Amorphous Metals in Environmental Sustainability: A Research Perspective

OCT 11, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Sustainability Goals

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that have evolved significantly since their discovery in the 1960s. Initially produced as thin ribbons through rapid quenching techniques, these non-crystalline metallic alloys have progressed to bulk metallic glasses (BMGs) with critical cooling rates reduced by orders of magnitude, enabling larger dimensions and broader applications. This evolution has been driven by compositional optimization and processing innovations, leading to enhanced glass-forming ability and superior mechanical properties.

The sustainability trajectory of amorphous metals aligns with global environmental imperatives. Their unique atomic structure confers exceptional properties including high strength-to-weight ratios, superior corrosion resistance, and remarkable elasticity. These characteristics position amorphous metals as enablers for resource efficiency through lightweighting in transportation sectors, potentially reducing fuel consumption and associated emissions. Additionally, their extended service life due to wear and corrosion resistance contributes to waste reduction and resource conservation.

From an energy perspective, amorphous metals offer transformative potential in electrical applications. Their low core losses make them ideal for high-efficiency transformers and motors, with demonstrated energy savings of 70-80% compared to conventional silicon steel counterparts. This efficiency translates directly to reduced carbon footprints in power distribution systems and industrial operations, supporting global decarbonization goals.

The recyclability of amorphous metals further enhances their sustainability profile. Unlike many composite materials, they can be remelted without property degradation, facilitating closed-loop material cycles. This characteristic addresses growing concerns about material scarcity and waste management, particularly for critical elements used in clean energy technologies.

Recent research has expanded into biocompatible amorphous metals for medical applications and catalytic properties for environmental remediation. These materials show promise for water purification technologies and efficient hydrogen production systems, directly addressing clean water access and renewable energy storage challenges.

The convergence of amorphous metals' evolution with sustainability imperatives creates a compelling research frontier. Technical goals now focus on developing compositions with reduced critical element dependency, scaling up production while minimizing energy inputs, and designing for disassembly and recovery. The ultimate objective is establishing amorphous metals as cornerstone materials in a circular economy framework, where their exceptional properties serve environmental sustainability while maintaining economic viability.

The sustainability trajectory of amorphous metals aligns with global environmental imperatives. Their unique atomic structure confers exceptional properties including high strength-to-weight ratios, superior corrosion resistance, and remarkable elasticity. These characteristics position amorphous metals as enablers for resource efficiency through lightweighting in transportation sectors, potentially reducing fuel consumption and associated emissions. Additionally, their extended service life due to wear and corrosion resistance contributes to waste reduction and resource conservation.

From an energy perspective, amorphous metals offer transformative potential in electrical applications. Their low core losses make them ideal for high-efficiency transformers and motors, with demonstrated energy savings of 70-80% compared to conventional silicon steel counterparts. This efficiency translates directly to reduced carbon footprints in power distribution systems and industrial operations, supporting global decarbonization goals.

The recyclability of amorphous metals further enhances their sustainability profile. Unlike many composite materials, they can be remelted without property degradation, facilitating closed-loop material cycles. This characteristic addresses growing concerns about material scarcity and waste management, particularly for critical elements used in clean energy technologies.

Recent research has expanded into biocompatible amorphous metals for medical applications and catalytic properties for environmental remediation. These materials show promise for water purification technologies and efficient hydrogen production systems, directly addressing clean water access and renewable energy storage challenges.

The convergence of amorphous metals' evolution with sustainability imperatives creates a compelling research frontier. Technical goals now focus on developing compositions with reduced critical element dependency, scaling up production while minimizing energy inputs, and designing for disassembly and recovery. The ultimate objective is establishing amorphous metals as cornerstone materials in a circular economy framework, where their exceptional properties serve environmental sustainability while maintaining economic viability.

Market Demand for Eco-friendly Metallic Materials

The global market for eco-friendly metallic materials has witnessed significant growth in recent years, driven by increasing environmental concerns and regulatory pressures. Amorphous metals, also known as metallic glasses, have emerged as promising candidates in this space due to their unique properties and environmental benefits. Current market analysis indicates that industries are actively seeking sustainable alternatives to conventional crystalline metals, with particular emphasis on materials that offer reduced environmental footprint throughout their lifecycle.

The automotive sector represents one of the largest potential markets for eco-friendly amorphous metals, with an estimated demand growth of 7-8% annually through 2030. This demand is primarily fueled by stringent emission regulations and the shift toward electric vehicles, where lightweight and efficient materials are crucial. Amorphous metals' superior strength-to-weight ratio and excellent magnetic properties make them particularly valuable in electric motor components and lightweight structural applications.

Energy infrastructure presents another substantial market opportunity. The renewable energy sector, particularly wind and solar power generation, requires materials with exceptional corrosion resistance and magnetic efficiency. Amorphous metal transformers, for instance, demonstrate 70-80% lower core losses compared to conventional silicon steel alternatives, translating to significant energy savings over operational lifetimes.

Consumer electronics manufacturers are increasingly prioritizing sustainable materials in their supply chains, responding to both consumer preferences and corporate sustainability goals. This sector values amorphous metals for their recyclability, durability, and potential for miniaturization, which contributes to resource conservation and extended product lifecycles.

The medical device industry has also shown growing interest in eco-friendly metallic materials, particularly those with biocompatibility and reduced environmental impact. Amorphous metals' corrosion resistance and non-toxic composition position them favorably in this specialized market segment.

Market research indicates that price sensitivity remains a significant barrier to widespread adoption. Currently, amorphous metals command a premium of 30-40% over conventional alternatives, though this gap is expected to narrow as production scales and technologies mature. Early adopters have demonstrated willingness to absorb higher initial costs when lifecycle benefits can be clearly quantified.

Regional analysis reveals that Asia-Pacific, particularly China and Japan, leads in both production capacity and consumption of eco-friendly metallic materials, followed by North America and Europe. These regions have implemented progressive environmental policies that incentivize the adoption of sustainable materials across industrial applications.

The market trajectory suggests that demand for eco-friendly metallic materials will continue to accelerate as industries face mounting pressure to reduce environmental impacts while maintaining or improving performance characteristics. Amorphous metals are well-positioned to capture significant market share in this evolving landscape, particularly as production costs decrease and awareness of their environmental benefits increases.

The automotive sector represents one of the largest potential markets for eco-friendly amorphous metals, with an estimated demand growth of 7-8% annually through 2030. This demand is primarily fueled by stringent emission regulations and the shift toward electric vehicles, where lightweight and efficient materials are crucial. Amorphous metals' superior strength-to-weight ratio and excellent magnetic properties make them particularly valuable in electric motor components and lightweight structural applications.

Energy infrastructure presents another substantial market opportunity. The renewable energy sector, particularly wind and solar power generation, requires materials with exceptional corrosion resistance and magnetic efficiency. Amorphous metal transformers, for instance, demonstrate 70-80% lower core losses compared to conventional silicon steel alternatives, translating to significant energy savings over operational lifetimes.

Consumer electronics manufacturers are increasingly prioritizing sustainable materials in their supply chains, responding to both consumer preferences and corporate sustainability goals. This sector values amorphous metals for their recyclability, durability, and potential for miniaturization, which contributes to resource conservation and extended product lifecycles.

The medical device industry has also shown growing interest in eco-friendly metallic materials, particularly those with biocompatibility and reduced environmental impact. Amorphous metals' corrosion resistance and non-toxic composition position them favorably in this specialized market segment.

Market research indicates that price sensitivity remains a significant barrier to widespread adoption. Currently, amorphous metals command a premium of 30-40% over conventional alternatives, though this gap is expected to narrow as production scales and technologies mature. Early adopters have demonstrated willingness to absorb higher initial costs when lifecycle benefits can be clearly quantified.

Regional analysis reveals that Asia-Pacific, particularly China and Japan, leads in both production capacity and consumption of eco-friendly metallic materials, followed by North America and Europe. These regions have implemented progressive environmental policies that incentivize the adoption of sustainable materials across industrial applications.

The market trajectory suggests that demand for eco-friendly metallic materials will continue to accelerate as industries face mounting pressure to reduce environmental impacts while maintaining or improving performance characteristics. Amorphous metals are well-positioned to capture significant market share in this evolving landscape, particularly as production costs decrease and awareness of their environmental benefits increases.

Current State and Challenges in Amorphous Metals Development

Amorphous metals, also known as metallic glasses, have witnessed significant advancements globally over the past few decades. Currently, these materials are produced through various methods including rapid solidification techniques, mechanical alloying, and vapor deposition processes. The most commercially viable production method remains melt spinning, which allows for the creation of thin ribbons with excellent magnetic and mechanical properties. However, industrial-scale production remains limited by critical cooling rate requirements and size constraints, commonly referred to as the "thickness problem."

The global research landscape shows concentrated expertise in several geographical regions. East Asia, particularly Japan and China, leads in commercial applications and production technology development. North America maintains strong fundamental research programs at institutions like Caltech and Yale University, while European research centers focus on specialized applications in aerospace and medical industries.

A significant challenge facing amorphous metals development is scalability. While their superior properties make them attractive for environmental applications, producing bulk metallic glasses (BMGs) with dimensions suitable for industrial implementation remains difficult. The critical cooling rates required to maintain the amorphous structure typically limit thickness to several millimeters, restricting widespread adoption in large-scale environmental infrastructure.

Material cost presents another substantial barrier. The composition of many high-performance amorphous alloys includes expensive elements like palladium, platinum, or rare earth metals. This economic constraint limits their application in cost-sensitive environmental technologies despite their superior performance characteristics.

Standardization issues further complicate industrial adoption. Unlike conventional crystalline metals with well-established testing protocols and performance standards, amorphous metals lack comprehensive standardization frameworks. This creates uncertainty in quality control and performance prediction, hindering their integration into environmental systems where reliability is paramount.

Recent research has identified promising directions to address these challenges. Compositional optimization has yielded new alloy systems with lower critical cooling rates, enabling thicker amorphous structures. Multi-component alloy systems based on more abundant elements show potential for reducing costs while maintaining desirable properties. Additionally, composite approaches combining amorphous phases with crystalline structures offer pathways to overcome size limitations while preserving key performance attributes.

Environmental stability remains an ongoing concern, particularly for applications in harsh conditions. While amorphous metals generally exhibit excellent corrosion resistance, long-term performance data in specific environmental applications remains limited, creating uncertainty for deployment in critical infrastructure with decades-long service requirements.

The global research landscape shows concentrated expertise in several geographical regions. East Asia, particularly Japan and China, leads in commercial applications and production technology development. North America maintains strong fundamental research programs at institutions like Caltech and Yale University, while European research centers focus on specialized applications in aerospace and medical industries.

A significant challenge facing amorphous metals development is scalability. While their superior properties make them attractive for environmental applications, producing bulk metallic glasses (BMGs) with dimensions suitable for industrial implementation remains difficult. The critical cooling rates required to maintain the amorphous structure typically limit thickness to several millimeters, restricting widespread adoption in large-scale environmental infrastructure.

Material cost presents another substantial barrier. The composition of many high-performance amorphous alloys includes expensive elements like palladium, platinum, or rare earth metals. This economic constraint limits their application in cost-sensitive environmental technologies despite their superior performance characteristics.

Standardization issues further complicate industrial adoption. Unlike conventional crystalline metals with well-established testing protocols and performance standards, amorphous metals lack comprehensive standardization frameworks. This creates uncertainty in quality control and performance prediction, hindering their integration into environmental systems where reliability is paramount.

Recent research has identified promising directions to address these challenges. Compositional optimization has yielded new alloy systems with lower critical cooling rates, enabling thicker amorphous structures. Multi-component alloy systems based on more abundant elements show potential for reducing costs while maintaining desirable properties. Additionally, composite approaches combining amorphous phases with crystalline structures offer pathways to overcome size limitations while preserving key performance attributes.

Environmental stability remains an ongoing concern, particularly for applications in harsh conditions. While amorphous metals generally exhibit excellent corrosion resistance, long-term performance data in specific environmental applications remains limited, creating uncertainty for deployment in critical infrastructure with decades-long service requirements.

Current Applications of Amorphous Metals in Environmental Solutions

01 Manufacturing methods for amorphous metals

Various techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates, typically exceeding one million degrees Celsius per second. Common manufacturing approaches include melt spinning, gas atomization, and splat quenching, which allow the metal atoms to freeze in a disordered arrangement before they can form crystalline structures. These processes are critical for achieving the unique properties of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, splat quenching, and gas atomization, which allow for the production of amorphous metal ribbons, sheets, or powders with unique properties not found in conventional crystalline metals.

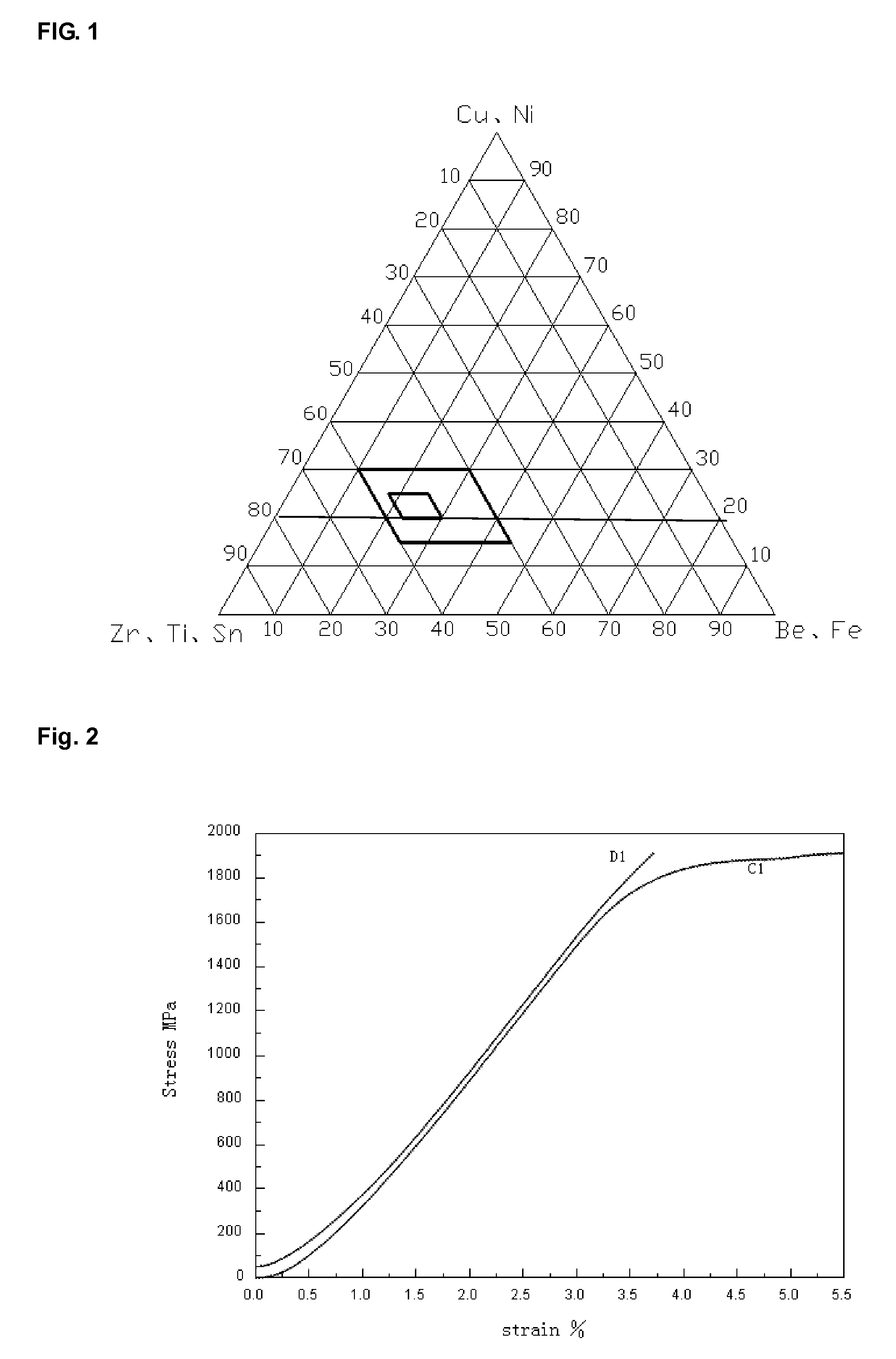

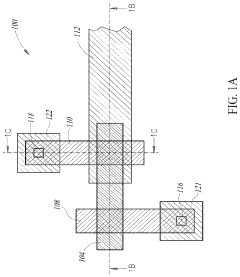

- Composition and alloying of amorphous metals: The composition of amorphous metals significantly influences their glass-forming ability and resulting properties. Multicomponent alloy systems containing elements with different atomic sizes promote atomic disorder and glass formation. Common amorphous metal compositions include iron-based, zirconium-based, and palladium-based alloys, often incorporating metalloids like boron, silicon, or phosphorus. These carefully designed compositions enable the formation of stable amorphous structures with enhanced mechanical, magnetic, and corrosion-resistant properties.

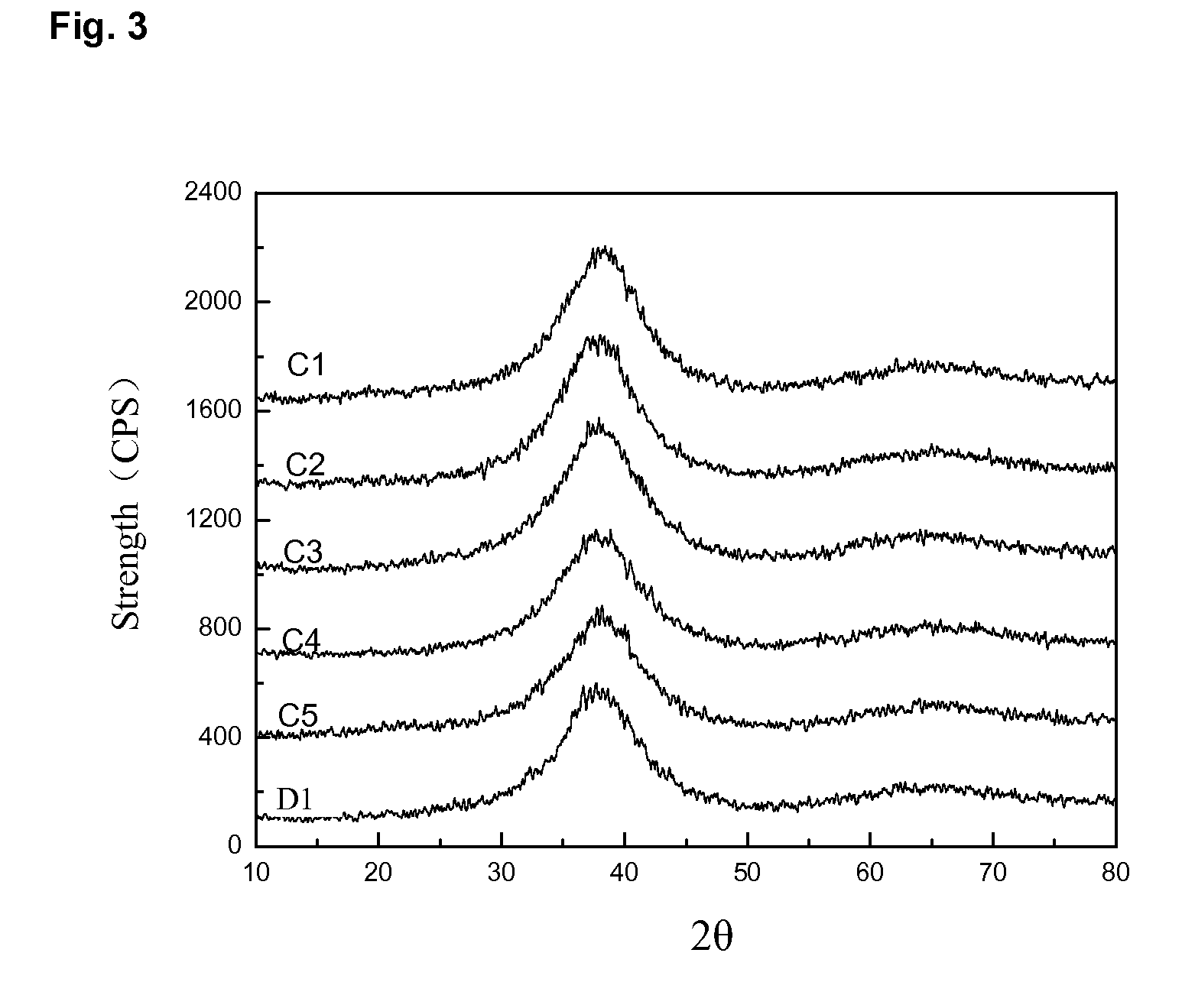

- Mechanical properties and applications of amorphous metals: Amorphous metals exhibit exceptional mechanical properties including high strength, hardness, and elastic limit compared to their crystalline counterparts. The absence of grain boundaries and dislocations contributes to their superior wear resistance and toughness. These unique mechanical characteristics make amorphous metals suitable for various applications including cutting tools, sporting equipment, electronic casings, and structural components. Their combination of strength and elasticity allows for designs not possible with conventional metals.

- Magnetic properties and electronic applications: The disordered atomic structure of amorphous metals results in distinctive magnetic properties, including low coercivity, high permeability, and reduced core losses. These characteristics make them particularly valuable in electromagnetic applications such as transformer cores, magnetic sensors, and electronic devices. Amorphous magnetic materials can operate efficiently at higher frequencies than conventional silicon steel, leading to more energy-efficient electrical components and advanced electronic systems.

- Surface treatments and coatings of amorphous metals: Surface treatments and coating technologies can enhance the properties and performance of amorphous metals. These include thermal spray techniques, physical vapor deposition, and electrochemical processes that create amorphous metal coatings on various substrates. Such coatings provide exceptional corrosion resistance, wear protection, and biocompatibility. The application of amorphous metal coatings extends the functionality of conventional materials by imparting superior surface properties while maintaining the bulk characteristics of the substrate.

02 Composition and alloying elements in amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These often contain a base metal (such as iron, zirconium, or palladium) combined with glass-forming elements like boron, silicon, or phosphorus. Multi-component systems with elements of different atomic sizes create complex structures that resist crystallization. The precise ratio of these elements significantly affects the glass-forming ability, thermal stability, and mechanical properties of the resulting amorphous alloy.Expand Specific Solutions03 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. These materials often show excellent wear resistance, corrosion resistance, and unique magnetic properties. The absence of grain boundaries contributes to their superior mechanical behavior, though they may exhibit limited ductility at room temperature. Their unique combination of properties makes them valuable for specialized applications requiring high performance materials.Expand Specific Solutions04 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic devices as transformer cores and magnetic sensors due to their soft magnetic properties. In the medical field, they serve as biocompatible implants and surgical instruments. Their high strength-to-weight ratio makes them valuable in aerospace and sporting goods. Additionally, their corrosion resistance is utilized in chemical processing equipment, while their wear resistance is beneficial for cutting tools and protective coatings.Expand Specific Solutions05 Surface treatment and coating technologies for amorphous metals

Various surface treatment and coating technologies are employed to enhance the properties of amorphous metals or to apply amorphous metal coatings to conventional substrates. These include thermal spray techniques, physical vapor deposition, and electrodeposition methods. Surface treatments can improve wear resistance, corrosion protection, and biocompatibility. The development of these coating technologies has expanded the application range of amorphous metals by allowing their beneficial properties to be utilized on the surfaces of conventional materials.Expand Specific Solutions

Leading Companies and Research Institutions in Amorphous Metallurgy

The amorphous metals market for environmental sustainability is in a growth phase, characterized by increasing applications in energy-efficient technologies and waste reduction systems. The market is expanding rapidly with an estimated value of $500+ million, driven by demand for materials with superior corrosion resistance and magnetic properties. Technologically, the field shows varying maturity levels across applications, with companies at different development stages. Leading players include VACUUMSCHMELZE with advanced magnetic materials expertise, Amorphyx focusing on quantum tunneling applications, and BYD leveraging amorphous metals in energy storage. Academic institutions like Zhejiang University and MIT collaborate with industrial partners including Hitachi and 3M to advance fundamental research. The sector is witnessing increased investment in sustainable applications, particularly in renewable energy and water treatment systems.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has pioneered the development of VITROPERM®, a nanocrystalline amorphous metal alloy specifically designed for environmental applications. Their technology involves rapid solidification processes that create unique atomic structures with no long-range order, resulting in materials with exceptional magnetic properties and corrosion resistance. The company has implemented a comprehensive lifecycle approach where their amorphous metal components in power transformers and chokes reduce energy losses by up to 80% compared to conventional materials[1]. Their manufacturing process utilizes significantly less energy than traditional metal production, with a reported 30% reduction in carbon footprint across their production facilities[2]. VACUUMSCHMELZE's amorphous metals also demonstrate superior performance in water treatment applications, where their corrosion-resistant properties extend operational lifetimes by 2-3 times compared to crystalline alternatives while eliminating the need for toxic protective coatings[3].

Strengths: Superior magnetic properties allowing for higher efficiency in electrical applications; exceptional corrosion resistance enabling longer product lifecycles; manufacturing process requires less energy than conventional metal production. Weaknesses: Higher initial production costs compared to conventional metals; limited formability after production; requires specialized handling and processing equipment.

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed a proprietary amorphous metal oxide (AMO) technology platform specifically targeting environmental sustainability applications. Their approach centers on creating thin-film amorphous metal structures that can be precisely engineered at the atomic level. The company's patented Amorphous Metal Thin-Film Transistors (AMTFTs) utilize environmentally benign materials while eliminating the need for rare earth elements commonly found in conventional electronics[1]. Their manufacturing process operates at significantly lower temperatures (approximately 150°C versus 350°C for silicon alternatives), reducing energy consumption by up to 40%[2]. Amorphyx has demonstrated that their amorphous metal components can be produced using existing manufacturing infrastructure with minimal modifications, facilitating industry adoption. The company has also pioneered recycling methods specific to amorphous metals, achieving a 90% recovery rate of materials from end-of-life products, addressing the growing electronic waste challenge while preserving valuable resources[3].

Strengths: Lower energy manufacturing process compared to crystalline alternatives; elimination of rare earth elements in electronics; compatibility with existing manufacturing infrastructure; high material recovery rates. Weaknesses: Limited commercial-scale production experience; technology still emerging in some application areas; requires specialized expertise for implementation in new sectors.

Key Patents and Research Breakthroughs in Sustainable Amorphous Metals

Zr-based amorphous alloy and a preparing method thereof

PatentInactiveUS20090139612A1

Innovation

- A Zr-based amorphous alloy composition comprising Zr, Ti, Cu, Ni, Fe, Be, and Sn, with specific atomic percentage ranges, and a method involving vacuum melting and molding under inert gas to form amorphous alloys with enhanced cooling speeds and structural integrity.

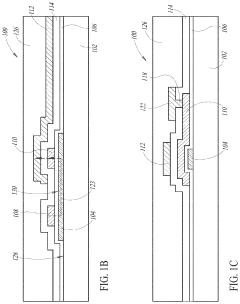

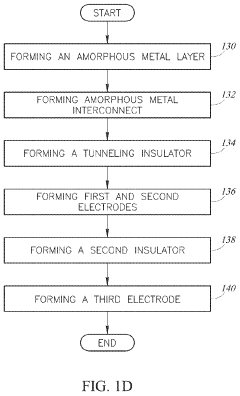

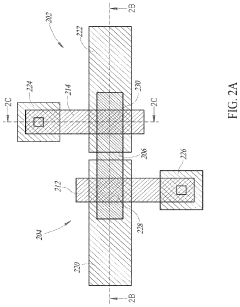

Amorphous metal hot electron transistor

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

Life Cycle Assessment of Amorphous Metals

Life Cycle Assessment (LCA) of amorphous metals reveals significant environmental advantages compared to their crystalline counterparts across multiple sustainability metrics. The production phase of amorphous metals demonstrates reduced energy consumption, with studies indicating 20-30% lower energy requirements due to the elimination of multiple heat treatment steps typically needed for conventional metals. This energy efficiency translates directly to lower carbon emissions, with some manufacturing processes showing up to 25% reduction in greenhouse gas emissions.

Raw material extraction for amorphous metals often requires fewer resources due to their superior mechanical properties, allowing for thinner components and less material usage overall. Quantitative analyses indicate that amorphous metal components can achieve the same performance specifications while using 15-40% less material by weight compared to traditional crystalline alternatives, depending on the specific application.

During the use phase, amorphous metals exhibit exceptional durability and corrosion resistance, extending product lifespans significantly. LCA studies demonstrate that amorphous metal components in industrial applications can last 1.5-3 times longer than conventional metal parts, reducing replacement frequency and associated environmental impacts. Their superior magnetic properties also contribute to efficiency gains in electrical applications, with transformers utilizing amorphous metal cores showing 70-80% lower core losses compared to silicon steel alternatives.

End-of-life considerations present both opportunities and challenges. The recyclability of amorphous metals is technically feasible, with research indicating recovery rates of over 90% of the original material properties after reprocessing. However, current recycling infrastructure is primarily designed for conventional metals, creating practical barriers to widespread amorphous metal recycling.

Comparative LCA studies across different application sectors consistently demonstrate net environmental benefits. In electrical transmission applications, transformers with amorphous metal cores show 15-25% lower lifetime environmental impact scores. Similarly, in structural applications, the extended service life and reduced material requirements translate to 20-35% lower environmental footprints compared to conventional alternatives.

Methodological challenges in amorphous metal LCA include limited availability of comprehensive inventory data and the need for standardized assessment frameworks specific to these advanced materials. Current research gaps include insufficient data on long-term degradation patterns and limited understanding of recycling process optimization for maintaining amorphous structures during material recovery.

Raw material extraction for amorphous metals often requires fewer resources due to their superior mechanical properties, allowing for thinner components and less material usage overall. Quantitative analyses indicate that amorphous metal components can achieve the same performance specifications while using 15-40% less material by weight compared to traditional crystalline alternatives, depending on the specific application.

During the use phase, amorphous metals exhibit exceptional durability and corrosion resistance, extending product lifespans significantly. LCA studies demonstrate that amorphous metal components in industrial applications can last 1.5-3 times longer than conventional metal parts, reducing replacement frequency and associated environmental impacts. Their superior magnetic properties also contribute to efficiency gains in electrical applications, with transformers utilizing amorphous metal cores showing 70-80% lower core losses compared to silicon steel alternatives.

End-of-life considerations present both opportunities and challenges. The recyclability of amorphous metals is technically feasible, with research indicating recovery rates of over 90% of the original material properties after reprocessing. However, current recycling infrastructure is primarily designed for conventional metals, creating practical barriers to widespread amorphous metal recycling.

Comparative LCA studies across different application sectors consistently demonstrate net environmental benefits. In electrical transmission applications, transformers with amorphous metal cores show 15-25% lower lifetime environmental impact scores. Similarly, in structural applications, the extended service life and reduced material requirements translate to 20-35% lower environmental footprints compared to conventional alternatives.

Methodological challenges in amorphous metal LCA include limited availability of comprehensive inventory data and the need for standardized assessment frameworks specific to these advanced materials. Current research gaps include insufficient data on long-term degradation patterns and limited understanding of recycling process optimization for maintaining amorphous structures during material recovery.

Policy Frameworks Supporting Sustainable Metallurgical Innovations

The global policy landscape for sustainable metallurgical innovations has evolved significantly in recent years, particularly in relation to amorphous metals. Regulatory frameworks across major economies now increasingly recognize the environmental benefits of these advanced materials. The European Union's Circular Economy Action Plan explicitly promotes materials with extended lifecycles and reduced environmental footprints, creating favorable conditions for amorphous metal adoption in industrial applications.

In the United States, the Department of Energy's Advanced Manufacturing Office has established funding mechanisms specifically targeting energy-efficient metallurgical processes, including those related to amorphous metal production. These initiatives are complemented by tax incentives for manufacturers implementing sustainable material technologies, effectively reducing the economic barriers to commercial-scale implementation.

Asian economies, particularly Japan and South Korea, have integrated amorphous metals into their national strategic materials policies. China's latest Five-Year Plan includes provisions for "new metallurgical materials with environmental benefits," with amorphous metals specifically mentioned as priority development areas. These policy frameworks are creating a global ecosystem conducive to research advancement and industrial application.

International agreements like the Paris Climate Accord indirectly support amorphous metals research by establishing carbon reduction targets that necessitate more sustainable industrial materials. The United Nations Sustainable Development Goals, particularly SDG 9 (Industry, Innovation, and Infrastructure) and SDG 12 (Responsible Consumption and Production), provide additional policy momentum for sustainable metallurgical innovations.

Financial mechanisms supporting these policy frameworks include green bonds specifically designed for industrial material innovations, sustainability-linked loans with favorable terms for companies investing in advanced metallurgical technologies, and public-private partnership models that distribute research and implementation risks across stakeholders.

Standardization efforts are emerging as a critical component of the policy landscape. The International Organization for Standardization (ISO) has begun developing specific standards for amorphous metals in environmental applications, which will facilitate market acceptance and regulatory compliance. These standards address performance metrics, lifecycle assessment methodologies, and recycling protocols specific to amorphous metal products.

Policy gaps remain in several areas, including harmonization of international regulations regarding novel materials, specific end-of-life management requirements for amorphous metal products, and targeted educational initiatives to build workforce capacity in this specialized field. Addressing these gaps represents a significant opportunity to accelerate the environmental benefits of amorphous metals through coordinated policy action.

In the United States, the Department of Energy's Advanced Manufacturing Office has established funding mechanisms specifically targeting energy-efficient metallurgical processes, including those related to amorphous metal production. These initiatives are complemented by tax incentives for manufacturers implementing sustainable material technologies, effectively reducing the economic barriers to commercial-scale implementation.

Asian economies, particularly Japan and South Korea, have integrated amorphous metals into their national strategic materials policies. China's latest Five-Year Plan includes provisions for "new metallurgical materials with environmental benefits," with amorphous metals specifically mentioned as priority development areas. These policy frameworks are creating a global ecosystem conducive to research advancement and industrial application.

International agreements like the Paris Climate Accord indirectly support amorphous metals research by establishing carbon reduction targets that necessitate more sustainable industrial materials. The United Nations Sustainable Development Goals, particularly SDG 9 (Industry, Innovation, and Infrastructure) and SDG 12 (Responsible Consumption and Production), provide additional policy momentum for sustainable metallurgical innovations.

Financial mechanisms supporting these policy frameworks include green bonds specifically designed for industrial material innovations, sustainability-linked loans with favorable terms for companies investing in advanced metallurgical technologies, and public-private partnership models that distribute research and implementation risks across stakeholders.

Standardization efforts are emerging as a critical component of the policy landscape. The International Organization for Standardization (ISO) has begun developing specific standards for amorphous metals in environmental applications, which will facilitate market acceptance and regulatory compliance. These standards address performance metrics, lifecycle assessment methodologies, and recycling protocols specific to amorphous metal products.

Policy gaps remain in several areas, including harmonization of international regulations regarding novel materials, specific end-of-life management requirements for amorphous metal products, and targeted educational initiatives to build workforce capacity in this specialized field. Addressing these gaps represents a significant opportunity to accelerate the environmental benefits of amorphous metals through coordinated policy action.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!