Carbon-negative Concrete's Role in Combating Climate Change

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Evolution and Objectives

Concrete, a fundamental building material in modern civilization, has historically been a significant contributor to global carbon emissions. The evolution of carbon-negative concrete represents a paradigm shift in construction materials science, transitioning from traditional carbon-intensive processes to innovative approaches that actively remove carbon dioxide from the atmosphere. This technological evolution began in the early 2000s with initial research into alternative cementitious materials, followed by breakthrough developments around 2010 when researchers successfully demonstrated the first carbon-sequestering concrete prototypes.

The trajectory of carbon-negative concrete has been marked by several key milestones. Between 2010 and 2015, laboratory-scale demonstrations proved the concept's viability, while the period from 2015 to 2020 saw the emergence of pilot projects and initial commercialization efforts. Since 2020, we have witnessed accelerated adoption and scaling of these technologies, driven by increasing climate urgency and supportive policy frameworks worldwide.

Current technological approaches to carbon-negative concrete primarily fall into three categories: carbon mineralization processes that permanently bind CO2 within the concrete matrix; alternative binding materials that replace traditional Portland cement; and carbon capture technologies integrated directly into the production process. Each approach represents a distinct evolutionary branch with specific advantages and implementation challenges.

The primary objective of carbon-negative concrete technology is to transform the construction industry from a major carbon emitter to a potential carbon sink. Specifically, the technology aims to achieve net carbon sequestration of at least 100kg CO2 per cubic meter of concrete while maintaining or exceeding the performance characteristics of traditional concrete, including compressive strength, durability, and workability.

Secondary objectives include reducing the energy intensity of concrete production by at least 40% compared to conventional methods, minimizing the use of virgin raw materials through incorporation of industrial byproducts and waste streams, and ensuring economic viability with production costs competitive with traditional concrete within a 5-10% premium range that can be offset by carbon credits or regulatory incentives.

Looking forward, the technology roadmap targets widespread commercial availability by 2030, with carbon-negative concrete comprising at least 15% of the global market by 2035 and 50% by 2050. This ambitious trajectory aligns with global climate commitments and represents a critical pathway for decarbonizing the built environment, which currently accounts for approximately 40% of global carbon emissions.

The trajectory of carbon-negative concrete has been marked by several key milestones. Between 2010 and 2015, laboratory-scale demonstrations proved the concept's viability, while the period from 2015 to 2020 saw the emergence of pilot projects and initial commercialization efforts. Since 2020, we have witnessed accelerated adoption and scaling of these technologies, driven by increasing climate urgency and supportive policy frameworks worldwide.

Current technological approaches to carbon-negative concrete primarily fall into three categories: carbon mineralization processes that permanently bind CO2 within the concrete matrix; alternative binding materials that replace traditional Portland cement; and carbon capture technologies integrated directly into the production process. Each approach represents a distinct evolutionary branch with specific advantages and implementation challenges.

The primary objective of carbon-negative concrete technology is to transform the construction industry from a major carbon emitter to a potential carbon sink. Specifically, the technology aims to achieve net carbon sequestration of at least 100kg CO2 per cubic meter of concrete while maintaining or exceeding the performance characteristics of traditional concrete, including compressive strength, durability, and workability.

Secondary objectives include reducing the energy intensity of concrete production by at least 40% compared to conventional methods, minimizing the use of virgin raw materials through incorporation of industrial byproducts and waste streams, and ensuring economic viability with production costs competitive with traditional concrete within a 5-10% premium range that can be offset by carbon credits or regulatory incentives.

Looking forward, the technology roadmap targets widespread commercial availability by 2030, with carbon-negative concrete comprising at least 15% of the global market by 2035 and 50% by 2050. This ambitious trajectory aligns with global climate commitments and represents a critical pathway for decarbonizing the built environment, which currently accounts for approximately 40% of global carbon emissions.

Market Analysis for Sustainable Construction Materials

The sustainable construction materials market is experiencing unprecedented growth, driven by increasing environmental concerns and regulatory pressures to reduce carbon emissions in the building sector. Currently valued at approximately $299 billion globally, this market is projected to reach $641 billion by 2030, with a compound annual growth rate of 11.4% between 2023 and 2030. Carbon-negative concrete represents one of the fastest-growing segments within this category, with market adoption accelerating as climate change mitigation becomes a priority across industries.

Consumer demand for sustainable building materials has shifted dramatically over the past five years, with 78% of commercial construction projects now specifying some form of low-carbon or carbon-negative materials. This trend is particularly pronounced in Europe and North America, where regulatory frameworks increasingly mandate carbon footprint reduction in new construction. The European Union's Green Deal and various national carbon neutrality commitments have created strong market pull for innovative concrete solutions.

The construction industry, responsible for approximately 38% of global carbon emissions, faces mounting pressure to decarbonize. Traditional concrete production alone accounts for 8% of global CO2 emissions, creating an urgent market need for carbon-negative alternatives. Market research indicates that 67% of construction firms are actively seeking ways to reduce embodied carbon in their projects, with concrete replacement or enhancement being the primary focus area.

Price sensitivity remains a significant factor influencing market adoption. Currently, carbon-negative concrete commands a premium of 15-30% over traditional concrete, though this gap is narrowing as production scales and technologies mature. Economic analyses suggest that when accounting for carbon credits, regulatory compliance benefits, and marketing advantages, the total cost of ownership difference drops to 5-10% in most markets.

Regional market variations are substantial, with Scandinavian countries leading adoption rates at 23% market penetration for carbon-negative concrete solutions, followed by Germany (18%), Canada (14%), and the United States (11%). Developing economies present significant growth opportunities, particularly China and India, where massive infrastructure development coincides with increasing climate commitments.

Market segmentation shows distinct adoption patterns across different construction sectors. Commercial buildings lead with 42% of sustainable concrete applications, followed by public infrastructure (27%), residential construction (19%), and industrial facilities (12%). The high-rise building segment demonstrates particularly strong growth potential due to structural performance requirements and high visibility for sustainability credentials.

Competitive dynamics in this market are evolving rapidly, with traditional cement manufacturers investing heavily in carbon-negative technologies while facing competition from well-funded startups with disruptive approaches. Market consolidation through strategic acquisitions is accelerating, with 14 significant mergers in the past two years focused specifically on sustainable concrete technology.

Consumer demand for sustainable building materials has shifted dramatically over the past five years, with 78% of commercial construction projects now specifying some form of low-carbon or carbon-negative materials. This trend is particularly pronounced in Europe and North America, where regulatory frameworks increasingly mandate carbon footprint reduction in new construction. The European Union's Green Deal and various national carbon neutrality commitments have created strong market pull for innovative concrete solutions.

The construction industry, responsible for approximately 38% of global carbon emissions, faces mounting pressure to decarbonize. Traditional concrete production alone accounts for 8% of global CO2 emissions, creating an urgent market need for carbon-negative alternatives. Market research indicates that 67% of construction firms are actively seeking ways to reduce embodied carbon in their projects, with concrete replacement or enhancement being the primary focus area.

Price sensitivity remains a significant factor influencing market adoption. Currently, carbon-negative concrete commands a premium of 15-30% over traditional concrete, though this gap is narrowing as production scales and technologies mature. Economic analyses suggest that when accounting for carbon credits, regulatory compliance benefits, and marketing advantages, the total cost of ownership difference drops to 5-10% in most markets.

Regional market variations are substantial, with Scandinavian countries leading adoption rates at 23% market penetration for carbon-negative concrete solutions, followed by Germany (18%), Canada (14%), and the United States (11%). Developing economies present significant growth opportunities, particularly China and India, where massive infrastructure development coincides with increasing climate commitments.

Market segmentation shows distinct adoption patterns across different construction sectors. Commercial buildings lead with 42% of sustainable concrete applications, followed by public infrastructure (27%), residential construction (19%), and industrial facilities (12%). The high-rise building segment demonstrates particularly strong growth potential due to structural performance requirements and high visibility for sustainability credentials.

Competitive dynamics in this market are evolving rapidly, with traditional cement manufacturers investing heavily in carbon-negative technologies while facing competition from well-funded startups with disruptive approaches. Market consolidation through strategic acquisitions is accelerating, with 14 significant mergers in the past two years focused specifically on sustainable concrete technology.

Global Status and Barriers in Carbon-negative Concrete Development

Carbon-negative concrete development is currently at varying stages across the globe, with significant regional disparities in research, implementation, and regulatory frameworks. In North America, particularly the United States and Canada, substantial research funding has been allocated to carbon-negative concrete technologies, with several pilot projects demonstrating promising results. Companies like CarbonCure and Solidia Technologies have established commercial-scale operations, though market penetration remains limited to approximately 3-5% of the total concrete market.

European nations, especially Scandinavian countries and Germany, lead in regulatory frameworks supporting carbon-negative building materials. The EU's Green Deal and circular economy initiatives have created favorable conditions for adoption, with carbon taxation mechanisms providing economic incentives for low-carbon alternatives. Research clusters in Switzerland and the Netherlands have made significant advances in alternative binding materials that can sequester carbon dioxide during curing processes.

The Asia-Pacific region presents a complex landscape. China, despite being the world's largest concrete producer, has only recently begun investing in carbon-negative concrete research. Japan and South Korea have established research programs but face challenges in scaling production. Australia has several promising startups working on mineral carbonation technologies specifically adapted to local raw materials.

Despite global progress, significant barriers impede widespread adoption of carbon-negative concrete. Technical challenges include ensuring long-term durability and structural performance comparable to traditional Portland cement concrete. Current carbon-negative formulations often exhibit slower strength development and may require modified curing conditions, limiting their application in time-sensitive construction projects.

Economic barriers remain formidable, with production costs typically 15-30% higher than conventional concrete. The absence of standardized carbon accounting methodologies for construction materials complicates accurate assessment of environmental benefits, creating uncertainty for potential adopters and investors. Supply chain limitations also restrict scaling, as specialized materials like industrial byproducts or novel binding agents may not be consistently available in sufficient quantities.

Regulatory hurdles present another significant obstacle. Building codes and construction standards in most countries were developed for traditional concrete and do not adequately address the unique properties of carbon-negative alternatives. The certification process for new construction materials can take 5-10 years in many jurisdictions, significantly slowing market entry. Additionally, fragmented international standards create compliance challenges for manufacturers seeking to operate across multiple markets.

Knowledge gaps and industry inertia further complicate adoption. The construction sector is traditionally risk-averse, with stakeholders often reluctant to adopt materials without decades of performance data. Limited awareness among architects, engineers, and contractors about carbon-negative concrete options and their appropriate applications restricts demand growth and market development.

European nations, especially Scandinavian countries and Germany, lead in regulatory frameworks supporting carbon-negative building materials. The EU's Green Deal and circular economy initiatives have created favorable conditions for adoption, with carbon taxation mechanisms providing economic incentives for low-carbon alternatives. Research clusters in Switzerland and the Netherlands have made significant advances in alternative binding materials that can sequester carbon dioxide during curing processes.

The Asia-Pacific region presents a complex landscape. China, despite being the world's largest concrete producer, has only recently begun investing in carbon-negative concrete research. Japan and South Korea have established research programs but face challenges in scaling production. Australia has several promising startups working on mineral carbonation technologies specifically adapted to local raw materials.

Despite global progress, significant barriers impede widespread adoption of carbon-negative concrete. Technical challenges include ensuring long-term durability and structural performance comparable to traditional Portland cement concrete. Current carbon-negative formulations often exhibit slower strength development and may require modified curing conditions, limiting their application in time-sensitive construction projects.

Economic barriers remain formidable, with production costs typically 15-30% higher than conventional concrete. The absence of standardized carbon accounting methodologies for construction materials complicates accurate assessment of environmental benefits, creating uncertainty for potential adopters and investors. Supply chain limitations also restrict scaling, as specialized materials like industrial byproducts or novel binding agents may not be consistently available in sufficient quantities.

Regulatory hurdles present another significant obstacle. Building codes and construction standards in most countries were developed for traditional concrete and do not adequately address the unique properties of carbon-negative alternatives. The certification process for new construction materials can take 5-10 years in many jurisdictions, significantly slowing market entry. Additionally, fragmented international standards create compliance challenges for manufacturers seeking to operate across multiple markets.

Knowledge gaps and industry inertia further complicate adoption. The construction sector is traditionally risk-averse, with stakeholders often reluctant to adopt materials without decades of performance data. Limited awareness among architects, engineers, and contractors about carbon-negative concrete options and their appropriate applications restricts demand growth and market development.

Current Carbon-negative Concrete Formulations and Methods

01 Carbon capture and sequestration in concrete

Technologies that enable concrete to absorb and permanently store carbon dioxide during the curing process, effectively making it carbon-negative. These methods involve specialized formulations that can absorb CO2 from the atmosphere or industrial sources and convert it into stable carbonate minerals within the concrete matrix, reducing the overall carbon footprint of construction projects.- Carbon capture and sequestration in concrete: Technologies that enable concrete to absorb and permanently store carbon dioxide during the curing process, effectively making it a carbon sink. These methods involve specialized formulations that can absorb CO2 from the atmosphere or industrial emissions, chemically binding it within the concrete matrix through carbonation reactions. This approach not only reduces the carbon footprint of concrete production but can potentially make concrete carbon-negative over its lifecycle.

- Alternative cementitious materials for reduced emissions: Development of novel cement alternatives that require less energy to produce and generate fewer carbon emissions compared to traditional Portland cement. These materials include geopolymers, alkali-activated materials, and supplementary cementitious materials derived from industrial byproducts such as fly ash, slag, and silica fume. By partially or completely replacing conventional cement, these alternatives can significantly reduce the carbon footprint of concrete while maintaining or even improving performance characteristics.

- Carbon accounting and monitoring systems for concrete: Advanced systems and methodologies for accurately measuring, tracking, and verifying carbon emissions throughout the concrete lifecycle. These technologies include digital platforms, IoT sensors, and blockchain-based solutions that enable real-time monitoring of carbon footprints from raw material extraction through manufacturing, transportation, construction, use, and end-of-life. Such systems provide transparency and accountability in carbon reduction claims and support carbon credit generation for carbon-negative concrete products.

- Biomass incorporation and biogenic materials in concrete: Integration of biomass-derived materials and biogenic substances into concrete formulations to reduce carbon emissions and enhance carbon sequestration. These innovations include the use of agricultural waste, wood products, algae, and other plant-based materials as aggregates or binders in concrete. The biogenic carbon contained in these materials remains sequestered in the concrete, while their use reduces the need for carbon-intensive traditional components, contributing to a negative carbon balance.

- Enhanced carbonation techniques and accelerated curing: Specialized methods to accelerate and maximize the carbonation process in concrete, enhancing its carbon absorption capacity. These techniques include controlled exposure to CO2-rich environments, pressure-based carbonation chambers, and catalytic additives that promote faster and more complete carbon mineralization. By optimizing curing conditions and concrete mix designs specifically for carbon uptake, these approaches can significantly increase the amount of CO2 permanently sequestered in concrete structures.

02 Alternative cementitious materials for reduced emissions

Development of novel cement alternatives that require less energy to produce and generate fewer carbon emissions compared to traditional Portland cement. These materials include geopolymers, alkali-activated materials, and supplementary cementitious materials derived from industrial byproducts such as fly ash, slag, and silica fume, which can significantly reduce the carbon footprint of concrete production.Expand Specific Solutions03 Carbon accounting and monitoring systems for concrete

Systems and methods for accurately measuring, tracking, and verifying carbon emissions and carbon sequestration in concrete production and throughout its lifecycle. These technologies include sensors, data analytics platforms, and certification methodologies that enable transparent carbon accounting, supporting carbon credit generation and regulatory compliance in the construction industry.Expand Specific Solutions04 Biomass incorporation in concrete manufacturing

Methods for incorporating biomass-derived materials into concrete to reduce its carbon footprint. These approaches include using agricultural waste, wood products, or other plant-based materials as partial replacements for traditional aggregates or as additives that can enhance concrete properties while sequestering biogenic carbon, creating pathways to carbon-negative construction materials.Expand Specific Solutions05 Electrochemical carbon reduction in cement production

Innovative electrochemical processes that reduce carbon emissions during cement and concrete production. These technologies use electrical energy, potentially from renewable sources, to drive chemical reactions that either capture carbon dioxide or avoid its generation during the manufacturing process, offering pathways to significantly decarbonize the concrete industry.Expand Specific Solutions

Leading Companies and Research Institutions in Carbon-negative Concrete

Carbon-negative concrete technology is emerging as a critical solution in climate change mitigation, currently in early market development stages. The global market for sustainable concrete is expanding rapidly, projected to reach significant scale as construction industries face increasing pressure to reduce carbon footprints. Technologically, the field shows varying maturity levels, with companies like Carbon Limit Co. pioneering carbon capture concrete technology, while established players such as China National Building Material Group and China Construction Commercial Concrete are integrating sustainable practices into traditional operations. Research institutions including Worcester Polytechnic Institute, Massachusetts Institute of Technology, and Swiss Federal Institute of Technology are advancing fundamental innovations, creating a competitive landscape balanced between startups with disruptive technologies and industry incumbents with manufacturing scale and distribution networks.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group (CNBM) has developed an innovative carbon-negative concrete solution that incorporates CO2 curing technology and carbon capture during the manufacturing process. Their approach involves using industrial by-products like fly ash and slag as supplementary cementitious materials, reducing the need for traditional Portland cement by up to 60%. CNBM's carbon-negative concrete technology employs a mineralization process where CO2 is permanently sequestered within the concrete matrix, creating stable carbonate compounds. The company has implemented pilot plants demonstrating that their concrete can absorb approximately 120-150 kg of CO2 per cubic meter, effectively transforming concrete from a carbon source to a carbon sink. CNBM has also developed specialized admixtures that enhance CO2 absorption while maintaining or improving concrete performance characteristics.

Strengths: Leverages China's abundant industrial waste streams as raw materials; Established manufacturing and distribution network across Asia; Significant R&D resources for continuous improvement. Weaknesses: Technology still scaling to full commercial deployment; Higher initial production costs compared to traditional concrete; Requires specialized equipment for CO2 injection and curing.

Carbon Limit Co.

Technical Solution: Carbon Limit has pioneered a proprietary carbon-negative concrete technology called "CarbonX" that focuses on post-consumer CO2 utilization. Their approach involves injecting captured carbon dioxide into specially formulated concrete mixtures during the curing process, where it undergoes accelerated carbonation to form calcium carbonate. This process not only sequesters CO2 but also improves concrete strength by up to 30% while reducing curing time. Carbon Limit's technology can be retrofitted into existing concrete production facilities with minimal modifications, making adoption more feasible for established manufacturers. Their concrete formulations can sequester approximately 100-200 kg of CO2 per cubic meter of concrete, depending on the specific mix design. The company has developed a blockchain-based verification system to quantify and certify the carbon sequestration achieved, enabling concrete producers to generate carbon credits.

Strengths: Retrofit capability for existing concrete plants reduces adoption barriers; Dual benefit of carbon sequestration and improved concrete performance; Established carbon credit generation system. Weaknesses: Requires reliable sources of captured CO2; Limited production scale compared to major concrete manufacturers; Higher initial investment costs for implementation.

Key Patents and Research in CO2 Sequestration Concrete

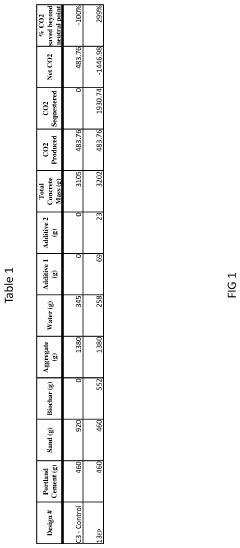

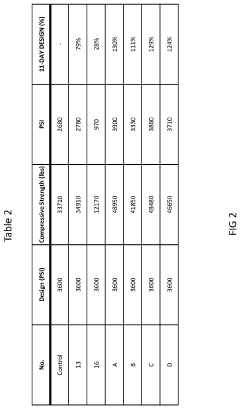

Carbon negative concrete production through the use of sustainable materials

PatentInactiveUS20230002276A1

Innovation

- Incorporating biochar, a high-carbon residue produced through low-oxygen pyrolysis, into concrete mixtures to sequester carbon and reduce emissions, while optimizing pyrolysis processes to power plants using syngas for self-sustainability and carbon neutrality.

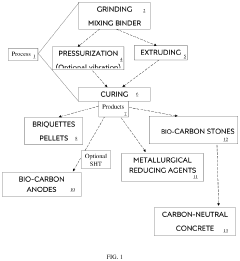

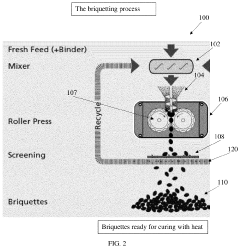

Charcoal products made with phenolic resin binder and methods for making thereof

PatentPendingUS20240209178A1

Innovation

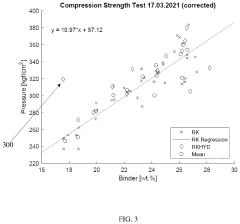

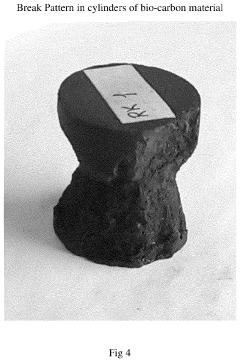

- A bio-carbon material comprising charcoal and a phenolic resin binder, with the binder comprising at least 50% phenolic resin, is developed, which can be compressed to achieve high strength and used in various forms such as briquettes, anodes, or concrete aggregates, reducing the need for fossil fuels and sequestering carbon.

Regulatory Frameworks and Carbon Credit Opportunities

The regulatory landscape for carbon-negative concrete is rapidly evolving as governments worldwide implement policies to address climate change. The European Union's Carbon Border Adjustment Mechanism (CBAM) represents a significant development, imposing carbon tariffs on imported cement and concrete products based on their carbon footprint. This mechanism creates strong economic incentives for manufacturers to adopt carbon-negative technologies and methodologies.

In the United States, the Inflation Reduction Act of 2022 provides substantial tax credits for carbon capture technologies, including those utilized in concrete production. These incentives can offset up to 85% of implementation costs for carbon-negative concrete technologies, dramatically improving their economic viability. Additionally, several states have implemented low-carbon concrete procurement policies, requiring public construction projects to use materials with reduced carbon footprints.

Carbon credit markets offer significant opportunities for concrete manufacturers embracing carbon-negative technologies. The voluntary carbon market has seen exponential growth, with carbon credits from engineered carbon removal solutions commanding premium prices of $200-600 per ton of CO2. Carbon-negative concrete producers can generate additional revenue streams by quantifying and selling the carbon sequestration achieved through their manufacturing processes.

Standardization of measurement protocols represents a critical regulatory challenge. Organizations such as the International Organization for Standardization (ISO) and ASTM International are developing standardized methodologies for measuring embodied carbon in building materials. These standards are essential for ensuring transparency and comparability across different concrete products and technologies.

Emerging regulatory frameworks are increasingly adopting lifecycle assessment approaches, considering the full environmental impact of concrete from raw material extraction through manufacturing, use, and end-of-life. This holistic approach benefits carbon-negative concrete technologies that may have higher upfront emissions but achieve net carbon reductions over their lifecycle.

Corporate sustainability reporting requirements, such as those proposed by the Securities and Exchange Commission in the US and the Corporate Sustainability Reporting Directive in the EU, are compelling large companies to disclose their carbon footprints. These requirements create downstream pressure on concrete suppliers to provide low or negative-carbon products, expanding market opportunities for innovative manufacturers.

In the United States, the Inflation Reduction Act of 2022 provides substantial tax credits for carbon capture technologies, including those utilized in concrete production. These incentives can offset up to 85% of implementation costs for carbon-negative concrete technologies, dramatically improving their economic viability. Additionally, several states have implemented low-carbon concrete procurement policies, requiring public construction projects to use materials with reduced carbon footprints.

Carbon credit markets offer significant opportunities for concrete manufacturers embracing carbon-negative technologies. The voluntary carbon market has seen exponential growth, with carbon credits from engineered carbon removal solutions commanding premium prices of $200-600 per ton of CO2. Carbon-negative concrete producers can generate additional revenue streams by quantifying and selling the carbon sequestration achieved through their manufacturing processes.

Standardization of measurement protocols represents a critical regulatory challenge. Organizations such as the International Organization for Standardization (ISO) and ASTM International are developing standardized methodologies for measuring embodied carbon in building materials. These standards are essential for ensuring transparency and comparability across different concrete products and technologies.

Emerging regulatory frameworks are increasingly adopting lifecycle assessment approaches, considering the full environmental impact of concrete from raw material extraction through manufacturing, use, and end-of-life. This holistic approach benefits carbon-negative concrete technologies that may have higher upfront emissions but achieve net carbon reductions over their lifecycle.

Corporate sustainability reporting requirements, such as those proposed by the Securities and Exchange Commission in the US and the Corporate Sustainability Reporting Directive in the EU, are compelling large companies to disclose their carbon footprints. These requirements create downstream pressure on concrete suppliers to provide low or negative-carbon products, expanding market opportunities for innovative manufacturers.

Life Cycle Assessment and Environmental Impact Metrics

Life Cycle Assessment (LCA) serves as a critical framework for evaluating carbon-negative concrete's true environmental impact across its entire existence. Traditional concrete production accounts for approximately 8% of global CO2 emissions, primarily from cement manufacturing. Carbon-negative concrete technologies must demonstrate genuine climate benefits through comprehensive LCA methodologies that capture impacts from raw material extraction through manufacturing, transportation, use, and end-of-life disposal.

Key environmental impact metrics for carbon-negative concrete include Global Warming Potential (GWP), measured in CO2-equivalent emissions, which must show negative values to validate carbon-negative claims. Energy consumption metrics track efficiency throughout production processes, while water usage metrics are particularly relevant given concrete's water-intensive manufacturing. Resource depletion indicators measure the sustainability of raw material sourcing, especially important when utilizing industrial byproducts or novel materials.

Standardized assessment protocols such as ISO 14040/14044 provide methodological consistency, though carbon-negative concrete requires specialized considerations. The temporal dimension of carbon sequestration presents a unique challenge, as carbon uptake occurs gradually over decades, necessitating time-adjusted carbon accounting methods to accurately represent climate benefits.

Boundary definition significantly impacts assessment outcomes. Cradle-to-gate assessments may underrepresent benefits by excluding in-use carbon absorption, while cradle-to-grave analyses provide more comprehensive environmental profiles but increase complexity. Allocation methods for industrial byproducts used in carbon-negative formulations must be carefully considered to avoid double-counting environmental benefits.

Comparative metrics against conventional concrete are essential for market adoption. The Embodied Carbon in Construction Calculator (EC3) and Environmental Product Declarations (EPDs) facilitate transparent comparison between different concrete formulations. Performance-normalized metrics that account for durability and service life provide more meaningful comparisons than raw emissions data alone.

Regional variations in electricity grid carbon intensity, transportation distances, and local material availability significantly influence LCA results. This necessitates region-specific assessments rather than universal environmental impact claims. As carbon-negative concrete technologies mature, standardized impact reporting frameworks will be crucial for preventing greenwashing and ensuring that climate benefits are scientifically verifiable and transparently communicated.

Key environmental impact metrics for carbon-negative concrete include Global Warming Potential (GWP), measured in CO2-equivalent emissions, which must show negative values to validate carbon-negative claims. Energy consumption metrics track efficiency throughout production processes, while water usage metrics are particularly relevant given concrete's water-intensive manufacturing. Resource depletion indicators measure the sustainability of raw material sourcing, especially important when utilizing industrial byproducts or novel materials.

Standardized assessment protocols such as ISO 14040/14044 provide methodological consistency, though carbon-negative concrete requires specialized considerations. The temporal dimension of carbon sequestration presents a unique challenge, as carbon uptake occurs gradually over decades, necessitating time-adjusted carbon accounting methods to accurately represent climate benefits.

Boundary definition significantly impacts assessment outcomes. Cradle-to-gate assessments may underrepresent benefits by excluding in-use carbon absorption, while cradle-to-grave analyses provide more comprehensive environmental profiles but increase complexity. Allocation methods for industrial byproducts used in carbon-negative formulations must be carefully considered to avoid double-counting environmental benefits.

Comparative metrics against conventional concrete are essential for market adoption. The Embodied Carbon in Construction Calculator (EC3) and Environmental Product Declarations (EPDs) facilitate transparent comparison between different concrete formulations. Performance-normalized metrics that account for durability and service life provide more meaningful comparisons than raw emissions data alone.

Regional variations in electricity grid carbon intensity, transportation distances, and local material availability significantly influence LCA results. This necessitates region-specific assessments rather than universal environmental impact claims. As carbon-negative concrete technologies mature, standardized impact reporting frameworks will be crucial for preventing greenwashing and ensuring that climate benefits are scientifically verifiable and transparently communicated.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!