Exploring New Patents in Carbon-negative Concrete Technologies

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Technology Background and Objectives

Concrete, as the most widely used building material globally, accounts for approximately 8% of worldwide carbon dioxide emissions. The urgency to address climate change has driven significant innovation in carbon-negative concrete technologies over the past decade. These technologies aim not only to reduce emissions but to actively sequester carbon dioxide, transforming concrete from a carbon source to a carbon sink.

The evolution of carbon-negative concrete technologies has progressed through several distinct phases. Initially, efforts focused on reducing the cement content in concrete mixtures, as cement production is responsible for the majority of concrete's carbon footprint. This approach evolved into the development of alternative cementitious materials, such as geopolymers and alkali-activated materials, which require less energy to produce and generate fewer emissions.

The current technological frontier involves direct carbon capture and utilization (CCU) within concrete production processes. This represents a paradigm shift from merely reducing emissions to actively incorporating carbon dioxide as a feedstock in concrete manufacturing. Recent breakthroughs have demonstrated the feasibility of mineralizing CO2 within concrete, where the gas chemically reacts with calcium compounds to form stable carbonate minerals, permanently sequestering the carbon while simultaneously improving concrete's mechanical properties.

The primary objective of carbon-negative concrete technology is to achieve net carbon sequestration throughout the material's lifecycle while maintaining or enhancing performance characteristics such as strength, durability, and workability. Secondary objectives include cost competitiveness with conventional concrete, scalability for global implementation, and compatibility with existing construction practices and infrastructure.

Technical goals in this field include optimizing carbonation processes to maximize CO2 uptake, developing efficient carbon capture systems specifically designed for concrete production facilities, and creating standardized methodologies for quantifying and verifying carbon sequestration in concrete products. Additionally, researchers aim to extend carbon-negative approaches beyond structural concrete to encompass the full range of cementitious materials used in construction.

The trajectory of innovation suggests that future developments will likely focus on integrating renewable energy sources into production processes, utilizing waste biomass as both an energy source and carbon feedstock, and developing smart concrete formulations that can continue to absorb carbon throughout their service life. These advancements will be crucial in transforming the construction industry from a major carbon emitter to a potential carbon sink, contributing significantly to global climate change mitigation efforts.

The evolution of carbon-negative concrete technologies has progressed through several distinct phases. Initially, efforts focused on reducing the cement content in concrete mixtures, as cement production is responsible for the majority of concrete's carbon footprint. This approach evolved into the development of alternative cementitious materials, such as geopolymers and alkali-activated materials, which require less energy to produce and generate fewer emissions.

The current technological frontier involves direct carbon capture and utilization (CCU) within concrete production processes. This represents a paradigm shift from merely reducing emissions to actively incorporating carbon dioxide as a feedstock in concrete manufacturing. Recent breakthroughs have demonstrated the feasibility of mineralizing CO2 within concrete, where the gas chemically reacts with calcium compounds to form stable carbonate minerals, permanently sequestering the carbon while simultaneously improving concrete's mechanical properties.

The primary objective of carbon-negative concrete technology is to achieve net carbon sequestration throughout the material's lifecycle while maintaining or enhancing performance characteristics such as strength, durability, and workability. Secondary objectives include cost competitiveness with conventional concrete, scalability for global implementation, and compatibility with existing construction practices and infrastructure.

Technical goals in this field include optimizing carbonation processes to maximize CO2 uptake, developing efficient carbon capture systems specifically designed for concrete production facilities, and creating standardized methodologies for quantifying and verifying carbon sequestration in concrete products. Additionally, researchers aim to extend carbon-negative approaches beyond structural concrete to encompass the full range of cementitious materials used in construction.

The trajectory of innovation suggests that future developments will likely focus on integrating renewable energy sources into production processes, utilizing waste biomass as both an energy source and carbon feedstock, and developing smart concrete formulations that can continue to absorb carbon throughout their service life. These advancements will be crucial in transforming the construction industry from a major carbon emitter to a potential carbon sink, contributing significantly to global climate change mitigation efforts.

Market Demand Analysis for Sustainable Construction Materials

The global construction industry is experiencing a significant shift towards sustainable building materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete technologies, has shown remarkable growth in recent years. Current market analysis indicates that the global green concrete market is valued at approximately $30 billion and is projected to grow at a compound annual growth rate of 9.1% through 2028.

This growth is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions in the construction sector, which accounts for nearly 40% of global CO2 emissions. The European Union's Green Deal and similar initiatives worldwide have established ambitious targets for carbon neutrality, creating substantial demand for innovative building materials that can reduce or even reverse carbon footprints.

Consumer preferences are also evolving, with a growing segment of environmentally conscious buyers willing to pay premium prices for sustainable buildings. This trend is particularly evident in commercial real estate, where green certifications like LEED and BREEAM have become significant market differentiators, driving demand for carbon-negative materials.

The market for carbon-negative concrete specifically shows promising growth potential. Industry surveys indicate that 78% of major construction firms are actively seeking alternatives to traditional concrete to meet sustainability goals. This represents a substantial market opportunity for carbon-negative concrete technologies, which can offer carbon sequestration capabilities while maintaining or improving upon the performance characteristics of conventional concrete.

Regional analysis reveals varying levels of market readiness. North America and Europe lead in adoption rates, driven by advanced regulatory frameworks and greater environmental awareness. The Asia-Pacific region, while currently lagging in adoption, represents the largest potential market due to rapid urbanization and infrastructure development, particularly in China and India.

Market segmentation shows distinct demand patterns across different construction sectors. Commercial buildings lead in adoption of sustainable materials, followed by public infrastructure projects. Residential construction presents a growing opportunity, particularly in high-end housing markets where sustainability features command premium pricing.

Supply chain considerations remain a critical factor affecting market growth. The availability of raw materials for carbon-negative concrete, such as industrial byproducts and natural pozzolans, varies significantly by region. This geographic disparity creates both challenges and opportunities for technology developers and material suppliers looking to scale production and distribution networks to meet growing global demand.

This growth is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions in the construction sector, which accounts for nearly 40% of global CO2 emissions. The European Union's Green Deal and similar initiatives worldwide have established ambitious targets for carbon neutrality, creating substantial demand for innovative building materials that can reduce or even reverse carbon footprints.

Consumer preferences are also evolving, with a growing segment of environmentally conscious buyers willing to pay premium prices for sustainable buildings. This trend is particularly evident in commercial real estate, where green certifications like LEED and BREEAM have become significant market differentiators, driving demand for carbon-negative materials.

The market for carbon-negative concrete specifically shows promising growth potential. Industry surveys indicate that 78% of major construction firms are actively seeking alternatives to traditional concrete to meet sustainability goals. This represents a substantial market opportunity for carbon-negative concrete technologies, which can offer carbon sequestration capabilities while maintaining or improving upon the performance characteristics of conventional concrete.

Regional analysis reveals varying levels of market readiness. North America and Europe lead in adoption rates, driven by advanced regulatory frameworks and greater environmental awareness. The Asia-Pacific region, while currently lagging in adoption, represents the largest potential market due to rapid urbanization and infrastructure development, particularly in China and India.

Market segmentation shows distinct demand patterns across different construction sectors. Commercial buildings lead in adoption of sustainable materials, followed by public infrastructure projects. Residential construction presents a growing opportunity, particularly in high-end housing markets where sustainability features command premium pricing.

Supply chain considerations remain a critical factor affecting market growth. The availability of raw materials for carbon-negative concrete, such as industrial byproducts and natural pozzolans, varies significantly by region. This geographic disparity creates both challenges and opportunities for technology developers and material suppliers looking to scale production and distribution networks to meet growing global demand.

Current Status and Challenges in Carbon-negative Concrete Development

Carbon-negative concrete technology has witnessed significant advancements globally, yet remains in early commercial deployment stages. Current implementations primarily exist as pilot projects and limited commercial applications, with full-scale industrial adoption still developing. Leading research institutions in North America, Europe, and Asia have established promising laboratory results, demonstrating carbon capture capabilities ranging from 100-300 kg CO₂ per ton of concrete produced, substantially exceeding the carbon footprint of conventional concrete production.

The technical landscape reveals several parallel approaches gaining traction. Carbonation curing processes, which accelerate CO₂ absorption during concrete hardening, have shown 20-30% improved strength development while sequestering carbon. Alternative binding materials utilizing industrial byproducts like slag and fly ash combined with novel activators have demonstrated up to 70% reduction in carbon emissions compared to Portland cement. Additionally, biomass-derived additives incorporated into concrete mixtures have exhibited enhanced carbon sequestration properties while maintaining structural integrity.

Despite these advances, significant challenges persist in scaling carbon-negative concrete technologies. The primary technical hurdle involves maintaining consistent performance across varying environmental conditions and raw material sources. Laboratory successes often fail to translate directly to field applications due to sensitivity to temperature fluctuations, humidity levels, and material heterogeneity. Quality control mechanisms for carbon-negative formulations remain less developed than those for conventional concrete, creating barriers to widespread adoption.

Economic viability presents another substantial challenge. Current production costs for carbon-negative concrete exceed conventional alternatives by approximately 15-40%, depending on the specific technology employed. This cost premium stems from specialized equipment requirements, more complex processing methods, and the need for high-purity CO₂ sources in some approaches. Without carbon pricing mechanisms or regulatory incentives, market penetration faces significant headwinds.

Regulatory frameworks and standardization pose additional obstacles. Existing building codes and concrete standards were developed for conventional materials, creating certification barriers for novel carbon-negative alternatives. The lengthy testing and approval processes required for construction materials (typically 3-5 years) slow market entry for innovative solutions. Furthermore, lifecycle assessment methodologies for accurately quantifying carbon sequestration benefits remain inconsistent across regions, complicating comparative analyses.

Infrastructure limitations further constrain deployment. The carbon capture component of these technologies often requires specialized equipment and CO₂ handling capabilities not present in traditional concrete production facilities. Retrofitting existing plants involves substantial capital investment, while the supply chain for novel binding agents and additives remains underdeveloped in many regions.

The technical landscape reveals several parallel approaches gaining traction. Carbonation curing processes, which accelerate CO₂ absorption during concrete hardening, have shown 20-30% improved strength development while sequestering carbon. Alternative binding materials utilizing industrial byproducts like slag and fly ash combined with novel activators have demonstrated up to 70% reduction in carbon emissions compared to Portland cement. Additionally, biomass-derived additives incorporated into concrete mixtures have exhibited enhanced carbon sequestration properties while maintaining structural integrity.

Despite these advances, significant challenges persist in scaling carbon-negative concrete technologies. The primary technical hurdle involves maintaining consistent performance across varying environmental conditions and raw material sources. Laboratory successes often fail to translate directly to field applications due to sensitivity to temperature fluctuations, humidity levels, and material heterogeneity. Quality control mechanisms for carbon-negative formulations remain less developed than those for conventional concrete, creating barriers to widespread adoption.

Economic viability presents another substantial challenge. Current production costs for carbon-negative concrete exceed conventional alternatives by approximately 15-40%, depending on the specific technology employed. This cost premium stems from specialized equipment requirements, more complex processing methods, and the need for high-purity CO₂ sources in some approaches. Without carbon pricing mechanisms or regulatory incentives, market penetration faces significant headwinds.

Regulatory frameworks and standardization pose additional obstacles. Existing building codes and concrete standards were developed for conventional materials, creating certification barriers for novel carbon-negative alternatives. The lengthy testing and approval processes required for construction materials (typically 3-5 years) slow market entry for innovative solutions. Furthermore, lifecycle assessment methodologies for accurately quantifying carbon sequestration benefits remain inconsistent across regions, complicating comparative analyses.

Infrastructure limitations further constrain deployment. The carbon capture component of these technologies often requires specialized equipment and CO₂ handling capabilities not present in traditional concrete production facilities. Retrofitting existing plants involves substantial capital investment, while the supply chain for novel binding agents and additives remains underdeveloped in many regions.

Current Patent Landscape for Carbon-negative Concrete Solutions

01 Carbon capture and sequestration in concrete

Carbon-negative concrete can be achieved through processes that capture and sequester carbon dioxide during concrete production. These methods involve incorporating CO2 into the concrete matrix, where it reacts with calcium compounds to form stable carbonates. This process not only reduces the carbon footprint of concrete manufacturing but can actually result in net carbon sequestration, making the concrete carbon-negative. Advanced curing techniques using CO2 can enhance this effect while also improving concrete strength and durability.- Carbon sequestration in concrete production: Carbon-negative concrete can be achieved through processes that sequester more carbon dioxide than is emitted during production. These methods involve capturing CO2 from industrial sources or directly from the atmosphere and incorporating it into the concrete mixture. The carbonation process converts CO2 into stable carbonate minerals within the concrete matrix, effectively locking away carbon for the long term while potentially improving concrete strength and durability.

- Alternative cementitious materials for carbon reduction: Using alternative cementitious materials such as supplementary cementitious materials (SCMs), geopolymers, or alkali-activated materials can significantly reduce the carbon footprint of concrete. These materials often replace traditional Portland cement, which is responsible for substantial CO2 emissions. Materials like fly ash, slag, silica fume, and natural pozzolans can be incorporated into concrete mixtures to achieve carbon negativity while maintaining or enhancing performance characteristics.

- Biomass incorporation and biogenic materials: Incorporating biomass or biogenic materials into concrete formulations can contribute to carbon negativity. These materials, which have already sequestered carbon during their growth phase, can be processed and used as partial replacements for traditional concrete components. Examples include agricultural waste products, wood derivatives, and other plant-based materials that can be carbonated or mineralized to create durable building materials with a negative carbon footprint.

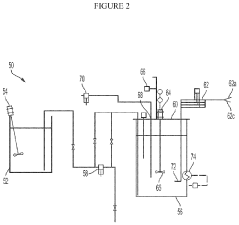

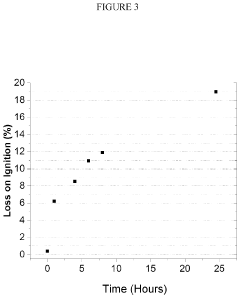

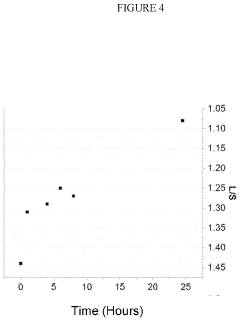

- Enhanced carbonation curing techniques: Specialized curing techniques that promote accelerated carbonation can transform concrete into a carbon sink. These methods involve exposing fresh concrete to controlled CO2-rich environments during the curing process, which enhances the natural carbonation reaction. The process can be optimized through factors such as pressure, temperature, humidity, and CO2 concentration to maximize carbon uptake while developing desired mechanical properties in the concrete.

- Carbon accounting and lifecycle assessment systems: Systems and methods for accurately measuring, tracking, and verifying the carbon negativity of concrete throughout its lifecycle are essential for validating environmental claims. These approaches involve comprehensive lifecycle assessments that account for all emissions and sequestration from raw material extraction through manufacturing, use, and end-of-life scenarios. Such systems may include monitoring technologies, certification protocols, and carbon credit mechanisms that incentivize the adoption of carbon-negative concrete technologies.

02 Alternative binders and supplementary cementitious materials

The use of alternative binders and supplementary cementitious materials (SCMs) can significantly reduce the carbon footprint of concrete. These include materials such as fly ash, slag, silica fume, and natural pozzolans that can partially replace traditional Portland cement. Some novel binders can even achieve carbon negativity by incorporating materials that have already sequestered carbon or that actively absorb CO2 during their service life. These alternative materials often require less energy to produce and can result in concrete with enhanced durability and performance characteristics.Expand Specific Solutions03 Biomass incorporation and carbonation techniques

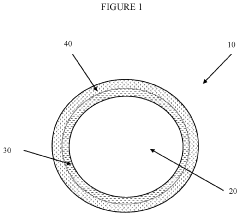

Incorporating biomass-derived materials into concrete formulations can contribute to carbon negativity. These materials, which have already sequestered carbon during their growth phase, can be used as aggregates or as part of the binder system. Additionally, accelerated carbonation techniques can be applied to concrete containing these biomass materials to further enhance carbon sequestration. This approach combines the benefits of using renewable resources with active carbon capture, resulting in construction materials with significantly reduced or even negative carbon footprints.Expand Specific Solutions04 Industrial waste utilization for carbon-negative concrete

Industrial wastes and by-products can be repurposed as ingredients in carbon-negative concrete formulations. Materials such as steel slag, bauxite residue, and various industrial ashes contain compounds that can react with CO2 and form stable carbonates. By utilizing these waste materials, concrete production can simultaneously address waste management challenges and carbon emissions. The resulting concrete products can achieve carbon negativity while maintaining or even improving performance characteristics compared to conventional concrete.Expand Specific Solutions05 Novel production processes and energy optimization

Innovative production processes and energy optimization techniques can contribute to achieving carbon-negative concrete. These include low-temperature synthesis methods, electrified production processes powered by renewable energy, and novel curing techniques that require less energy while promoting carbon sequestration. Some approaches involve redesigning the entire concrete production chain to minimize emissions at each stage and incorporate carbon capture throughout the process. These methods often result in concrete products with unique microstructures that enhance strength and durability while maintaining carbon negativity.Expand Specific Solutions

Key Industry Players in Carbon-negative Concrete Innovation

Carbon-negative concrete technology is in an early development stage, with growing market interest due to increasing environmental regulations and sustainability demands. The market is projected to expand significantly as construction industries seek to reduce carbon footprints. Leading players include Solidia Technologies and CarbonCure Technologies, who have developed commercial-scale CO2 utilization processes. Academic institutions like Shandong University and University of Houston are advancing fundamental research, while established companies such as Heidelberg Materials and Saudi Arabian Oil Co. are investing in carbon capture integration. Material.Evolution and Calera represent innovative startups with proprietary technologies. The competitive landscape shows a mix of specialized startups, research institutions, and traditional concrete manufacturers adapting to this emerging field.

Solidia Technologies, Inc.

Technical Solution: Solidia Technologies has developed a revolutionary carbon-negative concrete technology that fundamentally changes the chemistry of cement. Their patented process uses non-hydraulic calcium silicate cement that cures by carbonation rather than hydration, consuming CO2 during the curing process. The technology reduces the limestone content needed in cement production, lowering calcination emissions by up to 30%. Additionally, their concrete products absorb CO2 during the curing phase, which takes only 24 hours compared to traditional concrete's 28 days[1]. Solidia's process can reduce the carbon footprint of concrete by up to 70% - capturing 240-400 kg of CO2 per ton of cement used[3]. Their technology is compatible with existing concrete manufacturing equipment, requiring minimal retrofitting of current plants, which significantly lowers implementation barriers for industry adoption[5].

Strengths: Rapid curing time (24 hours vs 28 days for traditional concrete), significant carbon reduction (up to 70%), and compatibility with existing manufacturing infrastructure. Weaknesses: Requires a controlled CO2 curing environment, which may limit on-site applications, and the technology may have different performance characteristics in extreme environmental conditions compared to traditional Portland cement concrete.

CarbonCure Technologies, Inc.

Technical Solution: CarbonCure Technologies has pioneered a retrofit technology that injects captured CO2 into fresh concrete during mixing. Their patented process chemically converts and mineralizes the CO2 into calcium carbonate nanoparticles that become permanently embedded within the concrete. This mineralization process not only sequesters CO2 but also improves the concrete's compressive strength by approximately 10%, allowing for cement content reduction while maintaining performance standards[2]. The technology can be installed in existing concrete plants with minimal disruption, requiring only 1-2 days for installation. CarbonCure's system precisely measures and injects the optimal amount of CO2 based on mix design parameters, typically utilizing 0.2-0.3% CO2 by weight of cement[4]. Their solution has been implemented in over 500 concrete plants globally, demonstrating scalability and market acceptance. The technology reduces concrete's carbon footprint by 5-8% per cubic yard while potentially saving producers $2-3 per cubic yard through cement reduction[6].

Strengths: Easy integration into existing concrete production facilities without changing core processes, improved concrete strength properties allowing cement reduction, and proven commercial deployment across hundreds of plants worldwide. Weaknesses: Relatively modest carbon reduction compared to some alternative technologies (5-8% reduction), dependence on CO2 supply chains, and limited application to precast concrete products in some implementations.

Critical Patent Analysis and Technical Breakthroughs

Method of preparing supplementary cementitious materials, and supplementary cementitious materials prepared therefrom

PatentWO2023059777A1

Innovation

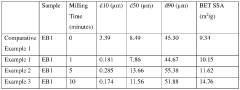

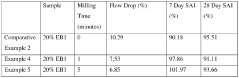

- A method involving pre-carbonation of a carbonatable clinker, followed by milling and repeated carbonation to enhance CO2 uptake, which is then incorporated into hydraulic cements as supplementary cementitious materials, reducing the clinker factor and integrating carbon capture into the cement production process.

Production of supplementary cementitious materials through wet carbonation method

PatentInactiveUS20230382792A1

Innovation

- A method of pre-carbonating a low CO2 emission clinker before adding it to hydraulic cement as a supplementary cementitious material, reducing the clinker factor and incorporating carbon capture into the production of conventional hydraulic cement or concrete, thereby achieving a double environmental benefit.

Environmental Impact Assessment and Carbon Accounting Methods

Environmental impact assessment for carbon-negative concrete technologies requires comprehensive methodologies that accurately quantify carbon sequestration throughout the product lifecycle. Current assessment frameworks typically employ Life Cycle Assessment (LCA) methodologies, which have been adapted specifically for concrete applications to account for unique carbon capture mechanisms during production, curing, and service life.

The carbon accounting methods for these innovative concrete technologies must address several critical parameters. First, they must quantify CO2 uptake during the carbonation process, which varies significantly depending on concrete formulation, curing conditions, and exposure environment. Recent patents have introduced standardized testing protocols that measure carbonation rates under controlled conditions, providing more reliable data for carbon calculations.

Second, these methods must account for emissions avoided through the replacement of traditional Portland cement with alternative binders. This includes calculating the carbon footprint reduction from using industrial byproducts like fly ash, slag, or novel materials such as magnesium oxide-based cements that inherently absorb CO2 during hardening.

Third, advanced carbon accounting frameworks now incorporate temporal considerations, recognizing that carbon sequestration in concrete occurs over extended timeframes. Patents filed since 2020 have introduced dynamic carbon accounting models that factor in the time-dependent nature of carbon uptake, providing more accurate representations of climate benefits.

Emerging verification technologies represent another significant advancement in this field. Several patented systems now employ embedded sensors and spectroscopic techniques to monitor real-time carbonation in concrete structures, offering continuous validation of carbon sequestration claims. These technologies address a critical challenge in carbon accounting: providing reliable, third-party verifiable data suitable for carbon credit markets.

Standardization efforts are also progressing rapidly. International organizations have begun developing specific protocols for carbon-negative concrete, with recent patents focusing on harmonizing measurement methodologies across different concrete applications and geographic regions. These standards are essential for establishing credibility in voluntary carbon markets and potential compliance mechanisms.

The economic implications of these accounting methods are substantial. Accurate carbon accounting enables concrete manufacturers to monetize carbon benefits through carbon credit markets, potentially transforming the economics of low-carbon concrete production. Recent patent filings indicate growing interest in blockchain-based verification systems that create immutable records of carbon sequestration, facilitating transparent trading of concrete-based carbon credits.

The carbon accounting methods for these innovative concrete technologies must address several critical parameters. First, they must quantify CO2 uptake during the carbonation process, which varies significantly depending on concrete formulation, curing conditions, and exposure environment. Recent patents have introduced standardized testing protocols that measure carbonation rates under controlled conditions, providing more reliable data for carbon calculations.

Second, these methods must account for emissions avoided through the replacement of traditional Portland cement with alternative binders. This includes calculating the carbon footprint reduction from using industrial byproducts like fly ash, slag, or novel materials such as magnesium oxide-based cements that inherently absorb CO2 during hardening.

Third, advanced carbon accounting frameworks now incorporate temporal considerations, recognizing that carbon sequestration in concrete occurs over extended timeframes. Patents filed since 2020 have introduced dynamic carbon accounting models that factor in the time-dependent nature of carbon uptake, providing more accurate representations of climate benefits.

Emerging verification technologies represent another significant advancement in this field. Several patented systems now employ embedded sensors and spectroscopic techniques to monitor real-time carbonation in concrete structures, offering continuous validation of carbon sequestration claims. These technologies address a critical challenge in carbon accounting: providing reliable, third-party verifiable data suitable for carbon credit markets.

Standardization efforts are also progressing rapidly. International organizations have begun developing specific protocols for carbon-negative concrete, with recent patents focusing on harmonizing measurement methodologies across different concrete applications and geographic regions. These standards are essential for establishing credibility in voluntary carbon markets and potential compliance mechanisms.

The economic implications of these accounting methods are substantial. Accurate carbon accounting enables concrete manufacturers to monetize carbon benefits through carbon credit markets, potentially transforming the economics of low-carbon concrete production. Recent patent filings indicate growing interest in blockchain-based verification systems that create immutable records of carbon sequestration, facilitating transparent trading of concrete-based carbon credits.

Regulatory Framework and Standardization Challenges

The regulatory landscape for carbon-negative concrete technologies is evolving rapidly as governments worldwide recognize the urgent need to address climate change. Current building codes and construction standards in most jurisdictions were developed for traditional concrete formulations, creating significant barriers for innovative carbon-negative alternatives. These regulations often specify minimum cement content or particular strength development profiles that inadvertently exclude novel formulations, despite their environmental benefits.

International standardization bodies such as ISO, ASTM International, and the European Committee for Standardization (CEN) are working to develop new testing protocols and performance criteria specifically for low-carbon and carbon-negative concrete. However, the pace of regulatory adaptation lags behind technological innovation, creating a challenging environment for market entry of patented carbon-negative concrete technologies.

Carbon accounting frameworks present another layer of complexity. The lack of standardized methodologies for quantifying carbon sequestration in building materials creates uncertainty for manufacturers and potential adopters. Different jurisdictions employ varying approaches to lifecycle assessment (LCA), making it difficult to consistently demonstrate and monetize the climate benefits of carbon-negative concrete technologies.

Certification systems for green building materials, such as LEED, BREEAM, and Green Star, are gradually incorporating provisions for carbon-negative materials, but the integration remains incomplete. This fragmentation in recognition systems further complicates market development and adoption of patented technologies.

Procurement policies represent both a challenge and opportunity. Public procurement, which accounts for a significant portion of concrete consumption globally, typically prioritizes lowest-cost bids rather than lifecycle environmental performance. Recent policy shifts in regions like the EU, California, and Canada are beginning to incorporate carbon footprint considerations into procurement decisions, potentially creating market pull for carbon-negative concrete technologies.

Liability concerns and insurance requirements create additional hurdles. The long service life expected of concrete structures (often 50-100 years) means that new formulations face skepticism regarding long-term durability and performance. Insurance providers and building owners may require extended warranties or additional testing before adopting carbon-negative concrete technologies, adding cost and time barriers to market entry.

International standardization bodies such as ISO, ASTM International, and the European Committee for Standardization (CEN) are working to develop new testing protocols and performance criteria specifically for low-carbon and carbon-negative concrete. However, the pace of regulatory adaptation lags behind technological innovation, creating a challenging environment for market entry of patented carbon-negative concrete technologies.

Carbon accounting frameworks present another layer of complexity. The lack of standardized methodologies for quantifying carbon sequestration in building materials creates uncertainty for manufacturers and potential adopters. Different jurisdictions employ varying approaches to lifecycle assessment (LCA), making it difficult to consistently demonstrate and monetize the climate benefits of carbon-negative concrete technologies.

Certification systems for green building materials, such as LEED, BREEAM, and Green Star, are gradually incorporating provisions for carbon-negative materials, but the integration remains incomplete. This fragmentation in recognition systems further complicates market development and adoption of patented technologies.

Procurement policies represent both a challenge and opportunity. Public procurement, which accounts for a significant portion of concrete consumption globally, typically prioritizes lowest-cost bids rather than lifecycle environmental performance. Recent policy shifts in regions like the EU, California, and Canada are beginning to incorporate carbon footprint considerations into procurement decisions, potentially creating market pull for carbon-negative concrete technologies.

Liability concerns and insurance requirements create additional hurdles. The long service life expected of concrete structures (often 50-100 years) means that new formulations face skepticism regarding long-term durability and performance. Insurance providers and building owners may require extended warranties or additional testing before adopting carbon-negative concrete technologies, adding cost and time barriers to market entry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!