Analysis of the Lightweight Properties of Amorphous Metals

OCT 11, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Lightweight Goals

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that emerged in the mid-20th century. Unlike conventional crystalline metals with ordered atomic arrangements, amorphous metals possess a non-crystalline, disordered atomic structure similar to glass. This unique structural characteristic was first discovered in 1960 when researchers at Caltech successfully produced an Au-Si alloy with amorphous structure through rapid cooling techniques. Since then, the field has evolved significantly, with major breakthroughs occurring in the 1990s and 2000s with the development of bulk metallic glasses (BMGs).

The evolution of amorphous metals has been driven by the pursuit of materials with exceptional combinations of properties that conventional metals cannot achieve. Their disordered atomic structure eliminates grain boundaries and crystalline defects, resulting in remarkable mechanical, chemical, and physical properties. The technology has progressed from thin ribbons and powders to bulk forms exceeding several centimeters in thickness, expanding potential applications dramatically.

Lightweight properties represent one of the most promising aspects of amorphous metals for modern industrial applications. With density reductions of 10-20% compared to their crystalline counterparts, these materials offer significant weight advantages while maintaining or improving mechanical performance. This characteristic is particularly valuable in transportation, aerospace, and portable electronics sectors where weight reduction directly translates to energy efficiency and performance improvements.

The primary technical goal in developing lightweight amorphous metals is to achieve optimal strength-to-weight ratios that surpass traditional lightweight materials like aluminum and titanium alloys. Current research focuses on aluminum and titanium-based amorphous systems that can deliver specific strengths (strength-to-weight ratios) up to 50% higher than conventional lightweight alloys. These developments aim to produce materials with densities below 4.5 g/cm³ while maintaining tensile strengths exceeding 1500 MPa.

Another critical objective is enhancing the glass-forming ability of lightweight amorphous compositions. Historically, achieving amorphous structures in lightweight metal systems has proven challenging due to their atomic bonding characteristics and required cooling rates. Researchers are exploring multi-component systems and microalloying strategies to improve glass formation in aluminum, magnesium, and titanium-based systems without compromising their lightweight advantages.

The technological trajectory points toward developing processing techniques that enable larger-scale production of lightweight amorphous metals with consistent properties. Current limitations in maximum sample size and cooling rate requirements restrict widespread industrial adoption. Innovations in manufacturing methods, including selective laser melting, suction casting, and spark plasma sintering, are being pursued to overcome these barriers and enable commercial-scale production of lightweight amorphous metal components.

The evolution of amorphous metals has been driven by the pursuit of materials with exceptional combinations of properties that conventional metals cannot achieve. Their disordered atomic structure eliminates grain boundaries and crystalline defects, resulting in remarkable mechanical, chemical, and physical properties. The technology has progressed from thin ribbons and powders to bulk forms exceeding several centimeters in thickness, expanding potential applications dramatically.

Lightweight properties represent one of the most promising aspects of amorphous metals for modern industrial applications. With density reductions of 10-20% compared to their crystalline counterparts, these materials offer significant weight advantages while maintaining or improving mechanical performance. This characteristic is particularly valuable in transportation, aerospace, and portable electronics sectors where weight reduction directly translates to energy efficiency and performance improvements.

The primary technical goal in developing lightweight amorphous metals is to achieve optimal strength-to-weight ratios that surpass traditional lightweight materials like aluminum and titanium alloys. Current research focuses on aluminum and titanium-based amorphous systems that can deliver specific strengths (strength-to-weight ratios) up to 50% higher than conventional lightweight alloys. These developments aim to produce materials with densities below 4.5 g/cm³ while maintaining tensile strengths exceeding 1500 MPa.

Another critical objective is enhancing the glass-forming ability of lightweight amorphous compositions. Historically, achieving amorphous structures in lightweight metal systems has proven challenging due to their atomic bonding characteristics and required cooling rates. Researchers are exploring multi-component systems and microalloying strategies to improve glass formation in aluminum, magnesium, and titanium-based systems without compromising their lightweight advantages.

The technological trajectory points toward developing processing techniques that enable larger-scale production of lightweight amorphous metals with consistent properties. Current limitations in maximum sample size and cooling rate requirements restrict widespread industrial adoption. Innovations in manufacturing methods, including selective laser melting, suction casting, and spark plasma sintering, are being pursued to overcome these barriers and enable commercial-scale production of lightweight amorphous metal components.

Market Demand Analysis for Lightweight Materials

The global market for lightweight materials has been experiencing robust growth, driven primarily by the automotive, aerospace, and consumer electronics industries seeking to improve energy efficiency and performance. Amorphous metals, also known as metallic glasses, represent a significant opportunity within this market due to their exceptional strength-to-weight ratios and unique mechanical properties.

Current market analysis indicates that the lightweight materials market is valued at approximately $142 billion globally, with projections suggesting growth to reach $237 billion by 2026, representing a compound annual growth rate of 8.8%. Within this broader market, advanced metals and alloys, including amorphous metals, constitute about 18% of the total market share, with increasing adoption rates observed across multiple industries.

The automotive sector remains the largest consumer of lightweight materials, accounting for nearly 40% of the total market demand. Stringent fuel efficiency regulations and emission standards worldwide have compelled manufacturers to reduce vehicle weight, creating substantial demand for innovative lightweight solutions. Amorphous metals, with their superior specific strength compared to conventional crystalline alloys, are increasingly viewed as viable alternatives for structural components, particularly in premium and electric vehicles.

Aerospace applications represent another significant market segment, where the weight reduction directly translates to fuel savings and increased payload capacity. The aerospace industry demands materials that combine lightweight properties with exceptional mechanical performance and corrosion resistance – characteristics inherent to many amorphous metal compositions. This sector is expected to grow at 9.5% annually in terms of lightweight material consumption.

Consumer electronics manufacturers are also showing heightened interest in amorphous metals, particularly for smartphone frames, laptop casings, and wearable devices. The combination of strength, lightweight properties, and aesthetic appeal makes these materials attractive for premium electronic products. Market research indicates that consumer willingness to pay a premium for lighter, more durable electronic devices has increased by 22% over the past three years.

Regional analysis reveals that North America and Europe currently lead in the adoption of advanced lightweight materials, including amorphous metals, while the Asia-Pacific region, particularly China and Japan, is experiencing the fastest growth rates. This geographic distribution aligns with centers of automotive and electronics manufacturing, as well as regions with strong aerospace industries.

Despite the promising market outlook, price sensitivity remains a significant factor influencing adoption rates. Current production costs for amorphous metals exceed those of traditional materials by 30-60%, limiting widespread implementation. However, as manufacturing processes mature and economies of scale are achieved, this price differential is expected to narrow, potentially accelerating market penetration across various industries.

Current market analysis indicates that the lightweight materials market is valued at approximately $142 billion globally, with projections suggesting growth to reach $237 billion by 2026, representing a compound annual growth rate of 8.8%. Within this broader market, advanced metals and alloys, including amorphous metals, constitute about 18% of the total market share, with increasing adoption rates observed across multiple industries.

The automotive sector remains the largest consumer of lightweight materials, accounting for nearly 40% of the total market demand. Stringent fuel efficiency regulations and emission standards worldwide have compelled manufacturers to reduce vehicle weight, creating substantial demand for innovative lightweight solutions. Amorphous metals, with their superior specific strength compared to conventional crystalline alloys, are increasingly viewed as viable alternatives for structural components, particularly in premium and electric vehicles.

Aerospace applications represent another significant market segment, where the weight reduction directly translates to fuel savings and increased payload capacity. The aerospace industry demands materials that combine lightweight properties with exceptional mechanical performance and corrosion resistance – characteristics inherent to many amorphous metal compositions. This sector is expected to grow at 9.5% annually in terms of lightweight material consumption.

Consumer electronics manufacturers are also showing heightened interest in amorphous metals, particularly for smartphone frames, laptop casings, and wearable devices. The combination of strength, lightweight properties, and aesthetic appeal makes these materials attractive for premium electronic products. Market research indicates that consumer willingness to pay a premium for lighter, more durable electronic devices has increased by 22% over the past three years.

Regional analysis reveals that North America and Europe currently lead in the adoption of advanced lightweight materials, including amorphous metals, while the Asia-Pacific region, particularly China and Japan, is experiencing the fastest growth rates. This geographic distribution aligns with centers of automotive and electronics manufacturing, as well as regions with strong aerospace industries.

Despite the promising market outlook, price sensitivity remains a significant factor influencing adoption rates. Current production costs for amorphous metals exceed those of traditional materials by 30-60%, limiting widespread implementation. However, as manufacturing processes mature and economies of scale are achieved, this price differential is expected to narrow, potentially accelerating market penetration across various industries.

Current State and Challenges in Amorphous Metals

Amorphous metals, also known as metallic glasses, have gained significant attention in recent years due to their unique lightweight properties combined with exceptional mechanical characteristics. Globally, research institutions and industrial manufacturers have made substantial progress in developing these materials, yet several challenges remain in their widespread application. The current state of amorphous metals technology represents a complex landscape of achievements and obstacles that require careful examination.

The development of amorphous metals has reached a critical juncture where laboratory success has begun transitioning to commercial applications. Currently, the most advanced research centers in the United States, Japan, Germany, and China have demonstrated the ability to produce amorphous metal components with densities 10-30% lower than their crystalline counterparts while maintaining superior strength-to-weight ratios. This represents a significant advancement in lightweight structural materials technology.

Despite these achievements, several technical challenges persist in the field. The most prominent limitation remains the critical cooling rate required for glass formation, which restricts the maximum thickness (critical casting thickness) of amorphous metal components. While bulk metallic glasses with thicknesses exceeding 10mm have been developed for some compositions, many lightweight amorphous alloys are limited to thicknesses below 5mm, constraining their application in larger structural components.

Production scalability presents another significant hurdle. Current manufacturing processes for lightweight amorphous metals often involve specialized equipment and precise control parameters that are difficult to implement in mass production environments. This has limited their industrial adoption despite their promising properties. The cost of raw materials, particularly for compositions containing rare earth elements that enhance glass-forming ability, further complicates commercial viability.

Geographically, research and development in lightweight amorphous metals shows distinct patterns. Japan and the United States lead in fundamental research and patent applications, while China has emerged as a major player in production technology development. European research institutions, particularly in Germany and Switzerland, have focused on specialized applications in precision engineering and medical devices where the lightweight properties offer significant advantages.

The stability of amorphous metals under various environmental conditions remains problematic. Some compositions exhibit structural relaxation or partial crystallization at elevated temperatures well below their glass transition temperature, compromising their mechanical properties over time. Additionally, certain lightweight amorphous metal compositions show susceptibility to corrosion in specific environments, requiring protective measures that may offset their weight advantages.

Recent breakthroughs in computational modeling have accelerated the discovery of new lightweight amorphous metal compositions, but the gap between theoretical prediction and practical implementation remains substantial. The lack of standardized testing protocols specifically designed for amorphous metals further complicates comparative analysis and industry adoption of these innovative materials.

The development of amorphous metals has reached a critical juncture where laboratory success has begun transitioning to commercial applications. Currently, the most advanced research centers in the United States, Japan, Germany, and China have demonstrated the ability to produce amorphous metal components with densities 10-30% lower than their crystalline counterparts while maintaining superior strength-to-weight ratios. This represents a significant advancement in lightweight structural materials technology.

Despite these achievements, several technical challenges persist in the field. The most prominent limitation remains the critical cooling rate required for glass formation, which restricts the maximum thickness (critical casting thickness) of amorphous metal components. While bulk metallic glasses with thicknesses exceeding 10mm have been developed for some compositions, many lightweight amorphous alloys are limited to thicknesses below 5mm, constraining their application in larger structural components.

Production scalability presents another significant hurdle. Current manufacturing processes for lightweight amorphous metals often involve specialized equipment and precise control parameters that are difficult to implement in mass production environments. This has limited their industrial adoption despite their promising properties. The cost of raw materials, particularly for compositions containing rare earth elements that enhance glass-forming ability, further complicates commercial viability.

Geographically, research and development in lightweight amorphous metals shows distinct patterns. Japan and the United States lead in fundamental research and patent applications, while China has emerged as a major player in production technology development. European research institutions, particularly in Germany and Switzerland, have focused on specialized applications in precision engineering and medical devices where the lightweight properties offer significant advantages.

The stability of amorphous metals under various environmental conditions remains problematic. Some compositions exhibit structural relaxation or partial crystallization at elevated temperatures well below their glass transition temperature, compromising their mechanical properties over time. Additionally, certain lightweight amorphous metal compositions show susceptibility to corrosion in specific environments, requiring protective measures that may offset their weight advantages.

Recent breakthroughs in computational modeling have accelerated the discovery of new lightweight amorphous metal compositions, but the gap between theoretical prediction and practical implementation remains substantial. The lack of standardized testing protocols specifically designed for amorphous metals further complicates comparative analysis and industry adoption of these innovative materials.

Current Lightweight Solutions Using Amorphous Metals

01 Composition and structure of lightweight amorphous metals

Amorphous metals with lightweight properties can be achieved through specific compositions and structures. These materials typically contain elements like aluminum, titanium, or magnesium combined with transition metals and metalloids to form metallic glasses. The amorphous structure, lacking crystalline grain boundaries, contributes to their reduced density while maintaining excellent mechanical properties. The rapid solidification techniques used in their production help preserve the disordered atomic arrangement that characterizes these lightweight amorphous alloys.- Composition and structure of lightweight amorphous metals: Amorphous metals with lightweight properties can be achieved through specific compositions and structures. These materials typically contain elements like aluminum, titanium, or magnesium combined with transition metals and metalloids. The amorphous structure, characterized by the absence of long-range atomic order, contributes to their reduced density while maintaining excellent mechanical properties. Various processing techniques can be employed to create these lightweight amorphous metals with controlled microstructures.

- Manufacturing processes for lightweight amorphous metals: Specialized manufacturing processes are essential for producing lightweight amorphous metals. These include rapid solidification techniques such as melt spinning, gas atomization, and splat quenching that prevent crystallization by cooling at extremely high rates. Other methods involve mechanical alloying, powder metallurgy, and additive manufacturing approaches. These processes enable the production of amorphous metals with reduced density while maintaining their unique properties, making them suitable for lightweight applications.

- Mechanical properties of lightweight amorphous metals: Lightweight amorphous metals exhibit exceptional mechanical properties despite their reduced density. These materials often demonstrate high strength-to-weight ratios, superior hardness, excellent elastic properties, and enhanced wear resistance compared to their crystalline counterparts. The absence of grain boundaries contributes to their improved mechanical behavior, making them particularly valuable for applications requiring both lightweight characteristics and superior mechanical performance.

- Applications of lightweight amorphous metals: Lightweight amorphous metals find applications across various industries due to their unique combination of properties. They are particularly valuable in aerospace and automotive sectors where weight reduction is critical for fuel efficiency. Other applications include sporting goods, electronic casings, biomedical implants, and military equipment. Their high strength-to-weight ratio, corrosion resistance, and unique magnetic properties make them suitable for specialized components where traditional materials cannot meet performance requirements.

- Surface treatments and coatings for amorphous metals: Surface treatments and coatings can further enhance the properties of lightweight amorphous metals. Various techniques including thermal treatments, chemical modifications, and application of protective layers can improve corrosion resistance, wear properties, and aesthetic appearance. These treatments can also address specific challenges associated with amorphous metals such as brittleness or environmental degradation, while maintaining their lightweight characteristics and core mechanical properties.

02 Manufacturing processes for lightweight amorphous metals

Various manufacturing techniques are employed to produce lightweight amorphous metals with desired properties. These include rapid solidification methods such as melt spinning, gas atomization, and splat quenching that prevent crystallization. Advanced processing techniques like selective laser melting and mechanical alloying can also be used to create amorphous metal components with controlled density. These manufacturing processes are critical in maintaining the amorphous structure while achieving the lightweight characteristics needed for specific applications.Expand Specific Solutions03 Mechanical properties of lightweight amorphous metals

Lightweight amorphous metals exhibit exceptional mechanical properties despite their reduced density. They typically demonstrate high strength-to-weight ratios, excellent elastic limits, and superior wear resistance compared to crystalline counterparts. The absence of grain boundaries contributes to their enhanced hardness and resistance to plastic deformation. These materials often show improved fatigue resistance and toughness, making them suitable for structural applications where weight reduction is critical while maintaining mechanical integrity.Expand Specific Solutions04 Applications of lightweight amorphous metals

Lightweight amorphous metals find applications across various industries due to their unique combination of properties. In aerospace and automotive sectors, they are used for structural components requiring high strength-to-weight ratios. These materials are also valuable in sporting goods, electronic casings, and medical devices where weight reduction is advantageous. Military applications include armor plating and ballistic protection systems. The combination of corrosion resistance, mechanical strength, and reduced weight makes these materials particularly suitable for demanding environments where traditional metals would be too heavy.Expand Specific Solutions05 Surface treatments and coatings for amorphous metals

Surface treatments and coatings can enhance the properties of lightweight amorphous metals. Various techniques including thermal spraying, physical vapor deposition, and chemical treatments can be applied to improve surface hardness, wear resistance, and corrosion protection. These treatments can also modify the surface energy and wettability of amorphous metals. Specialized coatings can provide additional functionality such as reduced friction, improved biocompatibility, or enhanced aesthetic appearance while preserving the lightweight nature of the base material.Expand Specific Solutions

Key Industry Players in Amorphous Metals Research

The lightweight properties of amorphous metals represent an emerging technological field currently in its growth phase. The market is expanding rapidly, with increasing applications in aerospace, automotive, and electronics sectors due to these materials' exceptional strength-to-weight ratios. While the global market remains moderate in size, it shows significant growth potential. Technologically, the field is advancing from early commercial applications toward broader industrial adoption. Leading players demonstrate varying levels of technological maturity: research institutions like Dalian University of Technology, California Institute of Technology, and Tsinghua University focus on fundamental research; while companies including VACUUMSCHMELZE, Advanced Technology & Materials, Vulkam SAS, and Qingdao Yunlu have developed commercial applications. Major industrial corporations like NIPPON STEEL, BYD, and Samsung are increasingly investing in amorphous metal technologies to enhance their product portfolios.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has developed advanced iron-based amorphous and nanocrystalline alloys with optimized lightweight properties through their proprietary VITROPERM® and VITROVAC® technologies. Their approach focuses on precise control of alloy composition, incorporating elements like silicon, boron, and phosphorus to reduce density while enhancing glass-forming ability. The company employs rapid solidification processing with cooling rates exceeding 10^6 K/s to produce ultra-thin amorphous ribbons (down to 15μm thickness), achieving density reductions of 10-15% compared to conventional crystalline counterparts. Their patented nanocrystallization heat treatment process creates a unique dual-phase structure with nanoscale crystallites embedded in an amorphous matrix, offering an exceptional combination of magnetic performance and mechanical properties. This technology enables the production of lightweight magnetic cores that reduce the overall weight of electrical components by up to 80% compared to traditional silicon steel alternatives, while simultaneously improving energy efficiency by reducing core losses to less than 0.2 W/kg at standard operating conditions.

Strengths: World-leading expertise in amorphous and nanocrystalline magnetic materials; established manufacturing capabilities for commercial-scale production; proven track record in high-efficiency electrical applications. Weaknesses: Limited to thin ribbon formats for fully amorphous states; higher production costs compared to conventional materials; challenges in mechanical forming and joining operations.

California Institute of Technology

Technical Solution: California Institute of Technology (Caltech) has pioneered fundamental research on lightweight amorphous metals through their Materials Science department. Their approach focuses on understanding the atomic-scale structure-property relationships that govern density and mechanical behavior in metallic glasses. Using advanced characterization techniques including synchrotron X-ray diffraction and atom probe tomography, Caltech researchers have identified optimal short-range ordering patterns that simultaneously reduce density and enhance mechanical properties. Their breakthrough work on aluminum-based metallic glasses has achieved densities as low as 2.8 g/cm³ while maintaining yield strengths above 1 GPa, resulting in specific strengths that exceed titanium alloys by approximately 30%. The research team has developed novel processing routes involving controlled partial crystallization to create nanoscale precipitates within the amorphous matrix, which serve as both strengthening agents and density-reduction features. This approach has enabled the creation of hierarchical structures with density gradients that optimize load-bearing capacity while minimizing overall weight. Caltech's computational modeling work has established predictive frameworks for glass-forming ability in lightweight alloy systems, accelerating the discovery of new compositions with enhanced properties.

Strengths: World-leading fundamental research capabilities; access to advanced characterization facilities; strong theoretical foundation for alloy design principles. Weaknesses: Limited focus on manufacturing scalability; primarily research-oriented rather than commercial applications; challenges in translating laboratory findings to industrial production.

Core Patents and Innovations in Amorphous Metal Structures

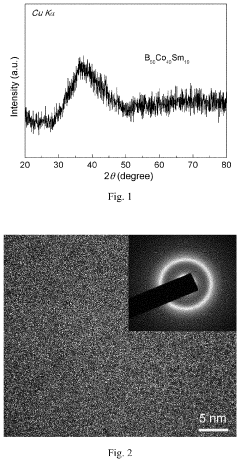

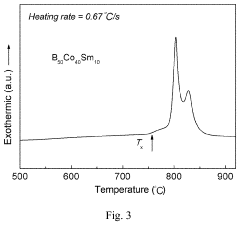

Boron-based amorphous alloys and preparation method thereof

PatentActiveUS20210254198A1

Innovation

- The development of B-based amorphous alloys with a composition formula of BaCobREcX1dX2eX3f, where RE includes rare earth elements, and X1, X2, and X3 are specific elements, prepared through a method involving material mixing, melting, and melt-spinning to produce amorphous ribbons with high thermal stability and hardness.

Amorphous metal alloy having high tensile strength and electrical resistivity

PatentActiveUS7771545B2

Innovation

- Development of amorphous metal alloys with specific compositions, such as (Co1-aFea)100-b-c-dCrbTcXd, incorporating elements like Cr, Mn, Mo, V, B, and Si, which enhance electrical resistivity and tensile strength by increasing structural disorder and preventing shear band formation, resulting in wires with high tensile strength and electrical resistivity.

Environmental Impact and Sustainability Factors

The environmental footprint of amorphous metals represents a significant advantage over traditional crystalline alloys. The production of amorphous metals typically requires less energy consumption compared to conventional metallurgical processes, as they can be formed at lower temperatures due to their unique atomic structure. This energy efficiency translates directly into reduced carbon emissions during manufacturing, positioning amorphous metals as a more environmentally friendly alternative in various industrial applications.

Recycling capabilities of amorphous metals further enhance their sustainability profile. Unlike many composite materials that present challenges in material separation, amorphous metals can be recycled with minimal degradation of their exceptional properties. This characteristic supports circular economy principles and reduces the demand for virgin material extraction, thereby minimizing associated environmental impacts such as habitat destruction and water pollution.

The lightweight nature of amorphous metals contributes substantially to sustainability in transportation applications. When implemented in automotive, aerospace, and marine sectors, these materials enable significant weight reduction without compromising structural integrity. This weight advantage leads to improved fuel efficiency and reduced emissions throughout the operational lifecycle of vehicles and vessels, representing a substantial environmental benefit that extends far beyond the production phase.

Durability and corrosion resistance inherent to amorphous metals further enhance their environmental credentials. These properties extend product lifespans considerably, reducing the frequency of replacement and associated resource consumption. The exceptional wear resistance of amorphous metals makes them particularly valuable in applications subject to harsh conditions, where conventional materials would require frequent maintenance or replacement.

Life cycle assessment (LCA) studies indicate that despite the potentially higher initial energy investment in specialized production techniques, amorphous metals often demonstrate superior environmental performance when evaluated across their entire life cycle. The combination of reduced material usage, extended service life, and recyclability typically results in a lower overall environmental impact compared to traditional metals and alloys.

Emerging research focuses on developing more energy-efficient methods for amorphous metal production, including advanced rapid solidification techniques and additive manufacturing approaches. These innovations promise to further reduce the environmental footprint of amorphous metals, potentially establishing them as a cornerstone material for sustainable engineering solutions in the coming decades.

Recycling capabilities of amorphous metals further enhance their sustainability profile. Unlike many composite materials that present challenges in material separation, amorphous metals can be recycled with minimal degradation of their exceptional properties. This characteristic supports circular economy principles and reduces the demand for virgin material extraction, thereby minimizing associated environmental impacts such as habitat destruction and water pollution.

The lightweight nature of amorphous metals contributes substantially to sustainability in transportation applications. When implemented in automotive, aerospace, and marine sectors, these materials enable significant weight reduction without compromising structural integrity. This weight advantage leads to improved fuel efficiency and reduced emissions throughout the operational lifecycle of vehicles and vessels, representing a substantial environmental benefit that extends far beyond the production phase.

Durability and corrosion resistance inherent to amorphous metals further enhance their environmental credentials. These properties extend product lifespans considerably, reducing the frequency of replacement and associated resource consumption. The exceptional wear resistance of amorphous metals makes them particularly valuable in applications subject to harsh conditions, where conventional materials would require frequent maintenance or replacement.

Life cycle assessment (LCA) studies indicate that despite the potentially higher initial energy investment in specialized production techniques, amorphous metals often demonstrate superior environmental performance when evaluated across their entire life cycle. The combination of reduced material usage, extended service life, and recyclability typically results in a lower overall environmental impact compared to traditional metals and alloys.

Emerging research focuses on developing more energy-efficient methods for amorphous metal production, including advanced rapid solidification techniques and additive manufacturing approaches. These innovations promise to further reduce the environmental footprint of amorphous metals, potentially establishing them as a cornerstone material for sustainable engineering solutions in the coming decades.

Manufacturing Processes and Scalability Assessment

The manufacturing of amorphous metals presents unique challenges compared to conventional crystalline alloys due to their metastable nature and specific cooling rate requirements. Current manufacturing processes primarily revolve around rapid solidification techniques that prevent atomic rearrangement into crystalline structures. Melt spinning represents the most established commercial method, where molten metal is ejected onto a rapidly rotating copper wheel, producing thin ribbons typically 20-50 micrometers thick. This process achieves cooling rates of 10^4-10^6 K/s but faces limitations in producing bulk components.

For larger amorphous metal parts, suction casting and copper mold casting have emerged as viable alternatives. These methods can produce components with thicknesses of several millimeters, though they require alloys with higher glass-forming ability. Powder metallurgy approaches, including gas atomization followed by consolidation techniques such as spark plasma sintering or hot isostatic pressing, offer promising routes for complex geometries while maintaining amorphous structure.

Additive manufacturing technologies represent the frontier in amorphous metal production. Selective laser melting and electron beam melting can create complex three-dimensional structures with localized rapid cooling. However, these processes require precise parameter control to maintain the amorphous state throughout the build, as heat accumulation can trigger unwanted crystallization.

Scalability remains a significant challenge for widespread industrial adoption. Current production volumes are limited by equipment costs, process complexity, and material-specific constraints. The critical cooling rate requirement creates fundamental size limitations - as component thickness increases, achieving uniform cooling becomes exponentially more difficult. This explains why commercial amorphous metals are predominantly available as thin ribbons, wires, or powders rather than bulk structural components.

Economic considerations further complicate scalability. The specialized equipment and precise process control required for amorphous metal manufacturing result in higher production costs compared to conventional alloys. Material yield issues and post-processing requirements add additional economic barriers. However, recent advances in computational modeling of cooling dynamics and the development of alloy compositions with enhanced glass-forming ability are gradually expanding manufacturing capabilities.

For lightweight applications specifically, manufacturing scalability faces the additional challenge of maintaining consistent mechanical properties across varying component geometries. The relationship between processing parameters, resulting microstructure, and mechanical performance requires extensive characterization to establish reliable manufacturing protocols for lightweight amorphous metal components.

For larger amorphous metal parts, suction casting and copper mold casting have emerged as viable alternatives. These methods can produce components with thicknesses of several millimeters, though they require alloys with higher glass-forming ability. Powder metallurgy approaches, including gas atomization followed by consolidation techniques such as spark plasma sintering or hot isostatic pressing, offer promising routes for complex geometries while maintaining amorphous structure.

Additive manufacturing technologies represent the frontier in amorphous metal production. Selective laser melting and electron beam melting can create complex three-dimensional structures with localized rapid cooling. However, these processes require precise parameter control to maintain the amorphous state throughout the build, as heat accumulation can trigger unwanted crystallization.

Scalability remains a significant challenge for widespread industrial adoption. Current production volumes are limited by equipment costs, process complexity, and material-specific constraints. The critical cooling rate requirement creates fundamental size limitations - as component thickness increases, achieving uniform cooling becomes exponentially more difficult. This explains why commercial amorphous metals are predominantly available as thin ribbons, wires, or powders rather than bulk structural components.

Economic considerations further complicate scalability. The specialized equipment and precise process control required for amorphous metal manufacturing result in higher production costs compared to conventional alloys. Material yield issues and post-processing requirements add additional economic barriers. However, recent advances in computational modeling of cooling dynamics and the development of alloy compositions with enhanced glass-forming ability are gradually expanding manufacturing capabilities.

For lightweight applications specifically, manufacturing scalability faces the additional challenge of maintaining consistent mechanical properties across varying component geometries. The relationship between processing parameters, resulting microstructure, and mechanical performance requires extensive characterization to establish reliable manufacturing protocols for lightweight amorphous metal components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!