Regulatory Must-Knows for the Implementation of Amorphous Metals

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Implementation Goals

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures found in traditional metals. First discovered in 1960 at Caltech, these materials are characterized by their disordered atomic arrangement, which results from rapid cooling processes that prevent crystallization. Over the past six decades, the field has evolved from laboratory curiosities to commercially viable materials with exceptional properties.

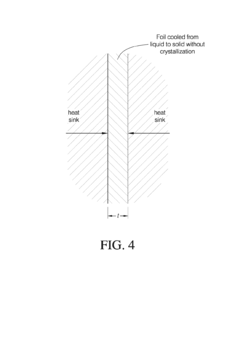

The evolution of amorphous metals has followed a trajectory marked by significant breakthroughs in processing techniques. Early development was limited by the critical cooling rates required (approximately 10^6 K/s), restricting production to thin ribbons and films. The 1990s saw the emergence of bulk metallic glasses (BMGs) with lower critical cooling rates, enabling the production of thicker samples and expanding potential applications.

Current technological trends indicate growing interest in amorphous metals across multiple industries, driven by their unique combination of properties: exceptional strength-to-weight ratios, superior elastic limits, excellent corrosion resistance, and distinctive magnetic characteristics. These attributes position amorphous metals as potential game-changers in aerospace, medical devices, electronics, and energy sectors.

The implementation goals for amorphous metals center on overcoming existing regulatory hurdles while capitalizing on their distinctive properties. Primary objectives include establishing standardized testing protocols specifically designed for these non-crystalline materials, as their mechanical behavior differs significantly from conventional metals. Additionally, developing comprehensive safety guidelines for manufacturing processes is crucial, particularly regarding the handling of potentially reactive alloy compositions.

Another critical implementation goal involves creating regulatory frameworks that accommodate the unique characteristics of amorphous metals in specific applications. For instance, in medical implants, regulatory bodies must establish new biocompatibility standards that account for the distinct surface chemistry and corrosion behavior of these materials. Similarly, in structural applications, building codes and engineering standards require updates to incorporate design parameters for amorphous metals.

Long-term technological objectives include scaling production capabilities while maintaining quality consistency, developing cost-effective manufacturing methods to compete with traditional materials, and establishing recycling protocols that address the complex compositions of many amorphous metal alloys. These goals align with broader sustainability initiatives and circular economy principles increasingly emphasized in regulatory frameworks worldwide.

The successful implementation of amorphous metals ultimately depends on bridging the gap between their promising technical capabilities and the regulatory landscape that governs their use across different sectors and geographical regions.

The evolution of amorphous metals has followed a trajectory marked by significant breakthroughs in processing techniques. Early development was limited by the critical cooling rates required (approximately 10^6 K/s), restricting production to thin ribbons and films. The 1990s saw the emergence of bulk metallic glasses (BMGs) with lower critical cooling rates, enabling the production of thicker samples and expanding potential applications.

Current technological trends indicate growing interest in amorphous metals across multiple industries, driven by their unique combination of properties: exceptional strength-to-weight ratios, superior elastic limits, excellent corrosion resistance, and distinctive magnetic characteristics. These attributes position amorphous metals as potential game-changers in aerospace, medical devices, electronics, and energy sectors.

The implementation goals for amorphous metals center on overcoming existing regulatory hurdles while capitalizing on their distinctive properties. Primary objectives include establishing standardized testing protocols specifically designed for these non-crystalline materials, as their mechanical behavior differs significantly from conventional metals. Additionally, developing comprehensive safety guidelines for manufacturing processes is crucial, particularly regarding the handling of potentially reactive alloy compositions.

Another critical implementation goal involves creating regulatory frameworks that accommodate the unique characteristics of amorphous metals in specific applications. For instance, in medical implants, regulatory bodies must establish new biocompatibility standards that account for the distinct surface chemistry and corrosion behavior of these materials. Similarly, in structural applications, building codes and engineering standards require updates to incorporate design parameters for amorphous metals.

Long-term technological objectives include scaling production capabilities while maintaining quality consistency, developing cost-effective manufacturing methods to compete with traditional materials, and establishing recycling protocols that address the complex compositions of many amorphous metal alloys. These goals align with broader sustainability initiatives and circular economy principles increasingly emphasized in regulatory frameworks worldwide.

The successful implementation of amorphous metals ultimately depends on bridging the gap between their promising technical capabilities and the regulatory landscape that governs their use across different sectors and geographical regions.

Market Applications and Demand Analysis

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by their unique properties and expanding applications across multiple industries. The current market size is estimated at $500 million, with projections indicating growth to reach $1.2 billion by 2028, representing a compound annual growth rate of approximately 16%. This growth trajectory is supported by increasing demand in key sectors including electronics, aerospace, medical devices, and renewable energy.

In the electronics industry, amorphous metals are gaining traction for transformer cores and electromagnetic shielding applications due to their superior magnetic properties and low core losses. The miniaturization trend in consumer electronics has further accelerated demand, with manufacturers seeking materials that can deliver enhanced performance in smaller form factors. The global transformer market alone represents a $60 billion opportunity where amorphous metal cores are increasingly preferred for their energy efficiency benefits.

The aerospace and defense sectors have emerged as significant consumers of amorphous metal technologies, particularly for structural components requiring exceptional strength-to-weight ratios and corrosion resistance. With the aerospace market expected to grow at 7% annually through 2030, demand for advanced materials like amorphous metals is projected to increase proportionally, especially in applications requiring high fatigue resistance and thermal stability.

Medical device manufacturing represents another high-growth application area, with amorphous metals being utilized for surgical instruments, implantable devices, and diagnostic equipment. Their biocompatibility, corrosion resistance, and non-magnetic properties make them ideal for medical applications. The global medical device market, valued at $430 billion, is increasingly adopting these advanced materials to meet stringent regulatory requirements and improve patient outcomes.

The renewable energy sector, particularly wind and solar power generation, has also begun incorporating amorphous metals in various components to enhance efficiency and durability. Amorphous metal transformers in solar inverters and wind turbine components can reduce energy losses by up to 80% compared to conventional materials, driving adoption as renewable energy installations continue to accelerate globally.

Regional analysis indicates that North America and Europe currently lead in amorphous metal adoption, accounting for approximately 60% of the global market. However, the Asia-Pacific region, particularly China, Japan, and South Korea, is experiencing the fastest growth rate at 20% annually, driven by rapid industrialization and significant investments in advanced manufacturing capabilities. This regional shift is expected to continue as Asian manufacturers expand their technological capabilities and domestic demand increases.

In the electronics industry, amorphous metals are gaining traction for transformer cores and electromagnetic shielding applications due to their superior magnetic properties and low core losses. The miniaturization trend in consumer electronics has further accelerated demand, with manufacturers seeking materials that can deliver enhanced performance in smaller form factors. The global transformer market alone represents a $60 billion opportunity where amorphous metal cores are increasingly preferred for their energy efficiency benefits.

The aerospace and defense sectors have emerged as significant consumers of amorphous metal technologies, particularly for structural components requiring exceptional strength-to-weight ratios and corrosion resistance. With the aerospace market expected to grow at 7% annually through 2030, demand for advanced materials like amorphous metals is projected to increase proportionally, especially in applications requiring high fatigue resistance and thermal stability.

Medical device manufacturing represents another high-growth application area, with amorphous metals being utilized for surgical instruments, implantable devices, and diagnostic equipment. Their biocompatibility, corrosion resistance, and non-magnetic properties make them ideal for medical applications. The global medical device market, valued at $430 billion, is increasingly adopting these advanced materials to meet stringent regulatory requirements and improve patient outcomes.

The renewable energy sector, particularly wind and solar power generation, has also begun incorporating amorphous metals in various components to enhance efficiency and durability. Amorphous metal transformers in solar inverters and wind turbine components can reduce energy losses by up to 80% compared to conventional materials, driving adoption as renewable energy installations continue to accelerate globally.

Regional analysis indicates that North America and Europe currently lead in amorphous metal adoption, accounting for approximately 60% of the global market. However, the Asia-Pacific region, particularly China, Japan, and South Korea, is experiencing the fastest growth rate at 20% annually, driven by rapid industrialization and significant investments in advanced manufacturing capabilities. This regional shift is expected to continue as Asian manufacturers expand their technological capabilities and domestic demand increases.

Current Regulatory Landscape and Technical Challenges

The regulatory landscape for amorphous metals implementation presents a complex framework that varies significantly across global jurisdictions. Currently, there is no unified international standard specifically governing amorphous metal applications, creating a fragmented regulatory environment that manufacturers must navigate carefully. In the United States, the FDA has established preliminary guidelines for amorphous metal alloys in medical devices, while the Department of Energy has issued technical specifications for their use in power distribution systems. The European Union, through its RoHS and REACH regulations, imposes strict requirements on material composition and manufacturing processes, particularly concerning the presence of heavy metals often found in amorphous metal formulations.

The aerospace industry faces particularly stringent certification requirements under FAA and EASA regulations, which have not been fully updated to accommodate the unique properties of amorphous metals. This regulatory lag creates significant barriers to implementation in safety-critical components despite their superior performance characteristics.

From a technical perspective, several challenges impede widespread adoption of amorphous metals in regulated industries. The primary challenge lies in quality control and reproducibility during manufacturing. The metastable nature of amorphous structures makes consistent production difficult, with slight variations in cooling rates leading to partial crystallization that can dramatically alter mechanical properties. This variability poses significant challenges for regulatory compliance, as current standards typically require highly predictable material behavior.

Material characterization represents another major hurdle. Traditional testing protocols designed for crystalline materials often fail to adequately assess the unique properties of amorphous metals. Regulatory bodies require extensive validation data, but the lack of standardized testing methodologies specifically for amorphous structures creates uncertainty in certification processes.

Long-term stability verification presents perhaps the most significant regulatory challenge. Many applications require performance guarantees spanning decades, but accelerated aging tests for amorphous metals remain underdeveloped. Regulatory authorities demand comprehensive aging data before approving applications in critical infrastructure or medical implants.

Environmental considerations add another layer of complexity. While amorphous metals offer potential sustainability benefits through energy efficiency and recyclability, their production often involves toxic elements like beryllium or phosphorus. Regulatory frameworks increasingly emphasize lifecycle assessment, requiring manufacturers to demonstrate environmental compliance from production through disposal.

The geographical distribution of technical expertise compounds these challenges. Research centers in Japan, Germany, and the United States lead development efforts, but regulatory knowledge remains unevenly distributed, creating additional barriers for global implementation strategies.

The aerospace industry faces particularly stringent certification requirements under FAA and EASA regulations, which have not been fully updated to accommodate the unique properties of amorphous metals. This regulatory lag creates significant barriers to implementation in safety-critical components despite their superior performance characteristics.

From a technical perspective, several challenges impede widespread adoption of amorphous metals in regulated industries. The primary challenge lies in quality control and reproducibility during manufacturing. The metastable nature of amorphous structures makes consistent production difficult, with slight variations in cooling rates leading to partial crystallization that can dramatically alter mechanical properties. This variability poses significant challenges for regulatory compliance, as current standards typically require highly predictable material behavior.

Material characterization represents another major hurdle. Traditional testing protocols designed for crystalline materials often fail to adequately assess the unique properties of amorphous metals. Regulatory bodies require extensive validation data, but the lack of standardized testing methodologies specifically for amorphous structures creates uncertainty in certification processes.

Long-term stability verification presents perhaps the most significant regulatory challenge. Many applications require performance guarantees spanning decades, but accelerated aging tests for amorphous metals remain underdeveloped. Regulatory authorities demand comprehensive aging data before approving applications in critical infrastructure or medical implants.

Environmental considerations add another layer of complexity. While amorphous metals offer potential sustainability benefits through energy efficiency and recyclability, their production often involves toxic elements like beryllium or phosphorus. Regulatory frameworks increasingly emphasize lifecycle assessment, requiring manufacturers to demonstrate environmental compliance from production through disposal.

The geographical distribution of technical expertise compounds these challenges. Research centers in Japan, Germany, and the United States lead development efforts, but regulatory knowledge remains unevenly distributed, creating additional barriers for global implementation strategies.

Compliance Solutions and Implementation Strategies

01 Manufacturing processes for amorphous metals

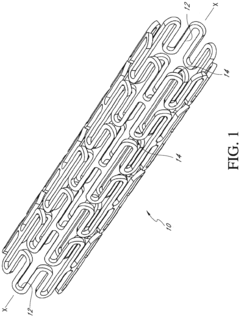

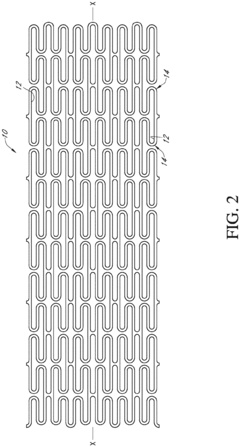

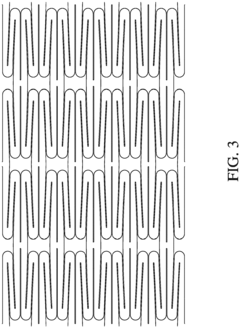

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying of amorphous metals: The composition of amorphous metals significantly affects their properties and glass-forming ability. Specific combinations of elements can enhance the stability of the amorphous structure and improve mechanical, magnetic, or corrosion-resistant properties. These alloys often contain a mixture of transition metals, metalloids, and rare earth elements in precise ratios to achieve desired characteristics while maintaining the non-crystalline structure.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic devices for transformer cores and magnetic sensors due to their superior magnetic properties. In medical fields, they serve as biocompatible implants. Their high strength and corrosion resistance make them valuable in structural applications, while their unique properties enable specialized uses in aerospace, defense, and consumer products.

- Surface treatment and coating technologies for amorphous metals: Surface treatments and coating technologies can enhance the properties of amorphous metals or apply amorphous metal coatings to conventional materials. These processes include thermal spray techniques, physical vapor deposition, and specialized surface modification methods. Such treatments can improve wear resistance, corrosion protection, and functional properties while maintaining the beneficial characteristics of the amorphous structure.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit distinctive mechanical and physical properties that differentiate them from crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limits combined with good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic behavior. These materials also show distinctive thermal properties, electrical conductivity, and response to mechanical deformation due to their disordered atomic structure.

02 Composition and alloying of amorphous metals

The composition of amorphous metals significantly affects their properties and glass-forming ability. Specific combinations of elements can enhance the stability of the amorphous state and improve mechanical, magnetic, or corrosion-resistant properties. These alloys often contain multiple elements in precise ratios, including transition metals, rare earth elements, and metalloids that promote glass formation by disrupting crystallization pathways.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique properties. They are used in electronic devices for transformer cores and magnetic sensors due to their soft magnetic properties. In medical fields, they serve as biocompatible implants. Their high strength-to-weight ratio makes them valuable in aerospace and sporting equipment, while their corrosion resistance benefits chemical processing industries.Expand Specific Solutions04 Surface treatment and coating technologies for amorphous metals

Surface treatments and coating technologies can enhance the properties of amorphous metals or apply amorphous metal coatings to conventional substrates. These processes include thermal spray techniques, physical vapor deposition, and chemical treatments that can improve wear resistance, corrosion protection, and other surface-dependent properties while maintaining the beneficial amorphous structure.Expand Specific Solutions05 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit distinctive mechanical and physical properties that differentiate them from their crystalline counterparts. These include exceptional hardness, elasticity, and yield strength, often combined with good ductility under certain conditions. They also demonstrate unique magnetic behavior, electrical conductivity patterns, and thermal characteristics due to their lack of grain boundaries and dislocations typical in crystalline materials.Expand Specific Solutions

Key Industry Players and Competitive Analysis

The amorphous metals regulatory landscape is evolving within a growing market projected to reach significant scale by 2030. The industry is transitioning from early development to commercial application phases, with varying levels of technical maturity across sectors. Leading players demonstrate distinct specialization patterns: VACUUMSCHMELZE and Heraeus Amloy Technologies focus on manufacturing processes, while research institutions like Huazhong University and KIST advance fundamental science. Major corporations including Samsung Electronics, BYD, and 3M are integrating amorphous metals into commercial applications, particularly in electronics and automotive sectors. Regulatory frameworks remain fragmented globally, with companies navigating complex compliance requirements across different jurisdictions as this advanced materials category gains industrial adoption.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has developed a sophisticated regulatory compliance system for their amorphous metal products, particularly focused on electromagnetic applications. Their approach centers on a three-tier regulatory framework addressing material composition, manufacturing processes, and end-use applications. For material composition, they've established protocols ensuring compliance with EU REACH regulations and RoHS directives, with specialized documentation for their iron-based amorphous alloys. Their manufacturing compliance strategy includes proprietary rapid solidification techniques that meet ISO 9001 quality management standards while adhering to industry-specific requirements for magnetic components. VACUUMSCHMELZE has pioneered regulatory pathways for amorphous metals in electrical grid applications, working closely with IEEE and IEC to establish standards for amorphous metal transformers that address energy efficiency regulations while meeting safety requirements. Their compliance documentation includes detailed magnetic performance characteristics under various regulatory test conditions, ensuring their materials meet emerging energy efficiency standards worldwide.

Strengths: Extensive experience with electromagnetic regulatory requirements; established relationships with standards bodies; comprehensive documentation for electrical applications of amorphous metals. Weaknesses: Regulatory approach heavily focused on electromagnetic applications with less developed frameworks for structural or mechanical applications; compliance costs may be prohibitive for smaller-scale implementations.

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed a specialized regulatory compliance framework focused on amorphous metals in semiconductor and display technologies. Their approach centers on a modular compliance system that addresses both material properties and manufacturing processes across international jurisdictions. For material composition, they've established protocols ensuring their amorphous metal thin films meet semiconductor industry standards for trace metal contamination while complying with EU REACH regulations. Their manufacturing compliance strategy includes cleanroom protocols that satisfy both ISO 14644 standards and specific semiconductor industry requirements, with documentation packages tailored to fab integration. Amorphyx has pioneered regulatory pathways for amorphous metals in display applications, working with industry bodies to establish testing protocols that address both performance and safety requirements. Their compliance documentation includes detailed electrical characterization under various environmental conditions, ensuring their materials meet reliability standards for consumer electronics. Additionally, they've developed specialized end-of-life protocols addressing recyclability concerns for amorphous metal components in electronic devices.

Strengths: Highly specialized expertise in electronics industry regulatory requirements; established testing protocols specific to semiconductor applications; comprehensive documentation for integration into existing manufacturing processes. Weaknesses: Regulatory framework primarily focused on thin-film applications rather than bulk amorphous metals; limited experience with mechanical or structural applications.

Critical Patents and Technical Standards Review

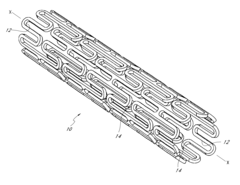

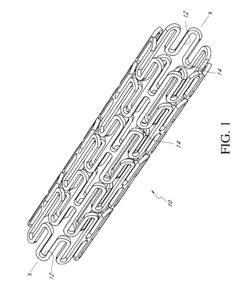

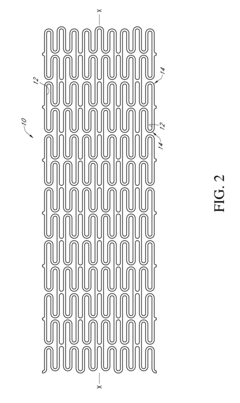

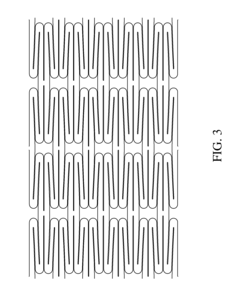

Medical Devices with Amorphous Metals and Methods Therefor

PatentInactiveEP2460544A1

Innovation

- The development of medical devices, including stents, filters, and guidewires, utilizing amorphous metals that are shape-set and coated with radiopaque, drug, or biocompatible coatings, which maintain amorphous properties under storage and sterilization conditions, offering enhanced corrosion resistance and MRI compatibility.

Medical devices with amorphous metals, and methods therefor

PatentInactiveUS8057530B2

Innovation

- The development of medical devices incorporating amorphous metals, which can be shape-set and coated for specific applications, offering improved corrosion resistance, MRI safety, and enhanced mechanical properties, including the ability to sustain partial conversion to crystalline structures for tailored properties.

Environmental Impact and Sustainability Considerations

The implementation of amorphous metals presents significant environmental advantages compared to conventional crystalline metals. These materials require lower processing temperatures during manufacturing, resulting in reduced energy consumption and associated carbon emissions. Studies indicate that amorphous metal production can achieve up to 30-50% energy savings compared to traditional metallurgical processes, contributing substantially to industrial decarbonization efforts.

Waste reduction represents another critical environmental benefit of amorphous metals. Their near-net-shape manufacturing capabilities minimize material waste during production. Additionally, the superior corrosion resistance of amorphous metals extends product lifespans, reducing the frequency of replacement and associated resource consumption. This longevity factor must be incorporated into lifecycle assessments when evaluating their overall environmental impact.

Regulatory frameworks increasingly emphasize end-of-life considerations for advanced materials. While amorphous metals offer excellent recyclability potential due to their homogeneous structure, specialized recycling infrastructure may be required. Manufacturers must develop comprehensive recycling protocols that comply with circular economy regulations, particularly in regions with advanced waste management legislation such as the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive.

The reduced reliance on critical raw materials presents another sustainability advantage. Many amorphous metal formulations can utilize more abundant elements compared to high-performance crystalline alloys. This characteristic aligns with regulatory initiatives like the EU Critical Raw Materials Act, which aims to reduce dependency on scarce resources. Companies implementing amorphous metals should document these material efficiency improvements to demonstrate regulatory compliance.

Water usage during manufacturing processes represents an often-overlooked environmental consideration. Rapid solidification techniques used in amorphous metal production typically require sophisticated cooling systems. Regulatory compliance may necessitate closed-loop water systems and treatment facilities to minimize water consumption and prevent contamination, particularly in water-stressed regions where stringent usage restrictions apply.

Toxicity assessments must be conducted for specific amorphous metal compositions, especially those containing elements like beryllium or lead. While the amorphous structure may reduce leaching potential compared to crystalline counterparts, regulatory bodies increasingly require comprehensive toxicological data. Manufacturers should proactively conduct biocompatibility testing according to standards such as ISO 10993 to ensure compliance with evolving chemical safety regulations.

Waste reduction represents another critical environmental benefit of amorphous metals. Their near-net-shape manufacturing capabilities minimize material waste during production. Additionally, the superior corrosion resistance of amorphous metals extends product lifespans, reducing the frequency of replacement and associated resource consumption. This longevity factor must be incorporated into lifecycle assessments when evaluating their overall environmental impact.

Regulatory frameworks increasingly emphasize end-of-life considerations for advanced materials. While amorphous metals offer excellent recyclability potential due to their homogeneous structure, specialized recycling infrastructure may be required. Manufacturers must develop comprehensive recycling protocols that comply with circular economy regulations, particularly in regions with advanced waste management legislation such as the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive.

The reduced reliance on critical raw materials presents another sustainability advantage. Many amorphous metal formulations can utilize more abundant elements compared to high-performance crystalline alloys. This characteristic aligns with regulatory initiatives like the EU Critical Raw Materials Act, which aims to reduce dependency on scarce resources. Companies implementing amorphous metals should document these material efficiency improvements to demonstrate regulatory compliance.

Water usage during manufacturing processes represents an often-overlooked environmental consideration. Rapid solidification techniques used in amorphous metal production typically require sophisticated cooling systems. Regulatory compliance may necessitate closed-loop water systems and treatment facilities to minimize water consumption and prevent contamination, particularly in water-stressed regions where stringent usage restrictions apply.

Toxicity assessments must be conducted for specific amorphous metal compositions, especially those containing elements like beryllium or lead. While the amorphous structure may reduce leaching potential compared to crystalline counterparts, regulatory bodies increasingly require comprehensive toxicological data. Manufacturers should proactively conduct biocompatibility testing according to standards such as ISO 10993 to ensure compliance with evolving chemical safety regulations.

International Trade Regulations and Market Access Barriers

The implementation of amorphous metals across global markets faces a complex landscape of international trade regulations and market access barriers that vary significantly by region. In the United States, amorphous metal products are subject to the International Traffic in Arms Regulations (ITAR) when used in defense applications, requiring manufacturers to obtain specific licenses and comply with strict export controls. Additionally, the Bureau of Industry and Security (BIS) classifies certain amorphous metal alloys as dual-use technologies under Export Administration Regulations (EAR), necessitating export licenses for international transactions.

The European Union implements the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which affects amorphous metals containing elements like cobalt, nickel, or beryllium. Manufacturers must register these substances with the European Chemicals Agency (ECHA) and provide comprehensive safety data. The EU's RoHS (Restriction of Hazardous Substances) directive further restricts certain elements in electronic applications, potentially limiting some amorphous metal compositions.

In Asia, regulatory frameworks present distinct challenges. China's export control law, implemented in 2020, classifies advanced materials including certain amorphous metal formulations as strategically important technologies subject to heightened scrutiny. Japanese regulations focus on environmental impact assessments for manufacturing processes involving amorphous metals, particularly those used in transformer cores and electronic components.

Tariff structures worldwide create additional market access barriers. The Harmonized System (HS) codes for amorphous metals often fall under specialized categories with varying duty rates. For instance, amorphous metal ribbons may face tariffs ranging from 3% to 25% depending on the importing country and intended application. Trade tensions between major economies have resulted in retaliatory tariffs affecting the amorphous metals supply chain, particularly between the US and China.

Certification requirements constitute another significant barrier. Products incorporating amorphous metals for electrical applications must obtain certifications such as UL in North America, CE marking in Europe, and CCC in China. These certification processes involve costly testing procedures and documentation requirements that can delay market entry by 6-18 months.

Intellectual property protection presents challenges in emerging markets where enforcement mechanisms may be less robust. Companies deploying amorphous metal technologies must navigate patent landscapes carefully, as cross-licensing agreements and patent pools have become increasingly common in this specialized field.

The European Union implements the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which affects amorphous metals containing elements like cobalt, nickel, or beryllium. Manufacturers must register these substances with the European Chemicals Agency (ECHA) and provide comprehensive safety data. The EU's RoHS (Restriction of Hazardous Substances) directive further restricts certain elements in electronic applications, potentially limiting some amorphous metal compositions.

In Asia, regulatory frameworks present distinct challenges. China's export control law, implemented in 2020, classifies advanced materials including certain amorphous metal formulations as strategically important technologies subject to heightened scrutiny. Japanese regulations focus on environmental impact assessments for manufacturing processes involving amorphous metals, particularly those used in transformer cores and electronic components.

Tariff structures worldwide create additional market access barriers. The Harmonized System (HS) codes for amorphous metals often fall under specialized categories with varying duty rates. For instance, amorphous metal ribbons may face tariffs ranging from 3% to 25% depending on the importing country and intended application. Trade tensions between major economies have resulted in retaliatory tariffs affecting the amorphous metals supply chain, particularly between the US and China.

Certification requirements constitute another significant barrier. Products incorporating amorphous metals for electrical applications must obtain certifications such as UL in North America, CE marking in Europe, and CCC in China. These certification processes involve costly testing procedures and documentation requirements that can delay market entry by 6-18 months.

Intellectual property protection presents challenges in emerging markets where enforcement mechanisms may be less robust. Companies deploying amorphous metal technologies must navigate patent landscapes carefully, as cross-licensing agreements and patent pools have become increasingly common in this specialized field.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!