Supply Chain And Manufacturing Readiness For Cryogenic Capture Modules

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cryogenic Capture Technology Background and Objectives

Cryogenic carbon capture (CCC) technology has emerged as a promising approach for reducing greenhouse gas emissions across various industrial sectors. The technology leverages thermodynamic principles to separate carbon dioxide from flue gases by cooling them to temperatures where CO2 desublimes into a solid phase while other gases remain in gaseous form. This process represents a significant advancement over conventional carbon capture methods, offering potentially higher efficiency and lower energy penalties.

The evolution of cryogenic capture technology can be traced back to early refrigeration systems developed in the mid-20th century, but its specific application to carbon capture gained momentum only in the early 2000s. Initial laboratory-scale demonstrations proved the concept's viability, leading to increased research interest and funding over the past decade. The technology has progressed from theoretical models to pilot-scale implementations, with several demonstration projects currently operational worldwide.

Current technological objectives for cryogenic capture modules focus on several critical areas. First, improving energy efficiency remains paramount, as the cooling process inherently requires significant energy input. Researchers aim to reduce this energy penalty through advanced heat integration systems and novel refrigeration cycles. Second, scaling capabilities present another key objective, with efforts directed toward developing modular designs that can be effectively deployed across different industrial settings with varying emission profiles.

Material science advancements represent another crucial objective, particularly regarding materials that can withstand extreme temperature cycling without degradation. This includes specialized alloys for heat exchangers, insulation materials with superior performance at cryogenic temperatures, and novel sorbents that can enhance the separation process when combined with cryogenic techniques.

Process optimization constitutes a fourth major objective, encompassing improvements in solid CO2 handling, defrosting cycles, and integration with downstream utilization or sequestration systems. Researchers are exploring various configurations to minimize operational complexities while maximizing capture efficiency.

The ultimate goal of current research efforts is to develop cryogenic capture modules that achieve capture costs below $50 per ton of CO2, with energy penalties less than 10% of the host facility's output. Additionally, these systems must demonstrate reliability in continuous operation for extended periods, with minimal maintenance requirements and the ability to handle fluctuations in flue gas composition and flow rates typical in industrial settings.

As climate policies worldwide increasingly mandate emissions reductions, the development timeline for commercial-scale cryogenic capture technology has accelerated, with industry stakeholders targeting widespread deployment readiness by 2030.

The evolution of cryogenic capture technology can be traced back to early refrigeration systems developed in the mid-20th century, but its specific application to carbon capture gained momentum only in the early 2000s. Initial laboratory-scale demonstrations proved the concept's viability, leading to increased research interest and funding over the past decade. The technology has progressed from theoretical models to pilot-scale implementations, with several demonstration projects currently operational worldwide.

Current technological objectives for cryogenic capture modules focus on several critical areas. First, improving energy efficiency remains paramount, as the cooling process inherently requires significant energy input. Researchers aim to reduce this energy penalty through advanced heat integration systems and novel refrigeration cycles. Second, scaling capabilities present another key objective, with efforts directed toward developing modular designs that can be effectively deployed across different industrial settings with varying emission profiles.

Material science advancements represent another crucial objective, particularly regarding materials that can withstand extreme temperature cycling without degradation. This includes specialized alloys for heat exchangers, insulation materials with superior performance at cryogenic temperatures, and novel sorbents that can enhance the separation process when combined with cryogenic techniques.

Process optimization constitutes a fourth major objective, encompassing improvements in solid CO2 handling, defrosting cycles, and integration with downstream utilization or sequestration systems. Researchers are exploring various configurations to minimize operational complexities while maximizing capture efficiency.

The ultimate goal of current research efforts is to develop cryogenic capture modules that achieve capture costs below $50 per ton of CO2, with energy penalties less than 10% of the host facility's output. Additionally, these systems must demonstrate reliability in continuous operation for extended periods, with minimal maintenance requirements and the ability to handle fluctuations in flue gas composition and flow rates typical in industrial settings.

As climate policies worldwide increasingly mandate emissions reductions, the development timeline for commercial-scale cryogenic capture technology has accelerated, with industry stakeholders targeting widespread deployment readiness by 2030.

Market Analysis for Cryogenic Capture Solutions

The global market for cryogenic capture solutions has witnessed significant growth in recent years, driven by increasing environmental regulations and the urgent need to reduce carbon emissions across various industries. The market size for carbon capture technologies, including cryogenic methods, was valued at approximately $2.5 billion in 2022 and is projected to grow at a compound annual growth rate of 19.2% through 2030, potentially reaching $7.8 billion.

Cryogenic capture technology represents a specialized segment within this broader market, with particular applications in industrial processes requiring ultra-low temperature gas separation. The demand for these solutions is particularly strong in sectors such as natural gas processing, hydrogen production, and carbon capture from industrial flue gases, where traditional capture methods face efficiency limitations.

Regional analysis indicates that North America currently holds the largest market share for cryogenic capture technologies, accounting for roughly 35% of the global market. This dominance is attributed to the region's extensive natural gas infrastructure and strong regulatory push toward emissions reduction. Europe follows closely with approximately 30% market share, driven by stringent environmental policies and ambitious climate targets established under the European Green Deal.

The Asia-Pacific region represents the fastest-growing market for cryogenic capture solutions, with China and India leading the expansion due to their rapidly growing industrial sectors and increasing focus on environmental sustainability. Market penetration in these regions is expected to accelerate as manufacturing capabilities mature and cost barriers decrease.

Customer segmentation reveals three primary market categories: energy production facilities (including power plants and natural gas processing), industrial manufacturing (particularly cement, steel, and chemical production), and emerging applications in direct air capture initiatives. The energy sector currently represents the largest customer base, accounting for approximately 45% of market demand.

Market drivers include tightening emissions regulations worldwide, carbon pricing mechanisms, government subsidies for clean technology adoption, and corporate sustainability commitments. The implementation of carbon border adjustment mechanisms by major economies is creating additional market pressure for adoption of effective carbon capture technologies.

Barriers to market growth include high capital expenditure requirements, energy intensity of cryogenic processes, and supply chain constraints for specialized components. The market also faces competition from alternative capture technologies such as amine-based systems, membrane separation, and solid sorbent approaches, each with distinct cost and performance profiles across different applications.

Cryogenic capture technology represents a specialized segment within this broader market, with particular applications in industrial processes requiring ultra-low temperature gas separation. The demand for these solutions is particularly strong in sectors such as natural gas processing, hydrogen production, and carbon capture from industrial flue gases, where traditional capture methods face efficiency limitations.

Regional analysis indicates that North America currently holds the largest market share for cryogenic capture technologies, accounting for roughly 35% of the global market. This dominance is attributed to the region's extensive natural gas infrastructure and strong regulatory push toward emissions reduction. Europe follows closely with approximately 30% market share, driven by stringent environmental policies and ambitious climate targets established under the European Green Deal.

The Asia-Pacific region represents the fastest-growing market for cryogenic capture solutions, with China and India leading the expansion due to their rapidly growing industrial sectors and increasing focus on environmental sustainability. Market penetration in these regions is expected to accelerate as manufacturing capabilities mature and cost barriers decrease.

Customer segmentation reveals three primary market categories: energy production facilities (including power plants and natural gas processing), industrial manufacturing (particularly cement, steel, and chemical production), and emerging applications in direct air capture initiatives. The energy sector currently represents the largest customer base, accounting for approximately 45% of market demand.

Market drivers include tightening emissions regulations worldwide, carbon pricing mechanisms, government subsidies for clean technology adoption, and corporate sustainability commitments. The implementation of carbon border adjustment mechanisms by major economies is creating additional market pressure for adoption of effective carbon capture technologies.

Barriers to market growth include high capital expenditure requirements, energy intensity of cryogenic processes, and supply chain constraints for specialized components. The market also faces competition from alternative capture technologies such as amine-based systems, membrane separation, and solid sorbent approaches, each with distinct cost and performance profiles across different applications.

Global Technical Challenges in Cryogenic Capture

The implementation of cryogenic capture technology for carbon dioxide and other greenhouse gases faces significant global technical challenges that require innovative solutions and international collaboration. These challenges span across multiple domains including materials science, energy efficiency, system integration, and operational reliability under extreme conditions.

Material compatibility at cryogenic temperatures represents a fundamental challenge, as conventional materials often become brittle or lose their structural integrity when exposed to temperatures approaching -150°C or lower. Engineers must identify and develop specialized alloys and composites that maintain their mechanical properties while providing adequate thermal insulation to minimize energy losses.

Energy consumption poses another critical hurdle, as the cooling processes required for cryogenic capture demand substantial power inputs. Current systems typically consume between 1-2 MWh per ton of CO₂ captured, making the technology economically viable only in specific contexts. Reducing this energy penalty through advanced heat exchange systems and process integration remains a priority for global research efforts.

Scale-up challenges persist as laboratory-proven technologies face difficulties in industrial implementation. The transition from pilot plants processing a few tons per day to commercial facilities handling thousands of tons presents complex engineering problems related to flow dynamics, heat transfer efficiency, and mechanical stress management in larger systems.

Thermal cycling effects create significant wear on cryogenic equipment, as components must withstand repeated temperature fluctuations between ambient and cryogenic conditions. This cycling accelerates material fatigue and can lead to premature system failures, necessitating robust design approaches and advanced predictive maintenance protocols.

Process control and automation present additional challenges, particularly in maintaining precise temperature gradients and managing the phase transitions critical to efficient separation. The development of specialized sensors capable of reliable operation at extreme temperatures remains an active area of research globally.

Integration with existing industrial infrastructure represents a significant barrier to widespread adoption. Many facilities lack the space, utility connections, or compatible processes needed to incorporate cryogenic capture modules, requiring substantial retrofitting or complete redesign of production lines.

Safety considerations add another layer of complexity, as the handling of cryogenic fluids and the potential for rapid pressure buildup in confined spaces necessitate comprehensive risk management strategies and specialized training programs for operational personnel.

Material compatibility at cryogenic temperatures represents a fundamental challenge, as conventional materials often become brittle or lose their structural integrity when exposed to temperatures approaching -150°C or lower. Engineers must identify and develop specialized alloys and composites that maintain their mechanical properties while providing adequate thermal insulation to minimize energy losses.

Energy consumption poses another critical hurdle, as the cooling processes required for cryogenic capture demand substantial power inputs. Current systems typically consume between 1-2 MWh per ton of CO₂ captured, making the technology economically viable only in specific contexts. Reducing this energy penalty through advanced heat exchange systems and process integration remains a priority for global research efforts.

Scale-up challenges persist as laboratory-proven technologies face difficulties in industrial implementation. The transition from pilot plants processing a few tons per day to commercial facilities handling thousands of tons presents complex engineering problems related to flow dynamics, heat transfer efficiency, and mechanical stress management in larger systems.

Thermal cycling effects create significant wear on cryogenic equipment, as components must withstand repeated temperature fluctuations between ambient and cryogenic conditions. This cycling accelerates material fatigue and can lead to premature system failures, necessitating robust design approaches and advanced predictive maintenance protocols.

Process control and automation present additional challenges, particularly in maintaining precise temperature gradients and managing the phase transitions critical to efficient separation. The development of specialized sensors capable of reliable operation at extreme temperatures remains an active area of research globally.

Integration with existing industrial infrastructure represents a significant barrier to widespread adoption. Many facilities lack the space, utility connections, or compatible processes needed to incorporate cryogenic capture modules, requiring substantial retrofitting or complete redesign of production lines.

Safety considerations add another layer of complexity, as the handling of cryogenic fluids and the potential for rapid pressure buildup in confined spaces necessitate comprehensive risk management strategies and specialized training programs for operational personnel.

Current Manufacturing Solutions for Cryogenic Modules

01 Manufacturing readiness for cryogenic capture systems

Manufacturing readiness for cryogenic capture systems involves assessing production capabilities, scaling processes, and ensuring quality control. This includes evaluating manufacturing facilities, equipment requirements, and production line optimization for cryogenic components. The manufacturing readiness level (MRL) assessment helps identify gaps in production capabilities and develop strategies to achieve full-scale manufacturing of cryogenic capture modules.- Cryogenic capture module manufacturing processes: Manufacturing processes for cryogenic capture modules involve specialized techniques to ensure proper functionality in extreme low-temperature environments. These processes include precision machining of components, assembly in controlled environments, and rigorous quality control testing. Advanced manufacturing techniques such as additive manufacturing may be employed for complex components, while specialized welding and joining methods ensure leak-tight seals critical for cryogenic applications.

- Supply chain management for cryogenic systems: Effective supply chain management for cryogenic capture modules requires coordination of specialized material suppliers, component manufacturers, and system integrators. This includes strategic sourcing of critical materials like specialty metals and insulation materials that can withstand extreme temperatures, inventory management systems tailored for low-volume high-value components, and supplier qualification processes to ensure quality standards are maintained throughout the supply network.

- Manufacturing readiness assessment frameworks: Manufacturing readiness assessment frameworks for cryogenic capture modules evaluate production capabilities, technological maturity, and supply chain resilience. These frameworks include standardized metrics for evaluating manufacturing process maturity, risk assessment methodologies specific to cryogenic technologies, and readiness level classifications that help stakeholders understand production capabilities and limitations. Implementation of these frameworks helps identify potential bottlenecks and guides investment in manufacturing infrastructure.

- Material selection and qualification for cryogenic applications: Material selection for cryogenic capture modules requires careful consideration of thermal properties, mechanical strength at low temperatures, and compatibility with captured substances. Qualification processes include extensive testing under cryogenic conditions to verify performance characteristics, evaluation of thermal expansion/contraction behaviors, and assessment of material degradation over multiple thermal cycles. Advanced composite materials and specialized metal alloys are often employed to meet the demanding requirements of cryogenic environments.

- Quality control and testing protocols: Quality control and testing protocols for cryogenic capture modules include specialized procedures to verify performance under extreme temperature conditions. These protocols encompass leak detection methodologies specific to cryogenic systems, thermal cycling tests to evaluate component integrity, and functional testing under operational conditions. Non-destructive testing techniques such as acoustic emission testing and thermal imaging are employed to detect defects without compromising system integrity, ensuring reliability in critical applications.

02 Supply chain management for cryogenic technologies

Effective supply chain management for cryogenic technologies involves coordinating suppliers, manufacturers, and distributors to ensure timely delivery of components and materials. This includes strategic sourcing of specialized materials, inventory management of temperature-sensitive components, and logistics planning for cryogenic equipment. Supply chain resilience strategies help mitigate risks associated with disruptions in the procurement of critical components for cryogenic capture modules.Expand Specific Solutions03 Cryogenic module design and integration

Cryogenic capture module design focuses on creating efficient systems that can operate at extremely low temperatures while maintaining structural integrity. This includes thermal insulation techniques, material selection for cryogenic environments, and integration of components such as heat exchangers, valves, and sensors. The design must consider thermal expansion/contraction, pressure management, and safety features to ensure reliable operation in capturing target substances at cryogenic temperatures.Expand Specific Solutions04 Quality assurance and testing protocols

Quality assurance for cryogenic capture modules involves rigorous testing protocols to verify performance at extremely low temperatures. This includes leak detection, thermal cycling tests, pressure testing, and functional verification under operating conditions. Non-destructive testing methods are employed to inspect welds, joints, and critical components. Standardized quality control procedures ensure consistency across manufacturing batches and compliance with industry standards for cryogenic equipment.Expand Specific Solutions05 Innovation and technological advancement in cryogenic capture

Ongoing innovation in cryogenic capture technology focuses on improving efficiency, reducing energy consumption, and enhancing capture rates. Advanced materials research aims to develop components that perform better at extremely low temperatures. Automation and digital monitoring systems are being integrated to optimize operation and maintenance. These technological advancements are driving the evolution of cryogenic capture modules, making them more cost-effective and environmentally sustainable for various industrial applications.Expand Specific Solutions

Key Industry Players in Cryogenic Capture Manufacturing

The cryogenic capture modules market is currently in an early growth phase, characterized by increasing adoption across research and industrial applications. The market size is expanding steadily, driven by growing demand in quantum computing, healthcare, and energy sectors, with projections suggesting significant growth over the next decade. Technologically, the field shows varying maturity levels, with established players like Air Liquide SA and Sumitomo Heavy Industries offering commercial solutions, while innovative companies such as kiutra GmbH and Montana Instruments are advancing media-independent cooling technologies. D-Wave Systems and IBM are driving quantum computing applications, while Highview Enterprises focuses on energy storage solutions. The supply chain remains complex, with specialized manufacturing capabilities concentrated among a few key players, creating both challenges and opportunities for new entrants seeking to address cryogenic capture module production at scale.

Montana Instruments Corporation

Technical Solution: Montana Instruments has developed advanced cryogenic capture modules featuring closed-cycle cryostats that eliminate the need for liquid helium. Their Cryostation platform provides temperature stability within millikelvin range and vibration isolation systems critical for quantum applications. The company has implemented a modular manufacturing approach that allows for customization of cryogenic capture modules based on specific research requirements. Their supply chain strategy involves vertical integration of key components, including proprietary vibration isolation technology and temperature control systems, while maintaining strategic partnerships with specialized material suppliers. Montana Instruments has also developed automated testing protocols to ensure reliability in extreme temperature conditions, significantly reducing failure rates in field deployments.

Strengths: Superior vibration isolation technology and temperature stability; modular design allowing customization for various applications. Weaknesses: Higher cost compared to traditional cryogenic systems; limited production capacity for large-scale industrial applications.

kiutra GmbH

Technical Solution: kiutra has pioneered magnetic cooling technology for cryogenic capture modules, eliminating the need for liquid helium or other cryogens. Their innovative approach uses magnetic refrigeration based on the magnetocaloric effect to reach temperatures below 1K. The company has developed a comprehensive supply chain strategy focused on sourcing rare earth materials critical for their magnetic cooling systems, establishing redundant supplier relationships to mitigate geopolitical risks. Their manufacturing process incorporates precision engineering for magnetic field generation components and automated assembly of cooling modules. kiutra has implemented just-in-time manufacturing principles adapted for specialized cryogenic equipment production, reducing inventory costs while maintaining quality control. Their systems feature modular designs that facilitate maintenance and upgrades, enhancing product lifecycle management.

Strengths: Revolutionary magnetic cooling technology eliminates dependence on liquid helium; environmentally friendly closed-cycle operation with lower operating costs. Weaknesses: Technology still relatively new with limited track record in industrial applications; higher initial capital investment compared to conventional cryogenic systems.

Critical Patents and Technical Literature Review

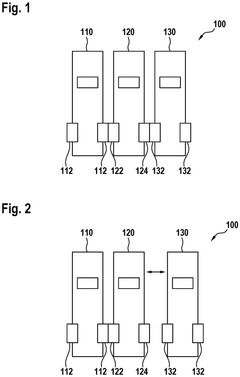

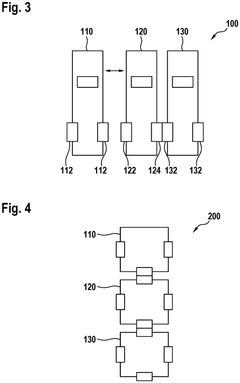

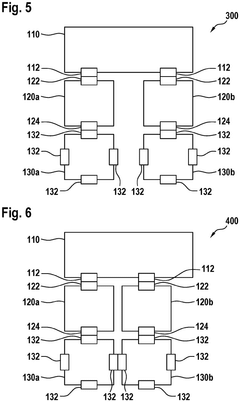

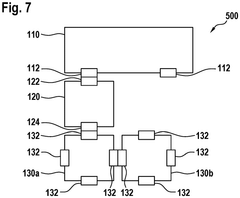

Cryogenic module for use in a modular cryogenic infrastructure and modular cryogenic infrastructure

PatentPendingEP4506643A1

Innovation

- A modular cryogenic infrastructure with a centralized pre-cooling module and independently operable cryogenic and operations modules, allowing for efficient operation of equipment at low temperatures, reduced downtime, and lower power consumption.

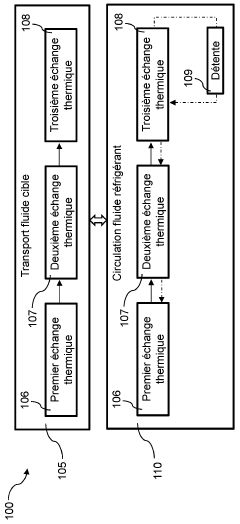

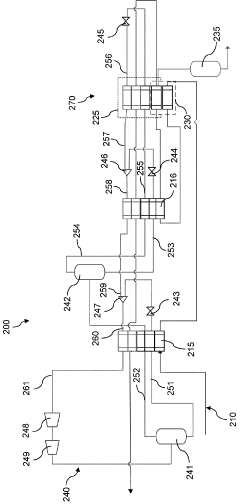

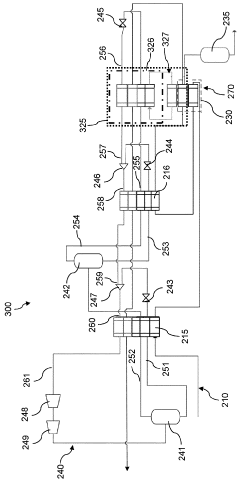

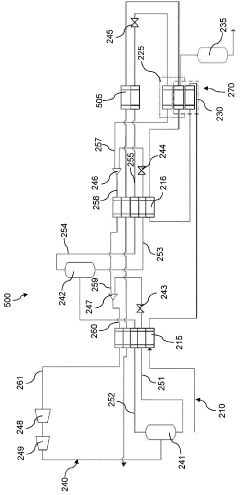

Device and method for cryogenic capture of carbon dioxide contained in a target fluid stream

PatentWO2024003285A1

Innovation

- A device and method for cryogenic capture of carbon dioxide using a closed circuit with multiple heat exchangers and a refrigerant fluid mixture of hydrocarbons (methane, ethane, propane, isobutane, and n-butane) that allows for pre-cooling and anti-sublimation without liquid condensation, optimizing heat exchanges and reducing energy costs.

Supply Chain Resilience and Risk Mitigation Strategies

The global supply chain for cryogenic capture modules faces unique vulnerabilities due to specialized materials, precision manufacturing requirements, and limited supplier networks. These vulnerabilities became particularly evident during recent global disruptions, highlighting the need for robust resilience strategies tailored to this specialized sector.

Primary supply chain risks for cryogenic capture technologies include single-source dependencies for critical components such as specialized alloys and cryogenic-rated seals. Geographic concentration of manufacturing capabilities, particularly in regions with advanced metallurgical expertise, creates potential bottlenecks. Additionally, the highly specialized nature of cryogenic equipment manufacturing means that alternative suppliers cannot be quickly onboarded during disruptions.

Implementing multi-sourcing strategies represents a critical mitigation approach, though challenges exist in qualifying alternative suppliers for components requiring stringent cryogenic performance standards. Leading manufacturers have begun establishing relationships with secondary suppliers in different geographic regions, requiring investment in supplier development and qualification processes.

Strategic inventory management offers another resilience pathway, with companies adopting hybrid approaches that maintain critical buffer stocks of long-lead components while implementing just-in-time practices for standard parts. Advanced analytics and AI-driven demand forecasting are increasingly employed to optimize these inventory strategies, reducing carrying costs while maintaining resilience.

Manufacturing flexibility presents a significant opportunity, with modular design approaches enabling production across multiple facilities. This requires standardization of interfaces and components, allowing for distributed manufacturing of subsystems that can be integrated at regional assembly centers. Several industry leaders have demonstrated success with this approach, reducing lead times by up to 40% while improving supply chain resilience.

Vertical integration strategies are gaining traction among larger manufacturers, who are selectively bringing production of critical components in-house. This approach provides greater control over quality and availability but requires significant capital investment and specialized expertise. Balanced approaches that combine strategic vertical integration with robust supplier partnerships appear most effective.

Digital supply chain technologies offer promising solutions for enhanced visibility and risk management. Implementation of blockchain-based tracking systems and digital twins enables real-time monitoring of component status and manufacturing readiness. These technologies support proactive risk identification and mitigation, though industry-wide adoption remains in early stages due to integration challenges with legacy systems and concerns regarding proprietary information sharing.

Primary supply chain risks for cryogenic capture technologies include single-source dependencies for critical components such as specialized alloys and cryogenic-rated seals. Geographic concentration of manufacturing capabilities, particularly in regions with advanced metallurgical expertise, creates potential bottlenecks. Additionally, the highly specialized nature of cryogenic equipment manufacturing means that alternative suppliers cannot be quickly onboarded during disruptions.

Implementing multi-sourcing strategies represents a critical mitigation approach, though challenges exist in qualifying alternative suppliers for components requiring stringent cryogenic performance standards. Leading manufacturers have begun establishing relationships with secondary suppliers in different geographic regions, requiring investment in supplier development and qualification processes.

Strategic inventory management offers another resilience pathway, with companies adopting hybrid approaches that maintain critical buffer stocks of long-lead components while implementing just-in-time practices for standard parts. Advanced analytics and AI-driven demand forecasting are increasingly employed to optimize these inventory strategies, reducing carrying costs while maintaining resilience.

Manufacturing flexibility presents a significant opportunity, with modular design approaches enabling production across multiple facilities. This requires standardization of interfaces and components, allowing for distributed manufacturing of subsystems that can be integrated at regional assembly centers. Several industry leaders have demonstrated success with this approach, reducing lead times by up to 40% while improving supply chain resilience.

Vertical integration strategies are gaining traction among larger manufacturers, who are selectively bringing production of critical components in-house. This approach provides greater control over quality and availability but requires significant capital investment and specialized expertise. Balanced approaches that combine strategic vertical integration with robust supplier partnerships appear most effective.

Digital supply chain technologies offer promising solutions for enhanced visibility and risk management. Implementation of blockchain-based tracking systems and digital twins enables real-time monitoring of component status and manufacturing readiness. These technologies support proactive risk identification and mitigation, though industry-wide adoption remains in early stages due to integration challenges with legacy systems and concerns regarding proprietary information sharing.

Regulatory Compliance and Safety Standards

The regulatory landscape for cryogenic capture modules encompasses a complex web of international, national, and industry-specific standards that manufacturers must navigate. At the international level, ISO 16924 and ISO 20421 provide critical guidelines for cryogenic vessels and equipment, establishing baseline requirements for design, manufacturing, and testing procedures. These standards are particularly relevant for ensuring the structural integrity of cryogenic capture modules under extreme temperature conditions.

In the United States, compliance with ASME Boiler and Pressure Vessel Code Section VIII is mandatory for pressure vessels operating at cryogenic temperatures. Additionally, manufacturers must adhere to the Department of Transportation's regulations (49 CFR) governing the transport of cryogenic materials and equipment. The Compressed Gas Association (CGA) further supplements these requirements with industry-specific guidelines such as CGA P-12 for safe handling of cryogenic liquids.

European manufacturers face additional compliance requirements under the Pressure Equipment Directive (PED 2014/68/EU) and ATEX Directive (2014/34/EU) for equipment intended for use in potentially explosive atmospheres. These directives necessitate CE marking and conformity assessment procedures that significantly impact supply chain planning and manufacturing processes.

Safety standards for cryogenic capture modules focus primarily on preventing hazards associated with extreme cold, asphyxiation risks, and pressure-related dangers. NFPA 55 (Compressed Gases and Cryogenic Fluids Code) provides comprehensive safety requirements for the installation and operation of cryogenic systems. Manufacturers must incorporate these safety considerations into their design and production processes, including appropriate material selection, thermal insulation systems, and pressure relief mechanisms.

Emerging regulatory trends indicate increasing scrutiny of environmental impact and energy efficiency in cryogenic systems. The EU's F-Gas Regulation and similar initiatives worldwide are driving manufacturers toward more sustainable refrigerants and closed-loop systems. This regulatory shift necessitates proactive adaptation in manufacturing processes and supply chain management.

Compliance verification presents significant challenges for supply chain management, requiring extensive documentation, testing protocols, and third-party certifications. Manufacturers must establish robust quality management systems that ensure traceability throughout the supply chain, with particular attention to critical components and materials used in cryogenic applications. The implementation of digital compliance management tools is becoming increasingly essential for navigating this complex regulatory environment efficiently.

In the United States, compliance with ASME Boiler and Pressure Vessel Code Section VIII is mandatory for pressure vessels operating at cryogenic temperatures. Additionally, manufacturers must adhere to the Department of Transportation's regulations (49 CFR) governing the transport of cryogenic materials and equipment. The Compressed Gas Association (CGA) further supplements these requirements with industry-specific guidelines such as CGA P-12 for safe handling of cryogenic liquids.

European manufacturers face additional compliance requirements under the Pressure Equipment Directive (PED 2014/68/EU) and ATEX Directive (2014/34/EU) for equipment intended for use in potentially explosive atmospheres. These directives necessitate CE marking and conformity assessment procedures that significantly impact supply chain planning and manufacturing processes.

Safety standards for cryogenic capture modules focus primarily on preventing hazards associated with extreme cold, asphyxiation risks, and pressure-related dangers. NFPA 55 (Compressed Gases and Cryogenic Fluids Code) provides comprehensive safety requirements for the installation and operation of cryogenic systems. Manufacturers must incorporate these safety considerations into their design and production processes, including appropriate material selection, thermal insulation systems, and pressure relief mechanisms.

Emerging regulatory trends indicate increasing scrutiny of environmental impact and energy efficiency in cryogenic systems. The EU's F-Gas Regulation and similar initiatives worldwide are driving manufacturers toward more sustainable refrigerants and closed-loop systems. This regulatory shift necessitates proactive adaptation in manufacturing processes and supply chain management.

Compliance verification presents significant challenges for supply chain management, requiring extensive documentation, testing protocols, and third-party certifications. Manufacturers must establish robust quality management systems that ensure traceability throughout the supply chain, with particular attention to critical components and materials used in cryogenic applications. The implementation of digital compliance management tools is becoming increasingly essential for navigating this complex regulatory environment efficiently.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!