Optimizing CFRP Mold Release Technologies

SEP 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CFRP Mold Release Background and Objectives

Carbon Fiber Reinforced Polymer (CFRP) composites have emerged as revolutionary materials in high-performance industries over the past four decades. Initially developed for aerospace applications in the 1970s, these lightweight yet incredibly strong materials have progressively expanded into automotive, marine, sporting goods, and renewable energy sectors. The evolution of CFRP technology has been characterized by continuous improvements in fiber architecture, resin systems, and manufacturing processes.

The mold release process represents a critical juncture in CFRP manufacturing, directly impacting production efficiency, part quality, and overall manufacturing costs. Historically, release agents have evolved from simple waxes to sophisticated semi-permanent systems incorporating advanced chemistry. This technological progression has been driven by increasing demands for faster cycle times, higher quality surface finishes, and reduced environmental impact.

Current market trends indicate a growing preference for water-based and solvent-free release systems that maintain performance while meeting stringent environmental regulations. Additionally, the industry is witnessing increased interest in release agents specifically formulated for high-temperature curing cycles and complex geometries, reflecting the expanding application scope of CFRP components.

The primary objective of optimizing CFRP mold release technologies is to develop next-generation release systems that simultaneously address several critical parameters: minimizing part defects, reducing cycle times, extending mold life, and decreasing environmental impact. These improvements must be achieved while maintaining or enhancing the mechanical properties and surface quality of the final composite parts.

Technical goals include formulating release agents with improved thermal stability for high-temperature curing processes exceeding 180°C, developing systems compatible with emerging fast-cure resin technologies, and creating release mechanisms that facilitate automated demolding operations in high-volume production environments. Additionally, there is significant interest in release technologies that can accommodate increasingly complex part geometries with deep draws and tight radii.

The trajectory of CFRP mold release technology is increasingly influenced by broader industry trends toward automation, digitalization, and sustainability. Future developments will likely focus on release systems that integrate with smart manufacturing processes, provide real-time data on release performance, and utilize renewable or bio-based raw materials. These advancements will be crucial in supporting the continued expansion of CFRP applications across multiple industries and enabling more cost-effective mass production of composite components.

The mold release process represents a critical juncture in CFRP manufacturing, directly impacting production efficiency, part quality, and overall manufacturing costs. Historically, release agents have evolved from simple waxes to sophisticated semi-permanent systems incorporating advanced chemistry. This technological progression has been driven by increasing demands for faster cycle times, higher quality surface finishes, and reduced environmental impact.

Current market trends indicate a growing preference for water-based and solvent-free release systems that maintain performance while meeting stringent environmental regulations. Additionally, the industry is witnessing increased interest in release agents specifically formulated for high-temperature curing cycles and complex geometries, reflecting the expanding application scope of CFRP components.

The primary objective of optimizing CFRP mold release technologies is to develop next-generation release systems that simultaneously address several critical parameters: minimizing part defects, reducing cycle times, extending mold life, and decreasing environmental impact. These improvements must be achieved while maintaining or enhancing the mechanical properties and surface quality of the final composite parts.

Technical goals include formulating release agents with improved thermal stability for high-temperature curing processes exceeding 180°C, developing systems compatible with emerging fast-cure resin technologies, and creating release mechanisms that facilitate automated demolding operations in high-volume production environments. Additionally, there is significant interest in release technologies that can accommodate increasingly complex part geometries with deep draws and tight radii.

The trajectory of CFRP mold release technology is increasingly influenced by broader industry trends toward automation, digitalization, and sustainability. Future developments will likely focus on release systems that integrate with smart manufacturing processes, provide real-time data on release performance, and utilize renewable or bio-based raw materials. These advancements will be crucial in supporting the continued expansion of CFRP applications across multiple industries and enabling more cost-effective mass production of composite components.

Market Analysis for CFRP Release Agents

The global market for CFRP (Carbon Fiber Reinforced Polymer) release agents is experiencing robust growth, driven primarily by the expanding applications of composite materials across multiple industries. Current market valuations indicate that the CFRP release agent sector reached approximately 290 million USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 6.8% through 2028.

Aerospace and automotive industries remain the dominant consumers of CFRP release agents, collectively accounting for over 60% of market demand. The aerospace sector's push for lightweight components to improve fuel efficiency has been particularly influential, with major manufacturers like Boeing and Airbus increasing their composite material usage by 15-20% in new aircraft models compared to previous generations.

The automotive industry presents the most significant growth opportunity, especially with the transition toward electric vehicles (EVs). EV manufacturers are increasingly adopting CFRP components to offset battery weight, creating new demand vectors for specialized release agents that can withstand the unique processing conditions required for automotive-grade composites.

Regional analysis reveals that North America and Europe currently dominate the market with approximately 65% combined market share, attributed to their advanced aerospace and automotive manufacturing bases. However, the Asia-Pacific region is emerging as the fastest-growing market, with China, Japan, and South Korea showing annual growth rates exceeding 9% in CFRP release agent consumption.

Market segmentation by product type shows that semi-permanent release agents hold the largest market share (approximately 45%), followed by permanent release agents (30%) and sacrificial release agents (25%). Water-based formulations are gaining significant traction due to increasing environmental regulations limiting VOC emissions, with their market share growing from 28% in 2018 to 37% in 2022.

Customer requirements are evolving toward release agents that offer multi-functionality beyond basic demolding properties. End-users increasingly demand products that provide surface quality enhancement, reduced cycle times, and compatibility with automated manufacturing processes. This trend is reflected in price premiums of 15-25% for advanced formulations compared to conventional products.

The competitive landscape features both specialized chemical manufacturers and diversified industrial conglomerates. Key players include Henkel, Chem-Trend, Marbocote, and Daikin, with market concentration relatively high as the top five companies control approximately 55% of global market share. Recent strategic movements indicate increased R&D investment in bio-based and nanomaterial-enhanced release agent technologies, signaling the next frontier of product development in this sector.

Aerospace and automotive industries remain the dominant consumers of CFRP release agents, collectively accounting for over 60% of market demand. The aerospace sector's push for lightweight components to improve fuel efficiency has been particularly influential, with major manufacturers like Boeing and Airbus increasing their composite material usage by 15-20% in new aircraft models compared to previous generations.

The automotive industry presents the most significant growth opportunity, especially with the transition toward electric vehicles (EVs). EV manufacturers are increasingly adopting CFRP components to offset battery weight, creating new demand vectors for specialized release agents that can withstand the unique processing conditions required for automotive-grade composites.

Regional analysis reveals that North America and Europe currently dominate the market with approximately 65% combined market share, attributed to their advanced aerospace and automotive manufacturing bases. However, the Asia-Pacific region is emerging as the fastest-growing market, with China, Japan, and South Korea showing annual growth rates exceeding 9% in CFRP release agent consumption.

Market segmentation by product type shows that semi-permanent release agents hold the largest market share (approximately 45%), followed by permanent release agents (30%) and sacrificial release agents (25%). Water-based formulations are gaining significant traction due to increasing environmental regulations limiting VOC emissions, with their market share growing from 28% in 2018 to 37% in 2022.

Customer requirements are evolving toward release agents that offer multi-functionality beyond basic demolding properties. End-users increasingly demand products that provide surface quality enhancement, reduced cycle times, and compatibility with automated manufacturing processes. This trend is reflected in price premiums of 15-25% for advanced formulations compared to conventional products.

The competitive landscape features both specialized chemical manufacturers and diversified industrial conglomerates. Key players include Henkel, Chem-Trend, Marbocote, and Daikin, with market concentration relatively high as the top five companies control approximately 55% of global market share. Recent strategic movements indicate increased R&D investment in bio-based and nanomaterial-enhanced release agent technologies, signaling the next frontier of product development in this sector.

Current Challenges in CFRP Demolding Technologies

Despite significant advancements in carbon fiber reinforced polymer (CFRP) manufacturing, the demolding process remains one of the most challenging aspects of production. Current demolding technologies face several critical limitations that impact production efficiency, component quality, and overall manufacturing costs. The primary challenge lies in the strong adhesion between the cured composite and mold surface, which frequently results in component damage during separation attempts.

Traditional release agents, while widely used, present inconsistent performance across varying geometries and resin systems. Silicone-based agents often transfer residue to parts, creating downstream issues for secondary bonding or painting operations. Fluoropolymer-based alternatives offer improved release characteristics but at significantly higher costs and with environmental concerns regarding PFAS compounds.

Semi-permanent release systems require precise application techniques that are highly operator-dependent, leading to quality variations between production batches. The thermal cycling inherent in CFRP processing gradually degrades these coatings, necessitating frequent reapplication and increasing production downtime.

Complex part geometries with deep draws, undercuts, or tight radii exacerbate demolding difficulties. These features create mechanical interlocking between the part and mold, requiring higher extraction forces that can induce micro-cracking, delamination, or fiber distortion in finished components. Current technologies struggle to provide uniform release performance across varying feature complexities.

Automation of the demolding process remains underdeveloped compared to other manufacturing steps. Manual demolding continues to dominate production environments, introducing ergonomic concerns for operators and limiting throughput in high-volume applications. Existing automated solutions typically require significant customization for specific part geometries, limiting their cost-effectiveness.

The increasing adoption of out-of-autoclave processing methods introduces additional demolding challenges. These processes often involve different cure kinetics and shrinkage behaviors compared to traditional autoclave curing, requiring specialized release strategies that are still evolving.

Environmental and regulatory pressures further complicate the landscape, with increasing restrictions on VOCs and certain chemical compounds traditionally used in release agents. Manufacturers must balance performance requirements against evolving compliance standards, often sacrificing optimal release characteristics to meet environmental regulations.

Temperature management during demolding represents another significant challenge, as premature demolding of incompletely cured parts can result in dimensional instability, while excessive cooling can increase internal stresses that complicate separation.

Traditional release agents, while widely used, present inconsistent performance across varying geometries and resin systems. Silicone-based agents often transfer residue to parts, creating downstream issues for secondary bonding or painting operations. Fluoropolymer-based alternatives offer improved release characteristics but at significantly higher costs and with environmental concerns regarding PFAS compounds.

Semi-permanent release systems require precise application techniques that are highly operator-dependent, leading to quality variations between production batches. The thermal cycling inherent in CFRP processing gradually degrades these coatings, necessitating frequent reapplication and increasing production downtime.

Complex part geometries with deep draws, undercuts, or tight radii exacerbate demolding difficulties. These features create mechanical interlocking between the part and mold, requiring higher extraction forces that can induce micro-cracking, delamination, or fiber distortion in finished components. Current technologies struggle to provide uniform release performance across varying feature complexities.

Automation of the demolding process remains underdeveloped compared to other manufacturing steps. Manual demolding continues to dominate production environments, introducing ergonomic concerns for operators and limiting throughput in high-volume applications. Existing automated solutions typically require significant customization for specific part geometries, limiting their cost-effectiveness.

The increasing adoption of out-of-autoclave processing methods introduces additional demolding challenges. These processes often involve different cure kinetics and shrinkage behaviors compared to traditional autoclave curing, requiring specialized release strategies that are still evolving.

Environmental and regulatory pressures further complicate the landscape, with increasing restrictions on VOCs and certain chemical compounds traditionally used in release agents. Manufacturers must balance performance requirements against evolving compliance standards, often sacrificing optimal release characteristics to meet environmental regulations.

Temperature management during demolding represents another significant challenge, as premature demolding of incompletely cured parts can result in dimensional instability, while excessive cooling can increase internal stresses that complicate separation.

Contemporary CFRP Mold Release Solutions

01 Fluoropolymer-based release agents

Fluoropolymer coatings and release agents provide excellent non-stick properties for CFRP molding applications. These materials create a low surface energy barrier between the mold and composite material, facilitating easier part removal. The fluoropolymer compounds can be applied as sprays, films, or permanent coatings on mold surfaces, offering high temperature resistance and multiple release cycles before reapplication is needed. This technology significantly improves release efficiency while reducing mold wear and composite part damage.- Fluoropolymer-based release agents: Fluoropolymer coatings and release agents provide excellent non-stick properties for CFRP molding applications. These materials create a low surface energy barrier between the mold and composite material, facilitating easier demolding with minimal force. Fluoropolymer-based systems can be applied as permanent or semi-permanent coatings, offering multiple release cycles before reapplication is necessary. Their chemical stability at high processing temperatures makes them particularly suitable for advanced composite manufacturing processes.

- Silicone-based release systems: Silicone-based release agents provide effective demolding solutions for CFRP manufacturing. These systems form a thin, thermally stable film on mold surfaces that prevents adhesion of the composite material. Silicone release agents can be formulated as sprays, liquids, or pastes, offering versatility for different application methods. They are particularly valued for their ability to withstand high curing temperatures while maintaining release properties, and can be modified with additives to enhance performance for specific composite formulations.

- Nano-engineered mold release technologies: Nano-engineered release technologies incorporate particles and structures at the nanoscale to create superior release surfaces for CFRP molding. These advanced systems can include nanoparticle-infused coatings, nano-textured surfaces, or hybrid materials that combine multiple release mechanisms. The nanoscale features provide exceptional release properties while minimizing surface defects on the finished composite parts. These technologies often result in improved cycle times, reduced contamination, and enhanced surface quality of the molded components.

- Automated release agent application systems: Automated systems for applying release agents improve consistency and efficiency in CFRP manufacturing processes. These technologies include robotic spray systems, precision dispensers, and integrated application equipment that ensure uniform coverage of release agents on complex mold geometries. Automated systems can be programmed to optimize release agent consumption while maintaining effective release properties, reducing waste and environmental impact. They also enable real-time monitoring and adjustment of application parameters to maintain consistent release performance.

- Water-based and environmentally friendly release agents: Water-based and environmentally friendly release agents provide sustainable alternatives for CFRP manufacturing. These formulations reduce or eliminate volatile organic compounds (VOCs) and hazardous air pollutants while maintaining effective release properties. They typically incorporate biodegradable components, renewable resources, or water-dispersible polymers as their base. These environmentally conscious solutions address increasing regulatory requirements and sustainability goals in composite manufacturing while offering comparable performance to traditional solvent-based systems.

02 Silicone-based release systems

Silicone-based release agents provide effective demolding solutions for CFRP manufacturing. These systems typically consist of polydimethylsiloxane compounds that form a thin, thermally stable barrier between the mold and composite material. Silicone release agents can be formulated as semi-permanent coatings or sacrificial layers, offering good release properties across multiple cycles. Advanced silicone formulations may incorporate additives to enhance thermal stability, reduce buildup, and improve compatibility with different resin systems, resulting in higher production efficiency and lower rejection rates.Expand Specific Solutions03 Nano-engineered mold release technologies

Nano-engineered release technologies incorporate particles and structures at the nanoscale to create superior release surfaces for CFRP molding. These advanced materials can include carbon nanotubes, graphene, ceramic nanoparticles, or metal oxide nanostructures that modify the surface properties of molds. The nanomaterials create ultra-smooth surfaces with precisely controlled topography and chemistry, minimizing mechanical interlocking between the mold and composite part. These technologies enable exceptional release efficiency, reduced cycle times, and improved surface quality of the final CFRP components.Expand Specific Solutions04 Automated release agent application systems

Automated systems for applying release agents improve consistency and efficiency in CFRP manufacturing. These technologies include robotic spray systems, precision dispensers, and computer-controlled application equipment that ensure uniform coverage of release agents on complex mold geometries. The automated systems can be integrated with production monitoring software to optimize release agent consumption, application patterns, and timing. By eliminating manual application variability, these systems enhance release efficiency, reduce material waste, and improve overall production throughput in CFRP manufacturing processes.Expand Specific Solutions05 Thermally-activated release mechanisms

Thermally-activated release mechanisms utilize temperature differentials to facilitate the separation of CFRP parts from molds. These technologies include specialized coatings or materials that change their physical properties at specific temperatures, creating a controlled release effect during the cooling phase of the molding process. Some systems incorporate thermally-expandable compounds that create microscopic separation between the mold and part when activated. Others use materials with different thermal expansion coefficients to generate shear forces that initiate release. These mechanisms enhance demolding efficiency while minimizing the need for external release agents.Expand Specific Solutions

Leading Manufacturers in CFRP Release Technology

The CFRP mold release technology market is currently in a growth phase, driven by increasing demand for lightweight materials in aerospace, automotive, and industrial applications. The global market size is estimated to exceed $500 million, with projected annual growth of 6-8%. Leading players include established materials giants like Toray Industries and SGL Carbon, who leverage their extensive CFRP expertise to develop advanced release solutions. Aerospace specialists such as Mitsubishi Heavy Industries, JAMCO, and RTX are advancing sector-specific technologies, while chemical companies like DIC, FUJIFILM, and Lonza focus on specialized release agents. The technology is approaching maturity in traditional applications but continues to evolve for complex geometries and high-temperature applications, with research institutions like Harbin FRP Institute and Shinshu University driving innovation through industry-academia collaboration.

Toray Industries, Inc.

Technical Solution: Toray has developed advanced fluoropolymer-based mold release systems specifically designed for CFRP manufacturing. Their technology incorporates nano-scale surface modification treatments that create an ultra-thin, highly durable release layer between the carbon fiber composite and the mold surface. This proprietary system utilizes a combination of fluorinated compounds and silicone-based additives that chemically bond to the mold surface, providing multiple release cycles without reapplication. Toray's solution includes both semi-permanent and sacrificial release agents, with their latest generation achieving up to 500 release cycles in production environments. The company has also pioneered water-based release systems that reduce VOC emissions by over 90% compared to traditional solvent-based alternatives, while maintaining equivalent release performance and surface finish quality.

Strengths: Superior durability with high cycle counts, environmentally friendly water-based formulations, and excellent surface finish quality. Weaknesses: Higher initial cost compared to conventional release agents, requires specialized application equipment, and some formulations have temperature limitations for high-temperature curing cycles.

Mitsubishi Heavy Industries, Ltd.

Technical Solution: Mitsubishi Heavy Industries has developed a hybrid mold release technology for CFRP manufacturing that combines physical and chemical release mechanisms. Their system utilizes a proprietary two-layer approach: a base layer containing ceramic nanoparticles that bond to the mold surface, and a top layer of fluoropolymer compounds that provide the actual release functionality. This dual-layer system creates micro-textured surfaces that reduce contact area between the composite and mold while maintaining excellent surface quality. MHI's technology incorporates automated spray application systems that ensure uniform coating thickness of 2-5 microns, optimizing material usage while ensuring consistent release performance. Their latest innovation includes thermally-responsive release agents that change properties during the cure cycle, providing strong adhesion during initial layup but transforming to release-promoting chemistry during the final cure phase.

Strengths: Excellent durability with reported 300+ release cycles, compatible with complex geometries, and provides consistent surface finish. Weaknesses: Requires precise application parameters and environmental controls, higher implementation cost than conventional systems, and limited compatibility with some resin systems.

Key Patents in Advanced Release Agent Technology

Polybutadiyne coated carbon fiber reinforced polymer composites

PatentInactiveUS4918117A

Innovation

- The use of vapor-deposited polybutadiyne as a coating for carbon fibers, which is formed by simultaneously depositing and polymerizing butadiyne monomers, creating a closely adherent film that promotes adhesion between the fibers and the matrix resin, with mild reaction temperatures and exceptional thermal stability, suitable for use in organic polymer matrix composites.

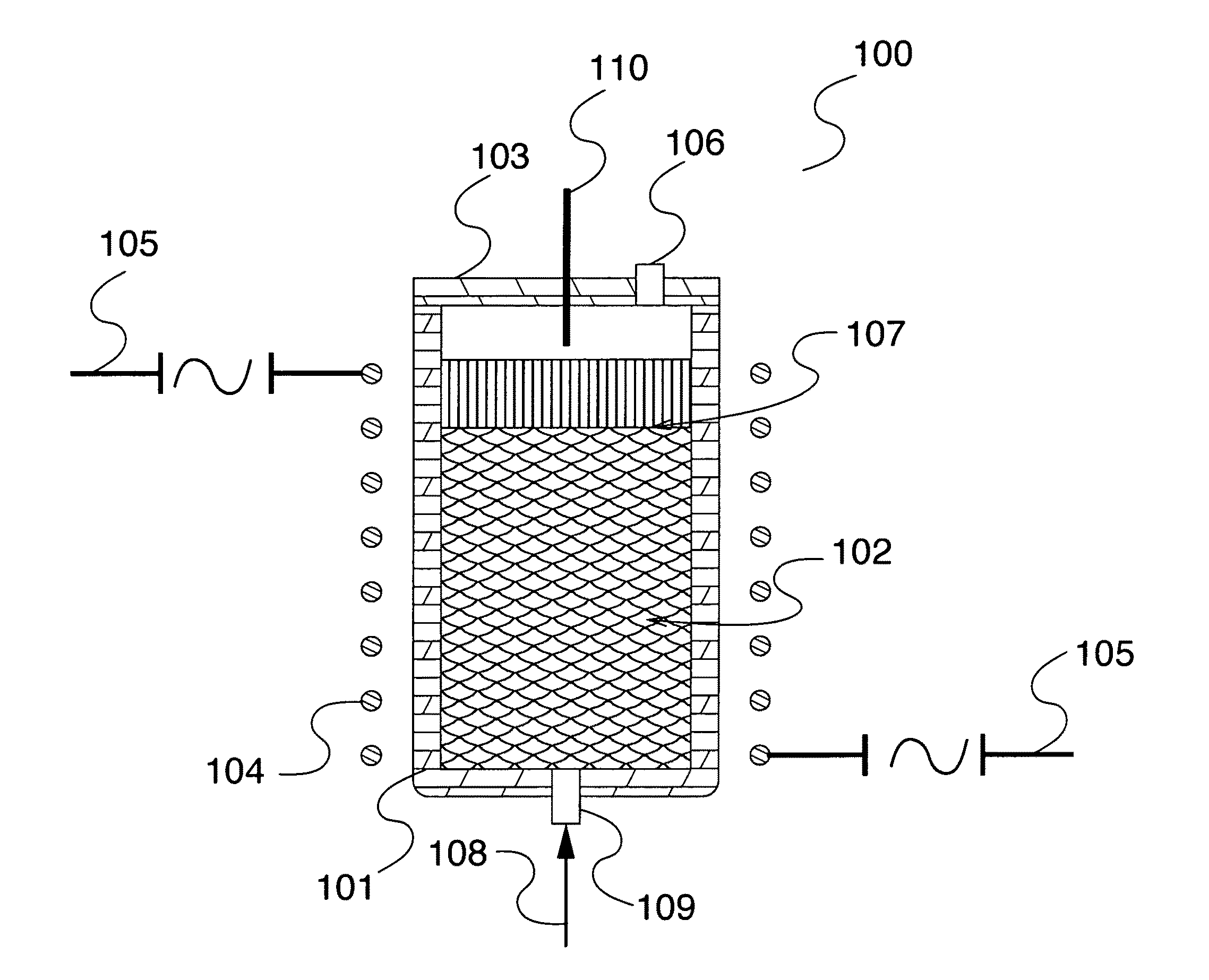

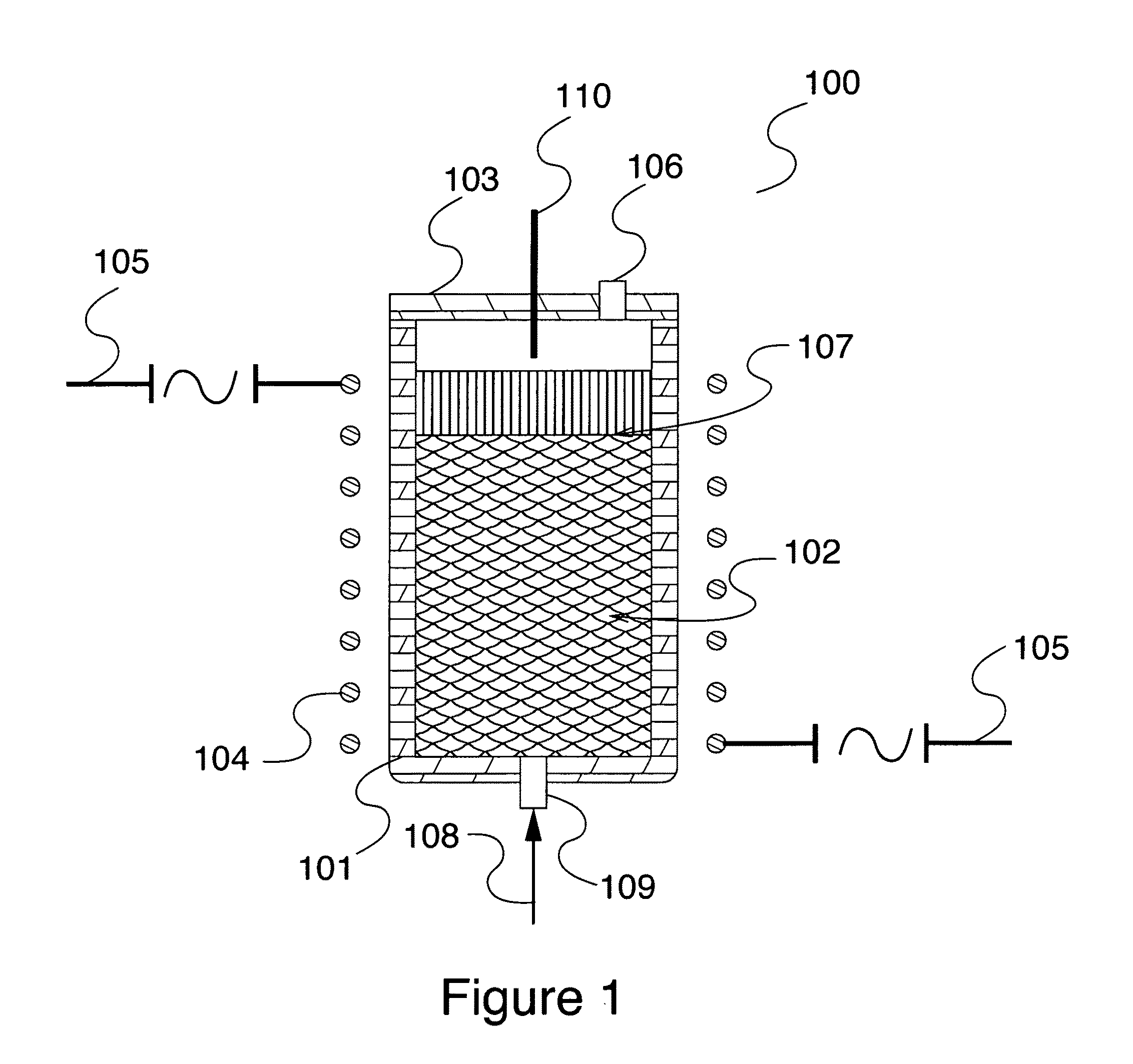

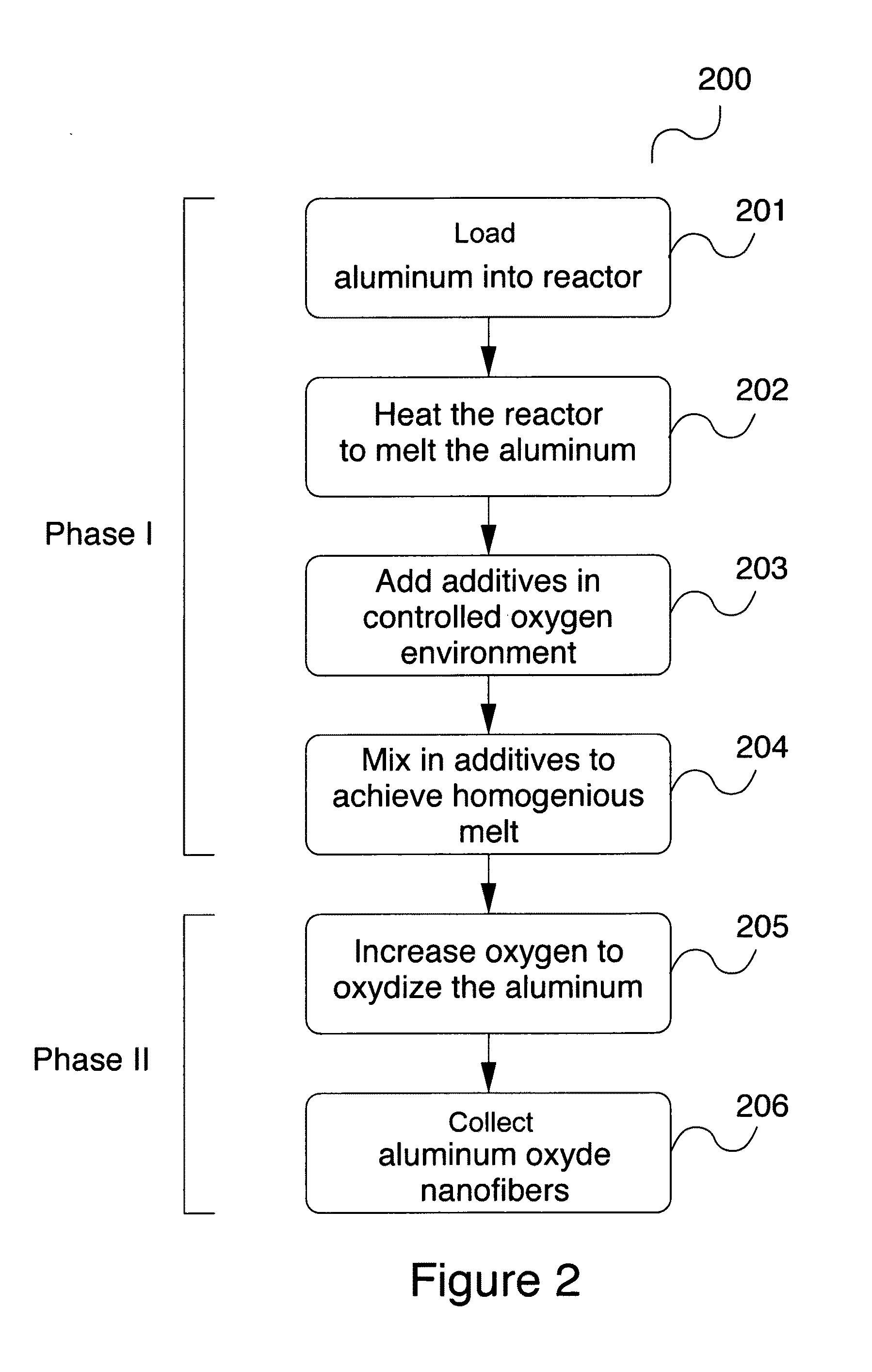

Method and apparatus for producing a carbon-fiber-reinforced polymers additiuonally reinforced by alumina nanofibers

PatentInactiveUS20160114500A1

Innovation

- The method involves saturating a structure of co-oriented pre-dispersed alumina Al2O3 nanofibers with a polymer matrix and facilitating polymerization, which includes pre-heating, cooling, exposure to ultraviolet light or electron beams, adding chemical hardeners, and applying ultrasound or hydrodynamic stress to enhance the dispersion and properties of the nanocomposite material.

Environmental Impact of Release Agents

The environmental impact of release agents used in CFRP (Carbon Fiber Reinforced Polymer) manufacturing processes represents a significant concern for industry stakeholders. Traditional release agents, particularly those based on petroleum derivatives and volatile organic compounds (VOCs), pose substantial environmental hazards throughout their lifecycle. These agents contribute to air pollution through VOC emissions during application and curing processes, with potential health implications for manufacturing personnel and surrounding communities.

Water contamination presents another critical environmental challenge, as residual release agents can enter water systems during cleaning operations or through improper disposal methods. Many conventional release agents contain persistent chemicals that resist biodegradation, accumulating in aquatic ecosystems and potentially entering the food chain. This bioaccumulation effect magnifies their environmental impact beyond the immediate manufacturing context.

Regulatory frameworks worldwide have increasingly targeted these environmental concerns, with legislation such as the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various Clean Air Acts imposing stricter limitations on permissible chemical compositions and emission levels. These regulations have accelerated industry transition toward more environmentally responsible alternatives.

Recent advancements in green chemistry have yielded promising developments in eco-friendly release agent formulations. Water-based systems have emerged as viable alternatives to solvent-based products, significantly reducing VOC emissions while maintaining acceptable performance characteristics. These formulations typically demonstrate 70-90% lower environmental impact scores in lifecycle assessments compared to traditional alternatives.

Plant-derived release agents represent another innovative approach, utilizing renewable resources such as vegetable oils and natural waxes as base materials. These bio-based alternatives offer enhanced biodegradability profiles while reducing dependency on finite petroleum resources. Research indicates that certain plant-derived formulations can achieve decomposition rates up to five times faster than conventional petroleum-based counterparts.

Solid film technologies, including advanced polymer coatings and semi-permanent release systems, further contribute to environmental sustainability by dramatically reducing application frequency and associated waste generation. These technologies can provide multiple release cycles without reapplication, minimizing both material consumption and environmental exposure.

The industry's shift toward environmentally responsible release technologies aligns with broader sustainability initiatives and circular economy principles. Manufacturers increasingly recognize that environmental performance constitutes not merely a regulatory compliance matter but a competitive advantage in markets where sustainability credentials influence purchasing decisions. This market-driven incentive, combined with regulatory pressure, continues to accelerate innovation in environmentally benign release agent technologies for CFRP manufacturing.

Water contamination presents another critical environmental challenge, as residual release agents can enter water systems during cleaning operations or through improper disposal methods. Many conventional release agents contain persistent chemicals that resist biodegradation, accumulating in aquatic ecosystems and potentially entering the food chain. This bioaccumulation effect magnifies their environmental impact beyond the immediate manufacturing context.

Regulatory frameworks worldwide have increasingly targeted these environmental concerns, with legislation such as the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various Clean Air Acts imposing stricter limitations on permissible chemical compositions and emission levels. These regulations have accelerated industry transition toward more environmentally responsible alternatives.

Recent advancements in green chemistry have yielded promising developments in eco-friendly release agent formulations. Water-based systems have emerged as viable alternatives to solvent-based products, significantly reducing VOC emissions while maintaining acceptable performance characteristics. These formulations typically demonstrate 70-90% lower environmental impact scores in lifecycle assessments compared to traditional alternatives.

Plant-derived release agents represent another innovative approach, utilizing renewable resources such as vegetable oils and natural waxes as base materials. These bio-based alternatives offer enhanced biodegradability profiles while reducing dependency on finite petroleum resources. Research indicates that certain plant-derived formulations can achieve decomposition rates up to five times faster than conventional petroleum-based counterparts.

Solid film technologies, including advanced polymer coatings and semi-permanent release systems, further contribute to environmental sustainability by dramatically reducing application frequency and associated waste generation. These technologies can provide multiple release cycles without reapplication, minimizing both material consumption and environmental exposure.

The industry's shift toward environmentally responsible release technologies aligns with broader sustainability initiatives and circular economy principles. Manufacturers increasingly recognize that environmental performance constitutes not merely a regulatory compliance matter but a competitive advantage in markets where sustainability credentials influence purchasing decisions. This market-driven incentive, combined with regulatory pressure, continues to accelerate innovation in environmentally benign release agent technologies for CFRP manufacturing.

Quality Control Standards for CFRP Surface Finish

Quality control standards for CFRP surface finish represent a critical aspect of the mold release technology optimization process. These standards must address both aesthetic and functional requirements, as surface defects can significantly impact the performance and market value of composite parts.

The industry has established several key parameters for evaluating CFRP surface quality, including gloss level, surface roughness (Ra value), void content, and dimensional accuracy. ASTM D523 and ISO 2813 provide standardized methods for measuring surface gloss, while ASTM D7127 and ISO 4287 govern surface roughness measurements. These standards typically specify maximum acceptable Ra values between 0.2-1.0 μm depending on the application.

Non-destructive testing (NDT) methods have become increasingly important in quality control protocols. Ultrasonic C-scan, thermography, and optical scanning technologies enable manufacturers to detect subsurface defects that may affect surface quality without damaging the component. The integration of these technologies with automated inspection systems has significantly improved detection rates and reduced inspection time.

Statistical process control (SPC) methodologies are now widely implemented to monitor and maintain consistent surface quality. Key performance indicators (KPIs) such as defect rates, surface consistency scores, and first-pass yield rates provide quantitative measures for continuous improvement initiatives. Industry benchmarks typically target defect rates below 2% and first-pass yields exceeding 95%.

Environmental factors significantly impact surface quality standards compliance. Temperature and humidity control during the molding and release processes must be maintained within ±2°C and ±5% relative humidity to ensure consistent results. Leading manufacturers have implemented climate-controlled clean rooms for critical applications where premium surface finishes are required.

Documentation requirements have also evolved, with digital traceability systems becoming the industry standard. These systems record all process parameters, release agent application methods, and post-release treatments, creating a comprehensive audit trail for each component. This documentation is particularly crucial for aerospace and automotive applications where regulatory compliance demands extensive quality assurance records.

Recent advancements in machine learning and computer vision have enabled the development of predictive quality control systems that can identify potential surface finish issues before they occur. These systems analyze patterns in process data and correlate them with historical quality outcomes, allowing for proactive adjustments to mold release parameters and significantly reducing rework rates.

The industry has established several key parameters for evaluating CFRP surface quality, including gloss level, surface roughness (Ra value), void content, and dimensional accuracy. ASTM D523 and ISO 2813 provide standardized methods for measuring surface gloss, while ASTM D7127 and ISO 4287 govern surface roughness measurements. These standards typically specify maximum acceptable Ra values between 0.2-1.0 μm depending on the application.

Non-destructive testing (NDT) methods have become increasingly important in quality control protocols. Ultrasonic C-scan, thermography, and optical scanning technologies enable manufacturers to detect subsurface defects that may affect surface quality without damaging the component. The integration of these technologies with automated inspection systems has significantly improved detection rates and reduced inspection time.

Statistical process control (SPC) methodologies are now widely implemented to monitor and maintain consistent surface quality. Key performance indicators (KPIs) such as defect rates, surface consistency scores, and first-pass yield rates provide quantitative measures for continuous improvement initiatives. Industry benchmarks typically target defect rates below 2% and first-pass yields exceeding 95%.

Environmental factors significantly impact surface quality standards compliance. Temperature and humidity control during the molding and release processes must be maintained within ±2°C and ±5% relative humidity to ensure consistent results. Leading manufacturers have implemented climate-controlled clean rooms for critical applications where premium surface finishes are required.

Documentation requirements have also evolved, with digital traceability systems becoming the industry standard. These systems record all process parameters, release agent application methods, and post-release treatments, creating a comprehensive audit trail for each component. This documentation is particularly crucial for aerospace and automotive applications where regulatory compliance demands extensive quality assurance records.

Recent advancements in machine learning and computer vision have enabled the development of predictive quality control systems that can identify potential surface finish issues before they occur. These systems analyze patterns in process data and correlate them with historical quality outcomes, allowing for proactive adjustments to mold release parameters and significantly reducing rework rates.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!