Analysis of Regulatory Frameworks for PEEK Polymer Use in Electronics

OCT 24, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PEEK Polymer Evolution and Regulatory Objectives

Polyetheretherketone (PEEK) has undergone significant evolution since its commercial introduction in the early 1980s by Imperial Chemical Industries (ICI). This high-performance thermoplastic polymer initially gained prominence in aerospace and automotive applications due to its exceptional thermal stability, chemical resistance, and mechanical strength. The evolution of PEEK in electronics applications began in the late 1980s when manufacturers recognized its potential as an insulating material for high-temperature electronic components.

Throughout the 1990s, PEEK's application in electronics expanded as miniaturization trends demanded materials capable of withstanding increasingly harsh operating conditions. The polymer's ability to maintain structural integrity at temperatures exceeding 300°C while offering excellent electrical insulation properties positioned it as a premium solution for advanced electronic systems. By the early 2000s, PEEK had become integral to semiconductor manufacturing equipment, connectors for harsh environments, and precision electronic components.

The regulatory landscape surrounding PEEK has evolved in parallel with its technological development. Initially, regulations focused primarily on basic safety parameters and mechanical performance standards. However, as electronics became more integrated into critical systems like medical devices, automotive safety systems, and aerospace controls, regulatory frameworks expanded to address reliability under extreme conditions, long-term stability, and environmental considerations.

A significant regulatory milestone occurred in 2011 when major electronics standards organizations incorporated specific provisions for high-performance polymers like PEEK in their guidelines. These standards established testing protocols for thermal cycling, chemical compatibility, and electrical performance specific to semi-crystalline polymers in electronic applications. The RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations in Europe further shaped PEEK's development by mandating compliance with environmental and toxicological requirements.

The current regulatory objectives for PEEK in electronics center on several key areas: ensuring consistent performance across manufacturing batches, establishing standardized testing methodologies specific to high-temperature polymers, developing end-of-life management protocols, and harmonizing international standards to facilitate global trade. Additionally, there is growing regulatory interest in PEEK's carbon footprint and sustainability profile, with emerging standards addressing recycling potential and life-cycle assessment.

Looking forward, regulatory frameworks are evolving toward performance-based approaches rather than prescriptive requirements, allowing for innovation while maintaining safety and reliability. The integration of PEEK into next-generation electronics, including flexible electronics, implantable devices, and high-frequency applications, is driving the development of new testing protocols and certification pathways tailored to these emerging use cases.

Throughout the 1990s, PEEK's application in electronics expanded as miniaturization trends demanded materials capable of withstanding increasingly harsh operating conditions. The polymer's ability to maintain structural integrity at temperatures exceeding 300°C while offering excellent electrical insulation properties positioned it as a premium solution for advanced electronic systems. By the early 2000s, PEEK had become integral to semiconductor manufacturing equipment, connectors for harsh environments, and precision electronic components.

The regulatory landscape surrounding PEEK has evolved in parallel with its technological development. Initially, regulations focused primarily on basic safety parameters and mechanical performance standards. However, as electronics became more integrated into critical systems like medical devices, automotive safety systems, and aerospace controls, regulatory frameworks expanded to address reliability under extreme conditions, long-term stability, and environmental considerations.

A significant regulatory milestone occurred in 2011 when major electronics standards organizations incorporated specific provisions for high-performance polymers like PEEK in their guidelines. These standards established testing protocols for thermal cycling, chemical compatibility, and electrical performance specific to semi-crystalline polymers in electronic applications. The RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations in Europe further shaped PEEK's development by mandating compliance with environmental and toxicological requirements.

The current regulatory objectives for PEEK in electronics center on several key areas: ensuring consistent performance across manufacturing batches, establishing standardized testing methodologies specific to high-temperature polymers, developing end-of-life management protocols, and harmonizing international standards to facilitate global trade. Additionally, there is growing regulatory interest in PEEK's carbon footprint and sustainability profile, with emerging standards addressing recycling potential and life-cycle assessment.

Looking forward, regulatory frameworks are evolving toward performance-based approaches rather than prescriptive requirements, allowing for innovation while maintaining safety and reliability. The integration of PEEK into next-generation electronics, including flexible electronics, implantable devices, and high-frequency applications, is driving the development of new testing protocols and certification pathways tailored to these emerging use cases.

Market Demand Analysis for PEEK in Electronics

The global market for PEEK (Polyetheretherketone) in electronics applications has been experiencing robust growth, driven primarily by the increasing demand for high-performance materials in advanced electronic systems. Current market assessments value the PEEK electronics segment at approximately $320 million, with projections indicating a compound annual growth rate of 6.8% through 2028. This growth trajectory is significantly outpacing many traditional engineering polymers, reflecting the unique value proposition that PEEK offers to electronics manufacturers.

The demand for PEEK in electronics is primarily fueled by several converging industry trends. Miniaturization continues to be a dominant force, with electronic components becoming increasingly compact while simultaneously requiring enhanced thermal management capabilities. PEEK's exceptional thermal stability up to 260°C makes it particularly valuable in this context, allowing for reliable performance in densely packed electronic assemblies where heat dissipation is critical.

Another significant market driver is the rapid expansion of the electric vehicle (EV) sector. The high-voltage systems in EVs require insulating materials with superior dielectric properties and long-term reliability under challenging operating conditions. PEEK components are increasingly specified for battery management systems, power electronics, and charging infrastructure, with the automotive electronics segment now accounting for approximately 22% of total PEEK consumption in electronics applications.

The telecommunications infrastructure market represents another substantial growth area, particularly with the ongoing global rollout of 5G networks. Base station equipment, antenna components, and high-frequency connectors all benefit from PEEK's combination of electrical insulation properties and mechanical stability across wide temperature ranges. Industry analysts note that telecommunications applications currently represent the fastest-growing segment for PEEK in electronics, with a projected growth rate of 8.3% annually.

Regional market analysis reveals that Asia-Pacific dominates PEEK consumption in electronics manufacturing, accounting for 58% of global demand. This concentration aligns with the region's position as the world's electronics manufacturing hub. However, North America and Europe are showing accelerated adoption rates, particularly in specialized applications such as aerospace electronics, medical devices, and industrial automation systems where regulatory compliance and reliability requirements are especially stringent.

Price sensitivity remains a significant factor influencing market penetration. With PEEK typically commanding a premium of 5-8 times the cost of conventional engineering polymers, manufacturers must carefully evaluate the total cost of ownership, including potential savings from extended product lifespans, reduced warranty claims, and elimination of secondary processing steps. Market research indicates that approximately 65% of electronics manufacturers cite cost as the primary barrier to wider PEEK adoption, despite acknowledging its superior technical properties.

The demand for PEEK in electronics is primarily fueled by several converging industry trends. Miniaturization continues to be a dominant force, with electronic components becoming increasingly compact while simultaneously requiring enhanced thermal management capabilities. PEEK's exceptional thermal stability up to 260°C makes it particularly valuable in this context, allowing for reliable performance in densely packed electronic assemblies where heat dissipation is critical.

Another significant market driver is the rapid expansion of the electric vehicle (EV) sector. The high-voltage systems in EVs require insulating materials with superior dielectric properties and long-term reliability under challenging operating conditions. PEEK components are increasingly specified for battery management systems, power electronics, and charging infrastructure, with the automotive electronics segment now accounting for approximately 22% of total PEEK consumption in electronics applications.

The telecommunications infrastructure market represents another substantial growth area, particularly with the ongoing global rollout of 5G networks. Base station equipment, antenna components, and high-frequency connectors all benefit from PEEK's combination of electrical insulation properties and mechanical stability across wide temperature ranges. Industry analysts note that telecommunications applications currently represent the fastest-growing segment for PEEK in electronics, with a projected growth rate of 8.3% annually.

Regional market analysis reveals that Asia-Pacific dominates PEEK consumption in electronics manufacturing, accounting for 58% of global demand. This concentration aligns with the region's position as the world's electronics manufacturing hub. However, North America and Europe are showing accelerated adoption rates, particularly in specialized applications such as aerospace electronics, medical devices, and industrial automation systems where regulatory compliance and reliability requirements are especially stringent.

Price sensitivity remains a significant factor influencing market penetration. With PEEK typically commanding a premium of 5-8 times the cost of conventional engineering polymers, manufacturers must carefully evaluate the total cost of ownership, including potential savings from extended product lifespans, reduced warranty claims, and elimination of secondary processing steps. Market research indicates that approximately 65% of electronics manufacturers cite cost as the primary barrier to wider PEEK adoption, despite acknowledging its superior technical properties.

Global Regulatory Landscape and Technical Challenges

The global regulatory landscape for PEEK polymer in electronics is characterized by a complex web of standards, certifications, and compliance requirements that vary significantly across regions. In North America, the FDA regulates PEEK for medical electronics applications, while the UL (Underwriters Laboratories) certification is crucial for general electronics applications, particularly focusing on flammability ratings under UL 94 standards. The European Union implements more stringent requirements through RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, which directly impact how PEEK polymers can be formulated and used in electronic components.

In Asia, particularly China and Japan, regulatory frameworks have evolved rapidly in recent years, with China's GB standards and Japan's JIS certification systems creating additional compliance hurdles for manufacturers utilizing PEEK in electronics. These regional variations create significant challenges for global supply chains and product development timelines, often requiring region-specific formulations or documentation.

Technical challenges in meeting these diverse regulatory requirements are multifaceted. The primary challenge involves maintaining PEEK's exceptional thermal stability (operating temperature up to 260°C) while simultaneously ensuring compliance with flame retardancy standards without using restricted halogenated compounds. Traditional flame retardants often compromise PEEK's electrical insulation properties or mechanical strength, creating a technical paradox that manufacturers must navigate.

Another significant challenge is the migration of additives from PEEK components during high-temperature operations, which may potentially violate substance restrictions in certain jurisdictions. Testing methodologies for such migration vary across regulatory bodies, creating inconsistent compliance benchmarks. This is particularly problematic for electronics operating in extreme environments where PEEK's thermal stability is most valuable.

The electrical property requirements also present regulatory challenges, as different standards exist for dielectric strength, volume resistivity, and tracking resistance. PEEK formulations optimized for one region's electrical safety standards may require modification to meet another's, increasing development costs and complexity.

Environmental regulations present perhaps the most dynamic challenge, with emerging restrictions on per- and polyfluoroalkyl substances (PFAS) potentially affecting certain PEEK formulations that utilize fluoropolymer processing aids. The end-of-life considerations, including recyclability requirements in the EU's Waste Electrical and Electronic Equipment (WEEE) directive, create additional complexity for PEEK applications in electronics.

These technical and regulatory challenges are further complicated by the lack of harmonization in testing protocols and certification processes, requiring manufacturers to navigate multiple, sometimes contradictory, compliance pathways simultaneously.

In Asia, particularly China and Japan, regulatory frameworks have evolved rapidly in recent years, with China's GB standards and Japan's JIS certification systems creating additional compliance hurdles for manufacturers utilizing PEEK in electronics. These regional variations create significant challenges for global supply chains and product development timelines, often requiring region-specific formulations or documentation.

Technical challenges in meeting these diverse regulatory requirements are multifaceted. The primary challenge involves maintaining PEEK's exceptional thermal stability (operating temperature up to 260°C) while simultaneously ensuring compliance with flame retardancy standards without using restricted halogenated compounds. Traditional flame retardants often compromise PEEK's electrical insulation properties or mechanical strength, creating a technical paradox that manufacturers must navigate.

Another significant challenge is the migration of additives from PEEK components during high-temperature operations, which may potentially violate substance restrictions in certain jurisdictions. Testing methodologies for such migration vary across regulatory bodies, creating inconsistent compliance benchmarks. This is particularly problematic for electronics operating in extreme environments where PEEK's thermal stability is most valuable.

The electrical property requirements also present regulatory challenges, as different standards exist for dielectric strength, volume resistivity, and tracking resistance. PEEK formulations optimized for one region's electrical safety standards may require modification to meet another's, increasing development costs and complexity.

Environmental regulations present perhaps the most dynamic challenge, with emerging restrictions on per- and polyfluoroalkyl substances (PFAS) potentially affecting certain PEEK formulations that utilize fluoropolymer processing aids. The end-of-life considerations, including recyclability requirements in the EU's Waste Electrical and Electronic Equipment (WEEE) directive, create additional complexity for PEEK applications in electronics.

These technical and regulatory challenges are further complicated by the lack of harmonization in testing protocols and certification processes, requiring manufacturers to navigate multiple, sometimes contradictory, compliance pathways simultaneously.

Current Compliance Solutions for PEEK in Electronics

01 PEEK polymer composition and synthesis

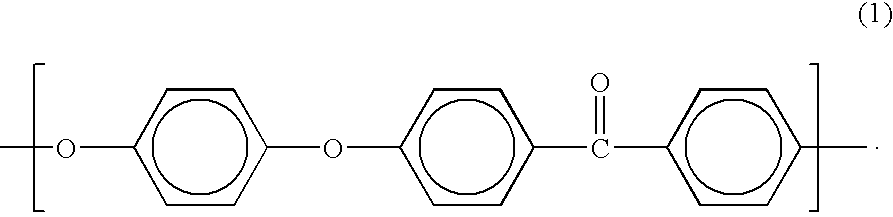

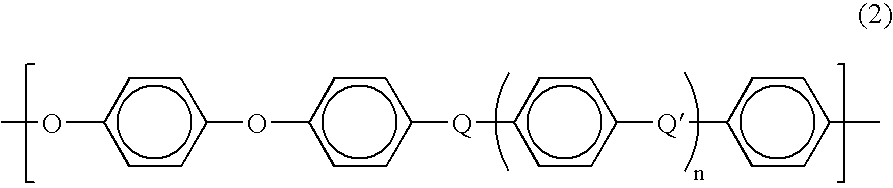

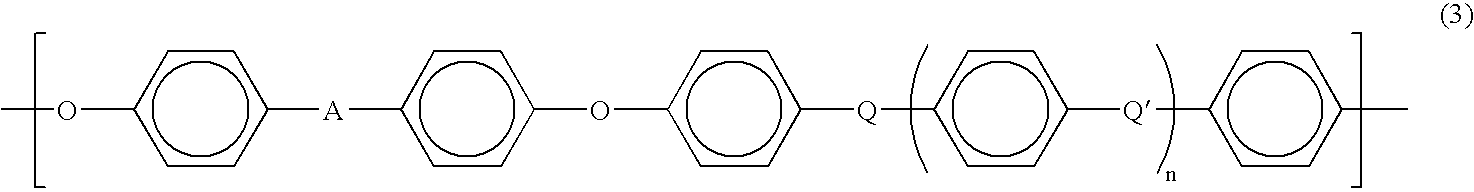

Polyetheretherketone (PEEK) is a high-performance thermoplastic polymer with excellent mechanical properties, chemical resistance, and thermal stability. Various methods for synthesizing PEEK polymers have been developed, including nucleophilic aromatic substitution reactions. The synthesis typically involves the reaction of diphenols with dihalides in the presence of a base. Modifications to the synthesis process can yield PEEK polymers with different molecular weights and properties tailored for specific applications.- PEEK polymer composition and synthesis: Polyetheretherketone (PEEK) is a high-performance thermoplastic polymer with excellent mechanical properties, chemical resistance, and thermal stability. Various methods for synthesizing PEEK polymers involve different reaction conditions and catalysts to achieve specific molecular weights and properties. The synthesis typically involves nucleophilic substitution reactions between diphenols and activated dihalides, resulting in polymers with high crystallinity and superior performance characteristics.

- PEEK polymer blends and composites: PEEK polymers can be blended with other materials or reinforced with fillers to enhance specific properties. These composites often incorporate carbon fibers, glass fibers, or other reinforcing agents to improve mechanical strength, wear resistance, and dimensional stability. The resulting materials exhibit superior performance in demanding applications where conventional polymers would fail, such as in aerospace, automotive, and industrial components that require high temperature resistance and mechanical strength.

- PEEK polymer applications in medical devices: PEEK polymers are widely used in medical applications due to their biocompatibility, radiolucency, and mechanical properties similar to human bone. These polymers are utilized in implantable medical devices, surgical instruments, and dental applications. The material's ability to withstand sterilization processes without degradation and its resistance to body fluids make it an ideal choice for long-term implants and medical components that require high reliability and performance.

- PEEK polymer processing techniques: Various processing techniques are employed for PEEK polymers, including injection molding, extrusion, and additive manufacturing. These methods require specific temperature profiles and processing parameters due to the high melting point and viscosity of PEEK. Advanced processing techniques have been developed to overcome challenges associated with PEEK's high processing temperatures and to achieve complex geometries while maintaining the polymer's exceptional properties.

- PEEK polymer surface modifications and treatments: Surface modifications of PEEK polymers can enhance their adhesion properties, bioactivity, and functionality for specific applications. These treatments include plasma treatment, chemical etching, coating applications, and functionalization with reactive groups. Modified PEEK surfaces show improved bonding with adhesives, enhanced cell attachment for medical applications, and better integration with other materials in composite structures.

02 PEEK polymer blends and composites

PEEK polymers can be blended with other materials to enhance specific properties. These blends and composites often incorporate reinforcing agents such as carbon fibers, glass fibers, or ceramic particles to improve mechanical strength, wear resistance, and thermal conductivity. The resulting composites find applications in aerospace, automotive, and industrial sectors where high performance under extreme conditions is required. The processing methods for these composites often require specialized techniques due to PEEK's high melting temperature.Expand Specific Solutions03 PEEK polymer for medical applications

PEEK polymers have gained significant attention in medical applications due to their biocompatibility, radiolucency, and mechanical properties similar to human bone. They are used in implantable medical devices, orthopedic implants, dental applications, and surgical instruments. Surface modifications of PEEK can enhance cell adhesion and osseointegration. The material's resistance to sterilization processes makes it particularly suitable for reusable medical devices.Expand Specific Solutions04 PEEK polymer in filtration and membrane technology

PEEK polymers are utilized in advanced filtration systems and membrane technologies due to their excellent chemical resistance and thermal stability. PEEK membranes can withstand harsh chemical environments and high temperatures, making them suitable for industrial separation processes, water treatment, and gas separation. The polymer's inherent properties allow for the creation of porous structures with controlled pore sizes for specific filtration applications.Expand Specific Solutions05 PEEK polymer processing techniques

Processing PEEK polymers requires specialized techniques due to their high melting temperatures (around 343°C) and viscosity. Various methods include injection molding, extrusion, compression molding, and additive manufacturing (3D printing). Recent advancements have focused on improving processability through modified PEEK grades with lower processing temperatures or through the use of additives. Post-processing treatments such as annealing can enhance crystallinity and mechanical properties of PEEK parts.Expand Specific Solutions

Key Industry Players and Regulatory Authorities

The regulatory landscape for PEEK polymer in electronics is evolving within a maturing market valued at approximately $1 billion globally, with projected annual growth of 6-8%. The industry is transitioning from early adoption to mainstream implementation, particularly in high-performance electronic applications. Technologically, PEEK has reached commercial maturity but continues to see innovation in specialized applications. Leading players include Victrex Manufacturing and Solvay Specialty Polymers, who dominate with established regulatory compliance frameworks, while Jilin Joinature Polymer and SABIC Global Technologies are expanding their regulatory expertise. Chinese manufacturers like Shenzhen Asia Pacific Industrial are rapidly developing capabilities to meet international standards, creating a competitive environment where regulatory compliance serves as a significant market differentiator.

Solvay Specialty Polymers USA LLC

Technical Solution: Solvay has developed a comprehensive regulatory compliance framework for their KetaSpire® PEEK polymers used in electronics applications. Their approach includes full documentation systems that track material compliance with RoHS, REACH, WEEE, and other global electronics regulations. Solvay's regulatory framework incorporates a three-tier compliance verification system: material qualification testing, manufacturing process controls, and end-product validation. Their PEEK materials undergo rigorous testing for restricted substances according to IEC 62321 standards, with particular focus on flame retardancy requirements while maintaining halogen-free compositions. Solvay provides customers with detailed Declaration of Compliance (DoC) documentation that includes full material disclosure when required by regulations, and maintains a global regulatory affairs team that monitors changing requirements across jurisdictions to ensure continuous compliance.

Strengths: Comprehensive global regulatory knowledge base; established documentation systems; proactive approach to emerging regulations. Weaknesses: Complex compliance documentation may increase administrative burden; regional regulatory variations require constant monitoring and updates to compliance frameworks.

Victrex Manufacturing Ltd.

Technical Solution: Victrex has established a sophisticated regulatory framework for their PEEK polymers in electronics that centers on their VICTREX™ PEEK product line. Their approach features a dedicated Electronic Material Compliance Program that addresses both current regulations and anticipates future regulatory developments. Victrex maintains comprehensive substance declarations that comply with IEC 62474 (Material Declaration for Products of and for the Electrotechnical Industry) standards. Their framework includes a proprietary database tracking over 50 global electronics regulations including RoHS, REACH, China RoHS, and California Proposition 65. Victrex's regulatory strategy incorporates regular third-party testing and certification of their PEEK materials, with particular emphasis on ensuring compliance with low-halogen requirements (IEC 61249-2-21) for modern electronics applications. They provide customers with regulatory compliance certificates and full material disclosure documentation to support downstream compliance requirements.

Strengths: Extensive regulatory tracking system; strong focus on future regulatory preparedness; robust third-party certification program. Weaknesses: Higher compliance costs may impact pricing; specialized regulatory requirements for high-performance applications may limit some market applications.

Critical Standards and Testing Protocols Analysis

High-strength and low-chroma polyetheretherketone and preparation method therefor

PatentPendingUS20240360279A1

Innovation

- A nucleophilic polycondensation reaction process under controlled pressure (0.15 MPa to 1.0 MPa) and temperature (140° C. to 260° C.) using specific monomers and alkali carbonates in an inert atmosphere to produce PEEK with improved impact strength and whiter color.

Semiconductive film, electric charge control member and process for production the semiconductive film

PatentInactiveUS20070020450A1

Innovation

- A production process involving extrusion of a resin composition comprising PEEK and a conductive filler through a T-die or ring die with controlled lip clearance and temperature, followed by cooling and solidification using a cooling roll or mandrel, to produce a semiconductive film with balanced properties including narrow thickness and volume resistivity scatter, high folding endurance, and excellent mechanical strength.

Environmental Impact and Sustainability Considerations

PEEK polymer applications in electronics present significant environmental considerations that must be evaluated within comprehensive regulatory frameworks. The material's exceptional durability contributes to extended product lifecycles, potentially reducing electronic waste generation compared to conventional polymers. When properly designed, PEEK-based electronic components can remain functional for 10-15 years under normal operating conditions, substantially exceeding the 3-5 year lifespan of components made with standard thermoplastics.

The high thermal stability of PEEK (maintaining structural integrity up to 260°C) enables more efficient recycling processes that preserve material properties through multiple cycles. Research indicates that PEEK can undergo up to five mechanical recycling cycles while retaining approximately 85-90% of its original mechanical properties, compared to conventional polymers that typically degrade significantly after 2-3 cycles.

Energy consumption during PEEK processing represents a sustainability challenge, as its high melting point (343°C) requires approximately 30-40% more energy input during manufacturing compared to common electronics polymers like polycarbonate. This increased energy demand must be balanced against lifecycle benefits when assessing overall environmental impact.

End-of-life management for PEEK-containing electronics presents both opportunities and challenges. While technically recyclable, the composite nature of most electronic applications complicates material separation. Current advanced separation technologies achieve only 60-75% recovery rates for PEEK from complex electronic assemblies. Regulatory frameworks increasingly emphasize design-for-disassembly principles that would improve these recovery rates.

Carbon footprint assessments reveal that PEEK production generates approximately 4-6 kg CO₂ equivalent per kilogram of polymer—higher than conventional alternatives. However, lifecycle analyses demonstrate that this initial carbon investment can be offset through extended product lifespans and reduced replacement frequency when properly implemented in electronic applications.

Water consumption during PEEK manufacturing is relatively modest compared to other high-performance polymers, requiring approximately 40-60 liters per kilogram of finished product. This represents a 15-20% reduction compared to liquid crystal polymers often used in similar applications, offering a sustainability advantage in regions where water scarcity is a concern.

Emerging regulations increasingly focus on chemical safety profiles, where PEEK demonstrates advantages through its minimal leaching characteristics and absence of substances of very high concern (SVHCs). This aligns with global initiatives like the EU's Restriction of Hazardous Substances (RoHS) directive and similar frameworks being adopted in Asia-Pacific markets where electronics manufacturing is concentrated.

The high thermal stability of PEEK (maintaining structural integrity up to 260°C) enables more efficient recycling processes that preserve material properties through multiple cycles. Research indicates that PEEK can undergo up to five mechanical recycling cycles while retaining approximately 85-90% of its original mechanical properties, compared to conventional polymers that typically degrade significantly after 2-3 cycles.

Energy consumption during PEEK processing represents a sustainability challenge, as its high melting point (343°C) requires approximately 30-40% more energy input during manufacturing compared to common electronics polymers like polycarbonate. This increased energy demand must be balanced against lifecycle benefits when assessing overall environmental impact.

End-of-life management for PEEK-containing electronics presents both opportunities and challenges. While technically recyclable, the composite nature of most electronic applications complicates material separation. Current advanced separation technologies achieve only 60-75% recovery rates for PEEK from complex electronic assemblies. Regulatory frameworks increasingly emphasize design-for-disassembly principles that would improve these recovery rates.

Carbon footprint assessments reveal that PEEK production generates approximately 4-6 kg CO₂ equivalent per kilogram of polymer—higher than conventional alternatives. However, lifecycle analyses demonstrate that this initial carbon investment can be offset through extended product lifespans and reduced replacement frequency when properly implemented in electronic applications.

Water consumption during PEEK manufacturing is relatively modest compared to other high-performance polymers, requiring approximately 40-60 liters per kilogram of finished product. This represents a 15-20% reduction compared to liquid crystal polymers often used in similar applications, offering a sustainability advantage in regions where water scarcity is a concern.

Emerging regulations increasingly focus on chemical safety profiles, where PEEK demonstrates advantages through its minimal leaching characteristics and absence of substances of very high concern (SVHCs). This aligns with global initiatives like the EU's Restriction of Hazardous Substances (RoHS) directive and similar frameworks being adopted in Asia-Pacific markets where electronics manufacturing is concentrated.

Cross-Industry Adoption and Harmonization Strategies

The harmonization of regulatory frameworks for PEEK polymer across different industries represents a critical pathway for accelerating its adoption in electronics applications. Currently, industries such as aerospace, medical devices, and automotive have established more mature regulatory frameworks for PEEK utilization, while electronics manufacturers often face fragmented compliance requirements that impede innovation and market entry.

Cross-industry collaboration presents a significant opportunity to streamline regulatory approaches. By examining successful implementation models from aerospace—where PEEK has gained widespread acceptance for high-temperature applications—electronics manufacturers can adopt similar testing protocols and safety standards. The medical device industry's rigorous biocompatibility testing frameworks also offer valuable templates for establishing electronics-specific standards for consumer safety.

Regulatory harmonization strategies should focus on creating unified testing methodologies that address the unique thermal, electrical, and mechanical properties of PEEK polymers. This approach would reduce redundant testing requirements across different markets and jurisdictions, potentially decreasing compliance costs by an estimated 30-40% for manufacturers operating globally.

Industry consortia and standards organizations play a pivotal role in facilitating this harmonization. Organizations such as IEC, IEEE, and ASTM International could develop cross-referenced standards that acknowledge testing and certification from adjacent industries, creating regulatory pathways that recognize the established safety profile of PEEK materials across different applications.

The development of shared material property databases represents another crucial harmonization strategy. By pooling research data on PEEK performance across different operating environments, industries can establish common reference points for regulatory compliance. This collaborative approach would accelerate the qualification process for new PEEK formulations and applications in electronics.

Regional regulatory alignment presents both challenges and opportunities. While the European Union's REACH regulations and RoHS directives provide comprehensive frameworks for polymer use in electronics, alignment with standards in North America and Asia requires strategic coordination. Mutual recognition agreements between regulatory bodies could significantly reduce market entry barriers while maintaining necessary safety standards.

For electronics manufacturers, adopting a modular approach to compliance documentation—where core PEEK material properties are validated once and supplemented with application-specific testing—offers a practical pathway to navigate the current regulatory landscape while broader harmonization efforts progress.

Cross-industry collaboration presents a significant opportunity to streamline regulatory approaches. By examining successful implementation models from aerospace—where PEEK has gained widespread acceptance for high-temperature applications—electronics manufacturers can adopt similar testing protocols and safety standards. The medical device industry's rigorous biocompatibility testing frameworks also offer valuable templates for establishing electronics-specific standards for consumer safety.

Regulatory harmonization strategies should focus on creating unified testing methodologies that address the unique thermal, electrical, and mechanical properties of PEEK polymers. This approach would reduce redundant testing requirements across different markets and jurisdictions, potentially decreasing compliance costs by an estimated 30-40% for manufacturers operating globally.

Industry consortia and standards organizations play a pivotal role in facilitating this harmonization. Organizations such as IEC, IEEE, and ASTM International could develop cross-referenced standards that acknowledge testing and certification from adjacent industries, creating regulatory pathways that recognize the established safety profile of PEEK materials across different applications.

The development of shared material property databases represents another crucial harmonization strategy. By pooling research data on PEEK performance across different operating environments, industries can establish common reference points for regulatory compliance. This collaborative approach would accelerate the qualification process for new PEEK formulations and applications in electronics.

Regional regulatory alignment presents both challenges and opportunities. While the European Union's REACH regulations and RoHS directives provide comprehensive frameworks for polymer use in electronics, alignment with standards in North America and Asia requires strategic coordination. Mutual recognition agreements between regulatory bodies could significantly reduce market entry barriers while maintaining necessary safety standards.

For electronics manufacturers, adopting a modular approach to compliance documentation—where core PEEK material properties are validated once and supplemented with application-specific testing—offers a practical pathway to navigate the current regulatory landscape while broader harmonization efforts progress.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!