioning around ammonia's role in the energy transition.

China Petroleum & Chemical Corp.

Technical Solution: Sinopec has developed a comprehensive ammonia-based decarbonization strategy for heavy industries, focusing on both production and utilization technologies. Their "Hydrogen-Ammonia Integration Platform" combines hydrogen production from various sources (including natural gas reforming with carbon capture and electrolysis) with advanced ammonia synthesis using their proprietary catalysts that operate at lower pressures (approximately 150 bar versus traditional 200+ bar). Sinopec has pioneered large-scale ammonia co-firing in industrial boilers, achieving up to 20% ammonia substitution rates while maintaining thermal efficiency. Their technology includes specialized ammonia cracking systems that can be integrated directly with industrial processes requiring hydrogen, such as refining and chemical production. Sinopec has demonstrated ammonia utilization in steel manufacturing, where their ammonia injection technology for blast furnaces has reduced carbon intensity by approximately 15-20%. The company has also developed specialized transportation and storage infrastructure for ammonia, including pressurized storage systems and dedicated pipeline networks that enable efficient distribution to industrial users.

Strengths: Vertical integration across the entire ammonia value chain; extensive existing infrastructure adaptable to ammonia; demonstrated applications across multiple industrial sectors. Weaknesses: Current focus primarily on blue rather than green ammonia; geographic concentration in Chinese market; technology deployment still in scaling phase for some applications.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed an integrated ammonia value chain approach to industrial decarbonization, leveraging their existing natural gas infrastructure. Their technology combines conventional ammonia synthesis with carbon capture and storage (CCS), producing "blue ammonia" with carbon capture rates exceeding 90%. The company has pioneered large-scale ammonia co-firing in power generation, successfully demonstrating 30% ammonia blending in conventional power plants without significant modifications to existing infrastructure. Their proprietary catalyst technology enables efficient ammonia cracking at distributed sites, facilitating hydrogen delivery for industrial applications. Aramco has developed specialized ammonia combustion systems for cement kilns that maintain production quality while reducing carbon emissions by approximately 20-25%. The company has also established the first international supply chain for blue ammonia, shipping demonstration cargoes to Japan for power generation applications, proving the feasibility of ammonia as a global energy carrier. Their integrated approach addresses both production and utilization challenges, creating complete pathways for industrial decarbonization.

Strengths: Extensive existing infrastructure adaptable to ammonia production; demonstrated international supply chain capabilities; integration of production with carbon capture technology. Weaknesses: Primary focus on blue rather than green ammonia; continued reliance on fossil fuel feedstocks; geographic concentration of production capacity.

Core Ammonia Combustion and Cracking Technologies

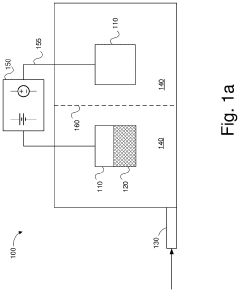

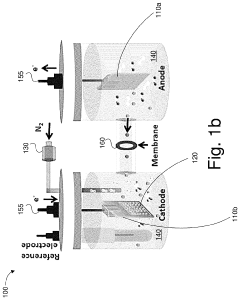

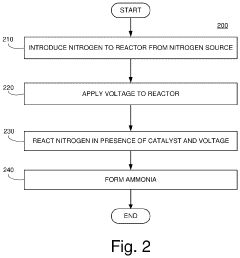

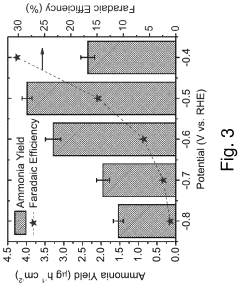

Systems and methods for forming nitrogen-based compounds

PatentActiveUS11885029B2

Innovation

- A system comprising an anode, cathode, and catalyst material with nanoparticles having interior cavities, configured to use nitrogen and water to generate ammonia, utilizing electrocatalytic fixation of nitrogen under ambient conditions with a voltage supply and electrolyte to enhance yield and Faradaic efficiency.

Generation of ammonia/hydrogen mixtures and/or hydrogen-enriched fuel mixtures

PatentWO2023137197A2

Innovation

- A membrane reactor system utilizing a sweep gas as a secondary fuel to enhance hydrogen recovery, allowing for complete decomposition of ammonia and mixing with hydrogen to form enriched fuel blends, operating at lower temperatures and pressures with reduced membrane selectivity requirements.

Safety and Infrastructure Requirements for Ammonia Adoption

The adoption of ammonia as a fuel in heavy industries necessitates comprehensive safety protocols and infrastructure development due to its toxic and corrosive properties. Current safety standards for ammonia handling in industrial refrigeration and agriculture provide a foundation, but must be significantly enhanced for fuel applications. This includes developing specialized training programs for personnel, implementing robust leak detection systems, and establishing emergency response protocols tailored to ammonia's unique hazards.

Infrastructure requirements for ammonia adoption span production, storage, transportation, and utilization phases. Production facilities need substantial modifications to scale up capacity from current fertilizer-oriented operations to meet energy demands. Storage infrastructure requires specialized materials resistant to ammonia's corrosive effects, with cryogenic tanks for liquid ammonia and pressurized vessels for gaseous form being essential components.

Transportation infrastructure presents significant challenges, requiring dedicated pipelines with appropriate materials and safety features. Existing natural gas pipelines cannot be directly repurposed without substantial modifications due to ammonia's different chemical properties. Port facilities for international shipping must be equipped with specialized loading/unloading equipment and safety systems to handle ammonia carriers.

End-use infrastructure in industrial settings demands purpose-built combustion systems, as conventional equipment cannot efficiently utilize ammonia fuel. This includes specialized burners, modified turbines, and catalytic systems to manage NOx emissions during combustion. Additionally, monitoring infrastructure must be deployed throughout the supply chain to ensure real-time detection of leaks or equipment failures.

Regulatory frameworks must evolve to address these infrastructure requirements, with international standards being developed to ensure consistency across global supply chains. The capital investment required for this infrastructure transformation is substantial, estimated at hundreds of billions of dollars globally, necessitating public-private partnerships and targeted incentives to accelerate development.

Phased implementation strategies offer the most practical approach, beginning with ammonia-natural gas co-firing in existing facilities while dedicated ammonia infrastructure is developed. This gradual transition allows for the development of safety expertise and operational experience while spreading capital costs over time.

Infrastructure requirements for ammonia adoption span production, storage, transportation, and utilization phases. Production facilities need substantial modifications to scale up capacity from current fertilizer-oriented operations to meet energy demands. Storage infrastructure requires specialized materials resistant to ammonia's corrosive effects, with cryogenic tanks for liquid ammonia and pressurized vessels for gaseous form being essential components.

Transportation infrastructure presents significant challenges, requiring dedicated pipelines with appropriate materials and safety features. Existing natural gas pipelines cannot be directly repurposed without substantial modifications due to ammonia's different chemical properties. Port facilities for international shipping must be equipped with specialized loading/unloading equipment and safety systems to handle ammonia carriers.

End-use infrastructure in industrial settings demands purpose-built combustion systems, as conventional equipment cannot efficiently utilize ammonia fuel. This includes specialized burners, modified turbines, and catalytic systems to manage NOx emissions during combustion. Additionally, monitoring infrastructure must be deployed throughout the supply chain to ensure real-time detection of leaks or equipment failures.

Regulatory frameworks must evolve to address these infrastructure requirements, with international standards being developed to ensure consistency across global supply chains. The capital investment required for this infrastructure transformation is substantial, estimated at hundreds of billions of dollars globally, necessitating public-private partnerships and targeted incentives to accelerate development.

Phased implementation strategies offer the most practical approach, beginning with ammonia-natural gas co-firing in existing facilities while dedicated ammonia infrastructure is developed. This gradual transition allows for the development of safety expertise and operational experience while spreading capital costs over time.

Economic Viability and Policy Support Mechanisms

The economic viability of ammonia as a fuel for decarbonizing heavy industries hinges on several interconnected factors. Currently, green ammonia production costs range between $600-1,200 per ton, significantly higher than conventional gray ammonia at $200-400 per ton. This price differential presents a substantial barrier to widespread adoption, particularly in cost-sensitive industrial sectors such as shipping, steel manufacturing, and cement production.

Production scale economies represent a critical pathway to cost reduction. Analysis indicates that increasing production facilities from pilot scale to industrial scale could potentially reduce green ammonia costs by 40-60% by 2030. This projection assumes technological improvements in electrolysis efficiency and renewable energy cost reductions, which are trending favorably but require sustained investment.

Infrastructure development constitutes another significant economic consideration. The transition to ammonia fuel necessitates substantial investments in storage facilities, specialized handling equipment, and transportation networks. These infrastructure costs are estimated at $80-120 billion globally over the next decade, representing a significant but manageable investment when distributed across major industrial economies.

Policy support mechanisms play a decisive role in bridging the economic gap between conventional and low-carbon ammonia. Carbon pricing mechanisms, implemented in various forms across 45 jurisdictions worldwide, provide economic signals that improve ammonia's competitiveness. At carbon prices exceeding $100 per ton CO2-equivalent, green ammonia approaches cost parity with conventional alternatives in many applications.

Direct subsidies and production incentives have demonstrated effectiveness in similar technology transitions. The Renewable Fuel Standard in transportation and various renewable energy production tax credits have successfully accelerated adoption of alternative technologies. Similar mechanisms tailored to ammonia production could accelerate market development, particularly during the critical scaling phase.

Regulatory frameworks that mandate emissions reductions in hard-to-abate sectors create market certainty for ammonia fuel investments. The International Maritime Organization's emissions reduction targets, for instance, have already stimulated significant research and investment in ammonia as a marine fuel. Similar regulatory approaches in steel and cement manufacturing could drive comparable investment patterns.

Public-private partnerships represent another promising support mechanism, distributing risk and accelerating technology deployment. The EU's Innovation Fund and similar initiatives in Japan and Australia have already allocated over $3 billion to ammonia fuel projects, demonstrating the potential of coordinated public-private investment approaches to overcome initial economic barriers.

Production scale economies represent a critical pathway to cost reduction. Analysis indicates that increasing production facilities from pilot scale to industrial scale could potentially reduce green ammonia costs by 40-60% by 2030. This projection assumes technological improvements in electrolysis efficiency and renewable energy cost reductions, which are trending favorably but require sustained investment.

Infrastructure development constitutes another significant economic consideration. The transition to ammonia fuel necessitates substantial investments in storage facilities, specialized handling equipment, and transportation networks. These infrastructure costs are estimated at $80-120 billion globally over the next decade, representing a significant but manageable investment when distributed across major industrial economies.

Policy support mechanisms play a decisive role in bridging the economic gap between conventional and low-carbon ammonia. Carbon pricing mechanisms, implemented in various forms across 45 jurisdictions worldwide, provide economic signals that improve ammonia's competitiveness. At carbon prices exceeding $100 per ton CO2-equivalent, green ammonia approaches cost parity with conventional alternatives in many applications.

Direct subsidies and production incentives have demonstrated effectiveness in similar technology transitions. The Renewable Fuel Standard in transportation and various renewable energy production tax credits have successfully accelerated adoption of alternative technologies. Similar mechanisms tailored to ammonia production could accelerate market development, particularly during the critical scaling phase.

Regulatory frameworks that mandate emissions reductions in hard-to-abate sectors create market certainty for ammonia fuel investments. The International Maritime Organization's emissions reduction targets, for instance, have already stimulated significant research and investment in ammonia as a marine fuel. Similar regulatory approaches in steel and cement manufacturing could drive comparable investment patterns.

Public-private partnerships represent another promising support mechanism, distributing risk and accelerating technology deployment. The EU's Innovation Fund and similar initiatives in Japan and Australia have already allocated over $3 billion to ammonia fuel projects, demonstrating the potential of coordinated public-private investment approaches to overcome initial economic barriers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!