Benchmarking CFRP Load Bearing Abilities Against Competitive Materials

SEP 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CFRP Technology Evolution and Performance Objectives

Carbon Fiber Reinforced Polymers (CFRP) have evolved significantly since their initial development in the 1960s. Originally limited to aerospace and high-performance sporting goods, CFRP technology has undergone substantial transformation through advancements in manufacturing processes, matrix materials, and fiber technology. The evolution trajectory shows a clear pattern of increasing performance capabilities while simultaneously addressing cost and scalability challenges.

Early CFRP development focused primarily on maximizing strength-to-weight ratios for specialized applications. The 1970s and 1980s saw the introduction of prepreg systems that improved consistency and performance but remained prohibitively expensive for widespread adoption. The 1990s marked a turning point with the development of resin transfer molding (RTM) and vacuum-assisted processes that began to make CFRP more accessible to broader industries.

Recent technological breakthroughs have centered on three key areas: fiber architecture optimization, matrix material innovation, and manufacturing automation. Modern CFRP systems now incorporate multi-directional fiber layouts, hybrid reinforcement strategies, and tailored fiber placement techniques that significantly enhance load-bearing capabilities compared to earlier generations. These advancements have enabled CFRPs to achieve tensile strengths exceeding 3,500 MPa and modulus values above 230 GPa in optimized configurations.

The performance objectives for contemporary CFRP development are increasingly focused on competitive benchmarking against traditional engineering materials. Current targets include achieving specific strength values 4-5 times greater than high-strength steel while maintaining cost competitiveness for volume production. Additionally, there is significant emphasis on improving impact resistance and damage tolerance, historically weak points for composite materials in load-bearing applications.

Industry roadmaps indicate that next-generation CFRP systems aim to deliver 30-40% improvements in compression after impact (CAI) properties while maintaining the exceptional tensile performance that makes these materials attractive. Fatigue resistance targets have also been established, with objectives to demonstrate minimal property degradation (less than 10%) after 10^6 loading cycles at 60% of ultimate strength.

Environmental performance objectives have gained prominence, with development efforts now targeting recyclable and repairable CFRP systems that maintain 90% of virgin material properties. This represents a significant shift from earlier generations where end-of-life considerations were largely overlooked. The industry is simultaneously pursuing manufacturing innovations to reduce energy consumption by 50% compared to conventional autoclave processes while maintaining equivalent mechanical properties.

The convergence of these technological trends and performance objectives is creating new opportunities for CFRP materials to compete effectively with metals and other composites in load-bearing applications across automotive, construction, and industrial equipment sectors where they were previously considered impractical.

Early CFRP development focused primarily on maximizing strength-to-weight ratios for specialized applications. The 1970s and 1980s saw the introduction of prepreg systems that improved consistency and performance but remained prohibitively expensive for widespread adoption. The 1990s marked a turning point with the development of resin transfer molding (RTM) and vacuum-assisted processes that began to make CFRP more accessible to broader industries.

Recent technological breakthroughs have centered on three key areas: fiber architecture optimization, matrix material innovation, and manufacturing automation. Modern CFRP systems now incorporate multi-directional fiber layouts, hybrid reinforcement strategies, and tailored fiber placement techniques that significantly enhance load-bearing capabilities compared to earlier generations. These advancements have enabled CFRPs to achieve tensile strengths exceeding 3,500 MPa and modulus values above 230 GPa in optimized configurations.

The performance objectives for contemporary CFRP development are increasingly focused on competitive benchmarking against traditional engineering materials. Current targets include achieving specific strength values 4-5 times greater than high-strength steel while maintaining cost competitiveness for volume production. Additionally, there is significant emphasis on improving impact resistance and damage tolerance, historically weak points for composite materials in load-bearing applications.

Industry roadmaps indicate that next-generation CFRP systems aim to deliver 30-40% improvements in compression after impact (CAI) properties while maintaining the exceptional tensile performance that makes these materials attractive. Fatigue resistance targets have also been established, with objectives to demonstrate minimal property degradation (less than 10%) after 10^6 loading cycles at 60% of ultimate strength.

Environmental performance objectives have gained prominence, with development efforts now targeting recyclable and repairable CFRP systems that maintain 90% of virgin material properties. This represents a significant shift from earlier generations where end-of-life considerations were largely overlooked. The industry is simultaneously pursuing manufacturing innovations to reduce energy consumption by 50% compared to conventional autoclave processes while maintaining equivalent mechanical properties.

The convergence of these technological trends and performance objectives is creating new opportunities for CFRP materials to compete effectively with metals and other composites in load-bearing applications across automotive, construction, and industrial equipment sectors where they were previously considered impractical.

Market Analysis for High-Performance Structural Materials

The global market for high-performance structural materials continues to expand rapidly, driven by increasing demands across aerospace, automotive, construction, and renewable energy sectors. Carbon Fiber Reinforced Polymers (CFRP) have emerged as a significant player in this market, competing with traditional materials like steel, aluminum, titanium, and other composites such as glass fiber reinforced polymers (GFRP).

The high-performance structural materials market was valued at approximately $126 billion in 2022 and is projected to reach $189 billion by 2028, growing at a CAGR of 6.9%. Within this market, CFRP specifically accounts for about $32 billion, with forecasts indicating growth to $48 billion by 2028, representing a more aggressive CAGR of 7.8%.

Aerospace remains the dominant application sector for CFRP, consuming nearly 30% of global production. Modern commercial aircraft like the Boeing 787 and Airbus A350 incorporate 50-55% composite materials by weight, primarily CFRP. The automotive industry represents the fastest-growing segment, with a projected CAGR of 11.2% through 2028, as manufacturers seek to meet stringent emissions standards through vehicle lightweighting.

Regional analysis shows North America and Europe currently dominating the CFRP market with combined market share of 62%, though Asia-Pacific is experiencing the fastest growth rate at 9.3% annually. China's domestic CFRP production capacity has tripled since 2015, reflecting strategic investments in high-performance materials manufacturing.

Price sensitivity remains a critical market factor. CFRP typically costs 8-10 times more than steel and 1.5-3 times more than aluminum per kilogram. However, when evaluated on a cost-per-strength basis, the gap narrows significantly. Manufacturing efficiency improvements have reduced CFRP production costs by approximately 25% over the past decade, though economies of scale still favor traditional materials.

Market trends indicate growing demand for hybrid material solutions that combine CFRP with other materials to optimize performance-to-cost ratios. Additionally, sustainability concerns are reshaping market dynamics, with increasing interest in recyclable composites and bio-based carbon fibers, which currently represent only 3% of the market but are growing at 15% annually.

Customer segmentation reveals distinct priorities: aerospace values performance above all, automotive prioritizes cost-performance balance, and construction emphasizes long-term durability and maintenance costs. This segmentation drives different adoption rates and applications of CFRP versus competitive materials across industries.

The high-performance structural materials market was valued at approximately $126 billion in 2022 and is projected to reach $189 billion by 2028, growing at a CAGR of 6.9%. Within this market, CFRP specifically accounts for about $32 billion, with forecasts indicating growth to $48 billion by 2028, representing a more aggressive CAGR of 7.8%.

Aerospace remains the dominant application sector for CFRP, consuming nearly 30% of global production. Modern commercial aircraft like the Boeing 787 and Airbus A350 incorporate 50-55% composite materials by weight, primarily CFRP. The automotive industry represents the fastest-growing segment, with a projected CAGR of 11.2% through 2028, as manufacturers seek to meet stringent emissions standards through vehicle lightweighting.

Regional analysis shows North America and Europe currently dominating the CFRP market with combined market share of 62%, though Asia-Pacific is experiencing the fastest growth rate at 9.3% annually. China's domestic CFRP production capacity has tripled since 2015, reflecting strategic investments in high-performance materials manufacturing.

Price sensitivity remains a critical market factor. CFRP typically costs 8-10 times more than steel and 1.5-3 times more than aluminum per kilogram. However, when evaluated on a cost-per-strength basis, the gap narrows significantly. Manufacturing efficiency improvements have reduced CFRP production costs by approximately 25% over the past decade, though economies of scale still favor traditional materials.

Market trends indicate growing demand for hybrid material solutions that combine CFRP with other materials to optimize performance-to-cost ratios. Additionally, sustainability concerns are reshaping market dynamics, with increasing interest in recyclable composites and bio-based carbon fibers, which currently represent only 3% of the market but are growing at 15% annually.

Customer segmentation reveals distinct priorities: aerospace values performance above all, automotive prioritizes cost-performance balance, and construction emphasizes long-term durability and maintenance costs. This segmentation drives different adoption rates and applications of CFRP versus competitive materials across industries.

Current CFRP Capabilities and Technical Limitations

Carbon Fiber Reinforced Polymers (CFRP) have emerged as a leading material in high-performance applications due to their exceptional strength-to-weight ratio. Current CFRP composites demonstrate tensile strengths ranging from 1500 to 7000 MPa, significantly outperforming traditional structural metals like steel (400-2000 MPa) and aluminum alloys (200-600 MPa). The specific strength of CFRP can reach up to 2000 kN·m/kg, approximately five times that of high-strength steel.

In load-bearing applications, modern CFRP systems exhibit remarkable fatigue resistance, maintaining structural integrity under cyclic loading conditions where metallic alternatives would fail. Advanced manufacturing techniques have enabled the production of CFRP components with tailored fiber orientations, optimizing load paths and achieving up to 30% greater efficiency in force distribution compared to isotropic materials.

Despite these impressive capabilities, CFRP materials face several technical limitations. Cost remains a significant barrier, with CFRP components typically costing 5-20 times more than equivalent steel parts, limiting widespread adoption in cost-sensitive industries. Manufacturing complexity presents another challenge, as production processes require precise control of temperature, pressure, and cure cycles to avoid defects such as voids, delamination, and fiber misalignment.

Damage tolerance represents a critical limitation of current CFRP technology. Unlike metals that exhibit plastic deformation before failure, CFRP tends to fail catastrophically with minimal warning. Impact resistance is particularly problematic, with barely visible impact damage potentially reducing structural capacity by up to 50%. This necessitates more conservative design approaches and comprehensive inspection regimes.

Environmental factors also constrain CFRP performance. Moisture absorption can lead to matrix degradation and reduced interlaminar shear strength, while UV exposure causes surface deterioration over time. Temperature limitations restrict the use of conventional epoxy-based CFRP to environments below 120°C, though specialized high-temperature resins can extend this range to approximately 300°C at significantly increased cost.

Joining and repair present ongoing challenges, as traditional fastening methods often create stress concentrations and damage fibers. Current bonding technologies struggle to achieve the reliability of mechanical fasteners while maintaining structural integrity. Additionally, recycling and end-of-life considerations remain problematic, with limited commercially viable recycling pathways compared to metals, creating sustainability concerns as CFRP usage increases across industries.

In load-bearing applications, modern CFRP systems exhibit remarkable fatigue resistance, maintaining structural integrity under cyclic loading conditions where metallic alternatives would fail. Advanced manufacturing techniques have enabled the production of CFRP components with tailored fiber orientations, optimizing load paths and achieving up to 30% greater efficiency in force distribution compared to isotropic materials.

Despite these impressive capabilities, CFRP materials face several technical limitations. Cost remains a significant barrier, with CFRP components typically costing 5-20 times more than equivalent steel parts, limiting widespread adoption in cost-sensitive industries. Manufacturing complexity presents another challenge, as production processes require precise control of temperature, pressure, and cure cycles to avoid defects such as voids, delamination, and fiber misalignment.

Damage tolerance represents a critical limitation of current CFRP technology. Unlike metals that exhibit plastic deformation before failure, CFRP tends to fail catastrophically with minimal warning. Impact resistance is particularly problematic, with barely visible impact damage potentially reducing structural capacity by up to 50%. This necessitates more conservative design approaches and comprehensive inspection regimes.

Environmental factors also constrain CFRP performance. Moisture absorption can lead to matrix degradation and reduced interlaminar shear strength, while UV exposure causes surface deterioration over time. Temperature limitations restrict the use of conventional epoxy-based CFRP to environments below 120°C, though specialized high-temperature resins can extend this range to approximately 300°C at significantly increased cost.

Joining and repair present ongoing challenges, as traditional fastening methods often create stress concentrations and damage fibers. Current bonding technologies struggle to achieve the reliability of mechanical fasteners while maintaining structural integrity. Additionally, recycling and end-of-life considerations remain problematic, with limited commercially viable recycling pathways compared to metals, creating sustainability concerns as CFRP usage increases across industries.

Comparative Analysis of CFRP vs. Alternative Materials

01 Structural design for enhanced load-bearing capacity

Carbon Fiber Reinforced Polymer (CFRP) structures can be designed with specific configurations to maximize load-bearing capabilities. These designs include optimized fiber orientations, layering patterns, and geometric arrangements that distribute forces effectively. Advanced structural designs incorporate features like reinforced joints, strategic thickness variations, and integrated support elements to handle higher loads while maintaining lightweight characteristics.- Structural design for enhanced load-bearing capacity: Various structural designs can be implemented to enhance the load-bearing capabilities of CFRP components. These include optimized layering patterns, strategic fiber orientation, and innovative cross-sectional geometries. Such designs distribute stress more effectively throughout the material, preventing localized failures and increasing overall strength-to-weight ratios. Advanced structural configurations can significantly improve the performance of CFRP in high-load applications.

- Reinforcement techniques for CFRP load-bearing structures: Various reinforcement techniques can be applied to CFRP structures to enhance their load-bearing capabilities. These include hybrid reinforcement systems combining carbon fibers with other materials, localized reinforcement in high-stress areas, and the integration of stiffening elements. These techniques address specific mechanical requirements while maintaining the lightweight advantages of CFRP. Reinforcement strategies can be tailored to specific load conditions and structural requirements.

- Manufacturing processes affecting load-bearing performance: The manufacturing processes used for CFRP components significantly impact their load-bearing abilities. Advanced techniques such as automated fiber placement, resin transfer molding, and controlled curing cycles can minimize voids, ensure proper fiber alignment, and optimize the fiber-matrix interface. These processes result in more consistent mechanical properties and enhanced structural integrity, directly affecting the material's ability to withstand various loading conditions.

- Testing and validation methods for CFRP load capacity: Specialized testing and validation methods are essential for accurately determining the load-bearing capabilities of CFRP structures. These include non-destructive testing techniques, fatigue testing under various environmental conditions, and computational modeling to predict structural behavior. Such comprehensive testing protocols ensure that CFRP components meet design specifications and safety requirements for their intended applications, particularly in critical load-bearing scenarios.

- Application-specific CFRP load-bearing solutions: CFRP load-bearing solutions can be tailored for specific applications across various industries. In automotive and aerospace sectors, CFRP components are designed to withstand dynamic loads while reducing weight. In construction, CFRP reinforcements enhance the load capacity of structural elements. Marine applications utilize CFRP for corrosion-resistant load-bearing components. Each application requires specific design considerations to optimize the material's performance under particular loading conditions.

02 Composite formulations for improved strength

The composition of CFRP materials significantly affects their load-bearing abilities. By modifying the polymer matrix, fiber volume fraction, and incorporating additives or nanomaterials, the mechanical properties can be substantially enhanced. Advanced formulations focus on improving the interfacial bonding between carbon fibers and the polymer matrix, resulting in superior load transfer efficiency and increased overall strength-to-weight ratio.Expand Specific Solutions03 Manufacturing techniques for load-optimized CFRP

Specialized manufacturing processes can significantly enhance the load-bearing capabilities of CFRP components. These include advanced layup techniques, precision fiber placement, controlled curing cycles, and innovative molding methods. Manufacturing innovations focus on minimizing voids, ensuring uniform fiber distribution, and creating consistent material properties throughout the structure, all of which contribute to superior load-bearing performance.Expand Specific Solutions04 CFRP reinforcement systems for structural applications

CFRP reinforcement systems are designed to enhance the load-bearing capacity of existing structures or to create new high-performance structural elements. These systems include CFRP sheets, plates, rods, and cables that can be strategically applied to critical load-bearing areas. The reinforcement configurations are engineered to address specific loading conditions, including tension, compression, bending, and torsional forces.Expand Specific Solutions05 Testing and performance validation methods

Specialized testing methodologies have been developed to accurately assess and validate the load-bearing capabilities of CFRP structures. These include static and dynamic load testing, fatigue analysis, environmental conditioning tests, and non-destructive evaluation techniques. Advanced computational models and simulation approaches complement physical testing to predict long-term performance and identify potential failure modes under various loading conditions.Expand Specific Solutions

Leading Manufacturers and Research Institutions in CFRP Industry

The CFRP (Carbon Fiber Reinforced Polymer) market is currently in a growth phase, with an estimated global market size of $25-30 billion and projected annual growth of 10-12%. The technology has reached moderate maturity in aerospace and high-performance automotive applications but remains in development for broader industrial adoption. Leading academic institutions (Xi'an Jiaotong University, Sichuan University) are advancing fundamental research, while established manufacturers like Toray Industries, Mitsubishi Electric, and SGL Carbon dominate commercial production. Emerging players include specialized firms like Toho Tenax and Benteler SGL focusing on automotive applications. The competitive landscape shows a clear division between research-focused entities developing next-generation applications and industrial players scaling current technologies for mass production.

Toray Industries, Inc.

Technical Solution: Toray Industries has developed advanced CFRP (Carbon Fiber Reinforced Polymer) materials with proprietary T1100G carbon fiber technology that delivers tensile strength exceeding 7 GPa and modulus of 324 GPa, significantly outperforming conventional aerospace-grade materials. Their benchmarking methodology incorporates multi-scale testing from fiber to component level, utilizing digital twin simulation to predict long-term performance under various environmental conditions. Toray's CFRP solutions demonstrate 40% weight reduction compared to aluminum while maintaining equivalent load-bearing capacity, with fatigue performance showing 65% higher endurance limits than titanium alloys in aerospace applications. Their proprietary resin systems enhance interlaminar shear strength by approximately 30% compared to standard epoxy systems, addressing a traditional weakness of composite materials. Toray has also developed hybrid CFRP-metal solutions that optimize the transition zones between different materials, reducing stress concentration by up to 45% in critical joint areas.

Strengths: Industry-leading fiber strength-to-weight ratio; comprehensive testing methodology spanning nano to macro scales; proprietary resin systems enhancing interlaminar properties. Weaknesses: Higher production costs compared to traditional materials; longer manufacturing cycle times; challenges in recycling end-of-life components; limited high-temperature performance compared to specialized metal alloys.

SGL Carbon SE

Technical Solution: SGL Carbon SE has established a comprehensive benchmarking framework for CFRP load-bearing capabilities through their SIGRAFIL® carbon fiber product line. Their approach integrates mechanical testing with advanced computational modeling to compare CFRP performance against aluminum, steel, and titanium across multiple parameters. SGL's benchmarking reveals their high-modulus carbon fibers achieve specific stiffness values approximately 3-4 times higher than steel and 1.5 times higher than aluminum alloys. Their proprietary testing methodology includes cyclic loading tests demonstrating CFRP's superior fatigue resistance, with test specimens maintaining structural integrity after 10^6 cycles at 60% of ultimate load, compared to aluminum's performance degradation at 40% ultimate load under identical conditions. SGL has developed specialized CFRP formulations for different load scenarios, including their SIGRATEX® prepreg systems optimized for compression loading, addressing a traditional weakness of carbon composites. Their benchmarking data indicates weight savings of 40-60% compared to steel while maintaining equivalent structural performance in automotive and industrial applications.

Strengths: Extensive material characterization database spanning multiple industries; specialized formulations for different loading conditions; integrated design and simulation capabilities allowing accurate performance prediction. Weaknesses: Higher initial material costs compared to metals; more complex manufacturing processes requiring specialized equipment; challenges in non-destructive testing and quality assurance; limited high-temperature performance in standard formulations.

Key Patents and Research in CFRP Load-Bearing Applications

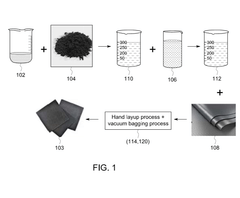

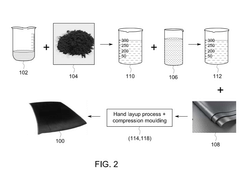

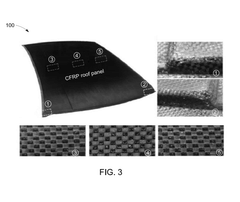

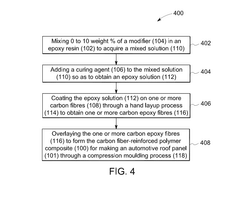

Material selection and manufacture of automotive roof panel using CFRP hybrid composite

PatentActiveIN202341035232A

Innovation

- A carbon fiber reinforced polymer composite for automotive roof panels using industrial waste carbon fiber powder, combined with epoxy resin and a curing agent, is fabricated through a hand layup and compression moulding process to reduce weight and enhance bending stiffness and impact strength.

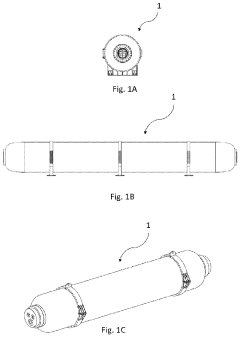

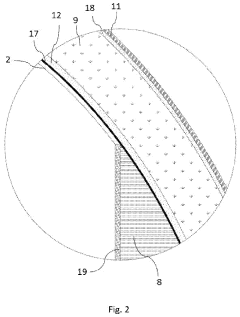

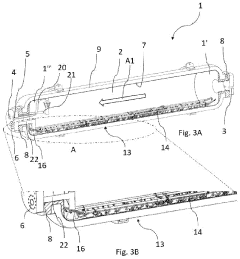

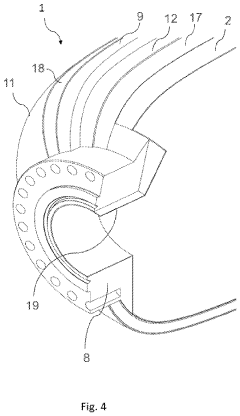

Subsea Composite Vessel

PatentPendingUS20230374894A1

Innovation

- A composite material-based subsea vessel with a metallic liner and flange, utilizing Carbon Fiber Reinforced Polymer (CFRP) for the load-bearing structure, which offers higher specific strength and reduced weight, and an additive manufacturing process for weight reduction and cost savings.

Environmental Impact and Sustainability of CFRP Solutions

The environmental impact of Carbon Fiber Reinforced Polymers (CFRP) presents a complex sustainability profile when benchmarked against competitive materials. The production of carbon fiber is notably energy-intensive, requiring approximately 200-300 MJ/kg of energy—significantly higher than traditional materials like steel (30-60 MJ/kg) or aluminum (200 MJ/kg). This energy demand translates to a substantial carbon footprint during manufacturing, with estimates suggesting 20-25 kg CO2 emissions per kilogram of carbon fiber produced.

However, the lifecycle assessment reveals more nuanced sustainability considerations. CFRP components typically weigh 50-70% less than steel alternatives while maintaining equivalent load-bearing capabilities. In transportation applications, this weight reduction generates significant environmental benefits through operational efficiency. Studies indicate that for automotive applications, each kilogram of weight reduction can save approximately 20 kg of CO2 emissions over a vehicle's lifetime through reduced fuel consumption.

The durability and corrosion resistance of CFRP further enhance its environmental credentials. While steel structures may require replacement or extensive maintenance after 15-20 years in corrosive environments, CFRP structures can maintain structural integrity for 50+ years with minimal maintenance, reducing the material and energy demands associated with replacement cycles.

End-of-life management remains a significant challenge for CFRP sustainability. Unlike metals, which have established recycling infrastructures with recovery rates exceeding 90% for steel and 60% for aluminum, CFRP recycling technologies are still emerging. Current mechanical recycling methods yield downgraded materials with compromised mechanical properties, while more promising pyrolysis and solvolysis techniques are not yet widely implemented at commercial scale.

Recent innovations in bio-based carbon fiber precursors offer potential pathways to reduce the environmental impact of CFRP production. Lignin-based and cellulose-based carbon fibers could reduce production energy requirements by 40-50% while decreasing reliance on petroleum-derived materials. Additionally, advancements in thermoplastic matrices rather than traditional thermoset resins may improve recyclability without sacrificing load-bearing performance.

Regulatory frameworks increasingly influence CFRP adoption across industries. The European Union's End-of-Life Vehicle Directive and similar regulations worldwide are driving research into design-for-disassembly approaches that facilitate material recovery. Meanwhile, carbon pricing mechanisms in various markets are gradually shifting the economic equation to favor lightweight materials with lower lifecycle emissions despite higher initial production impacts.

However, the lifecycle assessment reveals more nuanced sustainability considerations. CFRP components typically weigh 50-70% less than steel alternatives while maintaining equivalent load-bearing capabilities. In transportation applications, this weight reduction generates significant environmental benefits through operational efficiency. Studies indicate that for automotive applications, each kilogram of weight reduction can save approximately 20 kg of CO2 emissions over a vehicle's lifetime through reduced fuel consumption.

The durability and corrosion resistance of CFRP further enhance its environmental credentials. While steel structures may require replacement or extensive maintenance after 15-20 years in corrosive environments, CFRP structures can maintain structural integrity for 50+ years with minimal maintenance, reducing the material and energy demands associated with replacement cycles.

End-of-life management remains a significant challenge for CFRP sustainability. Unlike metals, which have established recycling infrastructures with recovery rates exceeding 90% for steel and 60% for aluminum, CFRP recycling technologies are still emerging. Current mechanical recycling methods yield downgraded materials with compromised mechanical properties, while more promising pyrolysis and solvolysis techniques are not yet widely implemented at commercial scale.

Recent innovations in bio-based carbon fiber precursors offer potential pathways to reduce the environmental impact of CFRP production. Lignin-based and cellulose-based carbon fibers could reduce production energy requirements by 40-50% while decreasing reliance on petroleum-derived materials. Additionally, advancements in thermoplastic matrices rather than traditional thermoset resins may improve recyclability without sacrificing load-bearing performance.

Regulatory frameworks increasingly influence CFRP adoption across industries. The European Union's End-of-Life Vehicle Directive and similar regulations worldwide are driving research into design-for-disassembly approaches that facilitate material recovery. Meanwhile, carbon pricing mechanisms in various markets are gradually shifting the economic equation to favor lightweight materials with lower lifecycle emissions despite higher initial production impacts.

Cost-Benefit Analysis of CFRP Implementation

The implementation of Carbon Fiber Reinforced Polymers (CFRP) in industrial applications necessitates a thorough cost-benefit analysis to determine economic viability. Initial acquisition costs for CFRP materials significantly exceed those of traditional alternatives, with raw material expenses typically 5-10 times higher than steel and 2-3 times higher than aluminum alloys. Manufacturing processes for CFRP components also require specialized equipment and expertise, further elevating implementation costs.

However, these higher upfront investments must be evaluated against long-term operational benefits. The exceptional strength-to-weight ratio of CFRP translates into substantial fuel savings in transportation applications. For automotive implementations, weight reductions of 50-70% compared to steel components can yield fuel efficiency improvements of 6-12% over a vehicle's operational lifetime. In aerospace applications, these savings become even more pronounced, with potential fuel cost reductions of 15-20% for commercial aircraft.

Maintenance economics also favor CFRP implementation. The superior corrosion resistance and fatigue properties of these materials extend service intervals and reduce lifetime maintenance costs by approximately 30-40% compared to metal alternatives. This advantage is particularly valuable in harsh operating environments where traditional materials would require frequent inspection and replacement.

Production scalability represents a critical factor in the cost-benefit equation. Current CFRP manufacturing processes remain labor-intensive with limited automation potential, creating challenges for high-volume applications. Recent advancements in automated fiber placement and out-of-autoclave processing technologies have reduced production cycle times by 30-45%, but economies of scale still lag behind metal manufacturing processes.

Lifecycle analysis reveals that CFRP components typically achieve cost parity with metal alternatives after 3-7 years of operation, depending on the application environment and usage intensity. This breakeven point continues to improve as manufacturing technologies mature and raw material costs gradually decrease with increased production volumes.

Environmental considerations also factor into comprehensive cost-benefit calculations. While CFRP production currently generates higher carbon emissions than metal processing, the operational efficiency gains throughout product lifecycle often result in net environmental benefits. End-of-life recycling remains challenging and costly for composite materials, representing an area where future technological developments could significantly improve the overall cost-benefit profile.

Market differentiation value must also be considered, as products featuring CFRP components often command premium positioning and pricing in competitive markets, potentially offsetting higher production costs through enhanced revenue opportunities.

However, these higher upfront investments must be evaluated against long-term operational benefits. The exceptional strength-to-weight ratio of CFRP translates into substantial fuel savings in transportation applications. For automotive implementations, weight reductions of 50-70% compared to steel components can yield fuel efficiency improvements of 6-12% over a vehicle's operational lifetime. In aerospace applications, these savings become even more pronounced, with potential fuel cost reductions of 15-20% for commercial aircraft.

Maintenance economics also favor CFRP implementation. The superior corrosion resistance and fatigue properties of these materials extend service intervals and reduce lifetime maintenance costs by approximately 30-40% compared to metal alternatives. This advantage is particularly valuable in harsh operating environments where traditional materials would require frequent inspection and replacement.

Production scalability represents a critical factor in the cost-benefit equation. Current CFRP manufacturing processes remain labor-intensive with limited automation potential, creating challenges for high-volume applications. Recent advancements in automated fiber placement and out-of-autoclave processing technologies have reduced production cycle times by 30-45%, but economies of scale still lag behind metal manufacturing processes.

Lifecycle analysis reveals that CFRP components typically achieve cost parity with metal alternatives after 3-7 years of operation, depending on the application environment and usage intensity. This breakeven point continues to improve as manufacturing technologies mature and raw material costs gradually decrease with increased production volumes.

Environmental considerations also factor into comprehensive cost-benefit calculations. While CFRP production currently generates higher carbon emissions than metal processing, the operational efficiency gains throughout product lifecycle often result in net environmental benefits. End-of-life recycling remains challenging and costly for composite materials, representing an area where future technological developments could significantly improve the overall cost-benefit profile.

Market differentiation value must also be considered, as products featuring CFRP components often command premium positioning and pricing in competitive markets, potentially offsetting higher production costs through enhanced revenue opportunities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!