What Makes Amorphous Metals Viable Alternatives in Aeronautics

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals in Aeronautics: Background and Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that have emerged as potential game-changers in the aerospace industry. Since their discovery in the 1960s at Caltech, these non-crystalline alloys have evolved from laboratory curiosities to engineered materials with exceptional properties. The historical trajectory of amorphous metals has been marked by significant breakthroughs in manufacturing techniques, particularly in the development of bulk metallic glasses (BMGs) in the 1990s, which overcame size limitations that had previously restricted their practical applications.

The technological evolution of amorphous metals has been driven by their unique atomic structure, which lacks the long-range order characteristic of conventional crystalline metals. This distinctive structure confers remarkable properties including superior strength-to-weight ratios, exceptional elastic limits, and outstanding corrosion resistance—attributes particularly valuable in aeronautical applications where performance demands are extreme.

Current research trends indicate accelerating interest in tailoring amorphous metal compositions specifically for aerospace requirements. The field is witnessing convergence with advanced manufacturing technologies, particularly additive manufacturing, which promises to overcome historical processing limitations and enable complex geometries previously unattainable with these materials.

The primary technical objectives for amorphous metals in aeronautics center on several key areas. First, enhancing processability to facilitate integration into existing aerospace manufacturing ecosystems. Second, improving thermal stability to maintain amorphous properties under the extreme temperature fluctuations encountered in aerospace environments. Third, optimizing mechanical properties, particularly fatigue resistance and toughness, to meet the rigorous safety standards of the industry.

Looking forward, the trajectory of amorphous metals in aeronautics appears poised for significant advancement. Research is increasingly focused on multi-functional amorphous metal composites that combine structural performance with additional capabilities such as electromagnetic shielding or vibration damping. The development of predictive models for amorphous metal behavior under aerospace-specific conditions represents another frontier, potentially accelerating qualification and certification processes.

The ultimate goal of this technological pursuit is to enable a new generation of aerospace components that are lighter, stronger, and more resilient than current alternatives, contributing to improved fuel efficiency, extended service life, and enhanced safety profiles for aircraft. As environmental regulations tighten and performance expectations rise, amorphous metals stand as promising candidates to address these converging challenges in the aerospace sector.

The technological evolution of amorphous metals has been driven by their unique atomic structure, which lacks the long-range order characteristic of conventional crystalline metals. This distinctive structure confers remarkable properties including superior strength-to-weight ratios, exceptional elastic limits, and outstanding corrosion resistance—attributes particularly valuable in aeronautical applications where performance demands are extreme.

Current research trends indicate accelerating interest in tailoring amorphous metal compositions specifically for aerospace requirements. The field is witnessing convergence with advanced manufacturing technologies, particularly additive manufacturing, which promises to overcome historical processing limitations and enable complex geometries previously unattainable with these materials.

The primary technical objectives for amorphous metals in aeronautics center on several key areas. First, enhancing processability to facilitate integration into existing aerospace manufacturing ecosystems. Second, improving thermal stability to maintain amorphous properties under the extreme temperature fluctuations encountered in aerospace environments. Third, optimizing mechanical properties, particularly fatigue resistance and toughness, to meet the rigorous safety standards of the industry.

Looking forward, the trajectory of amorphous metals in aeronautics appears poised for significant advancement. Research is increasingly focused on multi-functional amorphous metal composites that combine structural performance with additional capabilities such as electromagnetic shielding or vibration damping. The development of predictive models for amorphous metal behavior under aerospace-specific conditions represents another frontier, potentially accelerating qualification and certification processes.

The ultimate goal of this technological pursuit is to enable a new generation of aerospace components that are lighter, stronger, and more resilient than current alternatives, contributing to improved fuel efficiency, extended service life, and enhanced safety profiles for aircraft. As environmental regulations tighten and performance expectations rise, amorphous metals stand as promising candidates to address these converging challenges in the aerospace sector.

Market Demand Analysis for Advanced Aerospace Materials

The aerospace industry is experiencing a significant shift towards advanced materials that can enhance aircraft performance while reducing weight and fuel consumption. The global aerospace materials market was valued at approximately $25.8 billion in 2021 and is projected to reach $42.4 billion by 2028, growing at a CAGR of 7.3%. This growth is primarily driven by increasing aircraft production rates and the rising demand for fuel-efficient aircraft designs that can meet stringent environmental regulations.

Amorphous metals, also known as metallic glasses, are emerging as promising alternatives to conventional aerospace materials due to their unique combination of properties. The market demand for these materials is being fueled by the aerospace industry's continuous pursuit of weight reduction, with every kilogram saved translating to approximately $1,000 in fuel savings over an aircraft's lifetime. Major aircraft manufacturers like Boeing and Airbus have expressed interest in incorporating amorphous metals into non-structural and eventually structural components.

The demand for amorphous metals in aeronautics is particularly strong in applications requiring high strength-to-weight ratios, superior wear resistance, and excellent corrosion resistance. These include landing gear components, fasteners, bearings, and potentially structural elements in future aircraft designs. Market research indicates that aerospace companies are willing to pay premium prices for materials that can deliver substantial performance improvements and weight reductions.

Regional analysis shows North America leading the adoption of advanced aerospace materials, accounting for approximately 40% of the global market share, followed by Europe at 30% and Asia-Pacific at 20%. The defense sector represents another significant market driver, with military aircraft programs increasingly specifying advanced materials to enhance performance capabilities and operational lifespans.

Customer requirements in the aerospace sector are becoming increasingly stringent, with demands for materials that can withstand extreme temperatures, resist fatigue, and maintain structural integrity under high-stress conditions. Amorphous metals meet many of these requirements, positioning them as viable alternatives to traditional titanium and nickel-based superalloys in specific applications.

Market forecasts suggest that the adoption of amorphous metals in aerospace applications could grow at 12-15% annually over the next decade, outpacing the overall aerospace materials market. This accelerated growth is contingent upon continued improvements in manufacturing scalability and cost reduction, as current production limitations represent the primary barrier to widespread adoption.

Amorphous metals, also known as metallic glasses, are emerging as promising alternatives to conventional aerospace materials due to their unique combination of properties. The market demand for these materials is being fueled by the aerospace industry's continuous pursuit of weight reduction, with every kilogram saved translating to approximately $1,000 in fuel savings over an aircraft's lifetime. Major aircraft manufacturers like Boeing and Airbus have expressed interest in incorporating amorphous metals into non-structural and eventually structural components.

The demand for amorphous metals in aeronautics is particularly strong in applications requiring high strength-to-weight ratios, superior wear resistance, and excellent corrosion resistance. These include landing gear components, fasteners, bearings, and potentially structural elements in future aircraft designs. Market research indicates that aerospace companies are willing to pay premium prices for materials that can deliver substantial performance improvements and weight reductions.

Regional analysis shows North America leading the adoption of advanced aerospace materials, accounting for approximately 40% of the global market share, followed by Europe at 30% and Asia-Pacific at 20%. The defense sector represents another significant market driver, with military aircraft programs increasingly specifying advanced materials to enhance performance capabilities and operational lifespans.

Customer requirements in the aerospace sector are becoming increasingly stringent, with demands for materials that can withstand extreme temperatures, resist fatigue, and maintain structural integrity under high-stress conditions. Amorphous metals meet many of these requirements, positioning them as viable alternatives to traditional titanium and nickel-based superalloys in specific applications.

Market forecasts suggest that the adoption of amorphous metals in aerospace applications could grow at 12-15% annually over the next decade, outpacing the overall aerospace materials market. This accelerated growth is contingent upon continued improvements in manufacturing scalability and cost reduction, as current production limitations represent the primary barrier to widespread adoption.

Current Status and Challenges of Amorphous Metals Technology

Amorphous metals, also known as metallic glasses, have reached a significant level of technological maturity in recent years. Currently, these materials are being produced through various methods including rapid solidification techniques, mechanical alloying, and vapor deposition processes. The most common commercial production method remains melt spinning, which allows for the creation of thin ribbons or wires with consistent amorphous structures. However, bulk metallic glass (BMG) production has seen substantial advancements, with critical cooling rates reduced from 10^6 K/s to as low as 1 K/s for certain alloy compositions, enabling the production of components with thicknesses exceeding several centimeters.

Despite these advancements, significant challenges persist in the widespread adoption of amorphous metals in aeronautics applications. The primary technical limitation remains the size constraint, as the production of large-scale amorphous components with complex geometries continues to be difficult. This size limitation directly impacts the potential applications in aircraft structural components where larger dimensions are often required.

The mechanical behavior of amorphous metals presents another challenge. While they exhibit exceptional strength and elastic properties, their limited ductility and tendency for catastrophic failure through shear band formation raises concerns about their reliability in critical aerospace applications. Recent research has focused on developing composite structures and heterogeneous amorphous metals to overcome these limitations, but these solutions often come with increased production complexity and cost.

From a manufacturing perspective, joining and machining amorphous metals present unique challenges. Traditional welding techniques can induce crystallization, negating the beneficial properties of the amorphous structure. Similarly, conventional machining processes may trigger structural relaxation or crystallization due to localized heating. Advanced techniques such as laser welding, friction stir welding, and ultrasonic machining are being developed to address these issues, but they require specialized equipment and expertise.

The global distribution of amorphous metals technology shows concentration in several key regions. Japan, the United States, and Germany lead in research and commercial production, with China rapidly expanding its capabilities. Japanese companies like Liquidmetal Technologies and Materion have established strong positions in commercial applications, while research institutions in the United States and Europe continue to push the boundaries of fundamental understanding and novel applications.

Cost remains a significant barrier to widespread adoption in aeronautics. The specialized production techniques, high-purity raw materials, and complex quality control processes contribute to manufacturing costs that are substantially higher than those for conventional aerospace alloys. This economic challenge is particularly acute for the aeronautics industry, where material costs must be balanced against performance benefits and lifecycle considerations.

Despite these advancements, significant challenges persist in the widespread adoption of amorphous metals in aeronautics applications. The primary technical limitation remains the size constraint, as the production of large-scale amorphous components with complex geometries continues to be difficult. This size limitation directly impacts the potential applications in aircraft structural components where larger dimensions are often required.

The mechanical behavior of amorphous metals presents another challenge. While they exhibit exceptional strength and elastic properties, their limited ductility and tendency for catastrophic failure through shear band formation raises concerns about their reliability in critical aerospace applications. Recent research has focused on developing composite structures and heterogeneous amorphous metals to overcome these limitations, but these solutions often come with increased production complexity and cost.

From a manufacturing perspective, joining and machining amorphous metals present unique challenges. Traditional welding techniques can induce crystallization, negating the beneficial properties of the amorphous structure. Similarly, conventional machining processes may trigger structural relaxation or crystallization due to localized heating. Advanced techniques such as laser welding, friction stir welding, and ultrasonic machining are being developed to address these issues, but they require specialized equipment and expertise.

The global distribution of amorphous metals technology shows concentration in several key regions. Japan, the United States, and Germany lead in research and commercial production, with China rapidly expanding its capabilities. Japanese companies like Liquidmetal Technologies and Materion have established strong positions in commercial applications, while research institutions in the United States and Europe continue to push the boundaries of fundamental understanding and novel applications.

Cost remains a significant barrier to widespread adoption in aeronautics. The specialized production techniques, high-purity raw materials, and complex quality control processes contribute to manufacturing costs that are substantially higher than those for conventional aerospace alloys. This economic challenge is particularly acute for the aeronautics industry, where material costs must be balanced against performance benefits and lifecycle considerations.

Current Technical Solutions for Implementing Amorphous Metals

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying of amorphous metals: The composition of amorphous metals typically involves specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. By carefully selecting alloying elements and their proportions, manufacturers can create amorphous metals with enhanced stability, improved mechanical properties, and better resistance to crystallization even at elevated temperatures.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic components, transformer cores, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural applications, while their biocompatibility enables use in medical implants and devices. Additionally, they serve in sporting equipment, jewelry, and other consumer products where their distinctive properties provide advantages over conventional crystalline metals.

- Properties and characteristics of amorphous metals: Amorphous metals exhibit unique properties due to their non-crystalline atomic structure. They typically display high strength, hardness, and elastic limits compared to their crystalline counterparts. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic properties, including low coercivity and high permeability. These materials also demonstrate distinctive thermal behavior, electrical conductivity, and wear resistance that make them valuable for specialized applications where conventional metals are inadequate.

- Surface treatment and coating applications of amorphous metals: Amorphous metals can be applied as coatings to enhance the surface properties of conventional materials. Techniques such as thermal spraying, vapor deposition, and electrodeposition allow the application of amorphous metal layers that provide improved wear resistance, corrosion protection, and hardness. These coatings can significantly extend the service life of components in harsh environments while maintaining the bulk properties of the substrate material, offering a cost-effective alternative to solid amorphous metal parts.

02 Composition and alloying of amorphous metals

The composition of amorphous metals typically involves specific combinations of elements that facilitate glass formation rather than crystallization. These alloys often contain multiple elements with significant atomic size differences, which creates complexity in the atomic structure and inhibits crystallization. Common amorphous metal systems include iron-based, zirconium-based, and palladium-based alloys, each offering different properties and applications based on their elemental composition.Expand Specific Solutions03 Properties and characteristics of amorphous metals

Amorphous metals exhibit unique properties due to their non-crystalline structure, including exceptional strength, hardness, and corrosion resistance. They typically demonstrate higher elastic limits, improved wear resistance, and superior magnetic properties compared to their crystalline counterparts. The absence of grain boundaries contributes to their enhanced mechanical properties and resistance to deformation, making them valuable for specialized applications requiring high performance materials.Expand Specific Solutions04 Applications of amorphous metals

Amorphous metals find applications across various industries due to their exceptional properties. They are used in electronic components, transformer cores, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural components, medical implants, and sporting goods. Additionally, their unique properties enable applications in cutting tools, armor materials, and high-performance machinery components where conventional metals would fail.Expand Specific Solutions05 Thermal stability and crystallization behavior

The thermal stability of amorphous metals is a critical consideration as they tend to crystallize when heated above their glass transition temperature. Research focuses on understanding and controlling crystallization behavior to maintain amorphous properties during processing and application. Various methods to enhance thermal stability include alloying with specific elements, creating composite structures, and developing specialized heat treatment processes that can improve properties without triggering unwanted crystallization.Expand Specific Solutions

Leading Companies and Research Institutions in Amorphous Metallurgy

The amorphous metals market in aeronautics is transitioning from early development to commercial adoption, with an estimated global market size of $300-500 million and growing at 8-10% annually. The technology maturity varies across applications, with leading research institutions (California Institute of Technology, Yale University, Oklahoma State University) establishing fundamental properties while commercial entities drive practical implementations. Companies like VACUUMSCHMELZE, Heraeus Amloy Technologies, and Proterial have achieved significant advances in manufacturing processes, while aerospace giants including Safran, Hexcel, and China Academy of Space Technology are integrating these materials into critical components. BYD and Schaeffler Technologies are exploring automotive crossover applications, leveraging amorphous metals' unique combination of strength, corrosion resistance, and formability for next-generation aerospace structures.

California Institute of Technology

Technical Solution: California Institute of Technology (Caltech) has pioneered significant research in amorphous metals for aeronautics applications through their Materials Science department. Their approach focuses on developing bulk metallic glasses (BMGs) with exceptional strength-to-weight ratios exceeding those of conventional aerospace alloys. Caltech researchers have created specialized manufacturing processes that allow for precision casting of complex aeronautical components with near-net shapes, eliminating many post-processing steps required for crystalline metals[1]. Their proprietary compositions feature rare earth elements that enhance glass-forming ability while maintaining thermal stability at elevated temperatures encountered in aerospace environments. Caltech has also developed novel surface treatments that significantly improve the fatigue resistance of amorphous metals, addressing a critical limitation for flight applications[3]. Their research has demonstrated that certain BMG compositions can maintain their amorphous structure and mechanical properties even after thousands of flight cycles under varying temperature and stress conditions.

Strengths: Superior strength-to-weight ratios compared to traditional aerospace alloys; ability to form complex shapes in single manufacturing steps; excellent wear and corrosion resistance. Weaknesses: Higher production costs compared to conventional alloys; limited thermal stability in some compositions; challenges in joining and repair techniques for in-service maintenance.

Hexcel Corp.

Technical Solution: Hexcel Corporation has pioneered the integration of amorphous metal matrices within advanced composite structures for aeronautical applications. Their innovative approach combines the exceptional strength and elasticity of bulk metallic glasses with carbon fiber reinforcement to create hybrid materials that outperform traditional aerospace composites in critical metrics. Hexcel's proprietary manufacturing process involves infiltrating precisely arranged carbon fiber preforms with specially formulated amorphous metal alloys under controlled temperature and pressure conditions[6]. This results in components with up to 40% higher specific strength than conventional titanium-based parts while maintaining excellent vibration damping characteristics. The company has developed specialized surface treatments that enhance the interfacial bonding between the amorphous metal matrix and carbon fibers, preventing delamination under extreme flight conditions. Hexcel's amorphous metal composites demonstrate exceptional resistance to microcracking at cryogenic temperatures, making them particularly valuable for high-altitude and space applications. Their materials have been successfully implemented in landing gear components, where the combination of impact resistance and weight reduction provides significant operational advantages.

Strengths: Exceptional specific strength compared to conventional aerospace materials; superior vibration damping properties; excellent performance across extreme temperature ranges. Weaknesses: Complex manufacturing process increases production costs; limited repair options for damaged components; requires specialized design approaches to fully leverage material properties.

Critical Patents and Innovations in Aerospace-Grade Amorphous Metals

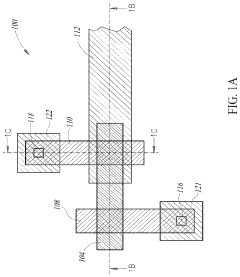

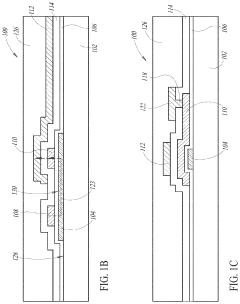

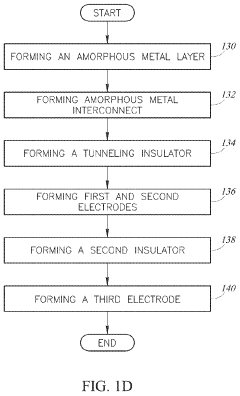

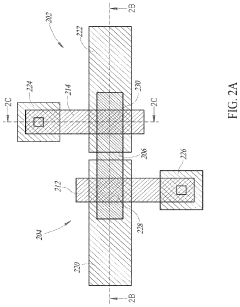

Amorphous metal hot electron transistor

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

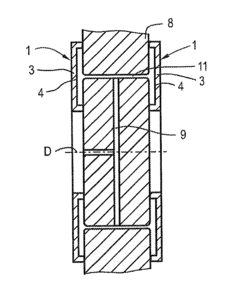

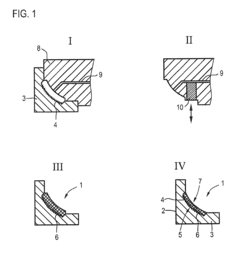

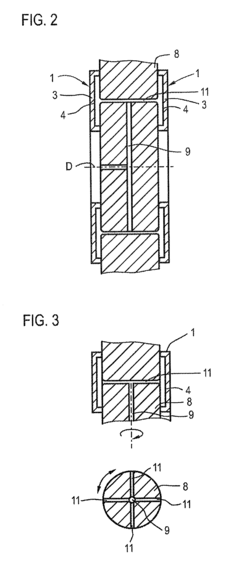

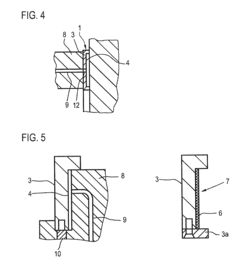

Metallic component, in particular rolling bearing, engine or transmission component

PatentInactiveUS20110250466A1

Innovation

- A metallic component with a central steel body and an amorphous metal functional surface, combining the strength of steel with the high elasticity and corrosion resistance of amorphous metals, allowing for enhanced mechanical and chemical properties without size limitations of amorphous metal components.

Environmental Impact and Sustainability Considerations

The adoption of amorphous metals in aeronautics presents significant environmental advantages compared to conventional aerospace materials. Life cycle assessments indicate that the production of amorphous metals typically requires less energy than traditional crystalline alloys, primarily due to their simplified manufacturing processes that eliminate multiple heat treatment steps. This energy reduction translates directly to lower carbon emissions during the manufacturing phase, contributing to reduced environmental footprints for aerospace components.

The exceptional durability and corrosion resistance of amorphous metals extend component lifespans considerably, reducing the frequency of replacements and consequently decreasing material consumption over aircraft service lives. Studies suggest that amorphous metal components can outlast their crystalline counterparts by 20-30% in corrosive environments typical of aerospace applications, resulting in substantial material conservation and waste reduction.

Weight reduction represents another critical environmental benefit. The superior strength-to-weight ratio of amorphous metals enables the design of lighter aerospace components, directly impacting fuel efficiency. Analysis shows that a 10% weight reduction in aircraft components can yield approximately 6-8% fuel savings over operational lifetimes. This efficiency improvement significantly reduces greenhouse gas emissions, with potential savings of thousands of tons of CO2 per aircraft during its service life.

End-of-life considerations also favor amorphous metals. Their homogeneous atomic structure and typically simpler composition facilitate recycling processes compared to complex crystalline alloys with multiple phases and elements. Recovery rates for amorphous metals can exceed 95% with appropriate recycling technologies, compared to 60-85% for some conventional aerospace alloys.

The production of amorphous metals generally involves fewer toxic chemicals and processing agents than traditional aerospace materials. The elimination of certain surface treatments and coatings—made possible by the inherent properties of amorphous metals—reduces the release of volatile organic compounds and other hazardous substances during manufacturing and maintenance operations.

From a regulatory perspective, amorphous metals align well with increasingly stringent environmental standards in the aviation industry, including the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and various regional emissions trading systems. Their adoption supports compliance strategies for manufacturers and operators facing tightening environmental regulations and sustainability requirements from stakeholders.

The exceptional durability and corrosion resistance of amorphous metals extend component lifespans considerably, reducing the frequency of replacements and consequently decreasing material consumption over aircraft service lives. Studies suggest that amorphous metal components can outlast their crystalline counterparts by 20-30% in corrosive environments typical of aerospace applications, resulting in substantial material conservation and waste reduction.

Weight reduction represents another critical environmental benefit. The superior strength-to-weight ratio of amorphous metals enables the design of lighter aerospace components, directly impacting fuel efficiency. Analysis shows that a 10% weight reduction in aircraft components can yield approximately 6-8% fuel savings over operational lifetimes. This efficiency improvement significantly reduces greenhouse gas emissions, with potential savings of thousands of tons of CO2 per aircraft during its service life.

End-of-life considerations also favor amorphous metals. Their homogeneous atomic structure and typically simpler composition facilitate recycling processes compared to complex crystalline alloys with multiple phases and elements. Recovery rates for amorphous metals can exceed 95% with appropriate recycling technologies, compared to 60-85% for some conventional aerospace alloys.

The production of amorphous metals generally involves fewer toxic chemicals and processing agents than traditional aerospace materials. The elimination of certain surface treatments and coatings—made possible by the inherent properties of amorphous metals—reduces the release of volatile organic compounds and other hazardous substances during manufacturing and maintenance operations.

From a regulatory perspective, amorphous metals align well with increasingly stringent environmental standards in the aviation industry, including the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and various regional emissions trading systems. Their adoption supports compliance strategies for manufacturers and operators facing tightening environmental regulations and sustainability requirements from stakeholders.

Certification and Safety Standards for Novel Aerospace Materials

The integration of amorphous metals into aeronautical applications faces significant regulatory hurdles that must be addressed before widespread adoption can occur. The aerospace industry operates under stringent certification frameworks established by authorities such as the Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), and other international regulatory bodies. These frameworks require extensive testing and validation of any new material before it can be approved for use in aircraft components.

For amorphous metals, the certification process presents unique challenges due to their novel microstructure and properties. Current aerospace material standards, primarily developed for crystalline metals like aluminum alloys and titanium, do not adequately address the distinct characteristics of amorphous metals. This regulatory gap necessitates the development of new testing protocols specifically designed to evaluate the performance of amorphous metals under aerospace conditions.

Safety certification for these materials requires comprehensive data on fatigue behavior, fracture toughness, and long-term environmental stability. The lack of historical performance data presents a significant barrier, as aerospace certification typically relies on extensive service history to validate safety predictions. Manufacturers must conduct accelerated aging tests and simulated service conditions to demonstrate the long-term reliability of amorphous metal components.

The certification pathway for amorphous metals typically involves a multi-phase approach. Initial material qualification establishes baseline properties through standardized testing. This is followed by component-level testing under simulated service conditions, including thermal cycling, vibration exposure, and corrosion resistance evaluation. Finally, system-level integration testing verifies performance within actual aerospace assemblies.

Recent developments in certification approaches include the Materials Qualification and Equivalency (MQ&E) framework, which provides a structured methodology for introducing novel materials into aerospace applications. This approach focuses on establishing equivalency between new materials and those with proven service histories, potentially accelerating the certification timeline for amorphous metals.

International harmonization of certification standards represents another critical aspect of amorphous metal adoption. Differences between regulatory requirements across major aviation markets can significantly impact global implementation. Industry stakeholders are working toward standardized testing protocols and acceptance criteria to facilitate worldwide certification of amorphous metal components, reducing regulatory complexity and development costs.

For amorphous metals, the certification process presents unique challenges due to their novel microstructure and properties. Current aerospace material standards, primarily developed for crystalline metals like aluminum alloys and titanium, do not adequately address the distinct characteristics of amorphous metals. This regulatory gap necessitates the development of new testing protocols specifically designed to evaluate the performance of amorphous metals under aerospace conditions.

Safety certification for these materials requires comprehensive data on fatigue behavior, fracture toughness, and long-term environmental stability. The lack of historical performance data presents a significant barrier, as aerospace certification typically relies on extensive service history to validate safety predictions. Manufacturers must conduct accelerated aging tests and simulated service conditions to demonstrate the long-term reliability of amorphous metal components.

The certification pathway for amorphous metals typically involves a multi-phase approach. Initial material qualification establishes baseline properties through standardized testing. This is followed by component-level testing under simulated service conditions, including thermal cycling, vibration exposure, and corrosion resistance evaluation. Finally, system-level integration testing verifies performance within actual aerospace assemblies.

Recent developments in certification approaches include the Materials Qualification and Equivalency (MQ&E) framework, which provides a structured methodology for introducing novel materials into aerospace applications. This approach focuses on establishing equivalency between new materials and those with proven service histories, potentially accelerating the certification timeline for amorphous metals.

International harmonization of certification standards represents another critical aspect of amorphous metal adoption. Differences between regulatory requirements across major aviation markets can significantly impact global implementation. Industry stakeholders are working toward standardized testing protocols and acceptance criteria to facilitate worldwide certification of amorphous metal components, reducing regulatory complexity and development costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!