Investigation of Amorphous Metals Market Growth and Innovations

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Research Objectives

Amorphous metals, also known as metallic glasses, represent a unique class of materials that possess a non-crystalline atomic structure, distinguishing them from conventional crystalline metals. First discovered in 1960 at Caltech by Pol Duwez, these materials have evolved from laboratory curiosities to commercially viable products over the past six decades. The disordered atomic arrangement of amorphous metals confers exceptional properties including superior strength, hardness, corrosion resistance, and unique magnetic characteristics that have attracted significant research interest across various industrial sectors.

The evolution of amorphous metals has been marked by several technological breakthroughs. Initially limited to rapid quenching techniques that could only produce thin ribbons or wires, manufacturing capabilities have expanded to include bulk metallic glasses (BMGs) with critical cooling rates low enough to form components with thicknesses exceeding several millimeters. This advancement has substantially broadened the application potential of these materials.

Current global research efforts are focused on addressing the inherent brittleness of many amorphous metal compositions and developing cost-effective manufacturing processes for large-scale production. The field has witnessed a compound annual growth rate of approximately 8.5% over the past five years, with projections indicating continued expansion as new applications emerge in aerospace, electronics, medical devices, and renewable energy sectors.

The primary objective of this technical research report is to comprehensively analyze the current market landscape for amorphous metals, identifying key growth drivers and barriers to wider commercial adoption. We aim to evaluate emerging innovations in composition design, processing techniques, and novel applications that could potentially disrupt traditional materials markets.

Additionally, this investigation seeks to map the technological trajectory of amorphous metals over the next decade, with particular emphasis on identifying opportunities for strategic investment and research collaboration. By examining patent landscapes, academic publications, and industry developments, we will highlight promising research directions and potential breakthrough technologies that could accelerate market penetration.

Furthermore, this report will assess the competitive positioning of major industry players and emerging startups, providing insights into their technological capabilities, market strategies, and intellectual property portfolios. Understanding this competitive landscape is crucial for identifying potential partnership opportunities and anticipating market shifts that could impact long-term strategic planning.

Through this comprehensive analysis, we intend to provide actionable intelligence that will inform our organization's R&D priorities, investment decisions, and product development roadmap in the rapidly evolving field of amorphous metals.

The evolution of amorphous metals has been marked by several technological breakthroughs. Initially limited to rapid quenching techniques that could only produce thin ribbons or wires, manufacturing capabilities have expanded to include bulk metallic glasses (BMGs) with critical cooling rates low enough to form components with thicknesses exceeding several millimeters. This advancement has substantially broadened the application potential of these materials.

Current global research efforts are focused on addressing the inherent brittleness of many amorphous metal compositions and developing cost-effective manufacturing processes for large-scale production. The field has witnessed a compound annual growth rate of approximately 8.5% over the past five years, with projections indicating continued expansion as new applications emerge in aerospace, electronics, medical devices, and renewable energy sectors.

The primary objective of this technical research report is to comprehensively analyze the current market landscape for amorphous metals, identifying key growth drivers and barriers to wider commercial adoption. We aim to evaluate emerging innovations in composition design, processing techniques, and novel applications that could potentially disrupt traditional materials markets.

Additionally, this investigation seeks to map the technological trajectory of amorphous metals over the next decade, with particular emphasis on identifying opportunities for strategic investment and research collaboration. By examining patent landscapes, academic publications, and industry developments, we will highlight promising research directions and potential breakthrough technologies that could accelerate market penetration.

Furthermore, this report will assess the competitive positioning of major industry players and emerging startups, providing insights into their technological capabilities, market strategies, and intellectual property portfolios. Understanding this competitive landscape is crucial for identifying potential partnership opportunities and anticipating market shifts that could impact long-term strategic planning.

Through this comprehensive analysis, we intend to provide actionable intelligence that will inform our organization's R&D priorities, investment decisions, and product development roadmap in the rapidly evolving field of amorphous metals.

Market Demand Analysis for Amorphous Metals

The global amorphous metals market has demonstrated robust growth in recent years, driven by increasing demand across multiple industrial sectors. Current market valuations indicate significant expansion, with the market expected to grow at a compound annual growth rate of approximately 9% through 2028. This growth trajectory is supported by the exceptional properties of amorphous metals, including high strength, superior magnetic characteristics, and excellent corrosion resistance.

The energy sector represents one of the largest demand drivers for amorphous metals. Power distribution transformers utilizing amorphous metal cores have gained substantial market share due to their ability to reduce energy losses by up to 75% compared to conventional silicon steel alternatives. This efficiency improvement directly addresses global energy conservation initiatives and regulatory requirements for reduced carbon emissions in power infrastructure.

Electronics and telecommunications industries constitute another significant market segment. The unique magnetic properties of amorphous metals make them ideal for electromagnetic interference (EMI) shielding applications, high-frequency transformers, and magnetic sensors. As 5G infrastructure deployment accelerates globally, demand for specialized amorphous metal components has increased substantially.

Aerospace and defense applications represent a premium market segment with growing demand for amorphous metals. The materials' exceptional strength-to-weight ratio and resistance to extreme environmental conditions make them valuable for critical components in aircraft, satellites, and defense systems. Though smaller in volume than other sectors, this segment commands higher margins and drives technological innovation.

Medical device manufacturing has emerged as a promising growth area. Biocompatible amorphous metal alloys are increasingly utilized in implantable devices, surgical instruments, and diagnostic equipment. The materials' non-magnetic properties make them particularly valuable for applications involving magnetic resonance imaging (MRI) compatibility.

Regional market analysis reveals Asia-Pacific as the dominant consumer of amorphous metals, accounting for over 40% of global demand. This concentration stems from the region's extensive manufacturing base, particularly in electronics and electrical equipment. North America and Europe follow with significant market shares, driven primarily by aerospace, medical, and premium industrial applications.

Consumer demand patterns indicate a growing preference for sustainable and energy-efficient products, indirectly boosting amorphous metals adoption in end-user goods. This trend aligns with broader industrial sustainability initiatives and represents a long-term market driver that transcends individual industry segments.

The energy sector represents one of the largest demand drivers for amorphous metals. Power distribution transformers utilizing amorphous metal cores have gained substantial market share due to their ability to reduce energy losses by up to 75% compared to conventional silicon steel alternatives. This efficiency improvement directly addresses global energy conservation initiatives and regulatory requirements for reduced carbon emissions in power infrastructure.

Electronics and telecommunications industries constitute another significant market segment. The unique magnetic properties of amorphous metals make them ideal for electromagnetic interference (EMI) shielding applications, high-frequency transformers, and magnetic sensors. As 5G infrastructure deployment accelerates globally, demand for specialized amorphous metal components has increased substantially.

Aerospace and defense applications represent a premium market segment with growing demand for amorphous metals. The materials' exceptional strength-to-weight ratio and resistance to extreme environmental conditions make them valuable for critical components in aircraft, satellites, and defense systems. Though smaller in volume than other sectors, this segment commands higher margins and drives technological innovation.

Medical device manufacturing has emerged as a promising growth area. Biocompatible amorphous metal alloys are increasingly utilized in implantable devices, surgical instruments, and diagnostic equipment. The materials' non-magnetic properties make them particularly valuable for applications involving magnetic resonance imaging (MRI) compatibility.

Regional market analysis reveals Asia-Pacific as the dominant consumer of amorphous metals, accounting for over 40% of global demand. This concentration stems from the region's extensive manufacturing base, particularly in electronics and electrical equipment. North America and Europe follow with significant market shares, driven primarily by aerospace, medical, and premium industrial applications.

Consumer demand patterns indicate a growing preference for sustainable and energy-efficient products, indirectly boosting amorphous metals adoption in end-user goods. This trend aligns with broader industrial sustainability initiatives and represents a long-term market driver that transcends individual industry segments.

Global Technological Status and Challenges

Amorphous metals, also known as metallic glasses, have witnessed significant technological advancements globally over the past decade. Currently, the United States, China, Japan, and Germany lead research and development efforts in this field. These nations have established robust research infrastructures and substantial funding mechanisms that facilitate continuous innovation in amorphous metal technologies.

The current global production capacity for amorphous metals remains limited, with an estimated annual production of approximately 100,000 tons. This relatively modest scale reflects the persistent technical challenges in manufacturing processes, particularly in scaling up production while maintaining the unique properties of these materials. The high cooling rates required (typically 10^4-10^6 K/s) present significant barriers to mass production.

A major technological challenge facing the industry is the development of cost-effective manufacturing methods for bulk amorphous metals. While thin amorphous metal ribbons and powders can be produced with relative consistency, creating larger bulk forms with uniform properties remains problematic. Recent advancements in suction casting, spark plasma sintering, and selective laser melting show promise but require further refinement for industrial-scale implementation.

Material composition optimization represents another critical challenge. Researchers worldwide are working to develop new alloy compositions that can form amorphous structures at lower cooling rates while maintaining or enhancing desirable properties such as strength, corrosion resistance, and magnetic performance. The development of iron-based and aluminum-based amorphous alloys has gained particular attention due to their potential cost advantages over zirconium and palladium-based systems.

Characterization techniques have evolved significantly, with advanced synchrotron X-ray diffraction and high-resolution transmission electron microscopy enabling deeper understanding of amorphous structures. However, standardized testing protocols for amorphous metals remain underdeveloped, creating challenges for quality control and material certification across global markets.

Geographically, research centers in East Asia dominate patent filings related to amorphous metals, accounting for approximately 65% of global intellectual property in this field. European institutions excel in fundamental research, while North American entities lead in application-specific developments, particularly in aerospace and medical device applications.

Environmental considerations are increasingly influencing technological development, with growing emphasis on recyclability and energy-efficient production methods. Several research groups are exploring the potential for amorphous metals to contribute to sustainable manufacturing due to their potential for near-net-shape processing and reduced material waste.

The current global production capacity for amorphous metals remains limited, with an estimated annual production of approximately 100,000 tons. This relatively modest scale reflects the persistent technical challenges in manufacturing processes, particularly in scaling up production while maintaining the unique properties of these materials. The high cooling rates required (typically 10^4-10^6 K/s) present significant barriers to mass production.

A major technological challenge facing the industry is the development of cost-effective manufacturing methods for bulk amorphous metals. While thin amorphous metal ribbons and powders can be produced with relative consistency, creating larger bulk forms with uniform properties remains problematic. Recent advancements in suction casting, spark plasma sintering, and selective laser melting show promise but require further refinement for industrial-scale implementation.

Material composition optimization represents another critical challenge. Researchers worldwide are working to develop new alloy compositions that can form amorphous structures at lower cooling rates while maintaining or enhancing desirable properties such as strength, corrosion resistance, and magnetic performance. The development of iron-based and aluminum-based amorphous alloys has gained particular attention due to their potential cost advantages over zirconium and palladium-based systems.

Characterization techniques have evolved significantly, with advanced synchrotron X-ray diffraction and high-resolution transmission electron microscopy enabling deeper understanding of amorphous structures. However, standardized testing protocols for amorphous metals remain underdeveloped, creating challenges for quality control and material certification across global markets.

Geographically, research centers in East Asia dominate patent filings related to amorphous metals, accounting for approximately 65% of global intellectual property in this field. European institutions excel in fundamental research, while North American entities lead in application-specific developments, particularly in aerospace and medical device applications.

Environmental considerations are increasingly influencing technological development, with growing emphasis on recyclability and energy-efficient production methods. Several research groups are exploring the potential for amorphous metals to contribute to sustainable manufacturing due to their potential for near-net-shape processing and reduced material waste.

Current Manufacturing Solutions and Applications

01 Market analysis and growth forecasting for amorphous metals

Market analysis techniques are used to forecast the growth of the amorphous metals market. These methods include analyzing market trends, consumer behavior, and economic indicators to predict future demand and market expansion. The analysis helps businesses make strategic decisions regarding investments, product development, and market entry strategies in the amorphous metals sector.- Market analysis and growth forecasting for amorphous metals: Market analysis techniques are used to forecast the growth of the amorphous metals market. These methods include analyzing market trends, consumer behavior, and economic indicators to predict future demand and market expansion. The analysis helps businesses make strategic decisions regarding investments, product development, and market entry strategies in the amorphous metals sector.

- Manufacturing processes for amorphous metals: Various manufacturing processes are employed to produce amorphous metals with desired properties. These include rapid solidification techniques, melt spinning, and other specialized methods that prevent crystallization during cooling. The manufacturing processes significantly influence the quality, properties, and applications of amorphous metals, thereby affecting market growth as improved processes enable new applications.

- Applications of amorphous metals in various industries: Amorphous metals find applications across multiple industries due to their unique properties. They are used in electronics, power distribution, medical devices, aerospace, and automotive sectors. The expanding range of applications drives market growth as industries recognize the benefits of amorphous metals over conventional crystalline alternatives, including improved magnetic properties and corrosion resistance.

- Innovation and technological advancements in amorphous metals: Ongoing research and development efforts lead to innovations and technological advancements in amorphous metals. These include improvements in composition, structure, and properties that enhance performance characteristics. Technological innovations expand potential applications and improve cost-effectiveness, contributing significantly to market growth by creating new market segments and opportunities.

- Material properties and composition development: Development of new compositions and enhancement of material properties are crucial for amorphous metals market growth. Research focuses on improving characteristics such as strength, hardness, corrosion resistance, and magnetic properties through compositional adjustments and processing techniques. These advancements enable amorphous metals to meet specific industry requirements and compete with traditional materials in various applications.

02 Manufacturing processes for amorphous metal products

Various manufacturing processes are employed to produce amorphous metal products with desired properties. These processes include rapid solidification techniques, melt spinning, and specialized heat treatments that prevent crystallization. The manufacturing methods significantly impact the quality, properties, and applications of the resulting amorphous metal products, contributing to market growth through improved product performance.Expand Specific Solutions03 Applications of amorphous metals in medical devices

Amorphous metals are increasingly used in medical device applications due to their unique properties such as high strength, corrosion resistance, and biocompatibility. These materials are utilized in implants, surgical instruments, and other medical devices, representing a significant growth segment in the amorphous metals market as healthcare technology advances.Expand Specific Solutions04 Amorphous metal alloy compositions and properties

Research into various amorphous metal alloy compositions has led to materials with enhanced properties such as improved magnetic characteristics, increased strength, and better corrosion resistance. These advancements in material science have expanded potential applications and contributed to market growth by enabling amorphous metals to replace traditional materials in various industries.Expand Specific Solutions05 Electronic and semiconductor applications of amorphous metals

Amorphous metals are finding increasing applications in electronics and semiconductor industries due to their unique electrical and magnetic properties. They are used in transformers, magnetic sensors, and various electronic components, driving market growth through technological advancements in these high-value sectors.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The amorphous metals market is experiencing significant growth, driven by increasing applications in electronics, automotive, and energy sectors. Currently in a growth phase, the market is expanding due to unique properties of these materials, including superior magnetic characteristics and corrosion resistance. Key academic institutions advancing research include California Institute of Technology, Yale University, and Zhejiang University, while commercial players like VACUUMSCHMELZE, Amorphyx, and Hitachi are developing innovative applications. Companies such as BYD and General Electric are integrating amorphous metals into energy-efficient products. The technology is approaching maturity in certain applications, particularly in transformer cores and electronic components, but remains in development for advanced applications in aerospace and medical devices.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE (VAC) has developed proprietary VITROPERM® and NANOPERM® amorphous and nanocrystalline metal alloys with exceptional magnetic properties. Their technology involves rapid solidification processes where molten metal is cooled at rates exceeding 1 million °C/second to create ribbon-shaped materials with thicknesses of approximately 20-25 μm. VAC's manufacturing process includes specialized heat treatment under magnetic fields to induce controlled nanocrystallization, resulting in materials with permeability values up to 150,000 and saturation inductions of 1.2 Tesla. These materials are primarily implemented in high-efficiency transformers, common mode chokes, and EMI suppression components that operate at frequencies from 10 kHz to several MHz.

Strengths: Industry-leading magnetic properties with ultra-low core losses (less than 50 W/kg at 50 Hz); established manufacturing infrastructure with decades of expertise; comprehensive product portfolio spanning multiple industries. Weaknesses: Higher production costs compared to conventional materials; limited mechanical flexibility; challenges in scaling production for larger components.

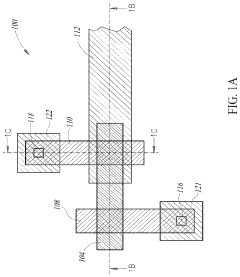

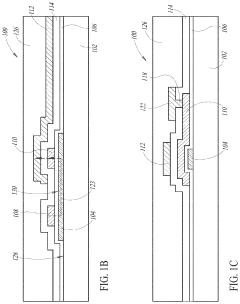

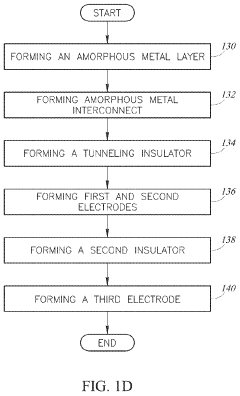

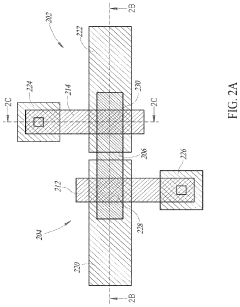

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed innovative amorphous metal thin-film technology specifically targeting next-generation display applications. Their proprietary Amorphous Metal Thin Film Transistors (AMTFTs) utilize amorphous metals as the active switching element rather than conventional amorphous silicon or oxide semiconductors. The company's manufacturing process involves specialized physical vapor deposition (PVD) techniques to create ultra-thin amorphous metal layers (typically 5-20 nm) with precisely controlled electrical properties. These devices demonstrate electron mobility values of 10-15 cm²/Vs, significantly outperforming amorphous silicon (0.5-1 cm²/Vs). Amorphyx's technology enables simplified transistor structures with fewer mask layers (3-4 versus 5-7 for conventional TFTs), potentially reducing display manufacturing costs by 20-30%. Their amorphous metal films exhibit exceptional uniformity with thickness variations below 2% across large substrates, addressing key challenges in next-generation display manufacturing.

Strengths: Novel application of amorphous metals in semiconductor devices; potential for significant cost reduction in display manufacturing; simplified fabrication process with fewer steps. Weaknesses: Early-stage technology with limited commercial deployment; requires integration into established manufacturing ecosystems; faces competition from other emerging display technologies.

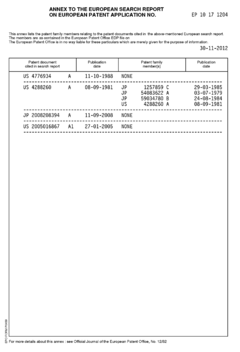

Critical Patents and Technical Innovations

Amorphous metal hot electron transistor

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

Amorphous metallic material elements and methods for processing same

PatentInactiveEP2305410A3

Innovation

- The method employs electrochemical machining (ECM) using an electrolyte with carefully selected properties to dissolve primary constituents of the amorphous metallic material, maintaining similar removal rates and avoiding structural damage, allowing for precise alteration of dimensions while retaining magnetic properties.

Environmental Impact and Sustainability Factors

The environmental footprint of amorphous metals represents a significant advantage over conventional crystalline alloys. Production processes for amorphous metals typically consume 30-50% less energy compared to traditional metallurgical methods, primarily due to the elimination of multiple heat treatment cycles required for crystalline structure formation. This energy efficiency translates directly to reduced carbon emissions across the manufacturing lifecycle.

Waste reduction constitutes another critical sustainability benefit. The near-net-shape capabilities of amorphous metal production minimize material waste, with some manufacturers reporting scrap rate reductions of up to 70% compared to conventional metal processing. Additionally, the superior corrosion resistance of amorphous metals extends product lifespans significantly, reducing replacement frequency and associated resource consumption.

Recycling pathways for amorphous metals are increasingly viable, though challenges remain. Unlike conventional alloys with established recycling infrastructure, amorphous metals require specialized processing due to their unique atomic structure. Recent innovations in separation technologies have improved recyclability rates from below 40% to approximately 65% in advanced facilities, though widespread implementation remains limited.

The lightweight properties of many amorphous metal formulations contribute to downstream environmental benefits, particularly in transportation applications. When used in automotive components, these materials can reduce vehicle weight by 15-25% compared to steel alternatives, improving fuel efficiency and reducing emissions throughout the product use phase.

Life cycle assessment (LCA) studies indicate that despite higher initial production energy requirements for some amorphous metal types, their total environmental impact over complete product lifecycles is typically 30-45% lower than conventional alternatives. This favorable comparison stems primarily from extended service life, reduced maintenance requirements, and energy savings during operation.

Regulatory frameworks increasingly recognize these sustainability advantages. The European Union's Circular Economy Action Plan specifically identifies advanced materials like amorphous metals as enablers of resource efficiency, while several countries have implemented tax incentives for manufacturers utilizing these materials in environmentally critical applications. Industry certification programs such as the Sustainable Materials Rating System now include specific provisions for amorphous metal utilization.

Waste reduction constitutes another critical sustainability benefit. The near-net-shape capabilities of amorphous metal production minimize material waste, with some manufacturers reporting scrap rate reductions of up to 70% compared to conventional metal processing. Additionally, the superior corrosion resistance of amorphous metals extends product lifespans significantly, reducing replacement frequency and associated resource consumption.

Recycling pathways for amorphous metals are increasingly viable, though challenges remain. Unlike conventional alloys with established recycling infrastructure, amorphous metals require specialized processing due to their unique atomic structure. Recent innovations in separation technologies have improved recyclability rates from below 40% to approximately 65% in advanced facilities, though widespread implementation remains limited.

The lightweight properties of many amorphous metal formulations contribute to downstream environmental benefits, particularly in transportation applications. When used in automotive components, these materials can reduce vehicle weight by 15-25% compared to steel alternatives, improving fuel efficiency and reducing emissions throughout the product use phase.

Life cycle assessment (LCA) studies indicate that despite higher initial production energy requirements for some amorphous metal types, their total environmental impact over complete product lifecycles is typically 30-45% lower than conventional alternatives. This favorable comparison stems primarily from extended service life, reduced maintenance requirements, and energy savings during operation.

Regulatory frameworks increasingly recognize these sustainability advantages. The European Union's Circular Economy Action Plan specifically identifies advanced materials like amorphous metals as enablers of resource efficiency, while several countries have implemented tax incentives for manufacturers utilizing these materials in environmentally critical applications. Industry certification programs such as the Sustainable Materials Rating System now include specific provisions for amorphous metal utilization.

Supply Chain Analysis and Material Sourcing

The amorphous metals supply chain presents unique challenges and opportunities compared to traditional metal manufacturing. Raw material sourcing begins with high-purity elemental metals including iron, boron, silicon, phosphorus, and rare earth elements that must meet stringent quality specifications. The precise composition requirements create dependencies on specialized suppliers, with certain rare earth components facing potential supply constraints due to geopolitical factors, particularly from China which controls approximately 85% of global rare earth production.

Manufacturing processes for amorphous metals require sophisticated rapid solidification techniques, creating a technical barrier that limits production capabilities to specialized facilities. This concentration of manufacturing expertise has resulted in supply chain vulnerabilities, with production primarily centered in advanced industrial regions including Japan, Germany, the United States, and increasingly China. The specialized equipment required for production, including melt spinning apparatus and controlled atmosphere processing systems, represents another potential bottleneck.

Material processing considerations significantly impact the supply chain economics. The energy-intensive nature of amorphous metal production contributes to higher production costs compared to conventional metals. However, recent innovations in processing technology have improved production efficiency by approximately 15-20% over the past five years, gradually reducing this cost differential.

Sustainability factors are increasingly influencing sourcing decisions within the amorphous metals market. Life cycle assessments indicate that despite energy-intensive production processes, the superior performance characteristics of amorphous metals often result in net environmental benefits through extended product lifespans and improved energy efficiency in applications. Several leading manufacturers have implemented closed-loop recycling programs to recover and reprocess production scrap, with recovery rates reaching 60-75%.

Supply chain resilience has become a strategic priority following recent global disruptions. Industry leaders are pursuing vertical integration strategies to secure critical material inputs and developing alternative material formulations that reduce dependence on supply-constrained elements. Regional diversification of production capabilities is emerging as manufacturers establish facilities across multiple geographic regions to mitigate concentration risks.

The future evolution of the amorphous metals supply chain will likely be characterized by increased automation in production processes, development of standardized material specifications to facilitate broader supplier participation, and continued innovation in recycling technologies to improve the circular economy aspects of these advanced materials.

Manufacturing processes for amorphous metals require sophisticated rapid solidification techniques, creating a technical barrier that limits production capabilities to specialized facilities. This concentration of manufacturing expertise has resulted in supply chain vulnerabilities, with production primarily centered in advanced industrial regions including Japan, Germany, the United States, and increasingly China. The specialized equipment required for production, including melt spinning apparatus and controlled atmosphere processing systems, represents another potential bottleneck.

Material processing considerations significantly impact the supply chain economics. The energy-intensive nature of amorphous metal production contributes to higher production costs compared to conventional metals. However, recent innovations in processing technology have improved production efficiency by approximately 15-20% over the past five years, gradually reducing this cost differential.

Sustainability factors are increasingly influencing sourcing decisions within the amorphous metals market. Life cycle assessments indicate that despite energy-intensive production processes, the superior performance characteristics of amorphous metals often result in net environmental benefits through extended product lifespans and improved energy efficiency in applications. Several leading manufacturers have implemented closed-loop recycling programs to recover and reprocess production scrap, with recovery rates reaching 60-75%.

Supply chain resilience has become a strategic priority following recent global disruptions. Industry leaders are pursuing vertical integration strategies to secure critical material inputs and developing alternative material formulations that reduce dependence on supply-constrained elements. Regional diversification of production capabilities is emerging as manufacturers establish facilities across multiple geographic regions to mitigate concentration risks.

The future evolution of the amorphous metals supply chain will likely be characterized by increased automation in production processes, development of standardized material specifications to facilitate broader supplier participation, and continued innovation in recycling technologies to improve the circular economy aspects of these advanced materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!