Closed-system cell concentration and formulation technologies for transition-to-clinic CGT workflows

SEP 2, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CGT Cell Processing Background and Objectives

Cell and gene therapies (CGT) have emerged as revolutionary treatment modalities with the potential to address previously untreatable diseases through genetic modification of cells. The evolution of CGT has progressed from early experimental treatments to FDA-approved therapies for various conditions including certain cancers, genetic disorders, and autoimmune diseases. This technological progression has been marked by significant breakthroughs in cell manipulation, genetic engineering, and manufacturing processes.

The current CGT landscape encompasses various therapeutic approaches including CAR-T cell therapy, gene editing technologies like CRISPR-Cas9, viral vector-based gene delivery systems, and stem cell therapies. Despite clinical successes, the transition from laboratory-scale production to clinical application remains challenging due to manufacturing complexities, particularly in cell concentration and formulation processes.

Cell concentration and formulation represent critical steps in the CGT manufacturing workflow, directly impacting product quality, efficacy, and safety. Traditional open-system methods introduce contamination risks and process variabilities that are incompatible with clinical standards. The industry is thus pivoting toward closed-system technologies that maintain sterility while improving process consistency and scalability.

The primary technical objective in this domain is to develop robust closed-system cell concentration and formulation technologies that can effectively transition laboratory-scale CGT processes to clinical manufacturing. These technologies must address several key requirements: maintenance of cell viability and functionality, reduction of processing time, minimization of product loss, elimination of contamination risks, and compatibility with downstream processes.

Additional objectives include automation of manual processes to reduce operator-dependent variability, implementation of in-process monitoring capabilities for quality control, development of scalable systems that can accommodate varying batch sizes, and creation of cost-effective solutions that can help reduce the overall expense of CGT products.

The achievement of these objectives would significantly advance the CGT field by enabling more efficient translation of promising therapies from research to clinical application. This would potentially increase patient access to these innovative treatments while ensuring consistent product quality and regulatory compliance. The ultimate goal is to establish standardized, reliable manufacturing platforms that can support the growing demand for cell and gene therapies across various therapeutic areas.

The current CGT landscape encompasses various therapeutic approaches including CAR-T cell therapy, gene editing technologies like CRISPR-Cas9, viral vector-based gene delivery systems, and stem cell therapies. Despite clinical successes, the transition from laboratory-scale production to clinical application remains challenging due to manufacturing complexities, particularly in cell concentration and formulation processes.

Cell concentration and formulation represent critical steps in the CGT manufacturing workflow, directly impacting product quality, efficacy, and safety. Traditional open-system methods introduce contamination risks and process variabilities that are incompatible with clinical standards. The industry is thus pivoting toward closed-system technologies that maintain sterility while improving process consistency and scalability.

The primary technical objective in this domain is to develop robust closed-system cell concentration and formulation technologies that can effectively transition laboratory-scale CGT processes to clinical manufacturing. These technologies must address several key requirements: maintenance of cell viability and functionality, reduction of processing time, minimization of product loss, elimination of contamination risks, and compatibility with downstream processes.

Additional objectives include automation of manual processes to reduce operator-dependent variability, implementation of in-process monitoring capabilities for quality control, development of scalable systems that can accommodate varying batch sizes, and creation of cost-effective solutions that can help reduce the overall expense of CGT products.

The achievement of these objectives would significantly advance the CGT field by enabling more efficient translation of promising therapies from research to clinical application. This would potentially increase patient access to these innovative treatments while ensuring consistent product quality and regulatory compliance. The ultimate goal is to establish standardized, reliable manufacturing platforms that can support the growing demand for cell and gene therapies across various therapeutic areas.

Market Analysis for Closed-System Cell Technologies

The global market for closed-system cell concentration and formulation technologies is experiencing robust growth, driven primarily by the expanding cell and gene therapy (CGT) sector. Current market valuations place the CGT tools and technologies segment at approximately $5.6 billion in 2023, with closed-system technologies representing a significant and rapidly growing portion of this market.

Market research indicates a compound annual growth rate (CAGR) of 18.2% for closed-system cell processing technologies through 2028, outpacing the broader bioprocessing equipment market. This accelerated growth reflects the increasing transition of cell therapies from research to clinical applications, creating urgent demand for GMP-compliant closed systems that can maintain sterility while improving process efficiency.

North America currently dominates the market with approximately 45% share, followed by Europe at 30% and Asia-Pacific at 20%. The remaining 5% is distributed across other regions. However, the Asia-Pacific region is projected to witness the fastest growth rate of 22.7% annually, driven by increasing investments in advanced healthcare infrastructure and favorable regulatory environments in countries like China, Japan, and South Korea.

By application segment, CAR-T cell therapy manufacturing represents the largest market share at 38%, followed by stem cell processing at 27%, and other cell therapies at 35%. The demand for closed-system technologies is particularly strong in the autologous cell therapy segment, where contamination risks and process variability must be minimized for patient-specific products.

Key market drivers include stringent regulatory requirements for GMP compliance, increasing focus on process automation to reduce labor costs and variability, and growing demand for scalable manufacturing solutions as therapies move from clinical trials to commercial production. The FDA's emphasis on closed systems as preferred processing methods has significantly influenced market adoption rates.

Customer pain points identified through market surveys include high capital equipment costs, challenges in system integration with existing workflows, technical limitations in processing high-volume cell suspensions, and concerns about recovery rates during concentration steps. These factors represent both market barriers and opportunities for technological innovation.

Market forecasts suggest that technologies offering improved cell recovery rates, reduced processing times, and enhanced integration capabilities will capture significant market share in the coming years. The trend toward automation and digitalization of cell processing workflows is expected to further accelerate market growth, with particular emphasis on solutions that can demonstrate consistent performance across different cell types and processing volumes.

Market research indicates a compound annual growth rate (CAGR) of 18.2% for closed-system cell processing technologies through 2028, outpacing the broader bioprocessing equipment market. This accelerated growth reflects the increasing transition of cell therapies from research to clinical applications, creating urgent demand for GMP-compliant closed systems that can maintain sterility while improving process efficiency.

North America currently dominates the market with approximately 45% share, followed by Europe at 30% and Asia-Pacific at 20%. The remaining 5% is distributed across other regions. However, the Asia-Pacific region is projected to witness the fastest growth rate of 22.7% annually, driven by increasing investments in advanced healthcare infrastructure and favorable regulatory environments in countries like China, Japan, and South Korea.

By application segment, CAR-T cell therapy manufacturing represents the largest market share at 38%, followed by stem cell processing at 27%, and other cell therapies at 35%. The demand for closed-system technologies is particularly strong in the autologous cell therapy segment, where contamination risks and process variability must be minimized for patient-specific products.

Key market drivers include stringent regulatory requirements for GMP compliance, increasing focus on process automation to reduce labor costs and variability, and growing demand for scalable manufacturing solutions as therapies move from clinical trials to commercial production. The FDA's emphasis on closed systems as preferred processing methods has significantly influenced market adoption rates.

Customer pain points identified through market surveys include high capital equipment costs, challenges in system integration with existing workflows, technical limitations in processing high-volume cell suspensions, and concerns about recovery rates during concentration steps. These factors represent both market barriers and opportunities for technological innovation.

Market forecasts suggest that technologies offering improved cell recovery rates, reduced processing times, and enhanced integration capabilities will capture significant market share in the coming years. The trend toward automation and digitalization of cell processing workflows is expected to further accelerate market growth, with particular emphasis on solutions that can demonstrate consistent performance across different cell types and processing volumes.

Current Challenges in Cell Concentration Technologies

Despite significant advancements in cell and gene therapy (CGT) manufacturing, cell concentration technologies continue to face substantial challenges that impede efficient transition from laboratory to clinical applications. Current centrifugation-based methods, while widely adopted, present considerable limitations in maintaining closed systems—a critical requirement for clinical-grade manufacturing. These methods often necessitate open processing steps that increase contamination risks and compromise product sterility, particularly problematic when scaling production for clinical trials.

Filtration-based concentration systems, though promising alternatives, struggle with membrane fouling and cell damage issues. The accumulation of cells on filter surfaces frequently leads to decreased flow rates and potentially compromised cell viability, especially when processing fragile therapeutic cell types such as T cells or stem cells. Additionally, these systems often demonstrate inconsistent recovery rates across different cell types and processing volumes.

Automation integration remains inadequate across most concentration platforms. Many existing technologies require significant manual intervention, introducing variability and increasing the risk of processing errors. This lack of automation creates bottlenecks in manufacturing workflows and complicates compliance with Good Manufacturing Practice (GMP) requirements essential for clinical applications.

Scalability presents another significant hurdle. Technologies that perform adequately at research scale often encounter efficiency losses when processing the larger volumes required for clinical applications. This scale-up challenge is particularly evident in the concentration of mesenchymal stem cells and CAR-T cell therapies, where maintaining consistent cell quality across varying batch sizes remains problematic.

Process monitoring capabilities are notably limited in current concentration systems. Real-time assessment of critical quality attributes during concentration steps is rarely available, forcing manufacturers to rely on post-process testing that delays production and increases costs. The inability to monitor cell quality parameters during concentration contributes to batch failures and product inconsistency.

Regulatory compliance frameworks for novel concentration technologies remain underdeveloped. Manufacturers face uncertainty regarding validation requirements for innovative closed-system approaches, particularly those employing new materials or mechanisms for cell concentration. This regulatory ambiguity often discourages adoption of potentially superior technologies in favor of established but less efficient methods.

Cost considerations further complicate technology selection, as many advanced closed-system concentration platforms require significant capital investment and specialized consumables. The economic burden of implementing these technologies can be prohibitive for smaller developers and academic institutions, limiting broader adoption across the CGT sector.

Filtration-based concentration systems, though promising alternatives, struggle with membrane fouling and cell damage issues. The accumulation of cells on filter surfaces frequently leads to decreased flow rates and potentially compromised cell viability, especially when processing fragile therapeutic cell types such as T cells or stem cells. Additionally, these systems often demonstrate inconsistent recovery rates across different cell types and processing volumes.

Automation integration remains inadequate across most concentration platforms. Many existing technologies require significant manual intervention, introducing variability and increasing the risk of processing errors. This lack of automation creates bottlenecks in manufacturing workflows and complicates compliance with Good Manufacturing Practice (GMP) requirements essential for clinical applications.

Scalability presents another significant hurdle. Technologies that perform adequately at research scale often encounter efficiency losses when processing the larger volumes required for clinical applications. This scale-up challenge is particularly evident in the concentration of mesenchymal stem cells and CAR-T cell therapies, where maintaining consistent cell quality across varying batch sizes remains problematic.

Process monitoring capabilities are notably limited in current concentration systems. Real-time assessment of critical quality attributes during concentration steps is rarely available, forcing manufacturers to rely on post-process testing that delays production and increases costs. The inability to monitor cell quality parameters during concentration contributes to batch failures and product inconsistency.

Regulatory compliance frameworks for novel concentration technologies remain underdeveloped. Manufacturers face uncertainty regarding validation requirements for innovative closed-system approaches, particularly those employing new materials or mechanisms for cell concentration. This regulatory ambiguity often discourages adoption of potentially superior technologies in favor of established but less efficient methods.

Cost considerations further complicate technology selection, as many advanced closed-system concentration platforms require significant capital investment and specialized consumables. The economic burden of implementing these technologies can be prohibitive for smaller developers and academic institutions, limiting broader adoption across the CGT sector.

Current Closed-System Cell Processing Methods

01 Closed-system cell concentration methods

Various methods for concentrating cells in closed systems have been developed to maintain sterility and reduce contamination risks. These methods include tangential flow filtration, centrifugation, and membrane-based separation techniques that allow for the efficient concentration of cells while preserving cell viability and functionality. Closed-system approaches are particularly important in biopharmaceutical manufacturing and cell therapy production where maintaining sterility is critical.- Closed-system cell concentration methods: Various methods for concentrating cells in closed systems have been developed to maintain sterility and reduce contamination risks. These methods include tangential flow filtration, centrifugation, and membrane-based separation techniques that allow for the efficient concentration of cells while preserving their viability and functionality. Closed systems prevent exposure to environmental contaminants during the concentration process, which is critical for therapeutic applications.

- Formulation technologies for cell preservation: Specialized formulation technologies have been developed to preserve concentrated cells during storage and transportation. These formulations typically include cryoprotectants, stabilizers, and buffers that maintain cell viability and functionality. Some formulations are designed to work at various temperatures, including room temperature, refrigerated, and cryogenic conditions, enabling flexible handling of cellular products while ensuring their therapeutic efficacy is maintained.

- Automated cell processing systems: Automated systems for cell concentration and formulation have been developed to standardize processes and reduce human error. These systems integrate multiple steps including cell separation, washing, concentration, and final formulation in a closed environment. Automation technologies incorporate sensors for real-time monitoring of critical parameters such as cell concentration, viability, and environmental conditions, ensuring consistent quality of the final cellular product.

- Cell concentration for battery applications: Cell concentration technologies have been adapted for use in battery manufacturing, particularly for concentrating electrolyte solutions and electrode materials. These technologies enable precise control of cell component concentrations, which directly impacts battery performance, energy density, and cycle life. Closed systems for battery cell manufacturing help prevent contamination that could degrade battery performance and ensure consistent quality across production batches.

- Microfluidic approaches for cell concentration: Microfluidic technologies offer precise control over cell concentration processes in miniaturized closed systems. These approaches utilize small channels and chambers to manipulate small volumes of cell suspensions, allowing for efficient concentration with minimal sample loss. Microfluidic devices can integrate multiple functions including cell sorting, washing, and concentration in a single platform, making them particularly valuable for applications requiring high purity and viability of concentrated cells.

02 Formulation technologies for cell preservation

Advanced formulation technologies have been developed to preserve concentrated cells during storage and transportation. These formulations typically include cryoprotectants, stabilizers, and other excipients that maintain cell viability and functionality. The composition of these formulations is tailored to specific cell types and intended applications, with considerations for osmolarity, pH, and nutrient availability to ensure optimal cell preservation.Expand Specific Solutions03 Automated cell concentration systems

Automated systems for cell concentration have been developed to standardize the process and reduce operator-dependent variability. These systems integrate various components such as pumps, sensors, and control units to monitor and adjust parameters during the concentration process. Automation allows for precise control over critical parameters such as flow rates, pressure, and temperature, resulting in consistent cell concentration outcomes with minimal manual intervention.Expand Specific Solutions04 Cell concentration for therapeutic applications

Cell concentration technologies specifically designed for therapeutic applications focus on maintaining cell potency and functionality while achieving the desired concentration. These technologies are optimized for various cell types including stem cells, immune cells (such as T cells and NK cells), and other therapeutic cell populations. The concentration process is designed to meet regulatory requirements for cell-based therapies, ensuring that the final product meets specifications for cell density, viability, and purity.Expand Specific Solutions05 Integration of cell concentration with downstream processing

Integrated systems that combine cell concentration with downstream processing steps have been developed to streamline manufacturing workflows. These systems connect cell concentration directly to subsequent processing steps such as washing, buffer exchange, or formulation, minimizing transfer steps and reducing the risk of contamination. The integration of multiple unit operations in a closed system improves process efficiency, reduces processing time, and enhances overall product quality.Expand Specific Solutions

Leading Companies in CGT Manufacturing Solutions

The cell and gene therapy (CGT) market is currently in a growth phase, with closed-system cell concentration and formulation technologies emerging as critical components for clinical translation. The global CGT market is projected to reach significant scale, driven by increasing investments and regulatory approvals. Technologically, the field shows varying maturity levels across different players. Industry leaders like Lonza Walkersville and National Resilience have established robust platforms, while innovative companies such as Cellares, Flaskworks, and Multiply Labs are developing automated closed systems to address manufacturing bottlenecks. Academic institutions including Duke University and Southeast University contribute fundamental research, while specialized firms like Iovance Biotherapeutics and Kite Pharma focus on therapy-specific solutions. The competitive landscape reflects a mix of established pharmaceutical companies, specialized biotech firms, and emerging startups working to overcome scalability and cost challenges in CGT manufacturing workflows.

Lonza Walkersville, Inc.

Technical Solution: Lonza has developed the Cocoon® Platform, a comprehensive closed-system solution that incorporates advanced cell concentration and formulation technologies for CGT manufacturing. Their system utilizes a combination of centrifugation and filtration technologies within a fully contained environment to achieve precise cell concentrations while maintaining high viability. The platform features automated buffer exchange capabilities that enable controlled formulation adjustments based on real-time cell monitoring data. Lonza's technology incorporates single-use components that eliminate cross-contamination risks between patient batches, addressing a critical requirement for personalized cell therapies. The system includes integrated process analytical technology (PAT) tools that continuously monitor cell concentration, viability, and metabolic parameters throughout the manufacturing process[6][7]. Their formulation technology employs proprietary media compositions optimized for specific cell types, enhancing post-thaw recovery and functionality of the final therapeutic product.

Strengths: Extensive experience in GMP manufacturing with established regulatory compliance track record; comprehensive automation reduces labor requirements and process variability; scalable platform suitable for both clinical and commercial production. Weaknesses: Higher operational costs compared to manual processing methods; requires significant facility infrastructure and technical expertise; system updates and modifications may require revalidation efforts.

National Resilience, Inc.

Technical Solution: Resilience has developed an integrated closed-system platform for cell concentration and formulation that addresses key challenges in CGT manufacturing. Their technology employs a combination of tangential flow filtration and acoustic cell separation methods within a fully contained environment. The system features automated buffer exchange capabilities that enable precise control over final formulation parameters while maintaining cell viability above 90%. Resilience's platform incorporates in-line monitoring systems that continuously assess critical quality attributes during the concentration process, allowing for real-time adjustments to optimize product quality. Their technology supports multiple concentration modalities that can be selected based on specific cell therapy requirements, providing flexibility across different therapeutic applications[5]. The system integrates seamlessly with upstream and downstream processes through standardized connection interfaces, facilitating smooth workflow transitions in clinical manufacturing settings.

Strengths: Highly flexible platform adaptable to various cell therapy modalities; robust in-process monitoring capabilities ensure consistent product quality; designed for GMP compliance with comprehensive data management systems. Weaknesses: Relatively new company with limited long-term track record in commercial manufacturing; complex integrated system may require significant technical support; higher initial investment compared to manual processing methods.

Key Innovations in Cell Concentration Technologies

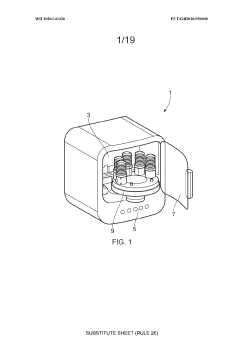

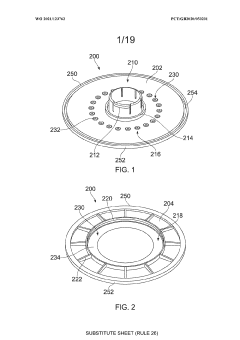

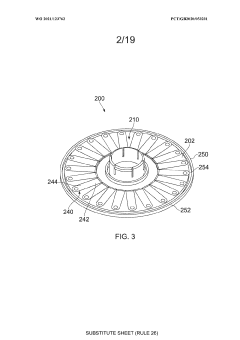

Cell processing container, cell processing system and methods of use thereof

PatentWO2020141326A1

Innovation

- A cell processing container and system that allows for flexible, compact, and low-cost multistep processing by using a compressible cell culture container with sterile connectors for aseptic connections, eliminating the need for pumps and reducing equipment complexity, and enabling processing within a single device without the requirement for constant cell transfer.

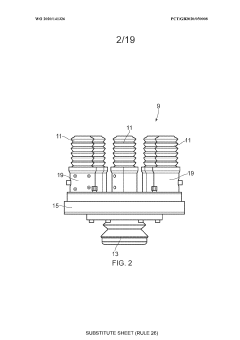

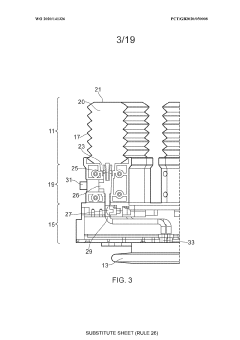

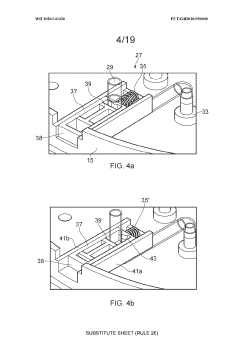

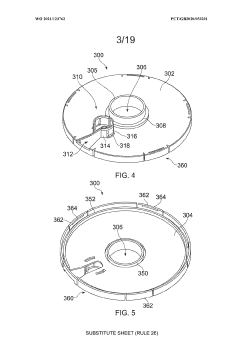

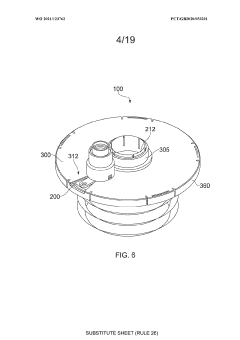

An apparatus

PatentWO2021123762A1

Innovation

- An apparatus with resealable ports and a cover mechanism that allows for the introduction and removal of materials from a container without the need for pumps, enabling automated and multi-step processes within a single device with a smaller footprint, reducing manual intervention and maintaining an aseptic environment.

Regulatory Considerations for Clinical CGT Manufacturing

The regulatory landscape for Cell and Gene Therapy (CGT) manufacturing presents significant challenges for developers transitioning from research to clinical applications. Regulatory bodies worldwide, including the FDA, EMA, and PMDA, have established stringent requirements for closed-system cell concentration and formulation technologies to ensure product safety, efficacy, and consistency. These requirements focus on contamination control, process validation, and product characterization throughout the manufacturing workflow.

Current Good Manufacturing Practice (cGMP) compliance is fundamental for clinical CGT manufacturing. Closed systems must demonstrate robust containment capabilities that minimize environmental contamination risks while maintaining cell viability and functionality. Documentation of system integrity testing, operator training protocols, and environmental monitoring data are essential components of regulatory submissions. Manufacturers must validate that their closed systems can consistently produce cellular products meeting predetermined quality attributes.

Risk-based approaches to validation have gained regulatory acceptance, allowing manufacturers to focus resources on critical process parameters that directly impact product quality. For cell concentration technologies, this includes demonstrating consistent cell recovery rates, viability preservation, and maintenance of cellular phenotype and function. Formulation technologies must ensure product stability throughout the intended shelf-life while preserving therapeutic potency.

Regulatory agencies increasingly emphasize the implementation of Quality by Design (QbD) principles in CGT manufacturing. This approach requires developers to establish a thorough understanding of how process parameters in closed systems affect critical quality attributes. Design space characterization for cell concentration and formulation steps must account for variability in starting materials, especially when working with patient-derived cells in autologous therapies.

Comparability studies represent another crucial regulatory consideration when implementing closed-system technologies. Manufacturers transitioning from open to closed processes must demonstrate that the resulting cellular products maintain equivalent critical quality attributes. These studies typically require extensive analytical characterization and may necessitate additional clinical data depending on the extent of process changes.

Global regulatory harmonization efforts, such as those through the International Council for Harmonisation (ICH), are gradually standardizing requirements for CGT manufacturing. However, significant regional differences persist, requiring developers to carefully navigate varying expectations when planning multi-regional clinical trials. Early and frequent engagement with regulatory authorities through mechanisms like the FDA's INTERACT program or EMA's scientific advice meetings can provide valuable guidance on closed-system implementation strategies.

Current Good Manufacturing Practice (cGMP) compliance is fundamental for clinical CGT manufacturing. Closed systems must demonstrate robust containment capabilities that minimize environmental contamination risks while maintaining cell viability and functionality. Documentation of system integrity testing, operator training protocols, and environmental monitoring data are essential components of regulatory submissions. Manufacturers must validate that their closed systems can consistently produce cellular products meeting predetermined quality attributes.

Risk-based approaches to validation have gained regulatory acceptance, allowing manufacturers to focus resources on critical process parameters that directly impact product quality. For cell concentration technologies, this includes demonstrating consistent cell recovery rates, viability preservation, and maintenance of cellular phenotype and function. Formulation technologies must ensure product stability throughout the intended shelf-life while preserving therapeutic potency.

Regulatory agencies increasingly emphasize the implementation of Quality by Design (QbD) principles in CGT manufacturing. This approach requires developers to establish a thorough understanding of how process parameters in closed systems affect critical quality attributes. Design space characterization for cell concentration and formulation steps must account for variability in starting materials, especially when working with patient-derived cells in autologous therapies.

Comparability studies represent another crucial regulatory consideration when implementing closed-system technologies. Manufacturers transitioning from open to closed processes must demonstrate that the resulting cellular products maintain equivalent critical quality attributes. These studies typically require extensive analytical characterization and may necessitate additional clinical data depending on the extent of process changes.

Global regulatory harmonization efforts, such as those through the International Council for Harmonisation (ICH), are gradually standardizing requirements for CGT manufacturing. However, significant regional differences persist, requiring developers to carefully navigate varying expectations when planning multi-regional clinical trials. Early and frequent engagement with regulatory authorities through mechanisms like the FDA's INTERACT program or EMA's scientific advice meetings can provide valuable guidance on closed-system implementation strategies.

Cost-Benefit Analysis of Closed vs Open Systems

When evaluating closed versus open systems for cell concentration and formulation in cell and gene therapy (CGT) workflows, a comprehensive cost-benefit analysis reveals significant trade-offs that impact both operational efficiency and clinical outcomes.

Initial capital investment represents a primary consideration, with closed systems typically requiring 2-3 times higher upfront expenditure compared to traditional open systems. A single closed processing platform may cost between $150,000-$500,000, whereas comparable open system equipment might range from $50,000-$200,000. However, this higher initial investment must be weighed against long-term operational savings.

Operational cost analysis demonstrates that closed systems significantly reduce clean room requirements, potentially downgrading from ISO 5/Grade A to ISO 7/Grade C environments. This facility classification reduction can yield 30-40% savings in clean room construction and maintenance costs over a five-year period. Additionally, closed systems minimize the need for extensive environmental monitoring, reducing associated labor and consumable expenses by approximately 25%.

Labor efficiency metrics favor closed systems, which typically reduce hands-on processing time by 40-60% compared to open methods. This efficiency translates to increased throughput capacity and better utilization of skilled personnel. Furthermore, closed systems demonstrate lower batch failure rates (1-3% versus 5-8% in open systems), representing substantial cost avoidance considering the high value of CGT starting materials and final products.

Consumable expenses present a more complex picture. While closed systems utilize specialized single-use kits that cost 30-50% more than open system components, this premium is often offset by reduced need for supplementary contamination control measures. The total per-batch consumable cost difference typically narrows to 10-15% when accounting for all materials required for comparable processing.

Risk mitigation value must also be quantified, as closed systems substantially reduce contamination risks that could lead to batch failures. Given that a single CGT product batch may represent $50,000-$500,000 in material costs alone, the improved success rates of closed systems provide significant financial risk protection.

Scalability considerations further favor closed systems, which demonstrate more consistent performance across batch sizes and facilitate smoother technology transfer between clinical phases. This scalability advantage reduces process redevelopment costs during clinical progression, estimated at $200,000-$500,000 per major process change.

When all factors are integrated into a five-year total cost of ownership model, closed systems typically demonstrate 15-25% lower overall costs despite higher initial investment, with the break-even point occurring between 18-24 months for most CGT applications.

Initial capital investment represents a primary consideration, with closed systems typically requiring 2-3 times higher upfront expenditure compared to traditional open systems. A single closed processing platform may cost between $150,000-$500,000, whereas comparable open system equipment might range from $50,000-$200,000. However, this higher initial investment must be weighed against long-term operational savings.

Operational cost analysis demonstrates that closed systems significantly reduce clean room requirements, potentially downgrading from ISO 5/Grade A to ISO 7/Grade C environments. This facility classification reduction can yield 30-40% savings in clean room construction and maintenance costs over a five-year period. Additionally, closed systems minimize the need for extensive environmental monitoring, reducing associated labor and consumable expenses by approximately 25%.

Labor efficiency metrics favor closed systems, which typically reduce hands-on processing time by 40-60% compared to open methods. This efficiency translates to increased throughput capacity and better utilization of skilled personnel. Furthermore, closed systems demonstrate lower batch failure rates (1-3% versus 5-8% in open systems), representing substantial cost avoidance considering the high value of CGT starting materials and final products.

Consumable expenses present a more complex picture. While closed systems utilize specialized single-use kits that cost 30-50% more than open system components, this premium is often offset by reduced need for supplementary contamination control measures. The total per-batch consumable cost difference typically narrows to 10-15% when accounting for all materials required for comparable processing.

Risk mitigation value must also be quantified, as closed systems substantially reduce contamination risks that could lead to batch failures. Given that a single CGT product batch may represent $50,000-$500,000 in material costs alone, the improved success rates of closed systems provide significant financial risk protection.

Scalability considerations further favor closed systems, which demonstrate more consistent performance across batch sizes and facilitate smoother technology transfer between clinical phases. This scalability advantage reduces process redevelopment costs during clinical progression, estimated at $200,000-$500,000 per major process change.

When all factors are integrated into a five-year total cost of ownership model, closed systems typically demonstrate 15-25% lower overall costs despite higher initial investment, with the break-even point occurring between 18-24 months for most CGT applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!