Carbon Trading Implications for Methane Pyrolysis.

SEP 5, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Methane Pyrolysis Carbon Trading Background and Objectives

Methane pyrolysis represents a significant technological advancement in hydrogen production, offering a pathway to produce hydrogen without direct carbon dioxide emissions. The evolution of this technology spans several decades, with initial research dating back to the 1960s, but substantial progress has been made in the last decade due to increasing focus on decarbonization strategies. The trajectory of methane pyrolysis development has been characterized by continuous improvements in catalysts, reactor designs, and process efficiency, moving from laboratory-scale experiments to pilot demonstrations.

The carbon trading implications for methane pyrolysis emerge from the global shift towards carbon pricing mechanisms designed to incentivize low-carbon technologies. Since 2005, when the European Union Emissions Trading System (EU ETS) was established, carbon markets have expanded globally, creating economic frameworks that potentially favor methane pyrolysis over conventional hydrogen production methods. The technology's unique position stems from its ability to produce solid carbon instead of CO2, potentially qualifying for carbon credits or avoiding carbon taxes.

The primary technical objective for methane pyrolysis in the carbon trading context is to achieve cost-competitive hydrogen production while maximizing the value of carbon byproducts. This requires optimizing reactor efficiency, reducing energy inputs, and developing high-value applications for the solid carbon output. Secondary objectives include scaling the technology to industrial levels, ensuring process stability, and establishing standardized methodologies for quantifying emissions reductions for carbon market participation.

Current carbon markets present both opportunities and challenges for methane pyrolysis. While the technology offers clear emissions advantages over steam methane reforming (SMR), existing carbon accounting frameworks may not fully recognize these benefits. The methodologies for calculating emissions reductions often focus on CO2 rather than considering the full lifecycle benefits of solid carbon sequestration. This creates a technical goal of developing robust life cycle assessment (LCA) protocols specifically adapted to methane pyrolysis.

Looking forward, the technology trajectory is likely to be influenced by evolving carbon pricing mechanisms, with higher carbon prices potentially accelerating commercial adoption. Industry projections suggest carbon prices could reach $50-100 per ton CO2e in major markets by 2030, potentially creating sufficient economic incentives for widespread methane pyrolysis implementation. The technical development path must therefore align with these market signals, focusing on process optimizations that maximize carbon credit generation while minimizing production costs.

The convergence of methane pyrolysis technology development and carbon market evolution represents a critical intersection of technical innovation and climate policy. Success in this domain requires not only technical excellence but also strategic engagement with evolving carbon accounting frameworks and market mechanisms.

The carbon trading implications for methane pyrolysis emerge from the global shift towards carbon pricing mechanisms designed to incentivize low-carbon technologies. Since 2005, when the European Union Emissions Trading System (EU ETS) was established, carbon markets have expanded globally, creating economic frameworks that potentially favor methane pyrolysis over conventional hydrogen production methods. The technology's unique position stems from its ability to produce solid carbon instead of CO2, potentially qualifying for carbon credits or avoiding carbon taxes.

The primary technical objective for methane pyrolysis in the carbon trading context is to achieve cost-competitive hydrogen production while maximizing the value of carbon byproducts. This requires optimizing reactor efficiency, reducing energy inputs, and developing high-value applications for the solid carbon output. Secondary objectives include scaling the technology to industrial levels, ensuring process stability, and establishing standardized methodologies for quantifying emissions reductions for carbon market participation.

Current carbon markets present both opportunities and challenges for methane pyrolysis. While the technology offers clear emissions advantages over steam methane reforming (SMR), existing carbon accounting frameworks may not fully recognize these benefits. The methodologies for calculating emissions reductions often focus on CO2 rather than considering the full lifecycle benefits of solid carbon sequestration. This creates a technical goal of developing robust life cycle assessment (LCA) protocols specifically adapted to methane pyrolysis.

Looking forward, the technology trajectory is likely to be influenced by evolving carbon pricing mechanisms, with higher carbon prices potentially accelerating commercial adoption. Industry projections suggest carbon prices could reach $50-100 per ton CO2e in major markets by 2030, potentially creating sufficient economic incentives for widespread methane pyrolysis implementation. The technical development path must therefore align with these market signals, focusing on process optimizations that maximize carbon credit generation while minimizing production costs.

The convergence of methane pyrolysis technology development and carbon market evolution represents a critical intersection of technical innovation and climate policy. Success in this domain requires not only technical excellence but also strategic engagement with evolving carbon accounting frameworks and market mechanisms.

Market Analysis for Carbon Credits from Methane Pyrolysis

The carbon credit market for methane pyrolysis presents a significant opportunity within the broader carbon trading ecosystem. Current market analysis indicates that methane pyrolysis-derived carbon credits are positioned to capture a growing share of the voluntary carbon market, which reached approximately $2 billion in 2022 and is projected to expand to $10-40 billion by 2030 according to McKinsey & Company research.

Methane pyrolysis offers a distinct advantage in carbon markets due to its dual environmental benefits: preventing methane emissions while producing hydrogen without CO2 generation. This positions these credits as premium offerings, with current trading values ranging between $50-150 per ton of CO2 equivalent, substantially higher than conventional carbon credits which typically trade at $5-25 per ton.

Demand drivers for these specialized credits include energy-intensive industries seeking high-quality offsets, particularly technology companies with net-zero commitments and oil and gas corporations looking to mitigate their methane footprint. Market research indicates that over 60% of Fortune 500 companies have established net-zero targets, creating sustained demand for premium carbon credits.

Regional market distribution shows Europe leading adoption with approximately 45% market share, followed by North America at 30% and Asia-Pacific at 20%. The European market benefits from the EU Emissions Trading System's inclusion of methane in its regulatory framework, while voluntary markets dominate in North America.

Supply constraints currently characterize the market, with methane pyrolysis projects delivering fewer than 500,000 carbon credits annually. This supply-demand imbalance has contributed to price premiums and volatility. Industry projections suggest capacity could increase tenfold by 2028 as technology scales and more facilities come online.

Market maturity indicators reveal that methane pyrolysis credits remain in an early growth phase, with standardization of measurement methodologies still evolving. Leading carbon registries including Verra and Gold Standard have begun developing specific protocols for methane pyrolysis, which will likely accelerate market adoption once finalized in 2024-2025.

Pricing trends demonstrate strong correlation with policy developments, with notable price increases following announcements of methane-specific regulations. Analysis of trading volumes indicates 30-40% annual growth in transaction volume for these specialized credits, outpacing the broader carbon market's 15-20% growth rate.

Methane pyrolysis offers a distinct advantage in carbon markets due to its dual environmental benefits: preventing methane emissions while producing hydrogen without CO2 generation. This positions these credits as premium offerings, with current trading values ranging between $50-150 per ton of CO2 equivalent, substantially higher than conventional carbon credits which typically trade at $5-25 per ton.

Demand drivers for these specialized credits include energy-intensive industries seeking high-quality offsets, particularly technology companies with net-zero commitments and oil and gas corporations looking to mitigate their methane footprint. Market research indicates that over 60% of Fortune 500 companies have established net-zero targets, creating sustained demand for premium carbon credits.

Regional market distribution shows Europe leading adoption with approximately 45% market share, followed by North America at 30% and Asia-Pacific at 20%. The European market benefits from the EU Emissions Trading System's inclusion of methane in its regulatory framework, while voluntary markets dominate in North America.

Supply constraints currently characterize the market, with methane pyrolysis projects delivering fewer than 500,000 carbon credits annually. This supply-demand imbalance has contributed to price premiums and volatility. Industry projections suggest capacity could increase tenfold by 2028 as technology scales and more facilities come online.

Market maturity indicators reveal that methane pyrolysis credits remain in an early growth phase, with standardization of measurement methodologies still evolving. Leading carbon registries including Verra and Gold Standard have begun developing specific protocols for methane pyrolysis, which will likely accelerate market adoption once finalized in 2024-2025.

Pricing trends demonstrate strong correlation with policy developments, with notable price increases following announcements of methane-specific regulations. Analysis of trading volumes indicates 30-40% annual growth in transaction volume for these specialized credits, outpacing the broader carbon market's 15-20% growth rate.

Technical Status and Barriers in Methane Pyrolysis

Methane pyrolysis technology has gained significant attention globally as a promising pathway for hydrogen production with solid carbon as a byproduct instead of CO2. Currently, the technology exists at various technology readiness levels (TRLs), with most commercial applications still in demonstration or early commercialization phases. Laboratory-scale processes have shown high conversion rates exceeding 90%, but industrial-scale implementations remain limited.

The global landscape shows concentrated research efforts in Europe, North America, and parts of Asia. Germany leads with several pilot projects, while the United States has invested substantially in research programs through the Department of Energy. Japan and South Korea focus on catalytic methods, whereas Australia has leveraged its natural gas resources to explore thermal decomposition approaches.

Despite promising developments, methane pyrolysis faces significant technical barriers. The high energy requirement constitutes a major challenge, with temperatures typically ranging from 700°C to 1200°C depending on the specific process. This energy intensity impacts both economic viability and carbon footprint unless powered by renewable energy sources.

Catalyst deactivation presents another substantial hurdle. Carbon deposition on catalysts reduces efficiency over time, necessitating frequent regeneration or replacement. Current catalysts, including nickel-based and noble metal systems, struggle to maintain performance beyond several hundred hours of operation under industrial conditions.

Reactor design limitations also impede commercialization. Existing reactors face challenges in continuous carbon removal without process interruption. Molten metal reactors show promise but encounter materials compatibility issues at high temperatures, while fluidized bed systems struggle with carbon separation efficiency.

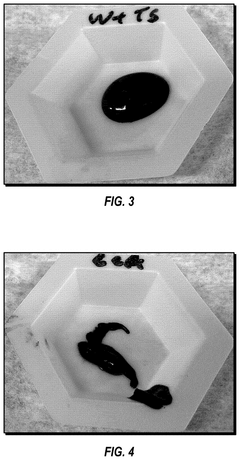

Carbon quality control remains problematic for market integration. The carbon byproduct varies significantly in structure and purity depending on process conditions, affecting its commercial value in carbon markets. Standardization of carbon quality metrics is lacking, complicating its integration into carbon trading frameworks.

Scale-up challenges persist as laboratory successes have proven difficult to replicate at industrial scales. Heat transfer inefficiencies, reactor geometry limitations, and process control complexities increase exponentially with scale. Several demonstration plants have reported throughput reductions of 30-50% compared to theoretical capacities.

From a carbon trading perspective, measurement and verification protocols for methane pyrolysis remain underdeveloped. The absence of standardized methodologies for quantifying avoided emissions creates uncertainty in carbon credit generation. Additionally, regulatory frameworks in most jurisdictions have not explicitly classified solid carbon from pyrolysis within existing carbon accounting systems.

The global landscape shows concentrated research efforts in Europe, North America, and parts of Asia. Germany leads with several pilot projects, while the United States has invested substantially in research programs through the Department of Energy. Japan and South Korea focus on catalytic methods, whereas Australia has leveraged its natural gas resources to explore thermal decomposition approaches.

Despite promising developments, methane pyrolysis faces significant technical barriers. The high energy requirement constitutes a major challenge, with temperatures typically ranging from 700°C to 1200°C depending on the specific process. This energy intensity impacts both economic viability and carbon footprint unless powered by renewable energy sources.

Catalyst deactivation presents another substantial hurdle. Carbon deposition on catalysts reduces efficiency over time, necessitating frequent regeneration or replacement. Current catalysts, including nickel-based and noble metal systems, struggle to maintain performance beyond several hundred hours of operation under industrial conditions.

Reactor design limitations also impede commercialization. Existing reactors face challenges in continuous carbon removal without process interruption. Molten metal reactors show promise but encounter materials compatibility issues at high temperatures, while fluidized bed systems struggle with carbon separation efficiency.

Carbon quality control remains problematic for market integration. The carbon byproduct varies significantly in structure and purity depending on process conditions, affecting its commercial value in carbon markets. Standardization of carbon quality metrics is lacking, complicating its integration into carbon trading frameworks.

Scale-up challenges persist as laboratory successes have proven difficult to replicate at industrial scales. Heat transfer inefficiencies, reactor geometry limitations, and process control complexities increase exponentially with scale. Several demonstration plants have reported throughput reductions of 30-50% compared to theoretical capacities.

From a carbon trading perspective, measurement and verification protocols for methane pyrolysis remain underdeveloped. The absence of standardized methodologies for quantifying avoided emissions creates uncertainty in carbon credit generation. Additionally, regulatory frameworks in most jurisdictions have not explicitly classified solid carbon from pyrolysis within existing carbon accounting systems.

Current Carbon Trading Mechanisms for Methane Pyrolysis

01 Carbon credit generation from methane pyrolysis

Methane pyrolysis processes can generate carbon credits by converting methane into hydrogen and solid carbon, thereby preventing methane emissions which have a higher global warming potential than CO2. These processes qualify for carbon trading schemes as they effectively reduce greenhouse gas emissions. The solid carbon byproduct can be sequestered or utilized in various applications, further enhancing the environmental benefits and economic value of the process.- Carbon credit generation from methane pyrolysis: Methane pyrolysis processes can generate carbon credits by converting methane into hydrogen and solid carbon, thereby preventing methane emissions. These carbon credits can be traded in carbon markets, providing economic incentives for methane pyrolysis projects. The solid carbon byproduct is considered a form of carbon sequestration, further enhancing the environmental benefits and carbon credit value of the process.

- Methane pyrolysis technology for hydrogen production: Advanced methane pyrolysis technologies focus on producing hydrogen while capturing solid carbon. These processes typically involve catalytic or thermal decomposition of methane at high temperatures, resulting in hydrogen gas and solid carbon products. The technology offers a cleaner alternative to traditional hydrogen production methods by avoiding CO2 emissions, which enhances its value in carbon trading markets.

- Carbon accounting methodologies for pyrolysis processes: Specialized carbon accounting methodologies have been developed to quantify the greenhouse gas emission reductions achieved through methane pyrolysis. These methodologies calculate the carbon credits by comparing emissions from pyrolysis processes to conventional methods. They consider factors such as energy inputs, process efficiency, and the fate of the solid carbon produced, providing a standardized approach for carbon credit verification and trading.

- Solid carbon utilization and marketability: The solid carbon produced from methane pyrolysis can be utilized in various applications, enhancing the economic viability of the process beyond carbon credits. Applications include carbon black for rubber products, carbon fibers, construction materials, and soil amendments. The quality and characteristics of the carbon product affect its market value and can be optimized through process control, creating additional revenue streams alongside carbon credit trading.

- Integration with renewable energy for enhanced carbon credits: Integrating renewable energy sources with methane pyrolysis processes can significantly enhance the carbon credit value. By powering the pyrolysis process with renewable electricity, the overall carbon footprint is further reduced, potentially qualifying for premium carbon credits. This integration creates a more sustainable system where methane is converted to hydrogen and solid carbon with minimal environmental impact, maximizing the economic benefits from carbon trading markets.

02 Technological innovations in methane pyrolysis reactors

Advanced reactor designs for methane pyrolysis focus on improving efficiency and carbon yield. These innovations include catalytic systems, molten metal reactors, and plasma-based technologies that enable more effective decomposition of methane into hydrogen and solid carbon. The reactor designs aim to optimize operating conditions such as temperature, pressure, and residence time to maximize conversion rates while minimizing energy consumption.Expand Specific Solutions03 Carbon quality control and marketability

The quality of carbon produced through methane pyrolysis significantly impacts its market value and potential applications. Various techniques are employed to control the morphology, purity, and structure of the carbon output, producing forms ranging from carbon black to graphite or carbon nanotubes. These high-value carbon products can be sold into markets for materials, construction, or electronics, creating additional revenue streams beyond carbon credits.Expand Specific Solutions04 Integration with renewable energy systems

Methane pyrolysis processes can be integrated with renewable energy sources to create low-carbon or carbon-negative hydrogen production systems. By powering the pyrolysis process with renewable electricity or heat, the overall carbon footprint is further reduced, potentially increasing the value of carbon credits generated. These integrated systems can operate intermittently to utilize excess renewable energy during peak production periods.Expand Specific Solutions05 Regulatory frameworks and verification methods

Carbon trading related to methane pyrolysis requires robust monitoring, reporting, and verification systems to quantify emission reductions accurately. Various methodologies have been developed to calculate the carbon credits generated, considering factors such as methane source, process efficiency, and end-use of products. Regulatory frameworks across different jurisdictions establish the criteria for qualifying methane pyrolysis projects for carbon markets, including baseline establishment and additionality requirements.Expand Specific Solutions

Key Industry Players in Carbon Trading and Methane Pyrolysis

The methane pyrolysis carbon trading landscape is evolving rapidly, with the market currently in its growth phase as industries seek low-carbon hydrogen production methods. Major oil companies like ExxonMobil, Shell, and Phillips 66 are leading commercial development, while research institutions such as Dalian Institute of Chemical Physics and University of California are advancing fundamental technologies. Technology maturity varies significantly across players, with companies like Coolbrook Oy and Electrochaea GmbH offering innovative reactor designs, while established corporations like BASF and thyssenkrupp Industrial Solutions leverage their industrial scale advantages. The market is expected to expand substantially as carbon pricing mechanisms mature globally, creating significant opportunities for solid carbon valorization and emissions reduction credits.

Shell Oil Co.

Technical Solution: Shell has developed an advanced methane pyrolysis technology called the Shell Blue Hydrogen Process that uses a proprietary catalyst system and molten metal bath reactor design. This process converts natural gas directly into hydrogen and solid carbon, with the hydrogen being captured for use as a clean fuel while the solid carbon can be sequestered or utilized in various applications. The technology operates at temperatures around 1000-1200°C and employs a bubble column reactor where methane is bubbled through the molten metal catalyst (typically nickel-based). Shell's approach integrates with carbon trading frameworks by producing hydrogen with significantly lower CO2 emissions compared to traditional steam methane reforming (SMR) processes - reducing emissions by up to 90%. The company has also developed carbon accounting methodologies specifically for methane pyrolysis that quantify the carbon credits generated through avoided emissions, which can be traded in various carbon markets. Shell's technology roadmap includes scaling up demonstration plants to commercial scale by 2025-2030, positioning the company to benefit from increasingly stringent carbon pricing mechanisms.

Strengths: Shell's technology produces hydrogen with minimal CO2 emissions, creating valuable carbon credits. Their established global presence provides infrastructure advantages for scaling and commercialization. Weaknesses: High energy requirements for the high-temperature process may impact economic viability in regions with expensive electricity. The technology remains at pre-commercial scale compared to conventional hydrogen production methods.

Coolbrook Oy

Technical Solution: Coolbrook has developed a revolutionary methane pyrolysis technology called the Roto Dynamic Reactor (RDR) that utilizes electric heating and advanced fluid dynamics principles rather than conventional catalysts. Their process achieves methane decomposition through a combination of high temperatures (1200-1500°C) and precisely controlled turbulent flow conditions that maximize conversion efficiency. The RDR technology can be powered entirely by renewable electricity, creating a truly zero-emission hydrogen production pathway. Coolbrook's approach is particularly well-positioned for carbon trading markets as it eliminates both direct and indirect emissions associated with hydrogen production. The company has developed detailed carbon accounting methodologies that demonstrate their process can achieve negative carbon intensity when powered by renewable electricity, potentially generating premium carbon credits in various trading schemes. Their technology has been validated at pilot scale, achieving methane conversion rates above 95% with minimal energy losses. Coolbrook has established partnerships with major industrial gas companies and renewable energy providers to create integrated zero-carbon hydrogen production systems. The company's roadmap includes commercial-scale implementation by 2024-2025, with projected carbon credit generation of 10-14 tons of CO2-equivalent per ton of hydrogen produced. Coolbrook is actively engaging with carbon market regulators to establish methodologies specifically for electrically-powered methane pyrolysis within existing trading frameworks.

Strengths: Coolbrook's technology eliminates the need for catalysts, avoiding associated deactivation and replacement issues. Their electrically-powered approach enables direct integration with renewable energy sources for zero-emission operation. Weaknesses: The extremely high operating temperatures require specialized materials and significant electricity input, potentially limiting economic viability in regions with high electricity costs. The technology remains at pilot scale and faces engineering challenges in scaling to commercial production.

Critical Patents and Research in Methane Decomposition

Pyrolysis of methane with a molten salt based catalyst system

PatentInactiveUS20210363013A1

Innovation

- A catalyst system utilizing a molten salt with dispersed catalytically active metals like iron, molybdenum, and copper, which promotes high temperature methane pyrolysis and controls carbon morphology by maintaining thermal stability and preventing carbon deposition on reactor walls, allowing for efficient production of hydrogen and solid carbon with desired structures.

Handling Carbon Nanoparticles Produced From Methane Pyrolysis

PatentPendingUS20250263300A1

Innovation

- A method and system for producing hydrogen through methane pyrolysis, capturing carbon nanoparticles in a separator, and forming a slurry or paste with a liquid to mitigate handling risks, enabling safe and efficient power distribution using hydrogen fuel cells or engines.

Regulatory Framework for Carbon Trading Markets

The global carbon trading landscape has evolved significantly over the past two decades, creating a complex regulatory environment that directly impacts emerging technologies like methane pyrolysis. The European Union Emissions Trading System (EU ETS), established in 2005, remains the world's largest carbon market and serves as a blueprint for many emerging systems. Its framework includes specific provisions for industrial processes that could potentially encompass methane pyrolysis operations, particularly under Phase 4 (2021-2030) which emphasizes innovation in low-carbon technologies.

In North America, regulatory frameworks vary considerably. California's Cap-and-Trade Program and the Regional Greenhouse Gas Initiative (RGGI) in the northeastern United States have established regional carbon pricing mechanisms. These systems generally recognize methane as having 25-28 times the global warming potential of CO2, creating significant potential value for methane abatement technologies like pyrolysis.

China's national Emissions Trading Scheme (ETS), launched in 2021, initially focuses on the power sector but is expected to expand to include industrial processes. This expansion could create substantial opportunities for methane pyrolysis technology deployment in the world's largest carbon-emitting nation, particularly as China pursues its 2060 carbon neutrality goal.

The Clean Development Mechanism (CDM) under the Kyoto Protocol and its successor under Article 6 of the Paris Agreement provide frameworks for international carbon offset projects. These mechanisms could potentially recognize methane pyrolysis projects that demonstrate additionality and measurable emissions reductions, particularly in developing economies where natural gas infrastructure exists but carbon capture capabilities are limited.

Methodologies for carbon accounting present significant challenges for methane pyrolysis. Current frameworks typically require robust monitoring, reporting, and verification (MRV) protocols. The technology's carbon footprint must account for energy inputs, potential methane leakage, and the end use of hydrogen and solid carbon outputs. The development of standardized methodologies specifically for pyrolysis processes remains a regulatory gap in most carbon markets.

Voluntary carbon markets offer an alternative pathway, with standards like Verra and Gold Standard potentially accommodating innovative technologies. These markets have shown increasing interest in methane mitigation projects, though specific methodologies for pyrolysis technologies are still emerging. The growing corporate demand for high-quality carbon offsets could accelerate the development of such frameworks.

In North America, regulatory frameworks vary considerably. California's Cap-and-Trade Program and the Regional Greenhouse Gas Initiative (RGGI) in the northeastern United States have established regional carbon pricing mechanisms. These systems generally recognize methane as having 25-28 times the global warming potential of CO2, creating significant potential value for methane abatement technologies like pyrolysis.

China's national Emissions Trading Scheme (ETS), launched in 2021, initially focuses on the power sector but is expected to expand to include industrial processes. This expansion could create substantial opportunities for methane pyrolysis technology deployment in the world's largest carbon-emitting nation, particularly as China pursues its 2060 carbon neutrality goal.

The Clean Development Mechanism (CDM) under the Kyoto Protocol and its successor under Article 6 of the Paris Agreement provide frameworks for international carbon offset projects. These mechanisms could potentially recognize methane pyrolysis projects that demonstrate additionality and measurable emissions reductions, particularly in developing economies where natural gas infrastructure exists but carbon capture capabilities are limited.

Methodologies for carbon accounting present significant challenges for methane pyrolysis. Current frameworks typically require robust monitoring, reporting, and verification (MRV) protocols. The technology's carbon footprint must account for energy inputs, potential methane leakage, and the end use of hydrogen and solid carbon outputs. The development of standardized methodologies specifically for pyrolysis processes remains a regulatory gap in most carbon markets.

Voluntary carbon markets offer an alternative pathway, with standards like Verra and Gold Standard potentially accommodating innovative technologies. These markets have shown increasing interest in methane mitigation projects, though specific methodologies for pyrolysis technologies are still emerging. The growing corporate demand for high-quality carbon offsets could accelerate the development of such frameworks.

Environmental Impact Assessment of Methane Pyrolysis

Methane pyrolysis represents a significant advancement in hydrogen production technology with potentially favorable environmental implications compared to traditional methods. This process involves the thermal decomposition of methane into hydrogen and solid carbon, eliminating direct CO2 emissions that characterize conventional hydrogen production methods such as steam methane reforming.

The environmental impact assessment of methane pyrolysis reveals several positive attributes. Foremost is the absence of direct greenhouse gas emissions during the hydrogen production process itself. Unlike steam methane reforming, which generates approximately 9-12 kg of CO2 per kg of hydrogen produced, methane pyrolysis produces zero direct CO2 emissions, offering a substantial reduction in carbon footprint.

Water consumption represents another environmental advantage of methane pyrolysis. Traditional hydrogen production methods require significant water inputs, whereas methane pyrolysis operates with minimal water requirements, potentially reducing pressure on water resources in regions where this technology might be deployed.

The solid carbon byproduct presents both environmental challenges and opportunities. When properly managed, this carbon can be sequestered in stable forms or utilized in various industrial applications, effectively preventing carbon from entering the atmosphere. Applications include construction materials, soil amendments, and advanced materials manufacturing, potentially creating circular economy opportunities.

Energy efficiency considerations reveal that methane pyrolysis requires substantial thermal energy input. The environmental impact depends significantly on the energy source powering the process. When renewable energy sources drive the pyrolysis reaction, the overall environmental footprint remains minimal. However, if fossil fuels power the process, indirect emissions must be factored into the environmental assessment.

Land use impacts of methane pyrolysis facilities appear relatively modest compared to other industrial processes. The compact nature of pyrolysis reactors means smaller physical footprints than many alternative hydrogen production methods, particularly electrolysis installations powered by land-intensive renewable energy sources.

Regarding air quality impacts, methane pyrolysis generates fewer criteria pollutants (NOx, SOx, particulate matter) than combustion-based hydrogen production methods. This characteristic could make it particularly valuable in regions struggling with air quality challenges, offering a pathway to hydrogen production with minimal local air pollution impacts.

Risk assessment studies indicate that methane pyrolysis presents manageable safety and environmental risks when implemented with appropriate engineering controls and operational protocols. The primary concerns involve methane handling and the potential for reactor failures, both addressable through established industrial safety practices.

The environmental impact assessment of methane pyrolysis reveals several positive attributes. Foremost is the absence of direct greenhouse gas emissions during the hydrogen production process itself. Unlike steam methane reforming, which generates approximately 9-12 kg of CO2 per kg of hydrogen produced, methane pyrolysis produces zero direct CO2 emissions, offering a substantial reduction in carbon footprint.

Water consumption represents another environmental advantage of methane pyrolysis. Traditional hydrogen production methods require significant water inputs, whereas methane pyrolysis operates with minimal water requirements, potentially reducing pressure on water resources in regions where this technology might be deployed.

The solid carbon byproduct presents both environmental challenges and opportunities. When properly managed, this carbon can be sequestered in stable forms or utilized in various industrial applications, effectively preventing carbon from entering the atmosphere. Applications include construction materials, soil amendments, and advanced materials manufacturing, potentially creating circular economy opportunities.

Energy efficiency considerations reveal that methane pyrolysis requires substantial thermal energy input. The environmental impact depends significantly on the energy source powering the process. When renewable energy sources drive the pyrolysis reaction, the overall environmental footprint remains minimal. However, if fossil fuels power the process, indirect emissions must be factored into the environmental assessment.

Land use impacts of methane pyrolysis facilities appear relatively modest compared to other industrial processes. The compact nature of pyrolysis reactors means smaller physical footprints than many alternative hydrogen production methods, particularly electrolysis installations powered by land-intensive renewable energy sources.

Regarding air quality impacts, methane pyrolysis generates fewer criteria pollutants (NOx, SOx, particulate matter) than combustion-based hydrogen production methods. This characteristic could make it particularly valuable in regions struggling with air quality challenges, offering a pathway to hydrogen production with minimal local air pollution impacts.

Risk assessment studies indicate that methane pyrolysis presents manageable safety and environmental risks when implemented with appropriate engineering controls and operational protocols. The primary concerns involve methane handling and the potential for reactor failures, both addressable through established industrial safety practices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!