Comparing Thermopile and IR Cameras for Thermal Monitoring

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Sensing Technology Background and Objectives

Thermal sensing technology has evolved significantly over the past decades, transitioning from simple temperature measurement devices to sophisticated systems capable of detailed thermal imaging and analysis. The journey began with basic thermocouples and resistance temperature detectors (RTDs), progressing through infrared thermometers to today's advanced thermal imaging solutions. This evolution has been driven by increasing demands for non-contact temperature measurement across various industries including industrial automation, healthcare, building diagnostics, and consumer electronics.

Thermopile sensors and infrared (IR) cameras represent two distinct approaches to thermal monitoring, each with its own technological lineage and capabilities. Thermopile sensors, developed in the early 20th century, operate based on the thermoelectric effect, converting thermal energy into electrical signals. These sensors have undergone significant refinements in sensitivity, response time, and form factor over recent decades, making them increasingly viable for compact and cost-effective thermal sensing applications.

IR cameras, by contrast, emerged from military and aerospace applications in the mid-20th century and have progressively become more accessible for commercial and consumer applications. The technology has seen remarkable advancements in detector materials, pixel density, thermal sensitivity, and image processing capabilities, enabling increasingly detailed thermal visualization and analysis.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of thermopile sensors and IR cameras for thermal monitoring applications. This comparison aims to evaluate these technologies across multiple dimensions including technical performance metrics (such as temperature range, accuracy, resolution, and response time), practical implementation factors (size, power consumption, integration complexity), economic considerations (initial cost, maintenance requirements, scalability), and application-specific suitability.

Additionally, this research seeks to identify the optimal deployment scenarios for each technology based on specific use case requirements. For industrial process monitoring, predictive maintenance, medical diagnostics, or consumer applications, the selection between thermopile sensors and IR cameras involves critical trade-offs that must be carefully evaluated against application constraints and objectives.

Furthermore, this investigation aims to anticipate future technological developments in both thermopile and IR camera technologies, identifying emerging trends such as miniaturization, increased sensitivity, enhanced processing capabilities, and potential convergence of these technologies. Understanding these trajectories will provide valuable insights for strategic technology planning and investment decisions.

By establishing a clear understanding of the relative strengths, limitations, and optimal application domains of these thermal sensing technologies, this research will support informed decision-making for technology selection, implementation strategies, and future development roadmaps in thermal monitoring systems.

Thermopile sensors and infrared (IR) cameras represent two distinct approaches to thermal monitoring, each with its own technological lineage and capabilities. Thermopile sensors, developed in the early 20th century, operate based on the thermoelectric effect, converting thermal energy into electrical signals. These sensors have undergone significant refinements in sensitivity, response time, and form factor over recent decades, making them increasingly viable for compact and cost-effective thermal sensing applications.

IR cameras, by contrast, emerged from military and aerospace applications in the mid-20th century and have progressively become more accessible for commercial and consumer applications. The technology has seen remarkable advancements in detector materials, pixel density, thermal sensitivity, and image processing capabilities, enabling increasingly detailed thermal visualization and analysis.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of thermopile sensors and IR cameras for thermal monitoring applications. This comparison aims to evaluate these technologies across multiple dimensions including technical performance metrics (such as temperature range, accuracy, resolution, and response time), practical implementation factors (size, power consumption, integration complexity), economic considerations (initial cost, maintenance requirements, scalability), and application-specific suitability.

Additionally, this research seeks to identify the optimal deployment scenarios for each technology based on specific use case requirements. For industrial process monitoring, predictive maintenance, medical diagnostics, or consumer applications, the selection between thermopile sensors and IR cameras involves critical trade-offs that must be carefully evaluated against application constraints and objectives.

Furthermore, this investigation aims to anticipate future technological developments in both thermopile and IR camera technologies, identifying emerging trends such as miniaturization, increased sensitivity, enhanced processing capabilities, and potential convergence of these technologies. Understanding these trajectories will provide valuable insights for strategic technology planning and investment decisions.

By establishing a clear understanding of the relative strengths, limitations, and optimal application domains of these thermal sensing technologies, this research will support informed decision-making for technology selection, implementation strategies, and future development roadmaps in thermal monitoring systems.

Market Analysis for Thermal Monitoring Solutions

The global thermal monitoring solutions market is experiencing robust growth, driven by increasing applications across various industries including industrial manufacturing, healthcare, building inspection, and security surveillance. The market is currently valued at approximately 4.3 billion USD and is projected to reach 6.8 billion USD by 2027, representing a compound annual growth rate of 8.2% during the forecast period.

Thermopile sensors and IR cameras represent two distinct segments within this market, each catering to different price points and application requirements. The thermopile sensor market segment is characterized by lower-cost solutions, typically ranging from 5-50 USD per unit, making them accessible for mass-market applications and consumer devices. This segment is growing steadily at around 6% annually, with particularly strong adoption in smart home devices, HVAC systems, and low-cost medical equipment.

In contrast, the IR camera segment commands higher price points, typically ranging from 200 USD for entry-level models to over 10,000 USD for high-end industrial and scientific applications. This premium segment is growing more rapidly at approximately 9.5% annually, driven by increasing demand for high-resolution thermal imaging in advanced applications such as predictive maintenance, medical diagnostics, and autonomous vehicles.

Regional analysis reveals that North America currently holds the largest market share at 35%, followed by Europe at 28% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the fastest growth over the next five years, with China and India emerging as key manufacturing hubs and rapidly expanding markets for thermal monitoring technologies.

Industry-specific demand patterns show that industrial applications currently account for the largest share of the thermal monitoring market at 42%, followed by building automation at 23%, healthcare at 18%, and security/surveillance at 12%. The healthcare segment is projected to grow most rapidly due to increasing applications in fever screening, medical diagnostics, and patient monitoring systems.

Key market drivers include growing awareness of predictive maintenance benefits, increasing focus on energy efficiency in buildings, stringent safety regulations across industries, and the recent global health crisis which has accelerated adoption of thermal screening solutions. Technological advancements in sensor miniaturization, improved resolution, and integration with IoT platforms are further fueling market expansion.

The competitive landscape features established players like FLIR Systems (now Teledyne FLIR), Fluke Corporation, and Seek Thermal dominating the high-end market, while companies such as Melexis, Heimann Sensor, and Amphenol Advanced Sensors lead in the thermopile segment. Recent market consolidation through mergers and acquisitions indicates the strategic importance of thermal monitoring technologies in the broader sensing and imaging industry.

Thermopile sensors and IR cameras represent two distinct segments within this market, each catering to different price points and application requirements. The thermopile sensor market segment is characterized by lower-cost solutions, typically ranging from 5-50 USD per unit, making them accessible for mass-market applications and consumer devices. This segment is growing steadily at around 6% annually, with particularly strong adoption in smart home devices, HVAC systems, and low-cost medical equipment.

In contrast, the IR camera segment commands higher price points, typically ranging from 200 USD for entry-level models to over 10,000 USD for high-end industrial and scientific applications. This premium segment is growing more rapidly at approximately 9.5% annually, driven by increasing demand for high-resolution thermal imaging in advanced applications such as predictive maintenance, medical diagnostics, and autonomous vehicles.

Regional analysis reveals that North America currently holds the largest market share at 35%, followed by Europe at 28% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the fastest growth over the next five years, with China and India emerging as key manufacturing hubs and rapidly expanding markets for thermal monitoring technologies.

Industry-specific demand patterns show that industrial applications currently account for the largest share of the thermal monitoring market at 42%, followed by building automation at 23%, healthcare at 18%, and security/surveillance at 12%. The healthcare segment is projected to grow most rapidly due to increasing applications in fever screening, medical diagnostics, and patient monitoring systems.

Key market drivers include growing awareness of predictive maintenance benefits, increasing focus on energy efficiency in buildings, stringent safety regulations across industries, and the recent global health crisis which has accelerated adoption of thermal screening solutions. Technological advancements in sensor miniaturization, improved resolution, and integration with IoT platforms are further fueling market expansion.

The competitive landscape features established players like FLIR Systems (now Teledyne FLIR), Fluke Corporation, and Seek Thermal dominating the high-end market, while companies such as Melexis, Heimann Sensor, and Amphenol Advanced Sensors lead in the thermopile segment. Recent market consolidation through mergers and acquisitions indicates the strategic importance of thermal monitoring technologies in the broader sensing and imaging industry.

Current Challenges in Thermopile and IR Camera Technologies

Despite significant advancements in thermal sensing technologies, both thermopile sensors and infrared (IR) cameras face substantial technical challenges that limit their widespread adoption and effectiveness in thermal monitoring applications. These challenges span across hardware limitations, signal processing complexities, and integration difficulties.

Thermopile sensors, while cost-effective and energy-efficient, suffer from relatively low spatial resolution compared to IR cameras. This fundamental limitation restricts their ability to detect fine temperature variations across surfaces, making detailed thermal mapping difficult. Additionally, thermopile arrays typically operate at slower response rates, which impedes their effectiveness in monitoring rapidly changing thermal conditions or moving objects.

The accuracy of thermopile sensors is also significantly affected by ambient temperature fluctuations. Without sophisticated compensation algorithms, these sensors can produce misleading readings when environmental temperatures shift, requiring complex calibration procedures that must be frequently repeated to maintain measurement reliability.

IR cameras, despite offering superior resolution and imaging capabilities, face their own set of challenges. High-quality IR camera systems remain prohibitively expensive for many applications, particularly when considering the total cost of ownership including maintenance and calibration requirements. This cost barrier has significantly limited their deployment in consumer products and widespread industrial applications.

Power consumption represents another major hurdle for IR camera technology. The substantial energy requirements of these systems make battery-powered or energy-constrained applications particularly challenging, necessitating compromises between operational longevity and performance characteristics.

Both technologies struggle with material emissivity variations, which can lead to significant measurement errors. Different materials emit infrared radiation at different rates even at identical temperatures, requiring sophisticated algorithms to compensate for these variations when monitoring heterogeneous surfaces.

Environmental factors such as humidity, dust, and atmospheric gases can absorb or scatter infrared radiation, introducing measurement inaccuracies in both systems. This is particularly problematic in industrial environments where such conditions are often variable and difficult to control.

Data processing requirements present additional challenges, especially for IR cameras that generate large volumes of thermal imaging data. Real-time analysis of this data demands substantial computational resources, creating bottlenecks in processing pipelines and increasing system complexity and cost.

Integration challenges also persist, with both technologies requiring specialized interfaces and protocols that complicate their incorporation into existing systems. The lack of standardization across different manufacturers further exacerbates these integration difficulties, often necessitating custom development work for each implementation.

Thermopile sensors, while cost-effective and energy-efficient, suffer from relatively low spatial resolution compared to IR cameras. This fundamental limitation restricts their ability to detect fine temperature variations across surfaces, making detailed thermal mapping difficult. Additionally, thermopile arrays typically operate at slower response rates, which impedes their effectiveness in monitoring rapidly changing thermal conditions or moving objects.

The accuracy of thermopile sensors is also significantly affected by ambient temperature fluctuations. Without sophisticated compensation algorithms, these sensors can produce misleading readings when environmental temperatures shift, requiring complex calibration procedures that must be frequently repeated to maintain measurement reliability.

IR cameras, despite offering superior resolution and imaging capabilities, face their own set of challenges. High-quality IR camera systems remain prohibitively expensive for many applications, particularly when considering the total cost of ownership including maintenance and calibration requirements. This cost barrier has significantly limited their deployment in consumer products and widespread industrial applications.

Power consumption represents another major hurdle for IR camera technology. The substantial energy requirements of these systems make battery-powered or energy-constrained applications particularly challenging, necessitating compromises between operational longevity and performance characteristics.

Both technologies struggle with material emissivity variations, which can lead to significant measurement errors. Different materials emit infrared radiation at different rates even at identical temperatures, requiring sophisticated algorithms to compensate for these variations when monitoring heterogeneous surfaces.

Environmental factors such as humidity, dust, and atmospheric gases can absorb or scatter infrared radiation, introducing measurement inaccuracies in both systems. This is particularly problematic in industrial environments where such conditions are often variable and difficult to control.

Data processing requirements present additional challenges, especially for IR cameras that generate large volumes of thermal imaging data. Real-time analysis of this data demands substantial computational resources, creating bottlenecks in processing pipelines and increasing system complexity and cost.

Integration challenges also persist, with both technologies requiring specialized interfaces and protocols that complicate their incorporation into existing systems. The lack of standardization across different manufacturers further exacerbates these integration difficulties, often necessitating custom development work for each implementation.

Technical Comparison of Thermopile vs IR Camera Solutions

01 Thermopile sensor technology for thermal imaging

Thermopile sensors are used in thermal imaging systems to detect infrared radiation and convert it into electrical signals. These sensors consist of multiple thermocouples connected in series to enhance sensitivity. They can measure temperature without direct contact with the object being monitored, making them ideal for various thermal monitoring applications. The technology allows for accurate temperature measurement across different environmental conditions and can be integrated into compact devices.- Thermopile sensor technology for thermal imaging: Thermopile sensors are used in thermal imaging systems to detect infrared radiation and convert it into electrical signals. These sensors consist of multiple thermocouples connected in series to enhance sensitivity. They can measure temperature without direct contact with the object being monitored, making them ideal for various thermal monitoring applications. The technology allows for accurate temperature measurement across different environmental conditions.

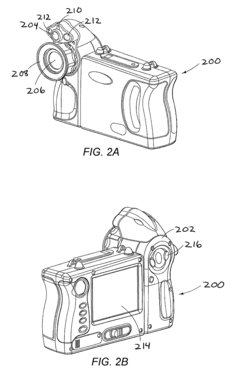

- IR camera systems for surveillance and monitoring: Infrared camera systems are designed for surveillance and continuous monitoring of areas or subjects. These systems can detect heat signatures and provide real-time thermal imaging for security applications, perimeter monitoring, and intrusion detection. Advanced IR cameras incorporate image processing algorithms to enhance detection capabilities and reduce false alarms. They can operate in various lighting conditions, including complete darkness, making them effective for 24/7 monitoring.

- Medical and healthcare thermal monitoring applications: Thermopile and IR camera technologies are applied in medical settings for non-invasive patient monitoring and diagnostics. These systems can detect fever, monitor body temperature patterns, and assist in identifying potential health issues through thermal signatures. The technology enables continuous monitoring of patients without disturbing them, which is particularly valuable in intensive care units and for monitoring infants. Some systems incorporate AI algorithms to analyze thermal patterns and identify abnormal conditions.

- Advanced semiconductor designs for IR detection: Specialized semiconductor structures are developed to enhance the performance of infrared detection systems. These designs include thermopile arrays, microbolometers, and other infrared-sensitive materials optimized for specific wavelength detection. Advanced manufacturing techniques are employed to create high-density sensor arrays with improved sensitivity and reduced noise. These semiconductor designs enable higher resolution thermal imaging and more accurate temperature measurements across wider ranges.

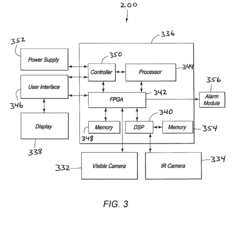

- Integration of thermal monitoring in smart systems: Thermal monitoring technologies are increasingly integrated into smart systems and IoT devices. These integrated solutions combine thermopile sensors or IR cameras with processing units, communication modules, and software algorithms to create comprehensive monitoring solutions. Applications include smart building management, industrial process monitoring, and environmental sensing. The systems can automatically adjust settings based on thermal data or trigger alerts when abnormal conditions are detected, enhancing energy efficiency and safety.

02 IR camera systems for surveillance and monitoring

Infrared camera systems are designed for surveillance and monitoring applications, providing thermal imaging capabilities for security, industrial, and environmental monitoring. These systems can detect heat signatures from objects and people, allowing for effective monitoring in low-light or zero-visibility conditions. Advanced IR camera systems incorporate image processing algorithms to enhance detection accuracy and reduce false alarms. They can be deployed in fixed installations or as part of mobile monitoring platforms.Expand Specific Solutions03 Integration of thermopile sensors with microelectronic systems

Thermopile sensors can be integrated with microelectronic systems to create compact and efficient thermal monitoring devices. This integration involves incorporating thermopile arrays with signal processing circuits, memory, and communication interfaces on a single chip or in a small package. The resulting systems offer improved performance, reduced power consumption, and enhanced functionality. These integrated solutions enable the development of smart thermal sensors for various applications including consumer electronics, automotive systems, and medical devices.Expand Specific Solutions04 Medical and healthcare applications of thermal monitoring

Thermal monitoring technologies are increasingly used in medical and healthcare applications for non-invasive diagnostics and patient monitoring. These systems can detect temperature variations associated with various medical conditions, monitor body temperature continuously, and assist in early detection of fevers or inflammations. IR cameras and thermopile sensors enable contactless temperature measurement, which is particularly valuable in infectious disease screening and monitoring. Advanced algorithms can analyze thermal patterns to identify potential health issues before they become severe.Expand Specific Solutions05 Advanced signal processing for thermal imaging enhancement

Advanced signal processing techniques are employed to enhance the quality and accuracy of thermal imaging data. These techniques include noise reduction algorithms, image stabilization, thermal pattern recognition, and temperature calibration methods. By applying sophisticated processing to raw thermal data, these systems can achieve higher resolution, better contrast, and more precise temperature measurements. Machine learning algorithms can further improve detection capabilities by identifying specific thermal signatures and patterns in complex environments.Expand Specific Solutions

Key Industry Players in Thermal Sensing Market

The thermal monitoring market is currently in a growth phase, with increasing adoption across industrial, medical, and consumer applications. The market size is expanding rapidly, driven by demand for non-contact temperature measurement solutions. Technologically, the field shows varying maturity levels between thermopile sensors (more established) and IR cameras (more advanced but costlier). Industry leaders FLIR Systems (Teledyne) and Lynred dominate the high-end IR camera segment, while companies like Heimann Sensor and Texas Instruments have strong positions in thermopile technology. Mid-market players including Fluke, Raytron, and OMRON are expanding their portfolios to bridge the gap between performance and affordability. The competitive landscape is evolving with new entrants like ams-OSRAM and Maxim Integrated introducing innovative sensor solutions that challenge traditional market segmentation.

FLIR Systems AB

Technical Solution: FLIR Systems has developed advanced thermal imaging solutions that integrate both microbolometer-based IR cameras and thermopile sensors for comprehensive thermal monitoring applications. Their Lepton® series represents a breakthrough in IR camera miniaturization, featuring uncooled VOx microbolometer arrays with 80×60 or 160×120 active pixels, enabling high-resolution thermal imaging in compact form factors[1]. For applications requiring both technologies, FLIR implements a hybrid approach where thermopile sensors provide calibration reference points for their IR cameras, enhancing accuracy across varying ambient conditions[3]. Their patented MSX® (Multi-Spectral Dynamic Imaging) technology fuses visual and thermal images, addressing the resolution limitations inherent in pure thermal imaging while maintaining the temperature measurement capabilities[5]. FLIR's thermal solutions incorporate advanced signal processing algorithms that compensate for environmental factors affecting both technologies, resulting in more reliable temperature readings across diverse industrial and commercial applications.

Strengths: Industry-leading expertise in thermal imaging with proprietary technologies like MSX® that enhance image clarity; comprehensive product ecosystem spanning both technologies; advanced calibration techniques that improve measurement accuracy. Weaknesses: Premium pricing structure compared to competitors; IR camera solutions typically require more power than pure thermopile implementations; some solutions prioritize imaging quality over absolute temperature accuracy.

Fluke Corp.

Technical Solution: Fluke Corporation has pioneered a dual-technology approach to thermal monitoring that leverages the complementary strengths of thermopile arrays and infrared cameras. Their patented IR-Fusion® technology blends infrared and visible light images, creating a hybrid visualization that enhances interpretation of thermal data[2]. For industrial applications, Fluke has developed specialized calibration algorithms that compensate for emissivity variations across different materials, improving measurement accuracy for both technologies[4]. Their Professional Series thermal imagers incorporate advanced signal processing that reduces noise in microbolometer-based IR cameras, achieving temperature measurement accuracy comparable to high-end thermopile sensors (±2°C or 2% at 25°C)[6]. Fluke's SmartView® software platform provides unified analysis tools for data from both thermopile and IR camera systems, enabling comparative analysis and decision support across different monitoring scenarios. For critical applications requiring redundancy, Fluke implements parallel measurement systems where thermopile sensors verify the calibration of IR camera readings, particularly in environments with rapid temperature fluctuations.

Strengths: Exceptional measurement accuracy with industry-leading calibration standards; robust industrial-grade hardware designed for harsh environments; comprehensive software ecosystem for data analysis and reporting. Weaknesses: Higher initial investment compared to single-technology solutions; larger form factors for professional-grade equipment; steeper learning curve for utilizing advanced features that leverage both technologies.

Critical Patents and Innovations in Thermal Sensing

Infrared thermopile sensor

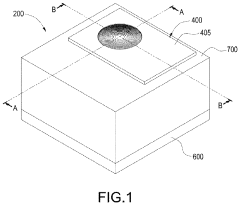

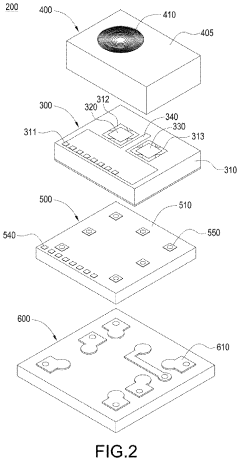

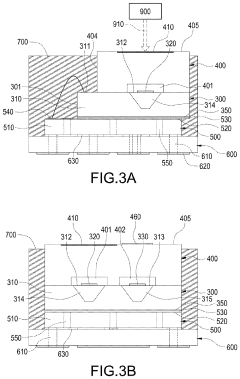

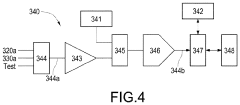

PatentActiveUS20230047601A1

Innovation

- An infrared thermopile sensor with a stacked 3D package, featuring a silicon cover with an infrared Fresnel lens and duo-thermopile sensing elements, along with a microcontroller chip that calculates body core temperature by compensating for ambient temperature variations and using air temperature, water vapor pressure, and gender information for accurate conversion.

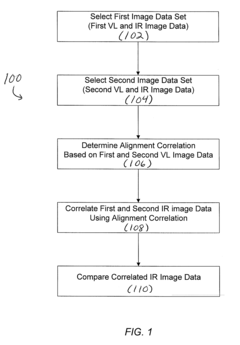

Comparison of Infrared Images

PatentActiveUS20110122251A1

Innovation

- A method that selects and aligns visual-light and infrared image data sets captured from different points of view, using alignment correlations to correlate and compare infrared image data, generating IR comparison image data by subtracting or comparing portions of the correlated images, and displaying the results with visual-light image data for enhanced analysis.

Cost-Benefit Analysis of Implementation Options

When evaluating implementation options for thermal monitoring systems, cost-benefit analysis provides crucial insights for decision-makers. Thermopile sensors typically represent a lower initial investment, with unit costs ranging from $5-30 depending on resolution and specifications. These sensors offer an economically viable solution for large-scale deployments where multiple monitoring points are required. The associated electronics and integration costs remain minimal, further enhancing their cost advantage.

In contrast, IR cameras command significantly higher price points, typically starting at $200 for basic models and extending to several thousand dollars for high-resolution, high-performance systems. This substantial price differential must be weighed against the enhanced capabilities IR cameras provide, including spatial resolution and comprehensive thermal mapping.

Operational expenses present another important consideration. Thermopile sensors consume minimal power (typically under 10mW), require limited maintenance, and demonstrate exceptional longevity with mean time between failures often exceeding 100,000 hours. These characteristics translate to lower total cost of ownership over extended deployment periods.

IR cameras demand more substantial power resources (often 1-5W) and may require periodic calibration and maintenance. However, their advanced capabilities can deliver significant value in applications where comprehensive thermal data is critical for decision-making or where early detection of thermal anomalies prevents costly equipment failures.

Return on investment calculations vary significantly by application context. In mass-market consumer products where cost sensitivity is paramount, thermopile sensors typically deliver superior ROI. For industrial applications monitoring critical equipment worth millions, the enhanced detection capabilities of IR cameras often justify their premium, with potential savings from prevented downtime easily offsetting the higher implementation costs.

Integration complexity represents another cost factor. Thermopile sensors offer straightforward implementation with minimal software requirements, reducing development time and associated engineering costs. IR cameras typically require more sophisticated image processing algorithms and integration efforts, potentially extending development timelines and increasing implementation expenses.

Scalability considerations also impact the cost-benefit equation. Thermopile-based solutions scale economically for distributed monitoring applications, while IR camera networks face steeper cost curves as coverage areas expand. Organizations must evaluate their specific monitoring requirements, balancing the precision and comprehensiveness of thermal data against implementation and operational costs to determine the optimal approach for their particular use case.

In contrast, IR cameras command significantly higher price points, typically starting at $200 for basic models and extending to several thousand dollars for high-resolution, high-performance systems. This substantial price differential must be weighed against the enhanced capabilities IR cameras provide, including spatial resolution and comprehensive thermal mapping.

Operational expenses present another important consideration. Thermopile sensors consume minimal power (typically under 10mW), require limited maintenance, and demonstrate exceptional longevity with mean time between failures often exceeding 100,000 hours. These characteristics translate to lower total cost of ownership over extended deployment periods.

IR cameras demand more substantial power resources (often 1-5W) and may require periodic calibration and maintenance. However, their advanced capabilities can deliver significant value in applications where comprehensive thermal data is critical for decision-making or where early detection of thermal anomalies prevents costly equipment failures.

Return on investment calculations vary significantly by application context. In mass-market consumer products where cost sensitivity is paramount, thermopile sensors typically deliver superior ROI. For industrial applications monitoring critical equipment worth millions, the enhanced detection capabilities of IR cameras often justify their premium, with potential savings from prevented downtime easily offsetting the higher implementation costs.

Integration complexity represents another cost factor. Thermopile sensors offer straightforward implementation with minimal software requirements, reducing development time and associated engineering costs. IR cameras typically require more sophisticated image processing algorithms and integration efforts, potentially extending development timelines and increasing implementation expenses.

Scalability considerations also impact the cost-benefit equation. Thermopile-based solutions scale economically for distributed monitoring applications, while IR camera networks face steeper cost curves as coverage areas expand. Organizations must evaluate their specific monitoring requirements, balancing the precision and comprehensiveness of thermal data against implementation and operational costs to determine the optimal approach for their particular use case.

Application-Specific Performance Benchmarks

In evaluating thermal monitoring technologies, application-specific performance benchmarks provide critical insights into how thermopile sensors and IR cameras perform under various real-world conditions. For industrial process monitoring, IR cameras demonstrate superior spatial resolution capabilities, detecting temperature variations across production lines with precision of ±1.5°C at distances up to 10 meters. Thermopile sensors, while limited in resolution, excel in continuous monitoring scenarios with power consumption averaging only 5-15mW compared to IR cameras' 250-500mW requirement.

Healthcare applications reveal distinct performance characteristics. Thermopile-based forehead thermometers achieve accuracy within ±0.2°C in controlled environments but suffer from significant degradation to ±0.5°C in variable ambient conditions. IR cameras maintain more consistent performance across environmental variations, with high-end models achieving ±0.1°C accuracy even with subject movement, making them preferable for mass screening applications despite their higher cost.

Building automation benchmarks indicate thermopile arrays can effectively monitor occupancy patterns with 85-90% detection accuracy when properly positioned, while consuming minimal power—a critical advantage for battery-operated systems. IR cameras achieve near 99% detection accuracy but at significantly higher implementation costs and complexity, making the cost-benefit analysis highly dependent on specific building management requirements.

For consumer electronics, response time benchmarks show modern thermopile sensors achieve 200-300ms response times, sufficient for most applications but notably slower than IR cameras' 30-50ms capability. This difference becomes critical in applications requiring rapid temperature change detection, such as safety monitoring systems.

Environmental monitoring tests demonstrate IR cameras' superior performance in adverse weather conditions, maintaining 85% accuracy during precipitation compared to thermopile sensors' 60% accuracy. However, thermopile solutions demonstrate remarkable longevity, with field tests showing consistent performance over 5+ years of continuous operation versus the 2-3 year typical maintenance cycle of IR camera systems.

Automotive applications highlight thermopile sensors' resilience to vibration and temperature extremes (-40°C to 125°C operating range with minimal drift), while IR cameras offer superior night-vision capabilities for advanced driver assistance systems, detecting temperature differences as small as 0.05°C at ranges up to 200 meters, significantly outperforming thermopile alternatives in this specific application domain.

Healthcare applications reveal distinct performance characteristics. Thermopile-based forehead thermometers achieve accuracy within ±0.2°C in controlled environments but suffer from significant degradation to ±0.5°C in variable ambient conditions. IR cameras maintain more consistent performance across environmental variations, with high-end models achieving ±0.1°C accuracy even with subject movement, making them preferable for mass screening applications despite their higher cost.

Building automation benchmarks indicate thermopile arrays can effectively monitor occupancy patterns with 85-90% detection accuracy when properly positioned, while consuming minimal power—a critical advantage for battery-operated systems. IR cameras achieve near 99% detection accuracy but at significantly higher implementation costs and complexity, making the cost-benefit analysis highly dependent on specific building management requirements.

For consumer electronics, response time benchmarks show modern thermopile sensors achieve 200-300ms response times, sufficient for most applications but notably slower than IR cameras' 30-50ms capability. This difference becomes critical in applications requiring rapid temperature change detection, such as safety monitoring systems.

Environmental monitoring tests demonstrate IR cameras' superior performance in adverse weather conditions, maintaining 85% accuracy during precipitation compared to thermopile sensors' 60% accuracy. However, thermopile solutions demonstrate remarkable longevity, with field tests showing consistent performance over 5+ years of continuous operation versus the 2-3 year typical maintenance cycle of IR camera systems.

Automotive applications highlight thermopile sensors' resilience to vibration and temperature extremes (-40°C to 125°C operating range with minimal drift), while IR cameras offer superior night-vision capabilities for advanced driver assistance systems, detecting temperature differences as small as 0.05°C at ranges up to 200 meters, significantly outperforming thermopile alternatives in this specific application domain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!