Conductive Adhesives' Impact on Thermal Management Systems

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Evolution and Objectives

Conductive adhesives have evolved significantly over the past several decades, transforming from simple electrical connection materials to sophisticated components critical for thermal management systems. The journey began in the 1950s with the introduction of basic silver-filled epoxies primarily used for electrical connections. By the 1970s, these materials started gaining attention for their thermal properties, though they remained secondary to their electrical functionality.

The 1990s marked a pivotal shift as electronics miniaturization created unprecedented thermal challenges, prompting researchers to develop specialized thermally conductive adhesives (TCAs). This evolution accelerated in the early 2000s with the introduction of nano-enhanced formulations incorporating carbon nanotubes, graphene, and metallic nanoparticles, dramatically improving thermal conductivity while maintaining necessary mechanical properties.

Recent developments have focused on creating multi-functional adhesives that simultaneously address thermal management, electrical conductivity, and mechanical reliability. The incorporation of phase change materials and liquid metal fillers represents the cutting edge of this technology, enabling thermal conductivity values approaching those of traditional solders while maintaining the processing advantages of adhesives.

The primary objective in conductive adhesive development for thermal management is achieving an optimal balance between thermal performance and practical application requirements. Current research aims to surpass the 5 W/m·K thermal conductivity threshold for commercial viability in high-performance electronics while maintaining reasonable cost structures and processing parameters.

Another critical goal is developing adhesives with directional thermal conductivity, allowing heat to flow preferentially along desired paths. This anisotropic behavior could revolutionize thermal design in complex electronic assemblies, enabling more efficient heat dissipation in increasingly compact devices.

Sustainability has emerged as a significant objective, with efforts to replace traditional metal-based fillers with bio-derived alternatives and develop formulations with reduced environmental impact. This aligns with global initiatives to create more environmentally responsible electronic components.

The integration of smart functionality represents perhaps the most ambitious objective in this field. Researchers are exploring adhesives that can respond to thermal conditions, adjusting their properties to optimize performance under varying heat loads. These adaptive materials could potentially self-heal during thermal cycling, extending device lifespan and reliability in demanding applications like automotive electronics, aerospace systems, and high-performance computing.

The 1990s marked a pivotal shift as electronics miniaturization created unprecedented thermal challenges, prompting researchers to develop specialized thermally conductive adhesives (TCAs). This evolution accelerated in the early 2000s with the introduction of nano-enhanced formulations incorporating carbon nanotubes, graphene, and metallic nanoparticles, dramatically improving thermal conductivity while maintaining necessary mechanical properties.

Recent developments have focused on creating multi-functional adhesives that simultaneously address thermal management, electrical conductivity, and mechanical reliability. The incorporation of phase change materials and liquid metal fillers represents the cutting edge of this technology, enabling thermal conductivity values approaching those of traditional solders while maintaining the processing advantages of adhesives.

The primary objective in conductive adhesive development for thermal management is achieving an optimal balance between thermal performance and practical application requirements. Current research aims to surpass the 5 W/m·K thermal conductivity threshold for commercial viability in high-performance electronics while maintaining reasonable cost structures and processing parameters.

Another critical goal is developing adhesives with directional thermal conductivity, allowing heat to flow preferentially along desired paths. This anisotropic behavior could revolutionize thermal design in complex electronic assemblies, enabling more efficient heat dissipation in increasingly compact devices.

Sustainability has emerged as a significant objective, with efforts to replace traditional metal-based fillers with bio-derived alternatives and develop formulations with reduced environmental impact. This aligns with global initiatives to create more environmentally responsible electronic components.

The integration of smart functionality represents perhaps the most ambitious objective in this field. Researchers are exploring adhesives that can respond to thermal conditions, adjusting their properties to optimize performance under varying heat loads. These adaptive materials could potentially self-heal during thermal cycling, extending device lifespan and reliability in demanding applications like automotive electronics, aerospace systems, and high-performance computing.

Market Demand Analysis for Thermal Management Solutions

The global thermal management market is experiencing robust growth, driven primarily by the increasing power densities in electronic devices and the miniaturization trend across industries. Current market valuations place the thermal interface materials sector at approximately 3.7 billion USD in 2023, with projections indicating a compound annual growth rate of 8.2% through 2030. Within this expanding market, conductive adhesives are emerging as a critical component, addressing the dual needs of mechanical bonding and thermal conductivity.

Consumer electronics represents the largest demand segment, accounting for nearly 40% of the thermal management solutions market. The proliferation of smartphones, tablets, and wearable devices with increasingly powerful processors has created substantial demand for effective heat dissipation solutions that maintain device reliability while enabling thinner form factors. Conductive adhesives offer significant advantages in these applications by eliminating the need for mechanical fasteners and providing consistent thermal interfaces.

Automotive electronics presents another rapidly growing market segment, particularly with the accelerating adoption of electric vehicles (EVs). The thermal management requirements for battery systems, power electronics, and motor controllers in EVs are substantially more demanding than in conventional vehicles. Market research indicates that the automotive thermal management segment is growing at 9.5% annually, outpacing the overall market. Conductive adhesives that can withstand automotive environmental conditions while providing reliable thermal pathways are experiencing particularly strong demand growth.

The telecommunications infrastructure sector, especially with the ongoing 5G network deployment, represents another significant market driver. The higher frequencies and increased power densities of 5G equipment create substantial thermal challenges that must be addressed to ensure system reliability and longevity. Industry analysts project that 5G-related thermal management solutions will grow at 12% annually through 2028.

Industrial applications, including power electronics, LED lighting, and renewable energy systems, collectively represent approximately 25% of the market demand. These applications typically require thermal solutions with long-term reliability under challenging environmental conditions, creating demand for advanced conductive adhesives with enhanced thermal stability and aging resistance.

Geographically, Asia-Pacific dominates the market demand, accounting for over 45% of global consumption, driven by the concentration of electronics manufacturing in the region. North America and Europe follow with approximately 25% and 20% market share respectively, with their demand primarily driven by automotive, aerospace, and high-performance computing applications.

The market increasingly values solutions that address multiple challenges simultaneously – thermal conductivity, electrical insulation or conductivity as required, mechanical strength, and environmental compliance. This trend favors advanced conductive adhesives that can deliver this multifunctional performance while remaining cost-effective and compatible with automated manufacturing processes.

Consumer electronics represents the largest demand segment, accounting for nearly 40% of the thermal management solutions market. The proliferation of smartphones, tablets, and wearable devices with increasingly powerful processors has created substantial demand for effective heat dissipation solutions that maintain device reliability while enabling thinner form factors. Conductive adhesives offer significant advantages in these applications by eliminating the need for mechanical fasteners and providing consistent thermal interfaces.

Automotive electronics presents another rapidly growing market segment, particularly with the accelerating adoption of electric vehicles (EVs). The thermal management requirements for battery systems, power electronics, and motor controllers in EVs are substantially more demanding than in conventional vehicles. Market research indicates that the automotive thermal management segment is growing at 9.5% annually, outpacing the overall market. Conductive adhesives that can withstand automotive environmental conditions while providing reliable thermal pathways are experiencing particularly strong demand growth.

The telecommunications infrastructure sector, especially with the ongoing 5G network deployment, represents another significant market driver. The higher frequencies and increased power densities of 5G equipment create substantial thermal challenges that must be addressed to ensure system reliability and longevity. Industry analysts project that 5G-related thermal management solutions will grow at 12% annually through 2028.

Industrial applications, including power electronics, LED lighting, and renewable energy systems, collectively represent approximately 25% of the market demand. These applications typically require thermal solutions with long-term reliability under challenging environmental conditions, creating demand for advanced conductive adhesives with enhanced thermal stability and aging resistance.

Geographically, Asia-Pacific dominates the market demand, accounting for over 45% of global consumption, driven by the concentration of electronics manufacturing in the region. North America and Europe follow with approximately 25% and 20% market share respectively, with their demand primarily driven by automotive, aerospace, and high-performance computing applications.

The market increasingly values solutions that address multiple challenges simultaneously – thermal conductivity, electrical insulation or conductivity as required, mechanical strength, and environmental compliance. This trend favors advanced conductive adhesives that can deliver this multifunctional performance while remaining cost-effective and compatible with automated manufacturing processes.

Current State and Challenges in Conductive Adhesive Technology

Conductive adhesives have emerged as a critical component in modern thermal management systems, with global market adoption accelerating across electronics, automotive, and aerospace industries. Currently, the technology landscape features three primary categories: isotropic conductive adhesives (ICAs), anisotropic conductive adhesives (ACAs), and non-conductive adhesives (NCAs), each serving distinct thermal management applications. Silver-filled epoxy systems dominate the market due to their superior thermal conductivity, though copper and aluminum-based alternatives have gained traction for cost-sensitive applications.

The current state of conductive adhesive technology presents several significant challenges. Thermal conductivity limitations remain a primary concern, with even advanced formulations achieving only 20-30 W/m·K, substantially lower than traditional solder (approximately 60 W/m·K). This performance gap becomes particularly problematic in high-power density applications such as 5G infrastructure and electric vehicle power modules where heat dissipation requirements continue to escalate.

Reliability issues persist across varying environmental conditions, with many conductive adhesives exhibiting performance degradation under thermal cycling, high humidity, and mechanical stress. Research indicates that after 1000 thermal cycles (-40°C to 125°C), silver-filled epoxy systems can experience up to 30% increase in thermal resistance, significantly compromising long-term system performance.

Manufacturing scalability presents another substantial hurdle. Current dispensing technologies struggle to achieve consistent bond line thickness below 20μm, which is increasingly required for advanced semiconductor packaging. Additionally, curing processes often require extended times (30-60 minutes) at elevated temperatures (150-180°C), limiting throughput and potentially damaging temperature-sensitive components.

Cost factors continue to constrain widespread adoption, particularly for silver-based formulations which can cost 5-10 times more than traditional soldering solutions. This economic barrier has slowed integration in consumer electronics and other price-sensitive market segments despite the technical advantages offered by conductive adhesives.

Environmental and regulatory challenges have intensified with global sustainability initiatives. While conductive adhesives generally contain fewer hazardous materials than lead-based solders, concerns remain regarding the environmental impact of silver nanoparticles and certain epoxy components. Recent studies have identified potential ecotoxicity issues that may trigger stricter regulatory oversight in key markets.

Geographical distribution of conductive adhesive technology development shows concentration in East Asia (particularly Japan, South Korea, and Taiwan), North America, and Western Europe, with emerging research clusters in China and India focusing on cost-effective formulations for their domestic electronics manufacturing sectors.

The current state of conductive adhesive technology presents several significant challenges. Thermal conductivity limitations remain a primary concern, with even advanced formulations achieving only 20-30 W/m·K, substantially lower than traditional solder (approximately 60 W/m·K). This performance gap becomes particularly problematic in high-power density applications such as 5G infrastructure and electric vehicle power modules where heat dissipation requirements continue to escalate.

Reliability issues persist across varying environmental conditions, with many conductive adhesives exhibiting performance degradation under thermal cycling, high humidity, and mechanical stress. Research indicates that after 1000 thermal cycles (-40°C to 125°C), silver-filled epoxy systems can experience up to 30% increase in thermal resistance, significantly compromising long-term system performance.

Manufacturing scalability presents another substantial hurdle. Current dispensing technologies struggle to achieve consistent bond line thickness below 20μm, which is increasingly required for advanced semiconductor packaging. Additionally, curing processes often require extended times (30-60 minutes) at elevated temperatures (150-180°C), limiting throughput and potentially damaging temperature-sensitive components.

Cost factors continue to constrain widespread adoption, particularly for silver-based formulations which can cost 5-10 times more than traditional soldering solutions. This economic barrier has slowed integration in consumer electronics and other price-sensitive market segments despite the technical advantages offered by conductive adhesives.

Environmental and regulatory challenges have intensified with global sustainability initiatives. While conductive adhesives generally contain fewer hazardous materials than lead-based solders, concerns remain regarding the environmental impact of silver nanoparticles and certain epoxy components. Recent studies have identified potential ecotoxicity issues that may trigger stricter regulatory oversight in key markets.

Geographical distribution of conductive adhesive technology development shows concentration in East Asia (particularly Japan, South Korea, and Taiwan), North America, and Western Europe, with emerging research clusters in China and India focusing on cost-effective formulations for their domestic electronics manufacturing sectors.

Current Technical Solutions for Thermal Interface Materials

01 Metal-filled conductive adhesives for thermal management

Metal-filled conductive adhesives incorporate particles such as silver, copper, or aluminum to enhance both electrical conductivity and thermal conductivity. These adhesives create effective thermal pathways in electronic assemblies while maintaining strong bonding properties. The metal fillers can be in various forms including flakes, spheres, or dendrites, with their concentration and distribution significantly affecting the thermal management capabilities of the adhesive system.- Metal-filled conductive adhesives for thermal management: Metal-filled conductive adhesives incorporate particles such as silver, copper, or aluminum to enhance both electrical conductivity and thermal management properties. These adhesives create effective thermal pathways that dissipate heat from electronic components. The metal fillers provide superior thermal conductivity compared to traditional adhesives, making them ideal for high-power electronic applications where heat management is critical.

- Carbon-based fillers in thermally conductive adhesives: Carbon-based materials such as graphene, carbon nanotubes, and graphite are incorporated into adhesive formulations to enhance thermal conductivity. These materials create efficient heat transfer networks within the adhesive matrix while maintaining flexibility. Carbon-based fillers offer advantages including lightweight properties, corrosion resistance, and the ability to be formulated into various adhesive systems for different electronic applications.

- Hybrid filler systems for enhanced thermal performance: Hybrid filler systems combine different types of thermally conductive materials to achieve synergistic effects in thermal management. These formulations typically blend metal particles with carbon-based materials or ceramic fillers to optimize both thermal conductivity and mechanical properties. The hybrid approach allows for customization of adhesive properties to meet specific application requirements while maintaining good processability and adhesion strength.

- Ceramic-filled adhesives for electrical insulation and thermal conductivity: Ceramic-filled adhesives incorporate materials such as aluminum oxide, boron nitride, or aluminum nitride to provide thermal conductivity while maintaining electrical insulation properties. These formulations are particularly valuable in applications where heat dissipation is required without electrical conductivity. The ceramic fillers offer high thermal stability, low coefficient of thermal expansion, and resistance to harsh environmental conditions.

- Phase change materials in thermally conductive adhesives: Phase change materials (PCMs) are incorporated into adhesive formulations to provide enhanced thermal management through latent heat absorption. These materials change phase at specific temperatures, absorbing excess heat during operation and releasing it during cooling cycles. PCM-enhanced adhesives offer improved thermal interface performance by filling microscopic gaps between surfaces and maintaining consistent contact pressure, resulting in more efficient heat transfer in electronic assemblies.

02 Carbon-based fillers in thermally conductive adhesives

Carbon-based materials such as graphene, carbon nanotubes, and graphite are incorporated into adhesive formulations to enhance thermal conductivity while maintaining flexibility. These materials create efficient heat dissipation networks within the adhesive matrix. The unique structure of carbon-based fillers allows for effective heat transfer across interfaces while requiring lower loading levels compared to traditional metal fillers, resulting in adhesives that maintain better mechanical properties.Expand Specific Solutions03 Hybrid filler systems for enhanced thermal performance

Hybrid filler systems combine different types of thermally conductive materials (such as metals with ceramics or carbon-based materials) to achieve synergistic effects in thermal management. These combinations optimize particle packing density and create more effective thermal networks within the adhesive matrix. The hybrid approach allows formulators to balance thermal conductivity, electrical properties, and mechanical strength while minimizing the negative impacts that high filler loadings can have on adhesion and flexibility.Expand Specific Solutions04 Polymer matrix modifications for thermal adhesives

Specialized polymer matrices are developed with inherently higher thermal conductivity or modified to better accommodate high filler loadings. These modifications include cross-linking structures, thermally conductive polymer blends, and copolymers designed specifically for heat transfer applications. The polymer matrix can be engineered to create better interfaces with fillers, reducing thermal boundary resistance and enhancing overall system thermal conductivity while maintaining essential adhesive properties.Expand Specific Solutions05 Interface engineering for thermal adhesive applications

Interface engineering techniques improve the thermal contact between adhesives and substrates by reducing thermal boundary resistance. These methods include surface treatments, coupling agents, and specialized additives that enhance wetting and bonding at thermal interfaces. By optimizing the interface between the adhesive and the components being joined, these technologies significantly improve heat transfer efficiency across the entire thermal management system, even without increasing the inherent thermal conductivity of the adhesive itself.Expand Specific Solutions

Key Industry Players in Conductive Adhesives Market

The conductive adhesives market for thermal management systems is in a growth phase, driven by increasing demand for efficient heat dissipation in electronics. The market is expanding rapidly with an estimated value exceeding $3 billion, fueled by miniaturization trends and higher power densities in electronic devices. Leading players like Henkel AG, 3M Innovative Properties, and Dow Global Technologies demonstrate advanced technical maturity through their extensive patent portfolios and commercial solutions. Asian manufacturers including LG Chem, Nitto Denko, and Hon Hai Precision are gaining market share by offering cost-effective alternatives. The technology is approaching maturity in traditional applications while innovation continues in high-performance segments, with companies like Siemens and Intel driving development of next-generation thermal interface materials for specialized applications.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed advanced thermally conductive adhesives that combine electrical conductivity with superior thermal management capabilities. Their LOCTITE ABLESTIK brand offers a comprehensive portfolio of conductive adhesives specifically engineered for thermal management applications. These include silver-filled epoxy adhesives that provide thermal conductivity values up to 3.0 W/m-K while maintaining excellent electrical conductivity. Henkel's solutions incorporate proprietary filler technology that optimizes the particle distribution and interface characteristics, resulting in reduced thermal resistance at bonding interfaces. Their latest generation products feature hybrid formulations that combine different conductive fillers (metal, ceramic, and carbon-based) to achieve an optimal balance between thermal performance, electrical conductivity, and mechanical reliability. Henkel has also pioneered reworkable thermally conductive adhesives that allow for component replacement without damaging sensitive substrates.

Strengths: Industry-leading thermal conductivity values; excellent adhesion to diverse substrates; customizable formulations for specific application requirements; global manufacturing capabilities ensuring consistent quality. Weaknesses: Higher cost compared to conventional adhesives; some formulations require specialized curing conditions; potential for thermal performance degradation under extreme temperature cycling.

3M Innovative Properties Co.

Technical Solution: 3M has developed a comprehensive range of thermally conductive adhesive solutions that address thermal management challenges across multiple industries. Their portfolio includes thermally conductive tapes, adhesives, and interface materials that utilize proprietary filler technologies to enhance heat dissipation while maintaining strong bonding characteristics. 3M's Thermally Conductive Epoxy Adhesives incorporate aluminum oxide, boron nitride, and other ceramic fillers to achieve thermal conductivity values ranging from 0.5 to 2.0 W/m-K. Their advanced formulations feature controlled flow properties that minimize bond line thickness, reducing thermal resistance at critical interfaces. 3M has also pioneered thermally conductive acrylic adhesives that offer the advantage of pressure-sensitive application without requiring heat curing, making them suitable for heat-sensitive components. Their latest innovations include phase-change materials embedded within conductive adhesive matrices that provide enhanced thermal performance during temperature fluctuations.

Strengths: Extensive product range covering multiple application requirements; excellent reliability under thermal cycling; strong R&D capabilities driving continuous innovation; established global supply chain. Weaknesses: Some formulations have lower thermal conductivity compared to metal-filled alternatives; potential for increased electrical resistance in certain applications; higher cost for specialized high-performance variants.

Critical Patents and Innovations in Conductive Adhesives

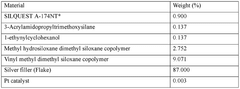

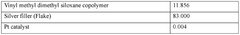

Thermally conductive silicone adhesive

PatentWO2025080439A1

Innovation

- A curable silicone-based adhesive composition is developed, comprising an organosiloxane preparation with reactive unsaturated groups and silicon hydride functional groups, along with thermally conductive particulate fillers and an adhesion promoter, to achieve the desired thermal conductivity and adhesion strength.

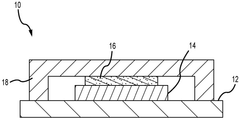

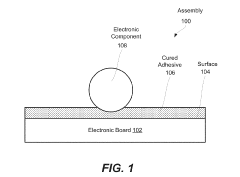

Thermally conductive flexible adhesive for aerospace applications

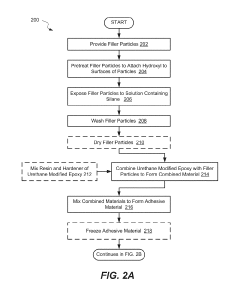

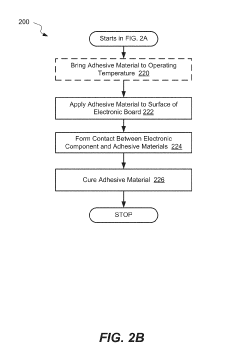

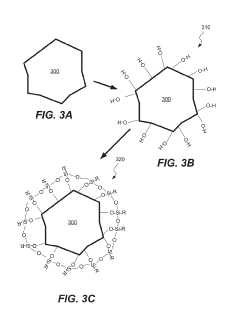

PatentActiveUS20190264073A1

Innovation

- A thermally conductive flexible adhesive is developed using boron nitride particles treated with silane and combined with urethane modified epoxy, providing a high thermal conductivity of at least 2 W/mK, low glass transition temperature, flexibility, and minimal outgassing, while maintaining mechanical strength and electrical insulation.

Environmental Impact and Sustainability Considerations

The environmental impact of conductive adhesives in thermal management systems represents a critical consideration as industries increasingly prioritize sustainability. Traditional thermal interface materials often contain heavy metals and environmentally persistent compounds that pose significant end-of-life disposal challenges. Conductive adhesives, particularly those utilizing silver, copper, or carbon-based fillers, offer potentially reduced environmental footprints compared to conventional soldering methods that rely on lead or other toxic metals.

Recent life cycle assessments reveal that silver-based conductive adhesives, despite their higher initial environmental impact during production, demonstrate superior sustainability over complete product lifecycles due to their enhanced durability and recyclability potential. The elimination of high-temperature soldering processes further reduces energy consumption during manufacturing, contributing to lower carbon emissions across the supply chain.

Water-based conductive adhesive formulations have emerged as particularly promising alternatives to solvent-based systems, significantly reducing volatile organic compound (VOC) emissions during application and curing processes. These formulations align with increasingly stringent global environmental regulations while maintaining necessary thermal performance characteristics.

Recyclability presents both challenges and opportunities in conductive adhesive applications. While the composite nature of these materials complicates end-of-life separation, innovative approaches utilizing selective solvents and mechanical separation techniques have demonstrated up to 85% recovery rates for valuable metals like silver and copper from spent adhesive matrices.

Biobased alternatives incorporating cellulose nanofibers and lignin-derived carbon structures as conductive fillers represent the cutting edge of sustainable development in this field. Though currently exhibiting lower thermal conductivity than conventional options, these materials offer dramatically improved biodegradability and reduced ecological toxicity.

The carbon footprint of conductive adhesives varies significantly based on production methods and material sources. Recent industry innovations have achieved carbon footprint reductions of 30-45% through localized supply chains and renewable energy implementation in manufacturing facilities. These improvements directly enhance the sustainability profile of thermal management systems utilizing these materials.

Regulatory frameworks worldwide increasingly influence material selection in thermal management applications. The European Union's RoHS and REACH regulations, alongside similar frameworks in Asia and North America, continue to drive formulation innovations toward lower environmental impact alternatives while maintaining thermal performance requirements.

Recent life cycle assessments reveal that silver-based conductive adhesives, despite their higher initial environmental impact during production, demonstrate superior sustainability over complete product lifecycles due to their enhanced durability and recyclability potential. The elimination of high-temperature soldering processes further reduces energy consumption during manufacturing, contributing to lower carbon emissions across the supply chain.

Water-based conductive adhesive formulations have emerged as particularly promising alternatives to solvent-based systems, significantly reducing volatile organic compound (VOC) emissions during application and curing processes. These formulations align with increasingly stringent global environmental regulations while maintaining necessary thermal performance characteristics.

Recyclability presents both challenges and opportunities in conductive adhesive applications. While the composite nature of these materials complicates end-of-life separation, innovative approaches utilizing selective solvents and mechanical separation techniques have demonstrated up to 85% recovery rates for valuable metals like silver and copper from spent adhesive matrices.

Biobased alternatives incorporating cellulose nanofibers and lignin-derived carbon structures as conductive fillers represent the cutting edge of sustainable development in this field. Though currently exhibiting lower thermal conductivity than conventional options, these materials offer dramatically improved biodegradability and reduced ecological toxicity.

The carbon footprint of conductive adhesives varies significantly based on production methods and material sources. Recent industry innovations have achieved carbon footprint reductions of 30-45% through localized supply chains and renewable energy implementation in manufacturing facilities. These improvements directly enhance the sustainability profile of thermal management systems utilizing these materials.

Regulatory frameworks worldwide increasingly influence material selection in thermal management applications. The European Union's RoHS and REACH regulations, alongside similar frameworks in Asia and North America, continue to drive formulation innovations toward lower environmental impact alternatives while maintaining thermal performance requirements.

Reliability Testing and Performance Standards

Reliability testing and performance standards for conductive adhesives in thermal management systems have evolved significantly to address the unique challenges these materials face in electronic applications. The testing protocols typically encompass thermal cycling, humidity resistance, mechanical stress, and long-term performance under various environmental conditions. Industry standards such as ASTM D5656 for thermal conductivity measurement and IPC-6012 for qualification requirements provide baseline metrics for evaluating adhesive performance.

Thermal cycling tests are particularly critical, as they simulate the expansion and contraction that occurs during device operation. Standard protocols often require conductive adhesives to withstand 1000+ cycles between temperature extremes (-40°C to +125°C) without significant degradation in thermal or electrical properties. The adhesive's ability to maintain consistent performance throughout these cycles directly impacts the longevity of thermal management systems.

Humidity resistance testing exposes adhesives to elevated temperature and humidity conditions (typically 85°C/85% RH) for extended periods, measuring changes in adhesion strength, electrical conductivity, and thermal performance. This test is essential for applications in automotive, outdoor telecommunications, and consumer electronics where moisture exposure is inevitable.

Mechanical reliability tests evaluate the adhesive's response to vibration, shock, and continuous stress. The JEDEC standard JESD22-B104 provides guidelines for mechanical shock testing, while MIL-STD-883 Method 2002 addresses vibration resistance. These standards help predict how conductive adhesives will perform in applications subject to movement or physical stress.

Accelerated aging tests attempt to compress years of operational degradation into manageable test periods. The Arrhenius equation is commonly applied to extrapolate long-term performance from elevated temperature exposure data. For conductive adhesives, maintaining thermal conductivity above 85% of initial values after accelerated aging is often considered acceptable performance.

Emerging standards are beginning to address specific requirements for next-generation electronics. The JEDEC JEP30-2 guideline for thermal measurement of LEDs and the IPC-4101 for printed circuit board materials both include considerations for conductive adhesives in thermal management applications. Additionally, automotive standards such as AEC-Q175 are being adapted to include specific requirements for thermally conductive materials in electric vehicle applications.

Standardized reporting metrics are equally important, with thermal resistance (°C/W), thermal conductivity (W/m·K), and bond line thickness consistency being primary indicators of performance quality. The industry is moving toward more comprehensive reliability metrics that combine thermal, mechanical, and electrical performance into unified qualification standards.

Thermal cycling tests are particularly critical, as they simulate the expansion and contraction that occurs during device operation. Standard protocols often require conductive adhesives to withstand 1000+ cycles between temperature extremes (-40°C to +125°C) without significant degradation in thermal or electrical properties. The adhesive's ability to maintain consistent performance throughout these cycles directly impacts the longevity of thermal management systems.

Humidity resistance testing exposes adhesives to elevated temperature and humidity conditions (typically 85°C/85% RH) for extended periods, measuring changes in adhesion strength, electrical conductivity, and thermal performance. This test is essential for applications in automotive, outdoor telecommunications, and consumer electronics where moisture exposure is inevitable.

Mechanical reliability tests evaluate the adhesive's response to vibration, shock, and continuous stress. The JEDEC standard JESD22-B104 provides guidelines for mechanical shock testing, while MIL-STD-883 Method 2002 addresses vibration resistance. These standards help predict how conductive adhesives will perform in applications subject to movement or physical stress.

Accelerated aging tests attempt to compress years of operational degradation into manageable test periods. The Arrhenius equation is commonly applied to extrapolate long-term performance from elevated temperature exposure data. For conductive adhesives, maintaining thermal conductivity above 85% of initial values after accelerated aging is often considered acceptable performance.

Emerging standards are beginning to address specific requirements for next-generation electronics. The JEDEC JEP30-2 guideline for thermal measurement of LEDs and the IPC-4101 for printed circuit board materials both include considerations for conductive adhesives in thermal management applications. Additionally, automotive standards such as AEC-Q175 are being adapted to include specific requirements for thermally conductive materials in electric vehicle applications.

Standardized reporting metrics are equally important, with thermal resistance (°C/W), thermal conductivity (W/m·K), and bond line thickness consistency being primary indicators of performance quality. The industry is moving toward more comprehensive reliability metrics that combine thermal, mechanical, and electrical performance into unified qualification standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!