Why Amorphous Metals Are a Game-Changer in Power Electronics

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that have evolved significantly since their discovery in the 1960s. Initially developed at Caltech through rapid cooling techniques that prevented crystallization, these materials exhibited unique atomic structures lacking the long-range order characteristic of conventional crystalline metals. The early amorphous metal alloys were limited to thin ribbons due to the extreme cooling rates required for their formation, constraining their practical applications.

The technological evolution accelerated in the 1990s with the development of bulk metallic glasses (BMGs), which could be produced at much slower cooling rates, enabling the creation of thicker samples and expanding potential applications. This breakthrough was achieved through careful alloy composition engineering, particularly with multi-component systems that inherently resist crystallization.

In the power electronics domain, the trajectory of amorphous metals has been particularly noteworthy. The first commercial applications emerged in the 1980s with distribution transformers utilizing amorphous metal cores, offering significant reductions in core losses compared to traditional silicon steel. This application demonstrated the material's superior magnetic properties, including lower hysteresis losses and higher electrical resistivity.

The primary objective driving amorphous metals research in power electronics has been efficiency improvement. With global energy consumption continuously rising and stringent efficiency regulations being implemented worldwide, the need for materials that can minimize energy losses in power conversion and transmission has become increasingly critical. Amorphous metals directly address this challenge through their unique magnetic characteristics.

Another key objective has been miniaturization of power electronic components. As electronic devices become more compact and powerful, the size and weight of power management systems become limiting factors. Amorphous metals enable higher operating frequencies with lower losses, allowing for smaller transformers, inductors, and other magnetic components without sacrificing performance.

Recent research objectives have expanded to include thermal stability enhancement and manufacturing process optimization. Current efforts focus on developing amorphous metal compositions that maintain their advantageous properties at higher operating temperatures while simultaneously developing more cost-effective and scalable production methods to facilitate broader commercial adoption.

The evolution of amorphous metals continues to be driven by the increasing demands of modern power electronics, with objectives now encompassing not only performance improvements but also sustainability considerations, as their energy efficiency benefits align perfectly with global efforts to reduce carbon emissions and conserve resources.

The technological evolution accelerated in the 1990s with the development of bulk metallic glasses (BMGs), which could be produced at much slower cooling rates, enabling the creation of thicker samples and expanding potential applications. This breakthrough was achieved through careful alloy composition engineering, particularly with multi-component systems that inherently resist crystallization.

In the power electronics domain, the trajectory of amorphous metals has been particularly noteworthy. The first commercial applications emerged in the 1980s with distribution transformers utilizing amorphous metal cores, offering significant reductions in core losses compared to traditional silicon steel. This application demonstrated the material's superior magnetic properties, including lower hysteresis losses and higher electrical resistivity.

The primary objective driving amorphous metals research in power electronics has been efficiency improvement. With global energy consumption continuously rising and stringent efficiency regulations being implemented worldwide, the need for materials that can minimize energy losses in power conversion and transmission has become increasingly critical. Amorphous metals directly address this challenge through their unique magnetic characteristics.

Another key objective has been miniaturization of power electronic components. As electronic devices become more compact and powerful, the size and weight of power management systems become limiting factors. Amorphous metals enable higher operating frequencies with lower losses, allowing for smaller transformers, inductors, and other magnetic components without sacrificing performance.

Recent research objectives have expanded to include thermal stability enhancement and manufacturing process optimization. Current efforts focus on developing amorphous metal compositions that maintain their advantageous properties at higher operating temperatures while simultaneously developing more cost-effective and scalable production methods to facilitate broader commercial adoption.

The evolution of amorphous metals continues to be driven by the increasing demands of modern power electronics, with objectives now encompassing not only performance improvements but also sustainability considerations, as their energy efficiency benefits align perfectly with global efforts to reduce carbon emissions and conserve resources.

Power Electronics Market Demand Analysis

The global power electronics market is experiencing robust growth, projected to reach $49.3 billion by 2027, with a compound annual growth rate (CAGR) of 5.7%. This expansion is primarily driven by the increasing demand for energy-efficient power conversion systems across multiple industries. The integration of renewable energy sources into existing power grids has created significant market opportunities for advanced power electronic components that can handle higher frequencies and power densities while maintaining efficiency.

In the automotive sector, the rapid adoption of electric vehicles (EVs) has generated substantial demand for high-performance power electronics. The global EV market is expected to grow at a CAGR of 21.7% through 2030, necessitating power electronic systems that can manage high-voltage battery systems efficiently. Amorphous metals, with their superior magnetic properties, are particularly well-positioned to address these requirements by enabling smaller, more efficient power converters and on-board chargers.

Industrial automation represents another significant market segment, valued at $227.2 billion in 2022, where power electronics play a crucial role in motor drives and control systems. The trend toward Industry 4.0 and smart manufacturing has intensified the need for more reliable and energy-efficient power management solutions. Amorphous metal-based components offer substantial advantages in these applications due to their reduced core losses and improved thermal performance.

Consumer electronics and data centers constitute rapidly growing market segments for advanced power electronics. With global data center power consumption expected to reach 8% of total electricity demand by 2030, there is increasing pressure to improve power conversion efficiency. The superior switching characteristics of amorphous metal-based components can significantly reduce energy losses in power supply units and server infrastructure.

Renewable energy integration presents perhaps the most compelling market opportunity. Solar and wind power installations are projected to add over 440 GW of new capacity annually by 2026. These systems require sophisticated power electronics for DC-AC conversion and grid synchronization. Amorphous metals can substantially improve inverter efficiency and reliability while reducing size and weight, addressing key pain points in renewable energy deployment.

Regional analysis indicates that Asia-Pacific dominates the power electronics market with a 45% share, followed by North America and Europe. China, Japan, and South Korea are leading in amorphous metal adoption for power applications, while North American and European markets are increasingly focused on high-efficiency solutions for renewable energy and transportation sectors.

In the automotive sector, the rapid adoption of electric vehicles (EVs) has generated substantial demand for high-performance power electronics. The global EV market is expected to grow at a CAGR of 21.7% through 2030, necessitating power electronic systems that can manage high-voltage battery systems efficiently. Amorphous metals, with their superior magnetic properties, are particularly well-positioned to address these requirements by enabling smaller, more efficient power converters and on-board chargers.

Industrial automation represents another significant market segment, valued at $227.2 billion in 2022, where power electronics play a crucial role in motor drives and control systems. The trend toward Industry 4.0 and smart manufacturing has intensified the need for more reliable and energy-efficient power management solutions. Amorphous metal-based components offer substantial advantages in these applications due to their reduced core losses and improved thermal performance.

Consumer electronics and data centers constitute rapidly growing market segments for advanced power electronics. With global data center power consumption expected to reach 8% of total electricity demand by 2030, there is increasing pressure to improve power conversion efficiency. The superior switching characteristics of amorphous metal-based components can significantly reduce energy losses in power supply units and server infrastructure.

Renewable energy integration presents perhaps the most compelling market opportunity. Solar and wind power installations are projected to add over 440 GW of new capacity annually by 2026. These systems require sophisticated power electronics for DC-AC conversion and grid synchronization. Amorphous metals can substantially improve inverter efficiency and reliability while reducing size and weight, addressing key pain points in renewable energy deployment.

Regional analysis indicates that Asia-Pacific dominates the power electronics market with a 45% share, followed by North America and Europe. China, Japan, and South Korea are leading in amorphous metal adoption for power applications, while North American and European markets are increasingly focused on high-efficiency solutions for renewable energy and transportation sectors.

Amorphous Metals Technology Status and Barriers

Amorphous metals, also known as metallic glasses, represent a significant technological advancement in materials science with profound implications for power electronics. Currently, these materials have achieved commercial implementation in specific applications, particularly in transformer cores and inductors, where their unique magnetic properties offer substantial efficiency improvements. Leading manufacturers in Japan, China, and the United States have established production capabilities for amorphous metal ribbons, though production volumes remain limited compared to conventional crystalline materials.

The global research landscape shows concentrated expertise in materials science centers across North America, Europe, and East Asia, with notable advancements emerging from collaborative efforts between academic institutions and industry partners. Recent breakthroughs in manufacturing techniques have expanded the dimensional range of available amorphous metal forms, enabling new applications beyond traditional ribbon formats.

Despite these advances, significant technical barriers persist. Manufacturing scalability represents a primary challenge, as the rapid solidification rates required for amorphous structure formation (cooling rates exceeding 10^6 K/s) limit production throughput and dimensional versatility. Current industrial processes can reliably produce ribbons with thicknesses below 100 μm, but broader form factors remain difficult to achieve economically at scale.

Material brittleness presents another substantial obstacle, particularly for applications requiring mechanical robustness or complex geometries. The inherent lack of crystalline slip planes in amorphous structures results in limited plastic deformation capability before catastrophic failure, complicating both manufacturing processes and end-use applications where vibration or physical stress may occur.

Thermal stability constraints further limit widespread adoption, as amorphous metals crystallize when heated above their crystallization temperature, typically well below their melting point. This characteristic restricts operating temperatures and processing options, particularly challenging for power electronics applications where thermal management is critical.

Cost factors also remain prohibitive for many potential applications. Current production methods for high-quality amorphous metals involve specialized equipment and precise process control, resulting in significantly higher material costs compared to conventional crystalline alternatives. This cost differential has confined amorphous metals primarily to premium applications where performance benefits clearly justify the price premium.

Standardization issues further complicate industry adoption, as the relatively recent emergence of these materials means that comprehensive standards for testing, specification, and application design remain underdeveloped compared to traditional materials. This regulatory gap creates uncertainty for design engineers and slows integration into established supply chains and manufacturing processes.

The global research landscape shows concentrated expertise in materials science centers across North America, Europe, and East Asia, with notable advancements emerging from collaborative efforts between academic institutions and industry partners. Recent breakthroughs in manufacturing techniques have expanded the dimensional range of available amorphous metal forms, enabling new applications beyond traditional ribbon formats.

Despite these advances, significant technical barriers persist. Manufacturing scalability represents a primary challenge, as the rapid solidification rates required for amorphous structure formation (cooling rates exceeding 10^6 K/s) limit production throughput and dimensional versatility. Current industrial processes can reliably produce ribbons with thicknesses below 100 μm, but broader form factors remain difficult to achieve economically at scale.

Material brittleness presents another substantial obstacle, particularly for applications requiring mechanical robustness or complex geometries. The inherent lack of crystalline slip planes in amorphous structures results in limited plastic deformation capability before catastrophic failure, complicating both manufacturing processes and end-use applications where vibration or physical stress may occur.

Thermal stability constraints further limit widespread adoption, as amorphous metals crystallize when heated above their crystallization temperature, typically well below their melting point. This characteristic restricts operating temperatures and processing options, particularly challenging for power electronics applications where thermal management is critical.

Cost factors also remain prohibitive for many potential applications. Current production methods for high-quality amorphous metals involve specialized equipment and precise process control, resulting in significantly higher material costs compared to conventional crystalline alternatives. This cost differential has confined amorphous metals primarily to premium applications where performance benefits clearly justify the price premium.

Standardization issues further complicate industry adoption, as the relatively recent emergence of these materials means that comprehensive standards for testing, specification, and application design remain underdeveloped compared to traditional materials. This regulatory gap creates uncertainty for design engineers and slows integration into established supply chains and manufacturing processes.

Current Amorphous Metal Implementation Solutions

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, splat quenching, and gas atomization, which are essential for achieving the unique properties of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve quickly cooling molten metal to bypass crystal formation, resulting in a disordered atomic structure. Specific techniques include melt spinning, gas atomization, and other rapid quenching approaches that achieve the cooling rates necessary to maintain the amorphous state. These processes are critical for creating bulk metallic glasses with desirable properties.

- Composition and alloy systems for amorphous metals: Specific alloy compositions are designed to enhance glass-forming ability and stability of amorphous metals. These compositions typically include combinations of elements with significant atomic size differences to disrupt crystallization. Common amorphous metal systems include zirconium-based, iron-based, and aluminum-based alloys, often incorporating elements like beryllium, titanium, copper, and rare earth metals. The precise composition determines key properties such as strength, corrosion resistance, and thermal stability.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit unique mechanical and physical properties due to their lack of crystalline structure. These materials typically demonstrate exceptional strength, hardness, and elastic properties compared to their crystalline counterparts. They often show superior wear resistance, corrosion resistance, and magnetic properties. The absence of grain boundaries contributes to their distinctive behavior, including high yield strength and elastic limit, though they may exhibit limited ductility. These properties make amorphous metals suitable for specialized applications requiring high performance materials.

- Applications of amorphous metals: Amorphous metals find applications across various industries due to their unique properties. They are used in electronic components, transformers, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural components, sporting goods, and medical implants. Additionally, amorphous metals are utilized in cutting tools, armor materials, and aerospace components. Their ability to be precisely formed and their exceptional mechanical properties enable applications where conventional crystalline metals would be inadequate.

- Surface treatment and coating technologies for amorphous metals: Various surface treatment and coating technologies can be applied to amorphous metals to enhance their properties or create composite materials. These include thermal spray coating, vapor deposition, and laser surface treatments. Such processes can create amorphous metal coatings on conventional substrates, improving wear resistance, corrosion protection, and other surface-dependent properties. These technologies enable the application of amorphous metal properties to larger structures or components where bulk amorphous metals would be impractical or cost-prohibitive.

02 Composition and alloying elements in amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals like iron, nickel, or zirconium combined with metalloids such as boron, silicon, or phosphorus. The precise ratio of these elements significantly affects the material's ability to form an amorphous structure and determines its mechanical, magnetic, and corrosion-resistant properties.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique combination of properties. They are used in transformer cores and magnetic sensors due to their soft magnetic properties, in sporting equipment for their high strength-to-weight ratio, in medical devices for their biocompatibility, and in electronic components. Their exceptional corrosion resistance also makes them suitable for protective coatings and structural applications in harsh environments.Expand Specific Solutions04 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limit while maintaining relatively low density. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic behavior, including low coercivity and high permeability. These materials also show distinctive thermal properties and can display superplastic behavior at certain temperatures.Expand Specific Solutions05 Surface treatment and coating applications of amorphous metals

Amorphous metals can be applied as coatings to enhance the surface properties of conventional materials. These coatings provide improved wear resistance, corrosion protection, and hardness to the substrate. Various deposition techniques are employed, including thermal spraying, physical vapor deposition, and electrodeposition. The amorphous structure of these coatings offers superior performance compared to crystalline alternatives, particularly in aggressive environments where chemical stability is crucial.Expand Specific Solutions

Leading Companies in Amorphous Metals for Power Electronics

Amorphous metals are emerging as a transformative technology in power electronics, with the market currently in a growth phase characterized by increasing adoption across various applications. The global market size for amorphous metal components in power electronics is expanding rapidly, driven by demands for higher energy efficiency and miniaturization. From a technological maturity perspective, companies like Hitachi Energy, Metglas, and Advanced Technology & Materials Co. are leading commercial deployment, while research institutions such as California Institute of Technology and University of Science & Technology Beijing continue to advance fundamental capabilities. Established industrial players including Siemens, Toyota, and IBM are integrating these materials into next-generation products, particularly for transformer cores and high-frequency applications. The competitive landscape shows a blend of specialized material manufacturers and large electronics conglomerates collaborating to overcome remaining technical challenges in manufacturing scalability and cost reduction.

Metglas, Inc.

Technical Solution: Metglas has developed a comprehensive suite of amorphous metal alloys specifically optimized for power electronics applications. Their flagship products utilize iron-based amorphous alloys (Fe78B13Si9) produced through proprietary rapid solidification techniques that achieve cooling rates of approximately 10^6 K/s. This process creates a non-crystalline atomic structure that virtually eliminates the magnetocrystalline anisotropy responsible for hysteresis losses in conventional magnetic materials. Metglas' amorphous ribbon cores demonstrate permeability values exceeding 50,000 at 1 kHz and core losses as low as 0.2 W/kg at 1.4T/60Hz - approximately 70-80% lower than conventional electrical steels. The company has successfully implemented these materials in distribution transformers, achieving efficiency improvements of 60-70% compared to silicon steel alternatives. Their recent innovations include specialized edge treatment processes that minimize stress-induced degradation and extend component lifespans. Metglas has also developed composite cores that combine amorphous metals with nanocrystalline materials to optimize performance across broader frequency ranges.

Strengths: Industry-leading expertise in amorphous metal production with established manufacturing capabilities and quality control systems. Their materials offer exceptional energy efficiency with demonstrated commercial success in transformer applications. Weaknesses: Limited thickness options (typically 25-35μm) restrict design flexibility, and the inherent brittleness of amorphous metals presents challenges for certain fabrication processes. Higher initial material costs compared to conventional alternatives, though often offset by lifetime energy savings.

Toyota Motor Corp.

Technical Solution: Toyota has developed proprietary amorphous metal technologies specifically optimized for automotive power electronics applications. Their approach focuses on iron-based amorphous alloys (typically Fe-Si-B-C compositions) engineered for high-performance operation in hybrid and electric vehicle power conversion systems. Toyota's manufacturing process employs specialized melt-spinning techniques that achieve cooling rates exceeding 10^6 K/s, producing ultra-thin ribbons (approximately 15-25μm) with carefully controlled magnetic domain structures. These materials exhibit saturation flux densities of 1.5-1.7 T while maintaining extremely low core losses - typically 70-80% lower than conventional silicon steel at equivalent operating frequencies. Toyota has successfully implemented these amorphous metal components in their hybrid and electric vehicle power electronics, achieving significant improvements in power density (approximately 30-40% higher) and conversion efficiency (2-3% improvement). Their recent innovations include specialized heat treatment processes that optimize the balance between amorphous and nanocrystalline phases, creating tailored magnetic properties for specific automotive requirements. Toyota has also developed advanced core construction techniques that minimize eddy current losses while maximizing thermal performance under the demanding conditions of automotive applications. These technologies have been instrumental in reducing the size and weight of power electronics components in Toyota's latest generation of electrified vehicles.

Strengths: Extensive integration experience specifically focused on automotive applications, with proven performance in demanding operational environments. Their vertical integration capabilities enable optimization across the entire power electronics system rather than just individual components. Weaknesses: Proprietary technologies may limit broader industry adoption and standardization. The specialized manufacturing processes required for automotive-grade amorphous components add complexity and cost compared to conventional alternatives, though typically offset by performance benefits.

Key Innovations in Amorphous Metal Core Technologies

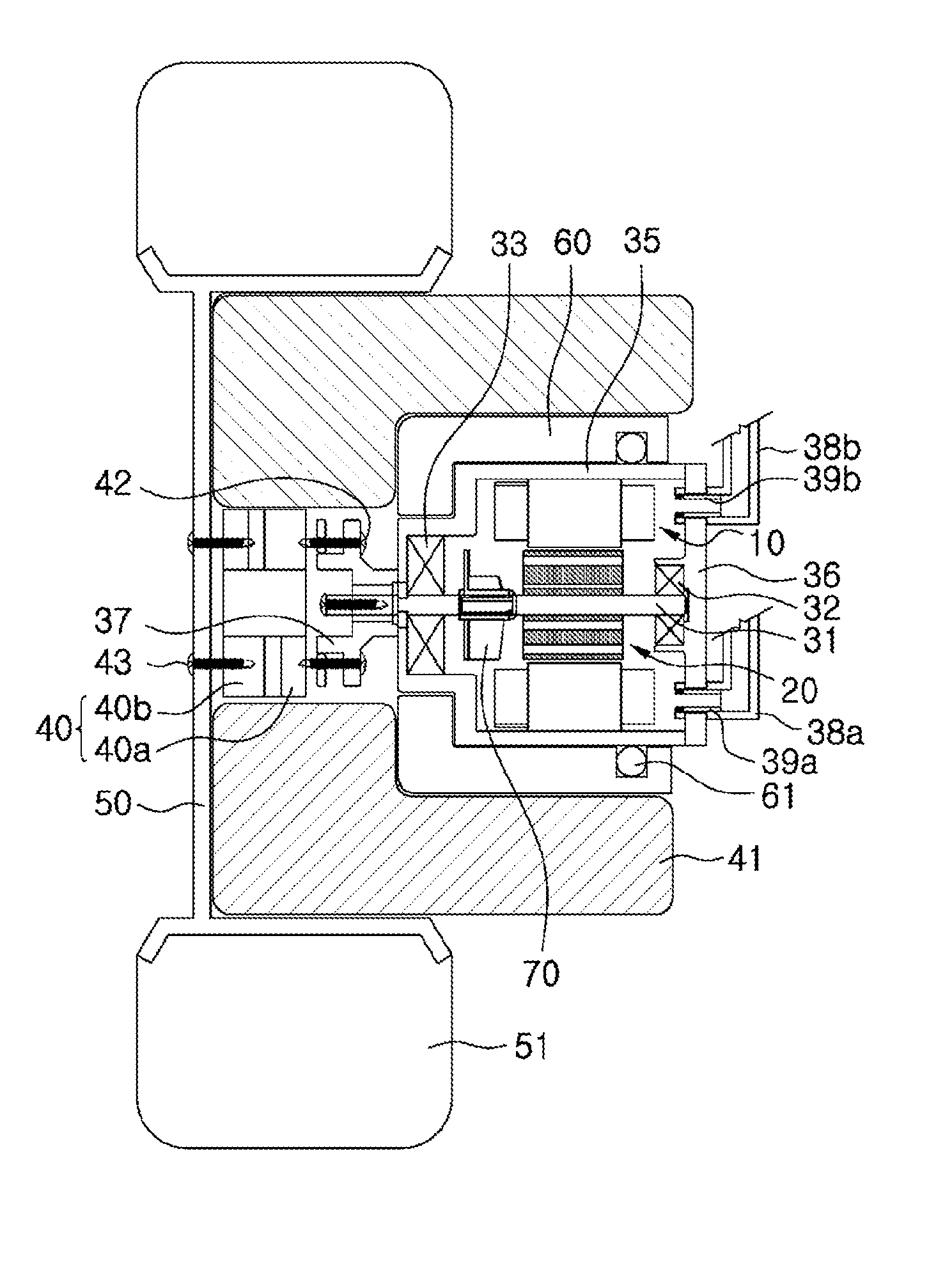

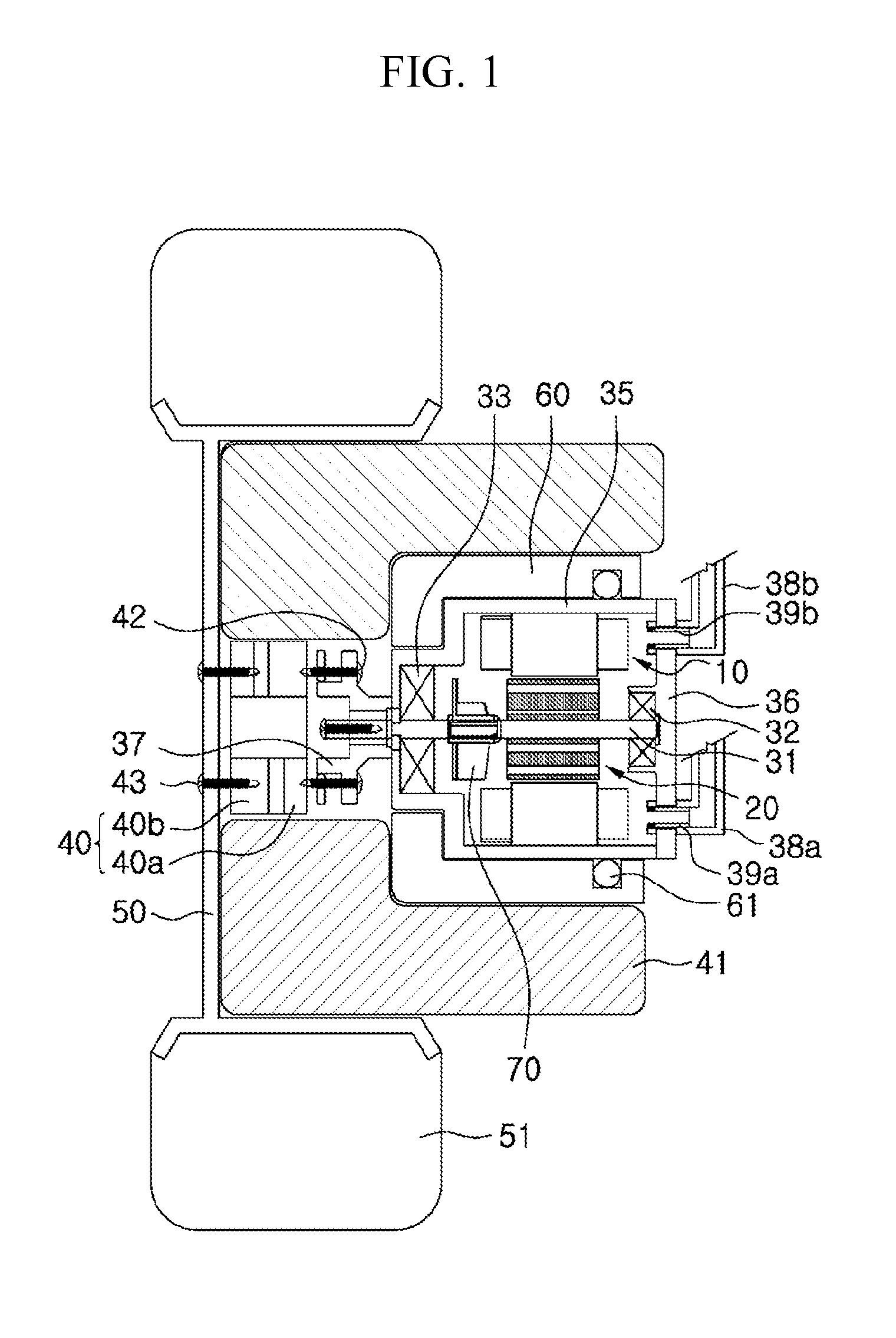

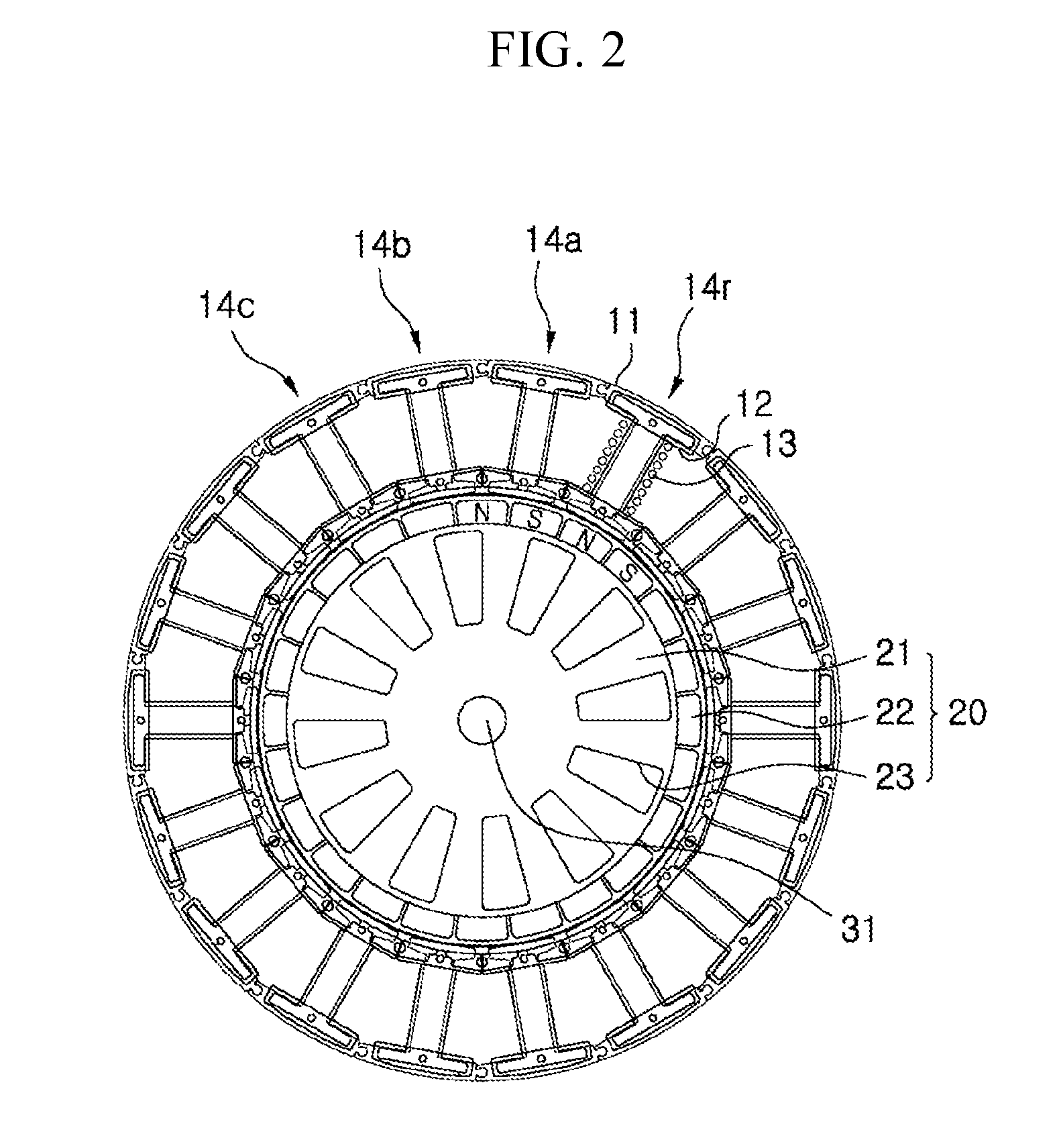

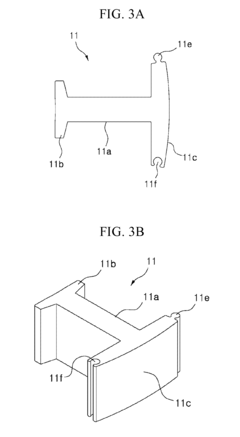

Amorphous magnetic component, electric motor using same and method for manufacturing same

PatentInactiveUS20130264894A1

Innovation

- The development of an amorphous magnetic component using powdered and compressed amorphous metal materials with added crystalline soft magnetic powder, allowing for improved permeability and packing density, enabling the creation of complex shapes and minimizing eddy current losses in high-frequency applications, and facilitating the use of amorphous alloy powder in a single-stator and single-rotor structure for efficient motor design.

Iron-based high saturation induction amorphous alloy

PatentActiveEP1853742A2

Innovation

- An iron-based amorphous alloy with a composition of FeaBbSiCd, where 81<a≤84, 10≤b≤18, 0<c≤5, and 0<d<1.5, is developed, which is ductile, thermally stable, and has a saturation induction greater than 1.6 tesla, achieved through a specific chemical composition and annealing process, resulting in low AC magnetic losses and high magnetic stability.

Energy Efficiency and Sustainability Impact

The adoption of amorphous metals in power electronics represents a significant advancement in energy efficiency across multiple applications. Power conversion systems utilizing amorphous metal cores demonstrate 70-80% reduced core losses compared to conventional silicon steel alternatives, resulting in overall efficiency improvements of 2-3% in power supplies and inverters. While this percentage may appear modest, when applied to global power electronics systems, it translates to potential energy savings of several terawatt-hours annually.

From a sustainability perspective, these efficiency gains directly contribute to reduced carbon emissions. Conservative estimates suggest that widespread implementation of amorphous metal components in power electronics could reduce global CO2 emissions by millions of tons annually, equivalent to removing hundreds of thousands of vehicles from roads. This aligns with increasingly stringent energy efficiency regulations and corporate sustainability commitments worldwide.

The manufacturing process of amorphous metals also presents environmental advantages. The rapid solidification technique used to produce these materials requires less energy than conventional metallurgical processes. Additionally, amorphous metal components typically have longer operational lifespans due to their superior mechanical properties and corrosion resistance, reducing replacement frequency and associated resource consumption.

In renewable energy applications, amorphous metals are particularly impactful. Solar inverters and wind power converters incorporating these materials achieve higher conversion efficiencies, effectively increasing the net energy yield from renewable sources without expanding physical infrastructure. This "efficiency multiplier effect" enhances the economic viability of renewable energy projects while accelerating carbon reduction goals.

The circular economy potential of amorphous metals further enhances their sustainability profile. Their composition, typically based on iron with additions of boron, silicon, and phosphorus, avoids rare earth elements and other critical materials facing supply constraints. Furthermore, end-of-life amorphous metal components are fully recyclable, with research indicating that reclaimed materials can retain most of their beneficial properties when properly processed.

As energy costs continue to rise globally and carbon pricing mechanisms become more prevalent, the economic case for amorphous metal adoption strengthens. Life-cycle assessments demonstrate that despite higher initial component costs, the total cost of ownership for power electronic systems using amorphous metals is typically lower when accounting for energy savings over operational lifetimes of 10-20 years.

From a sustainability perspective, these efficiency gains directly contribute to reduced carbon emissions. Conservative estimates suggest that widespread implementation of amorphous metal components in power electronics could reduce global CO2 emissions by millions of tons annually, equivalent to removing hundreds of thousands of vehicles from roads. This aligns with increasingly stringent energy efficiency regulations and corporate sustainability commitments worldwide.

The manufacturing process of amorphous metals also presents environmental advantages. The rapid solidification technique used to produce these materials requires less energy than conventional metallurgical processes. Additionally, amorphous metal components typically have longer operational lifespans due to their superior mechanical properties and corrosion resistance, reducing replacement frequency and associated resource consumption.

In renewable energy applications, amorphous metals are particularly impactful. Solar inverters and wind power converters incorporating these materials achieve higher conversion efficiencies, effectively increasing the net energy yield from renewable sources without expanding physical infrastructure. This "efficiency multiplier effect" enhances the economic viability of renewable energy projects while accelerating carbon reduction goals.

The circular economy potential of amorphous metals further enhances their sustainability profile. Their composition, typically based on iron with additions of boron, silicon, and phosphorus, avoids rare earth elements and other critical materials facing supply constraints. Furthermore, end-of-life amorphous metal components are fully recyclable, with research indicating that reclaimed materials can retain most of their beneficial properties when properly processed.

As energy costs continue to rise globally and carbon pricing mechanisms become more prevalent, the economic case for amorphous metal adoption strengthens. Life-cycle assessments demonstrate that despite higher initial component costs, the total cost of ownership for power electronic systems using amorphous metals is typically lower when accounting for energy savings over operational lifetimes of 10-20 years.

Manufacturing Challenges and Cost Analysis

Despite the promising properties of amorphous metals in power electronics applications, their widespread adoption faces significant manufacturing challenges. The production of amorphous metal components requires rapid cooling rates exceeding one million degrees Celsius per second to prevent crystallization. This necessitates specialized equipment and precise process control, creating substantial barriers to mass production. Conventional manufacturing facilities cannot easily be retrofitted for amorphous metal production, requiring significant capital investment in new infrastructure.

The ribbon casting process, the primary method for producing amorphous metal sheets, presents inherent limitations in thickness control and dimensional consistency. Current technology typically restricts amorphous metal ribbons to thicknesses below 50 micrometers, limiting their application in certain power electronic components requiring greater structural integrity. The process also struggles with producing uniform material properties across large production batches, creating quality control challenges.

From a cost perspective, amorphous metals currently command a premium of 30-50% over traditional silicon steel alternatives. This price differential stems from higher raw material costs, energy-intensive manufacturing processes, and lower production yields. The specialized rare earth elements often incorporated to enhance magnetic properties further increase material costs. Additionally, the intellectual property landscape surrounding amorphous metal manufacturing techniques is heavily protected, requiring licensing fees that contribute to overall production expenses.

The post-production processing of amorphous metals presents another cost driver. These materials exhibit exceptional hardness and brittleness in their as-cast state, making conventional machining and forming operations difficult and expensive. Specialized cutting, shaping, and assembly techniques must be developed, often requiring laser processing or advanced bonding methods that add to manufacturing complexity and cost.

Supply chain considerations also impact the economic viability of amorphous metals in power electronics. The limited number of suppliers capable of producing high-quality amorphous metal components creates potential bottlenecks and price volatility. Furthermore, the recyclability of these specialized alloys remains less developed than traditional materials, potentially affecting lifecycle costs and environmental sustainability metrics that increasingly influence purchasing decisions in the electronics industry.

Despite these challenges, economies of scale and manufacturing innovations are gradually reducing the cost gap. Recent advancements in continuous casting techniques and precision control systems have improved production yields by approximately 15% over the past five years. As production volumes increase and manufacturing processes mature, industry analysts project that the cost premium for amorphous metal components could decrease to 15-20% within the next decade, potentially accelerating adoption across broader power electronics applications.

The ribbon casting process, the primary method for producing amorphous metal sheets, presents inherent limitations in thickness control and dimensional consistency. Current technology typically restricts amorphous metal ribbons to thicknesses below 50 micrometers, limiting their application in certain power electronic components requiring greater structural integrity. The process also struggles with producing uniform material properties across large production batches, creating quality control challenges.

From a cost perspective, amorphous metals currently command a premium of 30-50% over traditional silicon steel alternatives. This price differential stems from higher raw material costs, energy-intensive manufacturing processes, and lower production yields. The specialized rare earth elements often incorporated to enhance magnetic properties further increase material costs. Additionally, the intellectual property landscape surrounding amorphous metal manufacturing techniques is heavily protected, requiring licensing fees that contribute to overall production expenses.

The post-production processing of amorphous metals presents another cost driver. These materials exhibit exceptional hardness and brittleness in their as-cast state, making conventional machining and forming operations difficult and expensive. Specialized cutting, shaping, and assembly techniques must be developed, often requiring laser processing or advanced bonding methods that add to manufacturing complexity and cost.

Supply chain considerations also impact the economic viability of amorphous metals in power electronics. The limited number of suppliers capable of producing high-quality amorphous metal components creates potential bottlenecks and price volatility. Furthermore, the recyclability of these specialized alloys remains less developed than traditional materials, potentially affecting lifecycle costs and environmental sustainability metrics that increasingly influence purchasing decisions in the electronics industry.

Despite these challenges, economies of scale and manufacturing innovations are gradually reducing the cost gap. Recent advancements in continuous casting techniques and precision control systems have improved production yields by approximately 15% over the past five years. As production volumes increase and manufacturing processes mature, industry analysts project that the cost premium for amorphous metal components could decrease to 15-20% within the next decade, potentially accelerating adoption across broader power electronics applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!