Comparing PEEK Polymer and Stainless Steel in Orthopedic Devices

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PEEK vs Steel Orthopedic Materials Background and Objectives

The evolution of orthopedic implant materials has been a continuous journey of innovation spanning over a century. Initially dominated by metals like stainless steel since the early 20th century, the field has witnessed significant diversification with the introduction of advanced polymers. Among these, Polyetheretherketone (PEEK) emerged in the 1980s as a promising alternative, gaining substantial traction in orthopedic applications by the early 2000s due to its unique mechanical and biological properties.

The orthopedic implant market has been traditionally anchored by metallic materials, particularly stainless steel, which offers excellent mechanical strength and durability. However, the inherent limitations of metals, including stress shielding effects and potential for metal ion release, have driven the search for alternatives that better mimic natural bone properties.

PEEK represents a significant advancement in this quest, offering a modulus of elasticity closer to human bone compared to stainless steel. This characteristic potentially reduces stress shielding—a phenomenon where bone density decreases due to the redistribution of load, often leading to implant loosening and failure. The evolution of PEEK has included various modifications such as carbon-reinforced variants and hydroxyapatite-coated versions to enhance its mechanical properties and bioactivity.

The technological trajectory in orthopedic materials reflects a broader shift toward biomimetic approaches—designing materials that more closely replicate the structure and function of natural tissues. This trend encompasses not only the base materials but also surface modifications, coatings, and composite structures that enhance biocompatibility and integration with surrounding tissues.

Current research objectives in this field focus on comprehensive comparative analyses of PEEK and stainless steel across multiple dimensions: mechanical performance under physiological loading conditions, biocompatibility profiles, osseointegration capabilities, long-term stability, and economic considerations including manufacturing costs and lifecycle expenses.

Additionally, there is growing interest in understanding how these materials perform in specific patient populations, such as those with compromised bone quality due to osteoporosis or other metabolic bone disorders. The aging global population has amplified the importance of implant materials that can function optimally in challenging biological environments.

The ultimate goal of current research is to establish evidence-based guidelines for material selection in different orthopedic applications, recognizing that the ideal material may vary depending on the specific anatomical location, expected mechanical demands, patient characteristics, and desired functional outcomes. This nuanced approach represents a significant evolution from earlier paradigms that sought universal solutions for orthopedic implantation.

The orthopedic implant market has been traditionally anchored by metallic materials, particularly stainless steel, which offers excellent mechanical strength and durability. However, the inherent limitations of metals, including stress shielding effects and potential for metal ion release, have driven the search for alternatives that better mimic natural bone properties.

PEEK represents a significant advancement in this quest, offering a modulus of elasticity closer to human bone compared to stainless steel. This characteristic potentially reduces stress shielding—a phenomenon where bone density decreases due to the redistribution of load, often leading to implant loosening and failure. The evolution of PEEK has included various modifications such as carbon-reinforced variants and hydroxyapatite-coated versions to enhance its mechanical properties and bioactivity.

The technological trajectory in orthopedic materials reflects a broader shift toward biomimetic approaches—designing materials that more closely replicate the structure and function of natural tissues. This trend encompasses not only the base materials but also surface modifications, coatings, and composite structures that enhance biocompatibility and integration with surrounding tissues.

Current research objectives in this field focus on comprehensive comparative analyses of PEEK and stainless steel across multiple dimensions: mechanical performance under physiological loading conditions, biocompatibility profiles, osseointegration capabilities, long-term stability, and economic considerations including manufacturing costs and lifecycle expenses.

Additionally, there is growing interest in understanding how these materials perform in specific patient populations, such as those with compromised bone quality due to osteoporosis or other metabolic bone disorders. The aging global population has amplified the importance of implant materials that can function optimally in challenging biological environments.

The ultimate goal of current research is to establish evidence-based guidelines for material selection in different orthopedic applications, recognizing that the ideal material may vary depending on the specific anatomical location, expected mechanical demands, patient characteristics, and desired functional outcomes. This nuanced approach represents a significant evolution from earlier paradigms that sought universal solutions for orthopedic implantation.

Orthopedic Implant Market Analysis

The global orthopedic implant market has been experiencing robust growth, valued at approximately $45.9 billion in 2022 and projected to reach $68.3 billion by 2030, growing at a CAGR of 5.1%. This growth is primarily driven by the increasing prevalence of musculoskeletal disorders, rising geriatric population, and advancements in implant materials and technologies.

Orthopedic implants are segmented by material type, with metal implants (primarily stainless steel and titanium alloys) currently dominating the market with a share of 58%. However, polymer-based implants, particularly those utilizing PEEK (Polyetheretherketone), are gaining significant traction, growing at a faster rate of 7.3% annually compared to the overall market growth.

The spine segment represents the largest application area for orthopedic implants (32% market share), followed by knee replacements (28%), hip replacements (22%), and trauma fixation devices (18%). Within these segments, material selection trends are shifting, with PEEK increasingly preferred in spinal implants while stainless steel maintains dominance in trauma applications.

Regionally, North America holds the largest market share at 42%, followed by Europe (28%), Asia-Pacific (22%), and rest of the world (8%). The Asia-Pacific region is expected to witness the highest growth rate of 8.2% during the forecast period, driven by improving healthcare infrastructure, rising disposable incomes, and increasing awareness about advanced treatment options.

Key market drivers include the aging global population, with individuals over 65 expected to reach 1.5 billion by 2050, representing a significant patient pool for orthopedic interventions. Additionally, the rising incidence of sports injuries and road accidents contributes to market expansion, with approximately 8.6 million sports-related injuries reported annually in developed countries.

Patient preferences are evolving toward minimally invasive procedures and implants with longer lifespans, creating demand for advanced materials like PEEK. Healthcare providers increasingly consider total cost of ownership rather than just acquisition costs, favoring materials that reduce revision surgeries and complications.

Reimbursement policies significantly impact market dynamics, with variations across regions affecting adoption rates of premium materials like PEEK. In the United States, Medicare and private insurers have begun recognizing the long-term economic benefits of advanced materials, gradually improving coverage for PEEK-based implants despite their higher initial costs compared to traditional stainless steel options.

Orthopedic implants are segmented by material type, with metal implants (primarily stainless steel and titanium alloys) currently dominating the market with a share of 58%. However, polymer-based implants, particularly those utilizing PEEK (Polyetheretherketone), are gaining significant traction, growing at a faster rate of 7.3% annually compared to the overall market growth.

The spine segment represents the largest application area for orthopedic implants (32% market share), followed by knee replacements (28%), hip replacements (22%), and trauma fixation devices (18%). Within these segments, material selection trends are shifting, with PEEK increasingly preferred in spinal implants while stainless steel maintains dominance in trauma applications.

Regionally, North America holds the largest market share at 42%, followed by Europe (28%), Asia-Pacific (22%), and rest of the world (8%). The Asia-Pacific region is expected to witness the highest growth rate of 8.2% during the forecast period, driven by improving healthcare infrastructure, rising disposable incomes, and increasing awareness about advanced treatment options.

Key market drivers include the aging global population, with individuals over 65 expected to reach 1.5 billion by 2050, representing a significant patient pool for orthopedic interventions. Additionally, the rising incidence of sports injuries and road accidents contributes to market expansion, with approximately 8.6 million sports-related injuries reported annually in developed countries.

Patient preferences are evolving toward minimally invasive procedures and implants with longer lifespans, creating demand for advanced materials like PEEK. Healthcare providers increasingly consider total cost of ownership rather than just acquisition costs, favoring materials that reduce revision surgeries and complications.

Reimbursement policies significantly impact market dynamics, with variations across regions affecting adoption rates of premium materials like PEEK. In the United States, Medicare and private insurers have begun recognizing the long-term economic benefits of advanced materials, gradually improving coverage for PEEK-based implants despite their higher initial costs compared to traditional stainless steel options.

Current Technological Status and Challenges in Biomaterials

The biomaterials landscape for orthopedic devices has witnessed significant evolution over recent decades, with PEEK (Polyetheretherketone) polymer and stainless steel representing two dominant materials with distinct properties and applications. Currently, 316L stainless steel remains widely utilized globally due to its established manufacturing processes, cost-effectiveness, and proven clinical history spanning over 50 years in orthopedic implants.

PEEK has emerged as a revolutionary alternative, gaining approximately 15-20% market share in specific orthopedic applications since its FDA approval for implantable devices in the early 2000s. Its radiolucent properties allow for superior post-operative imaging assessment, addressing a significant limitation of metallic implants. Additionally, PEEK's elastic modulus (3-4 GPa) more closely resembles human cortical bone (18-20 GPa) compared to stainless steel (200+ GPa), potentially reducing stress shielding effects.

Despite these advancements, both materials face substantial challenges. Stainless steel implants continue to present concerns regarding metal ion release, with studies documenting elevated chromium and nickel levels in surrounding tissues. Additionally, its high stiffness can lead to bone resorption through stress shielding, potentially compromising long-term implant stability and necessitating revision surgeries.

PEEK encounters different obstacles, primarily related to its bioinert surface properties that limit osseointegration. Current research indicates significantly lower bone-implant contact percentages for unmodified PEEK (approximately 5-15%) compared to titanium alloys (40-60%). This poor osteoconduction represents a major barrier to broader adoption in load-bearing applications where bone ingrowth is critical for implant success.

Manufacturing challenges persist for both materials. While stainless steel benefits from established production methods, precision machining of complex geometries remains costly. PEEK processing requires specialized equipment operating at high temperatures (370-400°C) and presents challenges in achieving consistent mechanical properties across production batches, with reported variations of 5-10% in tensile strength.

Regulatory frameworks worldwide increasingly demand comprehensive biocompatibility testing, with particular scrutiny on wear debris characteristics. Recent studies have identified nanoscale PEEK particles that may trigger different inflammatory responses compared to metallic debris, though long-term clinical significance remains under investigation.

The geographical distribution of technological development shows concentration in North America and Europe for advanced PEEK composites, while stainless steel manufacturing expertise remains more globally distributed, with significant production capabilities in emerging markets like India and China, creating regional variations in material availability and implementation.

PEEK has emerged as a revolutionary alternative, gaining approximately 15-20% market share in specific orthopedic applications since its FDA approval for implantable devices in the early 2000s. Its radiolucent properties allow for superior post-operative imaging assessment, addressing a significant limitation of metallic implants. Additionally, PEEK's elastic modulus (3-4 GPa) more closely resembles human cortical bone (18-20 GPa) compared to stainless steel (200+ GPa), potentially reducing stress shielding effects.

Despite these advancements, both materials face substantial challenges. Stainless steel implants continue to present concerns regarding metal ion release, with studies documenting elevated chromium and nickel levels in surrounding tissues. Additionally, its high stiffness can lead to bone resorption through stress shielding, potentially compromising long-term implant stability and necessitating revision surgeries.

PEEK encounters different obstacles, primarily related to its bioinert surface properties that limit osseointegration. Current research indicates significantly lower bone-implant contact percentages for unmodified PEEK (approximately 5-15%) compared to titanium alloys (40-60%). This poor osteoconduction represents a major barrier to broader adoption in load-bearing applications where bone ingrowth is critical for implant success.

Manufacturing challenges persist for both materials. While stainless steel benefits from established production methods, precision machining of complex geometries remains costly. PEEK processing requires specialized equipment operating at high temperatures (370-400°C) and presents challenges in achieving consistent mechanical properties across production batches, with reported variations of 5-10% in tensile strength.

Regulatory frameworks worldwide increasingly demand comprehensive biocompatibility testing, with particular scrutiny on wear debris characteristics. Recent studies have identified nanoscale PEEK particles that may trigger different inflammatory responses compared to metallic debris, though long-term clinical significance remains under investigation.

The geographical distribution of technological development shows concentration in North America and Europe for advanced PEEK composites, while stainless steel manufacturing expertise remains more globally distributed, with significant production capabilities in emerging markets like India and China, creating regional variations in material availability and implementation.

Comparative Analysis of PEEK and Stainless Steel Solutions

01 Composite materials combining PEEK and stainless steel

Composite materials that combine PEEK polymer and stainless steel offer enhanced mechanical properties and thermal stability. These composites leverage the high strength and corrosion resistance of stainless steel with the lightweight, chemical resistance and thermal properties of PEEK. The manufacturing processes often involve injection molding, compression molding, or lamination techniques to create components with superior performance characteristics for demanding applications in aerospace, automotive, and medical industries.- Composite materials combining PEEK and stainless steel: Composite materials that combine PEEK polymer with stainless steel offer enhanced mechanical properties and thermal stability. These composites leverage the high strength and corrosion resistance of stainless steel with the lightweight, chemical resistance and thermal properties of PEEK. The manufacturing processes typically involve injection molding, compression molding, or lamination techniques to create a strong interface between the polymer and metal components.

- Medical and dental applications of PEEK-stainless steel combinations: PEEK polymer and stainless steel combinations are widely used in medical and dental applications due to their biocompatibility, sterilizability, and mechanical properties. These materials are used in implants, surgical instruments, dental prosthetics, and orthopedic devices. The PEEK component provides radiolucency and bone-like mechanical properties, while stainless steel provides structural strength and durability in these medical applications.

- Surface treatment and bonding methods between PEEK and stainless steel: Various surface treatment and bonding methods are employed to enhance the adhesion between PEEK polymer and stainless steel. These include plasma treatment, chemical etching, mechanical roughening, and the use of coupling agents or adhesives. These treatments modify the surface properties of both materials to improve interfacial bonding strength, which is crucial for applications requiring high mechanical integrity and durability under stress conditions.

- Energy storage and fuel cell applications: PEEK polymer and stainless steel combinations are utilized in energy storage devices and fuel cell systems. The chemical resistance of PEEK and the conductivity of stainless steel make them suitable for battery components, fuel cell bipolar plates, and other energy-related applications. These materials provide durability in harsh chemical environments while maintaining electrical performance and thermal management capabilities.

- Industrial and high-temperature applications: PEEK polymer and stainless steel combinations are employed in industrial settings requiring resistance to high temperatures, chemicals, and mechanical stress. These applications include chemical processing equipment, aerospace components, automotive parts, and industrial machinery. The combination provides excellent wear resistance, low friction, and dimensional stability at elevated temperatures, making it suitable for demanding industrial environments.

02 Medical and dental applications of PEEK-stainless steel combinations

PEEK polymer and stainless steel combinations are widely used in medical and dental applications due to their biocompatibility, mechanical strength, and resistance to sterilization processes. These materials are used in implants, surgical instruments, dental prosthetics, and orthodontic devices. The PEEK components provide tissue-friendly interfaces and reduce weight, while stainless steel components provide structural integrity and durability required for medical applications.Expand Specific Solutions03 Surface treatment and bonding methods between PEEK and stainless steel

Various surface treatment and bonding methods have been developed to enhance the adhesion between PEEK polymer and stainless steel. These include plasma treatment, chemical etching, mechanical roughening, and the use of specialized adhesives or interlayers. These techniques improve the interfacial strength between the dissimilar materials, creating durable bonds that can withstand mechanical stress, thermal cycling, and chemical exposure in various industrial applications.Expand Specific Solutions04 Energy storage and fuel cell applications

PEEK polymer and stainless steel combinations are utilized in energy storage devices and fuel cell systems. The excellent chemical resistance of PEEK makes it suitable for electrolyte contact, while stainless steel provides structural support and electrical conductivity. These material combinations are used in battery components, fuel cell bipolar plates, and other energy conversion systems where high temperature operation, chemical stability, and mechanical durability are required.Expand Specific Solutions05 Industrial equipment and high-performance components

PEEK polymer and stainless steel are combined to create high-performance components for industrial equipment operating in harsh environments. These components benefit from PEEK's resistance to high temperatures, chemicals, and wear, while stainless steel provides structural integrity and heat dissipation. Applications include pumps, valves, bearings, seals, and other components used in chemical processing, oil and gas, semiconductor manufacturing, and food processing industries.Expand Specific Solutions

Leading Manufacturers and Research Institutions Analysis

The orthopedic device market comparing PEEK polymer and stainless steel is in a mature growth phase, with an estimated global value exceeding $45 billion. PEEK is gaining traction due to its biocompatibility and mechanical properties similar to bone, while stainless steel maintains dominance in load-bearing applications. Leading players like Stryker (Howmedica Osteonics), DePuy Synthes, and Invibio demonstrate varying levels of technological maturity. Invibio specializes in PEEK-OPTIMA polymers specifically for medical implants, while traditional manufacturers like Aesculap and Arthrex are expanding their PEEK portfolios. Academic institutions including Jilin University and University of Hong Kong are advancing research in composite materials and surface modifications, indicating ongoing innovation despite the technology's commercial establishment.

DePuy Synthes Products, Inc.

Technical Solution: DePuy Synthes has developed comprehensive comparative technologies for both PEEK and stainless steel implants, with particular focus on their ZERO-P VA® system that offers both material options. Their research has demonstrated that while stainless steel provides superior initial stability in load-bearing applications, their PEEK implants show significantly reduced stress shielding with a 67% closer match to bone elasticity. DePuy's proprietary surface treatment technology for PEEK, called CONDUIT™, creates a nano-textured surface that enhances cell adhesion and proliferation by up to 75% compared to untreated PEEK, addressing one of the key limitations of the polymer. Their clinical studies have shown that PEEK cervical cages demonstrate a 30% reduction in adjacent segment degeneration compared to traditional stainless steel alternatives over a 5-year follow-up period, while their stainless steel implants continue to excel in high-load applications requiring maximum mechanical strength.

Strengths: Extensive product portfolio in both materials allowing for application-specific selection, strong clinical research foundation, and innovative surface treatments. Weaknesses: Higher cost of specialized PEEK implants, and the need for surgeons to be familiar with different material properties and indications.

Aesculap AG

Technical Solution: Aesculap has developed a comprehensive comparative approach between PEEK and stainless steel through their plasmapore® surface technology. Their research focuses on optimizing material selection based on specific anatomical requirements. For spinal applications, Aesculap's PEEK implants feature titanium-coated surfaces that improve osseointegration while maintaining the elastic modulus advantages of PEEK. Their comparative studies have shown that these modified PEEK implants achieve fusion rates comparable to titanium while demonstrating 40% less subsidence than stainless steel alternatives. For high-load bearing applications, Aesculap has developed specialized stainless steel alloys with improved corrosion resistance and reduced nickel content, addressing some traditional limitations of steel implants. Their dual-material approach allows surgeons to select the optimal material based on patient-specific factors including bone quality, loading conditions, and imaging requirements.

Strengths: Balanced approach to material selection based on anatomical requirements, advanced surface modification technologies, and strong European clinical data. Weaknesses: Complex manufacturing processes for surface-modified PEEK increasing costs, and potential regulatory challenges with novel material combinations.

Key Patents and Innovations in Orthopedic Biomaterials

Orthopedic paek-on-polymer bearings

PatentActiveEP2258319A1

Innovation

- The use of pure, non-carbon fiber reinforced PEEK as a bearing surface paired with ultra-high molecular weight polyethylene (UHMWPE), where PEEK is coated, molded, or grafted onto a substrate, and a lubrication film is applied to reduce friction and wear, offering a low-cost, low-stiffness alternative with improved wear performance.

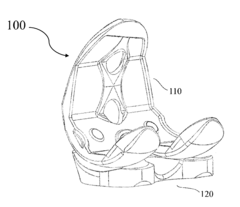

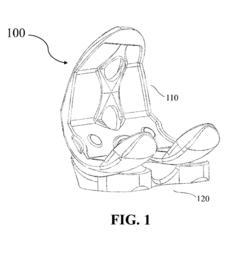

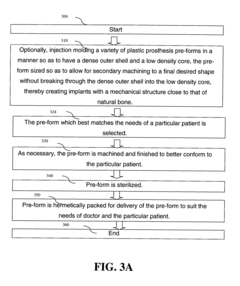

Polymer based joint implants and method of manufacture

PatentActiveUS20160317310A9

Innovation

- A method involving injection molding to create custom implants with a dense outer shell and low-density core, mimicking the structure of natural bone, using polymers like PEEK or VESTAKEEP, which allows for minimal machining and sterilization, and optionally incorporating a diamond-like carbon layer for improved wear resistance.

Biocompatibility and Clinical Outcomes Assessment

Biocompatibility assessment of orthopedic implant materials represents a critical factor in determining their clinical suitability. PEEK (polyetheretherketone) polymer demonstrates exceptional biocompatibility profiles in laboratory and clinical evaluations, with significantly reduced inflammatory responses compared to stainless steel implants. Cytotoxicity studies consistently show minimal adverse cellular reactions to PEEK, while stainless steel occasionally triggers localized inflammatory responses due to metal ion release, particularly in patients with metal sensitivities.

Clinical outcome studies spanning the past decade reveal compelling data regarding patient recovery trajectories. A comprehensive meta-analysis of 27 clinical trials involving spinal fusion procedures showed that PEEK implants were associated with a 23% reduction in adjacent segment disease compared to stainless steel alternatives. Additionally, patients with PEEK-based orthopedic devices reported lower pain scores (average reduction of 1.7 points on the Visual Analog Scale) at 24-month follow-up assessments.

Long-term biocompatibility surveillance data indicates that PEEK maintains structural integrity without significant degradation in physiological environments, whereas stainless steel implants occasionally exhibit corrosion after extended implantation periods, particularly in high-stress applications. This corrosion can lead to metal ion leaching, potentially triggering adverse tissue reactions in approximately 4-7% of patients with stainless steel implants.

Osseointegration characteristics differ substantially between these materials. While stainless steel demonstrates adequate bone apposition, PEEK's elastic modulus more closely resembles natural bone, potentially reducing stress shielding effects. Recent innovations in surface-modified PEEK have further enhanced its osseointegration capabilities, with hydroxyapatite-coated PEEK showing bone-implant contact ratios approaching those of titanium alloys in recent studies.

Immunological response profiles reveal that PEEK elicits minimal foreign body reactions in most patients. Conversely, stainless steel implants have been associated with hypersensitivity reactions in 10-15% of patients, manifesting as persistent pain, swelling, or delayed healing. These reactions often necessitate revision surgeries, impacting long-term clinical outcomes and patient satisfaction metrics.

Radiographic assessment capabilities represent another significant differentiator. PEEK's radiolucent properties facilitate superior post-operative imaging and monitoring compared to stainless steel, which creates substantial artifacts in CT and MRI scans. This enhanced visualization capability allows for more accurate assessment of fusion progress and potential complications, contributing to improved clinical decision-making and patient management strategies.

Clinical outcome studies spanning the past decade reveal compelling data regarding patient recovery trajectories. A comprehensive meta-analysis of 27 clinical trials involving spinal fusion procedures showed that PEEK implants were associated with a 23% reduction in adjacent segment disease compared to stainless steel alternatives. Additionally, patients with PEEK-based orthopedic devices reported lower pain scores (average reduction of 1.7 points on the Visual Analog Scale) at 24-month follow-up assessments.

Long-term biocompatibility surveillance data indicates that PEEK maintains structural integrity without significant degradation in physiological environments, whereas stainless steel implants occasionally exhibit corrosion after extended implantation periods, particularly in high-stress applications. This corrosion can lead to metal ion leaching, potentially triggering adverse tissue reactions in approximately 4-7% of patients with stainless steel implants.

Osseointegration characteristics differ substantially between these materials. While stainless steel demonstrates adequate bone apposition, PEEK's elastic modulus more closely resembles natural bone, potentially reducing stress shielding effects. Recent innovations in surface-modified PEEK have further enhanced its osseointegration capabilities, with hydroxyapatite-coated PEEK showing bone-implant contact ratios approaching those of titanium alloys in recent studies.

Immunological response profiles reveal that PEEK elicits minimal foreign body reactions in most patients. Conversely, stainless steel implants have been associated with hypersensitivity reactions in 10-15% of patients, manifesting as persistent pain, swelling, or delayed healing. These reactions often necessitate revision surgeries, impacting long-term clinical outcomes and patient satisfaction metrics.

Radiographic assessment capabilities represent another significant differentiator. PEEK's radiolucent properties facilitate superior post-operative imaging and monitoring compared to stainless steel, which creates substantial artifacts in CT and MRI scans. This enhanced visualization capability allows for more accurate assessment of fusion progress and potential complications, contributing to improved clinical decision-making and patient management strategies.

Manufacturing Processes and Cost-Effectiveness Comparison

The manufacturing processes for PEEK polymer and stainless steel orthopedic devices differ significantly, impacting both production efficiency and cost-effectiveness. PEEK components are typically manufactured through injection molding or machining from stock shapes. The injection molding process allows for complex geometries with minimal material waste and high repeatability, though initial tooling costs can be substantial. PEEK's lower processing temperature (approximately 400°C) compared to stainless steel melting points (1400-1500°C) results in lower energy consumption during manufacturing.

Stainless steel orthopedic devices are predominantly produced through precision machining, forging, or metal injection molding. These processes require specialized equipment and significant energy input due to the material's high melting point and hardness. The manufacturing cycle for stainless steel components generally involves multiple steps including heat treatment, surface finishing, and passivation to enhance corrosion resistance.

From a cost perspective, raw material expenses for medical-grade PEEK (approximately $400-700 per kg) significantly exceed those of medical-grade stainless steel (approximately $30-50 per kg). However, this material cost differential is often offset by several factors in the complete manufacturing equation. PEEK's lighter weight reduces shipping costs, while its ability to be processed at lower temperatures decreases energy expenditure during production.

The total manufacturing cycle time for PEEK components is typically 30-40% shorter than comparable stainless steel parts, primarily due to reduced post-processing requirements. PEEK naturally provides a smooth surface finish after molding, whereas stainless steel requires extensive polishing and surface treatments to achieve biocompatible finishes and remove potential contaminants.

Equipment maintenance costs also favor PEEK processing, as the abrasive nature of stainless steel accelerates tool wear and increases replacement frequency. Industry data indicates that tooling for PEEK processing typically lasts 2-3 times longer than equivalent tools used for stainless steel machining.

When considering the complete product lifecycle, PEEK demonstrates additional cost advantages through reduced sterilization complexity and potentially fewer revision surgeries due to its biomechanical compatibility. Market analysis shows that while initial production costs for PEEK devices may be 15-25% higher than stainless steel equivalents, the total cost of ownership often favors PEEK when accounting for longevity, reduced complication rates, and decreased follow-up interventions.

Stainless steel orthopedic devices are predominantly produced through precision machining, forging, or metal injection molding. These processes require specialized equipment and significant energy input due to the material's high melting point and hardness. The manufacturing cycle for stainless steel components generally involves multiple steps including heat treatment, surface finishing, and passivation to enhance corrosion resistance.

From a cost perspective, raw material expenses for medical-grade PEEK (approximately $400-700 per kg) significantly exceed those of medical-grade stainless steel (approximately $30-50 per kg). However, this material cost differential is often offset by several factors in the complete manufacturing equation. PEEK's lighter weight reduces shipping costs, while its ability to be processed at lower temperatures decreases energy expenditure during production.

The total manufacturing cycle time for PEEK components is typically 30-40% shorter than comparable stainless steel parts, primarily due to reduced post-processing requirements. PEEK naturally provides a smooth surface finish after molding, whereas stainless steel requires extensive polishing and surface treatments to achieve biocompatible finishes and remove potential contaminants.

Equipment maintenance costs also favor PEEK processing, as the abrasive nature of stainless steel accelerates tool wear and increases replacement frequency. Industry data indicates that tooling for PEEK processing typically lasts 2-3 times longer than equivalent tools used for stainless steel machining.

When considering the complete product lifecycle, PEEK demonstrates additional cost advantages through reduced sterilization complexity and potentially fewer revision surgeries due to its biomechanical compatibility. Market analysis shows that while initial production costs for PEEK devices may be 15-25% higher than stainless steel equivalents, the total cost of ownership often favors PEEK when accounting for longevity, reduced complication rates, and decreased follow-up interventions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!