Challenges in the Commercialization of Carbon-negative Concrete

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Background and Objectives

Concrete, a fundamental building material in modern construction, has been a significant contributor to global carbon emissions due to its production process, particularly cement manufacturing. The concept of carbon-negative concrete represents a revolutionary shift in construction materials, aiming not only to reduce the carbon footprint but to actively remove carbon dioxide from the atmosphere. This technological innovation has emerged over the past decade as a response to growing environmental concerns and the urgent need to mitigate climate change impacts.

The evolution of concrete technology has progressed from traditional high-emission formulations to low-carbon alternatives, and now to carbon-negative solutions. This progression reflects the construction industry's adaptation to sustainability imperatives and regulatory pressures. Carbon-negative concrete achieves its environmental benefits through innovative processes such as carbon capture during production, incorporation of carbon-absorbing materials, and utilization of alternative cementitious materials that require less energy to produce.

The primary objective of carbon-negative concrete technology is to transform a major source of greenhouse gas emissions into a carbon sink, while maintaining or enhancing the performance characteristics required for structural applications. This dual goal presents significant technical challenges that must be overcome for successful commercialization. Additionally, the technology aims to align with global carbon reduction targets established by international agreements such as the Paris Climate Accord.

Current research and development efforts focus on several approaches, including the use of supplementary cementitious materials like fly ash and slag, incorporation of novel carbon-sequestering aggregates, and development of alternative binding systems that consume CO2 during curing. These approaches vary in technological maturity, with some already in pilot production while others remain in laboratory testing phases.

The commercialization of carbon-negative concrete represents a potential paradigm shift in the construction materials industry, with implications extending beyond environmental benefits to include economic opportunities in carbon markets and competitive advantages in increasingly eco-conscious procurement processes. However, the path to widespread adoption faces numerous obstacles, including technical performance verification, cost competitiveness, regulatory approval, and industry acceptance.

Understanding the historical context and technological trajectory of carbon-negative concrete provides essential insights for evaluating its commercial viability and identifying strategic approaches to overcome implementation barriers. This analysis serves as a foundation for exploring the specific challenges and opportunities in bringing this promising technology to market at scale.

The evolution of concrete technology has progressed from traditional high-emission formulations to low-carbon alternatives, and now to carbon-negative solutions. This progression reflects the construction industry's adaptation to sustainability imperatives and regulatory pressures. Carbon-negative concrete achieves its environmental benefits through innovative processes such as carbon capture during production, incorporation of carbon-absorbing materials, and utilization of alternative cementitious materials that require less energy to produce.

The primary objective of carbon-negative concrete technology is to transform a major source of greenhouse gas emissions into a carbon sink, while maintaining or enhancing the performance characteristics required for structural applications. This dual goal presents significant technical challenges that must be overcome for successful commercialization. Additionally, the technology aims to align with global carbon reduction targets established by international agreements such as the Paris Climate Accord.

Current research and development efforts focus on several approaches, including the use of supplementary cementitious materials like fly ash and slag, incorporation of novel carbon-sequestering aggregates, and development of alternative binding systems that consume CO2 during curing. These approaches vary in technological maturity, with some already in pilot production while others remain in laboratory testing phases.

The commercialization of carbon-negative concrete represents a potential paradigm shift in the construction materials industry, with implications extending beyond environmental benefits to include economic opportunities in carbon markets and competitive advantages in increasingly eco-conscious procurement processes. However, the path to widespread adoption faces numerous obstacles, including technical performance verification, cost competitiveness, regulatory approval, and industry acceptance.

Understanding the historical context and technological trajectory of carbon-negative concrete provides essential insights for evaluating its commercial viability and identifying strategic approaches to overcome implementation barriers. This analysis serves as a foundation for exploring the specific challenges and opportunities in bringing this promising technology to market at scale.

Market Analysis for Carbon-negative Construction Materials

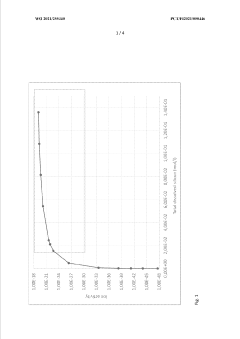

The global market for carbon-negative construction materials, particularly carbon-negative concrete, is experiencing significant growth driven by increasing environmental regulations and sustainability initiatives. Current market valuations indicate that green construction materials are projected to reach $523 billion by 2027, with carbon-negative concrete representing an emerging segment within this broader category. The compound annual growth rate (CAGR) for sustainable concrete alternatives is estimated at 9.1% through 2030, outpacing traditional concrete market growth rates of 3-4%.

Regional analysis reveals varying adoption rates and market potential. North America and Europe currently lead in carbon-negative concrete implementation, primarily due to stringent carbon regulations and well-established green building certification programs. The European market shows particular promise with its ambitious European Green Deal targeting carbon neutrality by 2050, creating substantial demand for carbon-negative building materials. Asia-Pacific represents the fastest-growing market, with China and India's massive construction sectors offering tremendous scaling potential despite current lower adoption rates.

Demand drivers for carbon-negative concrete extend beyond regulatory compliance. Corporate sustainability commitments, particularly from technology and retail giants with net-zero carbon pledges, are creating significant pull for innovative building materials. Additionally, government infrastructure spending increasingly incorporates green procurement requirements, with several countries implementing carbon taxes and embodied carbon regulations that favor carbon-negative alternatives.

Consumer sentiment analysis indicates growing awareness and preference for sustainable construction materials among both commercial and residential end-users. Premium pricing tolerance exists particularly in high-end commercial construction, with surveys showing 65% of commercial developers willing to pay 5-15% premiums for carbon-negative materials that contribute to certification achievements and corporate sustainability goals.

Market barriers remain significant despite positive growth indicators. Price sensitivity continues to be the primary obstacle, with carbon-negative concrete currently commanding 20-45% price premiums over traditional Portland cement concrete. Supply chain limitations and production scaling challenges further constrain market penetration, while conservative industry adoption practices slow implementation rates despite proven technical viability.

The competitive landscape is evolving rapidly, with both established concrete manufacturers and innovative startups entering the carbon-negative concrete space. Strategic partnerships between technology developers and traditional concrete producers are emerging as the dominant commercialization model, leveraging existing distribution networks while introducing revolutionary carbon sequestration technologies.

Regional analysis reveals varying adoption rates and market potential. North America and Europe currently lead in carbon-negative concrete implementation, primarily due to stringent carbon regulations and well-established green building certification programs. The European market shows particular promise with its ambitious European Green Deal targeting carbon neutrality by 2050, creating substantial demand for carbon-negative building materials. Asia-Pacific represents the fastest-growing market, with China and India's massive construction sectors offering tremendous scaling potential despite current lower adoption rates.

Demand drivers for carbon-negative concrete extend beyond regulatory compliance. Corporate sustainability commitments, particularly from technology and retail giants with net-zero carbon pledges, are creating significant pull for innovative building materials. Additionally, government infrastructure spending increasingly incorporates green procurement requirements, with several countries implementing carbon taxes and embodied carbon regulations that favor carbon-negative alternatives.

Consumer sentiment analysis indicates growing awareness and preference for sustainable construction materials among both commercial and residential end-users. Premium pricing tolerance exists particularly in high-end commercial construction, with surveys showing 65% of commercial developers willing to pay 5-15% premiums for carbon-negative materials that contribute to certification achievements and corporate sustainability goals.

Market barriers remain significant despite positive growth indicators. Price sensitivity continues to be the primary obstacle, with carbon-negative concrete currently commanding 20-45% price premiums over traditional Portland cement concrete. Supply chain limitations and production scaling challenges further constrain market penetration, while conservative industry adoption practices slow implementation rates despite proven technical viability.

The competitive landscape is evolving rapidly, with both established concrete manufacturers and innovative startups entering the carbon-negative concrete space. Strategic partnerships between technology developers and traditional concrete producers are emerging as the dominant commercialization model, leveraging existing distribution networks while introducing revolutionary carbon sequestration technologies.

Technical Barriers and Global Development Status

Carbon-negative concrete faces significant technical barriers that hinder its widespread commercialization. The primary challenge lies in the carbon capture and utilization processes, which currently require substantial energy inputs, potentially offsetting the carbon reduction benefits. Most existing technologies operate at laboratory scale, with limited demonstration of industrial-scale production capabilities that can meet global construction demands.

Material science limitations present another major obstacle. Carbon-negative concrete formulations often exhibit slower curing times compared to traditional Portland cement, extending construction schedules and increasing project costs. Mechanical performance issues, particularly reduced early-stage strength and durability concerns under various environmental conditions, create hesitation among engineers and contractors who prioritize structural reliability.

The global development status of carbon-negative concrete technologies varies significantly by region. North America leads in research and development, with several startups and university partnerships advancing novel formulations. Companies like CarbonCure and Solidia Technologies have achieved limited commercial deployment in specific markets. The European Union has established progressive regulatory frameworks supporting low-carbon building materials, creating favorable conditions for technology adoption.

In Asia, development is concentrated in advanced economies like Japan and South Korea, with China rapidly increasing investments in this sector. However, implementation in developing regions remains minimal due to cost barriers and technical expertise limitations. The technology readiness level (TRL) of most carbon-negative concrete solutions ranges between 5-7, indicating validation in relevant environments but incomplete commercial readiness.

Standardization and certification represent critical barriers to market acceptance. Current building codes and material standards were developed for traditional concrete, creating regulatory hurdles for novel formulations. The absence of universally accepted testing protocols and performance metrics for carbon-negative properties complicates quality assurance and market comparison.

Supply chain constraints further impede commercialization efforts. Many carbon-negative concrete technologies rely on industrial byproducts or specialized materials with limited availability. The geographical distribution of these resources often doesn't align with construction demand centers, creating logistical challenges and increasing embodied carbon from transportation.

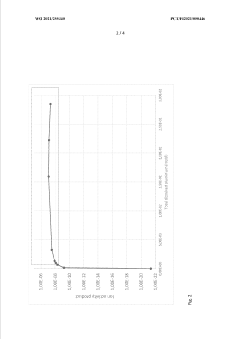

Economic viability remains perhaps the most significant barrier. Production costs for carbon-negative concrete typically exceed conventional alternatives by 15-40%, depending on the technology and location. Without carbon pricing mechanisms or regulatory mandates, the value proposition relies heavily on corporate sustainability commitments and green building certifications, limiting market penetration to premium construction segments.

Material science limitations present another major obstacle. Carbon-negative concrete formulations often exhibit slower curing times compared to traditional Portland cement, extending construction schedules and increasing project costs. Mechanical performance issues, particularly reduced early-stage strength and durability concerns under various environmental conditions, create hesitation among engineers and contractors who prioritize structural reliability.

The global development status of carbon-negative concrete technologies varies significantly by region. North America leads in research and development, with several startups and university partnerships advancing novel formulations. Companies like CarbonCure and Solidia Technologies have achieved limited commercial deployment in specific markets. The European Union has established progressive regulatory frameworks supporting low-carbon building materials, creating favorable conditions for technology adoption.

In Asia, development is concentrated in advanced economies like Japan and South Korea, with China rapidly increasing investments in this sector. However, implementation in developing regions remains minimal due to cost barriers and technical expertise limitations. The technology readiness level (TRL) of most carbon-negative concrete solutions ranges between 5-7, indicating validation in relevant environments but incomplete commercial readiness.

Standardization and certification represent critical barriers to market acceptance. Current building codes and material standards were developed for traditional concrete, creating regulatory hurdles for novel formulations. The absence of universally accepted testing protocols and performance metrics for carbon-negative properties complicates quality assurance and market comparison.

Supply chain constraints further impede commercialization efforts. Many carbon-negative concrete technologies rely on industrial byproducts or specialized materials with limited availability. The geographical distribution of these resources often doesn't align with construction demand centers, creating logistical challenges and increasing embodied carbon from transportation.

Economic viability remains perhaps the most significant barrier. Production costs for carbon-negative concrete typically exceed conventional alternatives by 15-40%, depending on the technology and location. Without carbon pricing mechanisms or regulatory mandates, the value proposition relies heavily on corporate sustainability commitments and green building certifications, limiting market penetration to premium construction segments.

Current Carbon Capture and Utilization Solutions

01 Carbon capture and sequestration technologies

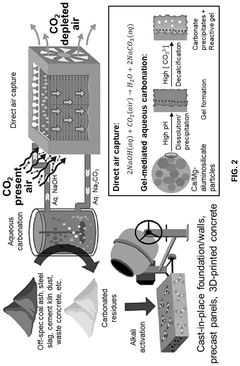

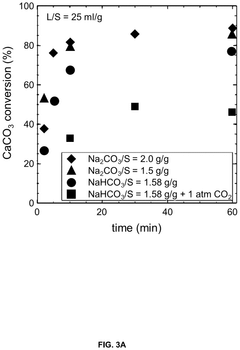

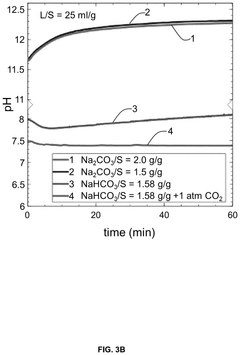

Carbon-negative concrete relies on technologies that capture and sequester CO2 during the manufacturing process. These technologies include mineral carbonation, where CO2 reacts with calcium or magnesium-rich materials to form stable carbonates. Commercialization challenges include scaling up these technologies, ensuring long-term carbon storage stability, and developing efficient carbon capture systems that can be integrated into existing concrete production facilities.- Carbon capture and sequestration technologies: Carbon-negative concrete technologies focus on capturing and sequestering CO2 during the manufacturing process. These methods involve incorporating CO2 into the concrete mixture, where it reacts with calcium compounds to form stable carbonates. This not only reduces the carbon footprint but also can improve concrete properties. Commercialization challenges include scaling up the carbon capture infrastructure, ensuring consistent quality of the end product, and developing cost-effective methods for CO2 integration into production processes.

- Alternative cementitious materials and binders: The development of alternative cementitious materials and binders is crucial for carbon-negative concrete. These include geopolymers, alkali-activated materials, and supplementary cementitious materials that can partially or completely replace traditional Portland cement. These alternatives often have lower carbon footprints and can even absorb CO2 during curing. Commercialization challenges include regulatory approval, industry acceptance, material availability, and ensuring long-term durability comparable to traditional concrete.

- Economic and market barriers: Economic and market barriers represent significant challenges to the commercialization of carbon-negative concrete. These include higher production costs compared to conventional concrete, lack of carbon pricing mechanisms, limited market demand, and competition from established products. Additionally, there are challenges related to securing investment for scaling up production, developing viable business models, and creating market incentives that value carbon reduction benefits.

- Regulatory and standardization issues: Regulatory and standardization issues pose significant challenges to carbon-negative concrete commercialization. Current building codes and standards are often based on traditional concrete compositions and may not accommodate innovative carbon-negative formulations. The lack of standardized testing protocols for carbon-negative concrete properties and environmental performance creates uncertainty. Additionally, obtaining necessary certifications and approvals from regulatory bodies requires extensive testing and documentation, which can be time-consuming and costly for innovators.

- Supply chain and infrastructure adaptation: Adapting existing supply chains and infrastructure for carbon-negative concrete production presents significant commercialization challenges. This includes sourcing alternative raw materials, modifying production equipment, developing new transportation and storage solutions, and training workers on new processes. The concrete industry's established infrastructure is optimized for traditional concrete production, making the transition to carbon-negative technologies costly and complex. Additionally, ensuring consistent quality and performance while scaling up production requires substantial investment in new facilities and equipment.

02 Alternative binders and raw materials

The development of alternative binders and raw materials is crucial for carbon-negative concrete. These include geopolymers, alkali-activated materials, and supplementary cementitious materials that can replace traditional Portland cement. Challenges include ensuring these materials meet performance standards, developing reliable supply chains for novel raw materials, and addressing variability in material properties that can affect concrete quality and durability.Expand Specific Solutions03 Economic and market barriers

Commercialization of carbon-negative concrete faces significant economic challenges. These include higher production costs compared to conventional concrete, lack of carbon pricing mechanisms that would make carbon-negative products more competitive, and market resistance to adopting new materials. Developing viable business models, securing investment for scaling up production, and creating market incentives are essential for overcoming these barriers.Expand Specific Solutions04 Regulatory and standardization issues

The lack of established standards and regulatory frameworks specifically for carbon-negative concrete impedes commercialization. Building codes and construction specifications often reference traditional concrete properties, creating barriers for innovative materials. Challenges include developing appropriate testing methodologies, establishing performance criteria that account for carbon benefits, and harmonizing standards across different regions to enable broader market adoption.Expand Specific Solutions05 Supply chain and infrastructure adaptation

Transitioning to carbon-negative concrete requires significant changes to existing supply chains and infrastructure. Challenges include retrofitting cement plants, developing new logistics networks for alternative materials, and training construction professionals in working with these new materials. The fragmented nature of the construction industry makes coordinated change difficult, while the capital-intensive nature of concrete production creates high barriers to entry for innovative technologies.Expand Specific Solutions

Key Industry Players and Competitive Landscape

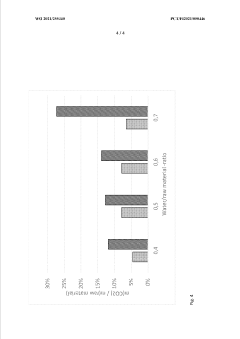

The commercialization of carbon-negative concrete faces a dynamic competitive landscape characterized by early market development with significant growth potential. The global market is expanding rapidly as construction industries seek sustainable alternatives, though widespread adoption remains challenged by technical and economic barriers. Technology maturity varies significantly among key players: established companies like Huaxin Cement and Lafarge are integrating carbon reduction into existing operations, while specialized innovators such as CarbonCure, Solidia Technologies, and Calera are pioneering breakthrough carbon sequestration methods. Academic institutions including MIT, Rice University, and Zhejiang University are advancing fundamental research, creating a collaborative ecosystem where industry-academia partnerships are accelerating commercialization pathways despite regulatory uncertainties and scaling challenges.

Solidia Technologies, Inc.

Technical Solution: Solidia Technologies has developed a revolutionary carbon-negative concrete solution that fundamentally alters the chemistry of cement. Their process uses non-hydraulic calcium silicate cement that cures by carbonation rather than hydration, consuming CO2 during the curing process. The technology reduces the limestone content in raw materials and lowers kiln temperatures to around 1200°C (compared to traditional 1450°C), resulting in up to 30% less energy consumption during manufacturing. Solidia's concrete products can sequester up to 240 kg of CO2 per ton of cement, creating a carbon footprint that is 70% lower than conventional Portland cement concrete. The company has successfully commercialized their technology through partnerships with major concrete manufacturers and has demonstrated scalability in precast applications.

Strengths: Lower energy requirements, significant carbon sequestration capability, compatible with existing manufacturing equipment, and proven commercial viability in precast applications. Weaknesses: Limited to primarily precast applications, requires controlled CO2 curing environments, and faces challenges in widespread adoption due to conservative industry practices and regulatory hurdles.

CarbonCure Technologies, Inc.

Technical Solution: CarbonCure Technologies has pioneered a retrofit technology that injects captured CO2 into fresh concrete during mixing, where it becomes permanently mineralized as calcium carbonate. This process not only sequesters carbon but also improves the concrete's compressive strength, allowing for cement reduction without compromising performance. Their system can be easily integrated into existing concrete plants with minimal disruption to operations, requiring only a small CO2 storage tank and injection system. CarbonCure's technology has been installed in over 500 concrete plants globally and has demonstrated the ability to reduce the carbon footprint of concrete by 5-8% initially, with potential for greater reductions as the technology evolves. The company operates on a technology licensing model, making adoption financially accessible for concrete producers while creating a market for captured carbon dioxide.

Strengths: Easy integration with existing production facilities, immediate commercial viability, improved concrete performance, and scalable business model with low barriers to entry. Weaknesses: Achieves more modest carbon reductions compared to some alternative technologies, depends on reliable sources of captured CO2, and requires ongoing education of building code officials and specifiers for wider market acceptance.

Core Patents and Innovations in CO2 Sequestration

Controlling carbonation

PatentWO2021255340A1

Innovation

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

Cementitious materials and methods of making and using same

PatentPendingUS20250042811A1

Innovation

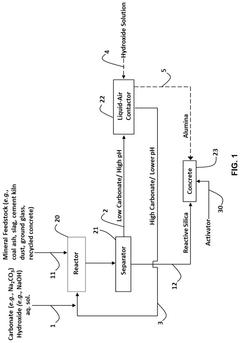

- A carbon mineralization-based direct-air capture process is used to produce carbon-negative cementitious materials by capturing CO2 from the air through an aqueous carbonation cycle, enhancing the pozzolanic reactivity of industrial mineral wastes, and incorporating the captured CO2 as solid carbonate in the concrete.

Regulatory Framework and Carbon Credit Mechanisms

The regulatory landscape surrounding carbon-negative concrete represents a critical factor in its commercial viability. Current regulatory frameworks across major economies exhibit significant variation in their approach to carbon-intensive industries. The European Union leads with its Emissions Trading System (ETS) and the Carbon Border Adjustment Mechanism (CBAM), which create financial incentives for low-carbon construction materials. In contrast, the United States employs a more fragmented approach with state-level initiatives like California's Low Carbon Fuel Standard complementing federal tax credits for carbon capture technologies.

These regulatory disparities create market uncertainties that complicate global commercialization strategies for carbon-negative concrete producers. Companies must navigate complex compliance requirements across jurisdictions, often facing inconsistent standards and reporting obligations that increase operational costs and administrative burdens.

Carbon credit mechanisms represent a potential economic enabler for carbon-negative concrete technologies. The voluntary carbon market has grown substantially, reaching $2 billion in 2022, with construction materials emerging as a promising category. However, methodologies for quantifying and verifying carbon sequestration in concrete remain underdeveloped, creating verification challenges that limit market confidence and price premiums.

Standardization efforts are gradually addressing these limitations. Organizations like the International Organization for Standardization (ISO) and ASTM International are developing specific protocols for measuring embodied carbon in building materials. These standards will be essential for establishing credible carbon accounting frameworks that can support legitimate carbon credit generation from carbon-negative concrete applications.

Policy innovations are emerging to accelerate market adoption. Several jurisdictions have implemented carbon procurement preferences that award government contracts based partly on embodied carbon metrics. For example, the Buy Clean California Act requires state agencies to consider the carbon footprint of construction materials in procurement decisions. Similar policies are being adopted in New York, Washington, and Colorado, creating market pull for low-carbon alternatives.

The integration of carbon-negative concrete into national climate strategies represents another regulatory development. Countries including Canada, the UK, and Sweden have explicitly included construction materials in their nationally determined contributions under the Paris Agreement, signaling long-term regulatory support for decarbonization in this sector.

These regulatory disparities create market uncertainties that complicate global commercialization strategies for carbon-negative concrete producers. Companies must navigate complex compliance requirements across jurisdictions, often facing inconsistent standards and reporting obligations that increase operational costs and administrative burdens.

Carbon credit mechanisms represent a potential economic enabler for carbon-negative concrete technologies. The voluntary carbon market has grown substantially, reaching $2 billion in 2022, with construction materials emerging as a promising category. However, methodologies for quantifying and verifying carbon sequestration in concrete remain underdeveloped, creating verification challenges that limit market confidence and price premiums.

Standardization efforts are gradually addressing these limitations. Organizations like the International Organization for Standardization (ISO) and ASTM International are developing specific protocols for measuring embodied carbon in building materials. These standards will be essential for establishing credible carbon accounting frameworks that can support legitimate carbon credit generation from carbon-negative concrete applications.

Policy innovations are emerging to accelerate market adoption. Several jurisdictions have implemented carbon procurement preferences that award government contracts based partly on embodied carbon metrics. For example, the Buy Clean California Act requires state agencies to consider the carbon footprint of construction materials in procurement decisions. Similar policies are being adopted in New York, Washington, and Colorado, creating market pull for low-carbon alternatives.

The integration of carbon-negative concrete into national climate strategies represents another regulatory development. Countries including Canada, the UK, and Sweden have explicitly included construction materials in their nationally determined contributions under the Paris Agreement, signaling long-term regulatory support for decarbonization in this sector.

Life Cycle Assessment and Environmental Impact

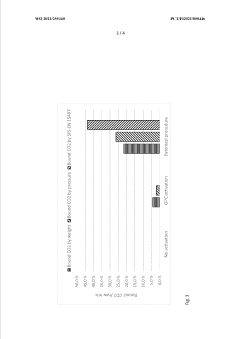

Life Cycle Assessment (LCA) represents a critical framework for evaluating the environmental viability of carbon-negative concrete technologies. Current LCA methodologies must be adapted to accurately capture the unique carbon sequestration properties of these innovative materials. Traditional concrete production accounts for approximately 8% of global CO2 emissions, primarily from cement manufacturing processes. In contrast, carbon-negative concrete technologies promise to absorb more CO2 throughout their lifecycle than emitted during production.

Comprehensive LCA studies reveal several environmental impact categories beyond carbon footprint that must be considered. These include resource depletion, water usage, land use changes, and potential toxicity impacts. Recent analyses indicate that while carbon-negative concrete shows promising results in greenhouse gas reduction, some formulations may present trade-offs in other environmental dimensions, such as increased water consumption or energy requirements during specialized curing processes.

The temporal dimension of carbon sequestration presents a significant methodological challenge. Unlike conventional materials, carbon-negative concrete continues to absorb CO2 throughout its service life, requiring dynamic assessment models rather than static evaluations. Research by the Global Carbon Capture and Storage Institute suggests that proper accounting for this time-dependent carbon uptake could improve lifecycle emissions profiles by 10-25% compared to current estimates.

Boundary definition represents another critical consideration in environmental assessment. A truly comprehensive evaluation must include raw material extraction, manufacturing processes, transportation, installation, use phase, end-of-life scenarios, and potential for material recycling. Studies from MIT's Concrete Sustainability Hub demonstrate that expanding system boundaries to include these elements can significantly alter the perceived environmental benefits of carbon-negative formulations.

Standardization of LCA methodologies specifically for carbon-negative building materials remains underdeveloped. The International Organization for Standardization (ISO) has yet to establish specific guidelines for these novel materials, creating inconsistencies in reporting and comparison across different technologies. This lack of standardization impedes investor confidence and regulatory acceptance, as stakeholders cannot easily compare environmental claims between competing solutions.

Regional variations in electricity grid carbon intensity, raw material availability, and transportation infrastructure significantly impact the environmental performance of carbon-negative concrete. Analysis from the World Resources Institute indicates that the same concrete formulation can show up to 40% variation in carbon footprint depending on geographic implementation context, highlighting the importance of localized assessment approaches rather than global generalizations.

Comprehensive LCA studies reveal several environmental impact categories beyond carbon footprint that must be considered. These include resource depletion, water usage, land use changes, and potential toxicity impacts. Recent analyses indicate that while carbon-negative concrete shows promising results in greenhouse gas reduction, some formulations may present trade-offs in other environmental dimensions, such as increased water consumption or energy requirements during specialized curing processes.

The temporal dimension of carbon sequestration presents a significant methodological challenge. Unlike conventional materials, carbon-negative concrete continues to absorb CO2 throughout its service life, requiring dynamic assessment models rather than static evaluations. Research by the Global Carbon Capture and Storage Institute suggests that proper accounting for this time-dependent carbon uptake could improve lifecycle emissions profiles by 10-25% compared to current estimates.

Boundary definition represents another critical consideration in environmental assessment. A truly comprehensive evaluation must include raw material extraction, manufacturing processes, transportation, installation, use phase, end-of-life scenarios, and potential for material recycling. Studies from MIT's Concrete Sustainability Hub demonstrate that expanding system boundaries to include these elements can significantly alter the perceived environmental benefits of carbon-negative formulations.

Standardization of LCA methodologies specifically for carbon-negative building materials remains underdeveloped. The International Organization for Standardization (ISO) has yet to establish specific guidelines for these novel materials, creating inconsistencies in reporting and comparison across different technologies. This lack of standardization impedes investor confidence and regulatory acceptance, as stakeholders cannot easily compare environmental claims between competing solutions.

Regional variations in electricity grid carbon intensity, raw material availability, and transportation infrastructure significantly impact the environmental performance of carbon-negative concrete. Analysis from the World Resources Institute indicates that the same concrete formulation can show up to 40% variation in carbon footprint depending on geographic implementation context, highlighting the importance of localized assessment approaches rather than global generalizations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!