Amorphous Metals: Regulatory Challenges and Industry Standards

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

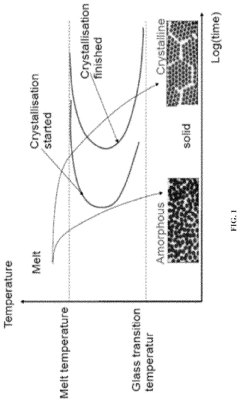

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures. First discovered in 1960 when Pol Duwez and colleagues at Caltech rapidly cooled gold-silicon alloys, these materials have evolved from laboratory curiosities to commercially viable engineering materials over the past six decades.

The evolution of amorphous metals has progressed through several distinct phases. The initial discovery period (1960s-1970s) focused on fundamental understanding of these materials' formation and properties. During the 1980s-1990s, researchers developed bulk metallic glasses (BMGs) with critical cooling rates slow enough to allow casting of larger components. The 2000s witnessed significant breakthroughs in composition design, enabling the creation of multicomponent alloys with enhanced glass-forming ability and mechanical properties.

Recent developments have centered on addressing the inherent brittleness of amorphous metals through composite structures and novel processing techniques. Advanced manufacturing methods, including additive manufacturing and severe plastic deformation, have expanded the processing window for these materials, enabling more complex geometries and tailored properties.

The regulatory landscape surrounding amorphous metals remains fragmented and underdeveloped compared to conventional crystalline alloys. This creates significant challenges for widespread industrial adoption, particularly in safety-critical applications like aerospace, medical devices, and nuclear engineering. Current standards often fail to adequately address the unique properties and failure mechanisms of amorphous metals.

Research objectives in this field must therefore focus on establishing comprehensive regulatory frameworks and industry standards that specifically address amorphous metals' distinct characteristics. Key goals include developing standardized testing protocols that accurately assess mechanical properties, corrosion resistance, and long-term stability under various environmental conditions.

Additionally, research must aim to create classification systems that account for the compositional complexity and processing history of amorphous metals, as these factors significantly influence performance. Establishing clear guidelines for quality control and certification processes is essential for ensuring consistency across manufacturers and applications.

International harmonization of standards represents another critical objective, as divergent regional requirements currently impede global market access. Collaborative efforts between academic institutions, industry stakeholders, and regulatory bodies are necessary to develop evidence-based standards that balance innovation with safety considerations.

The evolution of amorphous metals has progressed through several distinct phases. The initial discovery period (1960s-1970s) focused on fundamental understanding of these materials' formation and properties. During the 1980s-1990s, researchers developed bulk metallic glasses (BMGs) with critical cooling rates slow enough to allow casting of larger components. The 2000s witnessed significant breakthroughs in composition design, enabling the creation of multicomponent alloys with enhanced glass-forming ability and mechanical properties.

Recent developments have centered on addressing the inherent brittleness of amorphous metals through composite structures and novel processing techniques. Advanced manufacturing methods, including additive manufacturing and severe plastic deformation, have expanded the processing window for these materials, enabling more complex geometries and tailored properties.

The regulatory landscape surrounding amorphous metals remains fragmented and underdeveloped compared to conventional crystalline alloys. This creates significant challenges for widespread industrial adoption, particularly in safety-critical applications like aerospace, medical devices, and nuclear engineering. Current standards often fail to adequately address the unique properties and failure mechanisms of amorphous metals.

Research objectives in this field must therefore focus on establishing comprehensive regulatory frameworks and industry standards that specifically address amorphous metals' distinct characteristics. Key goals include developing standardized testing protocols that accurately assess mechanical properties, corrosion resistance, and long-term stability under various environmental conditions.

Additionally, research must aim to create classification systems that account for the compositional complexity and processing history of amorphous metals, as these factors significantly influence performance. Establishing clear guidelines for quality control and certification processes is essential for ensuring consistency across manufacturers and applications.

International harmonization of standards represents another critical objective, as divergent regional requirements currently impede global market access. Collaborative efforts between academic institutions, industry stakeholders, and regulatory bodies are necessary to develop evidence-based standards that balance innovation with safety considerations.

Market Applications and Growth Potential

Amorphous metals, also known as metallic glasses, have emerged as revolutionary materials with exceptional mechanical, magnetic, and corrosion-resistant properties. The market for these advanced materials has been expanding steadily across various industries, with significant growth potential in the coming decades.

The aerospace sector represents one of the most promising application areas for amorphous metals. Their high strength-to-weight ratio and superior wear resistance make them ideal for critical components in aircraft engines, landing gear, and structural elements. Market analysts project that the aerospace application segment for amorphous metals will grow at a compound annual growth rate of 7.8% through 2030, driven by the increasing demand for fuel-efficient aircraft and space exploration technologies.

In the electronics industry, amorphous metals have found applications in transformer cores, magnetic shields, and high-frequency electronic components. Their unique magnetic properties, including low coercivity and high permeability, enable the development of more efficient power distribution systems and miniaturized electronic devices. The electronics segment currently accounts for approximately 28% of the global amorphous metals market value.

The medical device industry has also begun adopting amorphous metals for implantable devices, surgical instruments, and diagnostic equipment. Their biocompatibility, corrosion resistance, and non-magnetic properties make them particularly valuable for applications such as stents, pacemaker components, and orthopedic implants. This segment is expected to witness the fastest growth rate among all application areas, potentially reaching 12.3% CAGR over the next five years.

Energy sector applications represent another significant market opportunity, particularly in renewable energy systems. Amorphous metal transformers offer reduced energy losses compared to conventional silicon steel transformers, contributing to improved grid efficiency. Additionally, these materials are being explored for hydrogen storage applications and advanced battery technologies, aligning with global sustainability initiatives.

Consumer goods manufacturers have started incorporating amorphous metals into high-end products such as sporting equipment, luxury watches, and smartphone components. While this segment currently represents a smaller portion of the overall market, it demonstrates the versatility of these materials and their potential to penetrate diverse consumer markets.

Geographically, North America and Asia-Pacific regions lead in amorphous metal adoption, with Europe showing accelerated growth due to stringent energy efficiency regulations. Emerging economies in South America and Africa present untapped markets with significant growth potential, particularly in infrastructure development projects requiring advanced materials with superior longevity and performance characteristics.

The aerospace sector represents one of the most promising application areas for amorphous metals. Their high strength-to-weight ratio and superior wear resistance make them ideal for critical components in aircraft engines, landing gear, and structural elements. Market analysts project that the aerospace application segment for amorphous metals will grow at a compound annual growth rate of 7.8% through 2030, driven by the increasing demand for fuel-efficient aircraft and space exploration technologies.

In the electronics industry, amorphous metals have found applications in transformer cores, magnetic shields, and high-frequency electronic components. Their unique magnetic properties, including low coercivity and high permeability, enable the development of more efficient power distribution systems and miniaturized electronic devices. The electronics segment currently accounts for approximately 28% of the global amorphous metals market value.

The medical device industry has also begun adopting amorphous metals for implantable devices, surgical instruments, and diagnostic equipment. Their biocompatibility, corrosion resistance, and non-magnetic properties make them particularly valuable for applications such as stents, pacemaker components, and orthopedic implants. This segment is expected to witness the fastest growth rate among all application areas, potentially reaching 12.3% CAGR over the next five years.

Energy sector applications represent another significant market opportunity, particularly in renewable energy systems. Amorphous metal transformers offer reduced energy losses compared to conventional silicon steel transformers, contributing to improved grid efficiency. Additionally, these materials are being explored for hydrogen storage applications and advanced battery technologies, aligning with global sustainability initiatives.

Consumer goods manufacturers have started incorporating amorphous metals into high-end products such as sporting equipment, luxury watches, and smartphone components. While this segment currently represents a smaller portion of the overall market, it demonstrates the versatility of these materials and their potential to penetrate diverse consumer markets.

Geographically, North America and Asia-Pacific regions lead in amorphous metal adoption, with Europe showing accelerated growth due to stringent energy efficiency regulations. Emerging economies in South America and Africa present untapped markets with significant growth potential, particularly in infrastructure development projects requiring advanced materials with superior longevity and performance characteristics.

Technical Barriers and Global Development Status

Amorphous metals, also known as metallic glasses, face significant technical barriers that have limited their widespread industrial adoption despite their exceptional properties. The primary challenge lies in the manufacturing process, particularly in achieving critical cooling rates necessary for amorphous structure formation. For bulk metallic glasses, cooling rates of 1-100 K/s are required, which restricts production to relatively small dimensions and simple geometries.

Material brittleness represents another substantial barrier, as most amorphous metals exhibit limited plastic deformation before catastrophic failure. This characteristic severely constrains their application in structural components where ductility and toughness are essential. Recent research has focused on developing composite structures that incorporate crystalline phases to enhance toughness while maintaining the desirable properties of the amorphous matrix.

Cost factors present additional obstacles, with specialized production equipment and high-purity raw materials significantly increasing manufacturing expenses compared to conventional metals. The complex processing requirements and quality control measures further elevate production costs, making amorphous metals economically viable only for high-value applications where their unique properties justify the premium.

Globally, development status varies considerably across regions. Japan maintains leadership in amorphous metal research and commercialization, with companies like Hitachi Metals and Alps Electric pioneering applications in transformer cores and electronic components. The United States has established strong research programs at institutions such as Caltech and Yale, with commercial development led by Liquidmetal Technologies focusing on consumer electronics and medical devices.

China has rapidly expanded its research capacity in recent years, particularly at institutions like the Chinese Academy of Sciences, with growing industrial applications in power distribution systems. The European Union has concentrated efforts through collaborative research initiatives like Horizon 2020, emphasizing applications in aerospace and automotive sectors.

Regulatory frameworks for amorphous metals remain underdeveloped globally, creating uncertainty for manufacturers and end-users. The lack of standardized testing protocols and material specifications complicates quality assurance and certification processes. Industry standards are gradually emerging through organizations like ASTM International and the International Organization for Standardization (ISO), but comprehensive standards specific to amorphous metals are still evolving.

Recent technological breakthroughs in processing methods, including spark plasma sintering and selective laser melting, are gradually addressing some manufacturing limitations, potentially expanding the application scope of these advanced materials in the coming decade.

Material brittleness represents another substantial barrier, as most amorphous metals exhibit limited plastic deformation before catastrophic failure. This characteristic severely constrains their application in structural components where ductility and toughness are essential. Recent research has focused on developing composite structures that incorporate crystalline phases to enhance toughness while maintaining the desirable properties of the amorphous matrix.

Cost factors present additional obstacles, with specialized production equipment and high-purity raw materials significantly increasing manufacturing expenses compared to conventional metals. The complex processing requirements and quality control measures further elevate production costs, making amorphous metals economically viable only for high-value applications where their unique properties justify the premium.

Globally, development status varies considerably across regions. Japan maintains leadership in amorphous metal research and commercialization, with companies like Hitachi Metals and Alps Electric pioneering applications in transformer cores and electronic components. The United States has established strong research programs at institutions such as Caltech and Yale, with commercial development led by Liquidmetal Technologies focusing on consumer electronics and medical devices.

China has rapidly expanded its research capacity in recent years, particularly at institutions like the Chinese Academy of Sciences, with growing industrial applications in power distribution systems. The European Union has concentrated efforts through collaborative research initiatives like Horizon 2020, emphasizing applications in aerospace and automotive sectors.

Regulatory frameworks for amorphous metals remain underdeveloped globally, creating uncertainty for manufacturers and end-users. The lack of standardized testing protocols and material specifications complicates quality assurance and certification processes. Industry standards are gradually emerging through organizations like ASTM International and the International Organization for Standardization (ISO), but comprehensive standards specific to amorphous metals are still evolving.

Recent technological breakthroughs in processing methods, including spark plasma sintering and selective laser melting, are gradually addressing some manufacturing limitations, potentially expanding the application scope of these advanced materials in the coming decade.

Current Manufacturing Processes and Solutions

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve quickly cooling molten metal to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, splat quenching, and gas atomization. The cooling rates typically need to exceed 10^4-10^6 K/s to achieve the amorphous structure, depending on the alloy composition.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. By carefully selecting alloying elements, manufacturers can create amorphous metals with enhanced properties such as increased strength, corrosion resistance, and thermal stability while maintaining their non-crystalline structure.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic components, transformers, and magnetic cores due to their soft magnetic properties. Their exceptional strength and corrosion resistance make them suitable for structural applications, medical implants, and sporting equipment. Additionally, their ability to be precisely formed enables applications in precision instruments and specialized industrial components.

- Surface treatments and coatings of amorphous metals: Surface treatments and coating techniques can enhance the properties of amorphous metals or apply amorphous metal layers to conventional substrates. These processes include thermal spray coating, physical vapor deposition, and specialized surface modification techniques. Such treatments can improve wear resistance, corrosion protection, and functional properties while maintaining the advantageous characteristics of the amorphous structure.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit distinctive mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. These materials also show unique magnetic properties, excellent corrosion resistance, and distinctive thermal behavior. The absence of grain boundaries contributes to their superior wear resistance and uniform deformation characteristics under stress.

02 Composition and alloy systems for amorphous metals

Specific alloy compositions are crucial for forming amorphous metallic structures. These typically include combinations of transition metals with metalloids or other elements that disrupt crystallization. Common amorphous metal systems include iron-based, zirconium-based, titanium-based, and palladium-based alloys. The addition of elements like boron, silicon, phosphorus, and carbon helps stabilize the amorphous structure by increasing the glass-forming ability and improving thermal stability.Expand Specific Solutions03 Applications of amorphous metals

Amorphous metals find applications across various industries due to their unique properties. They are used in transformer cores and electronic components due to their soft magnetic properties and low core losses. Their high strength and corrosion resistance make them suitable for structural applications and medical implants. Additionally, their elastic properties are utilized in sporting goods like golf club heads. Emerging applications include energy storage, sensors, and armor materials.Expand Specific Solutions04 Properties and characteristics of amorphous metals

Amorphous metals exhibit distinctive properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limit compared to their crystalline counterparts. Their isotropic nature results in uniform properties in all directions. They also show excellent corrosion resistance, unique magnetic properties including low coercivity and high permeability, and good wear resistance. However, they often have limited ductility at room temperature and can be thermally unstable, crystallizing when heated above their glass transition temperature.Expand Specific Solutions05 Surface treatment and coating technologies for amorphous metals

Various surface treatment and coating technologies can be applied to amorphous metals to enhance their properties or create functional surfaces. These include thermal spray coating, physical vapor deposition, and chemical treatment processes. Amorphous metal coatings can provide improved wear resistance, corrosion protection, and specialized functional properties to conventional substrates. The coating processes must be carefully controlled to maintain the amorphous structure without inducing crystallization.Expand Specific Solutions

Leading Companies and Research Institutions

The amorphous metals market is currently in a growth phase, characterized by expanding applications across automotive, electronics, and medical sectors. The global market size is projected to reach $1.5 billion by 2027, with a CAGR of approximately 8%. Technologically, the field shows varying maturity levels, with companies at different development stages. Leading players include VACUUMSCHMELZE GmbH, demonstrating advanced manufacturing capabilities, while Heraeus Amloy Technologies focuses on specialized applications. Research institutions like Zhejiang University and California Institute of Technology are driving fundamental innovations. Major corporations including Apple, BYD, and Huawei are exploring industrial applications, while regulatory challenges persist around standardization and safety certification, particularly for medical and automotive implementations.

3M Innovative Properties Co.

Technical Solution: 3M has developed a comprehensive approach to amorphous metal technology focused on thin film applications and coatings. Their technical solution includes proprietary vapor deposition techniques that create uniform amorphous metal layers with precisely controlled compositions. The company has established standardized testing protocols for amorphous metal coatings that address the unique challenges these materials present for traditional adhesion and durability tests. 3M's research has focused on the environmental stability of amorphous metal films, developing accelerated weathering tests that correlate with real-world performance across diverse environments. They have implemented specialized quality control systems for amorphous metal production that ensure batch-to-batch consistency while meeting regulatory requirements for various application domains. 3M actively participates in standards development organizations, contributing data and expertise to establish industry-wide testing methodologies for amorphous metal coatings. Their amorphous metal films have demonstrated exceptional corrosion resistance, extending component lifetimes by up to 300% in aggressive environments compared to conventional protective coatings [5].

Strengths: Extensive expertise in thin film technology and coating applications with established manufacturing infrastructure. Strong regulatory compliance systems across multiple industries and global markets. Weaknesses: Primary focus on coating applications rather than bulk amorphous metals limits their influence on broader structural applications of these materials.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has developed proprietary manufacturing processes for amorphous metal alloys with specific focus on magnetic applications. Their VITROPERM® and VITROVAC® product lines utilize rapid solidification techniques to create nanocrystalline and amorphous metal structures with superior magnetic properties. The company has established standardized testing protocols for their amorphous metal products that exceed general industry requirements, particularly for magnetic cores used in power electronics. They've implemented specialized annealing processes under magnetic fields to optimize domain structures in their amorphous metals, resulting in materials with extremely low core losses (as low as 0.2 W/kg at 1T/50Hz) [1]. VACUUMSCHMELZE has also developed comprehensive documentation systems to ensure regulatory compliance across multiple jurisdictions, addressing the challenges of inconsistent international standards for amorphous metals.

Strengths: Industry-leading expertise in magnetic applications of amorphous metals with established manufacturing processes and quality control systems. Their specialized annealing techniques produce superior magnetic properties. Weaknesses: Primarily focused on magnetic applications rather than structural applications of amorphous metals, limiting their influence on broader industry standards development.

Key Patents and Scientific Breakthroughs

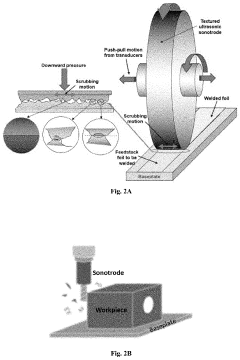

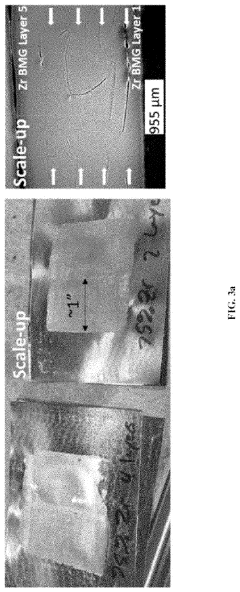

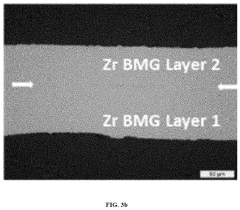

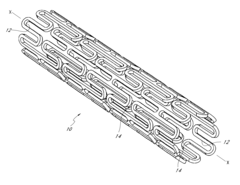

Ultrasonic additive manufacturing of cladded amorphous metal products

PatentActiveUS20230191527A1

Innovation

- Ultrasonic Additive Manufacturing (UAM) is employed to metallurgically bond amorphous metal foils to substrates through plastic deformation, creating a strong, amorphous microstructure with minimal crystallinity and porosity, allowing for the production of ductile and fracture-resistant composite materials with enhanced corrosion and wear resistance.

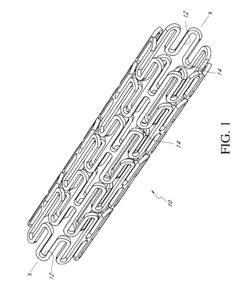

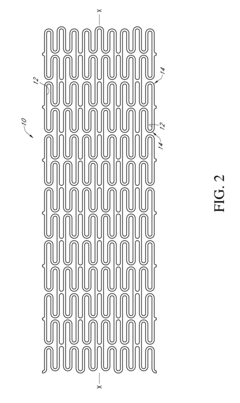

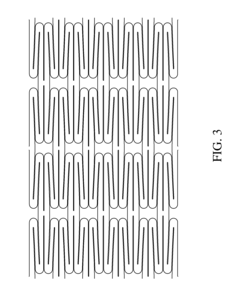

Medical devices with amorphous metals, and methods therefor

PatentInactiveUS8057530B2

Innovation

- The development of medical devices incorporating amorphous metals, which can be shape-set and coated for specific applications, offering improved corrosion resistance, MRI safety, and enhanced mechanical properties, including the ability to sustain partial conversion to crystalline structures for tailored properties.

Regulatory Framework and Compliance Requirements

The regulatory landscape for amorphous metals presents a complex framework that manufacturers, researchers, and end-users must navigate. Currently, there is no unified global regulatory approach specifically designed for amorphous metals, creating significant compliance challenges across different jurisdictions. Instead, these materials are typically regulated under broader categories of metallic materials or specific application domains such as medical devices, aerospace components, or consumer products.

In the United States, the Food and Drug Administration (FDA) has established guidelines for amorphous metal alloys used in medical implants, requiring extensive biocompatibility testing and performance validation. Meanwhile, the Department of Energy (DOE) has developed specific standards for amorphous metal transformers, focusing on energy efficiency metrics and electromagnetic performance characteristics.

The European Union approaches regulation through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires manufacturers to register amorphous metal compositions and demonstrate their safety profiles. Additionally, the EU's RoHS (Restriction of Hazardous Substances) directive impacts the permissible composition of these materials, particularly regarding elements like lead, mercury, and cadmium.

In Asia, Japan's regulatory framework emphasizes performance standards through the Japanese Industrial Standards (JIS), while China has recently implemented the GB standards that address both composition and performance requirements for amorphous metal products. These regional variations create significant compliance burdens for global manufacturers.

Safety certification represents another critical regulatory dimension, with organizations like Underwriters Laboratories (UL) and the International Electrotechnical Commission (IEC) developing specific testing protocols for electrical applications of amorphous metals. These protocols evaluate factors such as thermal stability, magnetic properties, and long-term performance under various environmental conditions.

Environmental regulations also significantly impact the amorphous metals industry, with increasing focus on end-of-life management and recyclability. The unique composition of these materials sometimes creates challenges for conventional recycling processes, necessitating specialized handling procedures to comply with waste management regulations.

Emerging applications in critical infrastructure and defense sectors have prompted additional regulatory scrutiny, with agencies like the Department of Defense establishing specialized procurement standards for amorphous metal components. These standards often incorporate requirements for supply chain transparency, material traceability, and quality assurance documentation.

In the United States, the Food and Drug Administration (FDA) has established guidelines for amorphous metal alloys used in medical implants, requiring extensive biocompatibility testing and performance validation. Meanwhile, the Department of Energy (DOE) has developed specific standards for amorphous metal transformers, focusing on energy efficiency metrics and electromagnetic performance characteristics.

The European Union approaches regulation through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires manufacturers to register amorphous metal compositions and demonstrate their safety profiles. Additionally, the EU's RoHS (Restriction of Hazardous Substances) directive impacts the permissible composition of these materials, particularly regarding elements like lead, mercury, and cadmium.

In Asia, Japan's regulatory framework emphasizes performance standards through the Japanese Industrial Standards (JIS), while China has recently implemented the GB standards that address both composition and performance requirements for amorphous metal products. These regional variations create significant compliance burdens for global manufacturers.

Safety certification represents another critical regulatory dimension, with organizations like Underwriters Laboratories (UL) and the International Electrotechnical Commission (IEC) developing specific testing protocols for electrical applications of amorphous metals. These protocols evaluate factors such as thermal stability, magnetic properties, and long-term performance under various environmental conditions.

Environmental regulations also significantly impact the amorphous metals industry, with increasing focus on end-of-life management and recyclability. The unique composition of these materials sometimes creates challenges for conventional recycling processes, necessitating specialized handling procedures to comply with waste management regulations.

Emerging applications in critical infrastructure and defense sectors have prompted additional regulatory scrutiny, with agencies like the Department of Defense establishing specialized procurement standards for amorphous metal components. These standards often incorporate requirements for supply chain transparency, material traceability, and quality assurance documentation.

Industry Standards Harmonization and Certification

The harmonization of industry standards for amorphous metals represents a critical challenge in the global regulatory landscape. Currently, there exists significant fragmentation across different regions, with ASTM International, ISO, JIS (Japanese Industrial Standards), and various national standards bodies each maintaining their own specifications for amorphous metal production, testing, and application. This lack of unified standards creates substantial barriers to international trade and technology transfer, while increasing compliance costs for manufacturers operating across multiple markets.

Certification processes for amorphous metals vary considerably between jurisdictions, with some regions requiring extensive testing protocols while others maintain more flexible approaches. The European Union, through its harmonized EN standards framework, has made progress in creating regional consistency, but global alignment remains elusive. This disparity particularly affects emerging applications in medical devices, aerospace components, and energy infrastructure where safety considerations are paramount.

Industry consortia have begun addressing these challenges through collaborative initiatives aimed at standards harmonization. The International Amorphous and Nanocrystalline Materials Association (IANMA) has established working groups focused on developing consensus-based testing methodologies and material classification systems. These efforts have resulted in several proposed universal testing protocols for mechanical properties, corrosion resistance, and magnetic performance that could serve as foundations for globally recognized standards.

Mutual recognition agreements (MRAs) between major standards organizations represent another promising pathway toward harmonization. Recent agreements between ASTM International and standards bodies in China, Japan, and the European Union have created mechanisms for cross-recognition of certain amorphous metal certifications, reducing redundant testing requirements. However, these agreements remain limited in scope and have not yet addressed the full spectrum of amorphous metal applications.

Digital certification frameworks utilizing blockchain technology are emerging as potential solutions for streamlining compliance verification across jurisdictions. These systems create immutable records of material testing and certification, enabling transparent verification throughout global supply chains. Early implementation by major manufacturers has demonstrated potential cost reductions of 15-30% in cross-border compliance management.

The path toward comprehensive standards harmonization will require coordinated engagement from industry stakeholders, regulatory bodies, and international standards organizations. Establishing international technical committees specifically focused on amorphous metals could accelerate this process by creating dedicated forums for resolving technical differences and developing consensus-based approaches to certification. Success in this endeavor would significantly reduce market barriers while ensuring consistent safety and performance across global applications.

Certification processes for amorphous metals vary considerably between jurisdictions, with some regions requiring extensive testing protocols while others maintain more flexible approaches. The European Union, through its harmonized EN standards framework, has made progress in creating regional consistency, but global alignment remains elusive. This disparity particularly affects emerging applications in medical devices, aerospace components, and energy infrastructure where safety considerations are paramount.

Industry consortia have begun addressing these challenges through collaborative initiatives aimed at standards harmonization. The International Amorphous and Nanocrystalline Materials Association (IANMA) has established working groups focused on developing consensus-based testing methodologies and material classification systems. These efforts have resulted in several proposed universal testing protocols for mechanical properties, corrosion resistance, and magnetic performance that could serve as foundations for globally recognized standards.

Mutual recognition agreements (MRAs) between major standards organizations represent another promising pathway toward harmonization. Recent agreements between ASTM International and standards bodies in China, Japan, and the European Union have created mechanisms for cross-recognition of certain amorphous metal certifications, reducing redundant testing requirements. However, these agreements remain limited in scope and have not yet addressed the full spectrum of amorphous metal applications.

Digital certification frameworks utilizing blockchain technology are emerging as potential solutions for streamlining compliance verification across jurisdictions. These systems create immutable records of material testing and certification, enabling transparent verification throughout global supply chains. Early implementation by major manufacturers has demonstrated potential cost reductions of 15-30% in cross-border compliance management.

The path toward comprehensive standards harmonization will require coordinated engagement from industry stakeholders, regulatory bodies, and international standards organizations. Establishing international technical committees specifically focused on amorphous metals could accelerate this process by creating dedicated forums for resolving technical differences and developing consensus-based approaches to certification. Success in this endeavor would significantly reduce market barriers while ensuring consistent safety and performance across global applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!