Market Impact of Directed Energy Deposition Innovations

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DED Technology Background and Objectives

Directed Energy Deposition (DED) has evolved significantly since its inception in the 1990s as a specialized additive manufacturing technology. Initially developed for repair applications in aerospace and defense sectors, DED has transformed from experimental technology to an increasingly mainstream manufacturing process. The technology utilizes focused thermal energy to fuse materials as they are deposited, enabling the creation of complex metal parts with superior mechanical properties compared to traditional manufacturing methods.

The evolution of DED technology has been marked by several key milestones, including the development of multi-axis deposition systems, integration of real-time monitoring capabilities, and the expansion of compatible material portfolios. Recent advancements have focused on hybrid manufacturing approaches that combine DED with subtractive processes, allowing for unprecedented flexibility in component production and repair.

Current technological trends in DED include enhanced process control through artificial intelligence, improved energy efficiency, and the development of multi-material deposition capabilities. These innovations are driving DED beyond its traditional applications in repair toward broader adoption in primary manufacturing processes across various industries.

The primary objective of DED technology development is to establish a versatile, cost-effective manufacturing solution that can produce complex metal components with minimal material waste and reduced lead times. Specific technical goals include improving deposition accuracy to sub-millimeter precision, enhancing surface finish quality to reduce post-processing requirements, and expanding the range of compatible materials to include high-performance alloys and functionally graded materials.

Additional objectives focus on increasing deposition rates while maintaining structural integrity, developing more sophisticated path planning algorithms, and creating standardized process parameters for consistent quality across different machine platforms. These advancements aim to position DED as a viable alternative to conventional manufacturing for low-volume, high-complexity metal components.

The long-term vision for DED technology encompasses fully automated production systems with integrated quality assurance, material property optimization through precise thermal management, and seamless integration with digital manufacturing ecosystems. As the technology matures, researchers and industry stakeholders are working toward establishing comprehensive design guidelines and material databases specifically tailored for DED processes, facilitating wider adoption across manufacturing sectors.

Understanding the technological trajectory of DED is essential for identifying market opportunities and potential disruptions in traditional manufacturing supply chains, particularly as the technology becomes more accessible to small and medium-sized enterprises through cost reductions and simplified operation.

The evolution of DED technology has been marked by several key milestones, including the development of multi-axis deposition systems, integration of real-time monitoring capabilities, and the expansion of compatible material portfolios. Recent advancements have focused on hybrid manufacturing approaches that combine DED with subtractive processes, allowing for unprecedented flexibility in component production and repair.

Current technological trends in DED include enhanced process control through artificial intelligence, improved energy efficiency, and the development of multi-material deposition capabilities. These innovations are driving DED beyond its traditional applications in repair toward broader adoption in primary manufacturing processes across various industries.

The primary objective of DED technology development is to establish a versatile, cost-effective manufacturing solution that can produce complex metal components with minimal material waste and reduced lead times. Specific technical goals include improving deposition accuracy to sub-millimeter precision, enhancing surface finish quality to reduce post-processing requirements, and expanding the range of compatible materials to include high-performance alloys and functionally graded materials.

Additional objectives focus on increasing deposition rates while maintaining structural integrity, developing more sophisticated path planning algorithms, and creating standardized process parameters for consistent quality across different machine platforms. These advancements aim to position DED as a viable alternative to conventional manufacturing for low-volume, high-complexity metal components.

The long-term vision for DED technology encompasses fully automated production systems with integrated quality assurance, material property optimization through precise thermal management, and seamless integration with digital manufacturing ecosystems. As the technology matures, researchers and industry stakeholders are working toward establishing comprehensive design guidelines and material databases specifically tailored for DED processes, facilitating wider adoption across manufacturing sectors.

Understanding the technological trajectory of DED is essential for identifying market opportunities and potential disruptions in traditional manufacturing supply chains, particularly as the technology becomes more accessible to small and medium-sized enterprises through cost reductions and simplified operation.

Market Demand Analysis for DED Applications

The Directed Energy Deposition (DED) market is experiencing significant growth driven by increasing demand across multiple industrial sectors. Current market analysis indicates that the global DED market is projected to reach approximately 2.3 billion USD by 2027, with a compound annual growth rate exceeding 14% from 2022 to 2027. This robust growth trajectory is primarily fueled by the aerospace, defense, medical, and automotive industries, which collectively account for over 65% of the total market share.

In the aerospace sector, demand for DED technology is particularly strong due to its capability to repair high-value components such as turbine blades, combustion chambers, and structural elements. The ability to restore these components rather than replace them represents potential cost savings of 30-70% per part, a compelling value proposition for an industry where component costs can reach hundreds of thousands of dollars.

The medical device industry presents another significant market opportunity, with demand growing for customized implants and prosthetics. DED's ability to create patient-specific medical devices with complex geometries and biocompatible materials addresses a market segment valued at approximately 1.1 billion USD, with projected annual growth rates of 16-18% through 2030.

From a geographical perspective, North America currently leads the DED market with approximately 38% market share, followed by Europe at 31% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next five years, driven by rapid industrialization in China, Japan, and South Korea, and substantial government investments in advanced manufacturing technologies.

Material consumption patterns reveal increasing demand for specialized metal powders compatible with DED processes. The market for these materials is growing at nearly 20% annually, with titanium alloys, nickel-based superalloys, and stainless steels being the most sought-after materials. This represents a complementary market opportunity exceeding 500 million USD annually.

End-user feedback indicates growing interest in hybrid manufacturing systems that combine DED with traditional machining capabilities. This trend reflects the industrial need for complete manufacturing solutions rather than standalone additive manufacturing technologies. Market surveys show that approximately 62% of potential industrial adopters prioritize integrated solutions that can seamlessly fit into existing production workflows.

The service sector surrounding DED technology, including training, maintenance, and application development, represents an additional market opportunity estimated at 300-400 million USD annually, with consistent growth expected as the installed base of DED systems expands globally.

In the aerospace sector, demand for DED technology is particularly strong due to its capability to repair high-value components such as turbine blades, combustion chambers, and structural elements. The ability to restore these components rather than replace them represents potential cost savings of 30-70% per part, a compelling value proposition for an industry where component costs can reach hundreds of thousands of dollars.

The medical device industry presents another significant market opportunity, with demand growing for customized implants and prosthetics. DED's ability to create patient-specific medical devices with complex geometries and biocompatible materials addresses a market segment valued at approximately 1.1 billion USD, with projected annual growth rates of 16-18% through 2030.

From a geographical perspective, North America currently leads the DED market with approximately 38% market share, followed by Europe at 31% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next five years, driven by rapid industrialization in China, Japan, and South Korea, and substantial government investments in advanced manufacturing technologies.

Material consumption patterns reveal increasing demand for specialized metal powders compatible with DED processes. The market for these materials is growing at nearly 20% annually, with titanium alloys, nickel-based superalloys, and stainless steels being the most sought-after materials. This represents a complementary market opportunity exceeding 500 million USD annually.

End-user feedback indicates growing interest in hybrid manufacturing systems that combine DED with traditional machining capabilities. This trend reflects the industrial need for complete manufacturing solutions rather than standalone additive manufacturing technologies. Market surveys show that approximately 62% of potential industrial adopters prioritize integrated solutions that can seamlessly fit into existing production workflows.

The service sector surrounding DED technology, including training, maintenance, and application development, represents an additional market opportunity estimated at 300-400 million USD annually, with consistent growth expected as the installed base of DED systems expands globally.

Current DED Technology Landscape and Challenges

Directed Energy Deposition (DED) technology has evolved significantly over the past decade, establishing itself as a critical additive manufacturing process for metal components. Currently, the global DED market is experiencing robust growth, with an estimated market size of approximately $500 million in 2023 and projected to reach $1.2 billion by 2028, representing a compound annual growth rate of 19.1%.

The current technological landscape of DED encompasses several variants, including Laser Engineered Net Shaping (LENS), Direct Metal Deposition (DMD), and Wire Arc Additive Manufacturing (WAAM). Each variant offers distinct advantages in terms of material compatibility, deposition rates, and precision. Laser-based DED systems dominate the market with approximately 65% share, while wire-feed systems are gaining traction due to their cost-effectiveness and higher deposition rates.

Despite its promising growth trajectory, DED technology faces several significant challenges. Material efficiency remains a concern, with typical powder utilization rates ranging from 70-85%, considerably lower than competing technologies like Powder Bed Fusion. This inefficiency contributes to higher operational costs and environmental concerns related to material waste.

Process stability and repeatability present another major hurdle. The complex thermal dynamics during deposition often lead to inconsistent material properties across builds, with variations in mechanical strength reported between 5-15% depending on process parameters. This variability hampers widespread adoption in industries with stringent quality requirements such as aerospace and medical devices.

Monitoring and quality control systems for DED processes remain underdeveloped compared to other additive manufacturing technologies. Current in-situ monitoring solutions capture only limited data points, creating challenges for real-time process adjustment and quality assurance. Industry reports indicate that approximately 60% of DED users identify quality control as their primary technical challenge.

Geographical distribution of DED technology development shows concentration in North America (38%), Europe (35%), and East Asia (22%), with emerging markets accounting for the remaining 5%. The United States, Germany, and China lead in patent filings related to DED innovations, collectively representing over 70% of global intellectual property in this domain.

Energy efficiency represents another significant challenge, with DED systems typically consuming 15-25 kW during operation, substantially higher than alternative manufacturing methods. This high energy demand not only increases operational costs but also raises concerns about the technology's environmental footprint, potentially limiting its adoption in industries prioritizing sustainability.

The current technological landscape of DED encompasses several variants, including Laser Engineered Net Shaping (LENS), Direct Metal Deposition (DMD), and Wire Arc Additive Manufacturing (WAAM). Each variant offers distinct advantages in terms of material compatibility, deposition rates, and precision. Laser-based DED systems dominate the market with approximately 65% share, while wire-feed systems are gaining traction due to their cost-effectiveness and higher deposition rates.

Despite its promising growth trajectory, DED technology faces several significant challenges. Material efficiency remains a concern, with typical powder utilization rates ranging from 70-85%, considerably lower than competing technologies like Powder Bed Fusion. This inefficiency contributes to higher operational costs and environmental concerns related to material waste.

Process stability and repeatability present another major hurdle. The complex thermal dynamics during deposition often lead to inconsistent material properties across builds, with variations in mechanical strength reported between 5-15% depending on process parameters. This variability hampers widespread adoption in industries with stringent quality requirements such as aerospace and medical devices.

Monitoring and quality control systems for DED processes remain underdeveloped compared to other additive manufacturing technologies. Current in-situ monitoring solutions capture only limited data points, creating challenges for real-time process adjustment and quality assurance. Industry reports indicate that approximately 60% of DED users identify quality control as their primary technical challenge.

Geographical distribution of DED technology development shows concentration in North America (38%), Europe (35%), and East Asia (22%), with emerging markets accounting for the remaining 5%. The United States, Germany, and China lead in patent filings related to DED innovations, collectively representing over 70% of global intellectual property in this domain.

Energy efficiency represents another significant challenge, with DED systems typically consuming 15-25 kW during operation, substantially higher than alternative manufacturing methods. This high energy demand not only increases operational costs but also raises concerns about the technology's environmental footprint, potentially limiting its adoption in industries prioritizing sustainability.

Current DED Implementation Solutions

01 Process fundamentals and equipment for Directed Energy Deposition

Directed Energy Deposition (DED) is an additive manufacturing process that uses focused thermal energy to fuse materials as they are deposited. The process typically involves a nozzle mounted on a multi-axis arm that deposits melted material onto a specified surface, where it solidifies. The energy source can be a laser, electron beam, or plasma arc. This technology allows for the creation of complex geometries and can be used for both new part manufacturing and repair applications.- Directed Energy Deposition Process Fundamentals: Directed Energy Deposition (DED) is an additive manufacturing process where focused thermal energy is used to fuse materials by melting as they are being deposited. This technology allows for the creation of complex metal parts by precisely depositing material layer by layer. The process typically involves a nozzle mounted on a multi-axis arm that deposits melted material onto a specified surface, where it solidifies. This technique is particularly valuable for repair applications and adding features to existing components.

- Material Innovations for DED Applications: Various materials can be used in Directed Energy Deposition processes, including metal powders, wire feedstock, and composite materials. Recent innovations focus on developing specialized alloys and material combinations that enhance the mechanical properties, corrosion resistance, and thermal stability of the final parts. These advancements enable the production of components with gradient material properties, which is particularly beneficial for aerospace, automotive, and medical applications where specific performance characteristics are required in different areas of the same part.

- Equipment and System Configurations: DED systems vary in configuration, with equipment designs tailored to specific applications. These systems typically include a power source (laser, electron beam, or plasma arc), material delivery system, motion control system, and monitoring equipment. Advanced DED machines incorporate multi-axis movement capabilities, allowing for the deposition of material at various angles and orientations. Some systems feature closed-loop control mechanisms that adjust process parameters in real-time based on sensor feedback, ensuring consistent quality and dimensional accuracy of the fabricated parts.

- Process Control and Quality Assurance: Effective process control is crucial for successful DED manufacturing. This includes precise management of energy input, material feed rate, deposition path, and cooling conditions. Advanced monitoring systems employ thermal cameras, spectrometers, and high-speed imaging to track the melt pool dynamics and solidification behavior. Machine learning algorithms analyze this data to detect anomalies and predict potential defects. Post-processing techniques such as heat treatment, machining, and surface finishing are often employed to achieve the desired mechanical properties and surface quality in DED-manufactured components.

- Hybrid Manufacturing Approaches: Hybrid manufacturing systems combine DED with traditional subtractive manufacturing methods, such as CNC machining, within a single platform. This integration allows for the deposition of material followed by precision machining in one setup, reducing production time and improving dimensional accuracy. These hybrid approaches are particularly valuable for repairing high-value components, adding features to existing parts, and creating complex geometries that would be difficult to achieve using either additive or subtractive methods alone. The combination of technologies enables manufacturers to leverage the strengths of both processes while minimizing their limitations.

02 Material considerations and feedstock systems

Various materials can be processed using Directed Energy Deposition, including metals, alloys, and composites. The material is typically supplied in powder or wire form through specialized feeding systems. The selection of appropriate feedstock materials and their delivery mechanisms significantly impacts the quality of the final product. Parameters such as particle size distribution, flow characteristics, and material compatibility with the energy source must be carefully controlled to achieve optimal deposition results.Expand Specific Solutions03 Process control and parameter optimization

Successful Directed Energy Deposition requires precise control of numerous process parameters including laser power, scan speed, powder feed rate, and layer thickness. Advanced monitoring systems are employed to maintain consistent quality throughout the build process. Real-time adjustments based on thermal imaging, melt pool monitoring, and other sensor data help optimize the deposition process. Machine learning algorithms can be utilized to predict optimal parameters for specific geometries and materials, reducing the need for extensive trial-and-error experimentation.Expand Specific Solutions04 Multi-material and functionally graded components

Directed Energy Deposition enables the fabrication of multi-material components and functionally graded materials where composition changes gradually throughout the part. This capability allows for the creation of components with location-specific properties, such as wear resistance in one area and heat resistance in another. The technology can blend different metal powders during deposition to create transition zones between dissimilar materials, addressing challenges related to thermal expansion mismatches and improving overall component performance.Expand Specific Solutions05 Repair and remanufacturing applications

One significant advantage of Directed Energy Deposition is its ability to add material to existing parts for repair or modification purposes. This capability is particularly valuable for high-value components in aerospace, defense, and industrial applications. The process can restore worn surfaces, repair cracks, and add features to existing components. Compared to traditional repair methods, DED offers advantages in terms of material efficiency, reduced heat-affected zones, and the ability to restore original geometries with minimal post-processing.Expand Specific Solutions

Key Industry Players in DED Manufacturing

The Directed Energy Deposition (DED) market is currently in a growth phase, with increasing adoption across aerospace, energy, and manufacturing sectors. The market size is projected to expand significantly due to advancements in additive manufacturing technologies and growing industrial applications. Key players like GE Avio, Rolls-Royce, and Stratasys are driving technological maturity through substantial R&D investments, while academic institutions such as Shanghai Jiao Tong University and Tianjin University are contributing fundamental research. Companies including Siemens AG, ABB Group, and SRI International are advancing industrial applications, focusing on process optimization and material development. The competitive landscape features established industrial giants alongside specialized additive manufacturing firms, with increasing collaboration between academic and commercial entities accelerating innovation and market penetration.

Rolls-Royce Corp.

Technical Solution: Rolls-Royce has developed advanced Directed Energy Deposition (DED) technologies specifically tailored for aerospace applications, focusing on large structural components and repair solutions for high-value engine parts. Their proprietary WireFeed DED system utilizes wire feedstock rather than powder, enabling faster deposition rates (up to 10kg/hour) while maintaining precise control over material properties. This approach significantly reduces material waste compared to traditional manufacturing methods. Rolls-Royce has integrated sophisticated thermal management systems that control cooling rates during deposition, allowing for tailored microstructure development in critical aerospace alloys including titanium, nickel superalloys, and specialized steel compositions. Their DED technology incorporates in-situ monitoring with infrared and optical sensors that provide real-time feedback on build quality, enabling adaptive control of process parameters to maintain consistent material properties throughout large structures. Rolls-Royce has successfully implemented this technology for repair operations on turbine components, extending part life and reducing maintenance costs.

Strengths: Wire-based feedstock provides cost advantages for large components; excellent material efficiency (>95%); proven capability for repair of high-value components; integrated quality assurance systems. Weaknesses: More limited in geometric complexity compared to powder-based systems; challenges with certain alloy compositions; requires significant post-processing for critical aerospace applications.

Stratasys, Inc.

Technical Solution: Stratasys has expanded its additive manufacturing portfolio to include Directed Energy Deposition (DED) technology through strategic partnerships and acquisitions. Their DED solution focuses on hybrid manufacturing, combining material deposition with in-process machining capabilities to achieve near-net shape components with finished surface quality. Stratasys' approach utilizes a 5-axis motion system that enables omnidirectional deposition, allowing for complex geometries without support structures and the ability to add features to existing parts. Their system incorporates dual material feeds that can switch between different metal powders during a single build process, enabling functionally graded materials and strategic reinforcement of high-stress regions. Stratasys has developed specialized software that optimizes toolpaths based on thermal modeling, reducing residual stress in finished parts and improving mechanical properties. Their DED technology achieves deposition rates of 0.5-2kg/hour while maintaining dimensional accuracy within ±0.2mm, positioning it as an efficient solution for medium to large metal components that would otherwise require extensive machining from solid billets.

Strengths: Hybrid manufacturing approach reduces post-processing requirements; excellent for adding features to existing parts; sophisticated software integration for optimized builds; good balance between speed and precision. Weaknesses: Higher initial investment compared to pure DED systems; complexity of maintaining both additive and subtractive capabilities; more limited material selection than some specialized DED providers.

Critical DED Patents and Technical Innovations

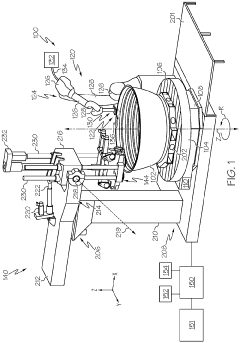

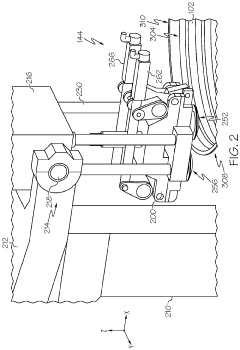

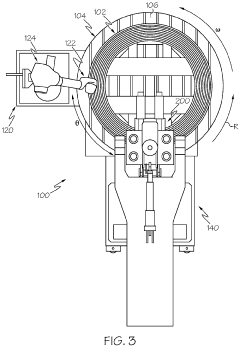

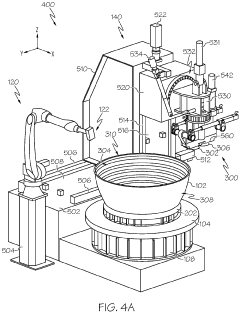

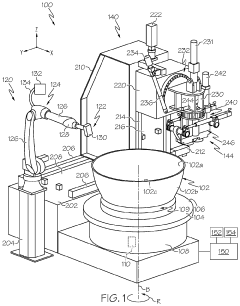

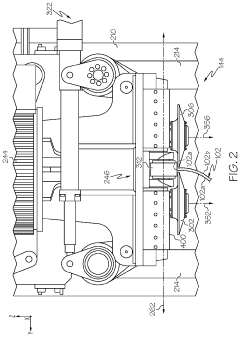

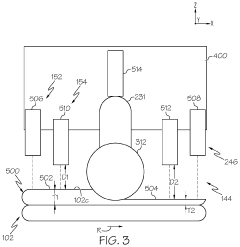

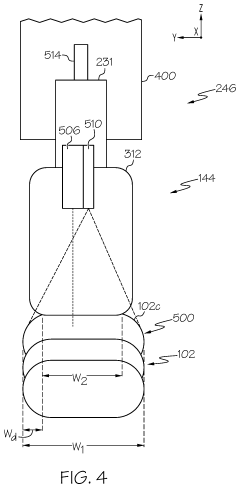

Additive manufacturing system and method for compression of material during material deposition

PatentPendingEP4302912A1

Innovation

- A DED system that integrates a rotary build table and a compression rig allowing simultaneous deposition and compression phases, utilizing a robotic arm and compression head with rollers to apply compressive loads during material deposition, controlled by a system that ensures uniform temperature and strain application.

Additive manufacturing systems or methods for compression of material based on detected temperature

PatentPendingUS20240009929A1

Innovation

- The implementation of a DED system that combines a deposition head with a compression rig, allowing for simultaneous material deposition and compression using a compression head with temperature and distance sensors to adjust the position and load applied, enabling continuous compressive loading during deposition.

Sustainability Impact of DED Manufacturing

Directed Energy Deposition (DED) manufacturing represents a significant advancement in sustainable manufacturing practices, offering numerous environmental benefits compared to traditional manufacturing methods. The additive nature of DED processes substantially reduces material waste, with utilization rates often exceeding 90% compared to conventional subtractive manufacturing techniques that may waste up to 80% of raw materials. This dramatic improvement in material efficiency directly translates to reduced resource extraction and associated environmental impacts.

Energy consumption patterns in DED manufacturing also demonstrate sustainability advantages. While the energy intensity during the deposition process itself can be high, the overall lifecycle energy requirements are frequently lower than conventional manufacturing when considering the entire production chain. Studies indicate potential energy savings of 25-50% for complex components, particularly when factoring in reduced transportation needs and simplified supply chains enabled by localized production capabilities.

Carbon footprint reduction represents another critical sustainability benefit of DED technologies. The combination of reduced material waste, optimized energy usage, and potential for using recycled feedstock materials contributes to greenhouse gas emission reductions. Research indicates that for certain applications, particularly in aerospace and medical industries, DED manufacturing can reduce carbon emissions by 30-60% compared to traditional manufacturing methods.

The circular economy potential of DED manufacturing further enhances its sustainability profile. The technology enables easier component repair and remanufacturing, extending product lifecycles and reducing the need for complete replacements. Additionally, DED processes can often utilize recycled materials as feedstock, creating closed-loop material systems that minimize virgin resource requirements and landfill waste.

Water usage in DED manufacturing processes is typically lower than in conventional manufacturing, particularly when compared to chemical-intensive processes. This reduced water footprint, combined with minimal use of harmful chemicals and coolants, contributes to overall environmental impact reduction and workplace safety improvements.

As DED technologies continue to mature, their sustainability benefits are likely to expand through improved process efficiency, material development, and integration with renewable energy sources. The adoption of DED manufacturing represents not only a technological advancement but also a significant step toward more sustainable industrial practices aligned with global environmental goals and circular economy principles.

Energy consumption patterns in DED manufacturing also demonstrate sustainability advantages. While the energy intensity during the deposition process itself can be high, the overall lifecycle energy requirements are frequently lower than conventional manufacturing when considering the entire production chain. Studies indicate potential energy savings of 25-50% for complex components, particularly when factoring in reduced transportation needs and simplified supply chains enabled by localized production capabilities.

Carbon footprint reduction represents another critical sustainability benefit of DED technologies. The combination of reduced material waste, optimized energy usage, and potential for using recycled feedstock materials contributes to greenhouse gas emission reductions. Research indicates that for certain applications, particularly in aerospace and medical industries, DED manufacturing can reduce carbon emissions by 30-60% compared to traditional manufacturing methods.

The circular economy potential of DED manufacturing further enhances its sustainability profile. The technology enables easier component repair and remanufacturing, extending product lifecycles and reducing the need for complete replacements. Additionally, DED processes can often utilize recycled materials as feedstock, creating closed-loop material systems that minimize virgin resource requirements and landfill waste.

Water usage in DED manufacturing processes is typically lower than in conventional manufacturing, particularly when compared to chemical-intensive processes. This reduced water footprint, combined with minimal use of harmful chemicals and coolants, contributes to overall environmental impact reduction and workplace safety improvements.

As DED technologies continue to mature, their sustainability benefits are likely to expand through improved process efficiency, material development, and integration with renewable energy sources. The adoption of DED manufacturing represents not only a technological advancement but also a significant step toward more sustainable industrial practices aligned with global environmental goals and circular economy principles.

Supply Chain Implications for DED Adoption

The adoption of Directed Energy Deposition (DED) technology is poised to fundamentally transform traditional manufacturing supply chains, creating both opportunities and challenges for industry stakeholders. As DED enables on-demand, localized production of complex metal components, the conventional centralized manufacturing model is giving way to more distributed production networks.

Primary supply chain implications include significant reductions in inventory requirements, as DED allows for just-in-time manufacturing of components that previously required substantial stockpiling. This shift minimizes warehousing costs and reduces capital tied up in inventory, particularly beneficial for high-value, low-volume parts common in aerospace and medical industries.

Transportation logistics stand to be dramatically simplified as DED technology enables localized production closer to end-users. The ability to manufacture components on-site or near point-of-use reduces shipping distances, costs, and associated carbon emissions. This localization effect may disrupt traditional global supply chain configurations that have historically been optimized for mass production economies of scale.

Raw material supply chains are also evolving to accommodate DED requirements. The technology primarily utilizes metal powders or wire feedstock with specific characteristics, driving suppliers to develop specialized materials with properties optimized for DED processes. This has created new market opportunities for material suppliers while potentially disrupting conventional metal supply formats.

Lead times across the supply chain are experiencing compression, with DED enabling rapid prototyping and production of components that previously required weeks or months to manufacture using traditional methods. This acceleration facilitates more responsive supply chains capable of adapting quickly to market demands and design iterations.

For maintenance and repair operations, DED offers revolutionary potential in extending product lifecycles through on-site repair capabilities. This reduces dependence on replacement part logistics and creates new service-oriented business models within traditional manufacturing supply chains.

However, adoption barriers remain significant. Integration of DED into existing supply chain management systems requires substantial investment in digital infrastructure to enable seamless information flow between design, production, and logistics functions. Additionally, quality assurance protocols must evolve to accommodate the distributed production model that DED enables, ensuring consistent part performance regardless of manufacturing location.

Primary supply chain implications include significant reductions in inventory requirements, as DED allows for just-in-time manufacturing of components that previously required substantial stockpiling. This shift minimizes warehousing costs and reduces capital tied up in inventory, particularly beneficial for high-value, low-volume parts common in aerospace and medical industries.

Transportation logistics stand to be dramatically simplified as DED technology enables localized production closer to end-users. The ability to manufacture components on-site or near point-of-use reduces shipping distances, costs, and associated carbon emissions. This localization effect may disrupt traditional global supply chain configurations that have historically been optimized for mass production economies of scale.

Raw material supply chains are also evolving to accommodate DED requirements. The technology primarily utilizes metal powders or wire feedstock with specific characteristics, driving suppliers to develop specialized materials with properties optimized for DED processes. This has created new market opportunities for material suppliers while potentially disrupting conventional metal supply formats.

Lead times across the supply chain are experiencing compression, with DED enabling rapid prototyping and production of components that previously required weeks or months to manufacture using traditional methods. This acceleration facilitates more responsive supply chains capable of adapting quickly to market demands and design iterations.

For maintenance and repair operations, DED offers revolutionary potential in extending product lifecycles through on-site repair capabilities. This reduces dependence on replacement part logistics and creates new service-oriented business models within traditional manufacturing supply chains.

However, adoption barriers remain significant. Integration of DED into existing supply chain management systems requires substantial investment in digital infrastructure to enable seamless information flow between design, production, and logistics functions. Additionally, quality assurance protocols must evolve to accommodate the distributed production model that DED enables, ensuring consistent part performance regardless of manufacturing location.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!