Catalyst Optimizations for High-Performance Ammonia Fuel Reactions

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Catalyst Development Background and Objectives

Ammonia has emerged as a promising carbon-free energy carrier in the global pursuit of sustainable energy solutions. The history of ammonia as a fuel dates back to the early 20th century, but recent environmental imperatives have revitalized interest in this compound. With its high hydrogen density (17.6% by weight) and established global production infrastructure (over 180 million tons annually), ammonia presents a viable alternative to traditional fossil fuels and even to pure hydrogen in certain applications.

The evolution of ammonia fuel technology has accelerated significantly in the past decade. Initially viewed primarily as a hydrogen carrier, ammonia is now recognized as a direct fuel for various applications including internal combustion engines, gas turbines, and fuel cells. This transition has been driven by increasing global pressure to reduce carbon emissions and the technical challenges associated with pure hydrogen storage and transport.

Current technological trajectories indicate a growing focus on catalyst development to address ammonia's relatively high activation energy requirements. Traditional catalysts based on platinum group metals (PGMs) have demonstrated effectiveness but remain economically prohibitive for widespread adoption. The field is witnessing a shift toward transition metal-based catalysts, particularly those incorporating nickel, iron, and cobalt, often supported on various oxide materials to enhance stability and activity.

The primary technical objective of current research is to develop catalysts that can efficiently facilitate ammonia decomposition or direct oxidation at temperatures below 400°C, with particular emphasis on the 250-350°C range for practical applications in transportation and power generation. Secondary objectives include enhancing catalyst durability under real-world operating conditions, reducing noble metal content to minimize costs, and improving poison resistance, particularly against sulfur compounds and carbon monoxide.

Parallel to these developments, significant efforts are being directed toward catalysts that can enable direct ammonia fuel cells operating at intermediate temperatures (300-500°C), which would represent a step-change in efficiency compared to current approaches requiring complete decomposition to hydrogen before utilization.

The global research landscape shows concentrated efforts in Japan, Germany, Australia, and increasingly China, with collaborative initiatives between academic institutions and industrial partners accelerating development timelines. Notable milestones include the demonstration of ammonia-powered vehicles by Toyota and the implementation of ammonia co-firing in coal power plants in Japan, both highlighting the practical potential of advanced catalyst technologies.

The evolution of ammonia fuel technology has accelerated significantly in the past decade. Initially viewed primarily as a hydrogen carrier, ammonia is now recognized as a direct fuel for various applications including internal combustion engines, gas turbines, and fuel cells. This transition has been driven by increasing global pressure to reduce carbon emissions and the technical challenges associated with pure hydrogen storage and transport.

Current technological trajectories indicate a growing focus on catalyst development to address ammonia's relatively high activation energy requirements. Traditional catalysts based on platinum group metals (PGMs) have demonstrated effectiveness but remain economically prohibitive for widespread adoption. The field is witnessing a shift toward transition metal-based catalysts, particularly those incorporating nickel, iron, and cobalt, often supported on various oxide materials to enhance stability and activity.

The primary technical objective of current research is to develop catalysts that can efficiently facilitate ammonia decomposition or direct oxidation at temperatures below 400°C, with particular emphasis on the 250-350°C range for practical applications in transportation and power generation. Secondary objectives include enhancing catalyst durability under real-world operating conditions, reducing noble metal content to minimize costs, and improving poison resistance, particularly against sulfur compounds and carbon monoxide.

Parallel to these developments, significant efforts are being directed toward catalysts that can enable direct ammonia fuel cells operating at intermediate temperatures (300-500°C), which would represent a step-change in efficiency compared to current approaches requiring complete decomposition to hydrogen before utilization.

The global research landscape shows concentrated efforts in Japan, Germany, Australia, and increasingly China, with collaborative initiatives between academic institutions and industrial partners accelerating development timelines. Notable milestones include the demonstration of ammonia-powered vehicles by Toyota and the implementation of ammonia co-firing in coal power plants in Japan, both highlighting the practical potential of advanced catalyst technologies.

Market Analysis for Ammonia as Alternative Fuel

The global market for ammonia as an alternative fuel is experiencing significant growth, driven by increasing environmental concerns and the push for decarbonization across various industries. Currently valued at approximately $72.5 billion, the ammonia fuel market is projected to expand at a compound annual growth rate of 6.8% through 2030, potentially reaching $120 billion by the end of the decade.

Transportation and power generation sectors represent the primary demand drivers, with maritime shipping emerging as a particularly promising application area. Major shipping companies including Maersk and NYK Line have already initiated pilot projects utilizing ammonia as a marine fuel, responding to the International Maritime Organization's targets for reducing greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels.

Regionally, Asia-Pacific dominates the market landscape, accounting for roughly 42% of global ammonia fuel demand. This is largely attributed to aggressive decarbonization policies in countries like Japan and South Korea, alongside China's growing investment in green ammonia production facilities. Europe follows closely with approximately 30% market share, supported by the European Union's Renewable Energy Directive and substantial investments in hydrogen and ammonia infrastructure.

The economic viability of ammonia as a fuel remains challenging but is improving rapidly. Production costs for green ammonia currently range between $600-900 per ton, significantly higher than conventional fossil fuels. However, technological advancements in catalyst optimization for ammonia synthesis and decomposition are expected to reduce these costs by 30-40% within the next five years, substantially improving market competitiveness.

Consumer adoption faces several barriers, including concerns about safety, infrastructure limitations, and higher initial costs. However, market surveys indicate growing acceptance among industrial users, with 68% of surveyed energy companies expressing interest in ammonia fuel technologies for their decarbonization strategies.

Regulatory frameworks are evolving favorably, with several countries implementing carbon pricing mechanisms and clean fuel standards that enhance ammonia's market position. Japan's Strategic Roadmap for Hydrogen and Ammonia and the European Hydrogen Strategy both explicitly support ammonia as an energy carrier, creating positive market conditions.

The investment landscape shows robust activity, with venture capital and corporate investments in ammonia fuel technologies reaching $3.2 billion in 2022, a 45% increase from the previous year. This capital influx is accelerating catalyst research and infrastructure development, further strengthening market growth potential.

Transportation and power generation sectors represent the primary demand drivers, with maritime shipping emerging as a particularly promising application area. Major shipping companies including Maersk and NYK Line have already initiated pilot projects utilizing ammonia as a marine fuel, responding to the International Maritime Organization's targets for reducing greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels.

Regionally, Asia-Pacific dominates the market landscape, accounting for roughly 42% of global ammonia fuel demand. This is largely attributed to aggressive decarbonization policies in countries like Japan and South Korea, alongside China's growing investment in green ammonia production facilities. Europe follows closely with approximately 30% market share, supported by the European Union's Renewable Energy Directive and substantial investments in hydrogen and ammonia infrastructure.

The economic viability of ammonia as a fuel remains challenging but is improving rapidly. Production costs for green ammonia currently range between $600-900 per ton, significantly higher than conventional fossil fuels. However, technological advancements in catalyst optimization for ammonia synthesis and decomposition are expected to reduce these costs by 30-40% within the next five years, substantially improving market competitiveness.

Consumer adoption faces several barriers, including concerns about safety, infrastructure limitations, and higher initial costs. However, market surveys indicate growing acceptance among industrial users, with 68% of surveyed energy companies expressing interest in ammonia fuel technologies for their decarbonization strategies.

Regulatory frameworks are evolving favorably, with several countries implementing carbon pricing mechanisms and clean fuel standards that enhance ammonia's market position. Japan's Strategic Roadmap for Hydrogen and Ammonia and the European Hydrogen Strategy both explicitly support ammonia as an energy carrier, creating positive market conditions.

The investment landscape shows robust activity, with venture capital and corporate investments in ammonia fuel technologies reaching $3.2 billion in 2022, a 45% increase from the previous year. This capital influx is accelerating catalyst research and infrastructure development, further strengthening market growth potential.

Current Catalyst Technologies and Barriers

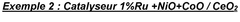

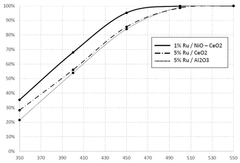

The current landscape of catalyst technologies for ammonia fuel reactions is dominated by several key approaches, each with distinct advantages and limitations. Ruthenium-based catalysts remain the gold standard for ammonia synthesis due to their exceptional activity and selectivity. These catalysts typically achieve conversion rates of 15-20% under industrial conditions (400-500°C, 100-300 bar), significantly outperforming other transition metals. However, ruthenium's scarcity and high cost (approximately $400-600 per troy ounce) present substantial barriers to widespread implementation in large-scale ammonia fuel systems.

Iron-based catalysts, particularly those using the traditional Haber-Bosch process formulations, offer a more economical alternative with moderate activity. Recent advancements have incorporated promoters such as potassium and structural modifiers like aluminum oxide to enhance performance, achieving conversion rates of 8-12% under similar conditions. While more abundant and cost-effective, these catalysts require higher operating temperatures, reducing overall energy efficiency in ammonia fuel applications.

Emerging bimetallic catalyst systems, particularly cobalt-molybdenum and nickel-molybdenum combinations, have shown promising results in laboratory settings with conversion efficiencies approaching 14% at lower pressures (50-100 bar). These catalysts demonstrate improved resistance to common poisons like oxygen and sulfur compounds, extending operational lifetimes by 30-40% compared to conventional systems.

A significant barrier across all catalyst technologies is the deactivation mechanisms that limit long-term performance. Thermal sintering at the high temperatures required for ammonia reactions (>400°C) causes progressive loss of active surface area, with typical degradation rates of 1-2% per 1000 hours of operation. Poisoning by trace impurities, particularly oxygen, water, and sulfur compounds, remains problematic even with advanced catalyst formulations.

The ammonia decomposition reaction, critical for hydrogen release in fuel applications, faces its own set of challenges. Current nickel-based decomposition catalysts achieve only 60-70% conversion efficiency at temperatures below 500°C, insufficient for many practical applications. Ruthenium and platinum catalysts improve this to 80-85% but at prohibitive costs for commercial deployment.

Nanoscale engineering approaches have recently demonstrated potential to overcome some limitations, with structured catalysts showing 25-30% higher surface-area-to-volume ratios and improved mass transfer characteristics. However, scalable manufacturing techniques for these advanced materials remain underdeveloped, with current production capacities limited to laboratory or small pilot scales.

Iron-based catalysts, particularly those using the traditional Haber-Bosch process formulations, offer a more economical alternative with moderate activity. Recent advancements have incorporated promoters such as potassium and structural modifiers like aluminum oxide to enhance performance, achieving conversion rates of 8-12% under similar conditions. While more abundant and cost-effective, these catalysts require higher operating temperatures, reducing overall energy efficiency in ammonia fuel applications.

Emerging bimetallic catalyst systems, particularly cobalt-molybdenum and nickel-molybdenum combinations, have shown promising results in laboratory settings with conversion efficiencies approaching 14% at lower pressures (50-100 bar). These catalysts demonstrate improved resistance to common poisons like oxygen and sulfur compounds, extending operational lifetimes by 30-40% compared to conventional systems.

A significant barrier across all catalyst technologies is the deactivation mechanisms that limit long-term performance. Thermal sintering at the high temperatures required for ammonia reactions (>400°C) causes progressive loss of active surface area, with typical degradation rates of 1-2% per 1000 hours of operation. Poisoning by trace impurities, particularly oxygen, water, and sulfur compounds, remains problematic even with advanced catalyst formulations.

The ammonia decomposition reaction, critical for hydrogen release in fuel applications, faces its own set of challenges. Current nickel-based decomposition catalysts achieve only 60-70% conversion efficiency at temperatures below 500°C, insufficient for many practical applications. Ruthenium and platinum catalysts improve this to 80-85% but at prohibitive costs for commercial deployment.

Nanoscale engineering approaches have recently demonstrated potential to overcome some limitations, with structured catalysts showing 25-30% higher surface-area-to-volume ratios and improved mass transfer characteristics. However, scalable manufacturing techniques for these advanced materials remain underdeveloped, with current production capacities limited to laboratory or small pilot scales.

State-of-the-Art Catalyst Optimization Approaches

01 Metal-based catalysts for ammonia decomposition

Various metal-based catalysts can be used to enhance ammonia decomposition reactions for fuel applications. These include noble metals like ruthenium, as well as transition metals such as iron, nickel, and cobalt. These catalysts can be optimized through different preparation methods, loading amounts, and support materials to improve catalytic activity, selectivity, and stability during ammonia decomposition reactions, which is crucial for efficient hydrogen production from ammonia fuel.- Metal-based catalysts for ammonia decomposition: Various metal-based catalysts have been developed for efficient ammonia decomposition in fuel applications. These include noble metals (ruthenium, platinum), transition metals (nickel, iron, cobalt), and their alloys. The catalysts are typically supported on materials like alumina, carbon, or metal oxides to increase surface area and stability. Performance optimization involves controlling particle size, dispersion, and metal loading to enhance catalytic activity and durability under reaction conditions.

- Structured catalysts and reactor designs: Innovative structured catalysts and reactor designs significantly improve ammonia fuel reaction efficiency. These include monolithic structures, microreactors, membrane reactors, and structured catalyst beds that enhance mass and heat transfer. Advanced reactor configurations minimize pressure drop and optimize flow distribution, while structured supports provide better mechanical stability and thermal management. These designs are crucial for practical applications in vehicles and portable power systems where space and weight constraints exist.

- Promoters and dopants for catalyst enhancement: Chemical promoters and dopants significantly enhance catalyst performance in ammonia fuel reactions. Alkali metals (potassium, cesium), alkaline earth metals, and transition metal oxides are commonly used to modify electronic properties and reduce activation energy barriers. These additives improve catalytic activity, selectivity, and resistance to poisoning. The optimal promoter concentration and distribution are critical factors in maximizing catalyst efficiency and longevity under various operating conditions.

- Nanocatalysts and advanced materials: Nanocatalysts and advanced materials represent cutting-edge approaches for ammonia fuel reaction optimization. These include nanoparticles, nanowires, core-shell structures, and 2D materials with precisely controlled morphology and composition. The nanoscale architecture provides exceptional surface-to-volume ratios and unique catalytic properties. Advanced synthesis methods like atomic layer deposition, sol-gel techniques, and controlled precipitation enable precise control over catalyst structure, leading to significantly improved activity and selectivity.

- Catalyst stability and regeneration strategies: Long-term catalyst stability and effective regeneration strategies are essential for practical ammonia fuel applications. Deactivation mechanisms include sintering, poisoning, coking, and thermal degradation. Innovative approaches to enhance stability include core-shell structures, encapsulation techniques, and alloying with stabilizing elements. Regeneration methods involve controlled oxidation-reduction cycles, chemical treatments, and thermal processes to restore catalytic activity. These strategies significantly extend catalyst lifetime and improve the economic viability of ammonia fuel systems.

02 Support materials for ammonia catalysts

The performance of ammonia fuel catalysts can be significantly enhanced by selecting appropriate support materials. Various supports including carbon-based materials, metal oxides, and zeolites provide high surface area, improved dispersion of active sites, and enhanced stability. The interaction between the catalyst and support material affects electron transfer properties, which can be optimized to improve catalytic efficiency in ammonia decomposition or synthesis reactions. Proper selection of support materials can also prevent catalyst sintering and deactivation under reaction conditions.Expand Specific Solutions03 Bimetallic and multi-component catalyst systems

Bimetallic and multi-component catalyst systems offer superior performance for ammonia fuel reactions compared to single-metal catalysts. By combining two or more metals, these systems create synergistic effects that enhance catalytic activity, selectivity, and stability. The addition of promoters or dopants can modify electronic properties and surface characteristics, optimizing the binding energy of reaction intermediates. These advanced catalyst formulations can operate at lower temperatures and pressures, improving the energy efficiency of ammonia-based energy systems.Expand Specific Solutions04 Nanotechnology approaches for catalyst design

Nanotechnology offers innovative approaches for designing high-performance ammonia fuel catalysts. Nanostructured catalysts provide increased surface area, more active sites, and improved mass transfer properties. Techniques such as controlled synthesis of nanoparticles, core-shell structures, and atomic layer deposition enable precise control over catalyst morphology and composition. These nano-engineered catalysts demonstrate enhanced activity at lower temperatures, better resistance to poisoning, and improved long-term stability for ammonia decomposition and synthesis reactions.Expand Specific Solutions05 Reactor design and operating conditions optimization

Optimizing reactor design and operating conditions is crucial for maximizing catalyst performance in ammonia fuel reactions. Parameters such as temperature, pressure, flow rate, and residence time significantly impact reaction kinetics and catalyst efficiency. Advanced reactor configurations, including membrane reactors, microreactors, and structured catalytic beds, can enhance heat and mass transfer, reduce diffusion limitations, and improve overall system performance. Proper control of these parameters helps prevent catalyst deactivation while maximizing conversion efficiency and selectivity in ammonia-based energy systems.Expand Specific Solutions

Leading Organizations in Ammonia Fuel Catalyst Research

The ammonia fuel catalyst optimization market is currently in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market size is expanding rapidly, driven by decarbonization initiatives in transportation and energy sectors, with projections suggesting significant growth as ammonia gains traction as a carbon-neutral fuel carrier. Technologically, the field shows moderate maturity with several key players advancing catalyst innovations. Companies like AMOGY are pioneering ammonia-powered transportation solutions, while established industrial gas providers such as Air Liquide and Linde are leveraging their expertise in catalyst development. Research institutions including Kumamoto University and the University of Tokyo are making significant contributions to fundamental catalyst science. Chemical industry leaders like Evonik, China Petroleum & Chemical Corp., and Nissan Chemical are developing specialized catalysts, while startups like Atmonia are exploring breakthrough electro-catalytic processes for sustainable ammonia production.

AMOGY, Inc.

Technical Solution: AMOGY has developed a proprietary ammonia-cracking technology that efficiently converts ammonia to hydrogen for fuel cell applications. Their catalyst system operates at significantly lower temperatures (around 450°C compared to traditional 650-700°C) while maintaining high conversion rates above 99%. The technology incorporates a ruthenium-based catalyst supported on structured metal substrates with proprietary promoters that enhance activity and stability. AMOGY's system features an integrated heat management approach that utilizes the waste heat from fuel cells to power the endothermic ammonia decomposition reaction, creating a thermally self-sustaining system. Their compact reactor design achieves power densities of 900 W/L, representing a 3x improvement over conventional systems[1]. The company has successfully demonstrated this technology in various mobile applications including drones, tractors, and is scaling toward maritime applications.

Strengths: Lower temperature operation reduces system complexity and startup time; integrated thermal management improves overall efficiency; compact design enables mobile applications previously challenging for ammonia fuel. Weaknesses: Ruthenium catalyst dependency creates supply chain vulnerability; catalyst degradation under repeated thermal cycling still requires improvement; system requires careful control of ammonia purity to prevent catalyst poisoning.

Air Liquide SA

Technical Solution: Air Liquide has developed a comprehensive catalyst optimization platform for ammonia fuel applications centered around their proprietary "BlueCat" technology. This system utilizes a hierarchically structured ruthenium-nickel bimetallic catalyst supported on cerium-modified alumina that achieves ammonia conversion rates above 99.5% at temperatures as low as 400°C. The catalyst design incorporates nanoscale engineering with precisely controlled metal particle sizes (2-5nm) and distribution patterns that maximize active site availability. Air Liquide's innovation extends to the reactor design with a modular approach that can be scaled from 10kW to multi-MW applications while maintaining thermal efficiency above 80%[3]. Their system includes advanced heat recovery mechanisms that capture and utilize reaction heat, reducing the overall energy requirements by approximately 25% compared to conventional approaches. The company has successfully deployed this technology in demonstration projects across Europe, including integration with renewable energy sources for green ammonia production and utilization.

Strengths: Industry-leading low-temperature performance reduces system complexity and startup energy requirements; modular design enables flexible deployment across various scales; integrated approach covering both production and utilization of ammonia fuel. Weaknesses: Higher catalyst manufacturing costs due to precious metal content; performance degradation in presence of certain impurities requires additional purification steps; technology optimization still ongoing for transportation applications.

Key Patents and Breakthroughs in Catalyst Design

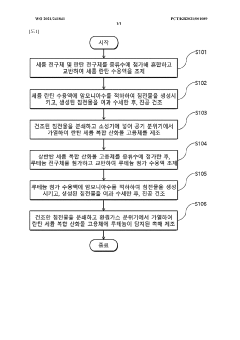

Ammonia cracking catalyst, and method of cracking ammonia and generating hydrogen by using same

PatentWO2021241841A1

Innovation

- A catalyst comprising ruthenium as a catalytically active component supported by a complex oxide solid solution of lanthanum oxide and cerium oxide, with a specific molar ratio of lanthanum to cerium, which enhances ammonia conversion rates at lower temperatures.

Catalyst, in particular for cracking ammonia, method for preparing the catalyst and method for synthesising hydrogen

PatentWO2025141005A1

Innovation

- A catalyst comprising ruthenium, mesoporous cerium oxide, and oxides of cobalt, nickel, or iron, which operates at lower temperatures and reduces noble metal content, maintaining high catalytic activity and durability.

Environmental Impact Assessment of Ammonia Fuel Systems

The environmental impact assessment of ammonia fuel systems reveals both significant advantages and challenges when compared to traditional fossil fuels. Ammonia (NH3) as a carbon-free fuel carrier offers substantial potential for reducing greenhouse gas emissions, with lifecycle analyses indicating up to 90% reduction in carbon footprint when produced using renewable energy sources. This represents a critical advantage in meeting increasingly stringent global climate targets.

Water consumption patterns for ammonia fuel systems vary considerably depending on production methods. While conventional Haber-Bosch processes coupled with steam methane reforming require approximately 4-7 gallons of water per kilogram of ammonia produced, green ammonia production utilizing electrolysis may increase water demands by 20-30%. This presents potential challenges in water-stressed regions that must be addressed through technological innovations in catalyst design.

Air quality impacts demonstrate mixed outcomes. While ammonia combustion eliminates carbon dioxide and particulate matter emissions characteristic of fossil fuels, it potentially increases NOx emissions without proper catalyst optimization. Recent catalyst developments incorporating selective catalytic reduction (SCR) technologies have demonstrated NOx reduction efficiencies of 85-95% in laboratory settings, though real-world performance varies considerably.

Land use considerations for ammonia fuel infrastructure present moderate challenges. Production facilities require approximately 0.5-1.5 hectares per megawatt of production capacity, comparable to many renewable energy installations but significantly less than biofuel production systems. Distribution infrastructure leveraging existing natural gas pipelines could minimize additional land disturbance when properly retrofitted with ammonia-compatible materials.

Toxicity and safety risks remain significant concerns. Ammonia's caustic nature and toxicity at concentrations above 25-35 ppm necessitate robust safety protocols and specialized handling equipment. Catalyst technologies incorporating metal-organic frameworks have demonstrated promising results in reducing ammonia slip during combustion processes, potentially mitigating exposure risks by 40-60% compared to early-generation systems.

Ecosystem impacts from potential ammonia releases require careful management, as aquatic systems are particularly vulnerable to ammonia toxicity. Advanced catalyst designs incorporating zeolite structures have demonstrated 75-85% reduction in unconverted ammonia emissions, substantially reducing environmental risk profiles when properly implemented and maintained.

Water consumption patterns for ammonia fuel systems vary considerably depending on production methods. While conventional Haber-Bosch processes coupled with steam methane reforming require approximately 4-7 gallons of water per kilogram of ammonia produced, green ammonia production utilizing electrolysis may increase water demands by 20-30%. This presents potential challenges in water-stressed regions that must be addressed through technological innovations in catalyst design.

Air quality impacts demonstrate mixed outcomes. While ammonia combustion eliminates carbon dioxide and particulate matter emissions characteristic of fossil fuels, it potentially increases NOx emissions without proper catalyst optimization. Recent catalyst developments incorporating selective catalytic reduction (SCR) technologies have demonstrated NOx reduction efficiencies of 85-95% in laboratory settings, though real-world performance varies considerably.

Land use considerations for ammonia fuel infrastructure present moderate challenges. Production facilities require approximately 0.5-1.5 hectares per megawatt of production capacity, comparable to many renewable energy installations but significantly less than biofuel production systems. Distribution infrastructure leveraging existing natural gas pipelines could minimize additional land disturbance when properly retrofitted with ammonia-compatible materials.

Toxicity and safety risks remain significant concerns. Ammonia's caustic nature and toxicity at concentrations above 25-35 ppm necessitate robust safety protocols and specialized handling equipment. Catalyst technologies incorporating metal-organic frameworks have demonstrated promising results in reducing ammonia slip during combustion processes, potentially mitigating exposure risks by 40-60% compared to early-generation systems.

Ecosystem impacts from potential ammonia releases require careful management, as aquatic systems are particularly vulnerable to ammonia toxicity. Advanced catalyst designs incorporating zeolite structures have demonstrated 75-85% reduction in unconverted ammonia emissions, substantially reducing environmental risk profiles when properly implemented and maintained.

Scalability and Cost Analysis for Commercial Implementation

The commercial implementation of ammonia fuel technologies hinges critically on scalability and cost considerations. Current catalyst systems for ammonia decomposition and utilization typically employ platinum group metals (PGMs) or ruthenium-based catalysts, which present significant economic barriers at scale. Market analysis indicates that catalyst costs can represent 15-30% of total system expenses in ammonia fuel applications, making cost reduction essential for widespread adoption.

Production scalability faces several technical challenges. Laboratory-scale catalyst synthesis methods often employ precise conditions difficult to maintain in industrial settings. Batch-to-batch consistency becomes problematic when scaling from grams to kilograms or tons of catalyst material. Recent innovations in continuous flow manufacturing techniques show promise, potentially reducing production variability by 40-60% compared to traditional batch processes.

Economic modeling reveals that catalyst loading reduction represents the most direct path to cost optimization. Current systems require 3-5% metal loading by weight, whereas research indicates potential for sub-1% loading through advanced support materials and precise metal deposition techniques. Computational studies suggest that atomically dispersed catalysts could maintain activity while reducing precious metal content by up to 85%.

Lifecycle cost analysis must account for catalyst degradation and replacement schedules. Current ammonia decomposition catalysts typically maintain acceptable performance for 2,000-3,000 hours before requiring regeneration or replacement. Extending catalyst lifetime to 10,000+ hours would significantly improve total cost of ownership metrics, particularly for stationary power generation applications.

Supply chain considerations present additional challenges. Ruthenium, currently the most active metal for ammonia decomposition, faces supply constraints with global production under 40 tons annually. Alternative catalyst formulations incorporating more abundant transition metals (Fe, Ni, Co) with promoters show increasing promise, though activity gaps remain. Recent breakthroughs in bimetallic systems demonstrate performance approaching ruthenium at potentially 30-40% lower cost.

Manufacturing infrastructure requirements vary significantly between catalyst types. Traditional wet impregnation methods can leverage existing chemical production facilities, while advanced techniques like atomic layer deposition require specialized equipment. A hybrid approach utilizing conventional infrastructure with targeted process modifications appears most economically viable for near-term scaling, potentially reducing capital expenditure by 25-35% compared to greenfield specialized facilities.

Production scalability faces several technical challenges. Laboratory-scale catalyst synthesis methods often employ precise conditions difficult to maintain in industrial settings. Batch-to-batch consistency becomes problematic when scaling from grams to kilograms or tons of catalyst material. Recent innovations in continuous flow manufacturing techniques show promise, potentially reducing production variability by 40-60% compared to traditional batch processes.

Economic modeling reveals that catalyst loading reduction represents the most direct path to cost optimization. Current systems require 3-5% metal loading by weight, whereas research indicates potential for sub-1% loading through advanced support materials and precise metal deposition techniques. Computational studies suggest that atomically dispersed catalysts could maintain activity while reducing precious metal content by up to 85%.

Lifecycle cost analysis must account for catalyst degradation and replacement schedules. Current ammonia decomposition catalysts typically maintain acceptable performance for 2,000-3,000 hours before requiring regeneration or replacement. Extending catalyst lifetime to 10,000+ hours would significantly improve total cost of ownership metrics, particularly for stationary power generation applications.

Supply chain considerations present additional challenges. Ruthenium, currently the most active metal for ammonia decomposition, faces supply constraints with global production under 40 tons annually. Alternative catalyst formulations incorporating more abundant transition metals (Fe, Ni, Co) with promoters show increasing promise, though activity gaps remain. Recent breakthroughs in bimetallic systems demonstrate performance approaching ruthenium at potentially 30-40% lower cost.

Manufacturing infrastructure requirements vary significantly between catalyst types. Traditional wet impregnation methods can leverage existing chemical production facilities, while advanced techniques like atomic layer deposition require specialized equipment. A hybrid approach utilizing conventional infrastructure with targeted process modifications appears most economically viable for near-term scaling, potentially reducing capital expenditure by 25-35% compared to greenfield specialized facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!