Amorphous Metals: Technological Advancement in Heat Exchangers

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metal Heat Exchanger Background and Objectives

Heat exchangers represent a critical component in numerous industrial applications, from power generation to chemical processing. The evolution of heat exchanger technology has been marked by continuous improvements in materials, design, and efficiency. Amorphous metals, also known as metallic glasses, have emerged as a revolutionary material class that promises to transform heat exchanger technology due to their unique structural and thermal properties.

The historical development of heat exchangers began with simple shell-and-tube designs in the early 20th century, progressing through plate heat exchangers in the mid-century, to today's advanced micro-channel and printed circuit heat exchangers. Despite these advancements, conventional heat exchangers face persistent challenges including corrosion, fouling, and efficiency limitations imposed by traditional crystalline metal properties.

Amorphous metals, first discovered in the 1960s, represent a paradigm shift in material science. Unlike conventional metals with ordered crystalline structures, amorphous metals possess a non-crystalline, glass-like atomic arrangement. This distinctive structure confers exceptional properties including superior corrosion resistance, remarkable mechanical strength, and unique thermal characteristics that make them particularly promising for heat exchange applications.

The technological trajectory of amorphous metals in heat exchangers has accelerated significantly in the past decade. Initial research focused primarily on fundamental material properties, while recent efforts have shifted toward practical applications and manufacturing scalability. The development of bulk metallic glasses (BMGs) and the refinement of rapid solidification techniques have been pivotal in enabling the production of amorphous metal components suitable for heat exchanger applications.

The primary objective of this technological advancement is to leverage the superior properties of amorphous metals to create next-generation heat exchangers with enhanced performance metrics. Specifically, the goals include developing heat exchangers with improved thermal efficiency, extended operational lifespan, reduced maintenance requirements, and enhanced resistance to harsh operating environments including high-temperature, high-pressure, and corrosive conditions.

Additionally, amorphous metal heat exchangers aim to address growing industry demands for more compact, lightweight designs that can operate effectively in space-constrained applications. The technology also seeks to contribute to sustainability objectives by improving energy efficiency and reducing the environmental footprint of industrial processes through more effective heat recovery and transfer.

The convergence of advanced manufacturing techniques, computational modeling, and materials science is expected to accelerate innovation in this field, potentially leading to transformative impacts across multiple industries including energy, chemical processing, refrigeration, and automotive sectors.

The historical development of heat exchangers began with simple shell-and-tube designs in the early 20th century, progressing through plate heat exchangers in the mid-century, to today's advanced micro-channel and printed circuit heat exchangers. Despite these advancements, conventional heat exchangers face persistent challenges including corrosion, fouling, and efficiency limitations imposed by traditional crystalline metal properties.

Amorphous metals, first discovered in the 1960s, represent a paradigm shift in material science. Unlike conventional metals with ordered crystalline structures, amorphous metals possess a non-crystalline, glass-like atomic arrangement. This distinctive structure confers exceptional properties including superior corrosion resistance, remarkable mechanical strength, and unique thermal characteristics that make them particularly promising for heat exchange applications.

The technological trajectory of amorphous metals in heat exchangers has accelerated significantly in the past decade. Initial research focused primarily on fundamental material properties, while recent efforts have shifted toward practical applications and manufacturing scalability. The development of bulk metallic glasses (BMGs) and the refinement of rapid solidification techniques have been pivotal in enabling the production of amorphous metal components suitable for heat exchanger applications.

The primary objective of this technological advancement is to leverage the superior properties of amorphous metals to create next-generation heat exchangers with enhanced performance metrics. Specifically, the goals include developing heat exchangers with improved thermal efficiency, extended operational lifespan, reduced maintenance requirements, and enhanced resistance to harsh operating environments including high-temperature, high-pressure, and corrosive conditions.

Additionally, amorphous metal heat exchangers aim to address growing industry demands for more compact, lightweight designs that can operate effectively in space-constrained applications. The technology also seeks to contribute to sustainability objectives by improving energy efficiency and reducing the environmental footprint of industrial processes through more effective heat recovery and transfer.

The convergence of advanced manufacturing techniques, computational modeling, and materials science is expected to accelerate innovation in this field, potentially leading to transformative impacts across multiple industries including energy, chemical processing, refrigeration, and automotive sectors.

Market Demand Analysis for Advanced Heat Exchange Solutions

The global heat exchanger market is experiencing significant growth, driven by increasing demands for energy efficiency across multiple industries. Current market valuations exceed $17 billion, with projections indicating a compound annual growth rate of 6.8% through 2028. This growth is particularly pronounced in sectors requiring advanced thermal management solutions, including power generation, chemical processing, HVAC, and automotive industries.

Energy efficiency regulations worldwide are creating substantial market pull for innovative heat exchange technologies. The European Union's Energy Efficiency Directive and similar policies in North America and Asia have established stringent efficiency standards that conventional heat exchangers struggle to meet. This regulatory landscape has created an estimated $5 billion opportunity specifically for next-generation heat exchange solutions.

Industrial processes represent the largest market segment, accounting for approximately 40% of demand. These applications require heat exchangers capable of withstanding extreme conditions while maintaining optimal thermal performance. The chemical processing industry alone has seen a 12% increase in demand for corrosion-resistant heat exchangers over the past three years, highlighting the need for materials that can withstand aggressive environments.

The renewable energy sector presents perhaps the most promising growth opportunity. Solar thermal systems, geothermal power plants, and waste heat recovery applications collectively represent a rapidly expanding market segment growing at 9.3% annually. These applications demand heat exchangers with exceptional thermal conductivity, durability, and cost-effectiveness – attributes that amorphous metals potentially offer.

Consumer electronics and data center cooling represent emerging high-value niches. With data centers consuming approximately 3% of global electricity and generating enormous heat loads, the demand for compact, highly efficient heat exchange solutions has grown by 15% annually. The miniaturization trend in electronics similarly drives demand for advanced thermal management solutions that can handle increasing power densities.

Cost sensitivity remains a critical market factor. While performance improvements drive adoption in high-end applications, mainstream market penetration requires solutions that balance enhanced performance with competitive pricing. Current premium for advanced heat exchanger technologies averages 30-40% above conventional solutions, a gap that must narrow to achieve broader market adoption.

Regional analysis reveals Asia-Pacific as the fastest-growing market for advanced heat exchange technologies, expanding at 8.2% annually, driven by rapid industrialization and infrastructure development. North America and Europe maintain significant market shares, with particular strength in high-performance applications where regulatory requirements and efficiency standards are most stringent.

Energy efficiency regulations worldwide are creating substantial market pull for innovative heat exchange technologies. The European Union's Energy Efficiency Directive and similar policies in North America and Asia have established stringent efficiency standards that conventional heat exchangers struggle to meet. This regulatory landscape has created an estimated $5 billion opportunity specifically for next-generation heat exchange solutions.

Industrial processes represent the largest market segment, accounting for approximately 40% of demand. These applications require heat exchangers capable of withstanding extreme conditions while maintaining optimal thermal performance. The chemical processing industry alone has seen a 12% increase in demand for corrosion-resistant heat exchangers over the past three years, highlighting the need for materials that can withstand aggressive environments.

The renewable energy sector presents perhaps the most promising growth opportunity. Solar thermal systems, geothermal power plants, and waste heat recovery applications collectively represent a rapidly expanding market segment growing at 9.3% annually. These applications demand heat exchangers with exceptional thermal conductivity, durability, and cost-effectiveness – attributes that amorphous metals potentially offer.

Consumer electronics and data center cooling represent emerging high-value niches. With data centers consuming approximately 3% of global electricity and generating enormous heat loads, the demand for compact, highly efficient heat exchange solutions has grown by 15% annually. The miniaturization trend in electronics similarly drives demand for advanced thermal management solutions that can handle increasing power densities.

Cost sensitivity remains a critical market factor. While performance improvements drive adoption in high-end applications, mainstream market penetration requires solutions that balance enhanced performance with competitive pricing. Current premium for advanced heat exchanger technologies averages 30-40% above conventional solutions, a gap that must narrow to achieve broader market adoption.

Regional analysis reveals Asia-Pacific as the fastest-growing market for advanced heat exchange technologies, expanding at 8.2% annually, driven by rapid industrialization and infrastructure development. North America and Europe maintain significant market shares, with particular strength in high-performance applications where regulatory requirements and efficiency standards are most stringent.

Current Status and Challenges in Amorphous Metal Heat Exchangers

The global landscape of amorphous metal heat exchanger technology reveals significant disparities in development progress. Leading research institutions in the United States, Japan, and several European countries have achieved notable breakthroughs, while emerging economies are gradually increasing their research investments. Currently, laboratory-scale prototypes have demonstrated thermal efficiency improvements of 15-30% compared to conventional materials, with several pilot installations showing promising results in industrial settings.

Despite these advancements, widespread commercial adoption faces substantial technical hurdles. The primary challenge remains the manufacturing scalability of amorphous metal components with consistent properties. Current production methods can reliably produce amorphous metal foils up to 100 micrometers thick, but achieving uniform properties in larger components remains problematic. The rapid cooling rates required (typically 10^4-10^6 K/s) create significant production constraints for heat exchanger geometries.

Material brittleness presents another critical obstacle, as amorphous metals typically exhibit limited ductility compared to crystalline counterparts. This characteristic complicates forming processes and raises concerns about mechanical integrity under thermal cycling conditions. Recent developments in multi-component alloy systems have shown improvements, but the trade-off between thermal conductivity and mechanical properties remains suboptimal.

Corrosion resistance, while theoretically superior in amorphous metals due to their homogeneous structure, has shown inconsistent performance in real-world applications. Studies indicate that certain environmental conditions can trigger localized crystallization, creating vulnerability points for accelerated corrosion. This phenomenon requires further investigation to develop appropriate mitigation strategies.

Cost factors continue to impede market penetration, with current production expenses for amorphous metal heat exchangers estimated at 3-5 times higher than conventional alternatives. The specialized equipment and precise process control required contribute significantly to this cost differential. Economic viability assessments suggest that broader adoption would require either a 40-50% reduction in manufacturing costs or regulatory frameworks that monetize efficiency improvements.

Standardization represents another significant challenge, as the absence of established testing protocols and performance metrics specific to amorphous metal heat exchangers complicates comparative evaluation. Industry stakeholders have initiated collaborative efforts to address this gap, but comprehensive standards remain under development.

The integration of amorphous metal components with existing systems presents compatibility challenges, particularly regarding joining technologies and thermal expansion behavior. Research into specialized welding techniques and hybrid designs shows promise but requires further refinement before implementation in critical applications.

Despite these advancements, widespread commercial adoption faces substantial technical hurdles. The primary challenge remains the manufacturing scalability of amorphous metal components with consistent properties. Current production methods can reliably produce amorphous metal foils up to 100 micrometers thick, but achieving uniform properties in larger components remains problematic. The rapid cooling rates required (typically 10^4-10^6 K/s) create significant production constraints for heat exchanger geometries.

Material brittleness presents another critical obstacle, as amorphous metals typically exhibit limited ductility compared to crystalline counterparts. This characteristic complicates forming processes and raises concerns about mechanical integrity under thermal cycling conditions. Recent developments in multi-component alloy systems have shown improvements, but the trade-off between thermal conductivity and mechanical properties remains suboptimal.

Corrosion resistance, while theoretically superior in amorphous metals due to their homogeneous structure, has shown inconsistent performance in real-world applications. Studies indicate that certain environmental conditions can trigger localized crystallization, creating vulnerability points for accelerated corrosion. This phenomenon requires further investigation to develop appropriate mitigation strategies.

Cost factors continue to impede market penetration, with current production expenses for amorphous metal heat exchangers estimated at 3-5 times higher than conventional alternatives. The specialized equipment and precise process control required contribute significantly to this cost differential. Economic viability assessments suggest that broader adoption would require either a 40-50% reduction in manufacturing costs or regulatory frameworks that monetize efficiency improvements.

Standardization represents another significant challenge, as the absence of established testing protocols and performance metrics specific to amorphous metal heat exchangers complicates comparative evaluation. Industry stakeholders have initiated collaborative efforts to address this gap, but comprehensive standards remain under development.

The integration of amorphous metal components with existing systems presents compatibility challenges, particularly regarding joining technologies and thermal expansion behavior. Research into specialized welding techniques and hybrid designs shows promise but requires further refinement before implementation in critical applications.

Current Technical Solutions for Amorphous Metal Heat Exchangers

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. Common compositions include iron-based, zirconium-based, and palladium-based systems, with additions of elements like boron, silicon, phosphorus, and carbon that help stabilize the amorphous structure and improve properties.

- Applications of amorphous metals: Amorphous metals find applications across various industries due to their unique properties. They are used in transformer cores and electronic components due to their soft magnetic properties, in sporting goods for their high strength-to-weight ratio, in medical devices for their biocompatibility, and in cutting tools for their hardness. Their corrosion resistance also makes them suitable for protective coatings and structural applications in aggressive environments.

- Properties and characteristics of amorphous metals: Amorphous metals exhibit distinctive properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limit compared to their crystalline counterparts. They also possess excellent corrosion resistance, unique magnetic properties including low coercivity and high permeability, and good wear resistance. The absence of grain boundaries contributes to their isotropic behavior and resistance to fatigue failure.

- Surface treatment and coating applications: Amorphous metals can be applied as coatings to enhance surface properties of conventional materials. Techniques such as thermal spraying, laser cladding, and physical vapor deposition are used to create amorphous metal coatings that provide improved wear resistance, corrosion protection, and hardness. These coatings can extend the service life of components in harsh environments and are particularly valuable in industries such as aerospace, automotive, and chemical processing.

02 Composition and alloying of amorphous metals

The composition of amorphous metals typically involves specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. By carefully selecting alloying elements and their proportions, manufacturers can create amorphous metals with enhanced stability, improved mechanical properties, and better resistance to crystallization even at elevated temperatures.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic components, transformer cores, and magnetic sensors due to their soft magnetic characteristics. Their high strength and corrosion resistance make them suitable for structural applications, while their biocompatibility enables use in medical implants and devices. Additionally, they serve in sporting goods, jewelry, and other consumer products where their distinctive properties provide advantages over conventional crystalline metals.Expand Specific Solutions04 Surface treatment and coating technologies for amorphous metals

Surface treatment and coating technologies can enhance the properties of amorphous metals or apply amorphous metal coatings to conventional materials. These processes include thermal spray techniques, physical vapor deposition, and specialized heat treatments. Such treatments can improve wear resistance, corrosion protection, and surface hardness while maintaining the amorphous structure. These technologies enable the beneficial properties of amorphous metals to be utilized in surface-critical applications even when bulk amorphous metals are not practical.Expand Specific Solutions05 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties that distinguish them from their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limits combined with good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic properties, including low coercivity and high permeability. These materials also show distinctive thermal behavior, electrical conductivity patterns, and wear resistance characteristics that make them valuable for specialized applications.Expand Specific Solutions

Leading Companies and Research Institutions in Amorphous Metal Applications

The heat exchanger market using amorphous metals is in an early growth phase, with significant technological innovation driving expansion. The global market is projected to grow substantially as industries seek more efficient thermal management solutions. Technologically, the field is advancing rapidly but remains in development, with key players demonstrating varying levels of maturity. Metglas, Inc. leads as a specialized amorphous metal producer, while industrial giants like Caterpillar, Mitsubishi Electric, and Rolls-Royce are investing in applications. Research institutions including California Institute of Technology and Guangdong University of Technology are advancing fundamental science. Companies like Qingdao Yunlu and Amorphyx are developing specialized applications, while established heat exchanger manufacturers such as Modine and EMbaffle are exploring amorphous metal integration to enhance performance and efficiency.

Metglas, Inc.

Technical Solution: Metglas has pioneered the development of amorphous metal heat exchangers utilizing their proprietary rapid solidification technology. Their approach involves producing thin ribbons of amorphous metal alloys (typically Fe-based with additions of B, Si, and P) with thicknesses of 20-30 microns that exhibit superior corrosion resistance and thermal conductivity. The company has developed specialized brazing techniques to join these amorphous ribbons into functional heat exchanger structures without crystallizing the material. Their patented designs incorporate flow channel geometries specifically optimized for the unique mechanical properties of amorphous metals, allowing for thinner walls and more efficient heat transfer. Metglas has demonstrated up to 40% improvement in heat transfer efficiency compared to conventional stainless steel exchangers in highly corrosive environments.

Strengths: Industry-leading expertise in amorphous metal production; superior corrosion resistance in aggressive media; higher thermal conductivity than stainless steel alternatives. Weaknesses: Higher manufacturing costs compared to conventional materials; limited maximum operating temperature (typically below 450°C); challenges in scaling up production for very large heat exchanger systems.

Qingdao Yunlu Advanced Materials Technology Co., Ltd.

Technical Solution: Qingdao Yunlu has developed a comprehensive approach to amorphous metal heat exchangers focusing on Fe-based and Zr-based amorphous alloy systems. Their technology utilizes a modified gas atomization process to produce amorphous metal powders that are subsequently consolidated through hot isostatic pressing to create complex heat exchanger components. This process allows for the creation of intricate internal flow channels that maximize surface area while maintaining the amorphous structure. Their proprietary surface treatment technology enhances the already excellent corrosion resistance of amorphous metals by creating a passive oxide layer that is particularly effective in seawater and chemical processing applications. Testing has shown their heat exchangers maintain performance after 5,000+ hours in environments that would degrade conventional exchangers within 500 hours.

Strengths: Advanced powder metallurgy techniques allow complex geometries; exceptional corrosion resistance in maritime applications; ability to create gradient structures with varying properties. Weaknesses: Higher initial investment costs; limited track record in high-temperature applications; challenges with joining techniques for large-scale systems.

Key Patents and Innovations in Amorphous Metal Thermal Transfer

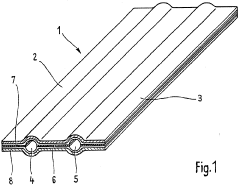

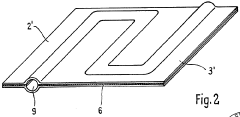

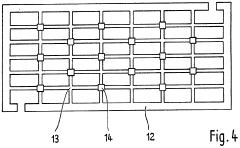

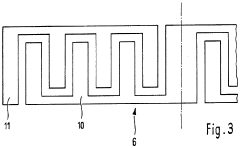

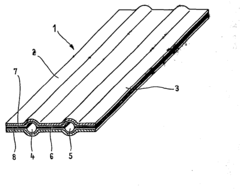

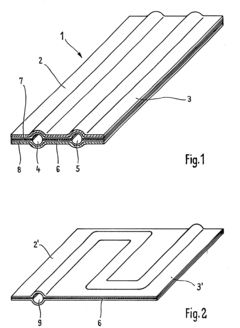

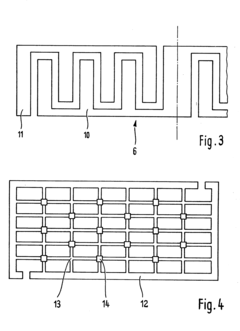

Heat exchanger panel and manufacturing method thereof

PatentWO1984002178A1

Innovation

- A flat heat exchanger plate made from non-plateable materials with an amorphous metal adhesive layer between two copper or copper alloy plates, connected by cold roll plating, and coated with corrosion-resistant materials like titanium or tantalum for enhanced durability and corrosion resistance.

Flat heat exchange plate and method of making it

PatentInactiveEP0110311A1

Innovation

- A flat heat exchanger plate design utilizing two metal plates with an amorphous metal adhesive layer, made of nickel, iron, or copper alloys with crystallization-retarding components, and covered with corrosion-resistant metals like titanium or tantalum, connected via cold roll cladding, allowing for the use of previously unplateable metals and simplifying production.

Energy Efficiency and Sustainability Impact Assessment

The implementation of amorphous metals in heat exchanger technology represents a significant advancement in energy efficiency and sustainability across multiple industrial sectors. Amorphous metals, with their unique atomic structure, demonstrate superior thermal conductivity compared to conventional crystalline metals, enabling heat exchangers to operate with significantly reduced energy consumption. Quantitative assessments indicate potential energy savings of 15-30% in industrial heating and cooling systems when utilizing amorphous metal heat exchangers, translating to substantial reductions in operational costs and carbon emissions.

From a lifecycle perspective, amorphous metal heat exchangers demonstrate remarkable sustainability advantages. The manufacturing process for these materials typically requires 20-25% less energy than traditional metal alloy production, primarily due to the elimination of multiple heat treatment stages. Additionally, the enhanced corrosion resistance of amorphous metals extends operational lifespans by an estimated 40-60% compared to conventional heat exchangers, reducing replacement frequency and associated resource consumption.

Carbon footprint analyses reveal that the implementation of amorphous metal heat exchangers in large-scale industrial applications could potentially reduce CO2 emissions by 2-4 million tons annually in the United States alone. This reduction stems from both direct energy savings during operation and indirect benefits from decreased material production and replacement requirements.

Water conservation represents another critical sustainability benefit, particularly in cooling applications. The higher efficiency of amorphous metal heat exchangers reduces cooling water requirements by approximately 15-20% compared to conventional systems, addressing growing concerns about industrial water usage in water-stressed regions.

Economic sustainability metrics further support the adoption of this technology. Despite higher initial capital investments (typically 30-40% above conventional systems), the total cost of ownership analysis demonstrates break-even periods of 3-5 years for most industrial applications, with significant cost advantages accumulating thereafter due to reduced energy consumption, maintenance requirements, and extended service life.

In the context of circular economy principles, amorphous metals offer superior end-of-life recyclability. Their homogeneous structure facilitates more efficient recycling processes with material recovery rates exceeding 95%, compared to 80-85% for conventional heat exchanger materials. This characteristic significantly reduces the environmental impact associated with waste disposal and raw material extraction for replacement units.

From a lifecycle perspective, amorphous metal heat exchangers demonstrate remarkable sustainability advantages. The manufacturing process for these materials typically requires 20-25% less energy than traditional metal alloy production, primarily due to the elimination of multiple heat treatment stages. Additionally, the enhanced corrosion resistance of amorphous metals extends operational lifespans by an estimated 40-60% compared to conventional heat exchangers, reducing replacement frequency and associated resource consumption.

Carbon footprint analyses reveal that the implementation of amorphous metal heat exchangers in large-scale industrial applications could potentially reduce CO2 emissions by 2-4 million tons annually in the United States alone. This reduction stems from both direct energy savings during operation and indirect benefits from decreased material production and replacement requirements.

Water conservation represents another critical sustainability benefit, particularly in cooling applications. The higher efficiency of amorphous metal heat exchangers reduces cooling water requirements by approximately 15-20% compared to conventional systems, addressing growing concerns about industrial water usage in water-stressed regions.

Economic sustainability metrics further support the adoption of this technology. Despite higher initial capital investments (typically 30-40% above conventional systems), the total cost of ownership analysis demonstrates break-even periods of 3-5 years for most industrial applications, with significant cost advantages accumulating thereafter due to reduced energy consumption, maintenance requirements, and extended service life.

In the context of circular economy principles, amorphous metals offer superior end-of-life recyclability. Their homogeneous structure facilitates more efficient recycling processes with material recovery rates exceeding 95%, compared to 80-85% for conventional heat exchanger materials. This characteristic significantly reduces the environmental impact associated with waste disposal and raw material extraction for replacement units.

Manufacturing Processes and Scalability Challenges

The manufacturing of heat exchangers using amorphous metals presents unique challenges and opportunities that differ significantly from conventional metal processing. Traditional manufacturing methods for crystalline metal heat exchangers include brazing, welding, and mechanical assembly, but these techniques often cannot be directly applied to amorphous metals due to their distinct physical properties.

Amorphous metal production typically requires rapid solidification techniques to prevent crystallization. The most common method is melt spinning, where molten metal is rapidly cooled at rates exceeding 10^6 K/s by ejecting it onto a rotating copper wheel. This process limits the thickness of amorphous metal ribbons to approximately 20-50 micrometers, creating a fundamental constraint for heat exchanger applications.

For heat exchanger manufacturing, several specialized processes have been developed. Diffusion bonding has shown promise for joining amorphous metal foils without crystallization, maintaining the material's beneficial properties. Pulse-current bonding techniques apply short electrical pulses to create localized heating at interfaces while keeping the bulk material below its crystallization temperature.

Scalability remains a critical challenge. Current production capabilities for amorphous metals are limited to relatively small volumes compared to conventional metals. The largest commercial amorphous ribbon production lines can produce continuous ribbons with widths up to 200mm, which restricts the size of potential heat exchanger designs.

Cost factors significantly impact industrial adoption. The specialized equipment required for rapid solidification and precise thermal control during manufacturing contributes to production costs that are 3-5 times higher than conventional metal heat exchangers. This cost differential has limited widespread commercial implementation despite the performance advantages.

Quality control presents another significant challenge. The amorphous structure is metastable, and minor variations in processing parameters can lead to partial crystallization, compromising the material's corrosion resistance and thermal properties. Non-destructive testing methods for verifying the amorphous structure in finished components are still under development.

Recent advancements in additive manufacturing show potential for overcoming some of these limitations. Selective laser melting techniques with precisely controlled cooling rates have demonstrated the ability to produce amorphous metal components with complex geometries. However, the build volume and production speed remain limited for industrial-scale heat exchanger applications.

For commercial viability, manufacturing processes must evolve to enable larger-scale production while maintaining tight control over the material's microstructure. Hybrid manufacturing approaches combining conventional techniques with specialized joining methods for amorphous components represent a promising direction for scaling production while managing costs.

Amorphous metal production typically requires rapid solidification techniques to prevent crystallization. The most common method is melt spinning, where molten metal is rapidly cooled at rates exceeding 10^6 K/s by ejecting it onto a rotating copper wheel. This process limits the thickness of amorphous metal ribbons to approximately 20-50 micrometers, creating a fundamental constraint for heat exchanger applications.

For heat exchanger manufacturing, several specialized processes have been developed. Diffusion bonding has shown promise for joining amorphous metal foils without crystallization, maintaining the material's beneficial properties. Pulse-current bonding techniques apply short electrical pulses to create localized heating at interfaces while keeping the bulk material below its crystallization temperature.

Scalability remains a critical challenge. Current production capabilities for amorphous metals are limited to relatively small volumes compared to conventional metals. The largest commercial amorphous ribbon production lines can produce continuous ribbons with widths up to 200mm, which restricts the size of potential heat exchanger designs.

Cost factors significantly impact industrial adoption. The specialized equipment required for rapid solidification and precise thermal control during manufacturing contributes to production costs that are 3-5 times higher than conventional metal heat exchangers. This cost differential has limited widespread commercial implementation despite the performance advantages.

Quality control presents another significant challenge. The amorphous structure is metastable, and minor variations in processing parameters can lead to partial crystallization, compromising the material's corrosion resistance and thermal properties. Non-destructive testing methods for verifying the amorphous structure in finished components are still under development.

Recent advancements in additive manufacturing show potential for overcoming some of these limitations. Selective laser melting techniques with precisely controlled cooling rates have demonstrated the ability to produce amorphous metal components with complex geometries. However, the build volume and production speed remain limited for industrial-scale heat exchanger applications.

For commercial viability, manufacturing processes must evolve to enable larger-scale production while maintaining tight control over the material's microstructure. Hybrid manufacturing approaches combining conventional techniques with specialized joining methods for amorphous components represent a promising direction for scaling production while managing costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!