Why Regulations on Carbon-negative Concrete Matter

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Technology Background and Objectives

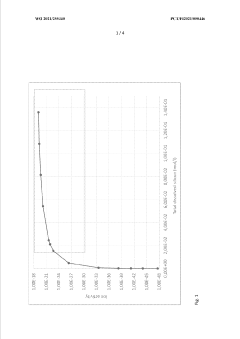

Concrete production is responsible for approximately 8% of global carbon emissions, making it one of the most significant contributors to climate change in the industrial sector. The development of carbon-negative concrete represents a revolutionary shift in construction materials technology, aiming to transform a major carbon emitter into a potential carbon sink. This technology has evolved from early experimental phases in the early 2000s to increasingly viable commercial applications in the 2020s.

The fundamental principle behind carbon-negative concrete involves capturing and permanently storing more CO2 during production than is emitted throughout its lifecycle. Traditional Portland cement production releases approximately one ton of CO2 for every ton of cement produced. In contrast, carbon-negative concrete technologies utilize alternative binding materials, incorporate captured carbon dioxide, and employ innovative production methods to achieve a net negative carbon footprint.

Recent technological breakthroughs have accelerated development in this field. These include the emergence of novel supplementary cementitious materials (SCMs) such as calcined clays and industrial byproducts, carbon mineralization processes that convert CO2 into stable carbonate compounds within the concrete matrix, and biomimetic approaches inspired by natural processes like coral reef formation.

The primary technical objective in this domain is to develop carbon-negative concrete solutions that maintain or exceed the performance characteristics of traditional concrete while significantly reducing environmental impact. This includes achieving comparable strength, durability, workability, and cost-effectiveness while ensuring scalability for mass production and adoption across diverse construction applications.

Secondary objectives include optimizing the carbon sequestration capacity of these materials, extending their service life to maximize carbon storage duration, and developing standardized methodologies for accurately measuring and verifying carbon negativity across the entire product lifecycle. Additionally, there is a focus on reducing other environmental impacts such as water usage, land disturbance, and energy consumption in the production process.

The technology evolution trajectory suggests a phased approach to market penetration, beginning with niche applications where performance requirements are less stringent, followed by broader adoption in structural applications as performance improves and costs decrease. The ultimate goal is to establish carbon-negative concrete as the industry standard, potentially transforming the construction sector from a major carbon emitter to a significant carbon sink.

Achieving these objectives requires interdisciplinary collaboration among materials scientists, civil engineers, climate scientists, and industry stakeholders, supported by appropriate regulatory frameworks and market incentives to accelerate adoption and implementation at scale.

The fundamental principle behind carbon-negative concrete involves capturing and permanently storing more CO2 during production than is emitted throughout its lifecycle. Traditional Portland cement production releases approximately one ton of CO2 for every ton of cement produced. In contrast, carbon-negative concrete technologies utilize alternative binding materials, incorporate captured carbon dioxide, and employ innovative production methods to achieve a net negative carbon footprint.

Recent technological breakthroughs have accelerated development in this field. These include the emergence of novel supplementary cementitious materials (SCMs) such as calcined clays and industrial byproducts, carbon mineralization processes that convert CO2 into stable carbonate compounds within the concrete matrix, and biomimetic approaches inspired by natural processes like coral reef formation.

The primary technical objective in this domain is to develop carbon-negative concrete solutions that maintain or exceed the performance characteristics of traditional concrete while significantly reducing environmental impact. This includes achieving comparable strength, durability, workability, and cost-effectiveness while ensuring scalability for mass production and adoption across diverse construction applications.

Secondary objectives include optimizing the carbon sequestration capacity of these materials, extending their service life to maximize carbon storage duration, and developing standardized methodologies for accurately measuring and verifying carbon negativity across the entire product lifecycle. Additionally, there is a focus on reducing other environmental impacts such as water usage, land disturbance, and energy consumption in the production process.

The technology evolution trajectory suggests a phased approach to market penetration, beginning with niche applications where performance requirements are less stringent, followed by broader adoption in structural applications as performance improves and costs decrease. The ultimate goal is to establish carbon-negative concrete as the industry standard, potentially transforming the construction sector from a major carbon emitter to a significant carbon sink.

Achieving these objectives requires interdisciplinary collaboration among materials scientists, civil engineers, climate scientists, and industry stakeholders, supported by appropriate regulatory frameworks and market incentives to accelerate adoption and implementation at scale.

Market Demand Analysis for Sustainable Construction Materials

The global construction industry is experiencing a significant shift towards sustainable building materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete, has shown remarkable growth in recent years. Current market analysis indicates that the global green building materials market reached approximately $256 billion in 2020 and is projected to grow at a compound annual growth rate of 11.3% through 2027, highlighting the expanding demand for environmentally responsible construction solutions.

Carbon-negative concrete represents a revolutionary segment within this market, addressing the critical issue of carbon emissions in traditional concrete production. Traditional concrete manufacturing accounts for nearly 8% of global CO2 emissions, making it a primary target for sustainability initiatives. Market research demonstrates that stakeholders across the construction value chain are increasingly prioritizing materials that can reduce or eliminate carbon footprints, with 67% of construction firms reporting increased client requests for sustainable alternatives.

The demand drivers for carbon-negative concrete span multiple sectors. Government infrastructure projects represent the largest potential market, with numerous countries incorporating green building requirements into public works. Commercial construction follows closely, with corporate sustainability commitments fueling adoption. Residential construction presents a growing opportunity, particularly in eco-conscious urban developments and high-end housing markets where sustainability certifications add significant property value.

Regional market analysis reveals varying adoption rates and potential. Europe leads in market maturity, with stringent regulations and carbon pricing mechanisms creating strong incentives for carbon-negative materials. North America shows rapid growth potential, driven by state-level initiatives and corporate sustainability goals. The Asia-Pacific region represents the largest potential market by volume, though adoption remains uneven across developed and developing economies.

Economic factors significantly influence market dynamics. While carbon-negative concrete typically commands a 15-30% price premium over traditional products, this gap is narrowing as production scales and carbon pricing mechanisms evolve. Total cost of ownership analyses increasingly favor sustainable materials when factoring in regulatory compliance costs, carbon credits, and building certification advantages.

Market forecasts suggest that regulatory frameworks will be the primary catalyst for market expansion. Jurisdictions with established carbon pricing mechanisms show adoption rates three times higher than unregulated markets. This correlation underscores why regulations on carbon-negative concrete matter – they create predictable market conditions that encourage investment in sustainable material development and manufacturing capacity, ultimately accelerating the transition to low-carbon construction practices.

Carbon-negative concrete represents a revolutionary segment within this market, addressing the critical issue of carbon emissions in traditional concrete production. Traditional concrete manufacturing accounts for nearly 8% of global CO2 emissions, making it a primary target for sustainability initiatives. Market research demonstrates that stakeholders across the construction value chain are increasingly prioritizing materials that can reduce or eliminate carbon footprints, with 67% of construction firms reporting increased client requests for sustainable alternatives.

The demand drivers for carbon-negative concrete span multiple sectors. Government infrastructure projects represent the largest potential market, with numerous countries incorporating green building requirements into public works. Commercial construction follows closely, with corporate sustainability commitments fueling adoption. Residential construction presents a growing opportunity, particularly in eco-conscious urban developments and high-end housing markets where sustainability certifications add significant property value.

Regional market analysis reveals varying adoption rates and potential. Europe leads in market maturity, with stringent regulations and carbon pricing mechanisms creating strong incentives for carbon-negative materials. North America shows rapid growth potential, driven by state-level initiatives and corporate sustainability goals. The Asia-Pacific region represents the largest potential market by volume, though adoption remains uneven across developed and developing economies.

Economic factors significantly influence market dynamics. While carbon-negative concrete typically commands a 15-30% price premium over traditional products, this gap is narrowing as production scales and carbon pricing mechanisms evolve. Total cost of ownership analyses increasingly favor sustainable materials when factoring in regulatory compliance costs, carbon credits, and building certification advantages.

Market forecasts suggest that regulatory frameworks will be the primary catalyst for market expansion. Jurisdictions with established carbon pricing mechanisms show adoption rates three times higher than unregulated markets. This correlation underscores why regulations on carbon-negative concrete matter – they create predictable market conditions that encourage investment in sustainable material development and manufacturing capacity, ultimately accelerating the transition to low-carbon construction practices.

Current Regulatory Landscape and Technical Challenges

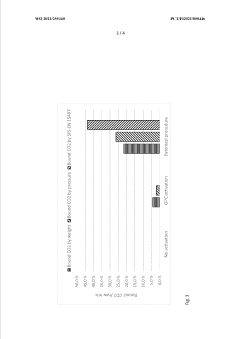

The global regulatory landscape for carbon-negative concrete is evolving rapidly as governments recognize the construction industry's significant contribution to carbon emissions. Currently, regulations vary widely across regions, with the European Union leading through its Emissions Trading System (ETS) and the recent Carbon Border Adjustment Mechanism (CBAM), which directly impacts cement and concrete imports. These frameworks establish carbon pricing mechanisms that incentivize low-carbon alternatives and penalize high-emission products.

In North America, regulations remain fragmented, with Canada implementing a federal carbon pricing system while the United States relies on state-level initiatives like California's Low Carbon Concrete Building Code. Asia presents a mixed regulatory environment, with countries like Singapore implementing a carbon tax affecting concrete production, while China has included cement in its national emissions trading scheme, though enforcement mechanisms remain underdeveloped.

A significant technical challenge in this regulatory landscape is the lack of standardized measurement protocols for carbon-negative concrete. Current methodologies for life cycle assessment (LCA) vary considerably, creating inconsistencies in how carbon negativity is verified and certified. This hampers regulatory effectiveness and creates market uncertainty for producers investing in carbon-negative technologies.

Material availability presents another substantial hurdle. Many carbon-negative concrete formulations rely on supplementary cementitious materials (SCMs) like fly ash and blast furnace slag, which are becoming scarcer as coal plants close and steel production methods evolve. Regulations rarely address this supply chain vulnerability, creating a disconnect between policy ambitions and practical implementation capabilities.

Performance verification standards for novel concrete formulations also remain inadequate. Building codes and construction standards typically lag behind innovation, creating regulatory barriers to adoption even when carbon benefits are clear. Engineers and specifiers require long-term performance data before adopting new materials, yet regulations seldom provide pathways for accelerated testing and certification.

Cost implications of regulatory compliance create additional challenges. The price premium for carbon-negative concrete can range from 20% to 100% above conventional concrete, depending on the technology employed. Without harmonized carbon pricing or incentive structures, market adoption remains constrained by economic factors despite regulatory pressure to reduce emissions.

Infrastructure readiness represents a final critical challenge. Carbon capture technologies often integral to carbon-negative concrete production require significant energy inputs and specialized equipment. Current regulations rarely address these enabling infrastructure needs, creating a chicken-and-egg problem where producers hesitate to invest without regulatory certainty, while regulators struggle to mandate technologies that lack widespread implementation capacity.

In North America, regulations remain fragmented, with Canada implementing a federal carbon pricing system while the United States relies on state-level initiatives like California's Low Carbon Concrete Building Code. Asia presents a mixed regulatory environment, with countries like Singapore implementing a carbon tax affecting concrete production, while China has included cement in its national emissions trading scheme, though enforcement mechanisms remain underdeveloped.

A significant technical challenge in this regulatory landscape is the lack of standardized measurement protocols for carbon-negative concrete. Current methodologies for life cycle assessment (LCA) vary considerably, creating inconsistencies in how carbon negativity is verified and certified. This hampers regulatory effectiveness and creates market uncertainty for producers investing in carbon-negative technologies.

Material availability presents another substantial hurdle. Many carbon-negative concrete formulations rely on supplementary cementitious materials (SCMs) like fly ash and blast furnace slag, which are becoming scarcer as coal plants close and steel production methods evolve. Regulations rarely address this supply chain vulnerability, creating a disconnect between policy ambitions and practical implementation capabilities.

Performance verification standards for novel concrete formulations also remain inadequate. Building codes and construction standards typically lag behind innovation, creating regulatory barriers to adoption even when carbon benefits are clear. Engineers and specifiers require long-term performance data before adopting new materials, yet regulations seldom provide pathways for accelerated testing and certification.

Cost implications of regulatory compliance create additional challenges. The price premium for carbon-negative concrete can range from 20% to 100% above conventional concrete, depending on the technology employed. Without harmonized carbon pricing or incentive structures, market adoption remains constrained by economic factors despite regulatory pressure to reduce emissions.

Infrastructure readiness represents a final critical challenge. Carbon capture technologies often integral to carbon-negative concrete production require significant energy inputs and specialized equipment. Current regulations rarely address these enabling infrastructure needs, creating a chicken-and-egg problem where producers hesitate to invest without regulatory certainty, while regulators struggle to mandate technologies that lack widespread implementation capacity.

Current Carbon Capture and Utilization Solutions in Concrete

01 Carbon capture and sequestration in concrete

Carbon-negative concrete technologies focus on capturing and sequestering CO2 during the concrete manufacturing process. These methods involve incorporating materials that can absorb and permanently store carbon dioxide, effectively turning concrete into a carbon sink. The captured CO2 becomes mineralized within the concrete matrix, creating stable carbonate compounds that enhance the material's strength while reducing its carbon footprint.- CO2 Capture and Sequestration in Concrete: Carbon-negative concrete technologies that actively capture and sequester CO2 during the manufacturing process. These methods involve injecting CO2 into concrete mixtures where it reacts with calcium compounds to form stable carbonates, effectively locking away carbon dioxide while simultaneously improving concrete strength and durability. This approach transforms concrete from a carbon source to a carbon sink.

- Alternative Cementitious Materials: The use of alternative cementitious materials to replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include geopolymers, alkali-activated materials, and supplementary cementitious materials derived from industrial byproducts such as fly ash, slag, and silica fume. These materials can reduce the carbon footprint of concrete while maintaining or enhancing performance characteristics.

- Biomass and Bio-based Additives: Incorporation of biomass and bio-based additives into concrete formulations to reduce carbon footprint. These additives, derived from agricultural waste, wood products, or other renewable resources, can partially replace cement or serve as carbon-sequestering fillers. The organic materials lock carbon within the concrete structure while often providing additional benefits such as improved insulation properties or reduced weight.

- Mineral Carbonation Processes: Advanced mineral carbonation processes that accelerate the natural weathering of minerals to capture CO2. These techniques involve exposing calcium or magnesium-rich materials to carbon dioxide under controlled conditions, forming stable carbonate minerals. When incorporated into concrete production, these carbonated minerals contribute to a negative carbon footprint while potentially enhancing concrete properties such as strength and resistance to chemical attack.

- Novel Curing Technologies: Innovative curing technologies that promote carbon sequestration during the concrete hardening process. These methods include CO2 curing chambers, accelerated carbonation techniques, and specialized curing agents that facilitate the absorption of atmospheric carbon dioxide. By optimizing the curing environment and duration, these technologies enhance carbon uptake while simultaneously improving concrete microstructure and reducing curing time.

02 Alternative cementitious materials

The development of alternative cementitious materials is crucial for carbon-negative concrete. These include supplementary cementitious materials (SCMs) like fly ash, slag, and natural pozzolans that can partially replace traditional Portland cement. Additionally, novel binders derived from industrial byproducts or naturally occurring materials can significantly reduce the carbon footprint of concrete while maintaining or improving its performance characteristics.Expand Specific Solutions03 Biomass incorporation and biogenic materials

Incorporating biomass and biogenic materials into concrete formulations offers a pathway to carbon negativity. These materials, which have already sequestered carbon during their growth phase, can be processed and used as aggregates or binders in concrete. Examples include agricultural waste products, wood derivatives, and other plant-based materials that reduce the need for carbon-intensive components while potentially enhancing certain concrete properties.Expand Specific Solutions04 Carbonation curing techniques

Carbonation curing techniques accelerate the absorption of CO2 into concrete during its curing phase. By exposing fresh concrete to controlled CO2-rich environments, these methods promote rapid carbonation reactions that not only sequester carbon but also improve concrete's early strength development. Advanced carbonation curing can be applied in precast concrete manufacturing or on-site, offering both environmental and performance benefits.Expand Specific Solutions05 Mineral additives and CO2-reactive aggregates

Specialized mineral additives and CO2-reactive aggregates can enhance carbon sequestration in concrete. These materials are designed to react with and bind atmospheric or injected CO2, forming stable carbonate minerals within the concrete matrix. Some technologies utilize waste materials like steel slag or mine tailings that have a high affinity for CO2, transforming industrial byproducts into valuable carbon-capturing concrete components.Expand Specific Solutions

Key Industry Players and Regulatory Bodies

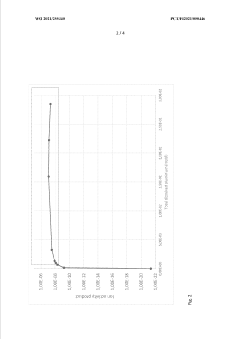

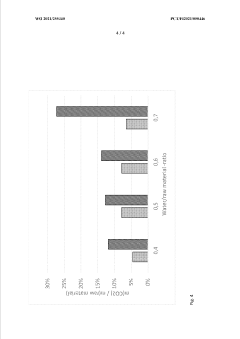

The carbon-negative concrete market is in an early growth phase, characterized by increasing regulatory attention due to its potential for significant carbon emissions reduction in the construction industry. While the global market remains relatively small, it is expanding rapidly as sustainability demands intensify. Technologically, the field shows promising developments but varying maturity levels across solutions. Leading players include established research institutions (MIT, Southeast University), specialized startups (Solidia Technologies), and industry incumbents exploring innovation (Bouygues, Fujita Corp). Major technology companies (TSMC) and research organizations (Electric Power Research Institute) are also entering this space, indicating growing cross-sector interest. The competitive landscape features collaboration between academic institutions and commercial entities, with government bodies increasingly influencing development through regulatory frameworks and incentives.

Solidia Technologies, Inc.

Technical Solution: Solidia Technologies has developed a revolutionary low-carbon cement and concrete manufacturing process that reduces the carbon footprint by up to 70% compared to traditional Portland cement. Their technology uses a non-hydraulic calcium silicate cement that cures by carbonation rather than hydration, actively sequestering CO2 during the curing process. The company's patented process operates at lower temperatures (around 1200°C versus 1450°C for traditional cement), significantly reducing energy consumption and associated emissions. Solidia's concrete products can permanently store approximately 240 kg of CO2 per ton of cement used, effectively making their concrete a carbon sink. The company has partnered with major industry players like LafargeHolcim to scale implementation and has received validation from the U.S. Department of Energy and EPA for their carbon reduction claims.

Strengths: Proven technology with significant carbon reduction (up to 70%), operates with existing manufacturing equipment requiring minimal retrofitting, produces stronger and more durable concrete products. Weaknesses: Requires pure CO2 for optimal curing, which may limit implementation in regions without access to industrial CO2 sources, and faces adoption barriers in an industry traditionally resistant to change.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered breakthrough research in carbon-negative concrete through its Concrete Sustainability Hub (CSHub). Their approach focuses on electrochemical methods to both reduce emissions and sequester carbon in concrete production. MIT researchers have developed an innovative process that uses calcium hydroxide and electrochemistry to capture CO2 directly from the air while simultaneously producing cement precursors. This technology can potentially remove up to 0.5 tons of CO2 from the atmosphere for every ton of cement produced. Additionally, MIT's work on reactive magnesia cements offers a pathway to concrete that can absorb more CO2 throughout its lifetime than emitted during production. The institute has also developed advanced computational models that optimize concrete mixtures for specific applications, reducing cement content while maintaining performance specifications, which can lower carbon footprints by 25-40% without sacrificing structural integrity.

Strengths: Cutting-edge research combining electrochemistry and materials science, strong industry partnerships for technology transfer, and comprehensive life-cycle assessment capabilities. Weaknesses: Many technologies still at laboratory scale requiring significant investment for commercial implementation, and some approaches may require specialized materials that increase initial costs.

Critical Patents and Innovations in Carbon-negative Concrete

Controlling carbonation

PatentWO2021255340A1

Innovation

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

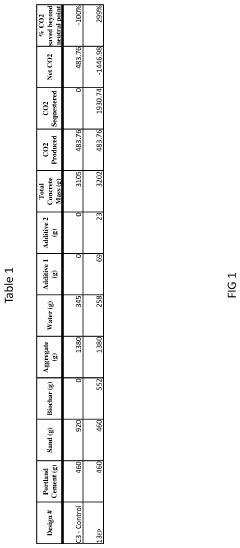

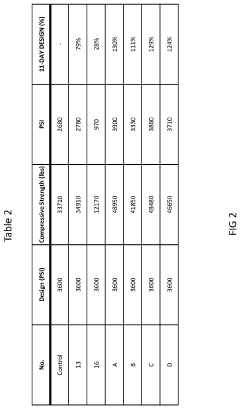

Carbon negative concrete production through the use of sustainable materials

PatentInactiveUS20230002276A1

Innovation

- Incorporating biochar, a high-carbon residue produced through low-oxygen pyrolysis, into concrete mixtures to sequester carbon and reduce emissions, while optimizing pyrolysis processes to power plants using syngas for self-sustainability and carbon neutrality.

Economic Implications of Carbon-negative Concrete Regulations

The implementation of carbon-negative concrete regulations presents significant economic implications across multiple sectors. These regulations fundamentally alter the cost structure of construction projects, with initial estimates suggesting a 15-30% increase in material costs compared to traditional concrete. However, this premium is projected to decrease over time as production scales and technology matures, potentially reaching price parity within 5-7 years according to industry forecasts.

For construction companies and developers, these regulations necessitate substantial adjustments to budgeting and project planning processes. The transition period will likely see varied absorption of these costs across different market segments, with high-end commercial and sustainability-focused projects more readily accommodating the premium than cost-sensitive residential developments.

From a macroeconomic perspective, carbon-negative concrete regulations create new market opportunities estimated at $25-30 billion globally by 2030. This emerging sector is driving investment in research and development, with venture capital funding for carbon capture in construction materials increasing by 118% between 2020 and 2022. The regulations are effectively accelerating the commercialization timeline for technologies that might otherwise remain economically unviable for years.

Labor markets will experience significant restructuring as demand grows for specialists in carbon capture technologies, sustainable materials engineering, and environmental compliance. Educational institutions and professional certification bodies are already developing specialized training programs to address this skills gap, though current estimates suggest a shortage of qualified professionals will persist for 3-5 years.

Supply chain economics are particularly impacted, with regulations creating demand for new raw materials and processing capabilities. Companies controlling access to key inputs such as industrial carbon capture systems and specialized binding agents are positioned to capture significant value. This has triggered vertical integration strategies among larger construction materials providers seeking to secure their supply chains.

The regulatory landscape also creates economic externalities through carbon pricing mechanisms. In regions with established carbon markets, carbon-negative concrete producers can generate additional revenue through carbon credits, effectively subsidizing production costs and accelerating market adoption. Analysis suggests this could improve project economics by 8-12% in markets with mature carbon pricing systems.

For construction companies and developers, these regulations necessitate substantial adjustments to budgeting and project planning processes. The transition period will likely see varied absorption of these costs across different market segments, with high-end commercial and sustainability-focused projects more readily accommodating the premium than cost-sensitive residential developments.

From a macroeconomic perspective, carbon-negative concrete regulations create new market opportunities estimated at $25-30 billion globally by 2030. This emerging sector is driving investment in research and development, with venture capital funding for carbon capture in construction materials increasing by 118% between 2020 and 2022. The regulations are effectively accelerating the commercialization timeline for technologies that might otherwise remain economically unviable for years.

Labor markets will experience significant restructuring as demand grows for specialists in carbon capture technologies, sustainable materials engineering, and environmental compliance. Educational institutions and professional certification bodies are already developing specialized training programs to address this skills gap, though current estimates suggest a shortage of qualified professionals will persist for 3-5 years.

Supply chain economics are particularly impacted, with regulations creating demand for new raw materials and processing capabilities. Companies controlling access to key inputs such as industrial carbon capture systems and specialized binding agents are positioned to capture significant value. This has triggered vertical integration strategies among larger construction materials providers seeking to secure their supply chains.

The regulatory landscape also creates economic externalities through carbon pricing mechanisms. In regions with established carbon markets, carbon-negative concrete producers can generate additional revenue through carbon credits, effectively subsidizing production costs and accelerating market adoption. Analysis suggests this could improve project economics by 8-12% in markets with mature carbon pricing systems.

International Standards and Policy Harmonization Efforts

The global nature of climate change necessitates coordinated international efforts to regulate carbon-negative concrete technologies. Currently, a patchwork of standards exists across different regions, creating challenges for industry-wide adoption and implementation. The European Union leads with its EN 15804 standard, which provides a framework for assessing environmental impacts of construction materials, including concrete. This standard has been instrumental in establishing methodologies for calculating carbon footprints throughout the product lifecycle.

In North America, ASTM International and the American Concrete Institute (ACI) have developed standards that address aspects of sustainable concrete production, though comprehensive carbon-negative specifications remain under development. The gap between European and North American approaches highlights the need for global harmonization.

The International Organization for Standardization (ISO) has been working to bridge these regional differences through ISO 14067 for carbon footprint quantification and ISO 20887 for design for disassembly and adaptability. These standards provide a foundation for consistent measurement methodologies across borders, though specific provisions for carbon-negative materials are still evolving.

Policy harmonization efforts have gained momentum through initiatives like the Clean Concrete Coalition, which brings together governments from major economies to align regulatory approaches. The Coalition's 2022 framework agreement established shared principles for carbon accounting in concrete production, marking a significant step toward international consistency.

The World Green Building Council's Net Zero Carbon Buildings Commitment represents another important harmonization mechanism, encouraging consistent approaches to embodied carbon reduction across 28 countries. This initiative has prompted several nations to incorporate carbon-negative material incentives into their building codes and procurement policies.

Challenges to harmonization persist, particularly regarding measurement methodologies and verification protocols. Different regions prioritize various aspects of sustainability, with some focusing primarily on operational carbon and others emphasizing embodied carbon. These divergent approaches complicate the development of universally accepted standards for carbon-negative concrete.

Recent diplomatic efforts through the G20 Sustainable Infrastructure Working Group have produced recommendations for aligning carbon assessment methodologies specifically for construction materials. These recommendations, if widely adopted, could accelerate the development of consistent international frameworks that recognize and incentivize carbon-negative concrete technologies across global markets.

In North America, ASTM International and the American Concrete Institute (ACI) have developed standards that address aspects of sustainable concrete production, though comprehensive carbon-negative specifications remain under development. The gap between European and North American approaches highlights the need for global harmonization.

The International Organization for Standardization (ISO) has been working to bridge these regional differences through ISO 14067 for carbon footprint quantification and ISO 20887 for design for disassembly and adaptability. These standards provide a foundation for consistent measurement methodologies across borders, though specific provisions for carbon-negative materials are still evolving.

Policy harmonization efforts have gained momentum through initiatives like the Clean Concrete Coalition, which brings together governments from major economies to align regulatory approaches. The Coalition's 2022 framework agreement established shared principles for carbon accounting in concrete production, marking a significant step toward international consistency.

The World Green Building Council's Net Zero Carbon Buildings Commitment represents another important harmonization mechanism, encouraging consistent approaches to embodied carbon reduction across 28 countries. This initiative has prompted several nations to incorporate carbon-negative material incentives into their building codes and procurement policies.

Challenges to harmonization persist, particularly regarding measurement methodologies and verification protocols. Different regions prioritize various aspects of sustainability, with some focusing primarily on operational carbon and others emphasizing embodied carbon. These divergent approaches complicate the development of universally accepted standards for carbon-negative concrete.

Recent diplomatic efforts through the G20 Sustainable Infrastructure Working Group have produced recommendations for aligning carbon assessment methodologies specifically for construction materials. These recommendations, if widely adopted, could accelerate the development of consistent international frameworks that recognize and incentivize carbon-negative concrete technologies across global markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!