Carbon-negative Concrete: Revolutionizing the Construction Industry

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Evolution and Objectives

Concrete, a fundamental building material in modern construction, has undergone significant evolution since its inception in ancient Rome. Traditional concrete production is highly carbon-intensive, contributing approximately 8% of global CO2 emissions primarily through the calcination process in cement manufacturing and energy consumption. This environmental impact has driven research into carbon-negative alternatives over the past two decades, marking a paradigm shift in construction material science.

The evolution of carbon-negative concrete began with early experiments in carbon sequestration techniques around 2005, followed by breakthrough research in alternative binding materials between 2010-2015. The period from 2015-2020 saw significant advancements in CO2 curing technologies and industrial-scale implementation trials. Recent years have witnessed accelerated development with major construction projects utilizing carbon-negative concrete solutions, demonstrating their technical viability and performance capabilities.

The primary objective of carbon-negative concrete technology is to transform a major carbon emitter into a carbon sink, effectively removing more CO2 from the atmosphere than is released during production. This ambitious goal requires fundamental rethinking of concrete chemistry, production processes, and supply chain management. Specifically, the technology aims to achieve net carbon sequestration of at least 100kg CO2 per ton of concrete produced, while maintaining or exceeding the structural performance characteristics of traditional Portland cement concrete.

Secondary objectives include developing solutions that are economically viable without heavy subsidies, ensuring scalability to meet global construction demands, and creating formulations adaptable to various climate conditions and construction requirements. The technology must also address practical considerations such as setting time, workability, and long-term durability to facilitate industry adoption.

From a sustainability perspective, carbon-negative concrete aims to contribute significantly to global climate goals by providing a pathway to decarbonize the construction sector. The technology seeks to align with circular economy principles by incorporating industrial byproducts and waste materials as key ingredients, thereby addressing multiple environmental challenges simultaneously.

The ultimate vision for carbon-negative concrete extends beyond mere carbon neutrality to position concrete as an active climate solution. By revolutionizing this ubiquitous building material, the construction industry could transition from a significant contributor to climate change to a potential leader in carbon drawdown technologies, fundamentally altering the environmental equation of modern infrastructure development.

The evolution of carbon-negative concrete began with early experiments in carbon sequestration techniques around 2005, followed by breakthrough research in alternative binding materials between 2010-2015. The period from 2015-2020 saw significant advancements in CO2 curing technologies and industrial-scale implementation trials. Recent years have witnessed accelerated development with major construction projects utilizing carbon-negative concrete solutions, demonstrating their technical viability and performance capabilities.

The primary objective of carbon-negative concrete technology is to transform a major carbon emitter into a carbon sink, effectively removing more CO2 from the atmosphere than is released during production. This ambitious goal requires fundamental rethinking of concrete chemistry, production processes, and supply chain management. Specifically, the technology aims to achieve net carbon sequestration of at least 100kg CO2 per ton of concrete produced, while maintaining or exceeding the structural performance characteristics of traditional Portland cement concrete.

Secondary objectives include developing solutions that are economically viable without heavy subsidies, ensuring scalability to meet global construction demands, and creating formulations adaptable to various climate conditions and construction requirements. The technology must also address practical considerations such as setting time, workability, and long-term durability to facilitate industry adoption.

From a sustainability perspective, carbon-negative concrete aims to contribute significantly to global climate goals by providing a pathway to decarbonize the construction sector. The technology seeks to align with circular economy principles by incorporating industrial byproducts and waste materials as key ingredients, thereby addressing multiple environmental challenges simultaneously.

The ultimate vision for carbon-negative concrete extends beyond mere carbon neutrality to position concrete as an active climate solution. By revolutionizing this ubiquitous building material, the construction industry could transition from a significant contributor to climate change to a potential leader in carbon drawdown technologies, fundamentally altering the environmental equation of modern infrastructure development.

Market Demand Analysis for Sustainable Construction Materials

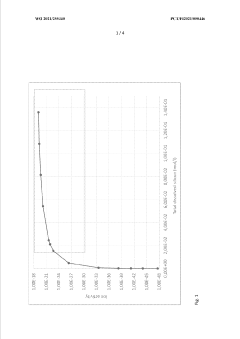

The global construction industry is experiencing a significant shift towards sustainable materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete, has shown remarkable growth in recent years. According to market research, the global green concrete market was valued at $26.2 billion in 2021 and is projected to reach $72.4 billion by 2030, growing at a CAGR of 12.1% during this period.

This growth is primarily fueled by stringent environmental regulations across major economies. The European Union's Green Deal aims to achieve carbon neutrality by 2050, while the United States has rejoined the Paris Agreement with ambitious emission reduction targets. China, the world's largest concrete producer, has pledged to reach carbon neutrality by 2060, creating substantial market opportunities for carbon-negative building materials.

Construction industry stakeholders are increasingly recognizing the environmental impact of traditional concrete, which accounts for approximately 8% of global CO2 emissions. This awareness has created a demand-pull effect, with major construction firms, property developers, and government infrastructure projects actively seeking sustainable alternatives. Market surveys indicate that 67% of construction companies are willing to pay a premium of 5-15% for carbon-negative concrete solutions that help meet their sustainability goals.

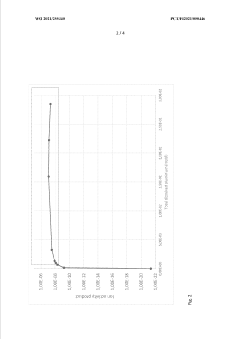

The market segmentation reveals diverse application areas for carbon-negative concrete. Commercial buildings represent the largest market segment (38%), followed by residential construction (27%), infrastructure projects (22%), and industrial facilities (13%). Geographically, Europe leads the adoption curve with 35% market share, followed by North America (28%), Asia-Pacific (25%), and other regions (12%).

Consumer preferences are also driving market growth, with increasing demand for green-certified buildings. LEED, BREEAM, and other certification systems have created tangible market incentives for using sustainable construction materials. Properties with green certifications command rental premiums of 6-10% and higher occupancy rates compared to conventional buildings.

Despite positive market signals, several barriers affect widespread adoption. The cost differential between conventional and carbon-negative concrete remains a significant challenge, though this gap is narrowing as production scales up and carbon pricing mechanisms become more prevalent. Technical performance concerns and industry conservatism also slow adoption rates, with many stakeholders requiring extensive validation before committing to new materials.

Looking forward, market projections indicate accelerating demand as regulatory pressures intensify and carbon pricing becomes more widespread. The carbon-negative concrete market is expected to grow at 18-20% annually through 2030, outpacing the broader construction materials sector and creating substantial opportunities for innovative solutions that can deliver both environmental and economic benefits.

This growth is primarily fueled by stringent environmental regulations across major economies. The European Union's Green Deal aims to achieve carbon neutrality by 2050, while the United States has rejoined the Paris Agreement with ambitious emission reduction targets. China, the world's largest concrete producer, has pledged to reach carbon neutrality by 2060, creating substantial market opportunities for carbon-negative building materials.

Construction industry stakeholders are increasingly recognizing the environmental impact of traditional concrete, which accounts for approximately 8% of global CO2 emissions. This awareness has created a demand-pull effect, with major construction firms, property developers, and government infrastructure projects actively seeking sustainable alternatives. Market surveys indicate that 67% of construction companies are willing to pay a premium of 5-15% for carbon-negative concrete solutions that help meet their sustainability goals.

The market segmentation reveals diverse application areas for carbon-negative concrete. Commercial buildings represent the largest market segment (38%), followed by residential construction (27%), infrastructure projects (22%), and industrial facilities (13%). Geographically, Europe leads the adoption curve with 35% market share, followed by North America (28%), Asia-Pacific (25%), and other regions (12%).

Consumer preferences are also driving market growth, with increasing demand for green-certified buildings. LEED, BREEAM, and other certification systems have created tangible market incentives for using sustainable construction materials. Properties with green certifications command rental premiums of 6-10% and higher occupancy rates compared to conventional buildings.

Despite positive market signals, several barriers affect widespread adoption. The cost differential between conventional and carbon-negative concrete remains a significant challenge, though this gap is narrowing as production scales up and carbon pricing mechanisms become more prevalent. Technical performance concerns and industry conservatism also slow adoption rates, with many stakeholders requiring extensive validation before committing to new materials.

Looking forward, market projections indicate accelerating demand as regulatory pressures intensify and carbon pricing becomes more widespread. The carbon-negative concrete market is expected to grow at 18-20% annually through 2030, outpacing the broader construction materials sector and creating substantial opportunities for innovative solutions that can deliver both environmental and economic benefits.

Global Status and Challenges in Carbon-negative Concrete Development

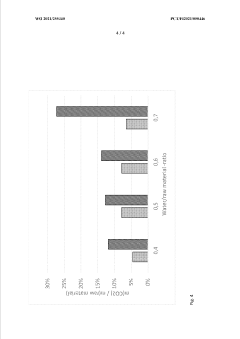

Carbon-negative concrete technology has seen significant global development in recent years, though with varying degrees of progress across different regions. In North America, companies like CarbonCure and Solidia Technologies have made substantial advancements, with CarbonCure's technology now implemented in over 500 concrete plants. The European Union leads in regulatory frameworks supporting carbon-negative construction materials, with countries like Sweden and Norway implementing carbon taxes that incentivize adoption of these technologies.

Asia-Pacific represents a critical frontier, with China—responsible for nearly 60% of global cement production—beginning to invest in carbon capture technologies for concrete production. However, implementation remains limited compared to Western markets. Developing regions in Africa and South America face significant barriers to adoption due to cost constraints and limited technological infrastructure.

Despite promising developments, carbon-negative concrete faces several critical challenges. Cost remains the primary obstacle, with production expenses typically 15-30% higher than conventional concrete. This price premium creates market resistance, particularly in cost-sensitive construction sectors and developing economies. The technology also faces scalability issues, as current carbon sequestration methods are difficult to implement at the massive scale required by the global concrete industry, which produces over 4 billion tons annually.

Technical challenges persist in ensuring long-term carbon sequestration stability. Questions remain about how carbon-negative concrete will perform over decades or centuries, particularly under various environmental conditions. The industry also struggles with standardization issues, as building codes and construction standards have been slow to incorporate these innovative materials, creating regulatory uncertainty that hampers adoption.

Infrastructure limitations present another significant barrier. Many existing concrete production facilities require substantial retrofitting to accommodate carbon-negative technologies, representing a major capital investment hurdle for manufacturers. Additionally, the supply chain for key ingredients in carbon-negative concrete formulations remains underdeveloped in many regions.

Knowledge gaps and expertise shortages further complicate implementation. The specialized knowledge required for proper mixing, pouring, and curing of carbon-negative concrete is not yet widespread among construction professionals. This technical expertise deficit creates resistance to adoption among contractors and builders who are unfamiliar with the material's properties and handling requirements.

Finally, market acceptance remains a challenge, with many stakeholders in the construction industry demonstrating risk aversion toward relatively new materials, particularly for structural applications where failure consequences are severe. Overcoming this resistance requires extensive demonstration projects and performance data that are still being accumulated.

Asia-Pacific represents a critical frontier, with China—responsible for nearly 60% of global cement production—beginning to invest in carbon capture technologies for concrete production. However, implementation remains limited compared to Western markets. Developing regions in Africa and South America face significant barriers to adoption due to cost constraints and limited technological infrastructure.

Despite promising developments, carbon-negative concrete faces several critical challenges. Cost remains the primary obstacle, with production expenses typically 15-30% higher than conventional concrete. This price premium creates market resistance, particularly in cost-sensitive construction sectors and developing economies. The technology also faces scalability issues, as current carbon sequestration methods are difficult to implement at the massive scale required by the global concrete industry, which produces over 4 billion tons annually.

Technical challenges persist in ensuring long-term carbon sequestration stability. Questions remain about how carbon-negative concrete will perform over decades or centuries, particularly under various environmental conditions. The industry also struggles with standardization issues, as building codes and construction standards have been slow to incorporate these innovative materials, creating regulatory uncertainty that hampers adoption.

Infrastructure limitations present another significant barrier. Many existing concrete production facilities require substantial retrofitting to accommodate carbon-negative technologies, representing a major capital investment hurdle for manufacturers. Additionally, the supply chain for key ingredients in carbon-negative concrete formulations remains underdeveloped in many regions.

Knowledge gaps and expertise shortages further complicate implementation. The specialized knowledge required for proper mixing, pouring, and curing of carbon-negative concrete is not yet widespread among construction professionals. This technical expertise deficit creates resistance to adoption among contractors and builders who are unfamiliar with the material's properties and handling requirements.

Finally, market acceptance remains a challenge, with many stakeholders in the construction industry demonstrating risk aversion toward relatively new materials, particularly for structural applications where failure consequences are severe. Overcoming this resistance requires extensive demonstration projects and performance data that are still being accumulated.

Current Carbon-negative Concrete Formulations and Production Methods

01 Carbon capture and sequestration in concrete

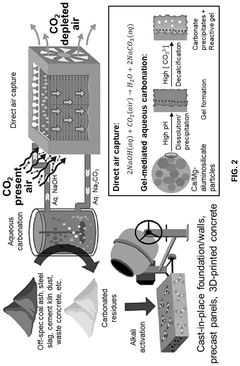

Concrete formulations that actively capture and sequester carbon dioxide during the curing process, transforming CO2 into stable carbonate minerals within the concrete matrix. These technologies enable concrete to act as a carbon sink, permanently removing CO2 from the atmosphere while enhancing material properties such as strength and durability. The process typically involves exposing fresh concrete to controlled CO2 environments or incorporating reactive materials that facilitate carbonation.- Carbon capture and sequestration in concrete: Technologies that enable concrete to absorb and permanently store carbon dioxide during the curing process, effectively making the concrete a carbon sink. These methods involve specialized formulations that can absorb CO2 from the atmosphere or industrial emissions, chemically binding it within the concrete matrix through carbonation reactions. This approach not only reduces the carbon footprint of concrete production but can potentially make concrete carbon-negative by sequestering more carbon than was emitted during its manufacture.

- Alternative low-carbon binders and cement substitutes: Development of novel binding materials that can partially or completely replace traditional Portland cement, which is responsible for significant carbon emissions. These alternatives include geopolymers, alkali-activated materials, magnesium-based cements, and various industrial byproducts like fly ash and slag. By reducing the clinker content or eliminating the need for energy-intensive cement production processes, these substitutes can substantially lower the carbon footprint of concrete while maintaining or even improving performance characteristics.

- CO2 utilization in concrete manufacturing: Innovative processes that deliberately inject or utilize CO2 during concrete production to create carbonated concrete products. These methods convert waste CO2 from industrial sources into valuable mineral carbonates that become permanently bound in the concrete. The carbonation process can improve concrete properties such as strength and durability while simultaneously reducing the need for traditional cement content. This approach represents a circular economy solution by transforming a greenhouse gas into a useful input for construction materials.

- Monitoring and verification systems for carbon-negative concrete: Advanced systems and methodologies for measuring, reporting, and verifying the carbon sequestration capabilities of concrete products. These technologies include sensors, data analytics platforms, and lifecycle assessment tools that can accurately quantify the amount of carbon captured and stored in concrete structures over time. Such systems are essential for validating carbon credits, ensuring regulatory compliance, and providing transparency in environmental claims related to carbon-negative concrete products.

- Biomass incorporation and biogenic materials in concrete: Integration of biomass-derived materials and biogenic substances into concrete formulations to reduce carbon emissions and enhance carbon sequestration. These approaches include incorporating agricultural waste, wood products, algae, or other plant-based materials that have naturally absorbed CO2 during their growth cycle. When these materials are included in concrete, they not only reduce the need for carbon-intensive ingredients but also lock away the biologically sequestered carbon for the lifetime of the concrete structure.

02 Alternative cementitious materials with lower carbon footprint

Development of cement alternatives and supplementary cementitious materials that significantly reduce the carbon emissions associated with traditional Portland cement production. These include geopolymers, alkali-activated materials, and various industrial byproducts such as fly ash, slag, and silica fume. These materials can replace substantial portions of conventional cement while maintaining or improving concrete performance characteristics, resulting in substantially lower embodied carbon.Expand Specific Solutions03 Monitoring and verification systems for carbon emissions

Technologies and methodologies for accurately measuring, reporting, and verifying carbon emissions throughout the concrete production lifecycle. These systems employ sensors, data analytics, and blockchain technologies to track carbon footprints from raw material extraction through manufacturing, transportation, construction, and end-of-life phases. Such systems enable carbon credits, regulatory compliance, and market differentiation for low-carbon concrete products.Expand Specific Solutions04 Novel production processes for carbon-negative concrete

Innovative manufacturing processes designed specifically to minimize or eliminate carbon emissions in concrete production. These include electrification of kilns, renewable energy integration, hydrogen-based heating, and carbon capture technologies integrated directly into production facilities. Some processes also incorporate biomass or waste materials as alternative fuel sources, further reducing the carbon footprint of concrete manufacturing.Expand Specific Solutions05 Biomass incorporation and carbon offsetting in concrete

Methods for incorporating biomass-derived materials into concrete formulations, effectively storing biogenic carbon within building materials. These approaches include using agricultural waste products, biochar, and other plant-derived materials as aggregates or admixtures. Additionally, some technologies focus on offsetting concrete's carbon footprint through integrated carbon credit systems or by coupling concrete production with reforestation or other carbon sequestration initiatives.Expand Specific Solutions

Leading Companies and Research Institutions in Carbon-negative Concrete

Carbon-negative concrete technology is currently in an early growth phase, with increasing market interest driven by global decarbonization efforts. The market size is expanding rapidly, projected to reach significant scale as construction industries seek sustainable alternatives. Technologically, the field shows varying maturity levels across players. Leading companies like Solidia Technologies and Carbicrete have developed commercial-ready solutions, while Carbon Limit Co. demonstrates innovative carbon capture integration. Traditional construction giants including China National Building Material Group and Holcim Technology are investing in research partnerships. Academic institutions such as Worcester Polytechnic Institute and Colorado School of Mines are advancing fundamental research. The competitive landscape features both established concrete manufacturers pivoting toward sustainability and specialized startups with disruptive carbon-negative formulations.

Solidia Technologies, Inc.

Technical Solution: Solidia Technologies has pioneered a low-carbon cement and concrete system that reduces the carbon footprint of concrete by up to 70%. Their proprietary technology involves two key innovations: (1) a sustainable cement manufacturing process that emits approximately 30% less CO2 than ordinary Portland cement production, and (2) a concrete curing process that uses CO2 instead of water, permanently sequestering carbon dioxide. The Solidia Cement™ is produced using the same raw materials and equipment as traditional cement but at lower temperatures, reducing energy consumption. During concrete production, Solidia's process consumes up to 300kg of CO2 per ton of cement used, effectively transforming CO2 from an industrial waste into a valuable feedstock for concrete manufacturing. The technology has been validated through partnerships with major industry players including LafargeHolcim and is commercially available in select markets.

Strengths: Dual approach addressing both cement production and concrete curing; compatible with existing manufacturing equipment; significant water savings (up to 100%); faster curing time (24 hours vs. 28 days); proven durability. Weaknesses: Not fully carbon-negative but rather low-carbon; requires modification to existing production facilities; market adoption faces industry conservatism; limited to certain concrete applications initially.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group (CNBM) has developed an integrated carbon-negative concrete system called "CNBM GreenCarbon" that combines several innovative approaches. Their technology utilizes industrial byproducts including steel slag, fly ash, and carbide slag as cement substitutes, reducing the carbon footprint by up to 60% in the production phase. CNBM's process incorporates a specialized CO2 mineralization technology that injects captured carbon dioxide during the concrete mixing process, where it reacts with calcium-rich components to form stable calcium carbonates. The company has implemented large-scale carbon capture facilities at several of their cement plants, with their Anhui demonstration project capturing over 50,000 tons of CO2 annually for use in concrete production. CNBM has also pioneered the use of alternative fuels in clinker production, further reducing the carbon intensity of their cement. Their technology has been implemented in major infrastructure projects across China, including portions of the Beijing-Shanghai high-speed railway.

Strengths: Massive production scale and implementation capacity; integrated supply chain from cement production to concrete application; strong government support for deployment; cost-competitive with conventional concrete in Chinese market. Weaknesses: Technology performance varies across different applications; international standards compliance still developing; carbon negativity depends on full implementation of all system components; limited transparency on performance metrics compared to Western competitors.

Key Patents and Innovations in CO2 Absorption Technologies

Controlling carbonation

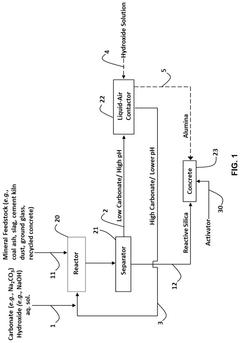

PatentWO2021255340A1

Innovation

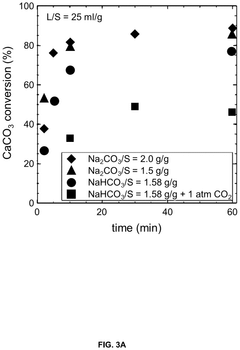

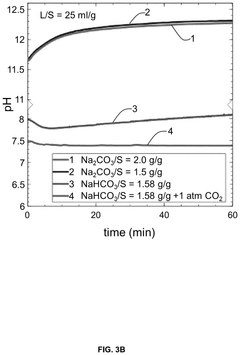

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

Cementitious materials and methods of making and using same

PatentPendingUS20250042811A1

Innovation

- A carbon mineralization-based direct-air capture process is used to produce carbon-negative cementitious materials by capturing CO2 from the air through an aqueous carbonation cycle, enhancing the pozzolanic reactivity of industrial mineral wastes, and incorporating the captured CO2 as solid carbonate in the concrete.

Regulatory Framework and Carbon Credit Opportunities

The regulatory landscape for carbon-negative concrete is rapidly evolving as governments worldwide implement policies to address climate change. The European Union's Emissions Trading System (EU ETS) has established a precedent for carbon pricing mechanisms that directly impact the construction industry. Similarly, the United States has introduced tax incentives through the Inflation Reduction Act that provides credits for carbon capture technologies, potentially benefiting carbon-negative concrete producers. These regulatory frameworks create financial incentives that can offset the initially higher costs of carbon-negative concrete production.

Carbon credit markets present significant opportunities for manufacturers of carbon-negative concrete. By sequestering more carbon than emitted during production, these companies can generate valuable carbon credits that can be sold on voluntary or compliance markets. The average value of carbon credits has increased by approximately 15% annually over the past five years, creating an additional revenue stream that enhances the economic viability of carbon-negative concrete technologies.

Certification standards are emerging as critical components of the regulatory framework. The International Organization for Standardization (ISO) has developed standards for carbon footprint measurement that apply to construction materials, while industry-specific certifications like the Concrete Sustainability Council (CSC) certification provide frameworks for evaluating environmental performance. These standards enable transparent verification of carbon-negative claims and facilitate market acceptance.

Regional variations in regulatory approaches create both challenges and opportunities. While the EU has implemented stringent carbon regulations with clear pathways for carbon-negative materials, developing economies often prioritize cost considerations over environmental impact. However, international climate finance mechanisms such as the Green Climate Fund are creating pathways for technology transfer and adoption of carbon-negative concrete in emerging markets.

Public procurement policies represent a powerful regulatory tool driving market adoption. Several countries have implemented green procurement requirements that favor low-carbon or carbon-negative building materials. For instance, California's Buy Clean California Act requires state agencies to consider the carbon footprint of construction materials in procurement decisions, creating guaranteed markets for innovative concrete solutions.

Looking forward, the integration of carbon-negative concrete into building codes represents the next frontier in regulatory development. Early adopters like Norway and Sweden have already begun incorporating carbon footprint requirements into their national building standards, potentially creating models for global adoption. These regulatory developments, combined with expanding carbon credit opportunities, are creating a favorable environment for the commercialization and scaling of carbon-negative concrete technologies.

Carbon credit markets present significant opportunities for manufacturers of carbon-negative concrete. By sequestering more carbon than emitted during production, these companies can generate valuable carbon credits that can be sold on voluntary or compliance markets. The average value of carbon credits has increased by approximately 15% annually over the past five years, creating an additional revenue stream that enhances the economic viability of carbon-negative concrete technologies.

Certification standards are emerging as critical components of the regulatory framework. The International Organization for Standardization (ISO) has developed standards for carbon footprint measurement that apply to construction materials, while industry-specific certifications like the Concrete Sustainability Council (CSC) certification provide frameworks for evaluating environmental performance. These standards enable transparent verification of carbon-negative claims and facilitate market acceptance.

Regional variations in regulatory approaches create both challenges and opportunities. While the EU has implemented stringent carbon regulations with clear pathways for carbon-negative materials, developing economies often prioritize cost considerations over environmental impact. However, international climate finance mechanisms such as the Green Climate Fund are creating pathways for technology transfer and adoption of carbon-negative concrete in emerging markets.

Public procurement policies represent a powerful regulatory tool driving market adoption. Several countries have implemented green procurement requirements that favor low-carbon or carbon-negative building materials. For instance, California's Buy Clean California Act requires state agencies to consider the carbon footprint of construction materials in procurement decisions, creating guaranteed markets for innovative concrete solutions.

Looking forward, the integration of carbon-negative concrete into building codes represents the next frontier in regulatory development. Early adopters like Norway and Sweden have already begun incorporating carbon footprint requirements into their national building standards, potentially creating models for global adoption. These regulatory developments, combined with expanding carbon credit opportunities, are creating a favorable environment for the commercialization and scaling of carbon-negative concrete technologies.

Life Cycle Assessment and Environmental Impact Metrics

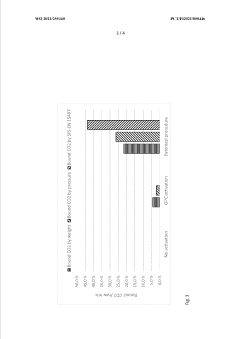

Life Cycle Assessment (LCA) serves as a critical framework for evaluating carbon-negative concrete technologies, providing comprehensive analysis across the entire product lifecycle from raw material extraction to end-of-life disposal. Traditional concrete production accounts for approximately 8% of global CO2 emissions, primarily from cement manufacturing. Carbon-negative alternatives must demonstrate quantifiable environmental benefits through standardized metrics to gain industry acceptance.

Key environmental impact metrics for carbon-negative concrete include Global Warming Potential (GWP), measured in CO2-equivalent emissions; embodied carbon, representing the total carbon footprint throughout production; and carbon sequestration capacity, indicating how much CO2 the material can permanently remove from the atmosphere. These metrics enable meaningful comparisons between conventional and innovative concrete formulations.

Robust LCA methodologies follow ISO 14040/14044 standards, ensuring consistent boundary conditions and functional units across assessments. Recent studies indicate that carbon-negative concrete technologies can potentially sequester 100-300 kg CO2 per cubic meter of concrete, compared to traditional concrete which emits 400-500 kg CO2 per cubic meter.

Environmental impact extends beyond carbon metrics to include resource depletion, water usage, and ecological toxicity. Carbon-negative concrete often utilizes industrial byproducts like fly ash or slag, contributing to circular economy principles while reducing landfill waste. However, these materials may introduce other environmental considerations that must be carefully evaluated through comprehensive LCA.

Temporal aspects of carbon accounting present unique challenges for carbon-negative concrete. While conventional concrete continues to slowly absorb CO2 through carbonation over its lifetime, new carbon-negative formulations may front-load sequestration during production or curing phases. This temporal distribution affects how benefits are calculated and reported, requiring standardized timeframes for fair comparison.

Industry stakeholders increasingly demand transparent environmental product declarations (EPDs) based on verified LCA data. These declarations support sustainable procurement decisions and compliance with emerging green building standards. As regulatory frameworks evolve to incentivize low-carbon construction materials, rigorous impact metrics will become essential for market differentiation and compliance verification.

Key environmental impact metrics for carbon-negative concrete include Global Warming Potential (GWP), measured in CO2-equivalent emissions; embodied carbon, representing the total carbon footprint throughout production; and carbon sequestration capacity, indicating how much CO2 the material can permanently remove from the atmosphere. These metrics enable meaningful comparisons between conventional and innovative concrete formulations.

Robust LCA methodologies follow ISO 14040/14044 standards, ensuring consistent boundary conditions and functional units across assessments. Recent studies indicate that carbon-negative concrete technologies can potentially sequester 100-300 kg CO2 per cubic meter of concrete, compared to traditional concrete which emits 400-500 kg CO2 per cubic meter.

Environmental impact extends beyond carbon metrics to include resource depletion, water usage, and ecological toxicity. Carbon-negative concrete often utilizes industrial byproducts like fly ash or slag, contributing to circular economy principles while reducing landfill waste. However, these materials may introduce other environmental considerations that must be carefully evaluated through comprehensive LCA.

Temporal aspects of carbon accounting present unique challenges for carbon-negative concrete. While conventional concrete continues to slowly absorb CO2 through carbonation over its lifetime, new carbon-negative formulations may front-load sequestration during production or curing phases. This temporal distribution affects how benefits are calculated and reported, requiring standardized timeframes for fair comparison.

Industry stakeholders increasingly demand transparent environmental product declarations (EPDs) based on verified LCA data. These declarations support sustainable procurement decisions and compliance with emerging green building standards. As regulatory frameworks evolve to incentivize low-carbon construction materials, rigorous impact metrics will become essential for market differentiation and compliance verification.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!