Comparison of Carbon-negative Concrete vs Low-carbon Concrete

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Concrete Technology Background and Objectives

Concrete, as the most widely used building material globally, has been under scrutiny for its significant carbon footprint, contributing approximately 8% of global CO2 emissions. The evolution of concrete technology has witnessed a paradigm shift from traditional Portland cement-based formulations to more environmentally conscious alternatives, driven by increasing regulatory pressures and sustainability goals across the construction industry.

The development trajectory of carbon concrete technology has accelerated significantly over the past decade, with research focusing on two distinct but complementary approaches: low-carbon concrete and carbon-negative concrete. Low-carbon concrete aims to reduce emissions through partial replacement of cement with supplementary cementitious materials (SCMs) like fly ash, slag, and silica fume, while carbon-negative concrete represents a more ambitious technological frontier that actively sequesters carbon dioxide during its lifecycle.

Historical milestones in this technological evolution include the initial development of blended cements in the 1970s, the commercialization of high-volume fly ash concrete in the 1990s, and the emergence of carbon capture technologies for concrete production in the 2010s. Recent breakthroughs in carbon-negative concrete formulations have demonstrated the potential to transform concrete from an environmental liability into a carbon sink.

The primary technical objective in this field is to develop concrete solutions that maintain or enhance performance characteristics while dramatically reducing carbon footprint. Specifically, the industry aims to achieve a 50% reduction in embodied carbon by 2030 compared to 2019 levels, with aspirations for widespread adoption of carbon-negative solutions by 2050, aligning with global net-zero carbon commitments.

Current research is exploring multiple pathways, including alternative binding systems like geopolymers and alkali-activated materials, carbon mineralization processes that convert CO2 into stable carbonate compounds within concrete, and novel curing technologies that utilize carbon dioxide as a reactant rather than a byproduct. These approaches vary significantly in their technological readiness levels, commercial viability, and potential carbon impact.

The technological landscape is further complicated by regional variations in material availability, regulatory frameworks, and market acceptance. While some regions have made significant progress in standardizing low-carbon concrete formulations, carbon-negative concrete technologies remain largely in the demonstration phase, with limited large-scale implementation.

As the construction industry faces increasing pressure to decarbonize, understanding the comparative advantages, limitations, and development potential of both low-carbon and carbon-negative concrete technologies becomes essential for strategic decision-making and investment prioritization in research and development efforts.

The development trajectory of carbon concrete technology has accelerated significantly over the past decade, with research focusing on two distinct but complementary approaches: low-carbon concrete and carbon-negative concrete. Low-carbon concrete aims to reduce emissions through partial replacement of cement with supplementary cementitious materials (SCMs) like fly ash, slag, and silica fume, while carbon-negative concrete represents a more ambitious technological frontier that actively sequesters carbon dioxide during its lifecycle.

Historical milestones in this technological evolution include the initial development of blended cements in the 1970s, the commercialization of high-volume fly ash concrete in the 1990s, and the emergence of carbon capture technologies for concrete production in the 2010s. Recent breakthroughs in carbon-negative concrete formulations have demonstrated the potential to transform concrete from an environmental liability into a carbon sink.

The primary technical objective in this field is to develop concrete solutions that maintain or enhance performance characteristics while dramatically reducing carbon footprint. Specifically, the industry aims to achieve a 50% reduction in embodied carbon by 2030 compared to 2019 levels, with aspirations for widespread adoption of carbon-negative solutions by 2050, aligning with global net-zero carbon commitments.

Current research is exploring multiple pathways, including alternative binding systems like geopolymers and alkali-activated materials, carbon mineralization processes that convert CO2 into stable carbonate compounds within concrete, and novel curing technologies that utilize carbon dioxide as a reactant rather than a byproduct. These approaches vary significantly in their technological readiness levels, commercial viability, and potential carbon impact.

The technological landscape is further complicated by regional variations in material availability, regulatory frameworks, and market acceptance. While some regions have made significant progress in standardizing low-carbon concrete formulations, carbon-negative concrete technologies remain largely in the demonstration phase, with limited large-scale implementation.

As the construction industry faces increasing pressure to decarbonize, understanding the comparative advantages, limitations, and development potential of both low-carbon and carbon-negative concrete technologies becomes essential for strategic decision-making and investment prioritization in research and development efforts.

Market Analysis for Sustainable Concrete Solutions

The sustainable concrete market is experiencing unprecedented growth as construction industries worldwide pivot towards environmentally responsible building materials. Currently valued at approximately $26.2 billion in 2023, this sector is projected to reach $47.5 billion by 2030, representing a compound annual growth rate of 8.9%. This robust expansion is primarily driven by stringent environmental regulations, increasing corporate sustainability commitments, and growing consumer awareness about carbon footprints in construction materials.

Low-carbon concrete solutions have gained significant market traction, currently accounting for about 18% of the global concrete market. These products typically reduce carbon emissions by 30-50% compared to traditional Portland cement concrete. The demand is particularly strong in developed regions like Europe and North America, where green building certifications such as LEED and BREEAM have become industry standards.

Carbon-negative concrete represents an emerging segment with explosive growth potential, albeit from a smaller base. Currently holding less than 3% market share, this revolutionary technology is projected to grow at 15.7% annually through 2030. The premium pricing of carbon-negative solutions—typically 20-40% higher than conventional concrete—remains a significant market barrier, though this premium is gradually decreasing as production scales up and technologies mature.

Regional market analysis reveals Europe leading the sustainable concrete adoption curve, with approximately 24% market penetration, followed by North America at 19%. The Asia-Pacific region, while currently at lower adoption rates of around 12%, represents the fastest-growing market due to rapid urbanization and increasing governmental environmental mandates, particularly in China and India.

Customer segmentation shows that public infrastructure projects constitute the largest demand segment (38%), followed by commercial construction (31%) and residential buildings (22%). The remaining 9% comes from specialized applications. This distribution reflects government procurement policies increasingly favoring sustainable materials and corporate ESG commitments driving commercial adoption.

Price sensitivity varies significantly across market segments. While premium commercial projects demonstrate willingness to absorb the 15-25% cost premium of carbon-negative concrete for sustainability credentials, cost-sensitive residential and infrastructure segments show greater resistance to price increases exceeding 10%. This price sensitivity is gradually decreasing as carbon pricing mechanisms become more widespread and regulatory requirements tighten.

Market forecasts indicate that by 2028, sustainable concrete solutions will become the dominant choice in new construction in developed markets, with carbon-negative variants potentially capturing up to 12% of the total concrete market by 2030, contingent upon continued technological advancement and supportive regulatory frameworks.

Low-carbon concrete solutions have gained significant market traction, currently accounting for about 18% of the global concrete market. These products typically reduce carbon emissions by 30-50% compared to traditional Portland cement concrete. The demand is particularly strong in developed regions like Europe and North America, where green building certifications such as LEED and BREEAM have become industry standards.

Carbon-negative concrete represents an emerging segment with explosive growth potential, albeit from a smaller base. Currently holding less than 3% market share, this revolutionary technology is projected to grow at 15.7% annually through 2030. The premium pricing of carbon-negative solutions—typically 20-40% higher than conventional concrete—remains a significant market barrier, though this premium is gradually decreasing as production scales up and technologies mature.

Regional market analysis reveals Europe leading the sustainable concrete adoption curve, with approximately 24% market penetration, followed by North America at 19%. The Asia-Pacific region, while currently at lower adoption rates of around 12%, represents the fastest-growing market due to rapid urbanization and increasing governmental environmental mandates, particularly in China and India.

Customer segmentation shows that public infrastructure projects constitute the largest demand segment (38%), followed by commercial construction (31%) and residential buildings (22%). The remaining 9% comes from specialized applications. This distribution reflects government procurement policies increasingly favoring sustainable materials and corporate ESG commitments driving commercial adoption.

Price sensitivity varies significantly across market segments. While premium commercial projects demonstrate willingness to absorb the 15-25% cost premium of carbon-negative concrete for sustainability credentials, cost-sensitive residential and infrastructure segments show greater resistance to price increases exceeding 10%. This price sensitivity is gradually decreasing as carbon pricing mechanisms become more widespread and regulatory requirements tighten.

Market forecasts indicate that by 2028, sustainable concrete solutions will become the dominant choice in new construction in developed markets, with carbon-negative variants potentially capturing up to 12% of the total concrete market by 2030, contingent upon continued technological advancement and supportive regulatory frameworks.

Current Status and Challenges in Carbon Concrete Development

The global concrete industry currently faces significant challenges in reducing its carbon footprint, with traditional concrete production accounting for approximately 8% of worldwide CO2 emissions. Both carbon-negative and low-carbon concrete technologies have emerged as promising solutions, though they differ substantially in their development stages and implementation challenges.

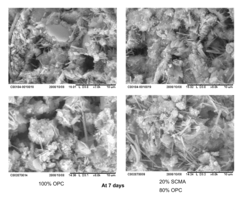

Low-carbon concrete has achieved greater market penetration, with numerous commercial applications already deployed across construction sectors. These solutions typically involve partial replacement of Portland cement with supplementary cementitious materials (SCMs) like fly ash, slag, or calcined clays, achieving carbon reductions of 30-50% compared to conventional concrete. Major construction companies and cement manufacturers have established standardized low-carbon concrete formulations that meet existing building codes in most developed markets.

Carbon-negative concrete, by contrast, remains predominantly in the research and early commercialization phase. These advanced solutions aim to sequester more carbon than emitted during production through innovative technologies such as CO2 mineralization, carbonate aggregates, and novel binding agents. While laboratory results demonstrate significant potential for carbon sequestration, scaling these technologies to industrial production volumes presents substantial technical hurdles.

A critical challenge for both technologies is performance verification under diverse environmental conditions. Carbon-negative concrete particularly faces questions regarding long-term durability, as accelerated aging tests cannot fully predict decades of real-world performance. This uncertainty creates regulatory barriers, as building codes and standards organizations remain cautious about approving materials without extensive performance history.

Supply chain limitations also constrain widespread adoption. Low-carbon concrete relies heavily on industrial byproducts like fly ash, which face declining availability as coal power generation decreases globally. Carbon-negative solutions often require specialized manufacturing facilities and carbon capture infrastructure that does not yet exist at scale.

Cost remains a significant barrier, especially for carbon-negative technologies. Current production methods typically result in 20-100% price premiums over conventional concrete, though this gap has narrowed for certain low-carbon formulations in markets with carbon pricing mechanisms. Without stronger regulatory incentives or carbon taxes, economic viability remains challenging for many advanced solutions.

Geographically, development efforts show distinct patterns. European countries lead in regulatory frameworks promoting low-carbon concrete adoption, while North American companies have pioneered several breakthrough carbon-negative technologies. The Asia-Pacific region, particularly China and India, represents both the largest concrete market and the most significant opportunity for emissions reduction, though implementation of advanced solutions there lags behind Western markets.

Low-carbon concrete has achieved greater market penetration, with numerous commercial applications already deployed across construction sectors. These solutions typically involve partial replacement of Portland cement with supplementary cementitious materials (SCMs) like fly ash, slag, or calcined clays, achieving carbon reductions of 30-50% compared to conventional concrete. Major construction companies and cement manufacturers have established standardized low-carbon concrete formulations that meet existing building codes in most developed markets.

Carbon-negative concrete, by contrast, remains predominantly in the research and early commercialization phase. These advanced solutions aim to sequester more carbon than emitted during production through innovative technologies such as CO2 mineralization, carbonate aggregates, and novel binding agents. While laboratory results demonstrate significant potential for carbon sequestration, scaling these technologies to industrial production volumes presents substantial technical hurdles.

A critical challenge for both technologies is performance verification under diverse environmental conditions. Carbon-negative concrete particularly faces questions regarding long-term durability, as accelerated aging tests cannot fully predict decades of real-world performance. This uncertainty creates regulatory barriers, as building codes and standards organizations remain cautious about approving materials without extensive performance history.

Supply chain limitations also constrain widespread adoption. Low-carbon concrete relies heavily on industrial byproducts like fly ash, which face declining availability as coal power generation decreases globally. Carbon-negative solutions often require specialized manufacturing facilities and carbon capture infrastructure that does not yet exist at scale.

Cost remains a significant barrier, especially for carbon-negative technologies. Current production methods typically result in 20-100% price premiums over conventional concrete, though this gap has narrowed for certain low-carbon formulations in markets with carbon pricing mechanisms. Without stronger regulatory incentives or carbon taxes, economic viability remains challenging for many advanced solutions.

Geographically, development efforts show distinct patterns. European countries lead in regulatory frameworks promoting low-carbon concrete adoption, while North American companies have pioneered several breakthrough carbon-negative technologies. The Asia-Pacific region, particularly China and India, represents both the largest concrete market and the most significant opportunity for emissions reduction, though implementation of advanced solutions there lags behind Western markets.

Technical Solutions Comparison in Carbon Concrete Industry

01 Carbon capture and sequestration in concrete

Technologies that enable concrete to capture and store carbon dioxide during its lifecycle, effectively reducing its carbon footprint. These methods involve incorporating materials that can absorb CO2 from the atmosphere or using CO2 directly in the curing process. This approach can transform conventional concrete into a carbon sink, potentially making it carbon-negative over its lifetime.- Carbon capture and sequestration in concrete: Technologies that enable concrete to capture and store carbon dioxide during its lifecycle, effectively reducing its carbon footprint. These methods involve incorporating materials that can absorb CO2 from the atmosphere or using CO2 directly in the curing process. This approach can transform conventional concrete into a carbon sink, potentially making it carbon-negative over its lifetime.

- Alternative binders and supplementary cementitious materials: The use of alternative binding materials and supplementary cementitious materials (SCMs) to partially or completely replace traditional Portland cement. These include materials like fly ash, slag, silica fume, and natural pozzolans that require less energy to produce and generate fewer emissions. By reducing the clinker content in concrete, these alternatives significantly lower the carbon footprint of the final product.

- Novel production methods for low-carbon concrete: Innovative manufacturing processes designed to reduce carbon emissions during concrete production. These include energy-efficient kilns, alternative fuels, and optimized mixing techniques that minimize the environmental impact of concrete manufacturing. Some methods involve lower temperature processing or mechanical activation to reduce energy consumption and associated carbon emissions.

- Carbon mineralization and utilization of industrial waste: Processes that incorporate industrial waste products and carbon mineralization techniques into concrete production. These methods convert carbon dioxide into stable mineral carbonates that can be used in concrete, while simultaneously utilizing waste materials from other industries. This approach offers dual benefits of carbon sequestration and waste reduction, contributing to a circular economy.

- Enhanced durability and performance optimization: Techniques focused on improving the durability and performance of low-carbon concrete to ensure it meets or exceeds the standards of conventional concrete. These include specialized admixtures, optimized aggregate selection, and advanced curing methods that enhance strength development while maintaining reduced carbon footprints. By extending the service life of concrete structures, these approaches further reduce lifetime carbon emissions associated with repairs and replacements.

02 Alternative cementitious materials for low-carbon concrete

Utilization of alternative materials to replace traditional Portland cement, which is responsible for significant carbon emissions in concrete production. These alternatives include supplementary cementitious materials like fly ash, slag, silica fume, and natural pozzolans. These materials can reduce the carbon footprint of concrete while maintaining or even improving its performance characteristics.Expand Specific Solutions03 Novel concrete mix designs for reduced carbon emissions

Innovative concrete formulations specifically designed to minimize carbon emissions while maintaining structural integrity. These designs optimize the ratio of ingredients, reduce cement content, and incorporate various additives to enhance performance with lower environmental impact. Advanced mix designs can significantly reduce the carbon footprint of concrete without compromising its strength or durability.Expand Specific Solutions04 Carbon mineralization processes in concrete production

Processes that accelerate the natural carbonation of concrete by intentionally exposing it to carbon dioxide during manufacturing. This technology mimics and speeds up the natural process where concrete absorbs CO2 over time, effectively locking carbon into the material structure. Carbon mineralization can be applied during mixing, curing, or recycling stages of concrete production.Expand Specific Solutions05 Recycled and waste materials for sustainable concrete

Incorporation of recycled aggregates, industrial byproducts, and waste materials into concrete to reduce its environmental impact. This approach diverts materials from landfills while reducing the need for virgin resources in concrete production. Materials such as recycled concrete aggregate, construction and demolition waste, and various industrial byproducts can be effectively utilized to create low-carbon concrete products.Expand Specific Solutions

Leading Companies in Carbon-negative and Low-carbon Concrete

The carbon-negative and low-carbon concrete market is in an early growth phase, with increasing momentum driven by global decarbonization efforts. The market size is expanding rapidly, projected to reach significant scale as construction industries worldwide seek sustainable alternatives. Technologically, the field shows varying maturity levels: established players like Holcim, Lafarge, and China National Building Material Group focus on commercializing low-carbon solutions, while innovative startups like Carbonbuilt and Materr'Up are developing carbon-negative technologies. Academic-industry collaborations involving institutions such as University of California and École normale supérieure Paris-Saclay are accelerating innovation. X Development and Ecocem represent the cutting edge with proprietary carbon capture technologies, while traditional cement manufacturers like Huaxin Cement and China West Construction are adapting their portfolios to include greener alternatives, indicating industry-wide transformation toward carbon-neutral construction materials.

Holcim Technology Ltd.

Technical Solution: Holcim has developed ECOPact, a carbon-negative concrete solution that incorporates carbon capture technology during the manufacturing process. Their approach combines several innovative techniques: (1) Using supplementary cementitious materials (SCMs) like fly ash and slag to replace portions of traditional cement; (2) Incorporating proprietary CO2 mineralization technology that permanently sequesters carbon dioxide within the concrete matrix; (3) Employing novel admixtures that enhance strength while reducing cement content; and (4) Implementing carbon capture at production facilities. Holcim's ECOPlanet cement can reduce carbon footprint by up to 90% compared to standard Portland cement. Their carbon-negative concrete not only captures more CO2 than it emits during production but also continues to absorb carbon throughout its lifecycle through enhanced carbonation properties.

Strengths: Industry-leading carbon reduction capabilities with proven commercial applications across multiple markets. Their solutions maintain or exceed performance standards of traditional concrete while achieving carbon negativity. Weaknesses: Higher initial production costs compared to conventional concrete, and requires specialized production facilities with carbon capture capabilities, limiting widespread adoption in developing markets.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group (CNBM) has developed a comprehensive carbon-negative concrete technology called CarbonLock. Their approach integrates several innovative components: (1) Alternative binding materials derived from industrial byproducts like steel slag and fly ash; (2) Direct carbon mineralization during the concrete curing process; (3) Novel admixtures that enhance CO2 absorption capacity; and (4) Integrated carbon capture systems at production facilities. CNBM's technology achieves carbon negativity by permanently sequestering CO2 within the concrete matrix through accelerated carbonation reactions. Their process can capture approximately 100-150kg of CO2 per cubic meter of concrete, effectively transforming concrete from a carbon source to a carbon sink. The company has implemented this technology at industrial scale across multiple facilities in China, demonstrating its commercial viability. Independent testing has verified that CNBM's carbon-negative concrete maintains equivalent or superior performance characteristics compared to traditional concrete, including compressive strength, durability, and resistance to environmental degradation.

Strengths: Massive production capacity and vertical integration allows for implementation at unprecedented scale. Their technology has been validated through numerous large-scale infrastructure projects throughout China. Weaknesses: Current implementation primarily focused on domestic Chinese market with limited international deployment. The technology requires significant capital investment for retrofitting existing production facilities, creating barriers to adoption for smaller producers.

Key Patents and Innovations in Carbon Concrete Technology

Charcoal products made with phenolic resin binder and methods for making thereof

PatentPendingUS20240209178A1

Innovation

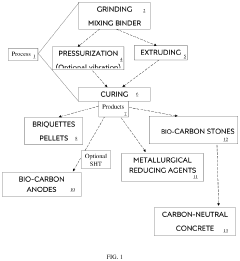

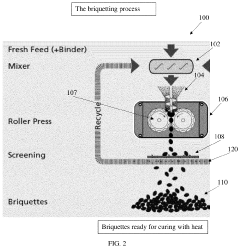

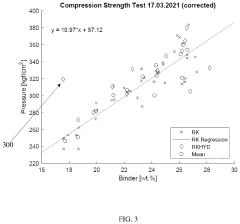

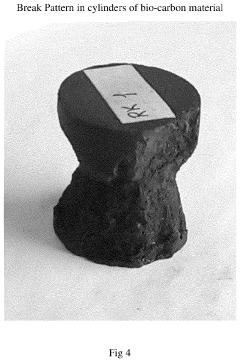

- A bio-carbon material comprising charcoal and a phenolic resin binder, with the binder comprising at least 50% phenolic resin, is developed, which can be compressed to achieve high strength and used in various forms such as briquettes, anodes, or concrete aggregates, reducing the need for fossil fuels and sequestering carbon.

Reduced-carbon footprint concrete compositions

PatentActiveUS20100083880A1

Innovation

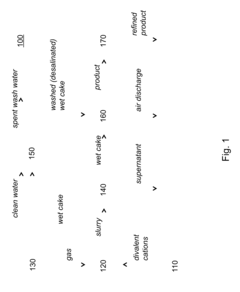

- A method of producing a synthetic carbonate component from a divalent cation-containing solution and industrial waste gas containing CO2, which is then incorporated into a reduced-carbon footprint concrete composition, reducing the carbon footprint by sequestering CO2 and avoiding CO2 emissions from traditional cement production.

Environmental Impact Assessment of Carbon Concrete Solutions

The environmental impact assessment of carbon concrete solutions reveals significant differences between carbon-negative and low-carbon concrete alternatives. Carbon-negative concrete technologies actively sequester more CO2 than they emit during production, creating a net environmental benefit. These solutions typically incorporate novel binding materials such as magnesium oxide derived from industrial waste streams or utilize carbon curing processes that permanently mineralize CO2 within the concrete matrix.

Low-carbon concrete, while less ambitious in its environmental goals, still offers substantial improvements over traditional Portland cement concrete. These formulations generally achieve 30-70% emissions reductions through clinker substitution with supplementary cementitious materials (SCMs) like fly ash, ground granulated blast furnace slag, and natural pozzolans. The environmental performance varies significantly based on regional availability of these materials and transportation requirements.

Life cycle assessment (LCA) studies demonstrate that carbon-negative concrete solutions can sequester between 50-300 kg of CO2 per cubic meter of concrete, depending on the specific technology employed. In contrast, low-carbon alternatives typically reduce emissions by 100-250 kg CO2 per cubic meter compared to conventional concrete. This distinction becomes particularly important when considering the massive scale of global concrete production, which exceeds 30 billion tons annually.

Water consumption patterns also differ markedly between these solutions. Carbon-negative technologies often require additional processing steps that can increase water usage by 15-30%, though some innovative approaches incorporate wastewater streams as part of their carbon sequestration process. Low-carbon concrete generally maintains water requirements similar to conventional concrete, with some formulations even reducing water demand through enhanced particle packing and superplasticizer technologies.

Land use impacts present another critical environmental consideration. Carbon-negative concrete production may require dedicated carbon capture facilities or specialized mineral extraction operations, potentially increasing land footprint by 20-40% compared to conventional concrete production. Low-carbon concrete typically utilizes existing industrial byproducts, minimizing additional land use requirements.

Ecosystem impacts extend beyond carbon considerations. Both solutions generally reduce air pollutants like SOx, NOx, and particulate matter compared to conventional concrete. However, carbon-negative technologies may introduce novel environmental risks through chemical processes required for carbon sequestration, necessitating careful monitoring and mitigation strategies to prevent unintended consequences in local ecosystems.

Low-carbon concrete, while less ambitious in its environmental goals, still offers substantial improvements over traditional Portland cement concrete. These formulations generally achieve 30-70% emissions reductions through clinker substitution with supplementary cementitious materials (SCMs) like fly ash, ground granulated blast furnace slag, and natural pozzolans. The environmental performance varies significantly based on regional availability of these materials and transportation requirements.

Life cycle assessment (LCA) studies demonstrate that carbon-negative concrete solutions can sequester between 50-300 kg of CO2 per cubic meter of concrete, depending on the specific technology employed. In contrast, low-carbon alternatives typically reduce emissions by 100-250 kg CO2 per cubic meter compared to conventional concrete. This distinction becomes particularly important when considering the massive scale of global concrete production, which exceeds 30 billion tons annually.

Water consumption patterns also differ markedly between these solutions. Carbon-negative technologies often require additional processing steps that can increase water usage by 15-30%, though some innovative approaches incorporate wastewater streams as part of their carbon sequestration process. Low-carbon concrete generally maintains water requirements similar to conventional concrete, with some formulations even reducing water demand through enhanced particle packing and superplasticizer technologies.

Land use impacts present another critical environmental consideration. Carbon-negative concrete production may require dedicated carbon capture facilities or specialized mineral extraction operations, potentially increasing land footprint by 20-40% compared to conventional concrete production. Low-carbon concrete typically utilizes existing industrial byproducts, minimizing additional land use requirements.

Ecosystem impacts extend beyond carbon considerations. Both solutions generally reduce air pollutants like SOx, NOx, and particulate matter compared to conventional concrete. However, carbon-negative technologies may introduce novel environmental risks through chemical processes required for carbon sequestration, necessitating careful monitoring and mitigation strategies to prevent unintended consequences in local ecosystems.

Regulatory Framework for Sustainable Construction Materials

The regulatory landscape for sustainable construction materials has evolved significantly in response to growing climate concerns, with specific frameworks now addressing both carbon-negative and low-carbon concrete. These regulations operate at multiple levels, from international agreements to local building codes, creating a complex compliance environment for manufacturers and construction companies.

At the international level, the Paris Agreement has catalyzed regulatory action by establishing carbon reduction targets that directly impact construction material standards. The European Union leads with its Construction Products Regulation (CPR) and the more recent European Green Deal, which specifically addresses embodied carbon in building materials. The EU Taxonomy for Sustainable Activities now classifies concrete manufacturing processes based on their carbon footprint, providing clear regulatory distinctions between traditional, low-carbon, and carbon-negative concrete formulations.

In North America, regulatory approaches vary significantly by jurisdiction. The United States lacks comprehensive federal regulation but has seen progressive state-level initiatives, particularly in California where the Buy Clean California Act requires Environmental Product Declarations (EPDs) for concrete used in public projects. Canada has implemented the Greening Government Strategy, which includes specific procurement requirements for low-carbon building materials including concrete alternatives.

Certification systems have become de facto regulatory mechanisms, with LEED, BREEAM, and other green building standards awarding points for carbon-reduced concrete usage. These systems increasingly differentiate between merely low-carbon concrete and truly carbon-negative solutions, with the latter receiving premium certification credits. The recent development of Product Category Rules (PCRs) for concrete has standardized how carbon metrics are calculated and reported across the industry.

Performance-based regulatory frameworks are gradually replacing prescriptive standards, allowing for innovation in concrete formulations while maintaining structural integrity requirements. This shift has been crucial for carbon-negative concrete technologies, which often utilize novel supplementary cementitious materials that would be excluded under traditional prescriptive codes.

Procurement policies represent another powerful regulatory tool, with governments increasingly mandating carbon thresholds for concrete in public infrastructure projects. The Netherlands' CO2 Performance Ladder and Sweden's climate declaration requirements for new buildings exemplify this approach, creating market demand for carbon-negative concrete solutions through regulatory mechanisms.

Looking forward, regulatory harmonization remains a significant challenge, with manufacturers of both low-carbon and carbon-negative concrete advocating for consistent standards across jurisdictions to facilitate market adoption and technological development. The ongoing development of ISO standards specifically addressing carbon accounting in concrete production represents a promising step toward this regulatory coherence.

At the international level, the Paris Agreement has catalyzed regulatory action by establishing carbon reduction targets that directly impact construction material standards. The European Union leads with its Construction Products Regulation (CPR) and the more recent European Green Deal, which specifically addresses embodied carbon in building materials. The EU Taxonomy for Sustainable Activities now classifies concrete manufacturing processes based on their carbon footprint, providing clear regulatory distinctions between traditional, low-carbon, and carbon-negative concrete formulations.

In North America, regulatory approaches vary significantly by jurisdiction. The United States lacks comprehensive federal regulation but has seen progressive state-level initiatives, particularly in California where the Buy Clean California Act requires Environmental Product Declarations (EPDs) for concrete used in public projects. Canada has implemented the Greening Government Strategy, which includes specific procurement requirements for low-carbon building materials including concrete alternatives.

Certification systems have become de facto regulatory mechanisms, with LEED, BREEAM, and other green building standards awarding points for carbon-reduced concrete usage. These systems increasingly differentiate between merely low-carbon concrete and truly carbon-negative solutions, with the latter receiving premium certification credits. The recent development of Product Category Rules (PCRs) for concrete has standardized how carbon metrics are calculated and reported across the industry.

Performance-based regulatory frameworks are gradually replacing prescriptive standards, allowing for innovation in concrete formulations while maintaining structural integrity requirements. This shift has been crucial for carbon-negative concrete technologies, which often utilize novel supplementary cementitious materials that would be excluded under traditional prescriptive codes.

Procurement policies represent another powerful regulatory tool, with governments increasingly mandating carbon thresholds for concrete in public infrastructure projects. The Netherlands' CO2 Performance Ladder and Sweden's climate declaration requirements for new buildings exemplify this approach, creating market demand for carbon-negative concrete solutions through regulatory mechanisms.

Looking forward, regulatory harmonization remains a significant challenge, with manufacturers of both low-carbon and carbon-negative concrete advocating for consistent standards across jurisdictions to facilitate market adoption and technological development. The ongoing development of ISO standards specifically addressing carbon accounting in concrete production represents a promising step toward this regulatory coherence.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!