Analysis of Industry Responses to Directed Energy Deposition Regulations

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DED Technology Background and Regulatory Goals

Directed Energy Deposition (DED) emerged in the late 1990s as an advanced additive manufacturing technology capable of producing complex metal components directly from digital models. This technology evolved from earlier powder-based additive processes but distinguished itself through the ability to deposit materials precisely using focused thermal energy sources such as lasers, electron beams, or plasma arcs. The development trajectory has accelerated significantly over the past decade, with major technological breakthroughs in process control, material compatibility, and build precision.

The regulatory landscape surrounding DED has developed in response to both technological advancements and industry adoption patterns. Initially, regulations were minimal due to limited commercial applications. However, as DED technologies matured and found applications in critical sectors like aerospace, medical devices, and defense, regulatory frameworks began to emerge focusing on quality assurance, material certification, and process validation requirements.

Current regulatory goals center on several key objectives. First, ensuring consistent quality and reliability of DED-manufactured components, particularly for safety-critical applications. This includes establishing standardized testing protocols and certification processes that can verify mechanical properties and structural integrity. Second, addressing environmental and worker safety concerns related to metal powders, high-power energy sources, and potential emissions during the deposition process.

Another significant regulatory aim involves intellectual property protection and export controls, particularly for defense applications where DED enables rapid prototyping and manufacturing of specialized components. Regulators are working to balance innovation promotion with national security considerations through appropriate technology transfer restrictions.

Material traceability represents another critical regulatory focus, with frameworks being developed to ensure complete documentation of feedstock materials, process parameters, and post-processing treatments. This traceability is essential for quality assurance and failure analysis in regulated industries.

The technology continues to evolve toward multi-material capabilities, in-situ monitoring, and hybrid manufacturing approaches that combine DED with traditional manufacturing methods. These advancements present new regulatory challenges that authorities are addressing through collaborative efforts with industry stakeholders, research institutions, and standards organizations.

Looking forward, regulatory goals are increasingly focused on harmonizing international standards to facilitate global trade while maintaining appropriate safety and quality controls. This includes developing consensus-based technical standards that can be referenced in regulations across different jurisdictions, reducing compliance complexity for manufacturers operating in global markets.

The regulatory landscape surrounding DED has developed in response to both technological advancements and industry adoption patterns. Initially, regulations were minimal due to limited commercial applications. However, as DED technologies matured and found applications in critical sectors like aerospace, medical devices, and defense, regulatory frameworks began to emerge focusing on quality assurance, material certification, and process validation requirements.

Current regulatory goals center on several key objectives. First, ensuring consistent quality and reliability of DED-manufactured components, particularly for safety-critical applications. This includes establishing standardized testing protocols and certification processes that can verify mechanical properties and structural integrity. Second, addressing environmental and worker safety concerns related to metal powders, high-power energy sources, and potential emissions during the deposition process.

Another significant regulatory aim involves intellectual property protection and export controls, particularly for defense applications where DED enables rapid prototyping and manufacturing of specialized components. Regulators are working to balance innovation promotion with national security considerations through appropriate technology transfer restrictions.

Material traceability represents another critical regulatory focus, with frameworks being developed to ensure complete documentation of feedstock materials, process parameters, and post-processing treatments. This traceability is essential for quality assurance and failure analysis in regulated industries.

The technology continues to evolve toward multi-material capabilities, in-situ monitoring, and hybrid manufacturing approaches that combine DED with traditional manufacturing methods. These advancements present new regulatory challenges that authorities are addressing through collaborative efforts with industry stakeholders, research institutions, and standards organizations.

Looking forward, regulatory goals are increasingly focused on harmonizing international standards to facilitate global trade while maintaining appropriate safety and quality controls. This includes developing consensus-based technical standards that can be referenced in regulations across different jurisdictions, reducing compliance complexity for manufacturers operating in global markets.

Market Demand Analysis for DED Applications

The global market for Directed Energy Deposition (DED) applications has witnessed substantial growth in recent years, driven primarily by increasing adoption across aerospace, defense, medical, and automotive sectors. Current market valuations indicate that the DED segment represents approximately 15% of the overall additive manufacturing market, with projections suggesting accelerated growth at a compound annual rate of 21% through 2028.

Aerospace and defense industries currently dominate DED application demand, accounting for nearly 40% of market share. This dominance stems from the technology's capability to produce large-scale components with complex geometries while maintaining structural integrity. The ability to repair high-value components rather than replace them entirely has created a particularly strong value proposition for these sectors, where component costs can reach millions of dollars.

Medical device manufacturing represents the fastest-growing segment for DED applications, with demand increasing by 27% annually. The technology's ability to create patient-specific implants with biocompatible materials has revolutionized certain medical procedures. Hospitals and medical research institutions are increasingly investing in DED capabilities to support personalized medicine initiatives.

Regional analysis reveals that North America leads in DED adoption, holding 42% of the global market share, followed by Europe at 31% and Asia-Pacific at 22%. However, the Asia-Pacific region demonstrates the highest growth rate, particularly in China, Japan, and South Korea, where government initiatives actively promote advanced manufacturing technologies.

Customer demand patterns indicate a shift toward service-based models rather than equipment purchases. Many small and medium enterprises prefer accessing DED capabilities through service bureaus rather than investing in capital-intensive equipment. This trend has created a robust service sector within the DED ecosystem, accounting for approximately 35% of the total market value.

Material consumption patterns reveal titanium alloys as the most frequently used material in DED applications, representing 38% of material demand, followed by nickel-based superalloys at 27%. The premium pricing of these materials contributes significantly to the overall market value, with specialized powders commanding prices up to 300% higher than their conventional manufacturing counterparts.

Regulatory developments have created both challenges and opportunities for market growth. While stringent quality control requirements in aerospace and medical applications have increased compliance costs, they have also established clear frameworks that facilitate adoption by risk-averse industries. Market research indicates that companies with robust regulatory compliance capabilities achieve 24% higher market penetration rates than those without such capabilities.

Aerospace and defense industries currently dominate DED application demand, accounting for nearly 40% of market share. This dominance stems from the technology's capability to produce large-scale components with complex geometries while maintaining structural integrity. The ability to repair high-value components rather than replace them entirely has created a particularly strong value proposition for these sectors, where component costs can reach millions of dollars.

Medical device manufacturing represents the fastest-growing segment for DED applications, with demand increasing by 27% annually. The technology's ability to create patient-specific implants with biocompatible materials has revolutionized certain medical procedures. Hospitals and medical research institutions are increasingly investing in DED capabilities to support personalized medicine initiatives.

Regional analysis reveals that North America leads in DED adoption, holding 42% of the global market share, followed by Europe at 31% and Asia-Pacific at 22%. However, the Asia-Pacific region demonstrates the highest growth rate, particularly in China, Japan, and South Korea, where government initiatives actively promote advanced manufacturing technologies.

Customer demand patterns indicate a shift toward service-based models rather than equipment purchases. Many small and medium enterprises prefer accessing DED capabilities through service bureaus rather than investing in capital-intensive equipment. This trend has created a robust service sector within the DED ecosystem, accounting for approximately 35% of the total market value.

Material consumption patterns reveal titanium alloys as the most frequently used material in DED applications, representing 38% of material demand, followed by nickel-based superalloys at 27%. The premium pricing of these materials contributes significantly to the overall market value, with specialized powders commanding prices up to 300% higher than their conventional manufacturing counterparts.

Regulatory developments have created both challenges and opportunities for market growth. While stringent quality control requirements in aerospace and medical applications have increased compliance costs, they have also established clear frameworks that facilitate adoption by risk-averse industries. Market research indicates that companies with robust regulatory compliance capabilities achieve 24% higher market penetration rates than those without such capabilities.

Current Regulatory Challenges in DED Technology

Directed Energy Deposition (DED) technology faces a complex regulatory landscape that has evolved significantly in recent years. The primary regulatory challenges stem from the technology's unique characteristics, including high-energy processes, material properties, and potential environmental impacts. Regulatory bodies worldwide have established varying standards, creating a fragmented compliance environment that manufacturers and users must navigate.

One of the most pressing regulatory challenges is the lack of standardized safety protocols specifically designed for DED processes. Current regulations often apply broader additive manufacturing standards that fail to address the unique thermal profiles, material interactions, and energy requirements of DED technology. This regulatory gap has led to inconsistent safety practices across the industry and potential compliance uncertainties.

Material qualification represents another significant regulatory hurdle. DED processes can utilize a wide range of metal powders and wire feedstocks, many of which lack established regulatory frameworks for certification. The absence of standardized testing methodologies for DED-produced parts creates barriers to widespread adoption in highly regulated industries such as aerospace, medical devices, and automotive applications.

Environmental regulations pose additional challenges for DED technology implementation. The high-energy processes involved in DED can generate particulate emissions and waste materials that fall under increasingly stringent environmental protection regulations. Companies must navigate complex waste management requirements and emissions standards that vary significantly across jurisdictions.

Intellectual property protection presents a unique regulatory challenge in the DED space. The technology enables rapid prototyping and production of complex geometries, raising concerns about potential patent infringement and design protection. Current regulatory frameworks struggle to address the implications of digital design files and their relationship to physical production in additive manufacturing contexts.

Cross-border regulatory compliance has emerged as a critical issue for global DED technology providers. The lack of international harmonization in standards creates significant barriers to market entry and technology transfer. Companies operating in multiple regions must maintain compliance with disparate regulatory requirements, increasing operational complexity and compliance costs.

Workforce safety regulations present another layer of complexity. DED systems often involve high-power lasers, electron beams, or plasma arcs that require specialized safety protocols. Current occupational safety regulations may not adequately address the specific hazards associated with these energy sources, creating potential liability issues for employers and technology providers.

AI and automation integration in DED systems introduces novel regulatory considerations related to process validation, quality assurance, and liability determination. As DED technology increasingly incorporates autonomous operation capabilities, regulatory frameworks must evolve to address questions of responsibility and compliance verification in systems where human oversight is reduced.

One of the most pressing regulatory challenges is the lack of standardized safety protocols specifically designed for DED processes. Current regulations often apply broader additive manufacturing standards that fail to address the unique thermal profiles, material interactions, and energy requirements of DED technology. This regulatory gap has led to inconsistent safety practices across the industry and potential compliance uncertainties.

Material qualification represents another significant regulatory hurdle. DED processes can utilize a wide range of metal powders and wire feedstocks, many of which lack established regulatory frameworks for certification. The absence of standardized testing methodologies for DED-produced parts creates barriers to widespread adoption in highly regulated industries such as aerospace, medical devices, and automotive applications.

Environmental regulations pose additional challenges for DED technology implementation. The high-energy processes involved in DED can generate particulate emissions and waste materials that fall under increasingly stringent environmental protection regulations. Companies must navigate complex waste management requirements and emissions standards that vary significantly across jurisdictions.

Intellectual property protection presents a unique regulatory challenge in the DED space. The technology enables rapid prototyping and production of complex geometries, raising concerns about potential patent infringement and design protection. Current regulatory frameworks struggle to address the implications of digital design files and their relationship to physical production in additive manufacturing contexts.

Cross-border regulatory compliance has emerged as a critical issue for global DED technology providers. The lack of international harmonization in standards creates significant barriers to market entry and technology transfer. Companies operating in multiple regions must maintain compliance with disparate regulatory requirements, increasing operational complexity and compliance costs.

Workforce safety regulations present another layer of complexity. DED systems often involve high-power lasers, electron beams, or plasma arcs that require specialized safety protocols. Current occupational safety regulations may not adequately address the specific hazards associated with these energy sources, creating potential liability issues for employers and technology providers.

AI and automation integration in DED systems introduces novel regulatory considerations related to process validation, quality assurance, and liability determination. As DED technology increasingly incorporates autonomous operation capabilities, regulatory frameworks must evolve to address questions of responsibility and compliance verification in systems where human oversight is reduced.

Current Compliance Strategies and Solutions

01 Directed Energy Deposition Process Fundamentals

Directed Energy Deposition (DED) is an additive manufacturing process that uses focused thermal energy to fuse materials as they are deposited. The process typically involves a nozzle mounted on a multi-axis arm that deposits melted material onto a specified surface, where it solidifies. This technology allows for the creation of complex geometries and can be used with various materials including metals, polymers, and ceramics. The process parameters such as energy source power, material feed rate, and deposition path significantly influence the quality of the final product.- Process fundamentals and equipment for Directed Energy Deposition: Directed Energy Deposition (DED) is an additive manufacturing process that uses focused thermal energy to fuse materials as they are deposited. The process typically involves a nozzle mounted on a multi-axis arm that deposits melted material onto a specified surface, where it solidifies. The energy source can be a laser, electron beam, or plasma arc. This technology allows for the creation of complex geometries and is particularly useful for repair applications and adding features to existing components.

- Material considerations in Directed Energy Deposition: Various materials can be used in the Directed Energy Deposition process, including metals, alloys, and composites. The selection of materials affects the mechanical properties, microstructure, and overall quality of the final product. Powder-based materials are commonly used, but wire feedstock is also an option for certain applications. The material delivery system must be carefully designed to ensure consistent flow and deposition rates, which directly impact the quality and properties of the fabricated parts.

- Process control and optimization in Directed Energy Deposition: Effective process control is crucial for successful Directed Energy Deposition. Parameters such as energy input, deposition rate, travel speed, and layer thickness must be carefully controlled to achieve desired material properties and dimensional accuracy. Real-time monitoring systems can be implemented to detect and correct process variations. Advanced control algorithms and machine learning techniques are being developed to optimize process parameters automatically, reducing defects and improving consistency in the manufactured parts.

- Multi-material and functionally graded components using Directed Energy Deposition: Directed Energy Deposition enables the fabrication of multi-material and functionally graded components, where material composition can be varied continuously throughout the part. This capability allows for the creation of components with location-specific properties, such as wear resistance in one area and heat resistance in another. The process can be used to deposit different materials in different regions of a part or to create gradual transitions between materials, resulting in components with unique property combinations that cannot be achieved through conventional manufacturing methods.

- Applications and advancements in Directed Energy Deposition technology: Directed Energy Deposition has diverse applications across industries including aerospace, automotive, medical, and energy sectors. It is particularly valuable for repair and refurbishment of high-value components, rapid prototyping, and production of large-scale metal parts. Recent advancements include hybrid systems that combine DED with machining operations, improved nozzle designs for better material efficiency, and enhanced process monitoring capabilities. Research is ongoing to expand the range of compatible materials and to improve surface finish and dimensional accuracy of DED-produced parts.

02 Material Considerations for DED Applications

The selection of materials for Directed Energy Deposition significantly impacts the properties of the manufactured components. Various metal powders and wire feedstocks can be used, including titanium alloys, nickel-based superalloys, stainless steels, and aluminum alloys. The material properties such as thermal conductivity, melting point, and powder flowability affect the deposition process and final part quality. Multi-material deposition is also possible, allowing for functionally graded materials and components with varying properties throughout their structure.Expand Specific Solutions03 Energy Sources and Delivery Systems

Different energy sources can be employed in Directed Energy Deposition systems, including lasers, electron beams, plasma arcs, and other focused heat sources. The energy delivery system is crucial for controlling the melt pool size, temperature distribution, and solidification rate. Advanced systems incorporate real-time monitoring and closed-loop control to adjust energy input based on process conditions. The selection of an appropriate energy source depends on the material being processed, desired build rate, and required feature resolution.Expand Specific Solutions04 Process Optimization and Control Strategies

Optimizing the Directed Energy Deposition process involves controlling numerous parameters to achieve desired part quality and properties. Key factors include travel speed, powder feed rate, laser power, spot size, and layer thickness. Advanced control strategies utilize sensors for real-time monitoring of the melt pool, temperature, and build geometry. Machine learning and artificial intelligence approaches are being developed to predict and compensate for process variations. Proper process optimization can minimize defects such as porosity, cracking, and residual stress in the final components.Expand Specific Solutions05 Applications and Emerging Trends

Directed Energy Deposition is widely used for component repair, feature addition to existing parts, and the creation of large-scale metal components. The technology is particularly valuable in aerospace, defense, automotive, and medical industries. Emerging trends include hybrid manufacturing systems that combine DED with traditional machining processes, enabling both additive and subtractive operations in a single setup. Research is also focusing on improving surface finish, dimensional accuracy, and material properties through post-processing techniques and in-situ treatments. The development of specialized DED variants for specific applications continues to expand the technology's capabilities.Expand Specific Solutions

Key Industry Players and Regulatory Responses

The Directed Energy Deposition (DED) industry is currently in a growth phase, characterized by increasing regulatory attention and technological advancement. The market is expanding rapidly, with projections indicating significant growth as industrial applications diversify across manufacturing sectors. From a technological maturity perspective, the landscape shows varied development levels among key players. State Grid Corporation of China and its research institutes demonstrate advanced capabilities in power transmission applications, while educational institutions like North China Electric Power University and Huazhong University of Science & Technology contribute fundamental research. Manufacturing leaders such as GE Avio, Rolls-Royce, and ABB Group are advancing industrial implementations, while research organizations like UT-Battelle and Wisconsin Alumni Research Foundation focus on innovation. The competitive environment reflects a balance between established energy corporations and emerging specialized technology providers.

GE Avio Srl

Technical Solution: GE Avio has developed advanced DED solutions primarily focused on aerospace engine components, addressing regulatory challenges through their integrated manufacturing approach. Their DED technology utilizes both laser and electron beam energy sources, allowing flexibility in meeting different regulatory requirements across markets. GE's regulatory compliance strategy centers on their Digital Twin concept, where virtual models of components are maintained throughout the manufacturing process, enabling digital traceability required by aerospace authorities. Their systems incorporate multiple sensor arrays that monitor build chamber atmosphere, energy input parameters, and material feed rates, generating comprehensive documentation for regulatory submission. GE Avio has implemented specialized powder handling protocols that ensure material consistency while meeting workplace safety regulations. Additionally, they've developed proprietary post-processing techniques that address regulatory concerns regarding material properties, particularly fatigue performance and microstructural consistency in critical applications.

Strengths: Comprehensive digital documentation system facilitates regulatory approval processes; extensive experience with aerospace certification provides credibility with regulatory bodies. Weaknesses: High implementation costs limit accessibility for smaller manufacturers; systems require significant technical expertise to maintain regulatory compliance.

ABB Group

Technical Solution: ABB Group has developed integrated automation solutions for DED manufacturing that address regulatory compliance through advanced robotics and control systems. Their approach focuses on industrial-scale implementation of DED technology with emphasis on energy efficiency and process repeatability to meet manufacturing regulations. ABB's regulatory strategy includes their PowerControl system that precisely manages energy input during deposition, ensuring compliance with energy consumption standards while maintaining build quality. Their robotic DED solutions incorporate advanced path planning algorithms that optimize material usage and reduce waste, addressing environmental regulations concerning material efficiency. ABB has also implemented comprehensive data logging systems that create detailed digital records of manufacturing parameters, facilitating regulatory documentation and traceability requirements. Their integrated safety systems address workplace regulations through automated risk assessment and mitigation features, including thermal monitoring and emergency shutdown protocols specific to high-energy DED processes.

Strengths: Extensive experience in industrial automation provides robust solutions for manufacturing compliance; global presence enables understanding of regional regulatory variations. Weaknesses: Less specialized in material science aspects of DED compared to dedicated additive manufacturing companies; solutions primarily target large industrial applications rather than research or specialized production.

Critical Patents and Technical Standards

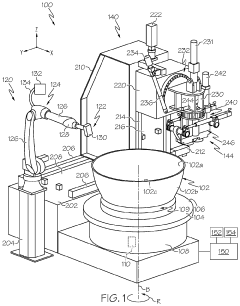

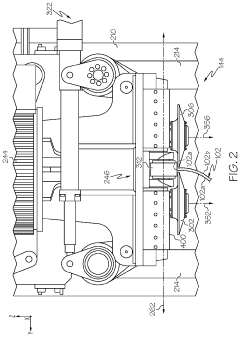

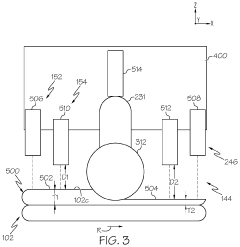

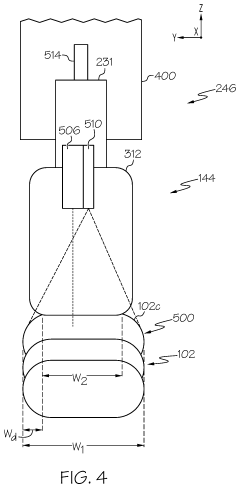

Additive manufacturing system and method for compression of material during material deposition

PatentPendingEP4302912A1

Innovation

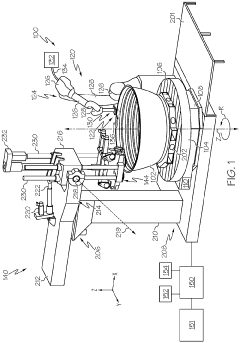

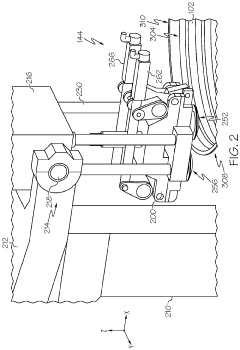

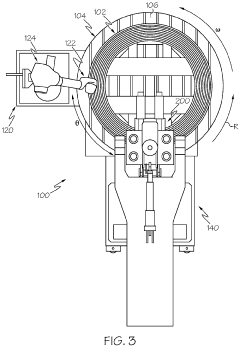

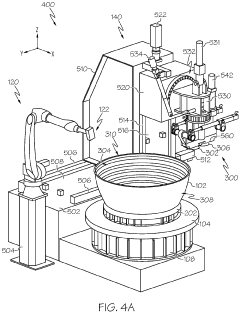

- A DED system that integrates a rotary build table and a compression rig allowing simultaneous deposition and compression phases, utilizing a robotic arm and compression head with rollers to apply compressive loads during material deposition, controlled by a system that ensures uniform temperature and strain application.

Additive manufacturing systems or methods for compression of material based on detected temperature

PatentPendingUS20240009929A1

Innovation

- The implementation of a DED system that combines a deposition head with a compression rig, allowing for simultaneous material deposition and compression using a compression head with temperature and distance sensors to adjust the position and load applied, enabling continuous compressive loading during deposition.

Environmental Impact Assessment of DED Technology

Directed Energy Deposition (DED) technology, while offering significant manufacturing advantages, presents notable environmental considerations that require comprehensive assessment. The environmental footprint of DED processes encompasses multiple dimensions, beginning with energy consumption patterns that typically exceed those of conventional manufacturing methods. Current data indicates that DED systems consume between 15-40 kWh per kilogram of deposited material, depending on the specific technology variant and material processed. This energy intensity necessitates careful evaluation within the broader context of industrial sustainability goals.

Material efficiency represents a positive environmental aspect of DED technology. Unlike subtractive manufacturing processes that can waste up to 90% of raw materials, DED demonstrates superior material utilization rates of 85-95%. This efficiency translates to reduced resource extraction demands and diminished waste generation. However, the environmental benefits gained through material efficiency must be balanced against the specialized metal powders required, which often involve energy-intensive production processes.

Atmospheric emissions constitute another significant environmental consideration. DED processes generate metal fumes, particulate matter, and in some cases, reactive gases that require sophisticated filtration and ventilation systems. Recent studies have documented particulate emissions ranging from 0.1-5.0 mg/m³ during active deposition, with particle sizes predominantly in the respirable range (<10 μm). These emissions present both occupational health concerns and potential environmental impacts if inadequately controlled.

Water usage in DED operations primarily relates to cooling systems and post-processing requirements. While direct process water consumption is relatively modest compared to traditional manufacturing, the potential for contamination with metal particles and processing chemicals necessitates appropriate treatment protocols. Industry best practices currently recommend closed-loop cooling systems that minimize water consumption and prevent discharge of contaminated effluent.

Lifecycle assessment (LCA) studies comparing DED to conventional manufacturing methods reveal complex environmental trade-offs. While DED typically demonstrates advantages in material efficiency and enables lightweight designs that reduce downstream environmental impacts, these benefits must be weighed against higher energy requirements during the manufacturing phase. Comprehensive LCA frameworks specific to DED technologies are still evolving, with current models indicating net environmental benefits primarily in applications involving complex geometries or specialized materials.

Regulatory frameworks addressing DED environmental impacts vary significantly across jurisdictions, creating compliance challenges for global manufacturers. Leading regulatory approaches emphasize emissions monitoring, energy efficiency standards, and waste management protocols specific to additive manufacturing processes. Industry responses have generally favored proactive environmental management systems that anticipate regulatory developments rather than merely meeting minimum compliance thresholds.

Material efficiency represents a positive environmental aspect of DED technology. Unlike subtractive manufacturing processes that can waste up to 90% of raw materials, DED demonstrates superior material utilization rates of 85-95%. This efficiency translates to reduced resource extraction demands and diminished waste generation. However, the environmental benefits gained through material efficiency must be balanced against the specialized metal powders required, which often involve energy-intensive production processes.

Atmospheric emissions constitute another significant environmental consideration. DED processes generate metal fumes, particulate matter, and in some cases, reactive gases that require sophisticated filtration and ventilation systems. Recent studies have documented particulate emissions ranging from 0.1-5.0 mg/m³ during active deposition, with particle sizes predominantly in the respirable range (<10 μm). These emissions present both occupational health concerns and potential environmental impacts if inadequately controlled.

Water usage in DED operations primarily relates to cooling systems and post-processing requirements. While direct process water consumption is relatively modest compared to traditional manufacturing, the potential for contamination with metal particles and processing chemicals necessitates appropriate treatment protocols. Industry best practices currently recommend closed-loop cooling systems that minimize water consumption and prevent discharge of contaminated effluent.

Lifecycle assessment (LCA) studies comparing DED to conventional manufacturing methods reveal complex environmental trade-offs. While DED typically demonstrates advantages in material efficiency and enables lightweight designs that reduce downstream environmental impacts, these benefits must be weighed against higher energy requirements during the manufacturing phase. Comprehensive LCA frameworks specific to DED technologies are still evolving, with current models indicating net environmental benefits primarily in applications involving complex geometries or specialized materials.

Regulatory frameworks addressing DED environmental impacts vary significantly across jurisdictions, creating compliance challenges for global manufacturers. Leading regulatory approaches emphasize emissions monitoring, energy efficiency standards, and waste management protocols specific to additive manufacturing processes. Industry responses have generally favored proactive environmental management systems that anticipate regulatory developments rather than merely meeting minimum compliance thresholds.

International Regulatory Harmonization Efforts

The global landscape of Directed Energy Deposition (DED) regulations presents significant challenges for multinational manufacturers and research institutions. Recognizing these challenges, several international bodies have initiated harmonization efforts to create more consistent regulatory frameworks across borders. The International Organization for Standardization (ISO) has established technical committees specifically focused on additive manufacturing technologies, including DED processes, with the goal of developing standardized terminology, test methods, and quality assurance protocols.

The America-Makes initiative in collaboration with the European Additive Manufacturing Group (EAMG) has launched a joint working group dedicated to aligning regulatory approaches between North America and Europe. This collaboration has resulted in the publication of cross-referenced standards that facilitate compliance across both regions, reducing the regulatory burden on companies operating in these markets.

In the Asia-Pacific region, the Asia Pacific Economic Cooperation (APEC) has implemented a regulatory convergence program for advanced manufacturing technologies. This program includes specific provisions for DED technologies, focusing on material qualification standards and process validation requirements. Japan, South Korea, and Singapore have been particularly active in contributing to these harmonization efforts, leveraging their advanced manufacturing capabilities.

The World Trade Organization's Technical Barriers to Trade (TBT) Committee has also addressed DED regulations, encouraging member states to adopt internationally recognized standards rather than developing country-specific requirements. This approach aims to prevent the creation of unnecessary trade barriers while maintaining appropriate safety and quality controls.

Notable progress has been made in harmonizing material certification processes, with the International Aerospace Quality Group (IAQG) developing a unified approach for aerospace applications of DED technologies. This framework has been adopted by regulatory authorities in multiple countries, creating a pathway for mutual recognition of material certifications.

Despite these advances, significant challenges remain in achieving full regulatory harmonization. Different national priorities regarding environmental protection, worker safety, and intellectual property protection continue to create divergent regulatory requirements. Additionally, the rapid pace of technological innovation in DED processes often outstrips the development of international standards, creating temporary regulatory gaps.

The Global Additive Manufacturing Regulatory Alliance (GAMRA), formed in 2021, represents the most comprehensive effort to date, bringing together regulatory authorities from 28 countries to develop a roadmap for progressive harmonization of DED regulations over the next decade. This initiative includes provisions for regular updates to accommodate technological advancements and emerging risk factors.

The America-Makes initiative in collaboration with the European Additive Manufacturing Group (EAMG) has launched a joint working group dedicated to aligning regulatory approaches between North America and Europe. This collaboration has resulted in the publication of cross-referenced standards that facilitate compliance across both regions, reducing the regulatory burden on companies operating in these markets.

In the Asia-Pacific region, the Asia Pacific Economic Cooperation (APEC) has implemented a regulatory convergence program for advanced manufacturing technologies. This program includes specific provisions for DED technologies, focusing on material qualification standards and process validation requirements. Japan, South Korea, and Singapore have been particularly active in contributing to these harmonization efforts, leveraging their advanced manufacturing capabilities.

The World Trade Organization's Technical Barriers to Trade (TBT) Committee has also addressed DED regulations, encouraging member states to adopt internationally recognized standards rather than developing country-specific requirements. This approach aims to prevent the creation of unnecessary trade barriers while maintaining appropriate safety and quality controls.

Notable progress has been made in harmonizing material certification processes, with the International Aerospace Quality Group (IAQG) developing a unified approach for aerospace applications of DED technologies. This framework has been adopted by regulatory authorities in multiple countries, creating a pathway for mutual recognition of material certifications.

Despite these advances, significant challenges remain in achieving full regulatory harmonization. Different national priorities regarding environmental protection, worker safety, and intellectual property protection continue to create divergent regulatory requirements. Additionally, the rapid pace of technological innovation in DED processes often outstrips the development of international standards, creating temporary regulatory gaps.

The Global Additive Manufacturing Regulatory Alliance (GAMRA), formed in 2021, represents the most comprehensive effort to date, bringing together regulatory authorities from 28 countries to develop a roadmap for progressive harmonization of DED regulations over the next decade. This initiative includes provisions for regular updates to accommodate technological advancements and emerging risk factors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!