Case Study: SALD For Flexible AMOLED Encapsulation

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SALD Technology Background and Encapsulation Goals

Spatial Atomic Layer Deposition (SALD) represents a significant evolution in thin film deposition technology, emerging as a response to the limitations of conventional Atomic Layer Deposition (ALD) processes. While traditional ALD offers exceptional film quality and conformality, its inherently slow deposition rates have historically restricted its industrial applicability, particularly in high-throughput manufacturing environments. SALD addresses this fundamental constraint by separating precursor gases spatially rather than temporally, enabling continuous deposition processes that maintain ALD's precision while dramatically improving production efficiency.

The development trajectory of SALD technology can be traced back to early conceptual work in the 2000s, with significant advancements occurring over the past decade as flexible electronics emerged as a critical application area. The technology has evolved from laboratory demonstrations to pilot-scale implementations, with recent years seeing increased focus on roll-to-roll compatible systems that align with the manufacturing requirements of flexible display technologies.

For flexible Active-Matrix Organic Light-Emitting Diode (AMOLED) displays, effective encapsulation represents perhaps the most critical technical challenge. These displays are inherently vulnerable to degradation from environmental factors, particularly oxygen and moisture, which can rapidly compromise the organic materials and electrode structures. Traditional rigid glass encapsulation methods are incompatible with the mechanical flexibility that defines next-generation display products.

The primary encapsulation goal for flexible AMOLED technology is to achieve an effective water vapor transmission rate (WVTR) below 10^-6 g/m²/day while maintaining mechanical flexibility through hundreds of thousands of bending cycles. Secondary objectives include optical transparency exceeding 90% in the visible spectrum, minimal thickness contribution to maintain overall device flexibility, and production compatibility with existing manufacturing infrastructure.

SALD technology offers a promising pathway to meet these demanding requirements through the deposition of nanolaminates—alternating layers of different materials that create tortuous diffusion pathways for water molecules. Aluminum oxide (Al₂O₃) and silicon dioxide (SiO₂) multilayers have emerged as particularly effective barrier structures, with recent research demonstrating that precisely controlled SALD processes can achieve the necessary barrier performance while maintaining the mechanical integrity required for flexible applications.

The convergence of SALD capabilities with flexible AMOLED encapsulation needs represents a critical technological alignment that could enable the next generation of foldable, rollable, and stretchable display products. As the technology continues to mature, the focus has shifted toward optimizing process parameters for specific barrier materials and developing integrated solutions that combine SALD with complementary technologies such as organic interlayers for enhanced mechanical performance.

The development trajectory of SALD technology can be traced back to early conceptual work in the 2000s, with significant advancements occurring over the past decade as flexible electronics emerged as a critical application area. The technology has evolved from laboratory demonstrations to pilot-scale implementations, with recent years seeing increased focus on roll-to-roll compatible systems that align with the manufacturing requirements of flexible display technologies.

For flexible Active-Matrix Organic Light-Emitting Diode (AMOLED) displays, effective encapsulation represents perhaps the most critical technical challenge. These displays are inherently vulnerable to degradation from environmental factors, particularly oxygen and moisture, which can rapidly compromise the organic materials and electrode structures. Traditional rigid glass encapsulation methods are incompatible with the mechanical flexibility that defines next-generation display products.

The primary encapsulation goal for flexible AMOLED technology is to achieve an effective water vapor transmission rate (WVTR) below 10^-6 g/m²/day while maintaining mechanical flexibility through hundreds of thousands of bending cycles. Secondary objectives include optical transparency exceeding 90% in the visible spectrum, minimal thickness contribution to maintain overall device flexibility, and production compatibility with existing manufacturing infrastructure.

SALD technology offers a promising pathway to meet these demanding requirements through the deposition of nanolaminates—alternating layers of different materials that create tortuous diffusion pathways for water molecules. Aluminum oxide (Al₂O₃) and silicon dioxide (SiO₂) multilayers have emerged as particularly effective barrier structures, with recent research demonstrating that precisely controlled SALD processes can achieve the necessary barrier performance while maintaining the mechanical integrity required for flexible applications.

The convergence of SALD capabilities with flexible AMOLED encapsulation needs represents a critical technological alignment that could enable the next generation of foldable, rollable, and stretchable display products. As the technology continues to mature, the focus has shifted toward optimizing process parameters for specific barrier materials and developing integrated solutions that combine SALD with complementary technologies such as organic interlayers for enhanced mechanical performance.

Market Analysis for Flexible AMOLED Display Technologies

The flexible AMOLED display market has experienced remarkable growth over the past decade, driven by increasing consumer demand for sleeker, more durable electronic devices. Market research indicates that the global flexible display market reached approximately $23 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 35% through 2028, with flexible AMOLED technology representing the dominant segment of this expansion.

Consumer electronics, particularly smartphones and wearable devices, currently constitute the largest application segment for flexible AMOLED displays. Major smartphone manufacturers have increasingly adopted flexible display technology in their flagship products, with Samsung leading the market through its Edge and Fold series. Apple has also integrated flexible AMOLED displays in its premium iPhone models, while Chinese manufacturers like Xiaomi, OPPO, and Huawei have rapidly expanded their flexible display product offerings.

The wearable technology sector represents another significant growth area, with smartwatches and fitness trackers increasingly utilizing flexible AMOLED displays for their superior visual performance and form factor advantages. Market analysis reveals that approximately 60% of premium smartwatches now incorporate some form of flexible display technology.

Emerging application areas include automotive displays, where curved AMOLED panels are being integrated into dashboard systems and entertainment consoles. The automotive flexible display market segment is growing at 40% annually, outpacing the overall market growth rate. Additionally, the commercial signage sector has begun adopting large-format flexible displays for retail and advertising applications.

Regional analysis shows Asia-Pacific dominating both production and consumption of flexible AMOLED displays, accounting for 65% of global market share. South Korea leads manufacturing capacity through Samsung Display and LG Display, while China is rapidly expanding its production capabilities through BOE Technology, Visionox, and TCL. North America and Europe represent significant consumer markets but have limited manufacturing presence.

The market faces several challenges, including high production costs associated with advanced encapsulation technologies like SALD. Current flexible AMOLED displays with effective barrier layers cost approximately 30% more to produce than rigid alternatives. Supply chain constraints, particularly for specialized materials used in thin-film encapsulation processes, have created production bottlenecks that manufacturers are actively working to resolve.

Consumer adoption trends indicate growing preference for devices with flexible displays, with market surveys showing 78% of premium smartphone buyers considering display flexibility as an important purchasing factor. This trend is expected to cascade to mid-range devices as production costs decrease through improved manufacturing processes like optimized SALD encapsulation techniques.

Consumer electronics, particularly smartphones and wearable devices, currently constitute the largest application segment for flexible AMOLED displays. Major smartphone manufacturers have increasingly adopted flexible display technology in their flagship products, with Samsung leading the market through its Edge and Fold series. Apple has also integrated flexible AMOLED displays in its premium iPhone models, while Chinese manufacturers like Xiaomi, OPPO, and Huawei have rapidly expanded their flexible display product offerings.

The wearable technology sector represents another significant growth area, with smartwatches and fitness trackers increasingly utilizing flexible AMOLED displays for their superior visual performance and form factor advantages. Market analysis reveals that approximately 60% of premium smartwatches now incorporate some form of flexible display technology.

Emerging application areas include automotive displays, where curved AMOLED panels are being integrated into dashboard systems and entertainment consoles. The automotive flexible display market segment is growing at 40% annually, outpacing the overall market growth rate. Additionally, the commercial signage sector has begun adopting large-format flexible displays for retail and advertising applications.

Regional analysis shows Asia-Pacific dominating both production and consumption of flexible AMOLED displays, accounting for 65% of global market share. South Korea leads manufacturing capacity through Samsung Display and LG Display, while China is rapidly expanding its production capabilities through BOE Technology, Visionox, and TCL. North America and Europe represent significant consumer markets but have limited manufacturing presence.

The market faces several challenges, including high production costs associated with advanced encapsulation technologies like SALD. Current flexible AMOLED displays with effective barrier layers cost approximately 30% more to produce than rigid alternatives. Supply chain constraints, particularly for specialized materials used in thin-film encapsulation processes, have created production bottlenecks that manufacturers are actively working to resolve.

Consumer adoption trends indicate growing preference for devices with flexible displays, with market surveys showing 78% of premium smartphone buyers considering display flexibility as an important purchasing factor. This trend is expected to cascade to mid-range devices as production costs decrease through improved manufacturing processes like optimized SALD encapsulation techniques.

Current SALD Encapsulation Challenges and Global Development Status

Spatial Atomic Layer Deposition (SALD) technology for flexible AMOLED encapsulation faces several significant challenges despite its promising advantages. The primary technical hurdle remains achieving uniform thin film deposition on large-area flexible substrates while maintaining high throughput. Current SALD systems struggle with precise gas flow control across larger dimensions, leading to thickness variations that compromise barrier performance. Additionally, the technology faces difficulties in managing the trade-off between deposition speed and film quality, particularly when creating multi-layer barrier structures.

Material compatibility presents another substantial challenge. The low temperature requirements of flexible substrates (typically below 100°C) limit the range of precursors and reactions available for SALD processes. This constraint affects the density and quality of deposited films, potentially reducing their effectiveness as moisture and oxygen barriers. Furthermore, the mechanical durability of SALD-deposited barriers under repeated bending and folding conditions remains problematic, with micro-crack formation during flexing compromising long-term barrier integrity.

From a global development perspective, SALD technology for flexible displays shows distinct regional patterns of advancement. South Korea leads commercial implementation, with Samsung and LG Display having developed proprietary SALD systems integrated into their flexible OLED production lines. Their focus has been on optimizing throughput while maintaining adequate barrier performance for consumer electronics applications. Japanese companies like Tokyo Electron and Canon Anelva have concentrated on high-precision SALD equipment with superior uniformity control, though at lower throughput rates.

European research institutions, particularly in the Netherlands and Finland, have pioneered fundamental SALD process innovations. TU Eindhoven and VTT Technical Research Centre have developed novel precursor chemistries and gas delivery systems specifically designed for low-temperature deposition on flexible substrates. These advancements have been gradually transferred to equipment manufacturers like Meyer Burger and BENEQ, who are commercializing research-scale solutions.

Chinese manufacturers have rapidly entered the SALD equipment market, focusing on cost-effective solutions with acceptable performance metrics. Companies like Sunic System and NAURA Technology Group have made significant investments in scaling up SALD technology for mass production environments. Meanwhile, North American contributions have centered around innovative precursor chemistry and in-line quality control systems, with Applied Materials and Veeco developing integrated metrology solutions for real-time barrier quality assessment.

The global SALD landscape reveals a technology at different maturity levels across regions, with Asian manufacturers leading in production integration while European and North American entities drive fundamental innovation. This geographical distribution of expertise creates both challenges and opportunities for technology transfer and collaborative development in addressing the remaining technical barriers.

Material compatibility presents another substantial challenge. The low temperature requirements of flexible substrates (typically below 100°C) limit the range of precursors and reactions available for SALD processes. This constraint affects the density and quality of deposited films, potentially reducing their effectiveness as moisture and oxygen barriers. Furthermore, the mechanical durability of SALD-deposited barriers under repeated bending and folding conditions remains problematic, with micro-crack formation during flexing compromising long-term barrier integrity.

From a global development perspective, SALD technology for flexible displays shows distinct regional patterns of advancement. South Korea leads commercial implementation, with Samsung and LG Display having developed proprietary SALD systems integrated into their flexible OLED production lines. Their focus has been on optimizing throughput while maintaining adequate barrier performance for consumer electronics applications. Japanese companies like Tokyo Electron and Canon Anelva have concentrated on high-precision SALD equipment with superior uniformity control, though at lower throughput rates.

European research institutions, particularly in the Netherlands and Finland, have pioneered fundamental SALD process innovations. TU Eindhoven and VTT Technical Research Centre have developed novel precursor chemistries and gas delivery systems specifically designed for low-temperature deposition on flexible substrates. These advancements have been gradually transferred to equipment manufacturers like Meyer Burger and BENEQ, who are commercializing research-scale solutions.

Chinese manufacturers have rapidly entered the SALD equipment market, focusing on cost-effective solutions with acceptable performance metrics. Companies like Sunic System and NAURA Technology Group have made significant investments in scaling up SALD technology for mass production environments. Meanwhile, North American contributions have centered around innovative precursor chemistry and in-line quality control systems, with Applied Materials and Veeco developing integrated metrology solutions for real-time barrier quality assessment.

The global SALD landscape reveals a technology at different maturity levels across regions, with Asian manufacturers leading in production integration while European and North American entities drive fundamental innovation. This geographical distribution of expertise creates both challenges and opportunities for technology transfer and collaborative development in addressing the remaining technical barriers.

Current SALD Implementation Methods for AMOLED Encapsulation

01 SALD equipment and apparatus design

Specialized equipment and apparatus designs for Spatial Atomic Layer Deposition (SALD) encapsulation processes. These designs include innovative reactor configurations, gas delivery systems, and substrate handling mechanisms that enable efficient and uniform deposition of thin films. The equipment is optimized for high throughput processing while maintaining precise control over the deposition parameters, which is crucial for effective encapsulation of sensitive devices.- SALD encapsulation for electronic devices: Spatial Atomic Layer Deposition (SALD) is used for encapsulating electronic devices such as OLEDs, displays, and solar cells. This technique provides a protective barrier against moisture and oxygen, extending device lifetime. SALD allows for high-quality thin film deposition at atmospheric pressure and lower temperatures compared to conventional ALD, making it suitable for temperature-sensitive substrates while maintaining excellent film uniformity and conformality.

- SALD equipment and apparatus design: Specialized equipment designs for SALD encapsulation processes include gas delivery systems with separated precursor zones, movable substrates, and precise gas flow control mechanisms. These designs enable atmospheric pressure operation while preventing precursor mixing, allowing for continuous deposition processes rather than the sequential cycles of traditional ALD. Innovations in equipment design focus on increasing throughput, improving precursor utilization efficiency, and enabling large-area deposition for industrial applications.

- Multi-layer barrier structures using SALD: Multi-layer barrier structures created using SALD techniques combine inorganic layers (such as metal oxides) with organic layers to create effective moisture and oxygen barriers. These alternating organic-inorganic structures provide enhanced protection by creating tortuous paths for permeating molecules. The inorganic layers provide the primary barrier properties while the organic layers help decouple defects between successive inorganic layers, resulting in superior barrier performance compared to single-layer encapsulation.

- SALD for flexible and transparent encapsulation: SALD techniques enable the deposition of high-quality barrier films on flexible and transparent substrates, which is crucial for next-generation flexible electronics. The low-temperature processing capability of SALD allows for encapsulation of temperature-sensitive polymer substrates without degradation. These processes can produce transparent barrier films with high optical clarity while maintaining effective protection against environmental factors, making them ideal for flexible displays, wearable electronics, and transparent photovoltaics.

- Process optimization for SALD encapsulation: Optimization strategies for SALD encapsulation processes focus on parameters such as precursor selection, gas flow rates, substrate temperature, and deposition speed. These optimizations aim to achieve the best balance between deposition rate, film quality, and manufacturing efficiency. Advanced process control methods, including real-time monitoring and feedback systems, help maintain consistent film properties across large areas and during extended production runs, ensuring reliable barrier performance in the final encapsulated devices.

02 Barrier film formation for device protection

Formation of barrier films using SALD for protecting electronic and optoelectronic devices from environmental factors. These barrier films provide effective encapsulation against moisture, oxygen, and other contaminants that can degrade device performance. The SALD process enables the deposition of ultra-thin, pinhole-free barrier layers with excellent conformality, even on complex topographies, resulting in enhanced device lifetime and reliability.Expand Specific Solutions03 Multi-layer encapsulation structures

Development of multi-layer encapsulation structures using SALD techniques to enhance barrier properties. These structures typically consist of alternating inorganic and organic layers, where the inorganic layers provide the primary barrier function while the organic layers decouple defects between adjacent inorganic layers. This approach significantly improves the overall barrier performance compared to single-layer encapsulation, offering superior protection for moisture-sensitive devices.Expand Specific Solutions04 Process optimization for high-speed deposition

Optimization of SALD processes for high-speed deposition while maintaining film quality for encapsulation applications. This includes innovations in precursor chemistry, gas flow dynamics, and temperature control to achieve faster deposition rates without compromising the barrier properties of the encapsulation layers. Advanced process control strategies are implemented to ensure uniformity and reproducibility across large substrate areas.Expand Specific Solutions05 Flexible and transparent encapsulation for next-generation devices

Development of flexible and transparent encapsulation solutions using SALD for next-generation devices such as flexible displays, wearable electronics, and photovoltaics. These encapsulation layers maintain their barrier properties under mechanical stress and bending conditions while providing optical transparency for light-emitting or light-harvesting devices. The SALD process enables low-temperature deposition, which is compatible with temperature-sensitive flexible substrates.Expand Specific Solutions

Key Industry Players in SALD and Flexible Display Manufacturing

The SALD (Spatial Atomic Layer Deposition) technology for flexible AMOLED encapsulation is currently in a growth phase, with the market expanding rapidly as demand for flexible displays increases. The global market is projected to grow significantly as major players invest in advanced encapsulation solutions. Technologically, the field shows varying maturity levels, with companies like Samsung Display, LG Display, and BOE Technology leading innovation through substantial R&D investments. Chinese manufacturers including TCL China Star and Visionox are rapidly advancing their capabilities, while established materials companies like Universal Display Corporation and Applied Materials provide critical technological components. The competitive landscape features both vertical integration by display manufacturers and specialized technology providers focusing on barrier film solutions.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed an advanced SALD system specifically optimized for flexible AMOLED encapsulation, featuring a multi-zone deposition architecture that enables simultaneous processing of multiple barrier layers. Their approach utilizes a proprietary gas distribution system with separated precursor zones and nitrogen purge curtains, allowing for high-speed continuous deposition while preventing cross-contamination. BOE's SALD technology focuses on depositing ultra-thin Al2O3 and SiO2 layers (typically 5-20nm each) in alternating sequences with organic buffer layers to create a robust multi-layer encapsulation structure. The company has achieved deposition rates exceeding 2 nm/second while maintaining excellent film uniformity (±3% across Gen 6 substrates). BOE has also developed specialized plasma-enhanced SALD variants that improve film density and barrier properties without increasing thermal load on the substrate. Their system incorporates in-situ monitoring capabilities that track film growth in real-time, enabling precise thickness control and immediate process adjustments to maintain quality standards.

Strengths: High throughput capability suitable for mass production; excellent thickness uniformity across large substrates; good compatibility with existing production lines; enhanced barrier performance through plasma assistance. Weaknesses: Higher energy consumption compared to conventional ALD; more complex maintenance requirements; challenges in achieving ultra-thin layers with perfect conformality; potential for increased precursor waste.

LG Display Co., Ltd.

Technical Solution: LG Display has developed a proprietary SALD technology for flexible AMOLED encapsulation that focuses on maximizing production efficiency while maintaining exceptional barrier properties. Their system employs a hybrid encapsulation approach combining SALD-deposited inorganic layers (primarily Al2O3 and SiNx) with specially formulated organic interlayers. LG's SALD process operates at lower temperatures (80-120°C) than conventional methods, making it particularly suitable for temperature-sensitive flexible substrates. The company has implemented an innovative gas flow system that creates virtual reaction chambers through precisely controlled nitrogen curtains, allowing for continuous deposition without physical barriers. This enables deposition rates of 5-10 nm/min while maintaining film density comparable to conventional ALD. LG has also developed specialized in-line monitoring systems that provide real-time feedback on film thickness and quality, allowing for immediate process adjustments to maintain consistent barrier performance across production runs.

Strengths: Lower processing temperatures suitable for sensitive substrates; excellent production efficiency with continuous processing capability; integrated quality monitoring systems; optimized for large-area displays. Weaknesses: Slightly higher defect rates compared to batch ALD processes; challenges in achieving ultra-thin layers below certain thresholds; higher precursor consumption; requires precise environmental control.

Critical Patents and Technical Innovations in SALD Encapsulation

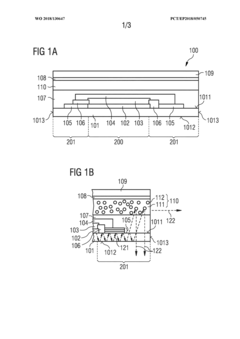

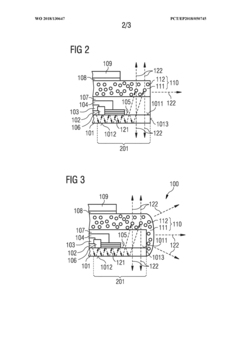

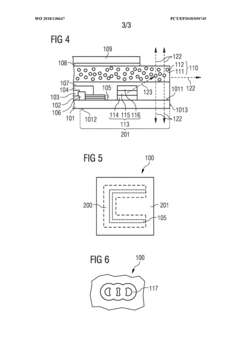

Organic light-emitting component

PatentWO2018130647A1

Innovation

- An organic light-emitting component with a transparent substrate and a specific layer structure, including a transparent first electrode, an organic functional layer stack, and a second electrode, is designed. The component features an encapsulation that extends laterally beyond the active area, incorporating a scattering layer and a metallic cover layer to facilitate light emission from the edge region without the organic functional layer stack, ensuring mechanical protection and efficient light distribution.

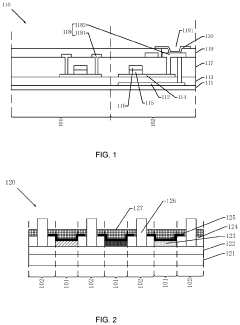

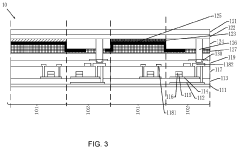

Display panel and manufacturing method thereof

PatentActiveUS20220344613A1

Innovation

- A display panel design featuring a light-emitting region and a non-light-emitting region with a retaining wall structure containing through-holes and retaining walls, where the light-emitting layer is positioned within the through-holes, and a packaging layer covers the structure, along with a second electrode extending from the light-emitting region to the non-light-emitting region, ensuring proper electrical connections and preventing short-circuiting.

Material Science Advancements for SALD Barrier Films

Recent advancements in material science have significantly propelled the development of Spatial Atomic Layer Deposition (SALD) barrier films for flexible AMOLED encapsulation. The evolution of these materials has focused primarily on achieving superior water vapor transmission rates (WVTR) while maintaining flexibility and optical transparency. Traditional barrier films relied heavily on inorganic materials like Al2O3 and SiO2, which offered excellent barrier properties but suffered from brittleness and crack formation during flexing.

The breakthrough came with the development of nanolaminate structures combining alternating layers of inorganic barriers with organic interlayers. These organic interlayers, typically composed of polymers like polyacrylate or parylene, serve as stress-relief zones that prevent crack propagation through the entire barrier structure. This multilayer approach has enabled WVTR values below 10^-6 g/m²/day, meeting the stringent requirements for OLED protection.

Material scientists have further enhanced SALD barrier films through surface modification techniques. Plasma treatment of surfaces prior to deposition creates reactive sites that improve adhesion between layers and reduce defect density. Additionally, the incorporation of self-healing materials, such as siloxane-based polymers that can flow and seal microcracks upon formation, has extended the lifetime of flexible displays under repeated bending conditions.

Nanocomposite materials represent another frontier in SALD barrier development. By incorporating nanoparticles like graphene oxide or montmorillonite clay into polymer matrices, researchers have created tortuous paths for water vapor molecules, significantly reducing permeation rates. These nanocomposites maintain flexibility while providing enhanced barrier properties compared to traditional polymer layers.

Recent innovations have also focused on reducing process temperatures for SALD deposition. Novel precursors and catalysts now enable high-quality barrier layer formation at temperatures below 100°C, making the process compatible with temperature-sensitive flexible substrates like polyimide and PET. This temperature reduction has been achieved without compromising the density and uniformity of the deposited films.

The latest generation of SALD barrier materials incorporates transparent conductive oxides (TCOs) like IZO and AZO, which serve dual functions as both barrier layers and functional components of the display. This material integration reduces the overall thickness of the encapsulation stack while maintaining or improving barrier performance, contributing to thinner and more flexible AMOLED displays.

The breakthrough came with the development of nanolaminate structures combining alternating layers of inorganic barriers with organic interlayers. These organic interlayers, typically composed of polymers like polyacrylate or parylene, serve as stress-relief zones that prevent crack propagation through the entire barrier structure. This multilayer approach has enabled WVTR values below 10^-6 g/m²/day, meeting the stringent requirements for OLED protection.

Material scientists have further enhanced SALD barrier films through surface modification techniques. Plasma treatment of surfaces prior to deposition creates reactive sites that improve adhesion between layers and reduce defect density. Additionally, the incorporation of self-healing materials, such as siloxane-based polymers that can flow and seal microcracks upon formation, has extended the lifetime of flexible displays under repeated bending conditions.

Nanocomposite materials represent another frontier in SALD barrier development. By incorporating nanoparticles like graphene oxide or montmorillonite clay into polymer matrices, researchers have created tortuous paths for water vapor molecules, significantly reducing permeation rates. These nanocomposites maintain flexibility while providing enhanced barrier properties compared to traditional polymer layers.

Recent innovations have also focused on reducing process temperatures for SALD deposition. Novel precursors and catalysts now enable high-quality barrier layer formation at temperatures below 100°C, making the process compatible with temperature-sensitive flexible substrates like polyimide and PET. This temperature reduction has been achieved without compromising the density and uniformity of the deposited films.

The latest generation of SALD barrier materials incorporates transparent conductive oxides (TCOs) like IZO and AZO, which serve dual functions as both barrier layers and functional components of the display. This material integration reduces the overall thickness of the encapsulation stack while maintaining or improving barrier performance, contributing to thinner and more flexible AMOLED displays.

Scalability and Cost Analysis for Commercial SALD Implementation

The commercial implementation of Spatial Atomic Layer Deposition (SALD) for flexible AMOLED encapsulation presents significant scalability challenges and cost considerations that must be carefully evaluated. Current SALD systems demonstrate throughput rates of approximately 15-20 m²/min for thin film deposition, which represents a substantial improvement over conventional ALD methods but still falls short of the volumes required for mass production of consumer electronics.

Equipment scaling represents the primary challenge, as SALD reactors must be designed to accommodate increasingly larger substrate dimensions while maintaining uniform deposition quality. Industrial-scale SALD systems currently cost between $2-5 million per installation, with additional expenses for clean room facilities and specialized gas handling systems. These capital expenditures necessitate high production volumes to achieve reasonable amortization periods of 3-5 years.

Operational costs include precursor materials, which account for approximately 15-20% of total production expenses. While traditional ALD processes consume relatively small quantities of precursors, the scaled-up nature of SALD operations increases material requirements significantly. Energy consumption for SALD processes averages 0.8-1.2 kWh per square meter of substrate, primarily for maintaining precise temperature control and gas flow management.

Maintenance requirements present another cost factor, with SALD systems requiring specialized technical expertise and regular downtime for cleaning and component replacement. Current systems demonstrate approximately 85-90% uptime efficiency, with maintenance intervals typically occurring every 500-700 operational hours.

Labor costs vary significantly by region but generally represent 10-15% of operational expenses. The specialized nature of SALD operations requires technicians with advanced training in vacuum systems, thin film deposition, and process control, commanding premium wages in the semiconductor manufacturing sector.

When comparing total cost of ownership against competing technologies, SALD demonstrates a crossover point at production volumes exceeding approximately 5 million units annually. Below this threshold, conventional encapsulation technologies may prove more economical, while above it, SALD's efficiency advantages begin to outweigh its higher initial investment requirements.

Future cost reduction pathways include precursor chemistry optimization to reduce material consumption by an estimated 25-30%, improved gas delivery systems to minimize waste, and enhanced automation to reduce labor requirements. Additionally, multi-substrate processing capabilities could potentially double throughput rates without proportional increases in equipment footprint or energy consumption.

Equipment scaling represents the primary challenge, as SALD reactors must be designed to accommodate increasingly larger substrate dimensions while maintaining uniform deposition quality. Industrial-scale SALD systems currently cost between $2-5 million per installation, with additional expenses for clean room facilities and specialized gas handling systems. These capital expenditures necessitate high production volumes to achieve reasonable amortization periods of 3-5 years.

Operational costs include precursor materials, which account for approximately 15-20% of total production expenses. While traditional ALD processes consume relatively small quantities of precursors, the scaled-up nature of SALD operations increases material requirements significantly. Energy consumption for SALD processes averages 0.8-1.2 kWh per square meter of substrate, primarily for maintaining precise temperature control and gas flow management.

Maintenance requirements present another cost factor, with SALD systems requiring specialized technical expertise and regular downtime for cleaning and component replacement. Current systems demonstrate approximately 85-90% uptime efficiency, with maintenance intervals typically occurring every 500-700 operational hours.

Labor costs vary significantly by region but generally represent 10-15% of operational expenses. The specialized nature of SALD operations requires technicians with advanced training in vacuum systems, thin film deposition, and process control, commanding premium wages in the semiconductor manufacturing sector.

When comparing total cost of ownership against competing technologies, SALD demonstrates a crossover point at production volumes exceeding approximately 5 million units annually. Below this threshold, conventional encapsulation technologies may prove more economical, while above it, SALD's efficiency advantages begin to outweigh its higher initial investment requirements.

Future cost reduction pathways include precursor chemistry optimization to reduce material consumption by an estimated 25-30%, improved gas delivery systems to minimize waste, and enhanced automation to reduce labor requirements. Additionally, multi-substrate processing capabilities could potentially double throughput rates without proportional increases in equipment footprint or energy consumption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!