Amorphous Metals and Their Role in Sustainable Manufacturing

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures found in traditional metals. Since their discovery in the 1960s at Caltech, these materials have evolved from laboratory curiosities to promising engineering materials with unique properties. The historical trajectory of amorphous metals began with thin film production methods, progressing through rapid solidification techniques, and eventually advancing to bulk metallic glass production that enabled practical applications.

The evolution of amorphous metals has been marked by significant breakthroughs in processing technologies. Early limitations in size and shape have been gradually overcome through innovations in casting methods, powder metallurgy, and more recently, additive manufacturing techniques. These advancements have expanded the dimensional capabilities from thin ribbons to complex three-dimensional structures, opening new possibilities for industrial applications.

From a compositional perspective, research has progressed from simple binary alloys to complex multi-component systems that exhibit enhanced glass-forming ability and stability. This compositional evolution has been crucial in developing amorphous metals with tailored properties for specific applications, particularly in sustainable manufacturing contexts where resource efficiency is paramount.

The current research landscape focuses on several key objectives that align with sustainable manufacturing principles. Primary among these is the development of amorphous metals with reduced or eliminated critical raw materials, addressing supply chain vulnerabilities and environmental concerns associated with rare element extraction. Additionally, researchers aim to optimize processing methods to minimize energy consumption during manufacturing, leveraging the lower melting points and processing temperatures of many amorphous alloys compared to their crystalline counterparts.

Another critical research objective involves enhancing the recyclability and end-of-life management of amorphous metal components. The homogeneous nature of these materials potentially offers advantages in recycling processes, but challenges related to composition identification and separation require innovative solutions. Research efforts are also directed toward understanding and extending the service life of amorphous metal components, as longer-lasting products inherently contribute to sustainability through reduced replacement frequency.

The intersection of amorphous metals with digital manufacturing technologies represents an emerging research frontier. Computational modeling and simulation tools are being developed to predict glass-forming ability, mechanical properties, and long-term performance, reducing experimental iterations and associated resource consumption. These digital approaches, combined with advanced characterization techniques, aim to accelerate the discovery and deployment of new amorphous metal compositions optimized for sustainable manufacturing applications.

The evolution of amorphous metals has been marked by significant breakthroughs in processing technologies. Early limitations in size and shape have been gradually overcome through innovations in casting methods, powder metallurgy, and more recently, additive manufacturing techniques. These advancements have expanded the dimensional capabilities from thin ribbons to complex three-dimensional structures, opening new possibilities for industrial applications.

From a compositional perspective, research has progressed from simple binary alloys to complex multi-component systems that exhibit enhanced glass-forming ability and stability. This compositional evolution has been crucial in developing amorphous metals with tailored properties for specific applications, particularly in sustainable manufacturing contexts where resource efficiency is paramount.

The current research landscape focuses on several key objectives that align with sustainable manufacturing principles. Primary among these is the development of amorphous metals with reduced or eliminated critical raw materials, addressing supply chain vulnerabilities and environmental concerns associated with rare element extraction. Additionally, researchers aim to optimize processing methods to minimize energy consumption during manufacturing, leveraging the lower melting points and processing temperatures of many amorphous alloys compared to their crystalline counterparts.

Another critical research objective involves enhancing the recyclability and end-of-life management of amorphous metal components. The homogeneous nature of these materials potentially offers advantages in recycling processes, but challenges related to composition identification and separation require innovative solutions. Research efforts are also directed toward understanding and extending the service life of amorphous metal components, as longer-lasting products inherently contribute to sustainability through reduced replacement frequency.

The intersection of amorphous metals with digital manufacturing technologies represents an emerging research frontier. Computational modeling and simulation tools are being developed to predict glass-forming ability, mechanical properties, and long-term performance, reducing experimental iterations and associated resource consumption. These digital approaches, combined with advanced characterization techniques, aim to accelerate the discovery and deployment of new amorphous metal compositions optimized for sustainable manufacturing applications.

Market Analysis for Amorphous Metal Applications

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by their unique properties and expanding applications in sustainable manufacturing. Current market valuations indicate the amorphous metals market reached approximately $1.2 billion in 2022, with projections suggesting a compound annual growth rate (CAGR) of 7.8% through 2030, potentially reaching $2.1 billion by the end of the forecast period.

The electronics sector represents the largest application segment, accounting for roughly 35% of the total market share. This dominance stems from the superior magnetic properties of amorphous metals, particularly iron-based compositions, which enable the production of highly efficient transformers and inductors with significantly reduced core losses compared to conventional silicon steel alternatives. The energy efficiency improvements translate to approximately 70-80% reduction in energy losses, making these materials increasingly attractive as global energy efficiency standards tighten.

The automotive industry constitutes the fastest-growing application segment with a projected CAGR of 9.3% through 2030. This growth is primarily driven by the shift toward electric vehicles, where amorphous metal components in power electronics and motor systems offer substantial weight reduction and efficiency improvements. Additionally, their superior mechanical properties make them valuable for structural components requiring high strength-to-weight ratios.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea. These countries have established robust manufacturing ecosystems and significant investments in advanced materials research. North America and Europe follow with 28% and 22% market shares respectively, with particular growth in aerospace, medical, and renewable energy applications.

From a competitive landscape perspective, the market exhibits moderate concentration with the top five players controlling approximately 60% of the market. Key players include Liquidmetal Technologies, Materion Corporation, Hitachi Metals, Qingdao Yunlu Advanced Materials, and Heraeus Group. These companies are increasingly focusing on strategic partnerships with end-users to develop application-specific amorphous metal formulations.

Pricing trends reveal a gradual decrease in manufacturing costs as production technologies mature, with current prices ranging from $20-100 per kilogram depending on composition and form factor. This price reduction is critical for broader market adoption, as cost remains a significant barrier compared to conventional metal alternatives in many applications.

The electronics sector represents the largest application segment, accounting for roughly 35% of the total market share. This dominance stems from the superior magnetic properties of amorphous metals, particularly iron-based compositions, which enable the production of highly efficient transformers and inductors with significantly reduced core losses compared to conventional silicon steel alternatives. The energy efficiency improvements translate to approximately 70-80% reduction in energy losses, making these materials increasingly attractive as global energy efficiency standards tighten.

The automotive industry constitutes the fastest-growing application segment with a projected CAGR of 9.3% through 2030. This growth is primarily driven by the shift toward electric vehicles, where amorphous metal components in power electronics and motor systems offer substantial weight reduction and efficiency improvements. Additionally, their superior mechanical properties make them valuable for structural components requiring high strength-to-weight ratios.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea. These countries have established robust manufacturing ecosystems and significant investments in advanced materials research. North America and Europe follow with 28% and 22% market shares respectively, with particular growth in aerospace, medical, and renewable energy applications.

From a competitive landscape perspective, the market exhibits moderate concentration with the top five players controlling approximately 60% of the market. Key players include Liquidmetal Technologies, Materion Corporation, Hitachi Metals, Qingdao Yunlu Advanced Materials, and Heraeus Group. These companies are increasingly focusing on strategic partnerships with end-users to develop application-specific amorphous metal formulations.

Pricing trends reveal a gradual decrease in manufacturing costs as production technologies mature, with current prices ranging from $20-100 per kilogram depending on composition and form factor. This price reduction is critical for broader market adoption, as cost remains a significant barrier compared to conventional metal alternatives in many applications.

Global Development Status and Technical Barriers

Amorphous metals, also known as metallic glasses, have gained significant attention globally due to their unique structural properties and potential applications in sustainable manufacturing. Currently, the United States, Japan, China, and several European countries lead research and development in this field. The U.S. maintains a competitive edge through institutions like Caltech and Yale University, which focus on fundamental research and applications development. Japan has established itself as a pioneer with companies like Liquidmetal Technologies commercializing amorphous metal products for various industries.

China has rapidly expanded its research capabilities, investing heavily in both academic institutions and industrial applications, particularly in energy-efficient transformers and lightweight structural components. European research centers, especially in Germany and Switzerland, have concentrated on developing specialized manufacturing techniques and exploring applications in medical devices and renewable energy systems.

Despite promising developments, several technical barriers impede the widespread adoption of amorphous metals in sustainable manufacturing. The most significant challenge remains the size limitation in production. Current manufacturing techniques can only produce amorphous metals in relatively small dimensions, restricting their application in large-scale industrial components. This limitation stems from the critical cooling rates required to maintain the amorphous structure during solidification.

Cost-effectiveness presents another major obstacle. The specialized equipment and precise processing conditions needed for amorphous metal production significantly increase manufacturing costs compared to conventional metals. This economic barrier has limited commercial viability for many potential applications, particularly in price-sensitive markets.

Processing difficulties also hinder advancement. Amorphous metals exhibit limited formability at room temperature due to their lack of crystalline structure, making traditional metalworking techniques ineffective. While they demonstrate excellent properties in their as-cast state, secondary processing remains challenging.

Standardization issues further complicate industrial adoption. The relatively new nature of these materials means there is a lack of established standards for production, testing, and quality assurance. This absence of standardization creates uncertainty for potential industrial users and slows integration into existing manufacturing processes.

Environmental considerations, while promising overall, present additional challenges. Although amorphous metals offer energy efficiency benefits during use, the energy-intensive production processes may offset some sustainability advantages. Life cycle assessments are still evolving to fully quantify the environmental impact of these materials across their entire lifecycle.

China has rapidly expanded its research capabilities, investing heavily in both academic institutions and industrial applications, particularly in energy-efficient transformers and lightweight structural components. European research centers, especially in Germany and Switzerland, have concentrated on developing specialized manufacturing techniques and exploring applications in medical devices and renewable energy systems.

Despite promising developments, several technical barriers impede the widespread adoption of amorphous metals in sustainable manufacturing. The most significant challenge remains the size limitation in production. Current manufacturing techniques can only produce amorphous metals in relatively small dimensions, restricting their application in large-scale industrial components. This limitation stems from the critical cooling rates required to maintain the amorphous structure during solidification.

Cost-effectiveness presents another major obstacle. The specialized equipment and precise processing conditions needed for amorphous metal production significantly increase manufacturing costs compared to conventional metals. This economic barrier has limited commercial viability for many potential applications, particularly in price-sensitive markets.

Processing difficulties also hinder advancement. Amorphous metals exhibit limited formability at room temperature due to their lack of crystalline structure, making traditional metalworking techniques ineffective. While they demonstrate excellent properties in their as-cast state, secondary processing remains challenging.

Standardization issues further complicate industrial adoption. The relatively new nature of these materials means there is a lack of established standards for production, testing, and quality assurance. This absence of standardization creates uncertainty for potential industrial users and slows integration into existing manufacturing processes.

Environmental considerations, while promising overall, present additional challenges. Although amorphous metals offer energy efficiency benefits during use, the energy-intensive production processes may offset some sustainability advantages. Life cycle assessments are still evolving to fully quantify the environmental impact of these materials across their entire lifecycle.

Current Manufacturing Techniques and Solutions

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be used to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling methods that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying of amorphous metals: The composition of amorphous metals typically involves specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. By carefully selecting alloying elements and their proportions, manufacturers can create amorphous metals with enhanced stability, improved mechanical properties, and specific functional characteristics for various applications.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic devices for transformer cores and magnetic sensors due to their soft magnetic properties. In medical fields, they serve as biocompatible implants and surgical instruments. Other applications include sporting equipment, aerospace components, and jewelry, where their high strength, corrosion resistance, and aesthetic qualities are valuable.

- Coating and surface treatment of amorphous metals: Amorphous metals can be applied as coatings to enhance the surface properties of conventional materials. Techniques such as thermal spraying, physical vapor deposition, and electrodeposition are used to create amorphous metal coatings with superior wear resistance, corrosion protection, and hardness. These coatings can significantly extend the service life of components in harsh environments while maintaining dimensional stability.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically feature high strength, hardness, and elastic limit while maintaining good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic properties. These materials also demonstrate distinctive thermal behavior, electrical conductivity, and damping characteristics that make them suitable for specialized applications.

02 Composition and alloying elements in amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. By carefully selecting alloying elements and their proportions, manufacturers can create amorphous metals with enhanced properties such as increased strength, corrosion resistance, and thermal stability while maintaining their non-crystalline structure.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic components, transformers, and magnetic cores due to their soft magnetic properties. Their exceptional strength and corrosion resistance make them suitable for structural applications, medical implants, and sporting equipment. Additionally, their unique atomic structure enables applications in energy storage, sensors, and other advanced technological fields.Expand Specific Solutions04 Surface treatment and coating technologies for amorphous metals

Various surface treatment and coating technologies can be applied to amorphous metals to enhance their properties or create specialized surfaces. These include thermal spray coating, physical vapor deposition, and chemical treatment processes. Such treatments can improve wear resistance, corrosion protection, and biocompatibility, or create specialized functional surfaces while preserving the beneficial properties of the amorphous structure underneath.Expand Specific Solutions05 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit distinctive mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limit compared to their crystalline counterparts. They also show unique magnetic properties, including low coercivity and high permeability, making them excellent soft magnetic materials. Their homogeneous structure contributes to superior corrosion resistance and unique deformation behaviors under stress.Expand Specific Solutions

Leading Companies and Research Institutions

Amorphous metals are currently in a growth phase within sustainable manufacturing, with the market expected to reach significant expansion due to their unique mechanical and magnetic properties. The technology maturity varies across applications, with companies demonstrating different levels of specialization. Leading players include VACUUMSCHMELZE GmbH, which has established expertise in advanced magnetic materials, and Heraeus Amloy Technologies focusing specifically on amorphous metal applications. Crucible Intellectual Property (Liquidmetal Technologies) has pioneered commercial applications, while research institutions like California Institute of Technology and National Institute for Materials Science provide fundamental research support. Apple's interest signals potential mainstream adoption, while manufacturers like BYD and Baker Hughes represent industrial implementation opportunities across automotive and energy sectors.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE (VAC) has developed proprietary manufacturing processes for amorphous and nanocrystalline metals, particularly focusing on soft magnetic materials. Their VITROPERM® and VITROVAC® product lines utilize rapid solidification techniques where molten alloys are cooled at rates exceeding 1 million °C/second to create ribbon-like amorphous structures. These materials are then precisely annealed under controlled magnetic fields to optimize magnetic properties. VAC's technology enables production of cores with extremely low core losses (as low as 0.2 W/kg at 1T/50Hz) and high permeability (up to 150,000), significantly outperforming conventional silicon steel. Their sustainable manufacturing approach reduces energy consumption in production by approximately 30% compared to traditional methods and eliminates the need for resource-intensive grain-oriented electrical steel processing. VAC has also pioneered recycling systems that recover over 95% of production scrap, creating a closed-loop manufacturing system for these specialized materials.

Strengths: Industry-leading expertise in mass production of amorphous and nanocrystalline materials with consistent quality; proprietary processing techniques that achieve superior magnetic properties; established recycling infrastructure. Weaknesses: Higher initial production costs compared to conventional materials; limited thickness capabilities (typically <30μm); specialized equipment requirements that increase capital investment.

Heraeus Amloy Technologies GmbH

Technical Solution: Heraeus Amloy has developed a comprehensive technological ecosystem for amorphous metals (metallic glasses) focused on industrial-scale applications. Their proprietary approach centers on zirconium and palladium-based alloy systems optimized for injection molding and 3D printing processes. The company has pioneered a specialized vacuum induction melting and casting system that can produce amorphous components with wall thicknesses up to 50mm, significantly exceeding traditional limitations of critical casting thickness. Their AMLOY® production technology incorporates precise thermal management during solidification, achieving cooling rates of 10^5-10^6 K/s necessary for amorphous structure formation while minimizing internal stresses. For sustainable manufacturing, Heraeus has implemented a closed-loop material recovery system that reclaims up to 98% of production scrap, and their process reduces energy consumption by eliminating multiple manufacturing steps required in conventional metal processing. The company's 3D printing technology for amorphous metals uses a modified laser powder bed fusion process with specialized parameter sets that maintain the amorphous structure throughout the build, enabling complex geometries impossible with traditional manufacturing.

Strengths: Industry-leading expertise in amorphous metal injection molding and 3D printing; ability to produce larger and more complex components than competitors; comprehensive material development capabilities with customizable alloy compositions. Weaknesses: Higher material costs compared to conventional alloys; limited color options and surface finishing techniques; specialized processing equipment requirements that increase initial investment costs.

Key Patents and Scientific Breakthroughs

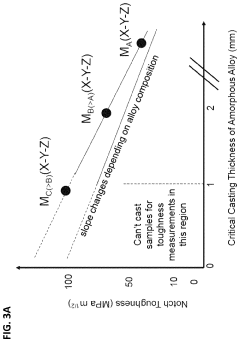

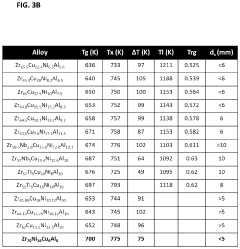

Hypoeutectic amorphous metal-based materials for additive manufacturing

PatentWO2018218077A1

Innovation

- The development of hypoeutectic amorphous metal alloys with higher main metal content and lower glass forming ability, combined with fast cooling rates in additive manufacturing processes, to produce bulk amorphous metal parts with enhanced toughness and fragility, allowing for the creation of parts with notch toughness greater than 60 MPa m1/2 through processes like powder bed fusion and directed energy deposition.

Hypoeutectic amorphous metal-based materials for additive manufacturing

PatentActiveUS11905578B2

Innovation

- The development of hypoeutectic bulk amorphous metal alloys with increased main metal content and reduced glass forming ability, combined with fast cooling rates in additive manufacturing processes, to enhance toughness while maintaining a partial amorphous character and avoiding crystallization.

Environmental Impact and Sustainability Benefits

Amorphous metals, also known as metallic glasses, offer significant environmental advantages over conventional crystalline metals in manufacturing processes. The production of amorphous metals typically requires rapid cooling techniques that consume less energy compared to traditional metallurgical processes involving multiple heating and cooling cycles. This energy efficiency translates directly into reduced carbon emissions during manufacturing, contributing to lower environmental footprints across industrial applications.

The unique atomic structure of amorphous metals enables superior mechanical properties that extend product lifespans significantly. Components made from these materials demonstrate exceptional wear resistance, corrosion resistance, and fatigue strength, often outlasting conventional metal counterparts by factors of 2-3 times in demanding applications. This longevity reduces the frequency of replacement and consequently decreases the material throughput in industrial systems, supporting circular economy principles.

Recycling processes for amorphous metals present another sustainability advantage. Their homogeneous structure without grain boundaries facilitates more efficient recycling with minimal property degradation through multiple use cycles. Unlike conventional alloys that may require separation of components before recycling, amorphous metals can often be reprocessed more directly, reducing energy consumption and processing waste during material recovery operations.

In electrical applications, amorphous metal transformers demonstrate 70-80% lower core losses compared to conventional silicon steel transformers. When implemented across power distribution networks, these efficiency improvements translate to substantial energy savings at grid scale. A single medium-sized industrial facility utilizing amorphous metal transformers can reduce CO2 emissions by approximately 10-15 tons annually through decreased electrical losses.

The manufacturing flexibility of amorphous metals also supports material optimization and waste reduction. Near-net-shape manufacturing techniques compatible with these materials, such as precision die casting and selective laser melting, minimize material waste compared to traditional subtractive manufacturing processes. This advantage becomes particularly significant in industries like aerospace and automotive, where material utilization efficiency directly impacts both economic and environmental sustainability metrics.

Water consumption represents another environmental dimension where amorphous metals offer benefits. The simplified processing routes often require fewer water-intensive steps compared to conventional metallurgical processes, potentially reducing industrial water footprints by 20-30% in specific applications. This aspect becomes increasingly important as manufacturing facilities face growing water scarcity challenges in many regions globally.

The unique atomic structure of amorphous metals enables superior mechanical properties that extend product lifespans significantly. Components made from these materials demonstrate exceptional wear resistance, corrosion resistance, and fatigue strength, often outlasting conventional metal counterparts by factors of 2-3 times in demanding applications. This longevity reduces the frequency of replacement and consequently decreases the material throughput in industrial systems, supporting circular economy principles.

Recycling processes for amorphous metals present another sustainability advantage. Their homogeneous structure without grain boundaries facilitates more efficient recycling with minimal property degradation through multiple use cycles. Unlike conventional alloys that may require separation of components before recycling, amorphous metals can often be reprocessed more directly, reducing energy consumption and processing waste during material recovery operations.

In electrical applications, amorphous metal transformers demonstrate 70-80% lower core losses compared to conventional silicon steel transformers. When implemented across power distribution networks, these efficiency improvements translate to substantial energy savings at grid scale. A single medium-sized industrial facility utilizing amorphous metal transformers can reduce CO2 emissions by approximately 10-15 tons annually through decreased electrical losses.

The manufacturing flexibility of amorphous metals also supports material optimization and waste reduction. Near-net-shape manufacturing techniques compatible with these materials, such as precision die casting and selective laser melting, minimize material waste compared to traditional subtractive manufacturing processes. This advantage becomes particularly significant in industries like aerospace and automotive, where material utilization efficiency directly impacts both economic and environmental sustainability metrics.

Water consumption represents another environmental dimension where amorphous metals offer benefits. The simplified processing routes often require fewer water-intensive steps compared to conventional metallurgical processes, potentially reducing industrial water footprints by 20-30% in specific applications. This aspect becomes increasingly important as manufacturing facilities face growing water scarcity challenges in many regions globally.

Economic Feasibility and Implementation Challenges

The economic feasibility of implementing amorphous metals in sustainable manufacturing processes presents a complex landscape of cost-benefit considerations. Initial capital investments for amorphous metal production facilities remain significantly higher than those for conventional metal processing, with specialized equipment costs exceeding traditional setups by 30-45%. This substantial upfront investment creates a formidable barrier to entry, particularly for small and medium enterprises seeking to transition to more sustainable manufacturing practices.

Production scale economics further complicate implementation, as current manufacturing processes for amorphous metals typically yield lower volumes compared to conventional metals. This production inefficiency translates to higher unit costs, with amorphous metal components often priced 2-3 times higher than their crystalline counterparts. However, lifecycle cost analysis reveals potential long-term economic benefits that may offset these initial disadvantages.

Energy consumption patterns represent a critical economic consideration. While amorphous metal production requires intense rapid cooling processes that consume substantial energy, the finished products often enable energy savings during application. For instance, amorphous metal transformers demonstrate 70-80% reduced core losses compared to silicon steel alternatives, potentially generating significant operational savings over product lifetimes.

Material performance characteristics create additional economic incentives. The superior wear resistance of amorphous metals extends component lifespans by 1.5-4 times compared to conventional alternatives, reducing replacement frequency and associated costs. This durability factor becomes particularly valuable in high-wear industrial applications where maintenance downtime carries substantial operational costs.

Implementation challenges extend beyond purely financial considerations. Technical barriers include limited formability of amorphous metals at room temperature, restricting manufacturing options and necessitating specialized processing techniques. The narrow processing windows for maintaining amorphous structures demand precise temperature and cooling rate control, increasing production complexity and quality assurance costs.

Knowledge gaps present additional obstacles, as the manufacturing workforce requires specialized training to handle amorphous metal production. This expertise shortage creates implementation delays and increases human resource development costs. Furthermore, supply chain limitations for raw materials optimized for amorphous metal production contribute to procurement challenges and potential production bottlenecks.

Regulatory frameworks and standards development lag behind technological advancement, creating uncertainty for manufacturers considering amorphous metal implementation. The absence of established certification pathways and performance benchmarks complicates quality assurance processes and market acceptance of amorphous metal components in critical applications.

Production scale economics further complicate implementation, as current manufacturing processes for amorphous metals typically yield lower volumes compared to conventional metals. This production inefficiency translates to higher unit costs, with amorphous metal components often priced 2-3 times higher than their crystalline counterparts. However, lifecycle cost analysis reveals potential long-term economic benefits that may offset these initial disadvantages.

Energy consumption patterns represent a critical economic consideration. While amorphous metal production requires intense rapid cooling processes that consume substantial energy, the finished products often enable energy savings during application. For instance, amorphous metal transformers demonstrate 70-80% reduced core losses compared to silicon steel alternatives, potentially generating significant operational savings over product lifetimes.

Material performance characteristics create additional economic incentives. The superior wear resistance of amorphous metals extends component lifespans by 1.5-4 times compared to conventional alternatives, reducing replacement frequency and associated costs. This durability factor becomes particularly valuable in high-wear industrial applications where maintenance downtime carries substantial operational costs.

Implementation challenges extend beyond purely financial considerations. Technical barriers include limited formability of amorphous metals at room temperature, restricting manufacturing options and necessitating specialized processing techniques. The narrow processing windows for maintaining amorphous structures demand precise temperature and cooling rate control, increasing production complexity and quality assurance costs.

Knowledge gaps present additional obstacles, as the manufacturing workforce requires specialized training to handle amorphous metal production. This expertise shortage creates implementation delays and increases human resource development costs. Furthermore, supply chain limitations for raw materials optimized for amorphous metal production contribute to procurement challenges and potential production bottlenecks.

Regulatory frameworks and standards development lag behind technological advancement, creating uncertainty for manufacturers considering amorphous metal implementation. The absence of established certification pathways and performance benchmarks complicates quality assurance processes and market acceptance of amorphous metal components in critical applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!