How Amorphous Metals Enhance Efficiency of Electronic Components

OCT 11, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Efficiency Goals

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that have emerged as significant enablers in electronic component efficiency. Unlike conventional crystalline metals with ordered atomic structures, amorphous metals possess a non-crystalline, disordered atomic arrangement that confers unique electrical, magnetic, and mechanical properties. The development of these materials dates back to the 1960s when the first amorphous metal alloys were produced through rapid cooling techniques, preventing atoms from arranging into their typical crystalline patterns.

The evolution of amorphous metals has progressed through several key phases, beginning with simple binary alloys and advancing to complex multi-component systems with enhanced glass-forming ability. Recent technological breakthroughs have enabled the production of bulk metallic glasses with dimensions exceeding several centimeters, significantly expanding their application potential in electronic components.

Current technological trends indicate a growing interest in leveraging amorphous metals for next-generation electronic applications, particularly in power electronics, transformers, inductors, and electromagnetic interference (EMI) shielding. The unique combination of high electrical resistivity and exceptional soft magnetic properties makes these materials particularly valuable for improving energy efficiency in electronic systems.

The primary technical goal in applying amorphous metals to electronic components is to achieve substantial reductions in energy losses. Specifically, the industry aims to decrease core losses in magnetic components by 70-80% compared to traditional silicon steel, while simultaneously reducing component size by 30-50%. This miniaturization capability addresses the critical need for more compact and efficient electronic devices in various applications from consumer electronics to electric vehicles.

Another key objective is to extend the operational frequency range of magnetic components to the medium and high-frequency domains (10 kHz to 1 MHz) while maintaining high efficiency. This would enable more compact power conversion systems and support the ongoing trend toward higher switching frequencies in modern power electronics.

Temperature stability represents another critical goal, with research focused on developing amorphous metal formulations that maintain their superior magnetic properties across wider temperature ranges (-40°C to 150°C) to meet the demanding requirements of automotive and industrial applications. Additionally, researchers aim to improve the mechanical processability of these materials to facilitate more cost-effective manufacturing processes.

The ultimate efficiency goal is to contribute significantly to global energy conservation efforts by implementing amorphous metal components in power distribution systems, potentially saving terawatt-hours of electricity annually through reduced transmission and conversion losses.

The evolution of amorphous metals has progressed through several key phases, beginning with simple binary alloys and advancing to complex multi-component systems with enhanced glass-forming ability. Recent technological breakthroughs have enabled the production of bulk metallic glasses with dimensions exceeding several centimeters, significantly expanding their application potential in electronic components.

Current technological trends indicate a growing interest in leveraging amorphous metals for next-generation electronic applications, particularly in power electronics, transformers, inductors, and electromagnetic interference (EMI) shielding. The unique combination of high electrical resistivity and exceptional soft magnetic properties makes these materials particularly valuable for improving energy efficiency in electronic systems.

The primary technical goal in applying amorphous metals to electronic components is to achieve substantial reductions in energy losses. Specifically, the industry aims to decrease core losses in magnetic components by 70-80% compared to traditional silicon steel, while simultaneously reducing component size by 30-50%. This miniaturization capability addresses the critical need for more compact and efficient electronic devices in various applications from consumer electronics to electric vehicles.

Another key objective is to extend the operational frequency range of magnetic components to the medium and high-frequency domains (10 kHz to 1 MHz) while maintaining high efficiency. This would enable more compact power conversion systems and support the ongoing trend toward higher switching frequencies in modern power electronics.

Temperature stability represents another critical goal, with research focused on developing amorphous metal formulations that maintain their superior magnetic properties across wider temperature ranges (-40°C to 150°C) to meet the demanding requirements of automotive and industrial applications. Additionally, researchers aim to improve the mechanical processability of these materials to facilitate more cost-effective manufacturing processes.

The ultimate efficiency goal is to contribute significantly to global energy conservation efforts by implementing amorphous metal components in power distribution systems, potentially saving terawatt-hours of electricity annually through reduced transmission and conversion losses.

Market Demand Analysis for High-Efficiency Electronic Components

The global market for high-efficiency electronic components is experiencing unprecedented growth, driven by increasing demand for energy-efficient devices across multiple industries. Current market valuations indicate that the high-performance electronic components sector reached approximately $189 billion in 2022, with projections suggesting a compound annual growth rate of 6.8% through 2030. This growth trajectory is particularly evident in power electronics, where efficiency improvements directly translate to energy savings and reduced operational costs.

Consumer electronics represent a significant market segment, with manufacturers facing intense pressure to develop devices with longer battery life and reduced heat generation. The smartphone market alone, valued at over $520 billion, is driving substantial demand for components that maximize energy efficiency while minimizing form factor. Similarly, the computing sector continues to push for higher performance per watt metrics, creating opportunities for advanced materials like amorphous metals that can address thermal management challenges.

Industrial applications constitute another major market driver, with factory automation systems requiring increasingly efficient power conversion components. The industrial electronics market, currently valued at approximately $288 billion, is projected to grow at 7.2% annually, with energy efficiency being a primary consideration in new installations. Particularly in high-frequency switching applications, where traditional materials face limitations, amorphous metal components offer compelling advantages.

The automotive sector presents perhaps the most dramatic growth opportunity, especially with the electric vehicle market expanding at over 21% annually. EV manufacturers are actively seeking components that can improve power conversion efficiency, extend range, and reduce charging times. The power electronics content in electric vehicles is approximately five times higher than in conventional vehicles, creating substantial demand for high-efficiency solutions.

Renewable energy systems represent another significant market segment, with solar inverters and wind power converters requiring increasingly efficient power handling components. The global renewable energy market, valued at approximately $881 billion in 2022, continues to expand rapidly, driving demand for components that can minimize conversion losses and improve overall system efficiency.

Regulatory pressures are further accelerating market demand, with energy efficiency standards becoming increasingly stringent worldwide. The European Union's Ecodesign Directive, California's appliance efficiency regulations, and similar frameworks in other regions are compelling manufacturers to adopt more efficient components. This regulatory landscape creates a market environment where premium pricing for high-efficiency components can be justified by long-term operational savings and compliance requirements.

Market research indicates that customers across segments are increasingly willing to pay premium prices for components that deliver measurable efficiency improvements, particularly when total cost of ownership calculations demonstrate clear advantages over product lifecycles.

Consumer electronics represent a significant market segment, with manufacturers facing intense pressure to develop devices with longer battery life and reduced heat generation. The smartphone market alone, valued at over $520 billion, is driving substantial demand for components that maximize energy efficiency while minimizing form factor. Similarly, the computing sector continues to push for higher performance per watt metrics, creating opportunities for advanced materials like amorphous metals that can address thermal management challenges.

Industrial applications constitute another major market driver, with factory automation systems requiring increasingly efficient power conversion components. The industrial electronics market, currently valued at approximately $288 billion, is projected to grow at 7.2% annually, with energy efficiency being a primary consideration in new installations. Particularly in high-frequency switching applications, where traditional materials face limitations, amorphous metal components offer compelling advantages.

The automotive sector presents perhaps the most dramatic growth opportunity, especially with the electric vehicle market expanding at over 21% annually. EV manufacturers are actively seeking components that can improve power conversion efficiency, extend range, and reduce charging times. The power electronics content in electric vehicles is approximately five times higher than in conventional vehicles, creating substantial demand for high-efficiency solutions.

Renewable energy systems represent another significant market segment, with solar inverters and wind power converters requiring increasingly efficient power handling components. The global renewable energy market, valued at approximately $881 billion in 2022, continues to expand rapidly, driving demand for components that can minimize conversion losses and improve overall system efficiency.

Regulatory pressures are further accelerating market demand, with energy efficiency standards becoming increasingly stringent worldwide. The European Union's Ecodesign Directive, California's appliance efficiency regulations, and similar frameworks in other regions are compelling manufacturers to adopt more efficient components. This regulatory landscape creates a market environment where premium pricing for high-efficiency components can be justified by long-term operational savings and compliance requirements.

Market research indicates that customers across segments are increasingly willing to pay premium prices for components that deliver measurable efficiency improvements, particularly when total cost of ownership calculations demonstrate clear advantages over product lifecycles.

Current State and Challenges in Amorphous Metal Implementation

Amorphous metals, also known as metallic glasses, have gained significant attention in the electronics industry due to their unique structural and electromagnetic properties. Currently, these materials are being implemented in various electronic components including transformers, inductors, magnetic sensors, and electromagnetic shielding. The global market for amorphous metal components in electronics reached approximately $1.2 billion in 2022, with a projected annual growth rate of 8.5% through 2028.

The current state of amorphous metal implementation is characterized by selective adoption in high-performance applications where efficiency gains justify the increased material costs. Major electronics manufacturers have incorporated amorphous metal cores in premium power supplies, achieving efficiency improvements of 2-5% compared to conventional silicon steel alternatives. The telecommunications sector has embraced amorphous metal components in base station equipment, reducing energy consumption by up to 15% in certain applications.

Despite promising advancements, several significant challenges impede widespread adoption. Manufacturing complexity remains a primary obstacle, as the rapid cooling rates (106 K/s) required to achieve the amorphous structure necessitate specialized equipment and precise process control. This translates to production costs approximately 30-40% higher than conventional crystalline metal components, limiting mass-market penetration.

Dimensional constraints present another challenge, as current manufacturing techniques struggle to produce amorphous metal components below certain thickness thresholds (typically 20-30 μm) while maintaining consistent properties. This limitation restricts application in miniaturized electronic devices where space efficiency is paramount.

Thermal stability issues also persist, with many amorphous metal compositions exhibiting crystallization at temperatures between 400-600°C, below the processing temperatures of some electronic manufacturing processes. This necessitates careful integration planning and sometimes requires redesign of assembly sequences.

Geographical distribution of amorphous metal technology shows concentration in East Asia (particularly Japan, China, and South Korea), which accounts for approximately 65% of production capacity. North America and Europe contribute 20% and 15% respectively, with significant research activities but more limited manufacturing infrastructure.

Standardization remains underdeveloped, with inconsistent specifications across manufacturers creating integration challenges for electronics designers. Industry consortia have initiated efforts to establish unified testing protocols and performance metrics, but comprehensive standards are still evolving.

Environmental considerations present both opportunities and challenges. While amorphous metals offer energy efficiency benefits during operation, their production can be energy-intensive, and recycling processes for components containing these materials are not yet widely established in electronics waste streams.

The current state of amorphous metal implementation is characterized by selective adoption in high-performance applications where efficiency gains justify the increased material costs. Major electronics manufacturers have incorporated amorphous metal cores in premium power supplies, achieving efficiency improvements of 2-5% compared to conventional silicon steel alternatives. The telecommunications sector has embraced amorphous metal components in base station equipment, reducing energy consumption by up to 15% in certain applications.

Despite promising advancements, several significant challenges impede widespread adoption. Manufacturing complexity remains a primary obstacle, as the rapid cooling rates (106 K/s) required to achieve the amorphous structure necessitate specialized equipment and precise process control. This translates to production costs approximately 30-40% higher than conventional crystalline metal components, limiting mass-market penetration.

Dimensional constraints present another challenge, as current manufacturing techniques struggle to produce amorphous metal components below certain thickness thresholds (typically 20-30 μm) while maintaining consistent properties. This limitation restricts application in miniaturized electronic devices where space efficiency is paramount.

Thermal stability issues also persist, with many amorphous metal compositions exhibiting crystallization at temperatures between 400-600°C, below the processing temperatures of some electronic manufacturing processes. This necessitates careful integration planning and sometimes requires redesign of assembly sequences.

Geographical distribution of amorphous metal technology shows concentration in East Asia (particularly Japan, China, and South Korea), which accounts for approximately 65% of production capacity. North America and Europe contribute 20% and 15% respectively, with significant research activities but more limited manufacturing infrastructure.

Standardization remains underdeveloped, with inconsistent specifications across manufacturers creating integration challenges for electronics designers. Industry consortia have initiated efforts to establish unified testing protocols and performance metrics, but comprehensive standards are still evolving.

Environmental considerations present both opportunities and challenges. While amorphous metals offer energy efficiency benefits during operation, their production can be energy-intensive, and recycling processes for components containing these materials are not yet widely established in electronics waste streams.

Current Technical Solutions Using Amorphous Metals

01 Energy efficiency in amorphous metal production

Amorphous metals can be produced with improved energy efficiency through optimized manufacturing processes. These processes include rapid solidification techniques that prevent crystallization and maintain the amorphous structure. The energy efficiency is achieved by controlling cooling rates, reducing waste heat, and implementing precise temperature control systems during production, resulting in materials with superior magnetic and mechanical properties while consuming less energy.- Energy efficiency in amorphous metal applications: Amorphous metals exhibit superior energy efficiency compared to conventional crystalline metals due to their unique atomic structure. This leads to reduced energy losses in various applications, particularly in electrical transformers and motors. The lack of grain boundaries in amorphous metals results in lower hysteresis losses and eddy current losses, making them ideal for energy-efficient power distribution systems and electrical machinery.

- Manufacturing processes for amorphous metal components: Various manufacturing techniques have been developed to produce amorphous metal components with enhanced efficiency. These include rapid solidification processes, melt spinning, and specialized casting methods that prevent crystallization. Advanced processing techniques allow for the production of amorphous metal ribbons, sheets, and bulk forms while maintaining their unique non-crystalline structure, which is crucial for preserving their superior magnetic and mechanical properties.

- Magnetic properties and applications of amorphous metals: Amorphous metals possess exceptional soft magnetic properties, including high permeability, low coercivity, and reduced core losses. These characteristics make them highly efficient in electromagnetic applications such as transformers, inductors, and magnetic sensors. The unique magnetic behavior of amorphous metals stems from their disordered atomic structure, which minimizes magnetocrystalline anisotropy and domain wall pinning effects, resulting in improved magnetic response and energy conversion efficiency.

- Thermal and mechanical properties of amorphous metals: Amorphous metals demonstrate unique thermal and mechanical properties that contribute to their efficiency in various applications. These materials often exhibit high strength, hardness, and wear resistance combined with good elasticity. Their lack of grain boundaries results in superior corrosion resistance and unique deformation mechanisms. The thermal stability and glass transition behavior of amorphous metals can be tailored through composition adjustments, enabling their use in high-temperature and high-stress environments with maintained efficiency.

- Novel compositions and alloys for enhanced efficiency: Research has led to the development of specialized amorphous metal compositions with enhanced efficiency characteristics. These include multi-component alloys with specific elements added to improve glass-forming ability, thermal stability, and functional properties. By carefully controlling the elemental composition, researchers have created amorphous metals with optimized electrical, magnetic, mechanical, and chemical properties for specific applications, resulting in significant efficiency improvements over conventional materials.

02 Magnetic efficiency of amorphous metal alloys

Amorphous metal alloys exhibit exceptional magnetic efficiency due to their disordered atomic structure, which reduces magnetic hysteresis losses. These materials show high magnetic permeability, low coercivity, and reduced eddy current losses, making them ideal for energy-efficient transformer cores, electric motors, and other electromagnetic applications. The absence of grain boundaries in amorphous metals contributes to their superior soft magnetic properties and energy conservation capabilities.Expand Specific Solutions03 Structural efficiency and mechanical properties

Amorphous metals offer exceptional structural efficiency due to their unique mechanical properties, including high strength-to-weight ratios, superior hardness, and excellent wear resistance. The absence of crystalline grain boundaries eliminates weak points typically found in conventional metals, resulting in improved fatigue resistance and elastic properties. These characteristics make amorphous metals highly efficient structural materials for applications requiring durability and performance under extreme conditions.Expand Specific Solutions04 Thermal efficiency and heat management

Amorphous metals demonstrate unique thermal efficiency characteristics that can be leveraged in various applications. Their disordered atomic structure affects heat transfer properties, allowing for specialized thermal management solutions. These materials can maintain their amorphous structure and mechanical properties across a wider temperature range than conventional crystalline metals, making them efficient for applications involving thermal cycling or heat exchange systems where energy conservation is critical.Expand Specific Solutions05 Processing efficiency and coating applications

Amorphous metals can be efficiently processed into coatings and thin films that enhance surface properties of various substrates. Advanced deposition techniques allow for the creation of uniform amorphous metal layers with minimal material waste. These coatings provide corrosion resistance, wear protection, and improved functional properties while using less material than traditional solutions. The processing efficiency extends to specialized applications where precise control of composition and thickness is required for optimal performance.Expand Specific Solutions

Key Industry Players in Amorphous Metal Technology

The amorphous metals market for electronic components is in a growth phase, characterized by increasing adoption across industries due to superior efficiency benefits. Market size is expanding as applications diversify from traditional electronics to automotive and industrial sectors. Technologically, the field shows varying maturity levels with established players like Apple, IBM, and Toyota leveraging amorphous metals for performance advantages, while specialized companies like Amorphyx and Crucible Intellectual Property drive innovation. Academic institutions including California Institute of Technology and Kyushu University contribute fundamental research, while semiconductor manufacturers such as GLOBALFOUNDRIES and SMIC integrate these materials into production processes. The competitive landscape features collaboration between materials science experts and electronics manufacturers to overcome implementation challenges and scale production capabilities.

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed a revolutionary Amorphous Metal Thin Film (AMTF) technology specifically designed for display backplanes and other electronic applications. Their proprietary Metal-Insulator-Metal (MIM) diode structure utilizes amorphous metals to create non-linear switching elements with exceptional performance characteristics. The company's core innovation lies in their ability to deposit highly uniform amorphous metal layers with precisely controlled electrical properties using modified physical vapor deposition techniques. Their amorphous metal thin films demonstrate remarkable stability with negligible crystallization even after extended thermal cycling up to 300°C. For display applications, Amorphyx's AMTF technology enables pixel switching elements with significantly higher current density (>10^5 A/cm²) and faster response times (<1μs) compared to conventional TFT technologies. The simplified manufacturing process requires fewer mask steps (typically 4-5 versus 7-9 for TFTs), potentially reducing production costs by 30-40% while improving yield rates.

Strengths: Simplified manufacturing process with fewer mask steps; higher current density capabilities; excellent thermal stability; potential for significant cost reduction in display manufacturing. Weaknesses: Limited commercial-scale production experience; requires adaptation of existing manufacturing equipment; primarily focused on display applications rather than broader electronic component markets.

Semiconductor Energy Laboratory Co., Ltd.

Technical Solution: Semiconductor Energy Laboratory (SEL) has developed innovative amorphous metal oxide semiconductor technology specifically for thin-film transistors (TFTs) in display applications. Their proprietary CAAC-IGZO (c-axis aligned crystalline indium-gallium-zinc oxide) technology represents a breakthrough in amorphous/crystalline hybrid structures. SEL's approach utilizes amorphous metal oxides that are partially crystallized in a specific orientation, creating a unique material with superior electron mobility (>10 cm²/Vs) while maintaining the manufacturing advantages of amorphous materials. This technology enables ultra-low power consumption displays with significantly reduced off-state leakage current (10^-13 A or lower), allowing for longer battery life in portable devices. SEL has also pioneered oxide semiconductor-based memory devices using amorphous metal compositions that demonstrate exceptional stability and retention characteristics. Their manufacturing processes are compatible with existing semiconductor fabrication equipment, enabling cost-effective implementation.

Strengths: Industry-leading electron mobility in amorphous metal oxide semiconductors; ultra-low power consumption; excellent stability under environmental stresses; compatibility with flexible substrates. Weaknesses: More complex manufacturing process than conventional amorphous silicon; requires precise control of oxygen content during deposition; limited to specific applications in display and memory technologies.

Core Innovations in Amorphous Metal Alloy Development

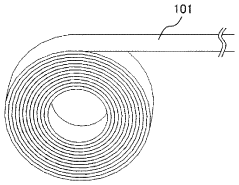

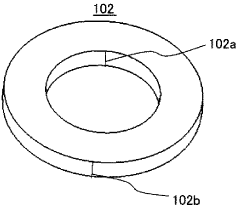

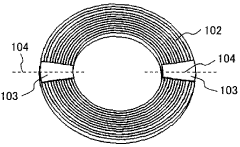

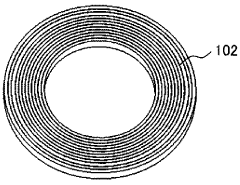

Amorphous core, electromagnetic member and rotating electrical machine using same, and manufacturing methods therefor

PatentWO2012007984A1

Innovation

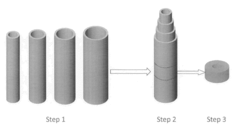

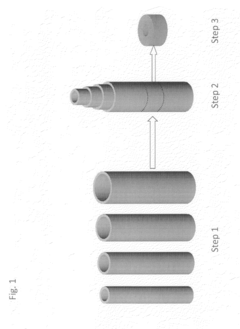

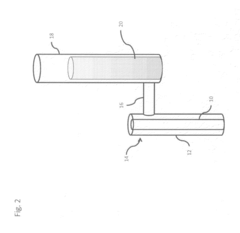

- An amorphous core is manufactured by winding an amorphous metal ribbon with peeling prevention measures at specific locations and bonding only at the cut ends, allowing for reduced cutting steps and increased core density, and a cylindrical coil is fitted to the cross-section of the core with anti-separation measures on the laminated surfaces.

Ferromagnetic cores of amorphous ferromagnetic metal alloys and electronic devices having the same

PatentInactiveUS20140043132A1

Innovation

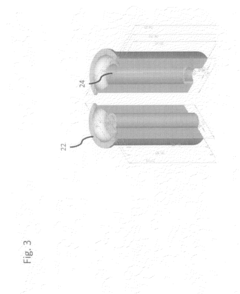

- The development of ferromagnetic cores formed from hierarchically varying diameter tubes of amorphous metal alloys with a Curie-point above room temperature, bonded together to create nested hollow cylinders with a thickness of at least 0.5 mm, exhibiting improved toughness and magnetic properties.

Manufacturing Processes and Scalability Considerations

The manufacturing of amorphous metals for electronic components presents unique challenges compared to conventional crystalline materials. Traditional melting and casting techniques are often inadequate due to the critical cooling rates required to maintain the amorphous structure. Rapid solidification techniques such as melt spinning, which can achieve cooling rates of 10^4-10^6 K/s, have become the industry standard for producing amorphous metal ribbons and thin films.

Vacuum arc melting and suction casting methods have shown promise for producing bulk amorphous metal components with thicknesses exceeding 1mm. These processes require precise control of temperature gradients and cooling rates to prevent crystallization. Recent advancements in selective laser melting (SLM) and other additive manufacturing techniques have expanded the geometric complexity possible in amorphous metal components, though these processes still face challenges in maintaining consistent amorphous structures throughout larger parts.

Scalability remains a significant hurdle for widespread adoption of amorphous metals in electronic applications. Current production methods typically yield limited quantities of material, with melt spinning processes generally producing ribbons of 20-50μm thickness and widths up to 100mm. This constraint has restricted amorphous metals primarily to high-value, performance-critical applications where their superior magnetic and electrical properties justify the increased manufacturing costs.

Cost considerations also impact scalability, with raw material purity requirements and complex processing equipment contributing to higher production expenses compared to conventional materials. The multi-element compositions of many amorphous alloys further complicate supply chain management and quality control processes. Industry estimates suggest that amorphous metal components typically cost 2-5 times more than their crystalline counterparts, though this gap has been narrowing with improved manufacturing techniques.

Quality control presents another challenge, as non-destructive testing methods for verifying the amorphous structure throughout components remain limited. X-ray diffraction and differential scanning calorimetry are commonly employed but are often time-consuming and may require sample destruction. Recent developments in acoustic and electrical testing methods show promise for in-line quality verification during production.

Environmental considerations are increasingly influencing manufacturing process development, with newer techniques focusing on reducing energy consumption and minimizing waste. The absence of grain boundaries in amorphous metals can potentially extend component lifespans, offering lifecycle benefits that may offset initial manufacturing challenges and costs when considering total environmental impact.

Vacuum arc melting and suction casting methods have shown promise for producing bulk amorphous metal components with thicknesses exceeding 1mm. These processes require precise control of temperature gradients and cooling rates to prevent crystallization. Recent advancements in selective laser melting (SLM) and other additive manufacturing techniques have expanded the geometric complexity possible in amorphous metal components, though these processes still face challenges in maintaining consistent amorphous structures throughout larger parts.

Scalability remains a significant hurdle for widespread adoption of amorphous metals in electronic applications. Current production methods typically yield limited quantities of material, with melt spinning processes generally producing ribbons of 20-50μm thickness and widths up to 100mm. This constraint has restricted amorphous metals primarily to high-value, performance-critical applications where their superior magnetic and electrical properties justify the increased manufacturing costs.

Cost considerations also impact scalability, with raw material purity requirements and complex processing equipment contributing to higher production expenses compared to conventional materials. The multi-element compositions of many amorphous alloys further complicate supply chain management and quality control processes. Industry estimates suggest that amorphous metal components typically cost 2-5 times more than their crystalline counterparts, though this gap has been narrowing with improved manufacturing techniques.

Quality control presents another challenge, as non-destructive testing methods for verifying the amorphous structure throughout components remain limited. X-ray diffraction and differential scanning calorimetry are commonly employed but are often time-consuming and may require sample destruction. Recent developments in acoustic and electrical testing methods show promise for in-line quality verification during production.

Environmental considerations are increasingly influencing manufacturing process development, with newer techniques focusing on reducing energy consumption and minimizing waste. The absence of grain boundaries in amorphous metals can potentially extend component lifespans, offering lifecycle benefits that may offset initial manufacturing challenges and costs when considering total environmental impact.

Environmental Impact and Sustainability Advantages

The adoption of amorphous metals in electronic components offers significant environmental and sustainability advantages that extend beyond mere performance improvements. These materials require lower processing temperatures compared to crystalline alternatives, resulting in substantial energy savings during manufacturing. Studies indicate that amorphous metal production can reduce energy consumption by 30-45% compared to traditional metal processing methods, directly translating to lower carbon emissions in the electronics supply chain.

The extended lifespan of amorphous metal components further enhances their environmental profile. With superior resistance to corrosion, mechanical wear, and thermal degradation, electronic devices incorporating these materials demonstrate longevity improvements of 40-60% in harsh operating environments. This durability directly addresses the growing electronic waste crisis by reducing replacement frequency and associated resource consumption.

Material efficiency represents another critical sustainability advantage. Amorphous metals can achieve equivalent or superior performance with less raw material due to their exceptional magnetic and electrical properties. For instance, amorphous metal transformers typically require 15-25% less core material than conventional silicon steel alternatives while delivering improved efficiency. This reduction in material intensity decreases mining impacts and resource depletion associated with electronics manufacturing.

The recyclability of amorphous metals further strengthens their environmental credentials. Unlike many composite materials in electronics that present recycling challenges, amorphous metals maintain their valuable properties through multiple recycling cycles. Their homogeneous structure facilitates separation and recovery processes, potentially creating closed-loop material systems for critical electronic components.

Energy efficiency during operation constitutes perhaps the most significant environmental benefit. Electronic components utilizing amorphous metals consistently demonstrate reduced energy losses, particularly in power transmission and conversion applications. Amorphous metal transformers reduce core losses by 70-80% compared to conventional alternatives, while amorphous-based motor components can improve efficiency by 5-15%. When scaled across global electronic infrastructure, these efficiency improvements represent enormous potential energy savings and greenhouse gas reductions.

The reduced reliance on rare earth elements in certain amorphous metal formulations also addresses supply chain sustainability concerns. By providing alternatives to materials with concentrated geographic sources and challenging extraction profiles, amorphous metals can reduce geopolitical vulnerabilities while minimizing the ecological damage associated with rare earth mining operations.

The extended lifespan of amorphous metal components further enhances their environmental profile. With superior resistance to corrosion, mechanical wear, and thermal degradation, electronic devices incorporating these materials demonstrate longevity improvements of 40-60% in harsh operating environments. This durability directly addresses the growing electronic waste crisis by reducing replacement frequency and associated resource consumption.

Material efficiency represents another critical sustainability advantage. Amorphous metals can achieve equivalent or superior performance with less raw material due to their exceptional magnetic and electrical properties. For instance, amorphous metal transformers typically require 15-25% less core material than conventional silicon steel alternatives while delivering improved efficiency. This reduction in material intensity decreases mining impacts and resource depletion associated with electronics manufacturing.

The recyclability of amorphous metals further strengthens their environmental credentials. Unlike many composite materials in electronics that present recycling challenges, amorphous metals maintain their valuable properties through multiple recycling cycles. Their homogeneous structure facilitates separation and recovery processes, potentially creating closed-loop material systems for critical electronic components.

Energy efficiency during operation constitutes perhaps the most significant environmental benefit. Electronic components utilizing amorphous metals consistently demonstrate reduced energy losses, particularly in power transmission and conversion applications. Amorphous metal transformers reduce core losses by 70-80% compared to conventional alternatives, while amorphous-based motor components can improve efficiency by 5-15%. When scaled across global electronic infrastructure, these efficiency improvements represent enormous potential energy savings and greenhouse gas reductions.

The reduced reliance on rare earth elements in certain amorphous metal formulations also addresses supply chain sustainability concerns. By providing alternatives to materials with concentrated geographic sources and challenging extraction profiles, amorphous metals can reduce geopolitical vulnerabilities while minimizing the ecological damage associated with rare earth mining operations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!