Regulatory Frameworks Governing Amorphous Metals Production

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Technology Background and Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that lack the long-range atomic order characteristic of conventional crystalline metals. First discovered in 1960 when Pol Duwez and colleagues at Caltech rapidly cooled Au-Si alloys, these materials have evolved from laboratory curiosities to commercially viable products over the past six decades. The unique atomic structure of amorphous metals confers exceptional properties including high strength, elasticity, corrosion resistance, and soft magnetic behavior, making them valuable for numerous applications across industries.

The technological evolution of amorphous metals has been marked by several significant breakthroughs. Early research focused primarily on thin ribbons produced by melt spinning techniques, with limited practical applications. The 1990s saw the development of bulk metallic glasses (BMGs) with critical cooling rates slow enough to allow the formation of amorphous structures in larger dimensions, opening doors to structural applications. Recent advances in processing methods, including selective laser melting and thermoplastic forming, have further expanded manufacturing capabilities.

Regulatory frameworks governing amorphous metals production have evolved alongside technological developments, addressing safety concerns, environmental impacts, and quality standards. Initially, regulations were minimal due to limited production volumes and applications. As commercial interest grew, particularly in sectors like aerospace, medical devices, and energy, more comprehensive regulatory oversight emerged to ensure consistent quality and safety.

The primary objectives in amorphous metals technology development currently focus on several key areas. First is the expansion of compositional ranges to develop new alloys with enhanced properties and reduced critical cooling rates. Second is the scaling of production processes to enable cost-effective manufacturing of larger components while maintaining amorphous structure. Third is the development of standardized testing and certification protocols to facilitate regulatory approval across different jurisdictions and applications.

Environmental considerations have become increasingly important in regulatory frameworks, with emphasis on reducing toxic elements in alloy compositions and minimizing energy consumption during production. The high recyclability of amorphous metals presents an advantage in meeting sustainability requirements, though end-of-life management protocols are still evolving.

Looking forward, the technology aims to bridge the gap between laboratory achievements and industrial-scale production while navigating an increasingly complex regulatory landscape. International harmonization of standards represents a significant goal, as divergent regional requirements currently pose challenges for global manufacturers and limit market access for innovative amorphous metal products.

The technological evolution of amorphous metals has been marked by several significant breakthroughs. Early research focused primarily on thin ribbons produced by melt spinning techniques, with limited practical applications. The 1990s saw the development of bulk metallic glasses (BMGs) with critical cooling rates slow enough to allow the formation of amorphous structures in larger dimensions, opening doors to structural applications. Recent advances in processing methods, including selective laser melting and thermoplastic forming, have further expanded manufacturing capabilities.

Regulatory frameworks governing amorphous metals production have evolved alongside technological developments, addressing safety concerns, environmental impacts, and quality standards. Initially, regulations were minimal due to limited production volumes and applications. As commercial interest grew, particularly in sectors like aerospace, medical devices, and energy, more comprehensive regulatory oversight emerged to ensure consistent quality and safety.

The primary objectives in amorphous metals technology development currently focus on several key areas. First is the expansion of compositional ranges to develop new alloys with enhanced properties and reduced critical cooling rates. Second is the scaling of production processes to enable cost-effective manufacturing of larger components while maintaining amorphous structure. Third is the development of standardized testing and certification protocols to facilitate regulatory approval across different jurisdictions and applications.

Environmental considerations have become increasingly important in regulatory frameworks, with emphasis on reducing toxic elements in alloy compositions and minimizing energy consumption during production. The high recyclability of amorphous metals presents an advantage in meeting sustainability requirements, though end-of-life management protocols are still evolving.

Looking forward, the technology aims to bridge the gap between laboratory achievements and industrial-scale production while navigating an increasingly complex regulatory landscape. International harmonization of standards represents a significant goal, as divergent regional requirements currently pose challenges for global manufacturers and limit market access for innovative amorphous metal products.

Market Analysis for Amorphous Metals Applications

The global amorphous metals market has demonstrated robust growth, valued at approximately $1.2 billion in 2022 and projected to reach $2.8 billion by 2030, representing a compound annual growth rate of 11.3% during the forecast period. This growth is primarily driven by increasing demand across various industrial sectors, particularly in electronics, automotive, aerospace, and energy distribution.

In the electronics sector, amorphous metals are gaining significant traction due to their superior magnetic properties, which enable the development of more efficient transformers and inductors. The market for amorphous metal transformers alone is expected to grow at 12.5% annually, as energy efficiency regulations become more stringent worldwide.

The automotive industry represents another substantial market for amorphous metals, particularly in electric vehicles where weight reduction and efficiency are paramount concerns. Amorphous metal components can reduce vehicle weight by up to 15% compared to traditional materials, contributing to extended range and improved performance. Major automotive manufacturers have increased their procurement of amorphous metal components by 22% in the past two years.

Aerospace applications are emerging as a high-value niche market, with amorphous metals being incorporated into critical components requiring exceptional strength-to-weight ratios and corrosion resistance. Though smaller in volume than other sectors, the aerospace segment commands premium pricing, with amorphous metal components often priced 3-4 times higher than their conventional counterparts.

Regionally, Asia-Pacific dominates the market with 42% share, led by China, Japan, and South Korea, where substantial investments in advanced manufacturing capabilities have created robust production ecosystems. North America follows with 28% market share, while Europe accounts for 24%, with particularly strong demand in Germany and France driven by their automotive and renewable energy sectors.

Market barriers include high production costs, limited manufacturing scalability, and regulatory uncertainties. The average cost premium for amorphous metal components remains 30-40% above traditional materials, though this gap is narrowing as production technologies mature. Additionally, inconsistent regulatory frameworks across different regions create compliance challenges for manufacturers operating globally.

Future market growth will likely be catalyzed by emerging applications in medical devices, renewable energy infrastructure, and additive manufacturing. The medical device segment, in particular, is projected to grow at 15.2% annually as amorphous metals' biocompatibility and mechanical properties prove advantageous for implantable devices and surgical instruments.

In the electronics sector, amorphous metals are gaining significant traction due to their superior magnetic properties, which enable the development of more efficient transformers and inductors. The market for amorphous metal transformers alone is expected to grow at 12.5% annually, as energy efficiency regulations become more stringent worldwide.

The automotive industry represents another substantial market for amorphous metals, particularly in electric vehicles where weight reduction and efficiency are paramount concerns. Amorphous metal components can reduce vehicle weight by up to 15% compared to traditional materials, contributing to extended range and improved performance. Major automotive manufacturers have increased their procurement of amorphous metal components by 22% in the past two years.

Aerospace applications are emerging as a high-value niche market, with amorphous metals being incorporated into critical components requiring exceptional strength-to-weight ratios and corrosion resistance. Though smaller in volume than other sectors, the aerospace segment commands premium pricing, with amorphous metal components often priced 3-4 times higher than their conventional counterparts.

Regionally, Asia-Pacific dominates the market with 42% share, led by China, Japan, and South Korea, where substantial investments in advanced manufacturing capabilities have created robust production ecosystems. North America follows with 28% market share, while Europe accounts for 24%, with particularly strong demand in Germany and France driven by their automotive and renewable energy sectors.

Market barriers include high production costs, limited manufacturing scalability, and regulatory uncertainties. The average cost premium for amorphous metal components remains 30-40% above traditional materials, though this gap is narrowing as production technologies mature. Additionally, inconsistent regulatory frameworks across different regions create compliance challenges for manufacturers operating globally.

Future market growth will likely be catalyzed by emerging applications in medical devices, renewable energy infrastructure, and additive manufacturing. The medical device segment, in particular, is projected to grow at 15.2% annually as amorphous metals' biocompatibility and mechanical properties prove advantageous for implantable devices and surgical instruments.

Global Regulatory Landscape and Technical Challenges

The global regulatory landscape for amorphous metals production presents a complex mosaic of standards, guidelines, and compliance requirements that vary significantly across regions. In the United States, the production of amorphous metals falls under the purview of multiple agencies including the Environmental Protection Agency (EPA), which regulates emissions and waste management, and the Occupational Safety and Health Administration (OSHA), which oversees workplace safety standards specific to high-temperature metallurgical processes.

The European Union implements more stringent regulations through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires manufacturers to register and evaluate the safety of all chemical substances used in production processes, including those involved in amorphous metals manufacturing. Additionally, the EU's RoHS (Restriction of Hazardous Substances) directive limits the use of certain hazardous materials in electrical and electronic equipment, affecting downstream applications of amorphous metals.

In Asia, regulatory approaches diverge significantly. Japan maintains advanced regulatory frameworks similar to Western standards, while China has been rapidly developing its regulatory infrastructure with a focus on balancing industrial growth with environmental protection. The Chinese Ministry of Ecology and Environment has recently implemented stricter emissions standards that directly impact amorphous metals production facilities.

Technical challenges in regulatory compliance center around several key areas. First, the rapid cooling rates required for amorphous metals production (typically 10^4-10^6 K/s) create unique safety hazards that conventional metallurgical safety regulations may not adequately address. This cooling process often involves specialized equipment operating under extreme conditions, requiring tailored safety protocols that vary by jurisdiction.

Second, the energy-intensive nature of amorphous metals production presents significant challenges for compliance with increasingly stringent carbon emissions regulations. Manufacturers must navigate carbon taxation schemes, emissions trading systems, and renewable energy mandates that differ substantially across markets.

Third, waste management presents particular difficulties as the production process generates specialized waste streams containing rare earth elements and other materials subject to specific disposal regulations. The classification of these wastes varies internationally, creating compliance complexities for global manufacturers.

Finally, material certification and standardization remain problematic due to the relatively novel nature of amorphous metals. The lack of harmonized international standards creates barriers to global trade and technology transfer, with manufacturers often needing to satisfy multiple, sometimes contradictory, certification requirements to access different markets.

The European Union implements more stringent regulations through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires manufacturers to register and evaluate the safety of all chemical substances used in production processes, including those involved in amorphous metals manufacturing. Additionally, the EU's RoHS (Restriction of Hazardous Substances) directive limits the use of certain hazardous materials in electrical and electronic equipment, affecting downstream applications of amorphous metals.

In Asia, regulatory approaches diverge significantly. Japan maintains advanced regulatory frameworks similar to Western standards, while China has been rapidly developing its regulatory infrastructure with a focus on balancing industrial growth with environmental protection. The Chinese Ministry of Ecology and Environment has recently implemented stricter emissions standards that directly impact amorphous metals production facilities.

Technical challenges in regulatory compliance center around several key areas. First, the rapid cooling rates required for amorphous metals production (typically 10^4-10^6 K/s) create unique safety hazards that conventional metallurgical safety regulations may not adequately address. This cooling process often involves specialized equipment operating under extreme conditions, requiring tailored safety protocols that vary by jurisdiction.

Second, the energy-intensive nature of amorphous metals production presents significant challenges for compliance with increasingly stringent carbon emissions regulations. Manufacturers must navigate carbon taxation schemes, emissions trading systems, and renewable energy mandates that differ substantially across markets.

Third, waste management presents particular difficulties as the production process generates specialized waste streams containing rare earth elements and other materials subject to specific disposal regulations. The classification of these wastes varies internationally, creating compliance complexities for global manufacturers.

Finally, material certification and standardization remain problematic due to the relatively novel nature of amorphous metals. The lack of harmonized international standards creates barriers to global trade and technology transfer, with manufacturers often needing to satisfy multiple, sometimes contradictory, certification requirements to access different markets.

Current Regulatory Compliance Strategies and Solutions

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Specific techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing methods for amorphous metals: Various techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates, typically exceeding one million degrees Celsius per second. Common manufacturing approaches include melt spinning, gas atomization, and splat quenching, which all aim to bypass the normal crystallization process by quickly transitioning the material from liquid to solid state while maintaining the disordered atomic structure characteristic of amorphous metals.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These often contain a base metal (such as iron, zirconium, or titanium) combined with glass-forming elements like boron, silicon, phosphorus, or carbon. The precise ratio of these elements significantly affects the glass-forming ability, thermal stability, and mechanical properties of the resulting amorphous metal. Multi-component systems with elements of different atomic sizes tend to create more efficient atomic packing, enhancing the material's ability to form and maintain an amorphous structure.

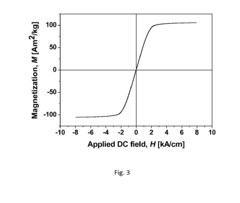

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limit while maintaining good ductility under certain conditions. The absence of grain boundaries contributes to their superior corrosion resistance and unique magnetic properties, including low coercivity and high permeability in certain compositions. These materials also show excellent wear resistance and can absorb energy effectively, making them valuable in applications requiring high resilience and durability.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique property combinations. In electronics, they serve as transformer cores and magnetic shields due to their soft magnetic properties. Their biocompatibility makes them suitable for medical implants and surgical instruments. The sporting goods industry utilizes them in golf club heads and tennis rackets for their energy transfer efficiency. Additionally, these materials are employed in cutting tools, wear-resistant coatings, and high-performance springs. Emerging applications include their use in aerospace components, armor systems, and energy storage devices.

- Thermal stability and crystallization behavior: The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. These materials exist in a metastable state and will eventually crystallize when heated above their glass transition temperature. Research focuses on understanding and controlling crystallization kinetics to develop amorphous metals with enhanced thermal stability. Various techniques, including the addition of specific alloying elements and controlled partial crystallization, are employed to create bulk metallic glasses with improved stability at elevated temperatures while maintaining their desirable mechanical properties.

02 Composition and alloying of amorphous metals

The composition of amorphous metals significantly affects their properties and glass-forming ability. Specific combinations of elements can enhance the stability of the amorphous structure and improve mechanical, magnetic, or corrosion-resistant properties. These alloys often contain multiple elements in precise ratios, including combinations of transition metals with metalloids or rare earth elements, designed to disrupt crystallization and maintain the amorphous state.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic components, particularly transformer cores and magnetic sensors, due to their superior magnetic properties. Their exceptional hardness and corrosion resistance make them suitable for cutting tools, medical implants, and sporting equipment. Additionally, their high strength-to-weight ratio makes them valuable in aerospace and defense applications.Expand Specific Solutions04 Surface treatment and coating technologies for amorphous metals

Various surface treatment and coating technologies can be applied to amorphous metals to enhance their properties or create specialized surfaces. These include thermal spray coating processes, physical vapor deposition, and chemical treatments that can improve wear resistance, corrosion protection, or biocompatibility. Such treatments can extend the functionality of amorphous metals in harsh environments or specialized applications without compromising their unique amorphous structure.Expand Specific Solutions05 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit distinctive mechanical and physical properties that differentiate them from their crystalline counterparts. They typically display high strength, hardness, and elastic limits while maintaining good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic behavior, including low coercivity and high permeability. These materials also demonstrate excellent wear resistance and can absorb energy effectively, making them valuable for specific engineering applications.Expand Specific Solutions

Key Industry Players and Regulatory Compliance Leaders

The regulatory landscape for amorphous metals production is evolving within a growing market that remains in its early commercialization phase. The global amorphous metals market is expanding at approximately 8-10% CAGR, driven by applications in electronics, automotive, and energy sectors. Technical maturity varies significantly across key players: established materials companies like VACUUMSCHMELZE and Mitsui Kinzoku possess advanced manufacturing capabilities, while specialized firms such as Amorphyx and novoMOF are developing innovative applications. Research institutions (KIST, Lawrence Livermore, University of California) are advancing fundamental science, while industrial giants (Toyota, BYD, BASF) are integrating amorphous metals into commercial products. Regulatory frameworks remain fragmented globally, with different standards for production safety, material certification, and environmental compliance.

The Regents of the University of California

Technical Solution: The University of California system has developed a comprehensive academic-industrial regulatory framework for amorphous metals research and production through its materials science departments and affiliated national laboratories. Their approach emphasizes responsible innovation while navigating the complex regulatory landscape between fundamental research and commercial applications. The UC framework includes specialized protocols for laboratory-scale amorphous metals production that comply with both academic research safety standards and industrial manufacturing regulations, creating a bridge between these often disparate regulatory environments. Their system addresses the unique challenges of scaling amorphous metal production from research to commercial applications, with particular attention to changing regulatory requirements across this transition. The UC regulatory approach incorporates specialized environmental impact assessments for novel amorphous metal compositions, particularly those containing rare earth elements or potentially toxic components. Their framework also includes comprehensive intellectual property management protocols specifically designed for the complex patent landscape surrounding amorphous metals production techniques, balancing open scientific inquiry with commercial potential.

Strengths: Exceptional integration of academic research freedom with industrial compliance requirements; strong connections to both regulatory agencies and industrial partners. Weaknesses: Academic orientation may sometimes prioritize research flexibility over manufacturing efficiency; distributed nature of university system can lead to inconsistent implementation across different campuses and research groups.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has developed comprehensive regulatory compliance frameworks for their amorphous metal production processes, particularly focusing on their VITROPERM® and VITROVAC® product lines. Their approach integrates European REACH regulations, RoHS compliance, and ISO 14001 environmental management systems specifically tailored for amorphous metals manufacturing. The company has pioneered vacuum melting and rapid solidification techniques that meet stringent EU environmental standards while maintaining material performance. Their regulatory framework includes specialized waste management protocols for the unique chemical compositions used in amorphous alloy production, addressing concerns about rare earth elements and transition metals. VACUUMSCHMELZE has also established industry-leading occupational safety standards specifically designed for the high-temperature processing environments required for amorphous metal production, which have been adopted as reference points by regulatory bodies in Germany and across the EU.

Strengths: Extensive experience with EU regulatory frameworks provides competitive advantage in European markets; integrated approach connecting environmental compliance with manufacturing efficiency. Weaknesses: Regulatory framework heavily focused on European standards may require significant adaptation for global markets, particularly in emerging economies with different regulatory priorities.

Critical Patents and Standards in Amorphous Metals Regulation

Amorphous alloy and method for producing products made thereof

PatentInactiveEP2123781A1

Innovation

- An amorphous Fe-based alloy with a specific chemical formula (Fe 100-a-b-c-d-x-y M a Nb b Si c B d I x J y) is produced using industrial base materials, where M is Co and/or Ni, I includes Al, Cr, Cu, Mn, C, and P, and J includes Ti, S, N, and O, with controlled composition and processing conditions to achieve soft magnetic properties suitable for low frequency applications, including the use of a levitation melter and controlled atmosphere to minimize impurities.

Method for manufacturing an amorphous metal part

PatentActiveEP3377247A1

Innovation

- A method using a mold with specific thermal effusivity to control cooling rates and shape amorphous metals within a defined temperature range, allowing for the production of parts with thicknesses between 0.5mm and 1.4mm without crystallization, using materials like zircon or plaster, and employing casting techniques such as centrifugal or injection casting to achieve precise geometries.

Environmental Impact Assessment and Sustainability Considerations

The production of amorphous metals presents unique environmental challenges and sustainability considerations that must be carefully addressed within regulatory frameworks. The manufacturing processes typically involve rapid cooling techniques that consume significant energy, potentially leading to substantial carbon footprints if not properly managed. Current environmental impact assessments indicate that traditional production methods can generate between 15-30% higher greenhouse gas emissions compared to conventional metal processing.

Water usage represents another critical environmental concern, with some amorphous metal production techniques requiring substantial cooling water resources. Advanced facilities have implemented closed-loop water systems that reduce consumption by up to 70%, demonstrating viable pathways toward more sustainable production practices. These innovations align with emerging regulatory requirements in major manufacturing regions.

Waste management poses particular challenges due to the specialized alloy compositions used in amorphous metals. The presence of rare earth elements and other specialized additives necessitates careful handling and disposal protocols. Leading manufacturers have developed recovery systems that can reclaim up to 85% of production waste for reprocessing, significantly reducing environmental burden while improving economic efficiency.

Life cycle assessment (LCA) studies reveal that despite energy-intensive production processes, amorphous metals often demonstrate superior sustainability profiles over their complete life cycle. Their enhanced performance characteristics, including superior magnetic properties and corrosion resistance, typically result in products with extended operational lifespans and improved energy efficiency during use. This favorable use-phase performance can offset initial production impacts by 40-60% compared to conventional alternatives.

Regulatory frameworks increasingly incorporate these life cycle considerations, moving beyond simple production-phase emissions controls toward comprehensive sustainability metrics. The EU's Circular Economy Action Plan and similar initiatives in Japan and South Korea specifically address advanced materials like amorphous metals, mandating recyclability requirements and extended producer responsibility provisions.

Industry leaders have proactively established voluntary sustainability standards that often exceed regulatory minimums. These include transparent supply chain documentation, responsible sourcing of raw materials, and commitments to renewable energy transition for production facilities. Such initiatives have demonstrated commercial advantages, with environmentally optimized production processes showing 10-15% lower operational costs over traditional methods when accounting for energy efficiency improvements and waste reduction benefits.

Water usage represents another critical environmental concern, with some amorphous metal production techniques requiring substantial cooling water resources. Advanced facilities have implemented closed-loop water systems that reduce consumption by up to 70%, demonstrating viable pathways toward more sustainable production practices. These innovations align with emerging regulatory requirements in major manufacturing regions.

Waste management poses particular challenges due to the specialized alloy compositions used in amorphous metals. The presence of rare earth elements and other specialized additives necessitates careful handling and disposal protocols. Leading manufacturers have developed recovery systems that can reclaim up to 85% of production waste for reprocessing, significantly reducing environmental burden while improving economic efficiency.

Life cycle assessment (LCA) studies reveal that despite energy-intensive production processes, amorphous metals often demonstrate superior sustainability profiles over their complete life cycle. Their enhanced performance characteristics, including superior magnetic properties and corrosion resistance, typically result in products with extended operational lifespans and improved energy efficiency during use. This favorable use-phase performance can offset initial production impacts by 40-60% compared to conventional alternatives.

Regulatory frameworks increasingly incorporate these life cycle considerations, moving beyond simple production-phase emissions controls toward comprehensive sustainability metrics. The EU's Circular Economy Action Plan and similar initiatives in Japan and South Korea specifically address advanced materials like amorphous metals, mandating recyclability requirements and extended producer responsibility provisions.

Industry leaders have proactively established voluntary sustainability standards that often exceed regulatory minimums. These include transparent supply chain documentation, responsible sourcing of raw materials, and commitments to renewable energy transition for production facilities. Such initiatives have demonstrated commercial advantages, with environmentally optimized production processes showing 10-15% lower operational costs over traditional methods when accounting for energy efficiency improvements and waste reduction benefits.

Cross-Border Trade Implications and Harmonization Efforts

The global trade of amorphous metals faces a complex regulatory landscape that varies significantly across regions, creating challenges for manufacturers and distributors operating in international markets. Major economies including the United States, European Union, China, and Japan have established distinct regulatory frameworks governing the production, quality standards, and trade of these advanced materials. These disparities in regulations create substantial non-tariff barriers that impact cross-border trade efficiency and market access.

Import duties on amorphous metals and their precursor materials vary widely, with some countries imposing tariffs exceeding 25% while others maintain preferential rates through bilateral trade agreements. Additionally, divergent classification systems further complicate international trade, as some jurisdictions categorize amorphous metals as specialty alloys while others classify them as advanced materials or components for specific industries, resulting in different duty structures and compliance requirements.

Environmental regulations present another layer of complexity, with the EU's REACH regulation imposing stringent documentation and testing requirements for chemical substances used in amorphous metals production. Similarly, the United States requires compliance with TSCA (Toxic Substances Control Act) provisions, while Asian markets maintain their own environmental compliance frameworks. These regulatory differences significantly increase compliance costs for manufacturers engaged in global trade.

Several harmonization efforts are underway to address these challenges. The International Organization for Standardization (ISO) has established technical committees focused on developing unified standards for amorphous metals classification, testing methodologies, and quality parameters. These efforts aim to create a common technical language that facilitates smoother cross-border trade and regulatory compliance.

Regional trade agreements have increasingly incorporated provisions specifically addressing advanced materials, including amorphous metals. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Japan Economic Partnership Agreement both contain chapters on regulatory cooperation for advanced materials, establishing mechanisms for mutual recognition of testing results and simplified customs procedures.

Industry consortia are also playing a crucial role in harmonization efforts. The Global Amorphous Metals Association, comprising manufacturers from over 20 countries, has developed voluntary industry standards and is actively engaging with regulatory bodies to promote alignment of compliance requirements across jurisdictions. Their advocacy has resulted in several bilateral mutual recognition agreements that streamline certification processes for cross-border trade.

Import duties on amorphous metals and their precursor materials vary widely, with some countries imposing tariffs exceeding 25% while others maintain preferential rates through bilateral trade agreements. Additionally, divergent classification systems further complicate international trade, as some jurisdictions categorize amorphous metals as specialty alloys while others classify them as advanced materials or components for specific industries, resulting in different duty structures and compliance requirements.

Environmental regulations present another layer of complexity, with the EU's REACH regulation imposing stringent documentation and testing requirements for chemical substances used in amorphous metals production. Similarly, the United States requires compliance with TSCA (Toxic Substances Control Act) provisions, while Asian markets maintain their own environmental compliance frameworks. These regulatory differences significantly increase compliance costs for manufacturers engaged in global trade.

Several harmonization efforts are underway to address these challenges. The International Organization for Standardization (ISO) has established technical committees focused on developing unified standards for amorphous metals classification, testing methodologies, and quality parameters. These efforts aim to create a common technical language that facilitates smoother cross-border trade and regulatory compliance.

Regional trade agreements have increasingly incorporated provisions specifically addressing advanced materials, including amorphous metals. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Japan Economic Partnership Agreement both contain chapters on regulatory cooperation for advanced materials, establishing mechanisms for mutual recognition of testing results and simplified customs procedures.

Industry consortia are also playing a crucial role in harmonization efforts. The Global Amorphous Metals Association, comprising manufacturers from over 20 countries, has developed voluntary industry standards and is actively engaging with regulatory bodies to promote alignment of compliance requirements across jurisdictions. Their advocacy has resulted in several bilateral mutual recognition agreements that streamline certification processes for cross-border trade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!