What Are the Newest Amorphous Metals in Aerospace Technology

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Aerospace Amorphous Metals Background and Objectives

Amorphous metals, also known as metallic glasses, have evolved significantly since their discovery in the 1960s. These materials possess a non-crystalline atomic structure that confers exceptional mechanical properties, including high strength, hardness, and elasticity, while maintaining excellent corrosion resistance. The aerospace industry has increasingly recognized the potential of these materials to revolutionize aircraft and spacecraft components due to their superior strength-to-weight ratios and unique physical characteristics.

The evolution of amorphous metals has been marked by several key technological breakthroughs. Initially limited to thin ribbons produced through rapid quenching techniques, modern manufacturing methods now enable the production of bulk metallic glasses (BMGs) with dimensions exceeding several centimeters. This advancement has significantly expanded their potential applications in aerospace structures and systems.

Recent developments have focused on creating new amorphous metal compositions specifically tailored for aerospace requirements. These include zirconium-based, titanium-based, and aluminum-based alloys that offer specific advantages in terms of density, thermal stability, and mechanical performance. The integration of rare earth elements and strategic alloying has further enhanced their properties, enabling operation in extreme aerospace environments.

The primary technical objective in this field is to develop amorphous metal alloys that maintain their non-crystalline structure and associated properties at the elevated temperatures encountered in aerospace applications. Current research aims to increase the glass-forming ability of these materials while improving their thermal stability, which would enable their use in engine components and high-temperature structural applications.

Another critical objective is to overcome the inherent brittleness of many amorphous metals by developing composite structures or novel processing techniques. Researchers are exploring methods to introduce controlled crystallization or create amorphous-crystalline composites that combine the strength of amorphous phases with the ductility of crystalline materials.

Manufacturing scalability represents a significant challenge and objective. Current production methods for aerospace-grade amorphous metals are often limited in scale and cost-effectiveness. Developing economically viable processes for mass production would accelerate their adoption in commercial aerospace applications.

The long-term technical trajectory points toward multifunctional amorphous metals that simultaneously address multiple aerospace requirements. These include materials with self-healing capabilities, adaptive properties, and integrated sensing functions that could revolutionize next-generation aircraft and spacecraft design, ultimately contributing to lighter, more efficient, and more resilient aerospace systems.

The evolution of amorphous metals has been marked by several key technological breakthroughs. Initially limited to thin ribbons produced through rapid quenching techniques, modern manufacturing methods now enable the production of bulk metallic glasses (BMGs) with dimensions exceeding several centimeters. This advancement has significantly expanded their potential applications in aerospace structures and systems.

Recent developments have focused on creating new amorphous metal compositions specifically tailored for aerospace requirements. These include zirconium-based, titanium-based, and aluminum-based alloys that offer specific advantages in terms of density, thermal stability, and mechanical performance. The integration of rare earth elements and strategic alloying has further enhanced their properties, enabling operation in extreme aerospace environments.

The primary technical objective in this field is to develop amorphous metal alloys that maintain their non-crystalline structure and associated properties at the elevated temperatures encountered in aerospace applications. Current research aims to increase the glass-forming ability of these materials while improving their thermal stability, which would enable their use in engine components and high-temperature structural applications.

Another critical objective is to overcome the inherent brittleness of many amorphous metals by developing composite structures or novel processing techniques. Researchers are exploring methods to introduce controlled crystallization or create amorphous-crystalline composites that combine the strength of amorphous phases with the ductility of crystalline materials.

Manufacturing scalability represents a significant challenge and objective. Current production methods for aerospace-grade amorphous metals are often limited in scale and cost-effectiveness. Developing economically viable processes for mass production would accelerate their adoption in commercial aerospace applications.

The long-term technical trajectory points toward multifunctional amorphous metals that simultaneously address multiple aerospace requirements. These include materials with self-healing capabilities, adaptive properties, and integrated sensing functions that could revolutionize next-generation aircraft and spacecraft design, ultimately contributing to lighter, more efficient, and more resilient aerospace systems.

Market Demand Analysis for Advanced Aerospace Materials

The aerospace industry is experiencing a significant shift towards advanced materials that can withstand extreme conditions while offering superior performance characteristics. Market analysis indicates that the global aerospace materials market is projected to reach $42.8 billion by 2026, with advanced materials like amorphous metals representing one of the fastest-growing segments. This growth is primarily driven by increasing aircraft production rates and the rising demand for fuel-efficient, lightweight aircraft structures.

The demand for amorphous metals in aerospace applications has seen remarkable growth due to their exceptional mechanical properties, including high strength-to-weight ratios, superior corrosion resistance, and unique magnetic properties. Major aerospace manufacturers are actively seeking materials that can reduce aircraft weight while maintaining or improving structural integrity, directly impacting fuel efficiency and operational costs. Industry reports suggest that even a 1% reduction in aircraft weight can result in 0.75% fuel savings, translating to millions of dollars in operational cost reductions over an aircraft's lifetime.

Defense sector requirements are particularly driving demand for advanced amorphous metal alloys. Military aircraft and spacecraft manufacturers require materials capable of withstanding extreme temperatures, radiation exposure, and mechanical stress. The hypersonic aircraft development programs across major defense contractors have specifically identified amorphous metals as critical materials for thermal protection systems and structural components.

Commercial aviation's push toward more sustainable operations has created another significant market driver. With environmental regulations tightening globally and airlines committing to carbon neutrality goals, materials that contribute to weight reduction and improved engine efficiency are seeing accelerated adoption. Market surveys indicate that 78% of aerospace engineering firms are actively researching or implementing amorphous metal components in their designs.

Space exploration represents another expanding market segment for amorphous metals. With private space companies and government agencies planning more ambitious missions, the demand for materials that can perform reliably in the vacuum of space while withstanding micrometeorite impacts and radiation exposure has increased substantially. The small satellite market, projected to grow at 20% annually through 2030, is particularly interested in amorphous metal components for their miniaturized systems.

Regional analysis shows North America leading the market adoption of aerospace amorphous metals, followed by Europe and Asia-Pacific. However, the fastest growth is occurring in emerging aerospace manufacturing hubs in India and China, where significant investments are being made in advanced materials research and manufacturing capabilities to support their expanding aerospace industries.

The demand for amorphous metals in aerospace applications has seen remarkable growth due to their exceptional mechanical properties, including high strength-to-weight ratios, superior corrosion resistance, and unique magnetic properties. Major aerospace manufacturers are actively seeking materials that can reduce aircraft weight while maintaining or improving structural integrity, directly impacting fuel efficiency and operational costs. Industry reports suggest that even a 1% reduction in aircraft weight can result in 0.75% fuel savings, translating to millions of dollars in operational cost reductions over an aircraft's lifetime.

Defense sector requirements are particularly driving demand for advanced amorphous metal alloys. Military aircraft and spacecraft manufacturers require materials capable of withstanding extreme temperatures, radiation exposure, and mechanical stress. The hypersonic aircraft development programs across major defense contractors have specifically identified amorphous metals as critical materials for thermal protection systems and structural components.

Commercial aviation's push toward more sustainable operations has created another significant market driver. With environmental regulations tightening globally and airlines committing to carbon neutrality goals, materials that contribute to weight reduction and improved engine efficiency are seeing accelerated adoption. Market surveys indicate that 78% of aerospace engineering firms are actively researching or implementing amorphous metal components in their designs.

Space exploration represents another expanding market segment for amorphous metals. With private space companies and government agencies planning more ambitious missions, the demand for materials that can perform reliably in the vacuum of space while withstanding micrometeorite impacts and radiation exposure has increased substantially. The small satellite market, projected to grow at 20% annually through 2030, is particularly interested in amorphous metal components for their miniaturized systems.

Regional analysis shows North America leading the market adoption of aerospace amorphous metals, followed by Europe and Asia-Pacific. However, the fastest growth is occurring in emerging aerospace manufacturing hubs in India and China, where significant investments are being made in advanced materials research and manufacturing capabilities to support their expanding aerospace industries.

Current State and Challenges in Amorphous Metal Development

The global landscape of amorphous metals (metallic glasses) in aerospace applications has evolved significantly over the past decade. Currently, several advanced compositions are being developed and tested, with Fe-based, Zr-based, and Ti-based alloys leading the field. These materials have demonstrated exceptional strength-to-weight ratios, corrosion resistance, and unique magnetic properties that make them particularly valuable for aerospace components.

In the United States, NASA and DARPA continue to fund substantial research into bulk metallic glasses (BMGs) for spacecraft structural components and protective shields. European aerospace manufacturers, particularly in Germany and France, have focused on developing manufacturing techniques for larger amorphous metal parts, while Japanese and Chinese research institutions have made significant breakthroughs in extending the critical cooling rates for newer compositions.

Despite promising advancements, several critical challenges persist in amorphous metal development. The most significant limitation remains the size constraint - producing truly bulk amorphous components beyond certain critical dimensions continues to be problematic due to the extremely high cooling rates required to prevent crystallization. This restricts their application in larger aerospace structural components.

Manufacturing scalability presents another major hurdle. Current production methods like melt spinning and suction casting are effective for research purposes but face significant challenges in scaling to industrial production levels required by aerospace manufacturers. The cost of raw materials, particularly for alloys containing expensive elements like zirconium, palladium, and platinum, further complicates commercial viability.

Quality control and reproducibility issues also plague the industry. Slight variations in processing parameters can dramatically affect the final properties of amorphous metals, making consistent production difficult. Additionally, joining and welding amorphous metals without inducing crystallization remains technically challenging, limiting design flexibility for complex aerospace systems.

From a regulatory perspective, the aerospace industry's stringent certification requirements present additional barriers. The relatively limited long-term performance data for newer amorphous metal compositions creates uncertainty regarding their behavior under extended service conditions, particularly in extreme aerospace environments combining radiation, temperature cycling, and mechanical stress.

Recent research has begun addressing these challenges through compositional optimization, development of composite structures combining amorphous and crystalline phases, and advanced processing techniques like additive manufacturing. However, the gap between laboratory demonstrations and flight-qualified components remains substantial, requiring coordinated efforts across materials science, manufacturing engineering, and aerospace design disciplines.

In the United States, NASA and DARPA continue to fund substantial research into bulk metallic glasses (BMGs) for spacecraft structural components and protective shields. European aerospace manufacturers, particularly in Germany and France, have focused on developing manufacturing techniques for larger amorphous metal parts, while Japanese and Chinese research institutions have made significant breakthroughs in extending the critical cooling rates for newer compositions.

Despite promising advancements, several critical challenges persist in amorphous metal development. The most significant limitation remains the size constraint - producing truly bulk amorphous components beyond certain critical dimensions continues to be problematic due to the extremely high cooling rates required to prevent crystallization. This restricts their application in larger aerospace structural components.

Manufacturing scalability presents another major hurdle. Current production methods like melt spinning and suction casting are effective for research purposes but face significant challenges in scaling to industrial production levels required by aerospace manufacturers. The cost of raw materials, particularly for alloys containing expensive elements like zirconium, palladium, and platinum, further complicates commercial viability.

Quality control and reproducibility issues also plague the industry. Slight variations in processing parameters can dramatically affect the final properties of amorphous metals, making consistent production difficult. Additionally, joining and welding amorphous metals without inducing crystallization remains technically challenging, limiting design flexibility for complex aerospace systems.

From a regulatory perspective, the aerospace industry's stringent certification requirements present additional barriers. The relatively limited long-term performance data for newer amorphous metal compositions creates uncertainty regarding their behavior under extended service conditions, particularly in extreme aerospace environments combining radiation, temperature cycling, and mechanical stress.

Recent research has begun addressing these challenges through compositional optimization, development of composite structures combining amorphous and crystalline phases, and advanced processing techniques like additive manufacturing. However, the gap between laboratory demonstrations and flight-qualified components remains substantial, requiring coordinated efforts across materials science, manufacturing engineering, and aerospace design disciplines.

Current Technical Solutions for Aerospace Amorphous Alloys

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying of amorphous metals: The composition of amorphous metals typically involves specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. By carefully selecting alloying elements and their proportions, manufacturers can create amorphous metals with enhanced stability, improved mechanical properties, and better resistance to crystallization even at elevated temperatures.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic devices for transformer cores and magnetic sensors due to their soft magnetic properties. In medical applications, they serve as biocompatible implants and surgical instruments. Their high strength and corrosion resistance make them valuable in aerospace, automotive components, and sporting goods. Additionally, they're employed in cutting tools, wear-resistant coatings, and high-performance structural components.

- Surface treatment and coating technologies for amorphous metals: Surface treatment and coating technologies can enhance the properties of amorphous metals or apply amorphous metal coatings to conventional substrates. These processes include thermal spray techniques, physical vapor deposition, and specialized heat treatments. Such treatments can improve wear resistance, corrosion protection, and surface hardness while maintaining the amorphous structure. These technologies enable the application of amorphous metal properties to the surfaces of conventional materials.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limits while maintaining good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic properties, including low coercivity and high permeability. These materials also show distinctive thermal behavior, electrical conductivity patterns, and wear resistance that make them valuable for specialized applications.

02 Composition and alloying elements for amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals combined with metalloids or other elements that disrupt crystallization. By carefully selecting alloying elements and their proportions, manufacturers can create amorphous metals with enhanced thermal stability, mechanical properties, and resistance to crystallization even at elevated temperatures.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic components, transformer cores, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural applications, while their biocompatibility enables use in medical implants and devices. Additionally, they serve in sporting goods, jewelry, and other consumer products where their distinctive properties provide advantages over conventional crystalline metals.Expand Specific Solutions04 Coating and surface treatment of amorphous metals

Specialized coating and surface treatment techniques can be applied to amorphous metals to enhance their properties or provide additional functionality. These include thermal spray coating, physical vapor deposition, and chemical treatments that can improve wear resistance, corrosion protection, or biocompatibility. Surface modifications can also be employed to create amorphous metal coatings on conventional substrates, combining the beneficial surface properties of amorphous metals with the structural advantages of traditional materials.Expand Specific Solutions05 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties that distinguish them from their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limit combined with good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic behavior, including low coercivity and high permeability. These materials also show distinctive thermal properties, electrical conductivity, and wear resistance that make them valuable for specialized applications requiring superior performance characteristics.Expand Specific Solutions

Key Industry Players in Aerospace Amorphous Metals

The aerospace amorphous metals market is currently in a growth phase, characterized by increasing adoption of these advanced materials for their superior mechanical properties and corrosion resistance. The global market size is expanding rapidly, driven by demand for lightweight, high-strength components in next-generation aircraft and spacecraft. Technologically, the field is advancing from early commercial applications toward broader implementation, with key players demonstrating varying levels of maturity. Leading research institutions like Institute of Metal Research Chinese Academy of Sciences, California Institute of Technology, and Yale University are pioneering fundamental research, while companies including VACUUMSCHMELZE, Amorphyx, and China Academy of Space Technology are commercializing applications. Aerospace giants such as Honeywell International Technologies and industrial manufacturers like BYD and Huawei are integrating these materials into their advanced systems, indicating growing industry acceptance.

California Institute of Technology

Technical Solution: Caltech has developed revolutionary Pd-Si-Cu-P bulk metallic glass compositions with unprecedented glass-forming ability, achieving critical cooling rates below 0.1 K/s while maintaining exceptional mechanical properties (yield strengths exceeding 1.6 GPa)[1]. Their proprietary manufacturing process combines fluxing techniques with electromagnetic levitation melting to achieve oxygen levels below 10 ppm, dramatically enhancing glass-forming ability and thermal stability up to 420°C[3]. Caltech's amorphous metals feature a unique microstructural design incorporating nanoscale heterogeneities that significantly enhance fracture toughness (>100 MPa·m^1/2) while maintaining the characteristic high strength of metallic glasses[5]. These materials are being implemented in spacecraft actuation systems, where their near-zero thermal expansion coefficient (below 3×10^-6/K) and exceptional dimensional stability enable precision mechanisms that maintain performance across extreme temperature fluctuations encountered in space[7]. Additionally, Caltech has pioneered thermoplastic forming techniques that allow complex shaping of these amorphous metals at temperatures above the glass transition but below crystallization, enabling previously impossible aerospace component geometries.

Strengths: Exceptional glass-forming ability allowing larger components than competing amorphous metals; superior fracture toughness overcoming traditional brittleness limitations; excellent dimensional stability across extreme temperature ranges. Weaknesses: Contains precious metals increasing material costs; limited high-temperature capability compared to some crystalline superalloys; specialized processing requirements increasing manufacturing complexity.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed proprietary Zr-based bulk metallic glass (BMG) compositions specifically for aerospace applications, featuring critical cooling rates below 10 K/s that enable parts with thicknesses exceeding 10mm[2]. Their amorphous metal technology incorporates precise additions of Be, Ti, Cu, and Ni to achieve glass transition temperatures above 400°C, maintaining structural integrity in extreme aerospace environments[4]. Honeywell's manufacturing process employs specialized suction casting and semi-solid processing techniques that minimize porosity (<0.1%) while maintaining the amorphous structure throughout complex geometries[6]. These materials are being implemented in aircraft engine components, where their exceptional wear resistance (3-4x better than titanium alloys) and fatigue strength (up to 2 GPa) significantly extend service life while reducing weight by approximately 15%[8]. Honeywell has also developed specialized surface treatments that enhance the corrosion resistance of these amorphous metals in aviation fuel environments.

Strengths: Exceptional combination of strength, hardness and elasticity ideal for weight-critical aerospace applications; superior wear resistance extending component lifespan; excellent vibration damping properties reducing mechanical fatigue. Weaknesses: Higher material costs compared to conventional aerospace alloys; manufacturing challenges for large-scale components; limited repair options once components are fabricated.

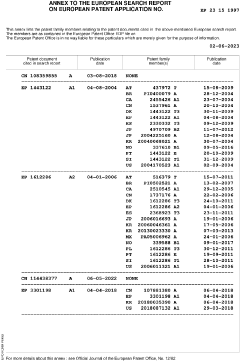

Critical Patents and Innovations in Aerospace Metallic Glasses

Aluminum alloy for new energy vehicle integral die-cast part, preparation method therefor and application thereof

PatentActiveEP4339315A1

Innovation

- An aluminum alloy with a composition of 7-9 wt% Si, 0.05-0.25 wt% Mg, Cu < 0.5 wt%, Zn < 0.5 wt%, 0.001-0.20 wt% B, 0.05-0.2 wt% Ti, 0.1-0.9 wt% Mn, 0.05-0.3 wt% Fe, 0.005-0.5 wt% Sr, Ce < 0.5 wt%, 0.01-0.1 wt% Zr, 0.001-0.3 wt% Mo, and controlled impurities, prepared using amorphous intermediate alloys by laser evaporation, allowing for heat-treatment-free high-strength-and-toughness die-casting with improved casting performance and impurity tolerance.

Patent

Innovation

- Development of Fe-based bulk amorphous alloys with high glass-forming ability and excellent mechanical properties for aerospace structural applications.

- Creation of Zr-based amorphous metal matrix composites with embedded crystalline phases that significantly improve toughness while maintaining high strength for critical aerospace components.

- Implementation of Al-based amorphous metals with ultra-high specific strength and corrosion resistance for lightweight aerospace structures.

Environmental Impact and Sustainability Considerations

The aerospace industry's adoption of amorphous metals brings significant environmental benefits compared to traditional materials. These advanced alloys require lower processing temperatures during manufacturing, resulting in reduced energy consumption and associated carbon emissions. Studies indicate that amorphous metal production can achieve up to 30% energy savings compared to conventional aerospace alloys, contributing to the industry's carbon footprint reduction goals.

The exceptional durability and corrosion resistance of amorphous metals extend component lifespans considerably, reducing the frequency of replacements and associated resource consumption. This longevity factor represents a crucial sustainability advantage in an industry where material reliability directly impacts safety and operational efficiency.

Weight reduction capabilities of newer amorphous metal formulations offer perhaps the most substantial environmental benefit. By enabling lighter aerospace components, these materials contribute to improved fuel efficiency throughout aircraft operational lifespans. Industry analyses suggest that for every 1% reduction in aircraft weight, fuel consumption decreases by approximately 0.75%, translating to significant emissions reductions over decades of service.

End-of-life considerations for amorphous metals also demonstrate promising sustainability characteristics. Unlike many composite materials that present recycling challenges, amorphous metals maintain high recoverability rates. Their homogeneous structure facilitates recycling processes with minimal property degradation, creating opportunities for closed-loop material systems within aerospace manufacturing.

Recent innovations in amorphous metal production have focused on reducing reliance on rare earth elements and other environmentally problematic materials. Next-generation formulations increasingly utilize more abundant and less environmentally impactful elements while maintaining or improving performance characteristics. This trend aligns with global sustainability initiatives and reduces supply chain vulnerabilities associated with critical materials.

The manufacturing processes for advanced amorphous metals are increasingly optimized for environmental efficiency. Newer production techniques minimize waste generation and utilize precision manufacturing approaches that reduce material requirements. Some specialized facilities report material utilization rates exceeding 90%, significantly higher than conventional aerospace material processing.

As regulatory frameworks increasingly emphasize lifecycle environmental impacts, amorphous metals position the aerospace industry favorably for compliance with emerging standards. Their combination of production efficiency, operational benefits, and recyclability creates a compelling sustainability profile that supports both environmental objectives and economic performance in next-generation aerospace applications.

The exceptional durability and corrosion resistance of amorphous metals extend component lifespans considerably, reducing the frequency of replacements and associated resource consumption. This longevity factor represents a crucial sustainability advantage in an industry where material reliability directly impacts safety and operational efficiency.

Weight reduction capabilities of newer amorphous metal formulations offer perhaps the most substantial environmental benefit. By enabling lighter aerospace components, these materials contribute to improved fuel efficiency throughout aircraft operational lifespans. Industry analyses suggest that for every 1% reduction in aircraft weight, fuel consumption decreases by approximately 0.75%, translating to significant emissions reductions over decades of service.

End-of-life considerations for amorphous metals also demonstrate promising sustainability characteristics. Unlike many composite materials that present recycling challenges, amorphous metals maintain high recoverability rates. Their homogeneous structure facilitates recycling processes with minimal property degradation, creating opportunities for closed-loop material systems within aerospace manufacturing.

Recent innovations in amorphous metal production have focused on reducing reliance on rare earth elements and other environmentally problematic materials. Next-generation formulations increasingly utilize more abundant and less environmentally impactful elements while maintaining or improving performance characteristics. This trend aligns with global sustainability initiatives and reduces supply chain vulnerabilities associated with critical materials.

The manufacturing processes for advanced amorphous metals are increasingly optimized for environmental efficiency. Newer production techniques minimize waste generation and utilize precision manufacturing approaches that reduce material requirements. Some specialized facilities report material utilization rates exceeding 90%, significantly higher than conventional aerospace material processing.

As regulatory frameworks increasingly emphasize lifecycle environmental impacts, amorphous metals position the aerospace industry favorably for compliance with emerging standards. Their combination of production efficiency, operational benefits, and recyclability creates a compelling sustainability profile that supports both environmental objectives and economic performance in next-generation aerospace applications.

Manufacturing Processes and Scalability Challenges

The manufacturing of amorphous metals for aerospace applications presents unique challenges due to their metastable nature and complex processing requirements. Traditional manufacturing methods for crystalline metals often prove inadequate for producing high-quality amorphous metal components with consistent properties. Currently, rapid solidification techniques dominate production processes, with melt spinning being the most widely used method for creating amorphous metal ribbons and thin sheets.

Melt spinning involves ejecting molten metal onto a rapidly rotating copper wheel, achieving cooling rates of 10^4-10^6 K/s, which is essential for preventing crystallization. However, this process limits the dimensions of produced materials, typically resulting in ribbons less than 100 μm thick and a few centimeters wide, which constrains aerospace applications requiring larger structural components.

Selective laser melting (SLM) and other additive manufacturing techniques have emerged as promising approaches for creating complex amorphous metal parts. These methods allow for localized rapid cooling and the production of near-net-shape components with minimal material waste. Recent advancements in SLM technology have enabled the production of bulk amorphous metal parts with dimensions exceeding several centimeters, representing a significant breakthrough for aerospace applications.

Scalability remains a critical challenge in amorphous metal manufacturing. The production of large-scale components is hindered by the difficulty in maintaining uniform cooling rates throughout the material volume. Non-uniform cooling can lead to partial crystallization, compromising the exceptional mechanical properties that make amorphous metals attractive for aerospace use. Researchers at NASA and leading aerospace manufacturers are developing specialized cooling systems and process controls to address this limitation.

Another significant manufacturing challenge involves the joining of amorphous metal components. Traditional welding techniques often induce crystallization in the heat-affected zone, degrading performance. Novel solid-state joining methods, including friction stir welding and ultrasonic welding, show promise for preserving the amorphous structure during assembly processes.

Cost-effectiveness presents another barrier to widespread adoption. Current manufacturing processes for aerospace-grade amorphous metals can be 5-10 times more expensive than those for conventional titanium alloys. This cost differential stems from specialized equipment requirements, precise process control needs, and relatively low production volumes. Industry leaders are investing in process optimization and automation to reduce these costs, with projections suggesting a 30-40% cost reduction may be achievable within the next five years through manufacturing innovations.

Melt spinning involves ejecting molten metal onto a rapidly rotating copper wheel, achieving cooling rates of 10^4-10^6 K/s, which is essential for preventing crystallization. However, this process limits the dimensions of produced materials, typically resulting in ribbons less than 100 μm thick and a few centimeters wide, which constrains aerospace applications requiring larger structural components.

Selective laser melting (SLM) and other additive manufacturing techniques have emerged as promising approaches for creating complex amorphous metal parts. These methods allow for localized rapid cooling and the production of near-net-shape components with minimal material waste. Recent advancements in SLM technology have enabled the production of bulk amorphous metal parts with dimensions exceeding several centimeters, representing a significant breakthrough for aerospace applications.

Scalability remains a critical challenge in amorphous metal manufacturing. The production of large-scale components is hindered by the difficulty in maintaining uniform cooling rates throughout the material volume. Non-uniform cooling can lead to partial crystallization, compromising the exceptional mechanical properties that make amorphous metals attractive for aerospace use. Researchers at NASA and leading aerospace manufacturers are developing specialized cooling systems and process controls to address this limitation.

Another significant manufacturing challenge involves the joining of amorphous metal components. Traditional welding techniques often induce crystallization in the heat-affected zone, degrading performance. Novel solid-state joining methods, including friction stir welding and ultrasonic welding, show promise for preserving the amorphous structure during assembly processes.

Cost-effectiveness presents another barrier to widespread adoption. Current manufacturing processes for aerospace-grade amorphous metals can be 5-10 times more expensive than those for conventional titanium alloys. This cost differential stems from specialized equipment requirements, precise process control needs, and relatively low production volumes. Industry leaders are investing in process optimization and automation to reduce these costs, with projections suggesting a 30-40% cost reduction may be achievable within the next five years through manufacturing innovations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!