Innovations in Amorphous Metals: From Research to Patent Filing

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures. Since their discovery in 1960 at Caltech, when researchers rapidly cooled gold-silicon alloys to prevent crystallization, these materials have evolved from laboratory curiosities to commercially viable engineering materials. The historical trajectory shows significant acceleration in research during the 1990s, with breakthrough developments in bulk metallic glasses (BMGs) that enabled larger sample sizes and expanded potential applications.

The evolution of amorphous metals has been characterized by progressive improvements in processing techniques, particularly in rapid solidification methods. Early limitations restricted these materials to thin ribbons or powders, but advances in copper mold casting, suction casting, and more recently, additive manufacturing have dramatically expanded fabrication capabilities. This technological progression has enabled the production of increasingly complex geometries while maintaining the unique non-crystalline structure that gives these materials their exceptional properties.

Current research objectives in the field focus on several key areas. First, expanding the compositional range of amorphous metals to incorporate more economically viable and sustainable elements while maintaining or enhancing performance characteristics. Second, improving processing technologies to increase critical casting thickness and enable more complex geometries, particularly through additive manufacturing approaches. Third, enhancing the fundamental understanding of glass-forming ability and structure-property relationships to enable more predictive design of new compositions.

Another critical research objective involves addressing the inherent brittleness that has limited widespread adoption of amorphous metals in structural applications. Strategies including the development of composite structures, controlled crystallization, and novel microstructural engineering approaches aim to improve toughness while preserving the desirable properties of the amorphous state. These efforts represent a significant frontier in materials science with substantial potential for innovation and patent development.

The intersection of computational modeling with experimental approaches has emerged as a particularly promising research direction. Machine learning algorithms and high-throughput computational screening are accelerating the discovery of new glass-forming compositions, while atomistic simulations provide deeper insights into deformation mechanisms and structural relaxation phenomena. These computational tools are increasingly essential for navigating the vast compositional space and optimizing processing parameters.

The ultimate objective of current research efforts is to transition amorphous metals from specialized niche applications to mainstream engineering materials, capable of addressing global challenges in energy efficiency, transportation, and sustainable manufacturing. This transition requires not only technical innovations but also strategic patent positioning to protect intellectual property in this rapidly evolving field.

The evolution of amorphous metals has been characterized by progressive improvements in processing techniques, particularly in rapid solidification methods. Early limitations restricted these materials to thin ribbons or powders, but advances in copper mold casting, suction casting, and more recently, additive manufacturing have dramatically expanded fabrication capabilities. This technological progression has enabled the production of increasingly complex geometries while maintaining the unique non-crystalline structure that gives these materials their exceptional properties.

Current research objectives in the field focus on several key areas. First, expanding the compositional range of amorphous metals to incorporate more economically viable and sustainable elements while maintaining or enhancing performance characteristics. Second, improving processing technologies to increase critical casting thickness and enable more complex geometries, particularly through additive manufacturing approaches. Third, enhancing the fundamental understanding of glass-forming ability and structure-property relationships to enable more predictive design of new compositions.

Another critical research objective involves addressing the inherent brittleness that has limited widespread adoption of amorphous metals in structural applications. Strategies including the development of composite structures, controlled crystallization, and novel microstructural engineering approaches aim to improve toughness while preserving the desirable properties of the amorphous state. These efforts represent a significant frontier in materials science with substantial potential for innovation and patent development.

The intersection of computational modeling with experimental approaches has emerged as a particularly promising research direction. Machine learning algorithms and high-throughput computational screening are accelerating the discovery of new glass-forming compositions, while atomistic simulations provide deeper insights into deformation mechanisms and structural relaxation phenomena. These computational tools are increasingly essential for navigating the vast compositional space and optimizing processing parameters.

The ultimate objective of current research efforts is to transition amorphous metals from specialized niche applications to mainstream engineering materials, capable of addressing global challenges in energy efficiency, transportation, and sustainable manufacturing. This transition requires not only technical innovations but also strategic patent positioning to protect intellectual property in this rapidly evolving field.

Market Applications and Demand Analysis for Amorphous Metals

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by their unique properties and expanding applications across multiple industries. The current market size is estimated at $1.2 billion with projections indicating growth to reach $2.5 billion by 2028, representing a compound annual growth rate of approximately 8.3% during the forecast period.

The electronics and electrical sector constitutes the largest application segment, accounting for nearly 35% of the total market share. Amorphous metal transformers have gained substantial traction due to their superior energy efficiency, with energy losses reduced by up to 80% compared to conventional silicon steel transformers. This efficiency translates to significant cost savings over the operational lifetime of the equipment, driving adoption despite higher initial investment costs.

Aerospace and defense applications represent the fastest-growing segment, with a projected growth rate of 10.2% annually. The exceptional strength-to-weight ratio and corrosion resistance of amorphous metals make them ideal for critical components in aircraft, satellites, and defense systems where performance under extreme conditions is paramount.

The medical device industry has emerged as another promising market, particularly for biocompatible amorphous metal alloys. These materials demonstrate excellent compatibility with human tissue while offering superior mechanical properties for applications such as orthopedic implants, surgical instruments, and dental prosthetics. The aging global population and increasing prevalence of chronic diseases are fueling demand in this sector.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 42% share, led by China, Japan, and South Korea. These countries have established robust manufacturing capabilities and significant R&D investments in amorphous metal technologies. North America follows with 28% market share, driven primarily by aerospace, defense, and medical applications.

Consumer electronics represents an emerging application area with substantial growth potential. Amorphous metal casings for smartphones, tablets, and wearable devices offer enhanced durability and aesthetic appeal compared to traditional materials. Several major electronics manufacturers have begun incorporating these materials into premium product lines.

Market challenges include high production costs, limited manufacturing scalability, and competition from established materials with entrenched supply chains. However, ongoing innovations in production techniques, particularly in rapid solidification methods and additive manufacturing, are gradually addressing these barriers and expanding the commercial viability of amorphous metals across new application domains.

The electronics and electrical sector constitutes the largest application segment, accounting for nearly 35% of the total market share. Amorphous metal transformers have gained substantial traction due to their superior energy efficiency, with energy losses reduced by up to 80% compared to conventional silicon steel transformers. This efficiency translates to significant cost savings over the operational lifetime of the equipment, driving adoption despite higher initial investment costs.

Aerospace and defense applications represent the fastest-growing segment, with a projected growth rate of 10.2% annually. The exceptional strength-to-weight ratio and corrosion resistance of amorphous metals make them ideal for critical components in aircraft, satellites, and defense systems where performance under extreme conditions is paramount.

The medical device industry has emerged as another promising market, particularly for biocompatible amorphous metal alloys. These materials demonstrate excellent compatibility with human tissue while offering superior mechanical properties for applications such as orthopedic implants, surgical instruments, and dental prosthetics. The aging global population and increasing prevalence of chronic diseases are fueling demand in this sector.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 42% share, led by China, Japan, and South Korea. These countries have established robust manufacturing capabilities and significant R&D investments in amorphous metal technologies. North America follows with 28% market share, driven primarily by aerospace, defense, and medical applications.

Consumer electronics represents an emerging application area with substantial growth potential. Amorphous metal casings for smartphones, tablets, and wearable devices offer enhanced durability and aesthetic appeal compared to traditional materials. Several major electronics manufacturers have begun incorporating these materials into premium product lines.

Market challenges include high production costs, limited manufacturing scalability, and competition from established materials with entrenched supply chains. However, ongoing innovations in production techniques, particularly in rapid solidification methods and additive manufacturing, are gradually addressing these barriers and expanding the commercial viability of amorphous metals across new application domains.

Global Development Status and Technical Barriers

Amorphous metals, also known as metallic glasses, have witnessed significant global development over the past few decades. The United States, Japan, China, and several European countries have established themselves as leaders in this field. The U.S. has pioneered fundamental research through institutions like Caltech and Yale University, focusing on theoretical understanding and novel applications. Japan has excelled in industrial applications, particularly through companies like Liquidmetal Technologies and Hitachi Metals, which have commercialized bulk metallic glasses for consumer electronics and sporting goods.

China has emerged as a rapidly growing force in amorphous metals research, with substantial government investment in both academic institutions and industrial applications. The Chinese Academy of Sciences has established dedicated research centers focusing on large-scale production techniques and cost reduction. European contributions, particularly from Germany and Switzerland, have centered on precision engineering applications and advanced characterization techniques.

Despite these advancements, significant technical barriers persist in the field of amorphous metals. The most fundamental challenge remains the limited size of bulk metallic glass components that can be produced. Critical cooling rates required to maintain the amorphous structure restrict the dimensions of parts that can be manufactured, typically limiting them to several centimeters in thickness. This size limitation severely constrains potential industrial applications, particularly in structural engineering.

Manufacturing consistency presents another major hurdle. The production of amorphous metals with uniform properties throughout the material volume remains difficult to achieve at scale. Minor variations in cooling rates or material composition can lead to partial crystallization, dramatically altering mechanical properties and compromising performance. This inconsistency creates significant challenges for quality control in industrial settings.

Cost factors continue to impede widespread adoption. The specialized equipment and precise processing conditions required for amorphous metal production result in manufacturing costs significantly higher than those for conventional crystalline alloys. Additionally, the raw materials used in many high-performance metallic glasses, such as palladium, platinum, and rare earth elements, contribute to prohibitive costs for mass-market applications.

Environmental stability represents another technical barrier. Many amorphous metal compositions exhibit sensitivity to oxidation and corrosion under certain conditions, limiting their application in harsh environments. Furthermore, the recyclability of these materials presents challenges due to their complex compositions and the difficulty in separating constituent elements during recycling processes.

China has emerged as a rapidly growing force in amorphous metals research, with substantial government investment in both academic institutions and industrial applications. The Chinese Academy of Sciences has established dedicated research centers focusing on large-scale production techniques and cost reduction. European contributions, particularly from Germany and Switzerland, have centered on precision engineering applications and advanced characterization techniques.

Despite these advancements, significant technical barriers persist in the field of amorphous metals. The most fundamental challenge remains the limited size of bulk metallic glass components that can be produced. Critical cooling rates required to maintain the amorphous structure restrict the dimensions of parts that can be manufactured, typically limiting them to several centimeters in thickness. This size limitation severely constrains potential industrial applications, particularly in structural engineering.

Manufacturing consistency presents another major hurdle. The production of amorphous metals with uniform properties throughout the material volume remains difficult to achieve at scale. Minor variations in cooling rates or material composition can lead to partial crystallization, dramatically altering mechanical properties and compromising performance. This inconsistency creates significant challenges for quality control in industrial settings.

Cost factors continue to impede widespread adoption. The specialized equipment and precise processing conditions required for amorphous metal production result in manufacturing costs significantly higher than those for conventional crystalline alloys. Additionally, the raw materials used in many high-performance metallic glasses, such as palladium, platinum, and rare earth elements, contribute to prohibitive costs for mass-market applications.

Environmental stability represents another technical barrier. Many amorphous metal compositions exhibit sensitivity to oxidation and corrosion under certain conditions, limiting their application in harsh environments. Furthermore, the recyclability of these materials presents challenges due to their complex compositions and the difficulty in separating constituent elements during recycling processes.

Current Manufacturing Techniques and Material Compositions

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, splat quenching, and gas atomization, which are critical for achieving the unique properties of amorphous metals.- Manufacturing methods for amorphous metals: Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to maintain the disordered atomic structure characteristic of amorphous metals. Techniques such as melt spinning, vapor deposition, and mechanical alloying are commonly used to achieve the necessary cooling rates and produce amorphous metal structures with desired properties.

- Composition and alloying of amorphous metals: The composition of amorphous metals significantly influences their properties and stability. Specific combinations of elements can enhance glass-forming ability, allowing for easier production of amorphous structures. Common alloying elements include transition metals, metalloids, and rare earth elements. These carefully designed compositions can improve thermal stability, mechanical properties, and resistance to crystallization, making the amorphous metals suitable for various applications.

- Thermal and mechanical properties of amorphous metals: Amorphous metals exhibit unique thermal and mechanical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. These materials often show excellent wear resistance, corrosion resistance, and magnetic properties. The absence of grain boundaries contributes to their superior mechanical behavior, though they may exhibit limited ductility at room temperature. Their thermal stability and glass transition behavior are critical parameters for processing and application.

- Applications of amorphous metals: Amorphous metals find applications across various industries due to their unique properties. They are used in electronic devices, transformers, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural components, medical implants, and sporting goods. Additionally, their unique processing capabilities allow for near-net-shape manufacturing of complex components. Emerging applications include energy storage, aerospace components, and biomedical devices.

- Surface treatment and coating technologies for amorphous metals: Various surface treatment and coating technologies are employed to enhance the properties of amorphous metals or to apply amorphous metal coatings on different substrates. These include thermal spray techniques, physical vapor deposition, and chemical vapor deposition methods. Surface treatments can improve wear resistance, corrosion protection, and biocompatibility. Amorphous metal coatings provide a way to impart the beneficial properties of these materials to conventional substrates, expanding their application range.

02 Composition and alloying elements in amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals (such as iron, nickel, or zirconium) combined with metalloids (like boron, silicon, or phosphorus) in precise ratios. The selection of alloying elements significantly influences the thermal stability, mechanical properties, and glass-forming ability of the resulting amorphous structure.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique combination of properties. They are used in transformer cores and electronic devices due to their superior magnetic properties and low core losses. Their high strength and corrosion resistance make them suitable for structural components, while their biocompatibility enables medical applications. Additionally, they serve in sporting goods, jewelry, and as protective coatings where their exceptional hardness and wear resistance are advantageous.Expand Specific Solutions04 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties that distinguish them from their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limit combined with good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic behavior, including low coercivity and high permeability. These materials also show distinctive thermal properties and can display superplastic behavior at certain temperatures.Expand Specific Solutions05 Surface treatment and coating applications of amorphous metals

Amorphous metals can be applied as coatings to enhance the surface properties of conventional materials. These coatings provide improved wear resistance, corrosion protection, and hardness to the substrate. Various deposition techniques are employed, including thermal spraying, physical vapor deposition, and electrodeposition. The amorphous structure of these coatings offers advantages such as uniform properties, absence of grain boundary corrosion, and superior bonding to substrates.Expand Specific Solutions

Leading Companies and Research Institutions in the Field

The amorphous metals market is in a growth phase, characterized by increasing research-to-patent conversion as the technology matures from laboratory curiosity to commercial applications. The global market is expanding rapidly, projected to reach significant scale as industries recognize the superior mechanical and magnetic properties these materials offer. Leading the technological development are specialized materials companies like Heraeus Amloy Technologies, Metglas, and Proterial, alongside research powerhouses including Tsinghua University and California Institute of Technology. Major industrial players such as BYD, Huawei, and Schaeffler are increasingly incorporating amorphous metals into their product development pipelines, particularly in energy, electronics, and automotive applications. The competitive landscape shows a balanced mix of established materials manufacturers, academic institutions, and end-product companies working to commercialize these advanced materials.

3M Innovative Properties Co.

Technical Solution: 3M has developed proprietary amorphous metal technology focused on thin film applications and specialized coatings. Their innovation centers on a magnetron sputtering process that creates precisely controlled amorphous metal films with thicknesses ranging from nanometers to microns. These films exhibit exceptional uniformity and adhesion to various substrates. 3M's patented alloy compositions, particularly those based on zirconium and titanium with carefully selected transition metal additions, demonstrate superior biocompatibility and corrosion resistance for medical device applications. The company has also pioneered hybrid materials that combine amorphous metals with polymers to create flexible, durable coatings with unique electrical and magnetic properties. Their recent innovations include gradient composition films that transition from crystalline to amorphous structures, providing optimized interfaces between dissimilar materials in electronic and optical applications.

Strengths: Exceptional thin film deposition capabilities; extensive experience integrating amorphous metals with other materials; strong intellectual property portfolio covering diverse applications. Weaknesses: Limited focus on bulk amorphous metals; primarily application-specific solutions rather than platform technologies; higher production costs for specialized applications.

Heraeus Amloy Technologies GmbH

Technical Solution: Heraeus Amloy has developed proprietary manufacturing processes for amorphous metals (metallic glasses) that overcome traditional limitations in size and complexity. Their technology combines precision injection molding with specialized rapid cooling techniques to produce near-net-shape components with exceptional dimensional accuracy. The company has pioneered a unique vacuum pressure die casting process that enables the production of larger amorphous metal parts with consistent properties throughout. Their patented approach allows for cooling rates exceeding 1000K/s, which is critical for maintaining the amorphous structure during solidification. Additionally, Heraeus Amloy has developed specialized surface treatment methods that enhance the already superior corrosion resistance of their zirconium-based amorphous alloys, making them suitable for harsh chemical environments and medical applications.

Strengths: Superior manufacturing capability for complex geometries with exceptional dimensional stability; specialized alloy compositions optimized for specific applications; comprehensive material property database supporting design engineers. Weaknesses: Higher production costs compared to conventional metals; limited maximum part size despite advances; requires specialized equipment for processing.

Key Patents and Scientific Breakthroughs in Amorphous Metals

Amorphous alloys having zirconium and methods thereof

PatentActiveUS20120073709A1

Innovation

- The method involves melting a mixture of Zr, Al, Cu, Ni, Sc, and Y metals under protective gas or vacuum conditions to form a melted alloy, which is then cooled and molded into an amorphous alloy with a specific atomic composition, ensuring high purity and controlled cooling rates to achieve the desired amorphous structure and properties.

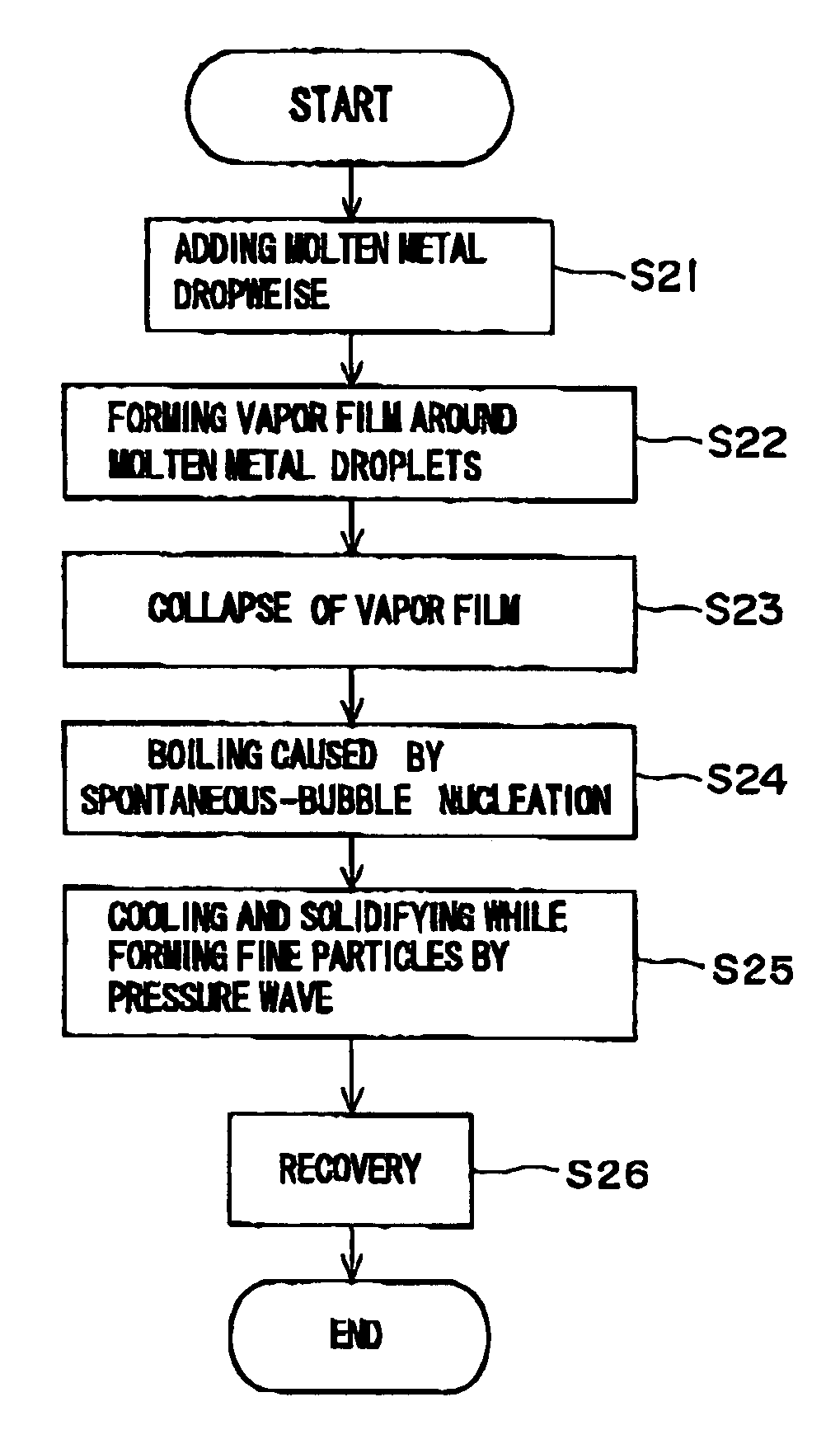

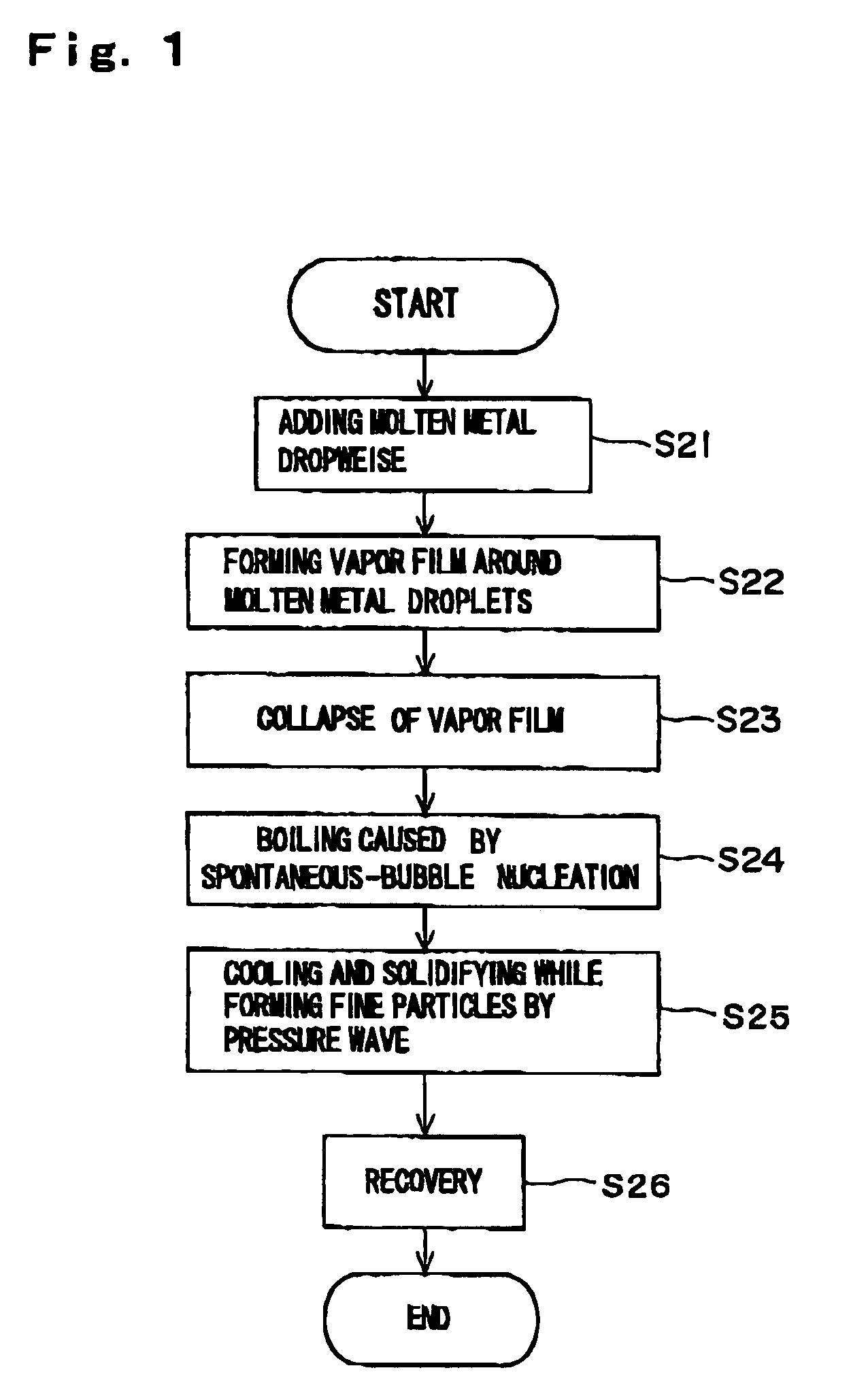

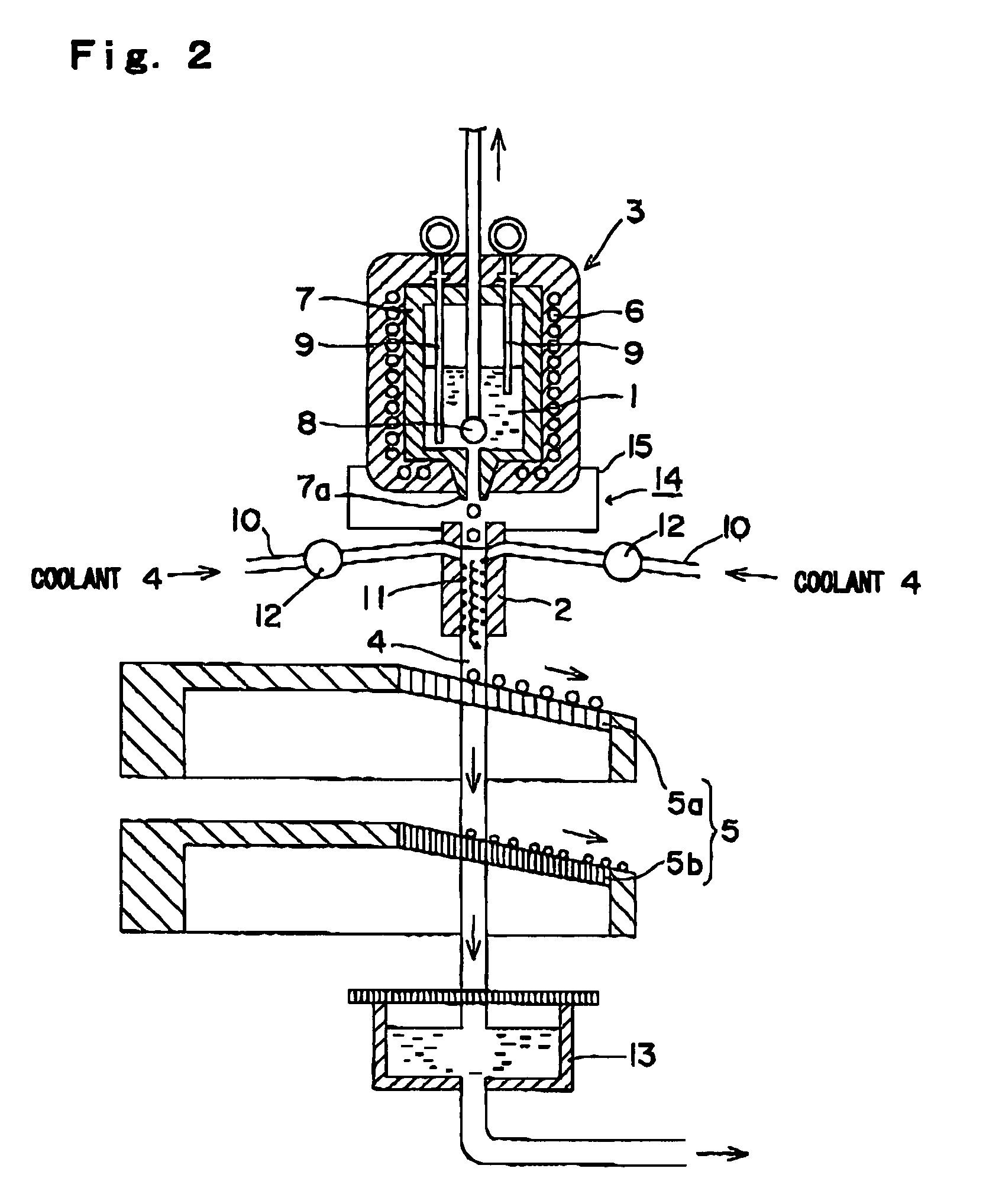

Method for producing amorphous metal, method and apparatus for producing amorphous metal fine particles, and amorphous metal fine particles

PatentInactiveUS7008463B2

Innovation

- A method involving the supply of molten metal into a liquid coolant, where a vapor film is formed and collapsed to induce boiling through spontaneous-bubble nucleation, generating pressure waves that fragment the metal into fine particles, allowing for rapid cooling and amorphization, with controlled molten metal and coolant quantities and the use of salt to facilitate vapor film collapse, ensuring efficient formation and high cooling rates.

IP Strategy and Patent Filing Considerations

Effective IP strategy for amorphous metals innovation requires a comprehensive approach that balances protection and commercialization. Patent filing should focus on core manufacturing processes, unique compositions, and novel applications rather than attempting to patent fundamental scientific principles. Companies must conduct thorough prior art searches, particularly examining patents from the 1960s-1980s when significant foundational work occurred in this field.

Strategic patent mapping is essential to identify white spaces in the amorphous metals landscape. This involves analyzing competitor portfolios and determining areas with minimal patent coverage but high commercial potential. For multinational operations, companies should consider jurisdictional differences in patent laws, particularly regarding what constitutes patentable subject matter in materials science across different regions.

The timing of patent filings presents a critical strategic consideration. Early filing secures priority dates but may result in incomplete protection if the technology continues to evolve. Conversely, delayed filing allows for more comprehensive claims but risks competitors establishing prior art. For amorphous metals, where incremental improvements often yield significant performance gains, a staged filing approach may be optimal.

Patent drafting for amorphous metals requires particular attention to composition ranges, processing parameters, and performance metrics. Claims should be structured with primary claims covering broad concepts and dependent claims addressing specific implementations. This creates a defensive perimeter around the core innovation while maintaining flexibility for future developments.

Beyond patents, companies should consider complementary IP protection mechanisms. Trade secrets may be appropriate for manufacturing processes difficult to reverse-engineer, while trademarks can protect brand identity for consumer-facing amorphous metal products. Licensing strategies should also be developed early, determining whether to pursue exclusive licensing, cross-licensing with complementary technology holders, or open innovation approaches.

Regular IP portfolio reviews are necessary to align protection with evolving business objectives. This includes identifying patents to maintain, abandon, or license based on market developments and competitive positioning. For amorphous metals specifically, companies should monitor emerging application areas where existing patents might find unexpected value.

Finally, defensive publication strategies can prevent competitors from patenting incremental innovations while preserving freedom to operate. This approach is particularly valuable for non-core technologies that support the main innovation but don't warrant dedicated patent protection themselves.

Strategic patent mapping is essential to identify white spaces in the amorphous metals landscape. This involves analyzing competitor portfolios and determining areas with minimal patent coverage but high commercial potential. For multinational operations, companies should consider jurisdictional differences in patent laws, particularly regarding what constitutes patentable subject matter in materials science across different regions.

The timing of patent filings presents a critical strategic consideration. Early filing secures priority dates but may result in incomplete protection if the technology continues to evolve. Conversely, delayed filing allows for more comprehensive claims but risks competitors establishing prior art. For amorphous metals, where incremental improvements often yield significant performance gains, a staged filing approach may be optimal.

Patent drafting for amorphous metals requires particular attention to composition ranges, processing parameters, and performance metrics. Claims should be structured with primary claims covering broad concepts and dependent claims addressing specific implementations. This creates a defensive perimeter around the core innovation while maintaining flexibility for future developments.

Beyond patents, companies should consider complementary IP protection mechanisms. Trade secrets may be appropriate for manufacturing processes difficult to reverse-engineer, while trademarks can protect brand identity for consumer-facing amorphous metal products. Licensing strategies should also be developed early, determining whether to pursue exclusive licensing, cross-licensing with complementary technology holders, or open innovation approaches.

Regular IP portfolio reviews are necessary to align protection with evolving business objectives. This includes identifying patents to maintain, abandon, or license based on market developments and competitive positioning. For amorphous metals specifically, companies should monitor emerging application areas where existing patents might find unexpected value.

Finally, defensive publication strategies can prevent competitors from patenting incremental innovations while preserving freedom to operate. This approach is particularly valuable for non-core technologies that support the main innovation but don't warrant dedicated patent protection themselves.

Sustainability and Environmental Impact Assessment

The environmental impact of amorphous metals represents a critical dimension in evaluating their overall viability for widespread industrial adoption. Compared to conventional crystalline metals, amorphous metals demonstrate significant sustainability advantages throughout their lifecycle. The production process typically requires less energy consumption due to the elimination of multiple heat treatment steps necessary in traditional metallurgy, potentially reducing carbon emissions by 20-30% depending on the specific alloy system.

Material efficiency constitutes another key environmental benefit. Amorphous metals exhibit superior corrosion resistance and mechanical properties, extending product lifespans and reducing replacement frequency. This durability translates directly into resource conservation and waste reduction across various applications from infrastructure to consumer electronics.

Recycling capabilities of amorphous metals present both opportunities and challenges. While their homogeneous structure theoretically simplifies recycling processes, the specialized composition of many amorphous alloys can complicate integration into existing metal recycling streams. Recent research indicates that specialized recycling protocols can recover up to 95% of rare earth elements from certain amorphous metal formulations, addressing critical material supply concerns.

Life cycle assessment (LCA) studies comparing amorphous metal components to their crystalline counterparts in electrical transformers show energy savings of approximately 70% over a 20-year operational period. These efficiency gains derive primarily from reduced core losses and improved thermal performance, demonstrating how environmental benefits extend beyond manufacturing into the use phase.

Water usage in amorphous metal production deserves particular attention. The rapid solidification techniques employed typically require sophisticated cooling systems, potentially increasing water consumption. However, closed-loop cooling technologies developed specifically for amorphous metal casting have demonstrated water usage reductions of up to 60% compared to conventional methods.

Regulatory frameworks increasingly recognize the environmental advantages of amorphous metals. Several jurisdictions now offer incentives for technologies that incorporate these materials, particularly in energy infrastructure applications where their efficiency characteristics align with carbon reduction goals. This regulatory support accelerates adoption while simultaneously encouraging further sustainability innovations in manufacturing processes.

Future research directions should prioritize developing amorphous metal compositions that maintain performance characteristics while eliminating environmentally problematic elements such as beryllium and certain rare earth metals, further enhancing their sustainability profile and ensuring their compatibility with circular economy principles.

Material efficiency constitutes another key environmental benefit. Amorphous metals exhibit superior corrosion resistance and mechanical properties, extending product lifespans and reducing replacement frequency. This durability translates directly into resource conservation and waste reduction across various applications from infrastructure to consumer electronics.

Recycling capabilities of amorphous metals present both opportunities and challenges. While their homogeneous structure theoretically simplifies recycling processes, the specialized composition of many amorphous alloys can complicate integration into existing metal recycling streams. Recent research indicates that specialized recycling protocols can recover up to 95% of rare earth elements from certain amorphous metal formulations, addressing critical material supply concerns.

Life cycle assessment (LCA) studies comparing amorphous metal components to their crystalline counterparts in electrical transformers show energy savings of approximately 70% over a 20-year operational period. These efficiency gains derive primarily from reduced core losses and improved thermal performance, demonstrating how environmental benefits extend beyond manufacturing into the use phase.

Water usage in amorphous metal production deserves particular attention. The rapid solidification techniques employed typically require sophisticated cooling systems, potentially increasing water consumption. However, closed-loop cooling technologies developed specifically for amorphous metal casting have demonstrated water usage reductions of up to 60% compared to conventional methods.

Regulatory frameworks increasingly recognize the environmental advantages of amorphous metals. Several jurisdictions now offer incentives for technologies that incorporate these materials, particularly in energy infrastructure applications where their efficiency characteristics align with carbon reduction goals. This regulatory support accelerates adoption while simultaneously encouraging further sustainability innovations in manufacturing processes.

Future research directions should prioritize developing amorphous metal compositions that maintain performance characteristics while eliminating environmentally problematic elements such as beryllium and certain rare earth metals, further enhancing their sustainability profile and ensuring their compatibility with circular economy principles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!