Amorphous Metals: Analyzing Market Trends and Industry Adoption

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Development Goals

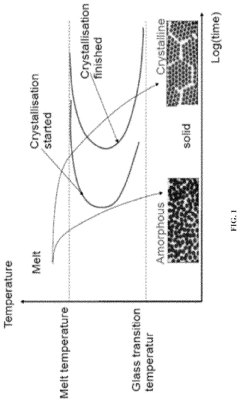

Amorphous metals, also known as metallic glasses or glassy metals, represent a unique class of materials that lack the crystalline structure typical of conventional metals. First discovered in 1960 at Caltech by Pol Duwez, these materials have evolved from laboratory curiosities to commercially viable engineering materials over the past six decades. The development trajectory has been marked by significant breakthroughs in composition design, processing techniques, and fundamental understanding of their atomic structure.

The early research focused primarily on thin ribbons produced by rapid solidification techniques, with cooling rates exceeding 10^6 K/s required to bypass crystallization. The 1990s witnessed a paradigm shift with the development of bulk metallic glasses (BMGs), which could be produced at much lower cooling rates, enabling the creation of thicker sections and more complex geometries. This advancement significantly expanded the potential application landscape for amorphous metals.

From a structural perspective, amorphous metals exhibit a disordered atomic arrangement that contributes to their exceptional properties, including high strength, hardness, elastic limit, and corrosion resistance. These characteristics position them as promising candidates for various high-performance applications across multiple industries, from aerospace components to medical implants.

The global research landscape has evolved from fundamental studies to application-oriented development, with major research hubs established in the United States, Japan, China, and Europe. Each region has developed specialized expertise in particular aspects of amorphous metal technology, creating a diverse global knowledge base.

Current development goals in the amorphous metals field are multifaceted. Primary objectives include expanding the compositional range to achieve specific property combinations, enhancing thermal stability to prevent crystallization during service, and developing cost-effective manufacturing processes for large-scale production. Researchers are particularly focused on overcoming the inherent brittleness that has limited widespread adoption in structural applications.

Another critical development goal involves establishing standardized testing and characterization methods specific to amorphous metals, as conventional metallurgical approaches often prove inadequate for these unique materials. This standardization would facilitate quality control and accelerate industry adoption.

The long-term vision for amorphous metals encompasses their integration into mainstream manufacturing processes, potentially revolutionizing industries that require materials with exceptional mechanical properties, wear resistance, and corrosion performance. Achieving this vision requires coordinated efforts across the value chain, from fundamental research to application engineering and market development.

The early research focused primarily on thin ribbons produced by rapid solidification techniques, with cooling rates exceeding 10^6 K/s required to bypass crystallization. The 1990s witnessed a paradigm shift with the development of bulk metallic glasses (BMGs), which could be produced at much lower cooling rates, enabling the creation of thicker sections and more complex geometries. This advancement significantly expanded the potential application landscape for amorphous metals.

From a structural perspective, amorphous metals exhibit a disordered atomic arrangement that contributes to their exceptional properties, including high strength, hardness, elastic limit, and corrosion resistance. These characteristics position them as promising candidates for various high-performance applications across multiple industries, from aerospace components to medical implants.

The global research landscape has evolved from fundamental studies to application-oriented development, with major research hubs established in the United States, Japan, China, and Europe. Each region has developed specialized expertise in particular aspects of amorphous metal technology, creating a diverse global knowledge base.

Current development goals in the amorphous metals field are multifaceted. Primary objectives include expanding the compositional range to achieve specific property combinations, enhancing thermal stability to prevent crystallization during service, and developing cost-effective manufacturing processes for large-scale production. Researchers are particularly focused on overcoming the inherent brittleness that has limited widespread adoption in structural applications.

Another critical development goal involves establishing standardized testing and characterization methods specific to amorphous metals, as conventional metallurgical approaches often prove inadequate for these unique materials. This standardization would facilitate quality control and accelerate industry adoption.

The long-term vision for amorphous metals encompasses their integration into mainstream manufacturing processes, potentially revolutionizing industries that require materials with exceptional mechanical properties, wear resistance, and corrosion performance. Achieving this vision requires coordinated efforts across the value chain, from fundamental research to application engineering and market development.

Market Demand Analysis for Amorphous Metal Applications

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by their unique properties and expanding applications across multiple industries. Current market analysis indicates that the amorphous metals market is projected to grow at a compound annual growth rate of 8.2% through 2028, with the global market value expected to reach approximately 645 million USD by that time.

The electronics and electrical sector represents the largest application segment, accounting for nearly 40% of the total market demand. This dominance stems from the superior magnetic properties of amorphous metals, particularly iron-based compositions, which enable the production of highly efficient transformers and power distribution systems. Energy efficiency regulations worldwide are accelerating adoption in this sector, with utility companies increasingly specifying amorphous metal transformers to reduce energy losses.

Aerospace and defense applications constitute the fastest-growing segment, with demand increasing as manufacturers seek lightweight, high-strength materials with exceptional corrosion resistance. The ability of amorphous metals to maintain structural integrity under extreme conditions makes them particularly valuable for critical components in aircraft engines and military equipment.

Medical device manufacturing represents another promising growth area, where the biocompatibility and wear resistance of certain amorphous metal compositions are driving adoption in implantable devices, surgical instruments, and diagnostic equipment. The market in this sector is expected to double within the next five years as regulatory approvals increase.

Regionally, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea, where substantial investments in electrical infrastructure and manufacturing capabilities have created strong demand. North America follows with roughly 30% market share, with particular strength in aerospace and medical applications.

Consumer electronics represents an emerging application area with significant growth potential, as manufacturers explore amorphous metals for smartphone frames, wearable devices, and other consumer products requiring both strength and aesthetic appeal. This segment is projected to grow at over 10% annually for the next decade.

Despite positive growth indicators, market penetration faces challenges including high production costs, limited manufacturing capacity for large-scale components, and competition from established materials. The price premium for amorphous metals remains a significant barrier to wider adoption, particularly in cost-sensitive applications where conventional materials meet minimum performance requirements.

The electronics and electrical sector represents the largest application segment, accounting for nearly 40% of the total market demand. This dominance stems from the superior magnetic properties of amorphous metals, particularly iron-based compositions, which enable the production of highly efficient transformers and power distribution systems. Energy efficiency regulations worldwide are accelerating adoption in this sector, with utility companies increasingly specifying amorphous metal transformers to reduce energy losses.

Aerospace and defense applications constitute the fastest-growing segment, with demand increasing as manufacturers seek lightweight, high-strength materials with exceptional corrosion resistance. The ability of amorphous metals to maintain structural integrity under extreme conditions makes them particularly valuable for critical components in aircraft engines and military equipment.

Medical device manufacturing represents another promising growth area, where the biocompatibility and wear resistance of certain amorphous metal compositions are driving adoption in implantable devices, surgical instruments, and diagnostic equipment. The market in this sector is expected to double within the next five years as regulatory approvals increase.

Regionally, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea, where substantial investments in electrical infrastructure and manufacturing capabilities have created strong demand. North America follows with roughly 30% market share, with particular strength in aerospace and medical applications.

Consumer electronics represents an emerging application area with significant growth potential, as manufacturers explore amorphous metals for smartphone frames, wearable devices, and other consumer products requiring both strength and aesthetic appeal. This segment is projected to grow at over 10% annually for the next decade.

Despite positive growth indicators, market penetration faces challenges including high production costs, limited manufacturing capacity for large-scale components, and competition from established materials. The price premium for amorphous metals remains a significant barrier to wider adoption, particularly in cost-sensitive applications where conventional materials meet minimum performance requirements.

Technical Challenges and Global Development Status

Amorphous metals, also known as metallic glasses, face significant technical challenges despite their promising properties. The primary obstacle remains the critical cooling rate required for glass formation, which limits the size of components that can be produced. While recent advancements have improved glass-forming ability through multi-component alloy systems, manufacturing large-scale amorphous metal parts remains difficult. This size limitation restricts widespread industrial adoption, particularly in structural applications where larger components are necessary.

Material brittleness presents another major challenge. Though amorphous metals exhibit exceptional strength, their limited ductility and tendency toward catastrophic failure under certain loading conditions hampers reliability in critical applications. Research efforts are focused on developing composite structures that combine the strength of amorphous phases with the ductility of crystalline phases, but optimizing these compositions remains complex.

Cost factors significantly impact commercial viability. The high-purity raw materials and specialized processing equipment required for amorphous metal production result in substantially higher costs compared to conventional metals. This cost differential has confined amorphous metals primarily to high-value niche applications where performance benefits justify premium pricing.

Globally, amorphous metals research and development demonstrates distinct regional patterns. The United States leads in fundamental research and specialized applications, particularly through institutions like Caltech and companies such as Liquidmetal Technologies. Japan maintains significant expertise in ribbon-form amorphous metals, with companies like Hitachi Metals dominating certain market segments. China has emerged as a rapidly growing force, investing heavily in both research infrastructure and manufacturing capabilities for amorphous metal products.

Europe contributes substantially through research institutions in Germany, France, and Switzerland, focusing on specialized applications in precision instruments and luxury goods. South Korea has developed notable capabilities in amorphous soft magnetic materials for electronic applications. This global distribution of expertise has created specialized centers of excellence, though knowledge transfer between regions remains limited by intellectual property considerations and competitive dynamics.

Recent years have witnessed increased international collaboration through joint research initiatives and industry partnerships, particularly in addressing fundamental challenges like improving glass-forming ability and enhancing mechanical properties. However, standardization remains underdeveloped, with different regions employing varied testing methodologies and material specifications, complicating global market development and technology transfer.

Material brittleness presents another major challenge. Though amorphous metals exhibit exceptional strength, their limited ductility and tendency toward catastrophic failure under certain loading conditions hampers reliability in critical applications. Research efforts are focused on developing composite structures that combine the strength of amorphous phases with the ductility of crystalline phases, but optimizing these compositions remains complex.

Cost factors significantly impact commercial viability. The high-purity raw materials and specialized processing equipment required for amorphous metal production result in substantially higher costs compared to conventional metals. This cost differential has confined amorphous metals primarily to high-value niche applications where performance benefits justify premium pricing.

Globally, amorphous metals research and development demonstrates distinct regional patterns. The United States leads in fundamental research and specialized applications, particularly through institutions like Caltech and companies such as Liquidmetal Technologies. Japan maintains significant expertise in ribbon-form amorphous metals, with companies like Hitachi Metals dominating certain market segments. China has emerged as a rapidly growing force, investing heavily in both research infrastructure and manufacturing capabilities for amorphous metal products.

Europe contributes substantially through research institutions in Germany, France, and Switzerland, focusing on specialized applications in precision instruments and luxury goods. South Korea has developed notable capabilities in amorphous soft magnetic materials for electronic applications. This global distribution of expertise has created specialized centers of excellence, though knowledge transfer between regions remains limited by intellectual property considerations and competitive dynamics.

Recent years have witnessed increased international collaboration through joint research initiatives and industry partnerships, particularly in addressing fundamental challenges like improving glass-forming ability and enhancing mechanical properties. However, standardization remains underdeveloped, with different regions employing varied testing methodologies and material specifications, complicating global market development and technology transfer.

Current Manufacturing Solutions and Techniques

01 Market analysis and forecasting for amorphous metals

Market analysis tools and methods are used to forecast trends in the amorphous metals industry. These include data collection, processing, and analysis techniques to predict market movements, identify growth opportunities, and understand consumer demand patterns. Advanced algorithms and machine learning models help in generating accurate market forecasts, enabling businesses to make informed strategic decisions in the amorphous metals sector.- Market analysis and forecasting for amorphous metals: Various methods and systems are used to analyze and forecast market trends for amorphous metals. These include data collection, processing, and analysis techniques to predict market movements, identify opportunities, and assess risks. Advanced algorithms and machine learning models help in generating accurate forecasts based on historical data and current market conditions, enabling businesses to make informed decisions about investments in amorphous metals technology.

- Supply chain management for amorphous metal products: Effective supply chain management systems are crucial for the amorphous metals market. These systems track raw materials, production processes, inventory levels, and distribution channels. Digital platforms enable real-time monitoring of supply chain activities, helping manufacturers optimize production schedules, reduce costs, and respond quickly to market demands. Improved supply chain visibility also helps in identifying potential disruptions and implementing mitigation strategies.

- Innovation and technological advancements in amorphous metals: The amorphous metals market is driven by continuous innovation and technological advancements. Research and development efforts focus on improving the properties of amorphous metals, such as strength, corrosion resistance, and magnetic characteristics. New manufacturing techniques are being developed to enhance production efficiency and reduce costs. These innovations are expanding the application range of amorphous metals across various industries, including electronics, automotive, and aerospace.

- Market segmentation and competitive analysis: The amorphous metals market is segmented based on product types, applications, and geographical regions. Competitive analysis tools help businesses understand market dynamics, identify key competitors, and develop effective strategies. These tools analyze factors such as pricing strategies, product portfolios, and market share to provide insights into competitive positioning. Understanding market segmentation and competition is essential for businesses to identify niche opportunities and develop targeted marketing approaches.

- Investment strategies and risk management: Various investment strategies and risk management approaches are employed in the amorphous metals market. These include portfolio diversification, hedging techniques, and risk assessment methodologies. Financial models help investors evaluate potential returns and risks associated with investments in amorphous metals technology. Risk management systems monitor market volatility, regulatory changes, and other factors that could impact investment performance, enabling investors to make timely adjustments to their strategies.

02 Investment strategies in amorphous metals markets

Various investment strategies are employed in the amorphous metals market to maximize returns. These include portfolio management approaches, risk assessment methodologies, and investment timing techniques specific to this specialized materials sector. Investment platforms provide tools for analyzing amorphous metals companies, tracking market performance, and executing trades based on market trends and technological developments in the field.Expand Specific Solutions03 Supply chain management for amorphous metals

Supply chain management systems are developed specifically for the amorphous metals industry to optimize production, distribution, and inventory management. These systems track raw materials, monitor manufacturing processes, and manage logistics to ensure efficient delivery to end users. Advanced supply chain technologies help companies respond to market fluctuations, reduce costs, and maintain competitive advantage in the rapidly evolving amorphous metals market.Expand Specific Solutions04 Technological innovations driving market growth

Technological innovations are key drivers of growth in the amorphous metals market. These include new manufacturing processes, improved material properties, and novel applications across various industries. Advancements in rapid solidification techniques, powder metallurgy, and precision casting methods have expanded the potential applications of amorphous metals, creating new market opportunities and driving increased demand for these specialized materials.Expand Specific Solutions05 Digital platforms for amorphous metals trading

Digital platforms are being developed to facilitate trading of amorphous metals and related products. These platforms incorporate e-commerce capabilities, market intelligence tools, and secure transaction processing systems specific to the materials industry. They connect buyers and sellers globally, provide real-time pricing information, and offer analytics to track market trends, enabling more efficient and transparent trading in the amorphous metals marketplace.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The amorphous metals market is currently in a growth phase, with increasing adoption across automotive, electronics, and energy sectors. The global market size is estimated to reach $1.5 billion by 2025, growing at a CAGR of approximately 8%. Technology maturity varies by application, with companies at different development stages. Academic institutions like Zhejiang University and Oklahoma State University are advancing fundamental research, while VACUUMSCHMELZE and Heraeus Amloy Technologies lead in commercial applications. Major corporations including Samsung Electronics, BYD, and General Electric are integrating amorphous metals into their product lines, particularly for energy-efficient transformers and electronic components. Specialized players like Amorphyx and Dongguan Yihao Metal Technology are developing niche applications, indicating the technology's expanding commercial viability across multiple industries.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE (VAC) has established itself as a global leader in amorphous and nanocrystalline soft magnetic materials, particularly through their VITROPERM® and VITROVAC® product lines. Their proprietary rapid solidification technology enables the production of amorphous metal ribbons with cooling rates exceeding 1 million degrees per second, creating materials with no crystalline structure. VAC has developed specialized annealing processes that allow precise control of magnetic properties in their amorphous metals, achieving permeabilities up to 150,000 and core losses below 10 W/kg at 50 Hz. Their manufacturing capabilities include the production of ultra-thin amorphous ribbons down to 15 μm thickness with consistent quality across large production volumes. VAC's amorphous metals are extensively used in high-efficiency transformers, achieving energy savings of up to 70% compared to conventional silicon steel cores. The company has recently expanded their technology to include customized amorphous metal components for electric vehicle power systems, where their materials provide 30-40% reduction in energy losses.

Strengths: Unparalleled expertise in magnetic applications of amorphous metals with established large-scale production capabilities and proven energy efficiency benefits. Their materials show exceptional magnetic properties with low core losses. Weaknesses: Primary focus on magnetic applications limits diversification into structural applications, and their materials typically require specialized handling and processing equipment for implementation.

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed innovative amorphous metal thin-film technology specifically targeted at next-generation display applications. Their Amorphous Metal Nonlinear Resistor (AMNR) and Amorphous Metal Thin Film Transistor (AMTFT) technologies utilize proprietary amorphous metal alloys deposited through specialized physical vapor deposition processes. These amorphous metal components serve as switching elements in display backplanes, offering significant advantages over conventional amorphous silicon or oxide semiconductor technologies. Amorphyx's amorphous metals demonstrate exceptional uniformity at the atomic level, enabling higher manufacturing yields and more consistent performance across large display areas. Their materials exhibit switching speeds up to 100 times faster than amorphous silicon while consuming approximately 50% less power. The company has developed scalable manufacturing processes compatible with existing display production lines, requiring only 3-4 mask steps compared to 5-7 for conventional technologies. Recent advancements include the development of flexible amorphous metal films that maintain electrical properties under repeated bending, opening applications in foldable and rollable displays.

Strengths: Highly specialized application of amorphous metals in display technology with potential for significant market disruption. Their materials offer superior electrical performance and manufacturing simplicity compared to existing solutions. Weaknesses: Relatively narrow focus on display applications limits broader market potential, and as a smaller company, they face challenges in scaling production to meet potential demand from major display manufacturers.

Core Patents and Technical Innovations

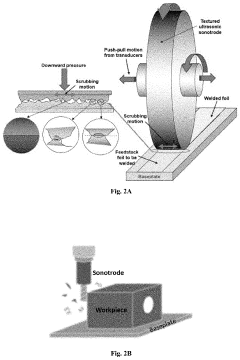

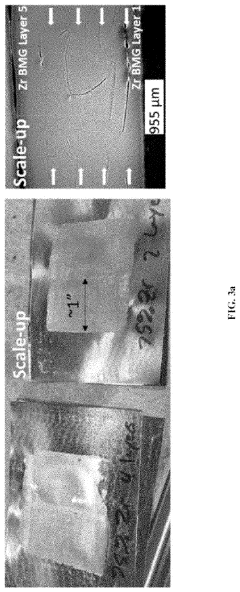

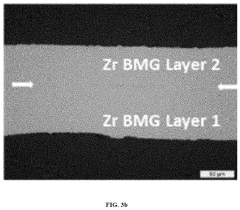

Ultrasonic additive manufacturing of cladded amorphous metal products

PatentActiveUS20230191527A1

Innovation

- Ultrasonic Additive Manufacturing (UAM) is employed to metallurgically bond amorphous metal foils to substrates through plastic deformation, creating a strong, amorphous microstructure with minimal crystallinity and porosity, allowing for the production of ductile and fracture-resistant composite materials with enhanced corrosion and wear resistance.

Hypoeutectic amorphous metal-based materials for additive manufacturing

PatentWO2018218077A1

Innovation

- The development of hypoeutectic amorphous metal alloys with higher main metal content and lower glass forming ability, combined with fast cooling rates in additive manufacturing processes, to produce bulk amorphous metal parts with enhanced toughness and fragility, allowing for the creation of parts with notch toughness greater than 60 MPa m1/2 through processes like powder bed fusion and directed energy deposition.

Sustainability Impact and Environmental Considerations

Amorphous metals, also known as metallic glasses, offer significant sustainability advantages compared to conventional crystalline metals. Their unique atomic structure enables superior mechanical properties while requiring less material input, contributing to resource conservation. The production of amorphous metals typically consumes 30-50% less energy than traditional metal manufacturing processes, resulting in a substantially reduced carbon footprint. This energy efficiency stems from lower melting temperatures and fewer processing steps required during manufacturing.

From a lifecycle perspective, amorphous metals demonstrate exceptional durability and corrosion resistance, extending product lifespans and reducing replacement frequency. Studies indicate that components made from amorphous metal alloys can last up to three times longer than their conventional counterparts in corrosive environments, significantly decreasing waste generation and resource consumption over time. This longevity factor represents a crucial environmental benefit that extends beyond initial production advantages.

Recycling capabilities of amorphous metals further enhance their environmental profile. Unlike many composite materials, amorphous metals can be fully recycled without degradation of their unique properties. The homogeneous atomic structure facilitates cleaner separation during recycling processes, minimizing contamination issues that plague other advanced materials. However, specialized recycling infrastructure for these materials remains underdeveloped, presenting an opportunity for industry investment.

The reduced weight of amorphous metal components, particularly in transportation applications, contributes to fuel efficiency and emissions reduction. When implemented in automotive and aerospace sectors, weight reductions of 15-25% have been documented, translating to meaningful decreases in operational environmental impact. This weight advantage compounds over the operational lifetime of vehicles, representing significant cumulative environmental benefits.

Challenges remain in scaling environmentally-friendly production methods for amorphous metals. Current manufacturing constraints limit production volumes and increase costs, hampering widespread adoption despite environmental advantages. Additionally, comprehensive lifecycle assessment data remains limited, creating uncertainty about total environmental impact across different application scenarios. Industry stakeholders are increasingly collaborating with research institutions to address these knowledge gaps and develop standardized sustainability metrics specific to amorphous metals.

As regulatory frameworks increasingly emphasize environmental performance, amorphous metals' sustainability advantages may become key market differentiators. Forward-thinking companies are already incorporating these materials into their sustainability strategies, recognizing both the environmental benefits and potential regulatory compliance advantages they offer in an increasingly carbon-constrained global economy.

From a lifecycle perspective, amorphous metals demonstrate exceptional durability and corrosion resistance, extending product lifespans and reducing replacement frequency. Studies indicate that components made from amorphous metal alloys can last up to three times longer than their conventional counterparts in corrosive environments, significantly decreasing waste generation and resource consumption over time. This longevity factor represents a crucial environmental benefit that extends beyond initial production advantages.

Recycling capabilities of amorphous metals further enhance their environmental profile. Unlike many composite materials, amorphous metals can be fully recycled without degradation of their unique properties. The homogeneous atomic structure facilitates cleaner separation during recycling processes, minimizing contamination issues that plague other advanced materials. However, specialized recycling infrastructure for these materials remains underdeveloped, presenting an opportunity for industry investment.

The reduced weight of amorphous metal components, particularly in transportation applications, contributes to fuel efficiency and emissions reduction. When implemented in automotive and aerospace sectors, weight reductions of 15-25% have been documented, translating to meaningful decreases in operational environmental impact. This weight advantage compounds over the operational lifetime of vehicles, representing significant cumulative environmental benefits.

Challenges remain in scaling environmentally-friendly production methods for amorphous metals. Current manufacturing constraints limit production volumes and increase costs, hampering widespread adoption despite environmental advantages. Additionally, comprehensive lifecycle assessment data remains limited, creating uncertainty about total environmental impact across different application scenarios. Industry stakeholders are increasingly collaborating with research institutions to address these knowledge gaps and develop standardized sustainability metrics specific to amorphous metals.

As regulatory frameworks increasingly emphasize environmental performance, amorphous metals' sustainability advantages may become key market differentiators. Forward-thinking companies are already incorporating these materials into their sustainability strategies, recognizing both the environmental benefits and potential regulatory compliance advantages they offer in an increasingly carbon-constrained global economy.

Industry Adoption Barriers and Implementation Strategies

Despite the significant technological advantages of amorphous metals, their widespread industry adoption faces several substantial barriers. Manufacturing complexity represents a primary obstacle, as producing amorphous metals requires precise cooling rates exceeding 10^6 K/s to prevent crystallization. This necessitates specialized equipment and expertise that many traditional manufacturing facilities lack, creating a significant entry barrier for potential adopters.

Cost considerations further impede adoption, with current production methods for amorphous metals being 2-5 times more expensive than conventional metal processing. This cost differential is particularly prohibitive for price-sensitive industries and applications where conventional materials remain "good enough" despite being technically inferior.

Scale limitations also present challenges, as most current amorphous metal production is restricted to relatively small components or thin sections due to the critical cooling rate requirements. Industries requiring large structural components find this limitation particularly problematic, forcing them to continue using conventional crystalline metals despite the performance advantages of amorphous alternatives.

Knowledge gaps and risk aversion constitute significant non-technical barriers. Many engineers and designers lack familiarity with amorphous metals' properties and design considerations, leading to reluctance in specifying these materials for new applications. Additionally, industries with stringent certification requirements, such as aerospace and medical devices, face lengthy and costly approval processes for new materials.

Effective implementation strategies to overcome these barriers include developing strategic partnerships between amorphous metal producers and end-users to create industry-specific solutions and demonstration projects. These collaborations can generate valuable application-specific data and reduce perceived implementation risks.

Incremental adoption approaches have proven successful, with companies first implementing amorphous metals in non-critical components before expanding to more crucial applications. This strategy allows organizations to build expertise and confidence while minimizing risk.

Investment in manufacturing innovation represents another critical strategy, with several companies developing improved production techniques such as suction casting and spark plasma sintering that promise to reduce costs and increase production volumes. These innovations could potentially reduce manufacturing costs by 30-40% within the next five years.

Education and technical support initiatives are equally important, with leading manufacturers establishing knowledge transfer programs and providing design assistance to potential customers. These programs help bridge the knowledge gap and accelerate adoption across various industrial sectors.

Cost considerations further impede adoption, with current production methods for amorphous metals being 2-5 times more expensive than conventional metal processing. This cost differential is particularly prohibitive for price-sensitive industries and applications where conventional materials remain "good enough" despite being technically inferior.

Scale limitations also present challenges, as most current amorphous metal production is restricted to relatively small components or thin sections due to the critical cooling rate requirements. Industries requiring large structural components find this limitation particularly problematic, forcing them to continue using conventional crystalline metals despite the performance advantages of amorphous alternatives.

Knowledge gaps and risk aversion constitute significant non-technical barriers. Many engineers and designers lack familiarity with amorphous metals' properties and design considerations, leading to reluctance in specifying these materials for new applications. Additionally, industries with stringent certification requirements, such as aerospace and medical devices, face lengthy and costly approval processes for new materials.

Effective implementation strategies to overcome these barriers include developing strategic partnerships between amorphous metal producers and end-users to create industry-specific solutions and demonstration projects. These collaborations can generate valuable application-specific data and reduce perceived implementation risks.

Incremental adoption approaches have proven successful, with companies first implementing amorphous metals in non-critical components before expanding to more crucial applications. This strategy allows organizations to build expertise and confidence while minimizing risk.

Investment in manufacturing innovation represents another critical strategy, with several companies developing improved production techniques such as suction casting and spark plasma sintering that promise to reduce costs and increase production volumes. These innovations could potentially reduce manufacturing costs by 30-40% within the next five years.

Education and technical support initiatives are equally important, with leading manufacturers establishing knowledge transfer programs and providing design assistance to potential customers. These programs help bridge the knowledge gap and accelerate adoption across various industrial sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!