Innovations in Thermal Conductivity Materials for Ammonia Fuel Use

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Thermal Materials Background and Objectives

Ammonia has emerged as a promising carbon-neutral fuel candidate in the global transition toward sustainable energy systems. The historical development of ammonia as an energy carrier dates back to the early 20th century, but recent climate change imperatives have accelerated research into its potential as a hydrogen carrier and direct fuel. The evolution of ammonia fuel technology has progressed from theoretical concepts to practical demonstrations in various applications including power generation, maritime propulsion, and industrial heating systems.

The thermal management challenges associated with ammonia fuel systems represent a critical technological barrier to widespread adoption. Ammonia's physical properties—including its lower energy density compared to conventional fuels, corrosive nature, and unique combustion characteristics—create specific thermal conductivity requirements that conventional materials struggle to address. The thermal conductivity materials used in ammonia fuel systems must simultaneously provide efficient heat transfer, corrosion resistance, and maintain structural integrity under varying temperature conditions.

Current research trajectories indicate growing interest in novel composite materials, ceramic-metal hybrids, and advanced polymer systems specifically engineered for ammonia fuel applications. The development of these materials follows a clear trend toward multi-functional properties that address the complex requirements of ammonia fuel systems. Industry projections suggest that breakthroughs in thermal conductivity materials could reduce system costs by 15-25% while improving overall efficiency by 8-12%.

The primary technical objectives for innovations in thermal conductivity materials for ammonia fuel use include developing materials with thermal conductivity values exceeding 50 W/m·K while maintaining ammonia compatibility, creating cost-effective manufacturing processes for these advanced materials, and ensuring long-term durability under cyclic thermal loading conditions. Secondary objectives focus on reducing material weight, minimizing environmental impact throughout the material lifecycle, and ensuring compatibility with existing manufacturing infrastructure.

Regulatory frameworks and international standards for ammonia fuel systems are still evolving, creating both challenges and opportunities for material innovation. The International Maritime Organization's emissions targets and various national hydrogen strategies have established timelines that directly influence research priorities in thermal materials development. These regulatory drivers, combined with increasing private sector investment in ammonia fuel technologies, have created a dynamic innovation ecosystem focused on overcoming the thermal management challenges that currently limit ammonia's potential as a mainstream fuel option.

The thermal management challenges associated with ammonia fuel systems represent a critical technological barrier to widespread adoption. Ammonia's physical properties—including its lower energy density compared to conventional fuels, corrosive nature, and unique combustion characteristics—create specific thermal conductivity requirements that conventional materials struggle to address. The thermal conductivity materials used in ammonia fuel systems must simultaneously provide efficient heat transfer, corrosion resistance, and maintain structural integrity under varying temperature conditions.

Current research trajectories indicate growing interest in novel composite materials, ceramic-metal hybrids, and advanced polymer systems specifically engineered for ammonia fuel applications. The development of these materials follows a clear trend toward multi-functional properties that address the complex requirements of ammonia fuel systems. Industry projections suggest that breakthroughs in thermal conductivity materials could reduce system costs by 15-25% while improving overall efficiency by 8-12%.

The primary technical objectives for innovations in thermal conductivity materials for ammonia fuel use include developing materials with thermal conductivity values exceeding 50 W/m·K while maintaining ammonia compatibility, creating cost-effective manufacturing processes for these advanced materials, and ensuring long-term durability under cyclic thermal loading conditions. Secondary objectives focus on reducing material weight, minimizing environmental impact throughout the material lifecycle, and ensuring compatibility with existing manufacturing infrastructure.

Regulatory frameworks and international standards for ammonia fuel systems are still evolving, creating both challenges and opportunities for material innovation. The International Maritime Organization's emissions targets and various national hydrogen strategies have established timelines that directly influence research priorities in thermal materials development. These regulatory drivers, combined with increasing private sector investment in ammonia fuel technologies, have created a dynamic innovation ecosystem focused on overcoming the thermal management challenges that currently limit ammonia's potential as a mainstream fuel option.

Market Analysis for Ammonia Fuel Applications

The global ammonia fuel market is experiencing significant growth, driven by the increasing demand for clean energy alternatives and the push towards decarbonization. Current market valuations indicate that the ammonia fuel sector is projected to reach $5.5 billion by 2030, with a compound annual growth rate of approximately 7.8% from 2023 to 2030. This growth trajectory is primarily fueled by ammonia's potential as a carbon-free hydrogen carrier and its compatibility with existing infrastructure.

The maritime industry represents the largest current market segment for ammonia fuel applications, accounting for nearly 40% of potential demand. Major shipping companies are actively investing in ammonia-powered vessels as part of their decarbonization strategies. The International Maritime Organization's stringent emissions regulations have accelerated this transition, creating a substantial market opportunity for thermal conductivity materials specifically designed for marine ammonia fuel systems.

Power generation constitutes the second-largest market segment, with an estimated 30% share. Several pilot projects for ammonia co-firing in conventional power plants are underway globally, particularly in Japan, Australia, and parts of Europe. These initiatives demonstrate the growing commercial viability of ammonia as a fuel source and highlight the need for advanced thermal management solutions.

The transportation sector, particularly heavy-duty vehicles and long-haul transport, represents an emerging market with significant growth potential. While currently accounting for only about 15% of the ammonia fuel market, this segment is expected to expand rapidly as hydrogen fuel cell technology advances and ammonia cracking technologies become more efficient and compact.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 45% share, led by Japan, South Korea, and Australia. Europe follows with a 30% market share, driven by aggressive decarbonization policies and substantial investments in green ammonia production. North America accounts for about 20% of the market, with growth accelerating due to recent policy shifts favoring clean energy.

The market for specialized thermal conductivity materials in ammonia fuel applications is currently valued at approximately $320 million, with projections indicating growth to $1.2 billion by 2030. This sub-segment is characterized by high margins and significant barriers to entry, making it an attractive area for materials innovation and specialized product development.

Customer requirements in this market emphasize materials that can withstand the corrosive properties of ammonia while maintaining excellent thermal conductivity across a wide temperature range. Additionally, there is growing demand for lightweight solutions that can be integrated into existing fuel system designs without significant modifications.

The maritime industry represents the largest current market segment for ammonia fuel applications, accounting for nearly 40% of potential demand. Major shipping companies are actively investing in ammonia-powered vessels as part of their decarbonization strategies. The International Maritime Organization's stringent emissions regulations have accelerated this transition, creating a substantial market opportunity for thermal conductivity materials specifically designed for marine ammonia fuel systems.

Power generation constitutes the second-largest market segment, with an estimated 30% share. Several pilot projects for ammonia co-firing in conventional power plants are underway globally, particularly in Japan, Australia, and parts of Europe. These initiatives demonstrate the growing commercial viability of ammonia as a fuel source and highlight the need for advanced thermal management solutions.

The transportation sector, particularly heavy-duty vehicles and long-haul transport, represents an emerging market with significant growth potential. While currently accounting for only about 15% of the ammonia fuel market, this segment is expected to expand rapidly as hydrogen fuel cell technology advances and ammonia cracking technologies become more efficient and compact.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 45% share, led by Japan, South Korea, and Australia. Europe follows with a 30% market share, driven by aggressive decarbonization policies and substantial investments in green ammonia production. North America accounts for about 20% of the market, with growth accelerating due to recent policy shifts favoring clean energy.

The market for specialized thermal conductivity materials in ammonia fuel applications is currently valued at approximately $320 million, with projections indicating growth to $1.2 billion by 2030. This sub-segment is characterized by high margins and significant barriers to entry, making it an attractive area for materials innovation and specialized product development.

Customer requirements in this market emphasize materials that can withstand the corrosive properties of ammonia while maintaining excellent thermal conductivity across a wide temperature range. Additionally, there is growing demand for lightweight solutions that can be integrated into existing fuel system designs without significant modifications.

Thermal Conductivity Materials: Current State and Barriers

Thermal conductivity materials play a critical role in the development and implementation of ammonia fuel systems. Currently, the state of these materials presents both promising advancements and significant challenges. Traditional thermal conductivity materials used in fuel systems, such as copper, aluminum, and various alloys, demonstrate limitations when exposed to ammonia's corrosive properties. This corrosion resistance challenge represents one of the primary barriers in material selection for ammonia fuel applications.

The current landscape of thermal conductivity materials suitable for ammonia fuel systems is dominated by specialized stainless steels, particularly austenitic grades like 304L and 316L, which offer moderate thermal conductivity (14-16 W/m·K) while maintaining acceptable corrosion resistance. However, this performance falls significantly short compared to copper (approximately 400 W/m·K) or aluminum (approximately 237 W/m·K), creating an inherent efficiency trade-off in system design.

Composite materials represent an emerging solution, with carbon-based composites showing particular promise. Materials such as graphene-enhanced polymers and carbon fiber reinforced metals demonstrate improved thermal conductivity while maintaining chemical stability in ammonia environments. However, manufacturing scalability and cost-effectiveness remain significant barriers to widespread adoption, with production costs often 5-10 times higher than conventional materials.

Ceramic-based thermal interface materials, particularly aluminum nitride and boron nitride composites, have demonstrated excellent ammonia compatibility while providing thermal conductivity values of 30-200 W/m·K. Despite these promising properties, their brittleness and integration challenges with metal components create implementation barriers in practical fuel system designs.

Surface treatment technologies and coatings represent another approach to enhancing existing materials. Advanced coatings such as diamond-like carbon (DLC) films and specialized polymer barriers can protect higher-conductivity base materials from ammonia corrosion. However, coating uniformity, long-term adhesion, and performance degradation under thermal cycling conditions remain unresolved challenges.

From a regulatory perspective, material certification for ammonia fuel systems faces uncertainty due to evolving standards and safety requirements. This regulatory ambiguity creates additional barriers for material developers and system integrators, often extending development timelines and increasing compliance costs.

The economic barriers cannot be overlooked, as specialized thermal conductivity materials for ammonia applications typically command premium pricing, with cost increases of 30-300% compared to conventional alternatives. This cost differential significantly impacts the overall economic viability of ammonia fuel systems, particularly in price-sensitive markets and applications.

The current landscape of thermal conductivity materials suitable for ammonia fuel systems is dominated by specialized stainless steels, particularly austenitic grades like 304L and 316L, which offer moderate thermal conductivity (14-16 W/m·K) while maintaining acceptable corrosion resistance. However, this performance falls significantly short compared to copper (approximately 400 W/m·K) or aluminum (approximately 237 W/m·K), creating an inherent efficiency trade-off in system design.

Composite materials represent an emerging solution, with carbon-based composites showing particular promise. Materials such as graphene-enhanced polymers and carbon fiber reinforced metals demonstrate improved thermal conductivity while maintaining chemical stability in ammonia environments. However, manufacturing scalability and cost-effectiveness remain significant barriers to widespread adoption, with production costs often 5-10 times higher than conventional materials.

Ceramic-based thermal interface materials, particularly aluminum nitride and boron nitride composites, have demonstrated excellent ammonia compatibility while providing thermal conductivity values of 30-200 W/m·K. Despite these promising properties, their brittleness and integration challenges with metal components create implementation barriers in practical fuel system designs.

Surface treatment technologies and coatings represent another approach to enhancing existing materials. Advanced coatings such as diamond-like carbon (DLC) films and specialized polymer barriers can protect higher-conductivity base materials from ammonia corrosion. However, coating uniformity, long-term adhesion, and performance degradation under thermal cycling conditions remain unresolved challenges.

From a regulatory perspective, material certification for ammonia fuel systems faces uncertainty due to evolving standards and safety requirements. This regulatory ambiguity creates additional barriers for material developers and system integrators, often extending development timelines and increasing compliance costs.

The economic barriers cannot be overlooked, as specialized thermal conductivity materials for ammonia applications typically command premium pricing, with cost increases of 30-300% compared to conventional alternatives. This cost differential significantly impacts the overall economic viability of ammonia fuel systems, particularly in price-sensitive markets and applications.

Current Thermal Conductivity Solutions for Ammonia Systems

01 Carbon-based thermal conductivity materials

Carbon-based materials such as graphene, carbon nanotubes, and carbon composites offer excellent thermal conductivity properties. These materials can be engineered to create high-performance thermal interface materials that efficiently transfer heat in electronic devices. The unique structure of carbon allotropes allows for superior heat dissipation compared to traditional materials, making them ideal for applications requiring efficient thermal management.- Carbon-based thermal conductivity materials: Carbon-based materials such as graphene, carbon nanotubes, and diamond-like carbon films exhibit exceptional thermal conductivity properties. These materials can be incorporated into composites or used as coatings to enhance heat dissipation in electronic devices, thermal management systems, and other applications requiring efficient heat transfer. The unique atomic structure of carbon-based materials allows for rapid phonon transport, contributing to their superior thermal conductivity performance.

- Polymer-based thermal conductivity composites: Polymer matrices filled with thermally conductive particles create composites with enhanced thermal conductivity while maintaining desirable mechanical properties. These composites typically incorporate fillers such as metal particles, ceramic powders, or carbon-based materials to improve heat transfer capabilities. The thermal conductivity of these materials can be tailored by adjusting filler concentration, particle size distribution, and processing methods. These composites find applications in electronic packaging, heat exchangers, and thermal interface materials.

- Ceramic and metal-based thermal conductivity materials: Ceramics like aluminum nitride, boron nitride, and silicon carbide, as well as metals such as copper, aluminum, and silver alloys, offer high thermal conductivity for specialized applications. These materials are often used in environments requiring both thermal conductivity and resistance to extreme conditions. The crystalline structure and purity of these materials significantly influence their thermal conductivity properties. Processing techniques such as sintering, hot pressing, and metal infiltration can be employed to optimize thermal performance while maintaining structural integrity.

- Thermal conductivity measurement methods: Various techniques for measuring thermal conductivity include laser flash analysis, hot wire method, transient plane source, and steady-state methods. These measurement approaches allow for accurate characterization of thermal properties across different material types and temperature ranges. The selection of an appropriate measurement technique depends on the sample geometry, expected thermal conductivity range, and required accuracy. Advanced computational models can complement experimental measurements to predict thermal behavior under various conditions.

- Phase change materials with enhanced thermal conductivity: Phase change materials (PCMs) with improved thermal conductivity offer efficient thermal energy storage capabilities. These materials can absorb, store, and release large amounts of heat during phase transitions while maintaining enhanced heat transfer properties. Thermal conductivity enhancement strategies include incorporating conductive fillers, creating composite structures, and engineering microstructural features. Applications include building materials for passive temperature regulation, electronic cooling systems, and renewable energy storage solutions.

02 Polymer-based thermal conductivity composites

Polymer matrices enhanced with thermally conductive fillers create versatile materials with tailored thermal conductivity. These composites combine the processability of polymers with the thermal properties of fillers like metal particles, ceramic powders, or carbon materials. By controlling the filler concentration, distribution, and interface characteristics, these materials can achieve significant improvements in thermal conductivity while maintaining other desirable properties such as flexibility, lightweight nature, and electrical insulation.Expand Specific Solutions03 Ceramic and metal-based thermal conductivity materials

Ceramics and metals offer high thermal conductivity solutions for applications requiring robust heat transfer. Materials such as aluminum nitride, boron nitride, aluminum oxide, copper, and aluminum alloys provide excellent thermal performance in harsh environments. These materials can be processed into various forms including powders, films, and bulk components to meet specific thermal management requirements in industries ranging from electronics to aerospace.Expand Specific Solutions04 Thermal conductivity measurement techniques

Various methods have been developed to accurately measure thermal conductivity of materials, including transient plane source, laser flash analysis, and steady-state techniques. These measurement approaches allow for precise characterization of thermal properties across different temperature ranges and material states. Advanced instrumentation enables researchers to evaluate thermal conductivity in bulk materials, thin films, and complex composite structures, providing essential data for material development and application design.Expand Specific Solutions05 Phase change materials with enhanced thermal conductivity

Phase change materials (PCMs) with improved thermal conductivity offer effective thermal energy storage and management solutions. These materials can absorb, store, and release large amounts of latent heat during phase transitions while efficiently transferring heat. By incorporating thermally conductive additives or creating novel microstructures, researchers have developed PCMs with enhanced thermal conductivity that maintain high energy storage capacity, making them suitable for applications in building materials, electronics cooling, and renewable energy systems.Expand Specific Solutions

Key Industry Players in Ammonia Fuel Technology

The thermal conductivity materials market for ammonia fuel use is in an early growth phase, characterized by increasing R&D investments as ammonia gains traction as a carbon-free energy carrier. The global market is projected to expand significantly with the rising focus on hydrogen economy and decarbonization initiatives. Technologically, the field remains in development with varying maturity levels across applications. Leading players include academic institutions like Xi'an Jiaotong University and University of Strathclyde conducting fundamental research, while industrial players demonstrate different specialization areas: AMOGY focusing on ammonia-powered transportation solutions, Linde and Sinopec developing industrial-scale applications, and thyssenkrupp advancing ammonia cracking technologies. Collaboration between research institutions and industrial partners is accelerating innovation in this emerging field.

Xi'an Jiaotong University

Technical Solution: Xi'an Jiaotong University has developed innovative graphene-based nanocomposite materials with exceptional thermal conductivity properties specifically tailored for ammonia fuel applications. Their research team has created a multi-layered graphene/metal matrix composite that achieves thermal conductivity exceeding 500 W/m·K while maintaining chemical stability in ammonia environments. The material incorporates precisely controlled interface engineering between graphene sheets and metal substrates to minimize thermal boundary resistance, resulting in superior heat dissipation capabilities. Their innovation includes a novel surface functionalization technique that prevents ammonia-induced degradation while preserving thermal transport pathways. The university has also pioneered a scalable manufacturing process for these high-performance materials, utilizing controlled pressure-assisted sintering to create bulk thermal management components with consistent properties. Testing has demonstrated that these materials maintain their thermal conductivity performance even after extended exposure to ammonia under various temperature and pressure conditions, making them particularly suitable for heat exchangers and thermal management systems in ammonia fuel cells and cracking reactors.

Strengths: Exceptional thermal conductivity values significantly exceeding conventional materials; demonstrated long-term stability in ammonia environments; potential for cost-effective scaled production. Weaknesses: Laboratory-scale development with limited full-system implementation data; may face challenges in manufacturing consistency at industrial scale; requires further optimization for specific application environments.

Linde GmbH

Technical Solution: Linde has developed advanced thermal conductivity materials specifically engineered for ammonia fuel infrastructure. Their technology centers on metal-organic framework (MOF) composites with tailored thermal properties that enable safe and efficient ammonia handling throughout the supply chain. These materials feature gradient thermal conductivity profiles that can adapt to varying temperature conditions during ammonia storage, transport, and utilization. Linde's innovation includes specialized cryogenic-grade materials with thermal conductivity values optimized for liquid ammonia storage (-33°C), incorporating nano-structured interfaces that minimize thermal resistance at material boundaries. Their thermal management systems employ proprietary metal alloys with ammonia-resistant coatings that maintain structural integrity while providing excellent heat transfer characteristics. Linde has also pioneered composite heat exchanger materials that combine high thermal conductivity with exceptional resistance to ammonia-induced stress corrosion cracking, a critical factor in long-term infrastructure reliability. These materials are integrated into Linde's comprehensive ammonia handling systems, from production facilities to fueling stations.

Strengths: Extensive experience in industrial gas handling and infrastructure; materials designed for full ammonia supply chain compatibility; proven scalability for commercial applications. Weaknesses: Higher initial implementation costs compared to conventional materials; requires specialized installation expertise; optimal performance dependent on system-wide integration.

Critical Patents in Ammonia-Compatible Thermal Materials

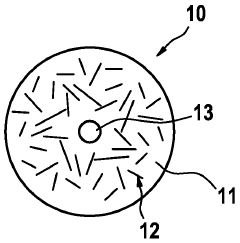

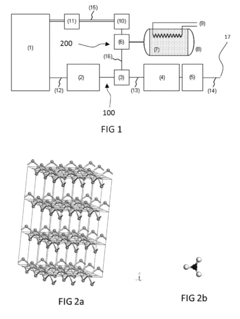

Device for releasing ammonia

PatentWO2009149982A2

Innovation

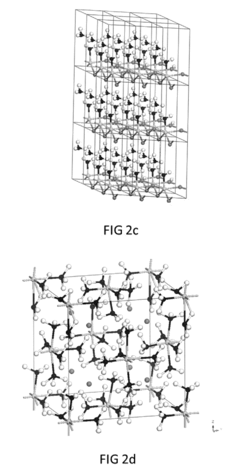

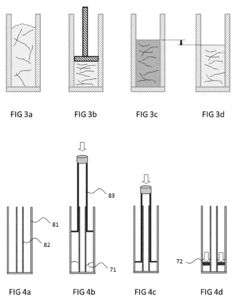

- Incorporating an additional substance with higher thermal conductivity, such as metal chips or graphite, into the ammonia-storing metal salts to enhance thermal conductivity and facilitate faster heating, allowing for quicker ammonia release and compliance with emissions regulations.

Ammonia storage structure and associated systems and method

PatentInactiveEP2695859A1

Innovation

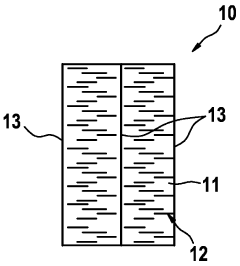

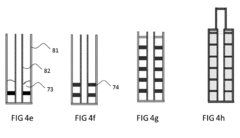

- A structure comprising alternating layers of powdered alkaline earth chlorides and thermally conductive materials, like expanded natural graphite, enhances heat transfer and reduces storage volume, improving efficiency and durability by facilitating ammonia absorption and desorption while minimizing electrical power usage.

Safety and Compatibility Considerations for Ammonia Fuel

Ammonia's potential as a carbon-free fuel carrier brings significant safety and compatibility challenges that must be addressed before widespread adoption. The toxicity of ammonia presents a primary concern, as exposure to concentrations as low as 50 ppm can cause respiratory irritation, while higher concentrations may lead to severe health effects including pulmonary edema and even death. This necessitates robust detection systems, proper ventilation, and comprehensive safety protocols in all ammonia fuel applications.

Material compatibility represents another critical consideration, as ammonia's corrosive nature can degrade many conventional materials used in fuel systems. Copper, brass, and zinc-containing alloys are particularly vulnerable to ammonia-induced stress corrosion cracking. Instead, specialized materials such as stainless steel (particularly grades 304 and 316), certain aluminum alloys, and specific polymers like PTFE and HDPE have demonstrated superior resistance to ammonia's corrosive effects.

The risk of ammonia leakage demands specialized containment strategies beyond those used for conventional fuels. Double-walled containment systems, advanced sealing technologies, and regular integrity testing protocols are essential components of safe ammonia fuel infrastructure. Additionally, the development of odorants and colorants for ammonia detection represents an active area of research to enhance early leak identification.

Thermal management during ammonia storage and transport presents unique challenges due to its high latent heat of vaporization. Innovative thermal conductivity materials are being developed to address the significant cooling effect that occurs during ammonia evaporation, which can lead to material embrittlement and system failures if not properly managed.

Regulatory frameworks for ammonia as a fuel remain under development globally, with organizations like the International Maritime Organization (IMO) and various national safety boards working to establish comprehensive guidelines. These emerging standards will significantly influence material selection and system design requirements for ammonia fuel applications.

The integration of ammonia with existing fuel infrastructure requires careful consideration of material transitions and interface points. Hybrid systems that gradually introduce ammonia into conventional fuel systems must address potential material incompatibilities at these transition zones, often requiring specialized interface materials with resistance to both conventional fuels and ammonia.

Emergency response protocols for ammonia fuel systems differ substantially from those for conventional fuels, necessitating specialized training, equipment, and materials for containment and neutralization in case of leaks or accidents. Water-based suppression systems must be designed with consideration for ammonia's high water solubility and the resulting alkaline solution.

Material compatibility represents another critical consideration, as ammonia's corrosive nature can degrade many conventional materials used in fuel systems. Copper, brass, and zinc-containing alloys are particularly vulnerable to ammonia-induced stress corrosion cracking. Instead, specialized materials such as stainless steel (particularly grades 304 and 316), certain aluminum alloys, and specific polymers like PTFE and HDPE have demonstrated superior resistance to ammonia's corrosive effects.

The risk of ammonia leakage demands specialized containment strategies beyond those used for conventional fuels. Double-walled containment systems, advanced sealing technologies, and regular integrity testing protocols are essential components of safe ammonia fuel infrastructure. Additionally, the development of odorants and colorants for ammonia detection represents an active area of research to enhance early leak identification.

Thermal management during ammonia storage and transport presents unique challenges due to its high latent heat of vaporization. Innovative thermal conductivity materials are being developed to address the significant cooling effect that occurs during ammonia evaporation, which can lead to material embrittlement and system failures if not properly managed.

Regulatory frameworks for ammonia as a fuel remain under development globally, with organizations like the International Maritime Organization (IMO) and various national safety boards working to establish comprehensive guidelines. These emerging standards will significantly influence material selection and system design requirements for ammonia fuel applications.

The integration of ammonia with existing fuel infrastructure requires careful consideration of material transitions and interface points. Hybrid systems that gradually introduce ammonia into conventional fuel systems must address potential material incompatibilities at these transition zones, often requiring specialized interface materials with resistance to both conventional fuels and ammonia.

Emergency response protocols for ammonia fuel systems differ substantially from those for conventional fuels, necessitating specialized training, equipment, and materials for containment and neutralization in case of leaks or accidents. Water-based suppression systems must be designed with consideration for ammonia's high water solubility and the resulting alkaline solution.

Environmental Impact Assessment of Thermal Materials

The environmental impact of thermal conductivity materials used in ammonia fuel systems extends beyond their operational efficiency to encompass their entire lifecycle. Advanced thermal materials, while crucial for ammonia's viability as a carbon-neutral fuel, present complex environmental considerations that must be thoroughly evaluated.

Manufacturing processes for high-performance thermal conductivity materials often require significant energy inputs and may involve environmentally sensitive chemicals. Ceramic-based materials, metal-organic frameworks (MOFs), and advanced polymer composites typically demand high-temperature synthesis conditions, contributing to substantial carbon footprints unless powered by renewable energy sources. Additionally, rare earth elements and specialized metals commonly incorporated into these materials face resource scarcity concerns and environmentally destructive mining practices.

Lifecycle assessment studies indicate that despite initial environmental costs, optimized thermal materials can deliver net positive environmental outcomes through operational efficiency gains in ammonia fuel systems. By enabling more efficient heat transfer, these materials reduce overall energy consumption, potentially offsetting their production impacts within 1-3 years of operation, depending on application intensity.

End-of-life considerations present another critical dimension of environmental impact. Many advanced thermal materials contain composite structures that challenge conventional recycling processes. Recent innovations in material design have begun addressing this concern through development of thermally conductive materials with improved recyclability and biodegradability characteristics, particularly in polymer-based composites.

Water consumption represents a frequently overlooked environmental factor in thermal material production. Nanomaterial synthesis and purification processes often require significant quantities of ultrapure water, potentially straining local water resources in manufacturing regions. Implementation of closed-loop water recycling systems has shown promise in reducing this impact by up to 70% in advanced manufacturing facilities.

Toxicity profiles of thermal materials must also be carefully evaluated, particularly for nanomaterials whose environmental behavior may differ significantly from bulk counterparts. Recent ecotoxicological studies have identified potential bioaccumulation risks for certain metal-based thermal nanomaterials, prompting development of alternative formulations with reduced environmental persistence.

Regulatory frameworks governing these materials continue to evolve, with increasing emphasis on full lifecycle environmental impact assessment. The European Union's REACH regulations and similar frameworks in other regions now require comprehensive environmental impact documentation for new thermal materials, driving innovation toward more environmentally benign alternatives while maintaining thermal performance requirements for ammonia fuel applications.

Manufacturing processes for high-performance thermal conductivity materials often require significant energy inputs and may involve environmentally sensitive chemicals. Ceramic-based materials, metal-organic frameworks (MOFs), and advanced polymer composites typically demand high-temperature synthesis conditions, contributing to substantial carbon footprints unless powered by renewable energy sources. Additionally, rare earth elements and specialized metals commonly incorporated into these materials face resource scarcity concerns and environmentally destructive mining practices.

Lifecycle assessment studies indicate that despite initial environmental costs, optimized thermal materials can deliver net positive environmental outcomes through operational efficiency gains in ammonia fuel systems. By enabling more efficient heat transfer, these materials reduce overall energy consumption, potentially offsetting their production impacts within 1-3 years of operation, depending on application intensity.

End-of-life considerations present another critical dimension of environmental impact. Many advanced thermal materials contain composite structures that challenge conventional recycling processes. Recent innovations in material design have begun addressing this concern through development of thermally conductive materials with improved recyclability and biodegradability characteristics, particularly in polymer-based composites.

Water consumption represents a frequently overlooked environmental factor in thermal material production. Nanomaterial synthesis and purification processes often require significant quantities of ultrapure water, potentially straining local water resources in manufacturing regions. Implementation of closed-loop water recycling systems has shown promise in reducing this impact by up to 70% in advanced manufacturing facilities.

Toxicity profiles of thermal materials must also be carefully evaluated, particularly for nanomaterials whose environmental behavior may differ significantly from bulk counterparts. Recent ecotoxicological studies have identified potential bioaccumulation risks for certain metal-based thermal nanomaterials, prompting development of alternative formulations with reduced environmental persistence.

Regulatory frameworks governing these materials continue to evolve, with increasing emphasis on full lifecycle environmental impact assessment. The European Union's REACH regulations and similar frameworks in other regions now require comprehensive environmental impact documentation for new thermal materials, driving innovation toward more environmentally benign alternatives while maintaining thermal performance requirements for ammonia fuel applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!