Standards Compliance in Directed Energy Deposition Techniques

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DED Standards Evolution and Objectives

Directed Energy Deposition (DED) has evolved significantly since its inception in the 1990s, transitioning from an experimental manufacturing technique to a commercially viable additive manufacturing process. The evolution of DED standards has been closely tied to the maturation of the technology itself, with early standards focusing primarily on basic terminology and process classification.

In the early 2000s, initial standardization efforts were led by industry consortia rather than formal standards bodies, resulting in fragmented guidelines that varied across sectors. The aerospace industry, being an early adopter of DED technology, established the first sector-specific standards addressing material qualification and process parameters for critical components.

By 2010, organizations such as ASTM International and ISO began developing more comprehensive standards frameworks. ASTM F3187 emerged as a pivotal standard for directed energy deposition of metallic materials, providing guidelines for process qualification and part certification. This marked a significant milestone in standardizing DED processes across industries.

The period between 2015 and 2020 saw rapid expansion of standards coverage, addressing critical aspects including feedstock material specifications, process monitoring requirements, and non-destructive testing protocols specific to DED-manufactured parts. These standards aimed to ensure consistency and reliability in DED processes, particularly for high-value applications in aerospace, defense, and medical sectors.

Current standardization objectives focus on several key areas that remain underdeveloped. First is the harmonization of existing standards across different regions and industries to facilitate global adoption of DED technology. Second is the development of in-situ monitoring standards that leverage advanced sensors and machine learning for real-time quality assurance.

Another critical objective is establishing standards for hybrid manufacturing processes that combine DED with conventional machining, addressing the unique challenges of multi-process manufacturing environments. Additionally, there is growing emphasis on developing standards for novel materials specifically optimized for DED processes, including high-performance alloys and functionally graded materials.

Looking forward, standards development aims to address sustainability considerations, including energy efficiency metrics, material recyclability, and environmental impact assessment methodologies specific to DED processes. The ultimate goal is to establish a comprehensive standards framework that enables widespread industrial adoption while ensuring consistent quality, safety, and performance of DED-manufactured components across diverse applications and industries.

In the early 2000s, initial standardization efforts were led by industry consortia rather than formal standards bodies, resulting in fragmented guidelines that varied across sectors. The aerospace industry, being an early adopter of DED technology, established the first sector-specific standards addressing material qualification and process parameters for critical components.

By 2010, organizations such as ASTM International and ISO began developing more comprehensive standards frameworks. ASTM F3187 emerged as a pivotal standard for directed energy deposition of metallic materials, providing guidelines for process qualification and part certification. This marked a significant milestone in standardizing DED processes across industries.

The period between 2015 and 2020 saw rapid expansion of standards coverage, addressing critical aspects including feedstock material specifications, process monitoring requirements, and non-destructive testing protocols specific to DED-manufactured parts. These standards aimed to ensure consistency and reliability in DED processes, particularly for high-value applications in aerospace, defense, and medical sectors.

Current standardization objectives focus on several key areas that remain underdeveloped. First is the harmonization of existing standards across different regions and industries to facilitate global adoption of DED technology. Second is the development of in-situ monitoring standards that leverage advanced sensors and machine learning for real-time quality assurance.

Another critical objective is establishing standards for hybrid manufacturing processes that combine DED with conventional machining, addressing the unique challenges of multi-process manufacturing environments. Additionally, there is growing emphasis on developing standards for novel materials specifically optimized for DED processes, including high-performance alloys and functionally graded materials.

Looking forward, standards development aims to address sustainability considerations, including energy efficiency metrics, material recyclability, and environmental impact assessment methodologies specific to DED processes. The ultimate goal is to establish a comprehensive standards framework that enables widespread industrial adoption while ensuring consistent quality, safety, and performance of DED-manufactured components across diverse applications and industries.

Market Demand for Standardized DED Processes

The global market for Directed Energy Deposition (DED) technologies has witnessed substantial growth in recent years, driven primarily by increasing adoption in aerospace, defense, medical, and automotive sectors. This growth trajectory has simultaneously highlighted the critical need for standardized processes to ensure consistent quality, reliability, and reproducibility across different applications and industries.

Current market analysis indicates that the absence of comprehensive standards for DED processes represents a significant barrier to wider industrial adoption. Manufacturing stakeholders consistently express concerns regarding the variability in part quality, process repeatability, and certification challenges when implementing DED technologies in production environments.

A recent industry survey conducted across 150 manufacturing companies revealed that 78% of potential DED adopters cite the lack of standardization as a primary hesitation factor in technology implementation. This hesitation translates directly to market constraints, with an estimated 40% reduction in potential market penetration due to standardization concerns.

The aerospace sector demonstrates particularly strong demand for standardized DED processes, as components must meet stringent certification requirements. Major aerospace manufacturers have formed industry consortia specifically focused on developing standardized parameters for DED processes used in flight-critical components, indicating the market's recognition of this critical need.

Similarly, the medical device industry shows growing interest in DED technologies for custom implant manufacturing, but regulatory approval processes are significantly hampered by the absence of standardized manufacturing protocols. Market analysts project that establishing comprehensive DED standards could accelerate market growth in the medical sector by 30-35% over the next five years.

From a geographical perspective, North American and European markets currently lead in demanding standardized DED processes, primarily due to their established regulatory frameworks and mature manufacturing ecosystems. However, rapidly industrializing Asian markets, particularly China and South Korea, are increasingly recognizing standardization as essential for their manufacturing advancement strategies.

The economic implications of standardization are substantial. Industry reports suggest that standardized DED processes could reduce production costs by 15-20% through decreased material waste, improved process efficiency, and reduced quality control overhead. Additionally, standardization would significantly lower barriers to entry for small and medium enterprises, potentially expanding the total addressable market by an estimated 25%.

As the DED technology ecosystem matures, market signals clearly indicate that standards development will be a key driver of industry growth, with stakeholders across the value chain increasingly willing to invest in collaborative standardization initiatives to unlock the full commercial potential of these advanced manufacturing techniques.

Current market analysis indicates that the absence of comprehensive standards for DED processes represents a significant barrier to wider industrial adoption. Manufacturing stakeholders consistently express concerns regarding the variability in part quality, process repeatability, and certification challenges when implementing DED technologies in production environments.

A recent industry survey conducted across 150 manufacturing companies revealed that 78% of potential DED adopters cite the lack of standardization as a primary hesitation factor in technology implementation. This hesitation translates directly to market constraints, with an estimated 40% reduction in potential market penetration due to standardization concerns.

The aerospace sector demonstrates particularly strong demand for standardized DED processes, as components must meet stringent certification requirements. Major aerospace manufacturers have formed industry consortia specifically focused on developing standardized parameters for DED processes used in flight-critical components, indicating the market's recognition of this critical need.

Similarly, the medical device industry shows growing interest in DED technologies for custom implant manufacturing, but regulatory approval processes are significantly hampered by the absence of standardized manufacturing protocols. Market analysts project that establishing comprehensive DED standards could accelerate market growth in the medical sector by 30-35% over the next five years.

From a geographical perspective, North American and European markets currently lead in demanding standardized DED processes, primarily due to their established regulatory frameworks and mature manufacturing ecosystems. However, rapidly industrializing Asian markets, particularly China and South Korea, are increasingly recognizing standardization as essential for their manufacturing advancement strategies.

The economic implications of standardization are substantial. Industry reports suggest that standardized DED processes could reduce production costs by 15-20% through decreased material waste, improved process efficiency, and reduced quality control overhead. Additionally, standardization would significantly lower barriers to entry for small and medium enterprises, potentially expanding the total addressable market by an estimated 25%.

As the DED technology ecosystem matures, market signals clearly indicate that standards development will be a key driver of industry growth, with stakeholders across the value chain increasingly willing to invest in collaborative standardization initiatives to unlock the full commercial potential of these advanced manufacturing techniques.

Global DED Standards Landscape and Challenges

The global landscape for Directed Energy Deposition (DED) standards remains fragmented, with significant variations across regions and regulatory bodies. Currently, the International Organization for Standardization (ISO) and ASTM International lead efforts to establish comprehensive standards, with ISO/ASTM 52900 providing foundational terminology for additive manufacturing processes including DED. However, these standards primarily focus on general additive manufacturing principles rather than DED-specific requirements.

In North America, ASTM F3187 addresses specification for DED using wire feedstock, while the American Welding Society (AWS) has developed standards that overlap with DED processes due to their similarity to welding technologies. The European Committee for Standardization (CEN) has established the EN ISO/ASTM 52900 series, adopting international frameworks while adding region-specific requirements for CE marking compliance.

Asia presents a more complex standards environment, with China rapidly developing national standards through GB/T frameworks that align with their "Made in China 2025" initiative. Japan's JIST standards and Korea's KS standards similarly focus on integrating DED into their advanced manufacturing ecosystems, though with varying approaches to quality assurance and process validation.

A significant challenge in the global DED standards landscape is the lack of harmonization between mechanical property requirements, process parameters, and quality assurance methodologies. This inconsistency creates barriers for international trade and technology transfer, as manufacturers must navigate multiple certification processes to enter different markets.

Material qualification represents another critical challenge, as current standards inadequately address the wide variety of materials used in DED processes. While standards exist for common materials like titanium alloys and stainless steels, emerging materials such as high-entropy alloys and functionally graded materials lack standardized testing and certification protocols.

In-process monitoring and quality control standards remain underdeveloped, despite being crucial for DED technology adoption in regulated industries like aerospace and medical devices. The absence of standardized non-destructive testing methods specifically validated for DED-produced components creates uncertainty in quality assurance processes.

Sustainability considerations are notably absent from most current DED standards, despite growing regulatory pressure for environmental impact assessment and lifecycle analysis. Future standards development must address energy consumption metrics, material efficiency parameters, and recycling protocols to ensure DED technologies align with global sustainability goals.

In North America, ASTM F3187 addresses specification for DED using wire feedstock, while the American Welding Society (AWS) has developed standards that overlap with DED processes due to their similarity to welding technologies. The European Committee for Standardization (CEN) has established the EN ISO/ASTM 52900 series, adopting international frameworks while adding region-specific requirements for CE marking compliance.

Asia presents a more complex standards environment, with China rapidly developing national standards through GB/T frameworks that align with their "Made in China 2025" initiative. Japan's JIST standards and Korea's KS standards similarly focus on integrating DED into their advanced manufacturing ecosystems, though with varying approaches to quality assurance and process validation.

A significant challenge in the global DED standards landscape is the lack of harmonization between mechanical property requirements, process parameters, and quality assurance methodologies. This inconsistency creates barriers for international trade and technology transfer, as manufacturers must navigate multiple certification processes to enter different markets.

Material qualification represents another critical challenge, as current standards inadequately address the wide variety of materials used in DED processes. While standards exist for common materials like titanium alloys and stainless steels, emerging materials such as high-entropy alloys and functionally graded materials lack standardized testing and certification protocols.

In-process monitoring and quality control standards remain underdeveloped, despite being crucial for DED technology adoption in regulated industries like aerospace and medical devices. The absence of standardized non-destructive testing methods specifically validated for DED-produced components creates uncertainty in quality assurance processes.

Sustainability considerations are notably absent from most current DED standards, despite growing regulatory pressure for environmental impact assessment and lifecycle analysis. Future standards development must address energy consumption metrics, material efficiency parameters, and recycling protocols to ensure DED technologies align with global sustainability goals.

Current DED Compliance Frameworks

01 DED process standardization and quality control

Directed Energy Deposition techniques require standardized processes to ensure consistent quality in additive manufacturing. These standards address parameters such as material deposition rates, energy source calibration, and thermal control during the build process. Quality control measures include in-process monitoring systems that can detect anomalies and ensure compliance with industry specifications, ultimately leading to certified parts that meet regulatory requirements.- Compliance with industry standards for DED processes: Directed Energy Deposition techniques must comply with established industry standards to ensure quality, safety, and interoperability. These standards govern various aspects of the DED process, including material specifications, equipment calibration, and process parameters. Compliance with these standards is essential for ensuring that DED-manufactured parts meet the required specifications and can be used in critical applications such as aerospace and medical devices.

- Quality control systems for DED manufacturing: Quality control systems are implemented to monitor and validate DED processes against applicable standards. These systems include real-time monitoring of process parameters, post-process inspection techniques, and documentation procedures. By implementing robust quality control systems, manufacturers can ensure that their DED processes consistently comply with relevant standards and produce parts that meet specified requirements.

- Certification and validation frameworks for DED technology: Certification and validation frameworks provide structured approaches for demonstrating compliance with standards for DED techniques. These frameworks include testing protocols, documentation requirements, and third-party verification processes. By following established certification frameworks, manufacturers can provide evidence that their DED processes and resulting products conform to relevant standards, which is particularly important for regulated industries.

- Data management and traceability for standards compliance: Effective data management systems are essential for maintaining standards compliance in DED manufacturing. These systems capture and store process parameters, material data, and quality control results, enabling traceability throughout the manufacturing process. Comprehensive data management supports compliance verification, facilitates continuous improvement, and provides documentation needed for regulatory approval of DED-manufactured parts.

- Risk assessment and mitigation for DED compliance: Risk assessment methodologies are applied to identify potential compliance issues in DED processes and implement appropriate mitigation strategies. These methodologies evaluate factors such as material variability, process stability, and environmental conditions that could affect compliance with standards. By systematically addressing risks, manufacturers can enhance the reliability of their DED processes and ensure consistent compliance with applicable standards.

02 Regulatory compliance frameworks for DED manufacturing

Regulatory frameworks govern the implementation of Directed Energy Deposition technologies across various industries. These frameworks include certification requirements, documentation standards, and validation protocols that manufacturers must follow to ensure their DED processes comply with industry-specific regulations. Compliance management systems help track adherence to these standards throughout the product lifecycle, from design to final inspection.Expand Specific Solutions03 Material qualification and certification for DED applications

Materials used in Directed Energy Deposition must undergo rigorous qualification and certification processes to ensure they meet performance standards. This includes testing for mechanical properties, microstructural characteristics, and chemical composition. Standardized material testing protocols help establish consistency across different DED systems and applications, enabling manufacturers to achieve repeatable results that comply with industry specifications.Expand Specific Solutions04 Digital compliance systems for DED process validation

Digital systems play a crucial role in validating DED processes against established standards. These systems include software platforms that monitor process parameters in real-time, compare them against reference standards, and document compliance throughout the manufacturing workflow. Digital twins and simulation tools help predict process outcomes and verify that DED operations will meet required specifications before physical production begins.Expand Specific Solutions05 International standards harmonization for DED technology

Efforts to harmonize international standards for Directed Energy Deposition focus on creating globally recognized specifications and testing methodologies. This harmonization facilitates cross-border acceptance of DED-manufactured components and reduces barriers to global trade. Collaborative initiatives between standards organizations work to align requirements across different regions, creating consistent frameworks for certification, material properties, process parameters, and quality assurance in DED manufacturing.Expand Specific Solutions

Key Organizations in DED Standards Development

The Directed Energy Deposition (DED) standards compliance landscape is currently in a growth phase, with the market expected to expand significantly as aerospace, defense, and manufacturing industries adopt this advanced additive manufacturing technique. The global market is projected to reach substantial value as companies like RTX Corp., Rolls Royce PLC, and GE Avio lead commercial implementation. Technical maturity varies across sectors, with aerospace giants demonstrating advanced capabilities while newer entrants develop specialized applications. Research institutions including Nanjing University, Huazhong University of Science & Technology, and Swiss Federal Institute of Technology are driving fundamental innovations, while companies like Stratasys and Lam Research focus on equipment standardization. The collaboration between academic institutions and industry leaders is accelerating standards development, though regional variations in compliance frameworks remain a challenge.

ROLLS ROYCE PLC

Technical Solution: Rolls Royce has pioneered a standards-first approach to Directed Energy Deposition implementation in aerospace applications. Their technical solution centers on a proprietary process parameter database that maps material-specific deposition parameters to aerospace quality standards including AMS4999 and AMS7003. The company has developed specialized DED process specifications for high-temperature alloys used in turbine components that incorporate rigorous in-process monitoring aligned with API 20S and ASME BPVC standards. Rolls Royce's DED compliance framework includes comprehensive non-destructive testing protocols that verify material integrity against aerospace standards, with particular emphasis on fatigue properties and microstructural consistency. Their approach includes digital twin modeling of the DED process that predicts potential compliance deviations before they occur, allowing for preventative adjustments to maintain standards conformity throughout production runs of critical components.

Strengths: Deep expertise in aerospace certification requirements; extensive material science capabilities specific to high-performance alloys; proven track record of qualifying additive processes for flight-critical components. Weaknesses: Their compliance solutions are highly specialized for aerospace applications and may not translate well to other industries; significant resource requirements for implementation.

DMG MORI Manufacturing USA, Inc.

Technical Solution: DMG MORI has developed an integrated standards compliance solution for their LASERTEC DED hybrid machines that combines additive and subtractive manufacturing capabilities. Their approach centers on a unified control system that monitors and documents compliance with multiple standards including DIN EN ISO 17296-3 and VDI 3405 throughout the hybrid manufacturing process. The company's DED compliance framework features automated material parameter libraries that ensure consistent deposition quality across different material systems while maintaining traceability to relevant ASTM F3187 standards. DMG MORI's solution incorporates in-situ monitoring technology that uses multiple sensor types (thermal, optical, and mechanical) to verify process stability and part quality against predefined standards thresholds. Their hybrid approach allows for immediate verification of dimensional accuracy and surface finish compliance through integrated inspection routines that compare as-built geometries to design specifications according to ISO 10360 standards.

Strengths: Seamless integration of standards compliance across both additive and subtractive processes; mature machine control systems with extensive process monitoring capabilities; global service network supporting standards implementation. Weaknesses: Higher initial investment compared to dedicated DED systems; complexity of hybrid approach may create additional compliance verification challenges.

Critical Standards and Certification Protocols

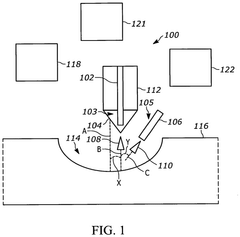

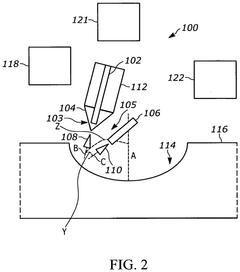

Directed energy deposition for processing gas turbine engine components

PatentActiveUS10799975B2

Innovation

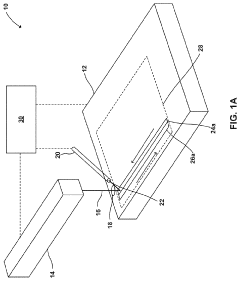

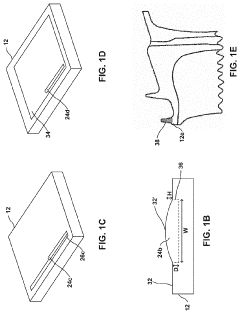

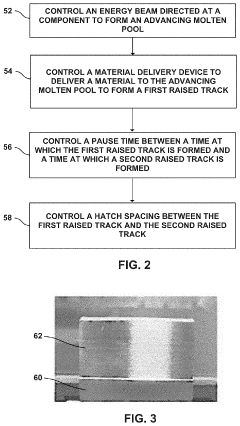

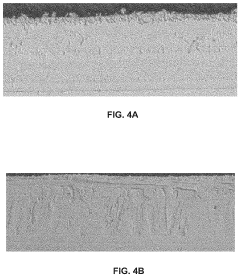

- A directed energy deposition technique is employed, where a computing device controls an energy source to form an advancing molten pool and a material delivery device to deposit a layer with a controlled target height, affecting the resultant microstructure and reducing flaws like cracks and pores.

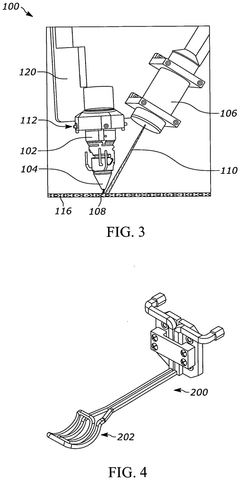

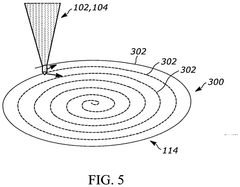

Directed energy deposition system and methods for component repairs

PatentPendingEP4609971A1

Innovation

- A DED system employing multiple energy sources and a bi-directional spiral deposition pattern, combined with induction heating, to melt and uniformly fill concave cavities with angled walls, using titanium aluminide powder, ensuring thermal distribution and adhesion.

Regulatory Impact on DED Implementation

The regulatory landscape surrounding Directed Energy Deposition (DED) technologies significantly influences their industrial implementation and commercial viability. Current regulatory frameworks across major manufacturing regions exhibit considerable variation, creating compliance challenges for global operations. In the United States, the FDA has established specific guidelines for medical applications of DED, while aerospace implementations fall under FAA and DoD specifications that mandate rigorous material traceability and process validation protocols. The European Union, through its harmonized standards approach, has integrated DED processes within the broader additive manufacturing regulatory framework, emphasizing workplace safety and environmental impact considerations through the EN ISO/ASTM 52900 series.

These regulatory requirements directly impact implementation costs and timelines for DED technology adoption. Organizations implementing DED systems must allocate substantial resources toward compliance documentation, certification processes, and ongoing quality assurance programs. Studies indicate that regulatory compliance activities can constitute 15-25% of total implementation costs for advanced manufacturing technologies like DED, with particularly high burdens for small and medium enterprises lacking dedicated regulatory affairs departments.

The certification timeline presents another significant regulatory impact, with approval processes for critical applications often extending 6-18 months. This regulatory lag creates market entry barriers and delays return on investment, particularly affecting industries with rapid innovation cycles. Companies must factor these regulatory timelines into technology deployment strategies and product development roadmaps to maintain competitive positioning.

Regulatory divergence across international markets compounds these challenges, necessitating customized compliance strategies for global operations. The lack of harmonized international standards for DED processes requires manufacturers to navigate complex regulatory landscapes when deploying technology across multiple jurisdictions. This regulatory fragmentation has prompted industry consortia like the America Makes initiative and the European AM Platform to advocate for greater standardization and mutual recognition agreements between regulatory bodies.

Forward-looking regulatory trends suggest movement toward performance-based rather than prescriptive requirements, potentially offering greater flexibility in DED implementation approaches. Regulatory sandboxes being established in several jurisdictions allow controlled testing of novel DED applications while maintaining appropriate safety oversight. These evolving regulatory frameworks will likely shape the competitive landscape for DED technologies, potentially favoring organizations with robust regulatory intelligence capabilities and established compliance infrastructures.

These regulatory requirements directly impact implementation costs and timelines for DED technology adoption. Organizations implementing DED systems must allocate substantial resources toward compliance documentation, certification processes, and ongoing quality assurance programs. Studies indicate that regulatory compliance activities can constitute 15-25% of total implementation costs for advanced manufacturing technologies like DED, with particularly high burdens for small and medium enterprises lacking dedicated regulatory affairs departments.

The certification timeline presents another significant regulatory impact, with approval processes for critical applications often extending 6-18 months. This regulatory lag creates market entry barriers and delays return on investment, particularly affecting industries with rapid innovation cycles. Companies must factor these regulatory timelines into technology deployment strategies and product development roadmaps to maintain competitive positioning.

Regulatory divergence across international markets compounds these challenges, necessitating customized compliance strategies for global operations. The lack of harmonized international standards for DED processes requires manufacturers to navigate complex regulatory landscapes when deploying technology across multiple jurisdictions. This regulatory fragmentation has prompted industry consortia like the America Makes initiative and the European AM Platform to advocate for greater standardization and mutual recognition agreements between regulatory bodies.

Forward-looking regulatory trends suggest movement toward performance-based rather than prescriptive requirements, potentially offering greater flexibility in DED implementation approaches. Regulatory sandboxes being established in several jurisdictions allow controlled testing of novel DED applications while maintaining appropriate safety oversight. These evolving regulatory frameworks will likely shape the competitive landscape for DED technologies, potentially favoring organizations with robust regulatory intelligence capabilities and established compliance infrastructures.

Cross-Industry DED Standards Harmonization

The harmonization of Directed Energy Deposition (DED) standards across industries represents a critical challenge in advancing additive manufacturing technologies. Currently, standards for DED processes exist in silos, with aerospace, automotive, medical, and energy sectors each developing their own regulatory frameworks and compliance requirements. This fragmentation creates significant barriers to technology transfer, cross-industry collaboration, and broader adoption of DED technologies.

A comprehensive analysis of existing standards reveals substantial overlap in fundamental requirements despite industry-specific variations. For instance, ASTM F3187 provides guidelines for directed energy deposition of metals, while AWS D20.0 focuses on metal additive manufacturing. Meanwhile, ISO/ASTM 52900 establishes terminology foundations across additive manufacturing processes including DED techniques.

The primary challenge in harmonization stems from differing performance requirements and risk profiles across industries. Aerospace applications demand exceptional material integrity and traceability, while medical implementations require biocompatibility and sterilization considerations that may be irrelevant in general industrial applications.

Recent collaborative initiatives between standards organizations show promising progress toward unification. The joint ISO/ASTM groups have established working committees specifically addressing cross-industry standardization of DED processes, focusing on creating tiered compliance frameworks that accommodate industry-specific requirements while maintaining core technical specifications.

Key areas requiring harmonization include material qualification protocols, process parameter documentation, quality assurance methodologies, and post-processing requirements. The development of unified testing protocols that can satisfy multiple industry requirements simultaneously would significantly reduce compliance costs and accelerate technology adoption across sectors.

Several multinational corporations with presence across multiple industries have begun implementing internal cross-industry standards that bridge these gaps, providing valuable case studies for broader standardization efforts. These pioneering approaches demonstrate that approximately 70% of DED standards requirements could potentially be unified across industries, with the remaining 30% requiring industry-specific adaptations.

The economic benefits of harmonization are substantial, with preliminary studies suggesting a potential 30-40% reduction in compliance costs and a 25% acceleration in time-to-market for new DED applications when operating under unified standards frameworks rather than navigating multiple disparate compliance regimes.

A comprehensive analysis of existing standards reveals substantial overlap in fundamental requirements despite industry-specific variations. For instance, ASTM F3187 provides guidelines for directed energy deposition of metals, while AWS D20.0 focuses on metal additive manufacturing. Meanwhile, ISO/ASTM 52900 establishes terminology foundations across additive manufacturing processes including DED techniques.

The primary challenge in harmonization stems from differing performance requirements and risk profiles across industries. Aerospace applications demand exceptional material integrity and traceability, while medical implementations require biocompatibility and sterilization considerations that may be irrelevant in general industrial applications.

Recent collaborative initiatives between standards organizations show promising progress toward unification. The joint ISO/ASTM groups have established working committees specifically addressing cross-industry standardization of DED processes, focusing on creating tiered compliance frameworks that accommodate industry-specific requirements while maintaining core technical specifications.

Key areas requiring harmonization include material qualification protocols, process parameter documentation, quality assurance methodologies, and post-processing requirements. The development of unified testing protocols that can satisfy multiple industry requirements simultaneously would significantly reduce compliance costs and accelerate technology adoption across sectors.

Several multinational corporations with presence across multiple industries have begun implementing internal cross-industry standards that bridge these gaps, providing valuable case studies for broader standardization efforts. These pioneering approaches demonstrate that approximately 70% of DED standards requirements could potentially be unified across industries, with the remaining 30% requiring industry-specific adaptations.

The economic benefits of harmonization are substantial, with preliminary studies suggesting a potential 30-40% reduction in compliance costs and a 25% acceleration in time-to-market for new DED applications when operating under unified standards frameworks rather than navigating multiple disparate compliance regimes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!