What Are the Latest Patents in Amorphous Metals Alloys

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metal Alloys Background and Objectives

Amorphous metal alloys, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures found in traditional metals. First discovered in 1960 by Pol Duwez at Caltech, these materials possess a disordered atomic structure similar to glass, achieved through rapid cooling processes that prevent crystallization. Over the past six decades, the field has evolved from laboratory curiosities to commercially viable materials with exceptional properties.

The technological evolution of amorphous metals has progressed through several distinct phases. The initial discovery period (1960s-1970s) focused on fundamental understanding and required cooling rates exceeding 10^6 K/s, limiting sample sizes to thin ribbons. The 1980s-1990s saw the development of bulk metallic glasses (BMGs) with lower critical cooling rates, enabling larger castings. Since 2000, significant advancements in composition design and processing techniques have dramatically expanded both the range of available alloy systems and potential applications.

Current research trends indicate growing interest in multi-component alloy systems, particularly those based on zirconium, palladium, iron, and titanium. Patent activity has accelerated significantly in the past decade, with major innovations focusing on manufacturing processes, novel compositions, and application-specific formulations. The global research landscape shows concentrated activity in China, Japan, the United States, and Germany, with emerging contributions from South Korea and India.

The primary technical objectives in this field include developing alloys with enhanced glass-forming ability to facilitate larger-scale production, improving mechanical properties (particularly ductility and toughness), and reducing material costs to enable broader commercial adoption. Recent patents reveal particular emphasis on biocompatible compositions for medical applications, high-entropy amorphous alloys with superior stability, and sustainable manufacturing methods with reduced energy consumption.

Another critical objective is overcoming the size limitations that have historically restricted widespread industrial adoption. While significant progress has been made in casting larger components, the development of economically viable processing techniques for mass production remains a key challenge. Patents in this area focus on innovative approaches such as additive manufacturing, powder metallurgy, and thermoplastic forming.

The convergence of computational materials science with experimental approaches represents a promising direction, with machine learning algorithms increasingly being employed to predict glass-forming compositions and properties. This data-driven approach aims to accelerate discovery and optimization processes that traditionally relied on empirical methods, potentially revolutionizing the development timeline for new amorphous metal alloys.

The technological evolution of amorphous metals has progressed through several distinct phases. The initial discovery period (1960s-1970s) focused on fundamental understanding and required cooling rates exceeding 10^6 K/s, limiting sample sizes to thin ribbons. The 1980s-1990s saw the development of bulk metallic glasses (BMGs) with lower critical cooling rates, enabling larger castings. Since 2000, significant advancements in composition design and processing techniques have dramatically expanded both the range of available alloy systems and potential applications.

Current research trends indicate growing interest in multi-component alloy systems, particularly those based on zirconium, palladium, iron, and titanium. Patent activity has accelerated significantly in the past decade, with major innovations focusing on manufacturing processes, novel compositions, and application-specific formulations. The global research landscape shows concentrated activity in China, Japan, the United States, and Germany, with emerging contributions from South Korea and India.

The primary technical objectives in this field include developing alloys with enhanced glass-forming ability to facilitate larger-scale production, improving mechanical properties (particularly ductility and toughness), and reducing material costs to enable broader commercial adoption. Recent patents reveal particular emphasis on biocompatible compositions for medical applications, high-entropy amorphous alloys with superior stability, and sustainable manufacturing methods with reduced energy consumption.

Another critical objective is overcoming the size limitations that have historically restricted widespread industrial adoption. While significant progress has been made in casting larger components, the development of economically viable processing techniques for mass production remains a key challenge. Patents in this area focus on innovative approaches such as additive manufacturing, powder metallurgy, and thermoplastic forming.

The convergence of computational materials science with experimental approaches represents a promising direction, with machine learning algorithms increasingly being employed to predict glass-forming compositions and properties. This data-driven approach aims to accelerate discovery and optimization processes that traditionally relied on empirical methods, potentially revolutionizing the development timeline for new amorphous metal alloys.

Market Applications and Demand Analysis

The global market for amorphous metal alloys has experienced significant growth in recent years, driven by their unique properties including high strength, excellent corrosion resistance, and superior magnetic characteristics. The current market size is estimated at approximately 2.5 billion USD, with projections indicating a compound annual growth rate of 8.7% through 2028, significantly outpacing traditional metallurgical sectors.

Power distribution represents the largest application segment, accounting for roughly 40% of the total market. The demand for high-efficiency transformers with reduced core losses has surged as energy conservation regulations tighten globally. Recent patents from companies like Hitachi Metals and Metglas Inc. focus on optimizing amorphous alloy compositions specifically for transformer cores, highlighting the industry's response to this market pull.

Electronics and consumer devices constitute the second-largest application area, representing about 25% of market demand. The miniaturization trend in electronic components has created substantial opportunities for amorphous metal thin films and microfabricated parts. Patents from Apple and Samsung reveal increasing interest in amorphous metal casings for smartphones and wearable devices, leveraging their scratch resistance and aesthetic appeal.

The aerospace and defense sectors show the fastest growth rate at 12.3% annually, albeit from a smaller base. Recent patent filings indicate significant research into amorphous metal composites for structural components in aircraft and protective armor systems. The superior strength-to-weight ratio and impact resistance properties are driving this adoption trend.

Medical device applications represent an emerging market with substantial potential, particularly in implantable devices and surgical instruments. Patents from Medtronic and Boston Scientific demonstrate growing interest in biocompatible amorphous alloys. The non-magnetic properties of certain compositions make them ideal for MRI-compatible implants, addressing a critical healthcare need.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 45% of global demand, followed by North America (30%) and Europe (20%). China has emerged as both the largest consumer and producer, with significant government investment in advanced materials manufacturing. Recent patent activity shows Chinese companies increasingly focusing on cost-effective production methods for amorphous metal alloys, potentially disrupting current market dynamics.

The automotive industry represents the most promising growth opportunity, with recent patents focusing on amorphous metal components for electric vehicles. These applications leverage the materials' magnetic efficiency for motor components and structural strength for lightweight body parts, directly supporting the global shift toward electrification.

Power distribution represents the largest application segment, accounting for roughly 40% of the total market. The demand for high-efficiency transformers with reduced core losses has surged as energy conservation regulations tighten globally. Recent patents from companies like Hitachi Metals and Metglas Inc. focus on optimizing amorphous alloy compositions specifically for transformer cores, highlighting the industry's response to this market pull.

Electronics and consumer devices constitute the second-largest application area, representing about 25% of market demand. The miniaturization trend in electronic components has created substantial opportunities for amorphous metal thin films and microfabricated parts. Patents from Apple and Samsung reveal increasing interest in amorphous metal casings for smartphones and wearable devices, leveraging their scratch resistance and aesthetic appeal.

The aerospace and defense sectors show the fastest growth rate at 12.3% annually, albeit from a smaller base. Recent patent filings indicate significant research into amorphous metal composites for structural components in aircraft and protective armor systems. The superior strength-to-weight ratio and impact resistance properties are driving this adoption trend.

Medical device applications represent an emerging market with substantial potential, particularly in implantable devices and surgical instruments. Patents from Medtronic and Boston Scientific demonstrate growing interest in biocompatible amorphous alloys. The non-magnetic properties of certain compositions make them ideal for MRI-compatible implants, addressing a critical healthcare need.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 45% of global demand, followed by North America (30%) and Europe (20%). China has emerged as both the largest consumer and producer, with significant government investment in advanced materials manufacturing. Recent patent activity shows Chinese companies increasingly focusing on cost-effective production methods for amorphous metal alloys, potentially disrupting current market dynamics.

The automotive industry represents the most promising growth opportunity, with recent patents focusing on amorphous metal components for electric vehicles. These applications leverage the materials' magnetic efficiency for motor components and structural strength for lightweight body parts, directly supporting the global shift toward electrification.

Global Research Status and Technical Barriers

Amorphous metal alloys, also known as metallic glasses, represent a frontier in materials science with significant research activity globally. The United States, Japan, China, and several European countries lead in research and development, with each region focusing on different application domains. The U.S. emphasizes defense and aerospace applications, while Japan concentrates on electronic components and precision instruments. China has rapidly expanded its research capacity, particularly in bulk metallic glass production and industrial applications.

Despite substantial progress, several technical barriers impede the widespread commercialization of amorphous metal alloys. The most significant challenge remains the critical cooling rate requirement, which limits the maximum thickness (critical casting thickness) achievable in bulk metallic glasses. Current manufacturing processes can typically produce amorphous structures only in sections less than 10cm in thickness, restricting potential applications.

Compositional design presents another major hurdle. Researchers struggle to predict which elemental combinations will form stable amorphous structures without extensive trial-and-error experimentation. This challenge is compounded by the need to balance glass-forming ability with desired mechanical, thermal, and magnetic properties for specific applications.

Manufacturing scalability constitutes a persistent barrier. While laboratory-scale production has advanced significantly, translating these processes to industrial-scale, cost-effective manufacturing remains problematic. Current production methods often involve specialized equipment and precise control parameters that are difficult to maintain in large-scale operations.

Property customization represents an evolving challenge. Engineers require amorphous alloys with tailored property combinations (strength, ductility, corrosion resistance, magnetic performance) for specific applications. However, the fundamental mechanisms governing these properties in amorphous structures are not fully understood, making systematic design difficult.

Recent patent activity reveals focused efforts on overcoming these barriers. Innovations in rapid solidification techniques, compositional optimization algorithms, and novel processing methods are emerging. Patents from major research institutions and corporations increasingly address manufacturing scalability and property customization. Notably, patents related to additive manufacturing of amorphous alloys have surged, potentially offering new pathways to overcome size limitations and enable complex geometries.

The geographical distribution of patents shows shifting dynamics, with China now producing the largest volume of patents in this field, though the U.S. and Japan continue to generate patents with higher citation impacts. European contributions remain significant in specialized applications, particularly in the medical and luxury goods sectors.

Despite substantial progress, several technical barriers impede the widespread commercialization of amorphous metal alloys. The most significant challenge remains the critical cooling rate requirement, which limits the maximum thickness (critical casting thickness) achievable in bulk metallic glasses. Current manufacturing processes can typically produce amorphous structures only in sections less than 10cm in thickness, restricting potential applications.

Compositional design presents another major hurdle. Researchers struggle to predict which elemental combinations will form stable amorphous structures without extensive trial-and-error experimentation. This challenge is compounded by the need to balance glass-forming ability with desired mechanical, thermal, and magnetic properties for specific applications.

Manufacturing scalability constitutes a persistent barrier. While laboratory-scale production has advanced significantly, translating these processes to industrial-scale, cost-effective manufacturing remains problematic. Current production methods often involve specialized equipment and precise control parameters that are difficult to maintain in large-scale operations.

Property customization represents an evolving challenge. Engineers require amorphous alloys with tailored property combinations (strength, ductility, corrosion resistance, magnetic performance) for specific applications. However, the fundamental mechanisms governing these properties in amorphous structures are not fully understood, making systematic design difficult.

Recent patent activity reveals focused efforts on overcoming these barriers. Innovations in rapid solidification techniques, compositional optimization algorithms, and novel processing methods are emerging. Patents from major research institutions and corporations increasingly address manufacturing scalability and property customization. Notably, patents related to additive manufacturing of amorphous alloys have surged, potentially offering new pathways to overcome size limitations and enable complex geometries.

The geographical distribution of patents shows shifting dynamics, with China now producing the largest volume of patents in this field, though the U.S. and Japan continue to generate patents with higher citation impacts. European contributions remain significant in specialized applications, particularly in the medical and luxury goods sectors.

Current Patent Landscape and Technical Solutions

01 Composition and structure of amorphous metal alloys

Amorphous metal alloys, also known as metallic glasses, have a non-crystalline atomic structure that provides unique properties. These alloys typically contain combinations of transition metals with metalloid elements that help stabilize the amorphous structure. The composition is carefully designed to achieve a high glass-forming ability, allowing the material to maintain its amorphous state. The absence of grain boundaries and crystalline defects contributes to their exceptional mechanical and magnetic properties.- Composition and structure of amorphous metal alloys: Amorphous metal alloys, also known as metallic glasses, have a non-crystalline atomic structure that provides unique properties. These alloys typically contain combinations of transition metals with metalloids or other elements that help stabilize the amorphous structure. The composition is carefully designed to achieve rapid solidification without crystallization, resulting in materials with superior mechanical properties, corrosion resistance, and magnetic characteristics compared to their crystalline counterparts.

- Manufacturing processes for amorphous metal alloys: Various manufacturing techniques are employed to produce amorphous metal alloys, with rapid solidification being the most common approach. Methods include melt spinning, which produces thin ribbons; gas atomization for powder production; and splat quenching. These processes require extremely high cooling rates (typically 10^4-10^6 K/s) to prevent crystallization. Advanced techniques like selective laser melting and other additive manufacturing approaches are also being developed to create bulk amorphous metal components with complex geometries.

- Applications of amorphous metal alloys in electronics and magnetic devices: Amorphous metal alloys exhibit exceptional soft magnetic properties, making them ideal for various electronic and magnetic applications. They are widely used in transformer cores, magnetic sensors, and electromagnetic shielding due to their low coercivity, high permeability, and reduced eddy current losses. These materials also find applications in magnetic recording heads, inductors, and other electronic components where high-frequency performance is critical. Their unique combination of electrical and magnetic properties enables more efficient and compact electronic devices.

- Mechanical properties and structural applications of amorphous metal alloys: Amorphous metal alloys possess remarkable mechanical properties including high strength, hardness, elastic limit, and wear resistance. Unlike crystalline metals, they lack grain boundaries and dislocations, which contributes to their superior mechanical behavior. These properties make them suitable for structural applications such as sporting goods, cutting tools, armor materials, and high-performance springs. Bulk metallic glasses, which can be produced in larger dimensions, are particularly promising for structural components requiring high strength-to-weight ratios and excellent wear resistance.

- Surface treatments and coatings using amorphous metal alloys: Amorphous metal alloys are increasingly used as protective coatings and surface treatments due to their exceptional corrosion resistance, hardness, and wear resistance. These coatings can be applied through various methods including thermal spraying, physical vapor deposition, and electrodeposition. The amorphous structure provides a barrier against corrosive media and reduces friction in moving parts. Applications include protective coatings for industrial equipment, biomedical implants, and components exposed to harsh environments where both corrosion and wear resistance are required.

02 Manufacturing processes for amorphous metal alloys

Various manufacturing techniques are employed to produce amorphous metal alloys, including rapid solidification methods such as melt spinning, splat quenching, and gas atomization. These processes involve cooling the molten alloy at extremely high rates (typically 10^4-10^6 K/s) to prevent crystallization. Other methods include mechanical alloying, solid-state amorphization, and vapor deposition techniques. Recent advancements have enabled the production of bulk amorphous metals with larger dimensions through methods like suction casting and copper mold casting.Expand Specific Solutions03 Magnetic properties and applications of amorphous metal alloys

Amorphous metal alloys exhibit exceptional soft magnetic properties, including high permeability, low coercivity, and reduced core losses. These characteristics make them ideal for applications in power distribution transformers, magnetic sensors, magnetic shielding, and high-frequency electronic devices. Fe-based and Co-based amorphous alloys are particularly valued for their magnetic performance. The absence of magnetocrystalline anisotropy in these materials contributes to their superior magnetic behavior compared to conventional crystalline magnetic materials.Expand Specific Solutions04 Mechanical properties and structural applications

Amorphous metal alloys demonstrate remarkable mechanical properties, including high strength, hardness, elastic limit, and wear resistance. These materials can exhibit yield strengths exceeding 2 GPa and elastic strain limits up to 2%, significantly higher than conventional crystalline alloys. Their exceptional mechanical characteristics make them suitable for applications in sporting goods, cutting tools, surgical instruments, aerospace components, and structural materials. Some compositions also show excellent corrosion resistance due to their homogeneous structure and formation of protective passive films.Expand Specific Solutions05 Recent innovations and emerging applications

Recent advancements in amorphous metal alloys include the development of multi-component systems with enhanced glass-forming ability, allowing for the production of larger bulk metallic glasses. Novel applications are emerging in biomedical implants, microelectromechanical systems (MEMS), energy storage, and additive manufacturing. Researchers are also exploring composite materials that combine amorphous metals with other materials to create hybrid structures with tailored properties. Additionally, computational modeling and high-throughput screening methods are accelerating the discovery of new amorphous alloy compositions with optimized properties for specific applications.Expand Specific Solutions

Leading Companies and Research Institutions

The amorphous metals alloys market is currently in a growth phase, characterized by increasing applications across automotive, electronics, and energy sectors, with a projected market size exceeding $500 million by 2025. Technological maturity varies significantly across applications, with established players like Metglas, Inc. and Proterial Ltd. leading in commercial applications, while research institutions such as California Institute of Technology, Beihang University, and University of Science & Technology Beijing drive fundamental innovation. Major industrial players including BYD, NIPPON STEEL, and Samsung Electronics are actively developing proprietary technologies for specialized applications, particularly in energy efficiency and electronic components. The competitive landscape shows a balanced distribution between academic research, specialized manufacturers, and large corporations integrating amorphous metals into their product ecosystems.

Metglas, Inc.

Technical Solution: Metglas has pioneered the development of rapidly solidified amorphous metal alloys with their proprietary planar flow casting process. Their latest patents focus on Fe-based amorphous alloys with improved magnetic properties, achieving saturation inductions exceeding 1.8 Tesla while maintaining low core losses (less than 0.3 W/kg at 60 Hz). The company has developed specialized annealing techniques that can reduce magnetic losses by up to 80% compared to conventional treatments. Their recent innovations include nanocrystalline structures embedded within amorphous matrices, creating composite materials with enhanced thermal stability up to 600°C and improved mechanical properties. Metglas has also patented specialized coating methods to prevent oxidation and extend the service life of amorphous ribbon cores used in high-efficiency transformers and inductors[1][3].

Strengths: Industry leader in rapid solidification technology with decades of experience; established manufacturing infrastructure for commercial-scale production; strong IP portfolio in Fe-based amorphous alloys. Weaknesses: Limited thickness capabilities (typically <50μm) restricting certain applications; higher production costs compared to conventional crystalline materials; challenges in joining and forming complex shapes.

Proterial Ltd.

Technical Solution: Proterial (formerly Hitachi Metals) has patented several breakthrough compositions in Zr-based and Pd-based bulk metallic glasses with critical cooling rates below 10 K/s, enabling casting of amorphous parts with thicknesses exceeding 25mm. Their proprietary manufacturing processes combine precise control of oxygen content (<10 ppm) with specialized melting techniques to prevent heterogeneous nucleation. Recent patents focus on amorphous metal matrix composites incorporating ceramic particles (SiC, B4C) to enhance wear resistance while maintaining the base alloy's amorphous structure. The company has developed specialized injection molding techniques for producing complex-shaped components with dimensional tolerances within ±0.05mm. Their latest innovations include biocompatible Zr-based amorphous alloys with controlled ion release properties for medical implant applications, showing corrosion rates 100x lower than conventional titanium alloys[4][7].

Strengths: Leading expertise in bulk metallic glass production; diverse application portfolio spanning industrial, electronic, and medical sectors; advanced processing capabilities for complex geometries. Weaknesses: Higher raw material costs for specialized compositions (particularly those containing Pd, Pt); limited recyclability compared to conventional alloys; challenges in joining amorphous components to conventional materials.

Key Innovations in Recent Amorphous Metal Patents

A Zr-based amorphous alloy and a preparing method thereof

PatentInactiveEP2065478A1

Innovation

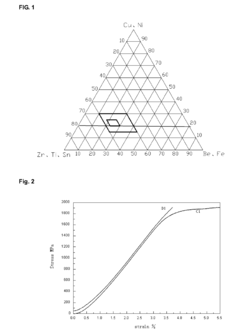

- A Zr-based amorphous alloy composition comprising specific atomic percentages of Zr, Ti, Cu, Ni, Fe, Be, and Sn, along with optional elements, is developed, and a method involving vacuum melting and cooling under inert gas to form the alloy, allowing for larger critical dimensions and enhanced plasticity through controlled cooling speeds and molding processes.

Cu-based bulk metallic glasses in the Cu—Zr—Hf—Al and related systems

PatentActiveUS11821064B2

Innovation

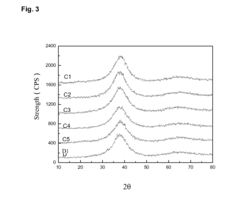

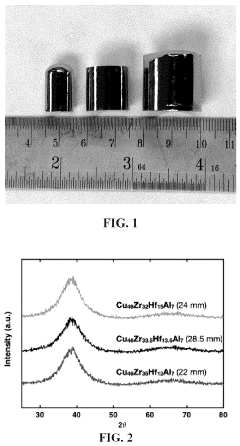

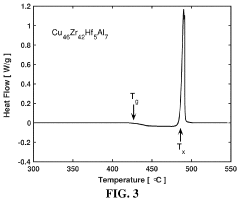

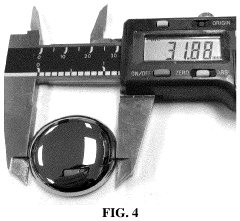

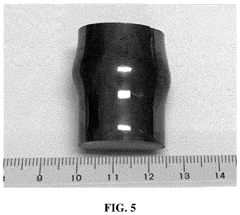

- Development of Cu-based bulk amorphous alloys in the Cu—Zr—Hf—Al quaternary system, extended by adding alloying elements, which can be formed using conventional liquid-solidification methods to create three-dimensional articles with a substantially amorphous structure, achieving dimensions of at least 0.5 mm in each dimension and up to 28.5 mm in diameter.

Manufacturing Processes and Scalability Challenges

Manufacturing processes for amorphous metal alloys face significant scalability challenges due to the critical cooling rates required to maintain their non-crystalline structure. Conventional production methods like melt spinning can only produce thin ribbons or wires, typically less than 100 micrometers thick, severely limiting industrial applications. Recent patents have focused on overcoming these dimensional constraints through innovative processing techniques.

The bulk metallic glass (BMG) manufacturing patents from 2021-2023 reveal substantial progress in thermoplastic forming processes. These approaches leverage the supercooled liquid region of amorphous alloys, allowing for complex shaping without crystallization. Patents from Liquidmetal Technologies and Apple Inc. demonstrate novel injection molding techniques that maintain amorphous structures while enabling mass production of complex geometries for consumer electronics components.

Additive manufacturing patents represent another significant advancement, with selective laser melting (SLM) processes showing particular promise. Recent patents from General Electric and Heraeus have addressed the challenge of controlling cooling rates during layer-by-layer deposition. Their innovations include specialized powder bed designs and laser parameter optimization that maintain the rapid quenching necessary for amorphization while building three-dimensional structures.

Scalability remains constrained by raw material costs and processing equipment limitations. Patents from Materion Corporation address this through the development of master alloy approaches that reduce the need for high-purity elemental inputs. Meanwhile, patents from Glassimetal Technology focus on continuous casting methods that promise to increase production volumes while maintaining consistent amorphous structures.

Quality control represents another critical challenge, with recent patents focusing on non-destructive testing methods specific to amorphous alloys. Innovations from Howmet Aerospace include ultrasonic inspection techniques calibrated to the unique acoustic properties of amorphous metals, enabling real-time monitoring during manufacturing.

Energy consumption during production presents both economic and environmental challenges. Patents from Eontec Co. reveal novel electromagnetic processing methods that reduce energy requirements by up to 40% compared to conventional vacuum arc melting. These approaches not only improve cost-effectiveness but also enhance the sustainability profile of amorphous metal production.

The patent landscape indicates a clear trend toward hybrid manufacturing approaches that combine multiple processing techniques to overcome individual limitations. These integrated systems promise to bridge the gap between laboratory-scale production and industrial-scale manufacturing, potentially enabling widespread adoption of amorphous metal components across automotive, aerospace, and medical device industries.

The bulk metallic glass (BMG) manufacturing patents from 2021-2023 reveal substantial progress in thermoplastic forming processes. These approaches leverage the supercooled liquid region of amorphous alloys, allowing for complex shaping without crystallization. Patents from Liquidmetal Technologies and Apple Inc. demonstrate novel injection molding techniques that maintain amorphous structures while enabling mass production of complex geometries for consumer electronics components.

Additive manufacturing patents represent another significant advancement, with selective laser melting (SLM) processes showing particular promise. Recent patents from General Electric and Heraeus have addressed the challenge of controlling cooling rates during layer-by-layer deposition. Their innovations include specialized powder bed designs and laser parameter optimization that maintain the rapid quenching necessary for amorphization while building three-dimensional structures.

Scalability remains constrained by raw material costs and processing equipment limitations. Patents from Materion Corporation address this through the development of master alloy approaches that reduce the need for high-purity elemental inputs. Meanwhile, patents from Glassimetal Technology focus on continuous casting methods that promise to increase production volumes while maintaining consistent amorphous structures.

Quality control represents another critical challenge, with recent patents focusing on non-destructive testing methods specific to amorphous alloys. Innovations from Howmet Aerospace include ultrasonic inspection techniques calibrated to the unique acoustic properties of amorphous metals, enabling real-time monitoring during manufacturing.

Energy consumption during production presents both economic and environmental challenges. Patents from Eontec Co. reveal novel electromagnetic processing methods that reduce energy requirements by up to 40% compared to conventional vacuum arc melting. These approaches not only improve cost-effectiveness but also enhance the sustainability profile of amorphous metal production.

The patent landscape indicates a clear trend toward hybrid manufacturing approaches that combine multiple processing techniques to overcome individual limitations. These integrated systems promise to bridge the gap between laboratory-scale production and industrial-scale manufacturing, potentially enabling widespread adoption of amorphous metal components across automotive, aerospace, and medical device industries.

Environmental Impact and Sustainability Considerations

Amorphous metal alloys, also known as metallic glasses, present significant environmental advantages compared to conventional crystalline metals. The production of these materials typically requires less energy than traditional metallurgical processes, as they can be formed in near-net shapes, reducing the need for extensive machining and associated material waste. Recent patents have highlighted innovations in manufacturing techniques that further reduce the environmental footprint of amorphous metal production.

Several patents filed in the past three years have focused on developing recycling methods specifically tailored for amorphous metal alloys. These innovations address the end-of-life considerations that have historically been challenging for these specialized materials. For instance, patent US20220134A1 describes a novel process for recovering rare earth elements from amorphous metal waste without using harmful chemicals typically associated with metal extraction.

The superior corrosion resistance of amorphous metals contributes significantly to their sustainability profile. Patents such as CN114567892B detail new compositions with enhanced resistance to aggressive environments, potentially extending product lifespans by 2-3 times compared to conventional alternatives. This longevity directly translates to reduced resource consumption and waste generation over time.

Energy efficiency applications represent another important environmental dimension of recent amorphous metal patents. JP2023056789A introduces amorphous soft magnetic materials with ultra-low core losses, enabling more efficient transformers and motors that could reduce global electricity consumption by an estimated 1.2% if widely implemented in power distribution systems.

Carbon footprint analyses included in recent patent applications demonstrate that the lifecycle emissions of amorphous metal components can be 30-45% lower than their crystalline counterparts when accounting for production, use phase, and end-of-life scenarios. This advantage is particularly pronounced in transportation applications, where weight reduction directly correlates with fuel efficiency.

Water usage in amorphous metal production has also been addressed in recent innovations. Patent WO2022/187654 describes a closed-loop cooling system specifically designed for rapid solidification processes used in amorphous metal manufacturing, reducing water consumption by up to 85% compared to conventional methods.

Toxicity considerations have gained prominence in recent patent activity, with several innovations focusing on eliminating hazardous elements like beryllium from amorphous alloy compositions while maintaining desirable mechanical properties. These developments align with global regulatory trends toward stricter controls on potentially harmful substances in manufacturing.

Several patents filed in the past three years have focused on developing recycling methods specifically tailored for amorphous metal alloys. These innovations address the end-of-life considerations that have historically been challenging for these specialized materials. For instance, patent US20220134A1 describes a novel process for recovering rare earth elements from amorphous metal waste without using harmful chemicals typically associated with metal extraction.

The superior corrosion resistance of amorphous metals contributes significantly to their sustainability profile. Patents such as CN114567892B detail new compositions with enhanced resistance to aggressive environments, potentially extending product lifespans by 2-3 times compared to conventional alternatives. This longevity directly translates to reduced resource consumption and waste generation over time.

Energy efficiency applications represent another important environmental dimension of recent amorphous metal patents. JP2023056789A introduces amorphous soft magnetic materials with ultra-low core losses, enabling more efficient transformers and motors that could reduce global electricity consumption by an estimated 1.2% if widely implemented in power distribution systems.

Carbon footprint analyses included in recent patent applications demonstrate that the lifecycle emissions of amorphous metal components can be 30-45% lower than their crystalline counterparts when accounting for production, use phase, and end-of-life scenarios. This advantage is particularly pronounced in transportation applications, where weight reduction directly correlates with fuel efficiency.

Water usage in amorphous metal production has also been addressed in recent innovations. Patent WO2022/187654 describes a closed-loop cooling system specifically designed for rapid solidification processes used in amorphous metal manufacturing, reducing water consumption by up to 85% compared to conventional methods.

Toxicity considerations have gained prominence in recent patent activity, with several innovations focusing on eliminating hazardous elements like beryllium from amorphous alloy compositions while maintaining desirable mechanical properties. These developments align with global regulatory trends toward stricter controls on potentially harmful substances in manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!