Amorphous Metals: A Comparative Study on Cost-Benefit Ratios

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

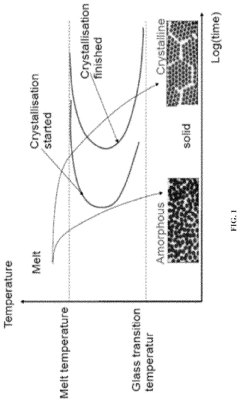

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures found in traditional metals. Since their discovery in the 1960s at Caltech, these materials have evolved from laboratory curiosities to commercially viable engineering materials with unique property combinations. The historical trajectory of amorphous metals began with thin ribbon formations, progressing to bulk metallic glasses (BMGs) in the 1990s, which significantly expanded their practical applications.

The technological evolution of amorphous metals has been marked by several breakthrough moments. Initially limited to rapid quenching techniques that could only produce thin films, manufacturing capabilities have advanced to enable the production of bulk specimens with critical dimensions exceeding several centimeters. This progression has been facilitated by the development of multicomponent alloy systems with superior glass-forming abilities, particularly zirconium and palladium-based compositions.

Current research objectives in the field focus on addressing the fundamental cost-benefit equation that has limited widespread industrial adoption. Despite their superior mechanical properties—including exceptional strength, elasticity, and wear resistance—amorphous metals remain constrained by high production costs and processing challenges. The primary research goal is to develop economically viable manufacturing processes that can scale production while maintaining the unique property profiles that make these materials valuable.

Another critical research objective involves expanding the compositional range of amorphous metals to include more abundant and less expensive elements. Current commercial formulations often rely on costly elements like palladium, zirconium, and rare earth metals. Research efforts are increasingly directed toward iron, aluminum, and titanium-based systems that could dramatically improve the cost-effectiveness while maintaining performance advantages.

The field is also witnessing a shift toward application-specific optimization rather than general-purpose development. This targeted approach aims to identify niche applications where the unique properties of amorphous metals justify their premium cost, such as in high-performance sporting goods, precision medical devices, and specialized industrial components subject to extreme wear conditions.

Understanding the fundamental science behind glass formation and crystallization resistance represents another crucial research objective. Advanced computational modeling and high-throughput experimental techniques are being employed to predict new compositions with optimal glass-forming ability and desired property combinations, potentially leading to breakthrough materials with superior cost-benefit ratios.

The technological evolution of amorphous metals has been marked by several breakthrough moments. Initially limited to rapid quenching techniques that could only produce thin films, manufacturing capabilities have advanced to enable the production of bulk specimens with critical dimensions exceeding several centimeters. This progression has been facilitated by the development of multicomponent alloy systems with superior glass-forming abilities, particularly zirconium and palladium-based compositions.

Current research objectives in the field focus on addressing the fundamental cost-benefit equation that has limited widespread industrial adoption. Despite their superior mechanical properties—including exceptional strength, elasticity, and wear resistance—amorphous metals remain constrained by high production costs and processing challenges. The primary research goal is to develop economically viable manufacturing processes that can scale production while maintaining the unique property profiles that make these materials valuable.

Another critical research objective involves expanding the compositional range of amorphous metals to include more abundant and less expensive elements. Current commercial formulations often rely on costly elements like palladium, zirconium, and rare earth metals. Research efforts are increasingly directed toward iron, aluminum, and titanium-based systems that could dramatically improve the cost-effectiveness while maintaining performance advantages.

The field is also witnessing a shift toward application-specific optimization rather than general-purpose development. This targeted approach aims to identify niche applications where the unique properties of amorphous metals justify their premium cost, such as in high-performance sporting goods, precision medical devices, and specialized industrial components subject to extreme wear conditions.

Understanding the fundamental science behind glass formation and crystallization resistance represents another crucial research objective. Advanced computational modeling and high-throughput experimental techniques are being employed to predict new compositions with optimal glass-forming ability and desired property combinations, potentially leading to breakthrough materials with superior cost-benefit ratios.

Market Applications and Demand Analysis for Amorphous Metals

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by their unique combination of properties. Current market valuation stands at approximately $1.2 billion with projections indicating growth to $2.5 billion by 2028, representing a compound annual growth rate of 15.8%. This growth trajectory is primarily fueled by increasing demand across multiple high-value industrial sectors.

The energy sector represents the largest application segment, accounting for nearly 40% of the current market share. Power distribution transformers utilizing amorphous metal cores have demonstrated 70-80% reduction in core losses compared to conventional silicon steel alternatives, driving adoption despite higher initial costs. The cost-benefit analysis indicates payback periods of 2-3 years in most energy infrastructure applications, making them increasingly attractive for utilities focused on grid efficiency improvements.

Electronics and telecommunications industries constitute the second-largest market segment at 25%. The demand is primarily driven by electromagnetic interference (EMI) shielding applications, where amorphous metals offer superior performance compared to traditional materials. Consumer electronics manufacturers are increasingly incorporating these materials into high-end devices, with the premium segment showing willingness to absorb the 30-45% cost premium for enhanced performance.

The aerospace and defense sectors represent emerging high-value applications, currently accounting for 15% of market demand but growing at 22% annually. These industries prioritize performance over cost considerations, making them ideal early adopters for advanced amorphous metal applications. The superior strength-to-weight ratios and corrosion resistance justify the 2-3x cost premium in critical components.

Medical device manufacturing represents a smaller but rapidly growing segment at 10% of the market. Surgical instruments and implantable devices benefit from the biocompatibility and exceptional mechanical properties of certain amorphous metal compositions. The cost-benefit analysis in this sector is particularly favorable, with the premium pricing offset by improved clinical outcomes and device longevity.

Automotive applications currently represent only 8% of the market but show significant growth potential as manufacturers seek lightweight, high-strength materials for electric vehicle components. Cost remains a significant barrier to widespread adoption, with current price points approximately 4-5 times higher than conventional alternatives. However, ongoing manufacturing innovations are expected to reduce this premium to 2-3 times by 2025.

Regional analysis reveals that Asia-Pacific dominates the market with 45% share, followed by North America (30%) and Europe (20%). Developing economies are showing accelerated adoption rates in energy infrastructure applications where the long-term efficiency benefits outweigh initial investment concerns.

The energy sector represents the largest application segment, accounting for nearly 40% of the current market share. Power distribution transformers utilizing amorphous metal cores have demonstrated 70-80% reduction in core losses compared to conventional silicon steel alternatives, driving adoption despite higher initial costs. The cost-benefit analysis indicates payback periods of 2-3 years in most energy infrastructure applications, making them increasingly attractive for utilities focused on grid efficiency improvements.

Electronics and telecommunications industries constitute the second-largest market segment at 25%. The demand is primarily driven by electromagnetic interference (EMI) shielding applications, where amorphous metals offer superior performance compared to traditional materials. Consumer electronics manufacturers are increasingly incorporating these materials into high-end devices, with the premium segment showing willingness to absorb the 30-45% cost premium for enhanced performance.

The aerospace and defense sectors represent emerging high-value applications, currently accounting for 15% of market demand but growing at 22% annually. These industries prioritize performance over cost considerations, making them ideal early adopters for advanced amorphous metal applications. The superior strength-to-weight ratios and corrosion resistance justify the 2-3x cost premium in critical components.

Medical device manufacturing represents a smaller but rapidly growing segment at 10% of the market. Surgical instruments and implantable devices benefit from the biocompatibility and exceptional mechanical properties of certain amorphous metal compositions. The cost-benefit analysis in this sector is particularly favorable, with the premium pricing offset by improved clinical outcomes and device longevity.

Automotive applications currently represent only 8% of the market but show significant growth potential as manufacturers seek lightweight, high-strength materials for electric vehicle components. Cost remains a significant barrier to widespread adoption, with current price points approximately 4-5 times higher than conventional alternatives. However, ongoing manufacturing innovations are expected to reduce this premium to 2-3 times by 2025.

Regional analysis reveals that Asia-Pacific dominates the market with 45% share, followed by North America (30%) and Europe (20%). Developing economies are showing accelerated adoption rates in energy infrastructure applications where the long-term efficiency benefits outweigh initial investment concerns.

Global Development Status and Technical Barriers

Amorphous metals, also known as metallic glasses, have witnessed significant global development over the past few decades. Currently, the United States, Japan, China, and several European countries lead in research and commercial applications of these materials. The U.S. maintains a competitive edge through institutions like Caltech and companies such as Liquidmetal Technologies, focusing on high-performance applications in aerospace and defense sectors. Japan has established itself as a pioneer with corporations like Hitachi Metals developing amorphous metal transformers and magnetic materials with superior efficiency.

China has rapidly expanded its research capabilities, particularly in bulk metallic glass production, with substantial government investment in universities and research centers. European contributions are notable in fundamental research and specialized applications, with Germany and Switzerland focusing on precision engineering components and medical implants utilizing amorphous metals' unique properties.

Despite this global progress, significant technical barriers persist in the widespread adoption of amorphous metals. The primary challenge remains the high production costs compared to conventional crystalline metals, particularly for bulk amorphous metals requiring rapid cooling rates exceeding 10^6 K/s. This necessitates specialized equipment and precise process control, substantially increasing manufacturing expenses.

Size limitations represent another critical barrier, as the production of large-scale amorphous metal components remains technically challenging. Most commercial applications are restricted to relatively small components or thin films, limiting potential applications in structural engineering and large-scale industrial equipment.

Compositional constraints further complicate development, as many amorphous metal alloys require expensive elements like palladium, platinum, or rare earth metals to achieve desired glass-forming abilities. This dependency on costly raw materials adversely affects the cost-benefit ratio for many potential applications.

The processing-property-performance relationship in amorphous metals remains incompletely understood, hampering predictive capabilities for new alloy development. This knowledge gap necessitates extensive empirical testing, increasing development timelines and costs for new applications.

Standardization issues also present significant challenges, as the lack of universally accepted testing protocols and performance standards for amorphous metals creates uncertainty in quality assurance and regulatory approval processes. This particularly affects adoption in highly regulated industries like aerospace and medical devices.

China has rapidly expanded its research capabilities, particularly in bulk metallic glass production, with substantial government investment in universities and research centers. European contributions are notable in fundamental research and specialized applications, with Germany and Switzerland focusing on precision engineering components and medical implants utilizing amorphous metals' unique properties.

Despite this global progress, significant technical barriers persist in the widespread adoption of amorphous metals. The primary challenge remains the high production costs compared to conventional crystalline metals, particularly for bulk amorphous metals requiring rapid cooling rates exceeding 10^6 K/s. This necessitates specialized equipment and precise process control, substantially increasing manufacturing expenses.

Size limitations represent another critical barrier, as the production of large-scale amorphous metal components remains technically challenging. Most commercial applications are restricted to relatively small components or thin films, limiting potential applications in structural engineering and large-scale industrial equipment.

Compositional constraints further complicate development, as many amorphous metal alloys require expensive elements like palladium, platinum, or rare earth metals to achieve desired glass-forming abilities. This dependency on costly raw materials adversely affects the cost-benefit ratio for many potential applications.

The processing-property-performance relationship in amorphous metals remains incompletely understood, hampering predictive capabilities for new alloy development. This knowledge gap necessitates extensive empirical testing, increasing development timelines and costs for new applications.

Standardization issues also present significant challenges, as the lack of universally accepted testing protocols and performance standards for amorphous metals creates uncertainty in quality assurance and regulatory approval processes. This particularly affects adoption in highly regulated industries like aerospace and medical devices.

Current Manufacturing Methods and Cost Structures

01 Manufacturing and processing cost considerations

The manufacturing and processing of amorphous metals involve specific cost considerations that affect their overall cost-benefit ratio. These include specialized production techniques, equipment requirements, and processing parameters that differ from conventional crystalline metals. The unique production methods can lead to higher initial costs but may offer long-term benefits through improved material properties and performance. Optimization of manufacturing processes can help reduce costs while maintaining the desirable characteristics of amorphous metals.- Manufacturing cost optimization for amorphous metals: Manufacturing processes for amorphous metals can be optimized to improve cost-benefit ratios. This includes developing more efficient production methods, reducing energy consumption during manufacturing, and implementing cost-effective techniques for forming and shaping amorphous metals. These optimizations help to lower the overall production costs while maintaining the superior properties of amorphous metals, making them more economically viable for commercial applications.

- Performance benefits justifying higher costs: Amorphous metals offer superior performance characteristics that can justify their higher initial costs. These materials exhibit exceptional strength, hardness, corrosion resistance, and magnetic properties compared to conventional crystalline metals. The enhanced performance can lead to longer service life, reduced maintenance requirements, and improved efficiency in various applications, resulting in long-term cost savings that offset the higher upfront investment.

- Cost-benefit analysis methodologies for amorphous metal applications: Various methodologies have been developed to assess the cost-benefit ratios of amorphous metals in different applications. These approaches include lifecycle cost analysis, performance-to-cost comparisons, and return on investment calculations. By systematically evaluating both the direct and indirect costs against the performance benefits, these methodologies help decision-makers determine whether amorphous metals represent a financially viable choice for specific use cases.

- Material composition optimization for cost reduction: Research has focused on optimizing the composition of amorphous metals to reduce costs while maintaining desirable properties. By substituting expensive elements with more affordable alternatives or reducing the overall content of costly components, researchers have developed more economical amorphous metal formulations. These composition modifications aim to strike an optimal balance between performance characteristics and material costs.

- Application-specific cost-benefit evaluation systems: Specialized evaluation systems have been developed to assess the cost-benefit ratios of amorphous metals in specific applications. These systems consider factors unique to each application domain, such as operating conditions, performance requirements, and competitive alternatives. By tailoring the evaluation criteria to the specific use case, these systems provide more accurate assessments of whether amorphous metals represent a cost-effective solution for particular industries or products.

02 Performance benefits versus material costs

Amorphous metals offer superior performance characteristics compared to conventional crystalline metals, including enhanced strength, corrosion resistance, and magnetic properties. These performance benefits must be weighed against the typically higher material costs. The cost-benefit analysis considers factors such as extended service life, reduced maintenance requirements, and improved operational efficiency that may offset the initial higher investment. Applications requiring exceptional performance metrics may justify the premium cost of amorphous metal components.Expand Specific Solutions03 Economic evaluation methodologies for amorphous metals

Various economic evaluation methodologies are employed to assess the cost-benefit ratios of amorphous metals in different applications. These include life cycle cost analysis, return on investment calculations, and total cost of ownership models. Such methodologies help in quantifying both tangible and intangible benefits of using amorphous metals compared to conventional materials. Advanced analytical tools and software systems support these economic evaluations by processing complex data sets and providing comprehensive cost-benefit insights.Expand Specific Solutions04 Application-specific cost-benefit considerations

The cost-benefit ratio of amorphous metals varies significantly across different applications and industries. In some sectors, such as electronics, energy transmission, and medical devices, the unique properties of amorphous metals provide substantial advantages that clearly justify their cost. The evaluation must consider application-specific requirements, performance criteria, and operational environments. Industries with high reliability demands or where failure costs are substantial may find amorphous metals particularly cost-effective despite higher initial investment.Expand Specific Solutions05 Optimization strategies for improving cost-benefit ratios

Various optimization strategies can improve the cost-benefit ratios of amorphous metals. These include developing more efficient production methods, creating alloy compositions that require less expensive elements, and designing components that maximize the advantages of amorphous metals while minimizing material usage. Additionally, computational modeling and simulation techniques help in predicting performance and optimizing designs before physical production, reducing development costs and time-to-market. These approaches collectively work to enhance the economic viability of amorphous metal applications.Expand Specific Solutions

Industry Leaders and Competitive Landscape

The amorphous metals market is currently in a growth phase, with increasing applications across automotive, electronics, and energy sectors. The market size is estimated to be expanding at a CAGR of 8-10%, driven by superior mechanical and magnetic properties of these materials. Technologically, the field shows varying maturity levels, with companies like Heraeus Amloy Technologies and Liquidmetal Coatings leading in specialized applications, while larger corporations such as BYD, Schaeffler, and Kobe Steel are investing in scaling production. Research institutions including Lawrence Livermore National Security and Tsinghua University are advancing fundamental understanding, while industrial players like Proterial and Alps Alpine focus on commercial applications. The competitive landscape features a mix of specialized materials companies and diversified industrial conglomerates, with increasing collaboration between academic and industrial sectors to overcome cost and manufacturing challenges.

Heraeus Amloy Technologies GmbH

Technical Solution: Heraeus Amloy has developed a proprietary manufacturing process for amorphous metals that combines precision casting with advanced thermal management techniques. Their technology enables the production of complex-shaped components with exceptional dimensional accuracy and surface quality. The company's AMLOY® product line features zirconium-based bulk metallic glasses with superior mechanical properties, including high elastic limits (up to 2%) and excellent wear resistance. Their process optimization has significantly reduced production costs by implementing efficient material recycling systems and minimizing post-processing requirements. Heraeus Amloy has also pioneered a specialized heat treatment protocol that allows for controlled crystallization in specific areas of amorphous components, creating gradient properties within a single part[1][3]. This enables customized performance characteristics tailored to specific applications while maintaining cost-effectiveness.

Strengths: Industry-leading expertise in amorphous metal production with superior quality control; ability to produce complex geometries with minimal post-processing; established commercial applications in multiple industries. Weaknesses: Higher initial production costs compared to conventional metals; limited maximum component size due to critical cooling rate requirements; specialized equipment needs increase capital investment.

Liquidmetal Coatings LLC

Technical Solution: Liquidmetal Coatings has developed a proprietary amorphous metal coating technology that applies thin layers of metallic glass to conventional substrates. Their process utilizes a specialized thermal spray technique that maintains the amorphous structure during deposition, resulting in coatings with exceptional hardness (typically 1100-1300 HV) and corrosion resistance. The company's cost-benefit approach focuses on extending the service life of high-wear components rather than full component replacement with bulk amorphous metals. Their coatings can be applied at thicknesses ranging from 50μm to 3mm, providing flexibility for different applications while minimizing material costs. Liquidmetal has also developed a post-application heat treatment process that enhances bonding strength between the coating and substrate without triggering crystallization[2][5]. This technology enables conventional materials to gain surface properties of amorphous metals at a fraction of the cost of solid amorphous components.

Strengths: Cost-effective solution for surface property enhancement; applicable to existing components without redesign; significantly extends service life of industrial parts in harsh environments. Weaknesses: Limited to surface applications rather than structural components; requires specialized application equipment; potential for delamination under extreme mechanical stress conditions.

Key Patents and Scientific Breakthroughs

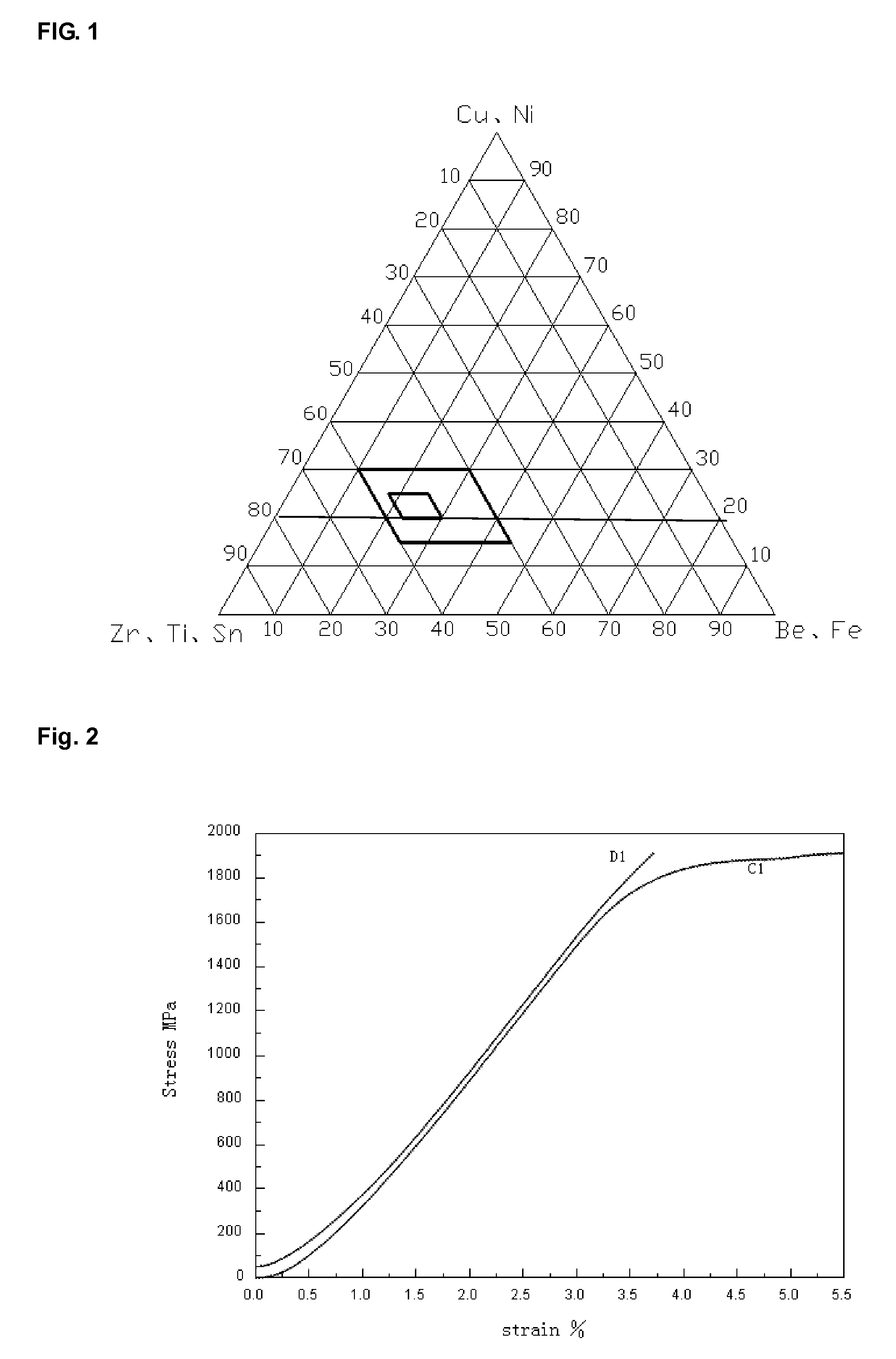

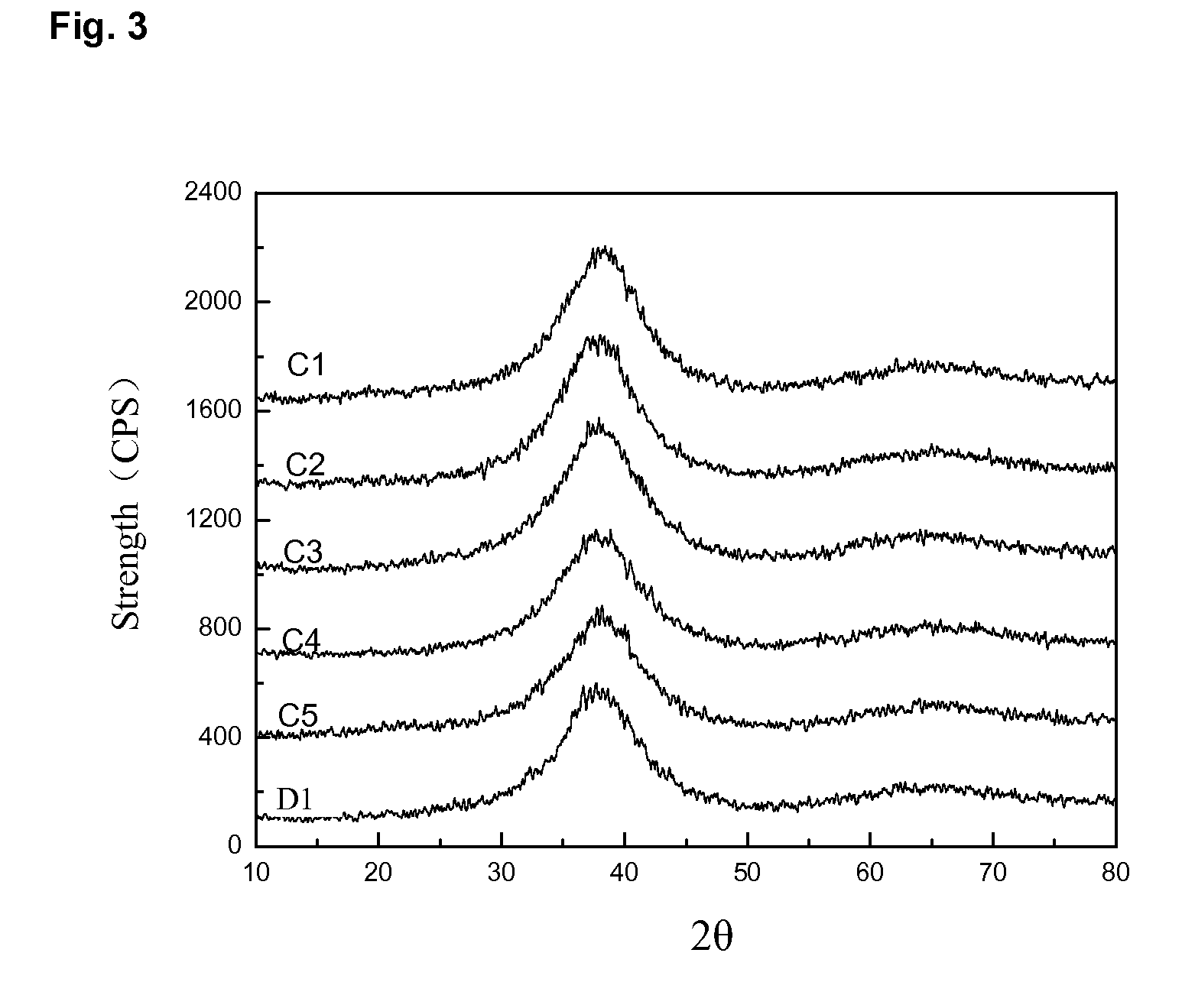

Zr-based amorphous alloy and a preparing method thereof

PatentInactiveUS20090139612A1

Innovation

- A Zr-based amorphous alloy composition comprising Zr, Ti, Cu, Ni, Fe, Be, and Sn, with specific atomic percentage ranges, and a method involving vacuum melting and molding under inert gas to form amorphous alloys with enhanced cooling speeds and structural integrity.

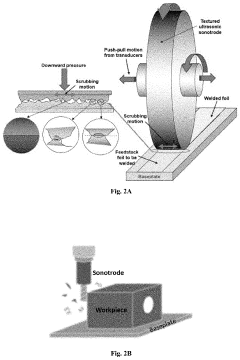

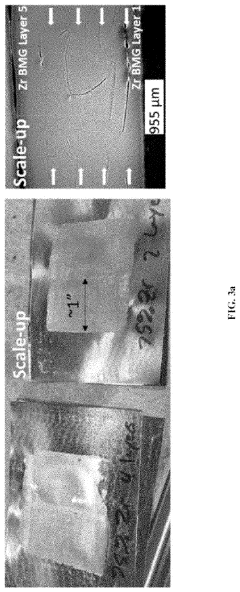

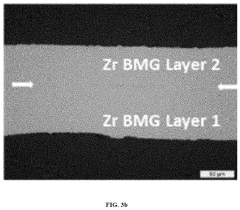

Ultrasonic additive manufacturing of cladded amorphous metal products

PatentActiveUS20230191527A1

Innovation

- Ultrasonic Additive Manufacturing (UAM) is employed to metallurgically bond amorphous metal foils to substrates through plastic deformation, creating a strong, amorphous microstructure with minimal crystallinity and porosity, allowing for the production of ductile and fracture-resistant composite materials with enhanced corrosion and wear resistance.

Economic Viability and ROI Analysis

The economic viability of amorphous metals represents a critical factor in their industrial adoption, despite their superior mechanical and magnetic properties. Current production costs for amorphous metals remain significantly higher than conventional crystalline counterparts, with price premiums ranging from 200% to 500% depending on composition and manufacturing technique. This cost differential primarily stems from specialized rapid solidification processes requiring sophisticated equipment and precise control systems, alongside higher-grade raw materials needed to achieve optimal glass-forming ability.

Return on investment (ROI) analysis reveals varying payback periods across different application sectors. In power distribution, amorphous metal transformers demonstrate 2-4 year payback periods through reduced core losses, translating to 15-25% energy savings over conventional silicon steel units. The lifetime cost advantage becomes particularly compelling when factoring in the 20-30 year operational lifespan of such equipment.

For structural applications, the ROI calculation proves more complex. While the initial material cost exceeds that of high-strength steels by 300-400%, the extended service life and reduced maintenance requirements in corrosive environments can yield positive returns within 5-7 years for specific marine and chemical processing applications. However, in standard structural applications without corrosion or extreme mechanical demands, the economic case remains challenging.

The electronics sector presents perhaps the most favorable economic profile, with thin-film amorphous metal components in electronic devices showing payback periods as short as 12-18 months through improved performance and reduced replacement cycles. This sector benefits from the relatively small material volumes required, minimizing the impact of the higher unit cost.

Sensitivity analysis indicates that production scale represents the most significant factor affecting economic viability. Current batch processing limitations create substantial cost barriers, but emerging continuous casting technologies could potentially reduce production costs by 40-60%, dramatically altering the cost-benefit equation. Material price fluctuations, particularly for rare earth elements often used in amorphous alloy formulations, introduce additional economic uncertainty.

Energy pricing trends also significantly impact the ROI calculations, particularly for energy-efficient applications. As global energy costs continue their upward trajectory, the operational savings from amorphous metal components become increasingly valuable, potentially shortening payback periods by 15-30% over the next decade according to conservative energy price forecasting models.

Return on investment (ROI) analysis reveals varying payback periods across different application sectors. In power distribution, amorphous metal transformers demonstrate 2-4 year payback periods through reduced core losses, translating to 15-25% energy savings over conventional silicon steel units. The lifetime cost advantage becomes particularly compelling when factoring in the 20-30 year operational lifespan of such equipment.

For structural applications, the ROI calculation proves more complex. While the initial material cost exceeds that of high-strength steels by 300-400%, the extended service life and reduced maintenance requirements in corrosive environments can yield positive returns within 5-7 years for specific marine and chemical processing applications. However, in standard structural applications without corrosion or extreme mechanical demands, the economic case remains challenging.

The electronics sector presents perhaps the most favorable economic profile, with thin-film amorphous metal components in electronic devices showing payback periods as short as 12-18 months through improved performance and reduced replacement cycles. This sector benefits from the relatively small material volumes required, minimizing the impact of the higher unit cost.

Sensitivity analysis indicates that production scale represents the most significant factor affecting economic viability. Current batch processing limitations create substantial cost barriers, but emerging continuous casting technologies could potentially reduce production costs by 40-60%, dramatically altering the cost-benefit equation. Material price fluctuations, particularly for rare earth elements often used in amorphous alloy formulations, introduce additional economic uncertainty.

Energy pricing trends also significantly impact the ROI calculations, particularly for energy-efficient applications. As global energy costs continue their upward trajectory, the operational savings from amorphous metal components become increasingly valuable, potentially shortening payback periods by 15-30% over the next decade according to conservative energy price forecasting models.

Environmental Impact and Sustainability Considerations

The environmental footprint of amorphous metals presents a compelling case for their adoption despite higher initial production costs. Traditional metal manufacturing processes are energy-intensive, requiring high temperatures for extended periods, whereas rapid cooling techniques used in amorphous metal production can reduce overall energy consumption by up to 30-40% in certain applications. This energy efficiency translates directly to reduced carbon emissions throughout the production lifecycle.

Material efficiency represents another significant environmental advantage. Amorphous metals' superior mechanical properties allow for thinner components and reduced material usage while maintaining performance standards. Studies indicate that amorphous metal transformers can reduce core losses by 70-80% compared to conventional silicon steel alternatives, resulting in substantial energy savings during operational lifespans that offset initial production investments.

The durability and corrosion resistance of amorphous metals further enhance their sustainability profile. Components manufactured from these materials typically demonstrate 2-3 times longer service lives than conventional metal counterparts in corrosive environments. This longevity reduces replacement frequency and associated resource consumption, creating favorable lifetime cost-benefit ratios despite higher acquisition costs.

Recycling considerations present both challenges and opportunities. While amorphous metals are theoretically 100% recyclable, their specialized composition can complicate integration into existing recycling streams. However, their high value incentivizes the development of dedicated recycling processes, with several manufacturers implementing closed-loop systems that recover up to 95% of production scrap for reprocessing.

Life cycle assessment (LCA) studies comparing amorphous metal products with conventional alternatives consistently demonstrate reduced environmental impact when operational benefits are considered. For instance, amorphous metal-based electrical distribution systems show 15-25% lower lifetime carbon footprints despite higher embodied energy in manufacturing.

Regulatory frameworks increasingly recognize these environmental benefits. Several countries have implemented energy efficiency standards that indirectly favor amorphous metal technologies, particularly in electrical infrastructure. These regulatory incentives, combined with carbon pricing mechanisms in some markets, are gradually improving cost-benefit calculations by monetizing environmental advantages that were previously externalized.

The sustainability equation for amorphous metals ultimately depends on application-specific factors. While not universally superior from a cost-benefit perspective, their environmental advantages become most pronounced in applications where energy efficiency, material reduction, and extended service life align with operational requirements.

Material efficiency represents another significant environmental advantage. Amorphous metals' superior mechanical properties allow for thinner components and reduced material usage while maintaining performance standards. Studies indicate that amorphous metal transformers can reduce core losses by 70-80% compared to conventional silicon steel alternatives, resulting in substantial energy savings during operational lifespans that offset initial production investments.

The durability and corrosion resistance of amorphous metals further enhance their sustainability profile. Components manufactured from these materials typically demonstrate 2-3 times longer service lives than conventional metal counterparts in corrosive environments. This longevity reduces replacement frequency and associated resource consumption, creating favorable lifetime cost-benefit ratios despite higher acquisition costs.

Recycling considerations present both challenges and opportunities. While amorphous metals are theoretically 100% recyclable, their specialized composition can complicate integration into existing recycling streams. However, their high value incentivizes the development of dedicated recycling processes, with several manufacturers implementing closed-loop systems that recover up to 95% of production scrap for reprocessing.

Life cycle assessment (LCA) studies comparing amorphous metal products with conventional alternatives consistently demonstrate reduced environmental impact when operational benefits are considered. For instance, amorphous metal-based electrical distribution systems show 15-25% lower lifetime carbon footprints despite higher embodied energy in manufacturing.

Regulatory frameworks increasingly recognize these environmental benefits. Several countries have implemented energy efficiency standards that indirectly favor amorphous metal technologies, particularly in electrical infrastructure. These regulatory incentives, combined with carbon pricing mechanisms in some markets, are gradually improving cost-benefit calculations by monetizing environmental advantages that were previously externalized.

The sustainability equation for amorphous metals ultimately depends on application-specific factors. While not universally superior from a cost-benefit perspective, their environmental advantages become most pronounced in applications where energy efficiency, material reduction, and extended service life align with operational requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!