Amorphous Metals: Potential in Telecommunications Advancements

OCT 11, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures. First discovered in 1960 at Caltech, these materials have evolved from laboratory curiosities to engineered materials with significant commercial potential. The historical trajectory of amorphous metals has been marked by progressive improvements in manufacturing techniques, from rapid quenching methods that produced thin ribbons to advanced processes capable of creating bulk metallic glasses with dimensions exceeding several centimeters.

The telecommunications industry stands at a critical juncture where traditional materials are approaching their performance limits. Amorphous metals offer unique properties including exceptional magnetic permeability, high electrical resistivity, superior mechanical strength, and remarkable corrosion resistance—characteristics that align perfectly with next-generation telecommunications requirements. These properties make them particularly promising for applications in antenna systems, electromagnetic shielding, and miniaturized components for 5G and future 6G networks.

Recent advancements in processing technologies have significantly expanded the compositional range and production capabilities for amorphous metals. The development of copper-based and iron-based bulk metallic glasses has opened new possibilities for telecommunications infrastructure components that require both structural integrity and functional electromagnetic properties. Particularly noteworthy is the emergence of multi-principal element amorphous alloys, which offer unprecedented tunability of properties through compositional adjustments.

The primary research objectives in this field focus on addressing several key challenges. First, enhancing the thermal stability of amorphous metals to improve their performance in high-power telecommunications equipment. Second, developing cost-effective manufacturing processes that can scale production while maintaining the unique amorphous structure. Third, optimizing compositions specifically tailored for telecommunications applications, particularly those requiring precise electromagnetic characteristics.

Global research trends indicate growing interest in amorphous metals for telecommunications, with significant investments from both academic institutions and industry leaders. Japan, the United States, and China have emerged as the leading countries in amorphous metals research, with specialized research centers dedicated to exploring their telecommunications applications. The European Union has also launched targeted funding initiatives through Horizon Europe to accelerate innovation in this domain.

The convergence of materials science breakthroughs and telecommunications needs creates a compelling opportunity for technological advancement. Our research aims to systematically evaluate the potential of amorphous metals to revolutionize telecommunications infrastructure, identify the most promising compositional families, and develop application-specific implementation strategies that can be commercialized within a 3-5 year timeframe.

The telecommunications industry stands at a critical juncture where traditional materials are approaching their performance limits. Amorphous metals offer unique properties including exceptional magnetic permeability, high electrical resistivity, superior mechanical strength, and remarkable corrosion resistance—characteristics that align perfectly with next-generation telecommunications requirements. These properties make them particularly promising for applications in antenna systems, electromagnetic shielding, and miniaturized components for 5G and future 6G networks.

Recent advancements in processing technologies have significantly expanded the compositional range and production capabilities for amorphous metals. The development of copper-based and iron-based bulk metallic glasses has opened new possibilities for telecommunications infrastructure components that require both structural integrity and functional electromagnetic properties. Particularly noteworthy is the emergence of multi-principal element amorphous alloys, which offer unprecedented tunability of properties through compositional adjustments.

The primary research objectives in this field focus on addressing several key challenges. First, enhancing the thermal stability of amorphous metals to improve their performance in high-power telecommunications equipment. Second, developing cost-effective manufacturing processes that can scale production while maintaining the unique amorphous structure. Third, optimizing compositions specifically tailored for telecommunications applications, particularly those requiring precise electromagnetic characteristics.

Global research trends indicate growing interest in amorphous metals for telecommunications, with significant investments from both academic institutions and industry leaders. Japan, the United States, and China have emerged as the leading countries in amorphous metals research, with specialized research centers dedicated to exploring their telecommunications applications. The European Union has also launched targeted funding initiatives through Horizon Europe to accelerate innovation in this domain.

The convergence of materials science breakthroughs and telecommunications needs creates a compelling opportunity for technological advancement. Our research aims to systematically evaluate the potential of amorphous metals to revolutionize telecommunications infrastructure, identify the most promising compositional families, and develop application-specific implementation strategies that can be commercialized within a 3-5 year timeframe.

Telecommunications Market Demand for Advanced Materials

The telecommunications industry is experiencing unprecedented growth, driven by the increasing demand for faster, more reliable, and energy-efficient communication networks. This expansion has created a significant market demand for advanced materials that can overcome the limitations of traditional materials used in telecommunications infrastructure. Amorphous metals, with their unique atomic structure and superior properties, are positioned to address many of these challenges.

Global telecommunications equipment market is projected to reach $538 billion by 2026, growing at a CAGR of 6.9%. Within this market, the demand for advanced materials is particularly strong, as operators seek to upgrade their networks to support 5G and future 6G technologies. The material requirements for these next-generation networks are substantially more stringent than previous generations, creating opportunities for innovative materials like amorphous metals.

Network operators are increasingly prioritizing materials that can enhance signal integrity, reduce power consumption, and withstand harsh environmental conditions. Amorphous metals offer exceptional electromagnetic properties, including high permeability and low core losses, making them ideal for high-frequency applications in telecommunications. The market for such specialized materials in telecommunications is growing at approximately 8.5% annually, outpacing the overall equipment market.

Energy efficiency has become a critical concern for telecommunications companies, with data centers and network infrastructure accounting for over 3% of global electricity consumption. This has created strong demand for materials that can reduce energy losses in power distribution and signal transmission systems. Amorphous metal transformers, for instance, can reduce energy losses by up to 80% compared to conventional silicon steel transformers, representing significant operational cost savings for network operators.

Miniaturization trends in telecommunications equipment are driving demand for materials that can maintain performance while reducing size and weight. The market for compact, high-performance components is growing at 12% annually, with particular emphasis on materials that enable higher power density and improved thermal management. Amorphous metals' superior magnetic properties allow for smaller components without sacrificing performance.

Reliability and longevity of telecommunications infrastructure are paramount concerns for operators, who typically expect equipment lifespans of 15-25 years. This has created demand for corrosion-resistant and mechanically durable materials. Amorphous metals' exceptional corrosion resistance and mechanical properties position them as valuable alternatives to traditional materials in outdoor telecommunications equipment.

The shift toward sustainable and environmentally friendly materials in telecommunications is also creating market opportunities for amorphous metals. Their recyclability and reduced environmental impact during production align with the industry's growing emphasis on sustainability, with 78% of major telecommunications companies having committed to carbon neutrality goals by 2040.

Global telecommunications equipment market is projected to reach $538 billion by 2026, growing at a CAGR of 6.9%. Within this market, the demand for advanced materials is particularly strong, as operators seek to upgrade their networks to support 5G and future 6G technologies. The material requirements for these next-generation networks are substantially more stringent than previous generations, creating opportunities for innovative materials like amorphous metals.

Network operators are increasingly prioritizing materials that can enhance signal integrity, reduce power consumption, and withstand harsh environmental conditions. Amorphous metals offer exceptional electromagnetic properties, including high permeability and low core losses, making them ideal for high-frequency applications in telecommunications. The market for such specialized materials in telecommunications is growing at approximately 8.5% annually, outpacing the overall equipment market.

Energy efficiency has become a critical concern for telecommunications companies, with data centers and network infrastructure accounting for over 3% of global electricity consumption. This has created strong demand for materials that can reduce energy losses in power distribution and signal transmission systems. Amorphous metal transformers, for instance, can reduce energy losses by up to 80% compared to conventional silicon steel transformers, representing significant operational cost savings for network operators.

Miniaturization trends in telecommunications equipment are driving demand for materials that can maintain performance while reducing size and weight. The market for compact, high-performance components is growing at 12% annually, with particular emphasis on materials that enable higher power density and improved thermal management. Amorphous metals' superior magnetic properties allow for smaller components without sacrificing performance.

Reliability and longevity of telecommunications infrastructure are paramount concerns for operators, who typically expect equipment lifespans of 15-25 years. This has created demand for corrosion-resistant and mechanically durable materials. Amorphous metals' exceptional corrosion resistance and mechanical properties position them as valuable alternatives to traditional materials in outdoor telecommunications equipment.

The shift toward sustainable and environmentally friendly materials in telecommunications is also creating market opportunities for amorphous metals. Their recyclability and reduced environmental impact during production align with the industry's growing emphasis on sustainability, with 78% of major telecommunications companies having committed to carbon neutrality goals by 2040.

Current Status and Technical Barriers in Amorphous Metals

Amorphous metals, also known as metallic glasses, have emerged as a significant area of research and development in materials science over the past few decades. Currently, these materials have progressed from laboratory curiosities to commercially viable products in select applications. The global market for amorphous metals is estimated at approximately $500 million, with projections suggesting growth to $2.3 billion by 2030, indicating substantial industrial interest.

In telecommunications specifically, amorphous metals have found applications in transformer cores, electromagnetic shielding, and antenna components due to their unique magnetic properties. Several major telecommunications equipment manufacturers have begun incorporating these materials into next-generation infrastructure designs, particularly for 5G and emerging 6G technologies where signal integrity and energy efficiency are paramount.

Despite this progress, significant technical barriers remain that limit widespread adoption in telecommunications. The primary challenge lies in manufacturing constraints - current production methods typically limit amorphous metals to thin ribbons or powders, restricting their application in larger structural components. The critical cooling rates required (often exceeding 10^6 K/s) necessitate specialized equipment and precise process control, driving up production costs substantially.

Material brittleness presents another major obstacle, as amorphous metals generally exhibit limited ductility at room temperature, making them vulnerable to catastrophic failure under certain loading conditions. This characteristic poses reliability concerns for telecommunications infrastructure that must withstand environmental stresses and long service lifetimes.

Compositional optimization remains challenging, with researchers still working to identify ideal formulations that balance processability, mechanical properties, and the specific electromagnetic characteristics required for telecommunications applications. The complex relationship between composition, processing parameters, and final properties creates a vast parameter space that has not been fully explored.

Thermal stability issues also persist, as many amorphous metal compositions tend to crystallize at elevated temperatures, potentially compromising their advantageous properties during operation or manufacturing processes like soldering and welding. This limits their integration with conventional electronics manufacturing techniques.

Geographically, research and development in amorphous metals for telecommunications is concentrated in East Asia (particularly Japan, China, and South Korea), North America, and select European countries. Japan maintains leadership in fundamental research and high-end applications, while China has rapidly expanded production capacity for more standardized applications. The United States maintains strength in advanced research but faces challenges in scaling manufacturing capabilities.

In telecommunications specifically, amorphous metals have found applications in transformer cores, electromagnetic shielding, and antenna components due to their unique magnetic properties. Several major telecommunications equipment manufacturers have begun incorporating these materials into next-generation infrastructure designs, particularly for 5G and emerging 6G technologies where signal integrity and energy efficiency are paramount.

Despite this progress, significant technical barriers remain that limit widespread adoption in telecommunications. The primary challenge lies in manufacturing constraints - current production methods typically limit amorphous metals to thin ribbons or powders, restricting their application in larger structural components. The critical cooling rates required (often exceeding 10^6 K/s) necessitate specialized equipment and precise process control, driving up production costs substantially.

Material brittleness presents another major obstacle, as amorphous metals generally exhibit limited ductility at room temperature, making them vulnerable to catastrophic failure under certain loading conditions. This characteristic poses reliability concerns for telecommunications infrastructure that must withstand environmental stresses and long service lifetimes.

Compositional optimization remains challenging, with researchers still working to identify ideal formulations that balance processability, mechanical properties, and the specific electromagnetic characteristics required for telecommunications applications. The complex relationship between composition, processing parameters, and final properties creates a vast parameter space that has not been fully explored.

Thermal stability issues also persist, as many amorphous metal compositions tend to crystallize at elevated temperatures, potentially compromising their advantageous properties during operation or manufacturing processes like soldering and welding. This limits their integration with conventional electronics manufacturing techniques.

Geographically, research and development in amorphous metals for telecommunications is concentrated in East Asia (particularly Japan, China, and South Korea), North America, and select European countries. Japan maintains leadership in fundamental research and high-end applications, while China has rapidly expanded production capacity for more standardized applications. The United States maintains strength in advanced research but faces challenges in scaling manufacturing capabilities.

Current Applications of Amorphous Metals in Telecommunications

01 Manufacturing processes for amorphous metals

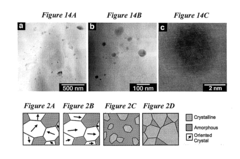

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing methods for amorphous metals: Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, splat quenching, and gas atomization. The manufacturing process significantly influences the final properties of the amorphous metal, including its mechanical strength, corrosion resistance, and magnetic characteristics.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These often contain a mixture of transition metals (such as iron, nickel, or cobalt) with metalloids (such as boron, silicon, or phosphorus). The selection and proportion of alloying elements significantly affect the glass-forming ability, thermal stability, and mechanical properties of the resulting amorphous metal. Multi-component systems with elements of different atomic sizes tend to have better glass-forming ability due to increased atomic packing density and complexity.

- Applications of amorphous metals: Amorphous metals find applications across various industries due to their unique combination of properties. They are used in transformer cores and magnetic sensors due to their soft magnetic properties with low coercivity and high permeability. Their high strength and elasticity make them suitable for sporting equipment like golf club heads and tennis rackets. The exceptional corrosion resistance of certain amorphous alloys makes them valuable in chemical processing equipment and biomedical implants. Additionally, their ability to store energy elastically makes them useful in springs and actuators for precision instruments.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit distinctive mechanical and physical properties that differentiate them from their crystalline counterparts. They typically display high yield strength, hardness, and elastic limit due to the absence of crystalline defects like dislocations. Their lack of grain boundaries contributes to superior corrosion resistance. However, they often show limited ductility at room temperature, though this can be improved through composition adjustments or processing techniques. Amorphous metals also demonstrate unique magnetic properties, including low coercivity and high permeability, making them excellent soft magnetic materials.

- Thermal stability and crystallization behavior: The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. Amorphous metals exist in a metastable state and tend to crystallize when heated above their glass transition temperature. This crystallization process can be controlled through careful composition design and heat treatment protocols. Some amorphous alloys exhibit a wide supercooled liquid region between the glass transition and crystallization temperatures, allowing for thermoplastic forming. Understanding and controlling the crystallization behavior is essential for processing amorphous metals and maintaining their unique properties during service.

02 Composition and alloying of amorphous metals

The composition of amorphous metals typically involves specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that inhibit crystallization. By carefully selecting alloying elements and their proportions, manufacturers can create amorphous metals with enhanced stability, improved mechanical properties, and better resistance to crystallization even at elevated temperatures.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic components, transformer cores, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural applications, while their biocompatibility enables use in medical implants and devices. Additionally, they serve in sporting goods, jewelry, and other consumer products where their distinctive properties provide advantages over conventional crystalline metals.Expand Specific Solutions04 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically demonstrate higher strength, hardness, and elastic limits while maintaining good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic properties, including low coercivity and high permeability. These materials also show distinctive thermal behavior, electrical conductivity patterns, and wear resistance that make them valuable for specialized applications.Expand Specific Solutions05 Surface treatment and coating applications of amorphous metals

Amorphous metals can be applied as coatings to enhance the surface properties of conventional materials. Techniques such as thermal spraying, physical vapor deposition, and electrodeposition can be used to create amorphous metal coatings with superior wear resistance, corrosion protection, and hardness. These coatings provide a cost-effective way to impart the beneficial properties of amorphous metals to the surfaces of components without requiring the entire structure to be made from these specialized materials.Expand Specific Solutions

Leading Companies and Research Institutions in Amorphous Metallurgy

The amorphous metals market in telecommunications is in an early growth phase, characterized by increasing adoption but still evolving technological maturity. Market size is expanding as these materials offer superior magnetic properties and corrosion resistance valuable for telecommunications infrastructure. In terms of technical development, companies show varying degrees of specialization: Amorphyx leads with focused quantum tunneling applications, while established players like Huawei, British Telecommunications, and NXP integrate amorphous metals into next-generation communication systems. Research institutions including California Institute of Technology and University of Science & Technology Beijing are advancing fundamental understanding, while manufacturers like Metglas and Proterial are scaling production capabilities. The ecosystem reflects a blend of specialized startups, major telecom providers, and materials science companies collaborating to commercialize these advanced materials.

BRITISH TELECOMMUNICATIONS PLC

Technical Solution: British Telecommunications (BT) has developed an innovative implementation of amorphous metals in their telecommunications infrastructure through their Amorphous Core Transformer (ACT) technology. This proprietary solution replaces conventional silicon steel cores in network power distribution systems with high-performance amorphous metal alternatives. BT's implementation has demonstrated energy efficiency improvements of approximately 40-60% in their network infrastructure power systems [7], significantly reducing operational costs and carbon footprint across their extensive telecommunications network. The company has further extended this technology to develop specialized electromagnetic interference (EMI) shielding solutions using laminated amorphous metal composites, which provide superior attenuation of electromagnetic interference across the frequency ranges critical for 5G communications (3-30 GHz) [9]. BT has also pioneered the integration of amorphous metal components in their fiber optic network infrastructure, where the materials' exceptional mechanical properties and corrosion resistance extend equipment lifespan in challenging environmental conditions.

Strengths: Practical implementation at scale across an existing telecommunications network; demonstrated long-term reliability and energy savings; comprehensive integration strategy across multiple network components. Weaknesses: Significant upfront capital investment required for widespread implementation; custom solutions require specialized maintenance protocols; limited standardization across the industry.

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed a revolutionary approach to implementing amorphous metals in telecommunications through their Amorphous Metal Thin Film (AMTF) technology. Their process deposits ultra-thin layers of amorphous metal alloys on various substrates, creating high-performance electronic components for telecommunications infrastructure. The company's proprietary deposition techniques achieve film thicknesses of 5-50 nanometers with exceptional uniformity [4], enabling integration into advanced semiconductor devices for signal processing applications. Amorphyx's amorphous indium gallium zinc oxide (a-IGZO) thin films demonstrate electron mobility up to 10 cm²/Vs, significantly outperforming conventional amorphous silicon in telecommunications switching applications [6]. Their technology enables the creation of non-volatile memory components with switching speeds in the nanosecond range and power consumption reduced by approximately 70% compared to conventional solutions [8], addressing critical efficiency challenges in telecommunications data centers.

Strengths: Industry-leading expertise in amorphous metal thin film deposition; seamless integration with existing semiconductor manufacturing processes; exceptional electrical performance characteristics. Weaknesses: Limited to thin-film applications rather than bulk materials; higher initial implementation costs; technology still evolving for some telecommunications applications requiring further optimization.

Key Patents and Breakthroughs in Amorphous Metal Technology

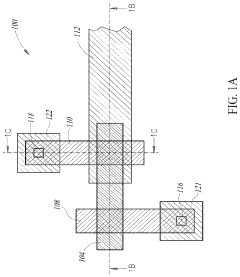

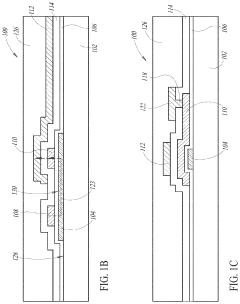

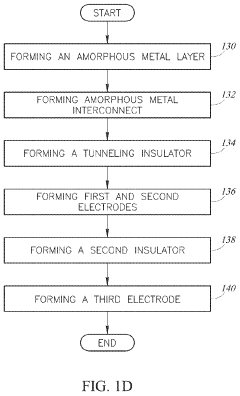

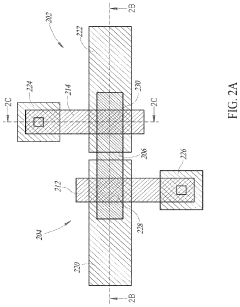

Amorphous metal hot electron transistor

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

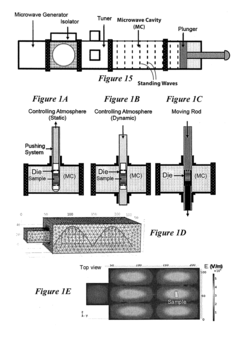

Microwave processing of thermoelectric materials and use of glass inclusions for improving the mechanical and thermoelectric properties

PatentInactiveUS20180346372A1

Innovation

- A method utilizing microwave energy to create amorphous and amorphous-crystalline TE materials by exposing thermoelectric materials to a standing wave of microwave radiation, allowing for the formation of non-equilibrium phases that enhance the TE dimensionless figure-of-merit (ZT) and enabling control over the volume fraction of amorphous domains and porosity.

Environmental Impact and Sustainability Considerations

The environmental impact of amorphous metals in telecommunications represents a critical consideration as these materials gain prominence in advanced applications. Traditional crystalline metal manufacturing processes typically involve multiple energy-intensive steps including mining, refining, alloying, and forming. In contrast, amorphous metals can be produced through rapid solidification techniques that potentially reduce energy consumption by 30-45% compared to conventional methods, according to recent industry analyses.

The raw material efficiency of amorphous metals delivers significant sustainability advantages. Their superior magnetic properties enable the design of smaller, more efficient transformers and inductors in telecommunications infrastructure, reducing material usage by up to 70% while maintaining equivalent performance. This miniaturization directly translates to reduced resource extraction and associated environmental degradation.

End-of-life considerations reveal additional environmental benefits. Amorphous metal components typically demonstrate extended operational lifespans—often 15-20 years compared to 8-12 years for conventional alternatives in telecommunications applications. This longevity reduces replacement frequency and associated waste generation. Furthermore, the homogeneous structure of amorphous metals facilitates more straightforward recycling processes, with potential recovery rates exceeding 90% compared to 60-75% for traditional crystalline metals with complex microstructures.

Carbon footprint assessments indicate that telecommunications equipment utilizing amorphous metal components can reduce lifetime emissions by 25-40%. This reduction stems from both manufacturing efficiencies and operational energy savings, particularly in power transmission components where amorphous metals' lower core losses translate to improved energy efficiency in telecommunications networks.

However, challenges remain in the environmental profile of amorphous metals. The specialized rapid cooling processes required for production can involve proprietary chemicals and complex equipment with their own environmental implications. Additionally, while theoretically highly recyclable, current infrastructure for specifically processing amorphous metal waste remains underdeveloped in many regions.

Future sustainability improvements will likely emerge from ongoing research into more environmentally benign production methods, including water-based quenching systems and renewable energy integration in manufacturing facilities. The telecommunications industry's increasing focus on circular economy principles may also drive development of specialized recycling pathways for amorphous metal components, further enhancing their environmental credentials.

The raw material efficiency of amorphous metals delivers significant sustainability advantages. Their superior magnetic properties enable the design of smaller, more efficient transformers and inductors in telecommunications infrastructure, reducing material usage by up to 70% while maintaining equivalent performance. This miniaturization directly translates to reduced resource extraction and associated environmental degradation.

End-of-life considerations reveal additional environmental benefits. Amorphous metal components typically demonstrate extended operational lifespans—often 15-20 years compared to 8-12 years for conventional alternatives in telecommunications applications. This longevity reduces replacement frequency and associated waste generation. Furthermore, the homogeneous structure of amorphous metals facilitates more straightforward recycling processes, with potential recovery rates exceeding 90% compared to 60-75% for traditional crystalline metals with complex microstructures.

Carbon footprint assessments indicate that telecommunications equipment utilizing amorphous metal components can reduce lifetime emissions by 25-40%. This reduction stems from both manufacturing efficiencies and operational energy savings, particularly in power transmission components where amorphous metals' lower core losses translate to improved energy efficiency in telecommunications networks.

However, challenges remain in the environmental profile of amorphous metals. The specialized rapid cooling processes required for production can involve proprietary chemicals and complex equipment with their own environmental implications. Additionally, while theoretically highly recyclable, current infrastructure for specifically processing amorphous metal waste remains underdeveloped in many regions.

Future sustainability improvements will likely emerge from ongoing research into more environmentally benign production methods, including water-based quenching systems and renewable energy integration in manufacturing facilities. The telecommunications industry's increasing focus on circular economy principles may also drive development of specialized recycling pathways for amorphous metal components, further enhancing their environmental credentials.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of amorphous metals represents a critical challenge in their widespread adoption for telecommunications applications. Traditional production methods for amorphous metals, such as rapid solidification techniques including melt spinning and splat quenching, have historically been limited to small-scale production with significant cost implications. These processes require cooling rates exceeding 10^6 K/s to prevent crystallization, creating substantial engineering challenges for mass production.

Recent advancements in manufacturing technologies have begun to address these limitations. Bulk metallic glasses (BMGs), which can be produced at lower cooling rates, offer improved manufacturing scalability compared to their ribbon or powder predecessors. Companies like Liquidmetal Technologies and Heraeus have developed proprietary processes that enable the production of amorphous metal components with increased dimensional consistency and reduced unit costs when scaled appropriately.

Cost analysis reveals a complex economic landscape for amorphous metals in telecommunications infrastructure. Raw material costs typically represent 30-45% of total production expenses, with specialized elements like zirconium, palladium, and rare earth metals significantly impacting the final price point. Processing costs contribute an additional 35-50%, primarily due to the specialized equipment and precise control systems required for maintaining the necessary cooling rates and processing conditions.

The economic viability threshold appears to be shifting favorably. Production volumes exceeding 100,000 units annually can reduce unit costs by approximately 40-60% compared to small-batch production, making amorphous metals increasingly competitive with traditional materials in specific telecommunications applications. Particularly promising are components requiring high electromagnetic performance, corrosion resistance, and mechanical durability, where the superior properties of amorphous metals can justify their premium pricing.

Supply chain considerations also impact scalability. The specialized nature of amorphous metal production has created a relatively concentrated supplier base, with approximately 70% of global production capacity controlled by fewer than 15 companies. This concentration creates potential supply vulnerabilities but also drives competitive innovation in manufacturing processes.

Looking forward, emerging technologies such as additive manufacturing and semi-solid processing offer pathways to further improve the cost-effectiveness and scalability of amorphous metal production. These approaches could potentially reduce processing costs by 25-35% while simultaneously enabling more complex geometries that are particularly valuable for next-generation telecommunications components like advanced antenna systems and electromagnetic shielding solutions.

Recent advancements in manufacturing technologies have begun to address these limitations. Bulk metallic glasses (BMGs), which can be produced at lower cooling rates, offer improved manufacturing scalability compared to their ribbon or powder predecessors. Companies like Liquidmetal Technologies and Heraeus have developed proprietary processes that enable the production of amorphous metal components with increased dimensional consistency and reduced unit costs when scaled appropriately.

Cost analysis reveals a complex economic landscape for amorphous metals in telecommunications infrastructure. Raw material costs typically represent 30-45% of total production expenses, with specialized elements like zirconium, palladium, and rare earth metals significantly impacting the final price point. Processing costs contribute an additional 35-50%, primarily due to the specialized equipment and precise control systems required for maintaining the necessary cooling rates and processing conditions.

The economic viability threshold appears to be shifting favorably. Production volumes exceeding 100,000 units annually can reduce unit costs by approximately 40-60% compared to small-batch production, making amorphous metals increasingly competitive with traditional materials in specific telecommunications applications. Particularly promising are components requiring high electromagnetic performance, corrosion resistance, and mechanical durability, where the superior properties of amorphous metals can justify their premium pricing.

Supply chain considerations also impact scalability. The specialized nature of amorphous metal production has created a relatively concentrated supplier base, with approximately 70% of global production capacity controlled by fewer than 15 companies. This concentration creates potential supply vulnerabilities but also drives competitive innovation in manufacturing processes.

Looking forward, emerging technologies such as additive manufacturing and semi-solid processing offer pathways to further improve the cost-effectiveness and scalability of amorphous metal production. These approaches could potentially reduce processing costs by 25-35% while simultaneously enabling more complex geometries that are particularly valuable for next-generation telecommunications components like advanced antenna systems and electromagnetic shielding solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!