Comparative CapEx/OpEx Drivers For Cryogenic Versus Chemical Capture Systems

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Evolution and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to commercial applications across various industries. The evolution began in the 1970s with early experiments in capturing carbon dioxide from industrial flue gases, primarily motivated by enhanced oil recovery applications rather than climate concerns. By the 1990s, as climate change awareness grew, carbon capture research expanded substantially, with the first large-scale projects emerging in the early 2000s.

The technological landscape has diversified into three primary pathways: post-combustion capture, pre-combustion capture, and oxy-fuel combustion. Chemical absorption using amine solvents dominated early developments, with companies like Fluor and Mitsubishi Heavy Industries pioneering commercial solutions. Cryogenic carbon capture emerged as a promising alternative in the mid-2000s, offering potentially lower energy penalties but requiring significant capital investment in specialized equipment.

Recent technological advancements have focused on reducing the energy penalty and capital costs associated with carbon capture systems. The energy requirement for carbon capture has decreased from approximately 450-550 kWh/tCO2 in early systems to 200-300 kWh/tCO2 in modern designs, representing substantial progress toward economic viability. However, the capital expenditure remains a significant barrier to widespread adoption.

The primary objectives driving carbon capture technology development include achieving cost-effective carbon dioxide removal at scale, minimizing energy penalties, and ensuring long-term storage security. For cryogenic versus chemical capture systems specifically, research aims to determine optimal deployment scenarios based on facility size, emission concentration, and regional energy costs. Chemical systems have traditionally dominated due to lower initial capital requirements, while cryogenic systems potentially offer advantages in operational expenditure over time.

Global climate targets have accelerated technology development timelines, with the International Energy Agency identifying carbon capture as essential for meeting Paris Agreement goals. Current objectives include reducing capture costs to below $50/tCO2 by 2030 and achieving widespread commercial deployment across hard-to-abate sectors like cement, steel, and petrochemicals. The comparative analysis of cryogenic versus chemical capture systems represents a critical decision point for industries planning decarbonization strategies.

The technology evolution continues to be shaped by policy incentives, with mechanisms like the 45Q tax credit in the United States and carbon pricing in Europe creating market pull for innovation. Research objectives now increasingly focus on system integration, process intensification, and developing hybrid approaches that combine the advantages of both chemical and cryogenic capture methodologies.

The technological landscape has diversified into three primary pathways: post-combustion capture, pre-combustion capture, and oxy-fuel combustion. Chemical absorption using amine solvents dominated early developments, with companies like Fluor and Mitsubishi Heavy Industries pioneering commercial solutions. Cryogenic carbon capture emerged as a promising alternative in the mid-2000s, offering potentially lower energy penalties but requiring significant capital investment in specialized equipment.

Recent technological advancements have focused on reducing the energy penalty and capital costs associated with carbon capture systems. The energy requirement for carbon capture has decreased from approximately 450-550 kWh/tCO2 in early systems to 200-300 kWh/tCO2 in modern designs, representing substantial progress toward economic viability. However, the capital expenditure remains a significant barrier to widespread adoption.

The primary objectives driving carbon capture technology development include achieving cost-effective carbon dioxide removal at scale, minimizing energy penalties, and ensuring long-term storage security. For cryogenic versus chemical capture systems specifically, research aims to determine optimal deployment scenarios based on facility size, emission concentration, and regional energy costs. Chemical systems have traditionally dominated due to lower initial capital requirements, while cryogenic systems potentially offer advantages in operational expenditure over time.

Global climate targets have accelerated technology development timelines, with the International Energy Agency identifying carbon capture as essential for meeting Paris Agreement goals. Current objectives include reducing capture costs to below $50/tCO2 by 2030 and achieving widespread commercial deployment across hard-to-abate sectors like cement, steel, and petrochemicals. The comparative analysis of cryogenic versus chemical capture systems represents a critical decision point for industries planning decarbonization strategies.

The technology evolution continues to be shaped by policy incentives, with mechanisms like the 45Q tax credit in the United States and carbon pricing in Europe creating market pull for innovation. Research objectives now increasingly focus on system integration, process intensification, and developing hybrid approaches that combine the advantages of both chemical and cryogenic capture methodologies.

Market Analysis for Carbon Capture Solutions

The carbon capture market is experiencing significant growth driven by increasing global focus on emissions reduction and climate change mitigation. Currently valued at approximately $2 billion, the market is projected to reach $7 billion by 2028, representing a compound annual growth rate of 19.2%. This growth trajectory is supported by strengthening regulatory frameworks across major economies, including carbon pricing mechanisms and emissions reduction mandates.

Chemical capture systems currently dominate the market with over 70% market share, primarily due to their technological maturity and established operational track record. These systems have been deployed across various industries including power generation, cement production, and natural gas processing. Major players in this segment include Fluor Corporation, Mitsubishi Heavy Industries, and Aker Solutions.

Cryogenic capture systems, while representing a smaller market segment at roughly 15% share, are experiencing accelerated growth rates of 25-30% annually. This emerging technology is gaining traction particularly in applications requiring high purity CO2 output and in regions with access to low-cost electricity. Companies like Air Liquide, Linde, and Chart Industries are leading development in this space.

Regional analysis shows North America currently leads the carbon capture market with 40% share, followed by Europe at 35% and Asia-Pacific at 20%. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next five years due to rapid industrialization coupled with increasing environmental regulations in China, Japan, and South Korea.

Customer segmentation reveals distinct preferences between sectors. Power generation and heavy manufacturing industries tend to favor chemical capture solutions due to their scalability and ability to handle variable flue gas compositions. Conversely, food and beverage, electronics manufacturing, and certain specialized industrial applications show increasing interest in cryogenic systems due to their higher output purity and potential for integration with existing cryogenic processes.

Market adoption barriers differ significantly between technologies. Chemical capture systems face challenges related to solvent degradation, energy penalties, and waste management costs. Cryogenic systems encounter market resistance primarily due to higher upfront capital requirements, specialized operational expertise needs, and energy infrastructure dependencies.

Pricing trends indicate that while chemical capture systems typically offer lower initial capital expenditure, their lifetime operational costs can be substantially higher than cryogenic alternatives in certain applications. This total cost of ownership differential is becoming an increasingly important factor in technology selection decisions as the market matures and customers become more sophisticated in their evaluation processes.

Chemical capture systems currently dominate the market with over 70% market share, primarily due to their technological maturity and established operational track record. These systems have been deployed across various industries including power generation, cement production, and natural gas processing. Major players in this segment include Fluor Corporation, Mitsubishi Heavy Industries, and Aker Solutions.

Cryogenic capture systems, while representing a smaller market segment at roughly 15% share, are experiencing accelerated growth rates of 25-30% annually. This emerging technology is gaining traction particularly in applications requiring high purity CO2 output and in regions with access to low-cost electricity. Companies like Air Liquide, Linde, and Chart Industries are leading development in this space.

Regional analysis shows North America currently leads the carbon capture market with 40% share, followed by Europe at 35% and Asia-Pacific at 20%. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next five years due to rapid industrialization coupled with increasing environmental regulations in China, Japan, and South Korea.

Customer segmentation reveals distinct preferences between sectors. Power generation and heavy manufacturing industries tend to favor chemical capture solutions due to their scalability and ability to handle variable flue gas compositions. Conversely, food and beverage, electronics manufacturing, and certain specialized industrial applications show increasing interest in cryogenic systems due to their higher output purity and potential for integration with existing cryogenic processes.

Market adoption barriers differ significantly between technologies. Chemical capture systems face challenges related to solvent degradation, energy penalties, and waste management costs. Cryogenic systems encounter market resistance primarily due to higher upfront capital requirements, specialized operational expertise needs, and energy infrastructure dependencies.

Pricing trends indicate that while chemical capture systems typically offer lower initial capital expenditure, their lifetime operational costs can be substantially higher than cryogenic alternatives in certain applications. This total cost of ownership differential is becoming an increasingly important factor in technology selection decisions as the market matures and customers become more sophisticated in their evaluation processes.

Current Landscape and Technical Barriers

The carbon capture technology landscape is currently dominated by two primary approaches: chemical absorption systems and cryogenic capture systems. Chemical absorption, particularly using amine-based solvents like monoethanolamine (MEA), represents the most mature and widely deployed technology, accounting for approximately 70% of existing carbon capture installations globally. These systems have been operational at commercial scale for decades, primarily in natural gas processing and limited power plant applications. In contrast, cryogenic capture systems remain largely in the demonstration phase, with fewer than a dozen significant pilot projects worldwide.

The technical maturity gap between these technologies creates distinct capital expenditure (CapEx) and operational expenditure (OpEx) profiles. Chemical capture systems benefit from established supply chains and standardized engineering practices, resulting in more predictable initial costs. However, they face significant technical barriers including solvent degradation (requiring regular replacement at 1-3% of volume per day), corrosion of equipment, and high energy penalties for solvent regeneration that can consume 15-30% of a power plant's output.

Cryogenic systems, while less mature, demonstrate promising theoretical advantages in energy efficiency and operational simplicity. These systems operate by cooling flue gas to temperatures where CO₂ freezes or liquefies, allowing for physical separation. The primary technical barriers include managing the substantial refrigeration requirements, preventing ice formation that can block heat exchangers, and addressing the significant energy demands during initial cooling phases.

Scale-up challenges differ significantly between the technologies. Chemical systems face diminishing efficiency returns at larger scales due to mass transfer limitations in absorption columns. Cryogenic systems, conversely, may benefit from economies of scale in refrigeration equipment but struggle with the enormous heat exchange surfaces required for industrial applications.

Geographic distribution of technology development shows chemical capture research concentrated in North America and Europe, with significant operational experience in the United States, Canada, and Norway. Cryogenic technology development is more distributed, with notable research clusters in Australia, China, and parts of Europe focusing on novel refrigeration cycles and heat integration strategies.

The regulatory landscape further complicates technology deployment, with chemical systems facing increasing scrutiny regarding amine emissions and waste disposal protocols. Cryogenic systems must address safety concerns related to cryogenic fluid handling and potential asphyxiation hazards from CO₂ releases in confined spaces.

Both technologies face the fundamental challenge of high parasitic energy loads, though the nature of these loads differs—chemical systems primarily consume thermal energy for solvent regeneration, while cryogenic systems require substantial electrical input for refrigeration cycles.

The technical maturity gap between these technologies creates distinct capital expenditure (CapEx) and operational expenditure (OpEx) profiles. Chemical capture systems benefit from established supply chains and standardized engineering practices, resulting in more predictable initial costs. However, they face significant technical barriers including solvent degradation (requiring regular replacement at 1-3% of volume per day), corrosion of equipment, and high energy penalties for solvent regeneration that can consume 15-30% of a power plant's output.

Cryogenic systems, while less mature, demonstrate promising theoretical advantages in energy efficiency and operational simplicity. These systems operate by cooling flue gas to temperatures where CO₂ freezes or liquefies, allowing for physical separation. The primary technical barriers include managing the substantial refrigeration requirements, preventing ice formation that can block heat exchangers, and addressing the significant energy demands during initial cooling phases.

Scale-up challenges differ significantly between the technologies. Chemical systems face diminishing efficiency returns at larger scales due to mass transfer limitations in absorption columns. Cryogenic systems, conversely, may benefit from economies of scale in refrigeration equipment but struggle with the enormous heat exchange surfaces required for industrial applications.

Geographic distribution of technology development shows chemical capture research concentrated in North America and Europe, with significant operational experience in the United States, Canada, and Norway. Cryogenic technology development is more distributed, with notable research clusters in Australia, China, and parts of Europe focusing on novel refrigeration cycles and heat integration strategies.

The regulatory landscape further complicates technology deployment, with chemical systems facing increasing scrutiny regarding amine emissions and waste disposal protocols. Cryogenic systems must address safety concerns related to cryogenic fluid handling and potential asphyxiation hazards from CO₂ releases in confined spaces.

Both technologies face the fundamental challenge of high parasitic energy loads, though the nature of these loads differs—chemical systems primarily consume thermal energy for solvent regeneration, while cryogenic systems require substantial electrical input for refrigeration cycles.

Comparative Analysis of Cryogenic vs Chemical Methods

01 Cryogenic carbon capture system design and efficiency

Cryogenic carbon capture systems utilize low-temperature processes to separate CO2 from flue gases by freezing or condensing it. Key CapEx drivers include specialized heat exchangers, cryogenic equipment, and insulation materials. OpEx considerations involve energy consumption for cooling, system maintenance, and refrigerant management. Advanced designs focus on heat integration and energy recovery to improve overall efficiency and reduce operating costs.- Cryogenic carbon capture system design and efficiency: Cryogenic carbon capture systems utilize low-temperature processes to separate CO2 from flue gases. Key CapEx drivers include specialized heat exchangers, cryogenic equipment, and insulation materials. OpEx is influenced by energy consumption for cooling, system maintenance, and refrigerant management. Advanced designs focus on heat integration and recovery to improve energy efficiency and reduce operational costs, making these systems more economically viable for large-scale applications.

- Chemical absorption and solvent-based capture technologies: Chemical absorption systems use solvents like amines to capture CO2 from gas streams. Major CapEx factors include absorption columns, regeneration equipment, and solvent handling systems. OpEx drivers are dominated by solvent degradation and replacement costs, energy requirements for solvent regeneration, and equipment maintenance. Innovations in solvent chemistry and process optimization aim to reduce energy penalties and extend solvent lifetime, directly impacting the economic feasibility of these systems.

- Integration of carbon capture with industrial processes: Integration of carbon capture systems with existing industrial facilities presents unique cost considerations. CapEx drivers include retrofitting expenses, space constraints, and compatibility with existing infrastructure. OpEx is affected by process disruptions, operational synergies, and potential revenue from captured CO2 utilization. Effective integration can leverage waste heat, reduce energy penalties, and create value-added products, significantly improving the economic case for carbon capture implementation.

- Modular and scalable carbon capture solutions: Modular carbon capture designs offer flexibility in deployment and scaling. Initial CapEx may be lower due to standardized manufacturing and simplified installation. Key economic drivers include transportation and assembly costs, as well as the ability to incrementally expand capacity. OpEx benefits include easier maintenance, component replacement, and operational flexibility. These systems are particularly advantageous for distributed emission sources or applications where capture requirements may change over time.

- Economic optimization and cost reduction strategies: Cost reduction strategies focus on optimizing both capital and operational expenditures for carbon capture systems. Key approaches include advanced materials development, process intensification, and automation. Economic drivers also include regulatory incentives, carbon pricing mechanisms, and potential revenue streams from captured CO2. Lifecycle cost analysis and techno-economic assessments are essential tools for identifying cost-effective configurations and operational parameters that can make carbon capture economically sustainable.

02 Chemical absorption and solvent-based capture technologies

Chemical absorption systems use solvents (like amines) to selectively capture CO2 from gas streams. Major CapEx drivers include absorption columns, regeneration equipment, and solvent handling systems. OpEx is significantly influenced by solvent degradation rates, energy requirements for regeneration, and makeup solvent costs. Innovations in solvent chemistry and process optimization aim to reduce the energy penalty associated with solvent regeneration, which represents one of the largest operational expenses.Expand Specific Solutions03 Integration and scaling considerations for carbon capture systems

The integration of carbon capture systems with existing industrial facilities presents significant CapEx/OpEx challenges. Initial capital costs are driven by system size requirements, retrofit complexity, and site-specific constraints. Operational expenses vary based on integration efficiency, utility availability, and process synergies. Economies of scale play a crucial role in determining the economic viability of these systems, with larger installations generally achieving lower costs per ton of CO2 captured. Modular designs are emerging to address scaling challenges and reduce upfront investment requirements.Expand Specific Solutions04 Monitoring, control systems and operational optimization

Advanced monitoring and control systems represent a significant but essential capital investment for carbon capture facilities. These systems enable real-time optimization of capture efficiency, energy consumption, and operational parameters. Key OpEx drivers include maintenance of sensors, control equipment, and data management systems. Predictive maintenance approaches and AI-based control strategies are being developed to minimize downtime and maximize capture efficiency, ultimately reducing long-term operational costs and improving system reliability.Expand Specific Solutions05 CO2 compression, transport and storage infrastructure

Post-capture CO2 handling represents a substantial portion of both capital and operational expenses. Compression equipment for preparing CO2 for transport is energy-intensive and requires significant upfront investment. Pipeline infrastructure or alternative transport methods add to capital costs, while energy for compression and transport contributes to ongoing operational expenses. Storage site preparation, monitoring, and long-term management also impact the overall economic profile of carbon capture projects. Innovations in compression technology and transport logistics are critical for improving the financial viability of complete carbon capture and storage systems.Expand Specific Solutions

Industry Leaders in Carbon Capture Systems

The carbon capture technology market is currently in a growth phase, with cryogenic and chemical capture systems competing for dominance. The market is projected to expand significantly as climate regulations tighten globally, with estimates suggesting a multi-billion dollar industry by 2030. Technologically, chemical capture systems are more mature and widely deployed, with companies like Air Liquide, Saudi Aramco, and Petrobras leading commercial implementations. Cryogenic capture technology, while less mature, is gaining momentum through research advancements from institutions like MIT, Fraunhofer-Gesellschaft, and CNRS. State Grid Corp of China and Huaneng Clean Energy Research Institute are driving large-scale implementation in emerging markets, while Southwest Research Institute and Commonwealth Scientific & Industrial Research Organisation are developing hybrid approaches to optimize both CapEx and OpEx considerations.

Air Liquide SA

Technical Solution: Air Liquide has developed advanced cryogenic carbon capture systems that utilize their expertise in industrial gas handling and cryogenic technologies. Their approach involves cooling flue gas to temperatures where CO2 solidifies (approximately -140°C), allowing for separation through desublimation. The company has implemented a proprietary heat exchange system that recovers cold energy from the separated CO2 stream to pre-cool incoming flue gas, significantly reducing operational energy requirements. Their process achieves capture rates exceeding 90% while maintaining energy penalties below 0.9 GJ/tCO2. Air Liquide's cryogenic systems are particularly effective for high-concentration CO2 streams and can be integrated with their existing industrial gas infrastructure, creating operational synergies that reduce both capital and operational expenditures compared to traditional amine-based systems.

Strengths: Leverages extensive industrial gas expertise and existing infrastructure; achieves high capture rates with lower energy penalties than many chemical systems; produces high-purity CO2 suitable for direct utilization. Weaknesses: Higher initial capital costs than some chemical systems; requires significant cooling infrastructure; most economical at larger scales and for high-concentration CO2 streams.

Commonwealth Scientific & Industrial Research Organisation

Technical Solution: CSIRO has pioneered comparative analysis frameworks for carbon capture technologies with particular focus on cryogenic versus chemical systems. Their research has developed detailed techno-economic models that account for both direct and indirect costs across the entire capture process lifecycle. CSIRO's analysis shows that while cryogenic systems typically have 15-25% higher initial capital expenditure than amine-based systems, they demonstrate 20-30% lower operational costs over a 20-year plant lifetime for high-volume applications. Their models incorporate regional energy pricing variations, equipment degradation rates, and maintenance requirements to provide location-specific comparative analyses. CSIRO has also developed hybrid systems that combine cryogenic pre-concentration with targeted chemical absorption, optimizing the cost structure by leveraging the strengths of both approaches while minimizing their respective weaknesses.

Strengths: Comprehensive lifecycle cost modeling; development of hybrid systems that optimize overall economics; strong focus on regional implementation factors affecting real-world costs. Weaknesses: Models require extensive validation in commercial-scale operations; some analyses rely on theoretical performance projections rather than long-term operational data.

Key Patents and Technical Innovations

Dynamic unit resource usage price calibrator for a virtual data center

PatentInactiveUS9524516B2

Innovation

- A dynamic unit resource usage price calibrator is implemented in a management server, which analyzes capacity and cost trends to compute and calibrate unit resource usage prices for each billing cycle, ensuring a predictable and desired ROI by integrating computation engines, calibrators, and estimation modules to dynamically adjust pricing based on capital and operating expenditures and business needs.

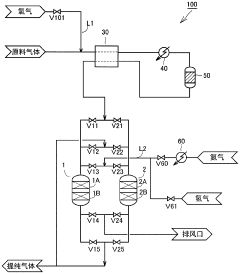

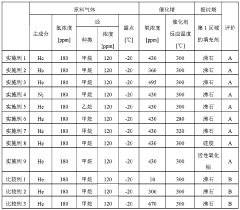

Purified gas manufacturing device, and purified gas manufacturing method

PatentInactiveCN111491711A

Innovation

- A device including a catalytic tower and a purification tower is designed. In the catalytic tower, catalytic reactions are carried out in the presence of oxygen to convert combustible components. In the purification tower, water and oxygen are adsorbed by materials such as zeolite, activated alumina and silica gel, and the copper content is used. High getters further remove oxygen, enabling continuous operation and reducing equipment count.

Economic Modeling and ROI Assessment

Economic modeling for carbon capture technologies requires comprehensive analysis of both capital expenditures (CapEx) and operational expenditures (OpEx) to determine the most cost-effective solution. For cryogenic and chemical capture systems, these financial drivers differ significantly, impacting the return on investment (ROI) calculations.

Cryogenic capture systems typically demonstrate higher initial CapEx due to specialized equipment requirements including cryogenic distillation columns, heat exchangers, and refrigeration systems. These components must withstand extreme low temperatures, necessitating premium materials and precision engineering. However, the operational simplicity of cryogenic systems often translates to lower maintenance costs over time.

Chemical capture systems, conversely, generally feature lower upfront investment but higher ongoing operational costs. The chemical solvents require regular replacement or regeneration, contributing significantly to OpEx. Additionally, the energy penalty associated with solvent regeneration—often requiring substantial heat input—creates a persistent operational expense that impacts long-term financial performance.

ROI assessment models must incorporate time-value considerations, as the different cost structures of these technologies create distinct payback profiles. Cryogenic systems typically demonstrate longer payback periods but may offer superior returns in extended operational scenarios exceeding 15-20 years. Chemical systems often provide faster initial returns but face increasing costs as solvent degradation accelerates.

Sensitivity analysis reveals that energy prices significantly impact the comparative economics of these systems. Cryogenic processes are particularly sensitive to electricity costs, while chemical systems demonstrate greater vulnerability to thermal energy pricing fluctuations. In regions with low electricity costs, cryogenic systems may present more attractive economics despite higher initial investment.

Scale effects also play a crucial role in economic modeling. Cryogenic systems benefit substantially from economies of scale, with per-ton capture costs decreasing significantly at larger capacities. Chemical systems show more linear scaling characteristics, potentially favoring smaller applications where capital constraints are more pressing than long-term operational efficiency.

Tax incentives and carbon pricing mechanisms dramatically alter ROI calculations for both technologies. Current policy frameworks in many jurisdictions provide tax credits based on captured carbon quantities, potentially accelerating payback periods by 30-40% depending on regional policies and implementation scales.

Cryogenic capture systems typically demonstrate higher initial CapEx due to specialized equipment requirements including cryogenic distillation columns, heat exchangers, and refrigeration systems. These components must withstand extreme low temperatures, necessitating premium materials and precision engineering. However, the operational simplicity of cryogenic systems often translates to lower maintenance costs over time.

Chemical capture systems, conversely, generally feature lower upfront investment but higher ongoing operational costs. The chemical solvents require regular replacement or regeneration, contributing significantly to OpEx. Additionally, the energy penalty associated with solvent regeneration—often requiring substantial heat input—creates a persistent operational expense that impacts long-term financial performance.

ROI assessment models must incorporate time-value considerations, as the different cost structures of these technologies create distinct payback profiles. Cryogenic systems typically demonstrate longer payback periods but may offer superior returns in extended operational scenarios exceeding 15-20 years. Chemical systems often provide faster initial returns but face increasing costs as solvent degradation accelerates.

Sensitivity analysis reveals that energy prices significantly impact the comparative economics of these systems. Cryogenic processes are particularly sensitive to electricity costs, while chemical systems demonstrate greater vulnerability to thermal energy pricing fluctuations. In regions with low electricity costs, cryogenic systems may present more attractive economics despite higher initial investment.

Scale effects also play a crucial role in economic modeling. Cryogenic systems benefit substantially from economies of scale, with per-ton capture costs decreasing significantly at larger capacities. Chemical systems show more linear scaling characteristics, potentially favoring smaller applications where capital constraints are more pressing than long-term operational efficiency.

Tax incentives and carbon pricing mechanisms dramatically alter ROI calculations for both technologies. Current policy frameworks in many jurisdictions provide tax credits based on captured carbon quantities, potentially accelerating payback periods by 30-40% depending on regional policies and implementation scales.

Regulatory Framework and Incentive Structures

The regulatory landscape surrounding carbon capture technologies significantly influences the economic viability of both cryogenic and chemical capture systems. Current global climate policies increasingly incorporate carbon pricing mechanisms, with the European Union's Emissions Trading System (ETS) setting carbon prices at approximately €80-90 per tonne, while North American jurisdictions typically range from $15-65 per tonne. These pricing structures directly impact the operational economics of capture technologies, particularly favoring systems with lower energy penalties.

Tax incentives specifically designed for carbon capture deployment have emerged as powerful economic drivers. The U.S. 45Q tax credit, recently enhanced under the Inflation Reduction Act to provide up to $85 per tonne for captured carbon, has dramatically altered investment calculations for both technology pathways. Similar incentive structures are developing in Canada, the UK, and Australia, creating a more favorable environment for capital-intensive technologies like cryogenic systems that offer long-term operational advantages.

Permitting frameworks present distinct challenges for each technology. Chemical capture systems typically face more stringent regulatory scrutiny regarding amine degradation products and potential atmospheric emissions of concern. Cryogenic systems, while generally facing fewer chemical management regulations, must navigate comprehensive safety protocols related to cryogenic fluid handling and storage. These regulatory differences translate directly to compliance costs that affect both capital and operational expenditures.

Energy efficiency standards and carbon intensity regulations increasingly influence technology selection. Jurisdictions with stringent industrial energy efficiency requirements may favor cryogenic systems due to their potential for energy recovery and integration. Conversely, regions with less developed energy efficiency regulations may not fully value these advantages in regulatory compliance calculations.

The evolving nature of carbon accounting methodologies also impacts technology economics. Life cycle assessment requirements are becoming more comprehensive in regulatory frameworks, potentially benefiting cryogenic systems with their lower chemical input requirements and reduced waste streams. However, the higher embodied carbon in specialized cryogenic equipment manufacturing may partially offset these advantages depending on accounting boundaries.

Regulatory stability represents a critical factor in investment decisions between these technologies. Chemical capture systems, with their lower upfront costs but higher operational expenses, may present lower regulatory risk in uncertain policy environments. Cryogenic systems, requiring higher initial capital investment but offering potentially lower lifetime costs, become more attractive under stable, long-term regulatory frameworks that provide investment certainty.

Tax incentives specifically designed for carbon capture deployment have emerged as powerful economic drivers. The U.S. 45Q tax credit, recently enhanced under the Inflation Reduction Act to provide up to $85 per tonne for captured carbon, has dramatically altered investment calculations for both technology pathways. Similar incentive structures are developing in Canada, the UK, and Australia, creating a more favorable environment for capital-intensive technologies like cryogenic systems that offer long-term operational advantages.

Permitting frameworks present distinct challenges for each technology. Chemical capture systems typically face more stringent regulatory scrutiny regarding amine degradation products and potential atmospheric emissions of concern. Cryogenic systems, while generally facing fewer chemical management regulations, must navigate comprehensive safety protocols related to cryogenic fluid handling and storage. These regulatory differences translate directly to compliance costs that affect both capital and operational expenditures.

Energy efficiency standards and carbon intensity regulations increasingly influence technology selection. Jurisdictions with stringent industrial energy efficiency requirements may favor cryogenic systems due to their potential for energy recovery and integration. Conversely, regions with less developed energy efficiency regulations may not fully value these advantages in regulatory compliance calculations.

The evolving nature of carbon accounting methodologies also impacts technology economics. Life cycle assessment requirements are becoming more comprehensive in regulatory frameworks, potentially benefiting cryogenic systems with their lower chemical input requirements and reduced waste streams. However, the higher embodied carbon in specialized cryogenic equipment manufacturing may partially offset these advantages depending on accounting boundaries.

Regulatory stability represents a critical factor in investment decisions between these technologies. Chemical capture systems, with their lower upfront costs but higher operational expenses, may present lower regulatory risk in uncertain policy environments. Cryogenic systems, requiring higher initial capital investment but offering potentially lower lifetime costs, become more attractive under stable, long-term regulatory frameworks that provide investment certainty.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!